Hello everyone, welcome to the season 4 of the steemit crypto academy. This is a beginners level course delivered by professor @awesononso and the class was on The Bid-Ask Spread. After taking the lessons I have tried to justify my understanding of the course by trying my hands on the task given by professor.

Properly explain the Bid-Ask Spread.

Bid price and ask price are involved in the selling and buying of crypto assets at a particular point. These bid price and ask price are determined by the buyers and sellers in the market. Let’s use this scenario to illustrate an example. Trader X wants to buy crypto assets at 2 USDT. The seller who is assumed to be trader Y, wants to sell an asset at 2.5 USDT. The below observations can be made from this scenario.

Bid price

The highest amount trader X wants to buy the asset is 2 USDT. This is referred to as the bid priceAsk price

The lowest amount trader Y wants to sell the asset 2.5 USDT. This is referred to as the ask price.Bid-Ask Spread

This Bid-Ask Spread is basically the difference between the Ask price and the bid price of the crypto asset on board. It is mathematically presented as

Bid-Ask Spread = Ask price - Bid price

Using the example given above, we can calculate the Bid-Ask Spread of that particular asset.

Bid-Ask Spread = 2.5 USDT - 2 USDT

Bid-Ask Spread = 0.5 USDT

Why is the Bid-Ask Spread important in a market?

The importance of Bid-Ask Spread in the market of cryptocurrencies is very massive. The Bid-Ask Spread helps in giving measured information on the correct prices of cryptocurrencies. Liquidity is determined by demand and supply which is very relevant in the market. Traders in the crypto market will need the liquidity in order to be able to know the right time to buy and sell cryptocurrencies. This liquidity aid traders in making correct choices in the crypto market in order to minimize losses.

Good traders make analysis on liquidity before engaging in trading. When a market is liquid, it means the Bid-Ask Spread is small which indicates that there are several transactions in the market. Conversely, when the market is illiquid it means the Bid-Ask Spread is large which indicates that the transactions ongoing in the market are minimal.

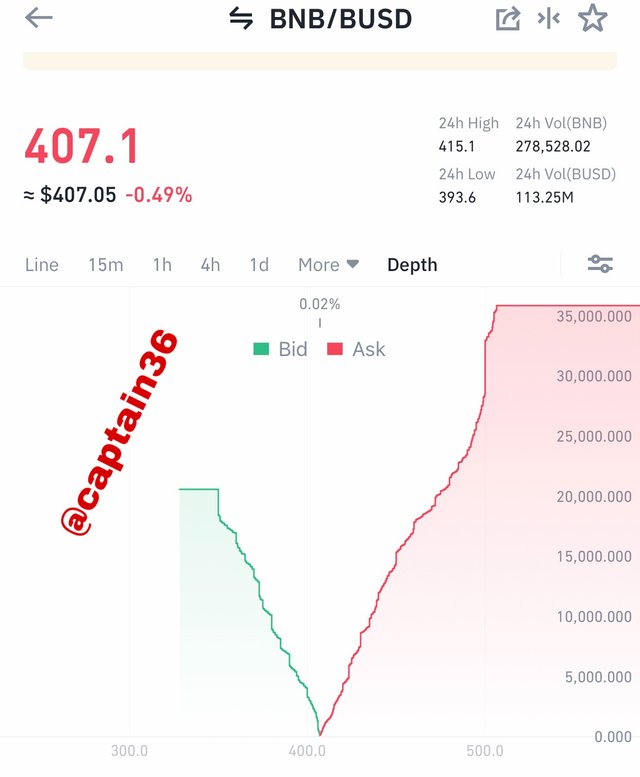

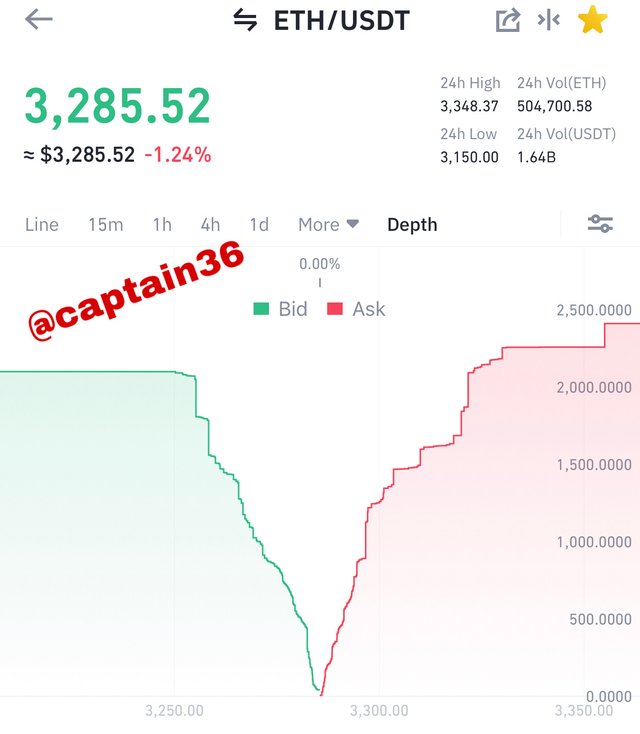

screenshot from Binance

The charts above are Bid-Ask Spread indicatons of BNB/BUSD and ETH/USDT. As shown in the first graph, the difference in the Bid-Ask Spread of BNB/BUSD is very large which means the liquidity is low. Then looking at the second chart, the difference in the Bid-Ask Spread is very small which shows that the liquidity is very high. We can use this conclusion we drew on these two graphs to make a good decision in the market.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a. calculating Bid-Ask Spread

Bid price = $5

ask price = $5.20

Bid-Ask Spread = Ask Price - Bid Price

Bid-Ask Spread = $5.20 - $5

Bid-Ask Spread = $0.20

b. Calculating Bid-Ask spread in percentage

Ask Price = $5.20

Bid-Ask Spread = $0.20

Percentage Spread = (Spread/Ask Price)100

Percentage Spread = ($0.20/$5.20)100

Percentage Spread = 3.846%

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a. Calculating the Bid-Ask Spread

Bid Price = $8.40

Ask Price = $8.80

Bid-Ask Spread = Ask Price - Bid Price

Bid-Ask Spread = $8.80 - $8.40

Bid-Ask Spread = $0.40

b. Calculating Bid-Ask Spread in percentage

Ask Price = $8.80

Bid-Ask Spread = $0.40

%Spread = (Spread/Ask Price) x 100

%Spread = ($0.40/$8.80) x 100

%Spread = 4.545%

In one statement, which of the assets above has the higher liquidity and why?

Crypto X has higher liquidity because it has a Bid-Ask Spread of $0.2 which is smaller than the Bid-Ask Spread of crypto Y which is $0.4. Crypto X shows the small difference of Bid-Ask Spread which confirms that it has a higher liquidity.

Explain Slippage.

A slippage in cryptocurrencies occurs when an order is executed at a price that is slightly different from the intended price. This happens because cryptocurrencies are very volatile and there can be very sharp changes that can occur between the time of the order and it’s execution. The price of the crypto asset to be executed can rise and fall at any point in time within a matter of seconds. This time of sharp changes cannot be predicted when we want to place an order. Slippage indicates low liquidity because it usually happens on large spreads. The trading volume displayed is also low.

For example, a trader intends to buy Steem/USDT at $0.65. The Steem/USDT order was placed at $0.65 but due to the low liquidity and low trading volume of Steem/USDT the slight delay between the order and execution points was capitalized on and the order was executed at a price of $0.68. This is because Steem is very volatile and within that slight delay, a quick change in price happened. This is a clear scenario of slippage during the transaction of Steem/USDT.

Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive Slippage

Positive slippage happens when the difference in the price ordered and the price executed goes in favor of the trader because the price is very volatile. In this case when a buy order is placed, it will be executed at a lower price than the intended price. On the other hand, when a sell order is placed, it will be executed higher than the intended price.

Buy order

A trader intends to buy SOL/USDT at $160. The order takes time to be executed due to the low liquidity and low trade volume and the order was eventually executed at $157. In this case there is a slippage which has earned the trader some profit. This is called positive slippage because the trader has gained a profit of $160-$157=$3Sell order

In this scenario, a trader wants to sell Steem/USDT at $0.7. The order was executed at a price of $0.75 due to a slight delay in execution as a result of low liquidity and low trading volume in the market. In this case during the selling, the trader made a profit of $0.75-$0.7=$0.05. This called positive slippage.

Negative spillage

Negative slippage happens when the slight change that happens between the time of order and execution time due to the volatility of the market affects the trader negatively. In this case, a buy order will be executed at a higher price than the intended price. On the other hand, a sell other will be executed at a lower price than the intended price.

Buy order

In this scenario, a trader wants to buy Steem/USDT at $0.7. The order was executed at a price of $0.75 due to a slight delay in execution as a result of low liquidity and low trading volume in the market. In this case during the buying, the trader made a loss of $0.75-$0.7=$0.05. This called negative slippage.Sell order

A trader intends to sell SOL/USDT at $160. The order takes time to be executed due to the low liquidity and low trade volume and the order was eventually executed at $157. In this case there is a slippage which has earned the trader some loss. This is called negative slippage because the trader made a loss of $160-$157=$3

Conclusion

Good traders are very familiar with terms such as Bid, Ask, Slippage among others. For these traders to become very successful in trading, they master these terms and apply them accordingly.

Like stated in the above explanations, slippage is the slight difference in the prices of cryptocurrencies which happens between the time of order and the time of execution. The Bid-Ask Spread has also been discussed clearly above.

Thank you professor @awesononso for this detailed lecture.

Hello @captain36,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

The spreads you provided do not have much of a difference. The illustration is not complete.

I still expected a few more original points on the topic.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit