Thank you @lenonmc21 for the lecture, I have learnt alot from your notes and I will appy them very well in my trading work, this is the solution to the assignment given after the lecture, thank you.

Theory (no images)

Define in your own words what is the Stochastic Oscillator?

A stochastic oscillator is a force marker that figures whether the price of a security is overbought or oversold when contrasted with price development over a predefined period.

The oscillator basically weighs up the latest price level as a level of the reach (most noteworthy high to least low) throughout a characterized timeframe.

The stochastic oscillator presents two moving lines that ‘oscillate’ between two horizontal lines. A solid white line called the %K and is dictated by a particular formula and a red dotted line called the %D.

Price is demonstrated to be 'overbought' when the two moving lines break over the upper horizontal line and 'oversold' once they break underneath the lower horizontal line.

The overbought line addresses price levels that fit into the top 80% of the new price range (high to low) over a characterized period – with the default time frame frequently being '14'. In like manner, the oversold line addresses price levels that fit into the base 20% of the new price range.

- PROS AND CONS OF STOCHASTIC

Pros

The signals for entry and exist are very clear and easy to identify.

Frequent appearance of signals depend on the time settings.

Adroitly straightforward.

Accessible on most charting packages.

Cons

Can deliver bogus signs when utilized erroneously.

In the event that exchanging against the pattern, costs can remain overbought or oversold for extensive stretches.

Explain and define all components of the Stochastic Oscillator (% k line,% D line + overbought and oversold limits).

%K line: This line addresses the stochastic itself, what's more, this would be the quick normal drawing ceaselessly, its supplement, which is the other moving normal, assists with producing purchase and/or sell signals by and large. It is calculated using this formula;

%K = 100(C - L14) / (H14 - L14)

where:

C = the instrument’s latest closing price

L14 = the instrument’s lowest price of the 14-day period

H14 = the instrument’s highest price of the 14-day period#D line :This is the second moving normal, which begins from a similar estimation of the Line% K, likewise, this would be the sluggish normal, which is drawn intermittently and is actually the most significant , in light of the fact that it is the one that gives us the exchanging signals, obviously related to the Line% K.

%D is a smoothed average of %K, to minimize whipsaws while remaining in the larger trend.'''%D = SMA(%K, periodD)The indicator works by zeroing in on the area of an instrument's end cost corresponding to the high-low scope of the cost over a set number of past periods. Ordinarily, 14 past periods are utilized. By contrasting the end cost with past value developments, the marker endeavors to anticipate value inversion focuses.

The stochastic pointer is a two-line marker that can be applied to any diagram. It varies somewhere in the range of 0 and 100. The indicator shows how the current value thinks about to the most elevated and least value levels over a foreordained past period. The past period normally comprises of 14 individual periods. For instance, on a week by week outline, this will be 14 weeks. On an hourly outline, this will be 14 hours.

At the point when the stochastic indicator is applied, a white line( colors might be different for another person but it is usually shown in the chart which color is for which line) will show up beneath the diagram. This white line is the %K line. There will likewise be a red line on the outline, which is the three-time frame moving normal of %K. This is alluded to as %D.

In an essential overbought/oversold system, merchants can utilize the stochastic indicator to recognize exchange exit and entry focuses.

- For the most part, merchants hope to put a purchase exchange when an instrument is oversold. A purchase signal is frequently given when the stochastic indicator has been under 20 and afterward transcends 20. Conversely, merchants hope to put a sell exchange when an instrument is overbought. A sell signal is frequently given when the stochastic marker has been over 80 and afterward falls under 80.

Be that as it may, overbought and oversold marks can be deceiving. An instrument will not really fall in cost since it is overbought. Additionally, an instrument will not naturally ascend in cost since it is oversold. Overbought and oversold essentially mean the cost is exchanging close to the top or lower part of the reach. These conditions can keep going for some time.

Briefly describe at least 2 ways to use the Stochastic Oscillator in a trade.

- The Stochastic Indicator is combined with other indicators in trading.

Stochastic Indicator is helpful to recognize space of significant worth on your diagram and to fill in as a passage trigger. The main approach is to consolidate the Stochastic with a moving average: Utilize a moving average to decide the pattern. Utilize the Stochastic to distinguish the space of significant worth in the pattern. Then, at that point use candlestick pattern to fill in as entry trigger.

- The Stochastic indicator is used to filter your trades.

Let's assume you need to go long on the 1-hour timespan. Then, at that point before you do as such you would need to check the every day time span and see where you are to go. You need to ensure the every day time span isn't in a downtrend with Stochastic overbought. Since that is the place where the market is probably going to head lower and you would prefer not to be long.

Define in your own words what is Parabolic Sar?

The parabolic SAR is a specialized indicator used to decide the price bearing of a resource, just as cause to notice when the price course is evolving. Some of the time known as the "stop and reversal system," the parabolic SAR was created by J. Welles Wilder Jr.

- On a chart, the indicator shows up as a progression of spots put either above or beneath the price bars. A spot underneath the price is considered to be a bullish sign. Then again, a spot over the price is utilized to outline that the bears are in charge and that the momentum is probably going to stay descending. At the point when the spots flip, it demonstrates that a possible shift in price bearing is in progress. For instance, if the dabs are over the price, when they flip underneath the price, it could flag a further ascent in price.

Explain in detail what the price must do for the Parabolic Sar to change from bullish to bearish direction and vice versa.

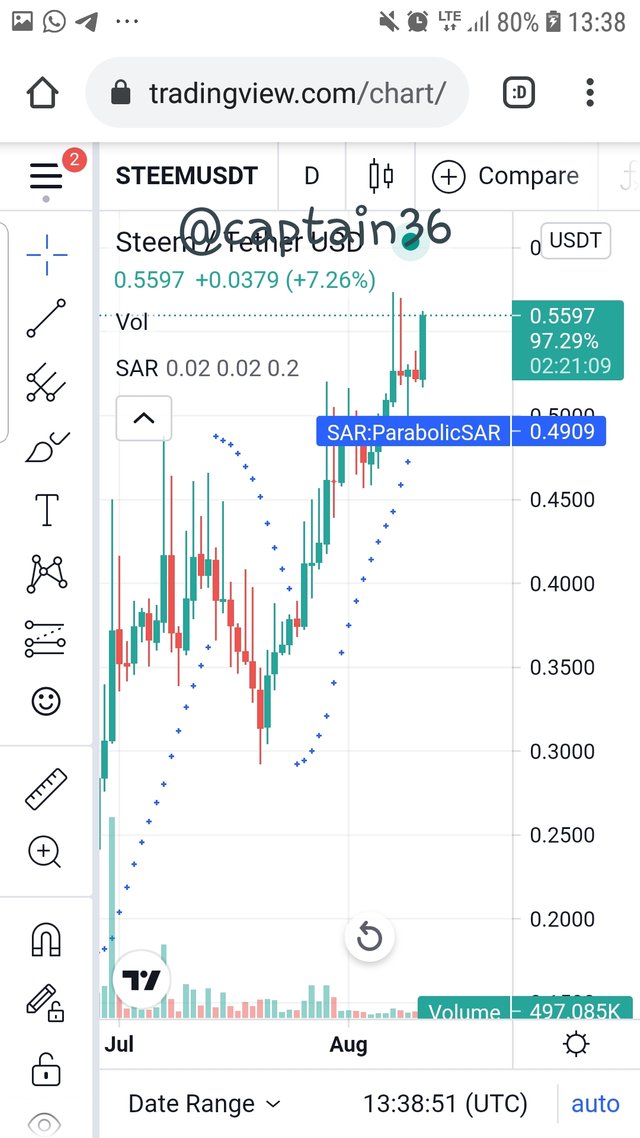

The Parabolic SAR is utilized to affirm the course of a trend and shows expected reversals in price development. The indicator shows up as a progression of dots, situated above and underneath the price graph. The situation of the dots comparative with the price demonstrates the course the price is moving in. On the off chance that the dots are underneath the price this is viewed as bullish and that the price will proceed in a vertical trend, recommending purchasing or going long. On the off chance that the dots are situated over the price this is considered bearish, recommending selling or going short.

Where the dots change position from beneath the price to over the price and from over the price to underneath the price, shows a reversal in price development and that an expected difference in trend has happened – giving a purchase signal when the dots moves beneath price and a sell signal when the dots moves above price.

The Parabolic SAR is extremely valuable for setting following stop misfortune orders. (In reality, SAR is another way to say "Stop And Reversal"). The stop misfortune is moved in accordance with the Parabolic SAR level, securing benefits.

Briefly describe at least 2 ways to use Parabolic Sar in a trade?

Distinguishing the trend. On the off chance that the curve is over the price, the market is in a bearish trend. In case it's beneath, a bullish trend.

Change of trend. On the off chance that the current dot shows up on the contrary side (the price crosses the curve), then, at that point a reversal or possibly a significant remedy ought not out of the ordinary. A Parabolic SAR buy signal happens when the parabola is over the price in a downtrend. Also, after that the primary dot is shaped beneath the bar. Likewise, a signal to sell will be the contrary circumstance, when the lower dots change to the upper focuses.

Practice (Only Use your own images)

It shows a step by step on how to add the Stochastic Oscillator to the chart (Indicating the% k Line and the% D Line, the overbought and oversold zone.

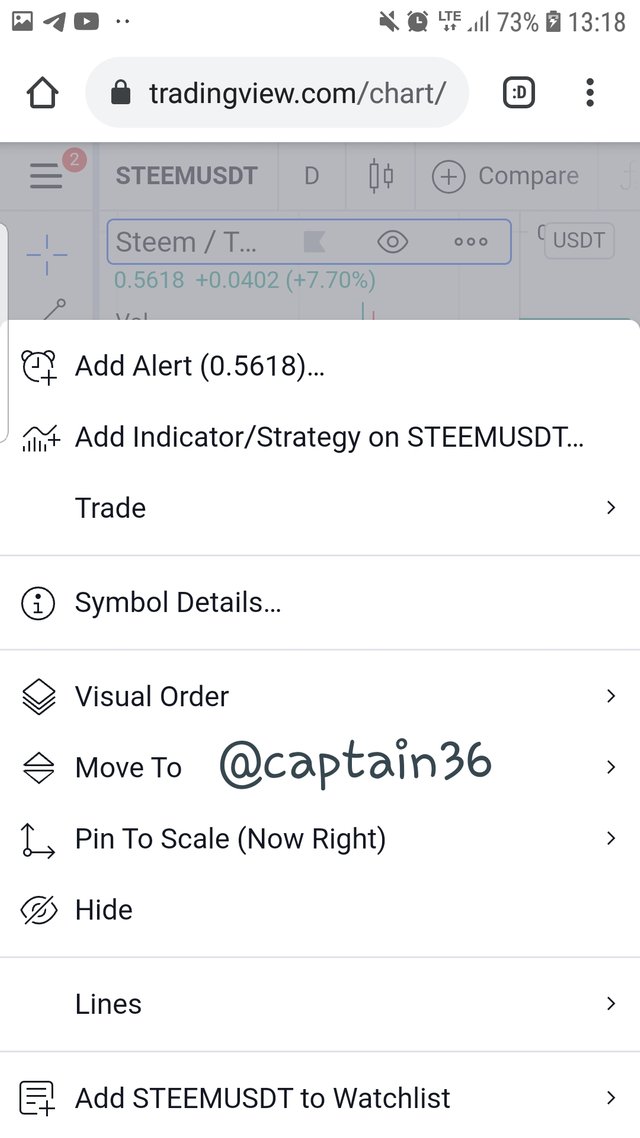

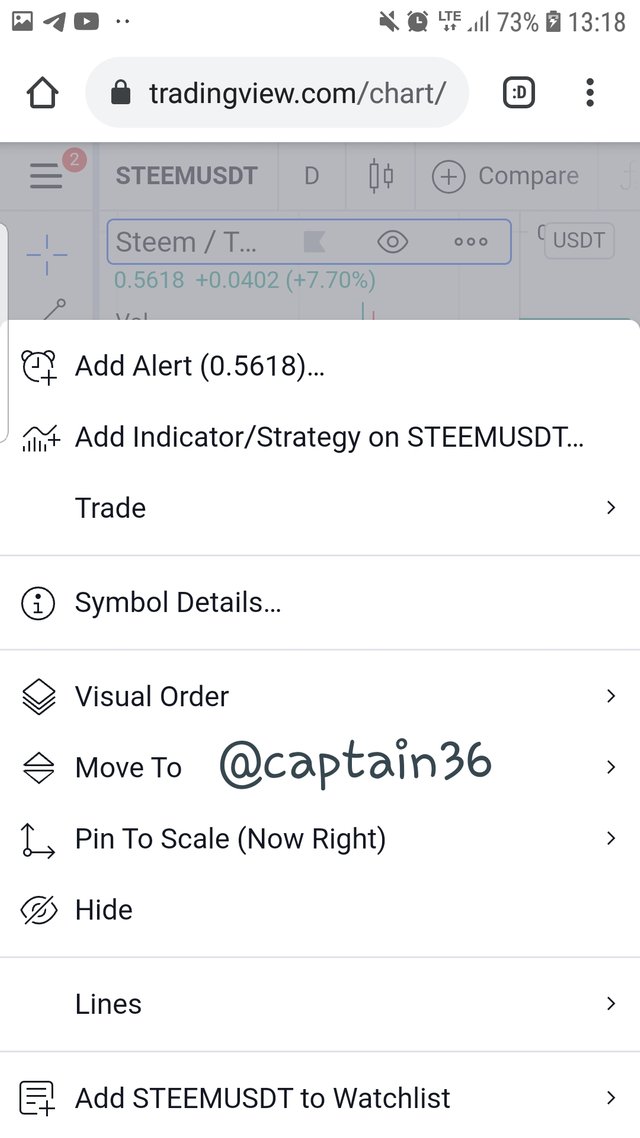

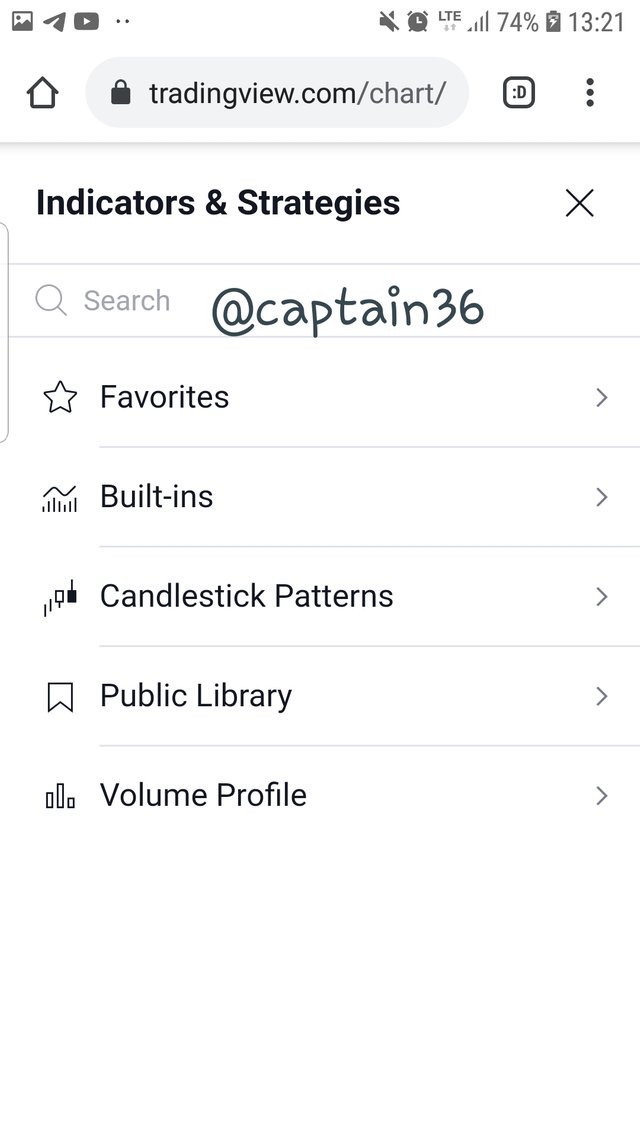

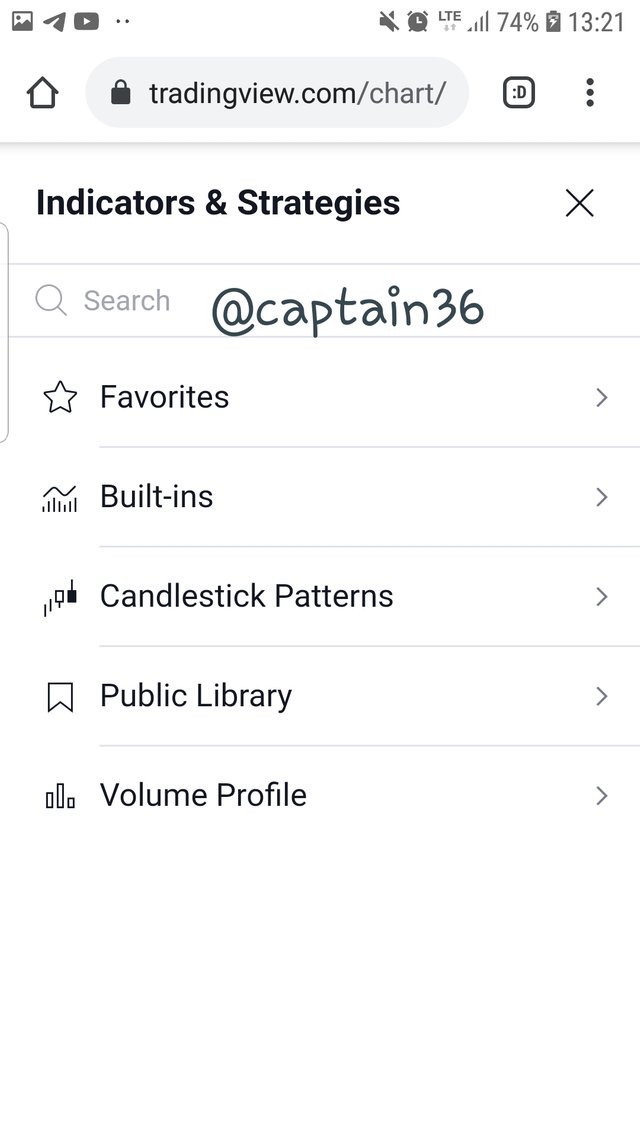

- Open trading view chart

- Click on the three dots in the circled area

- Click on add indicators from the pop up menu

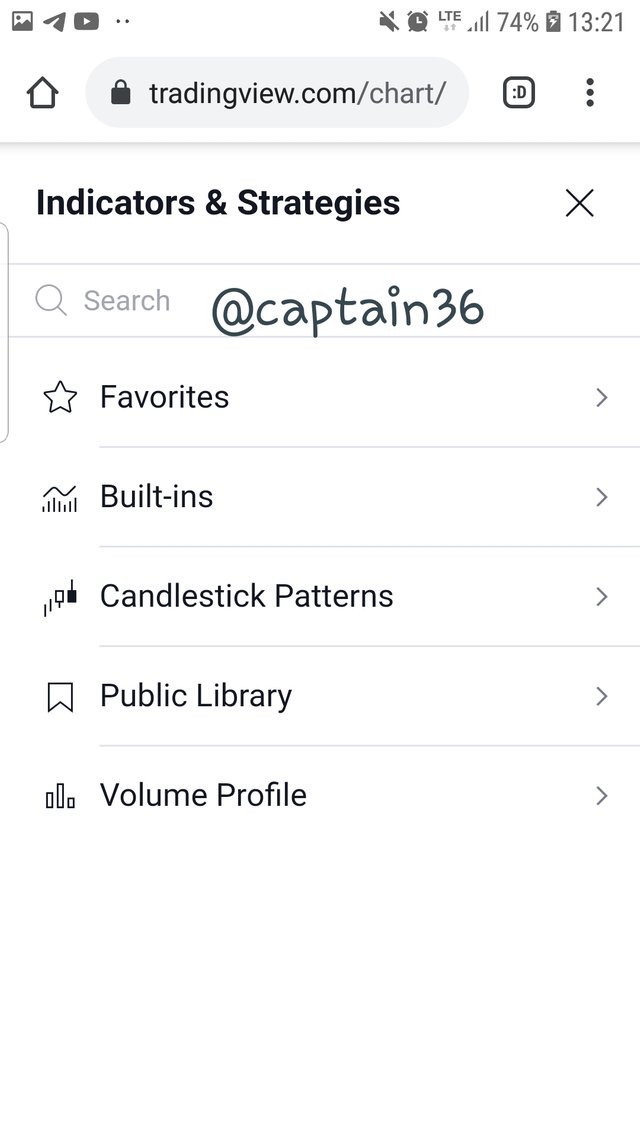

- Click on Built-in from the pop up menu

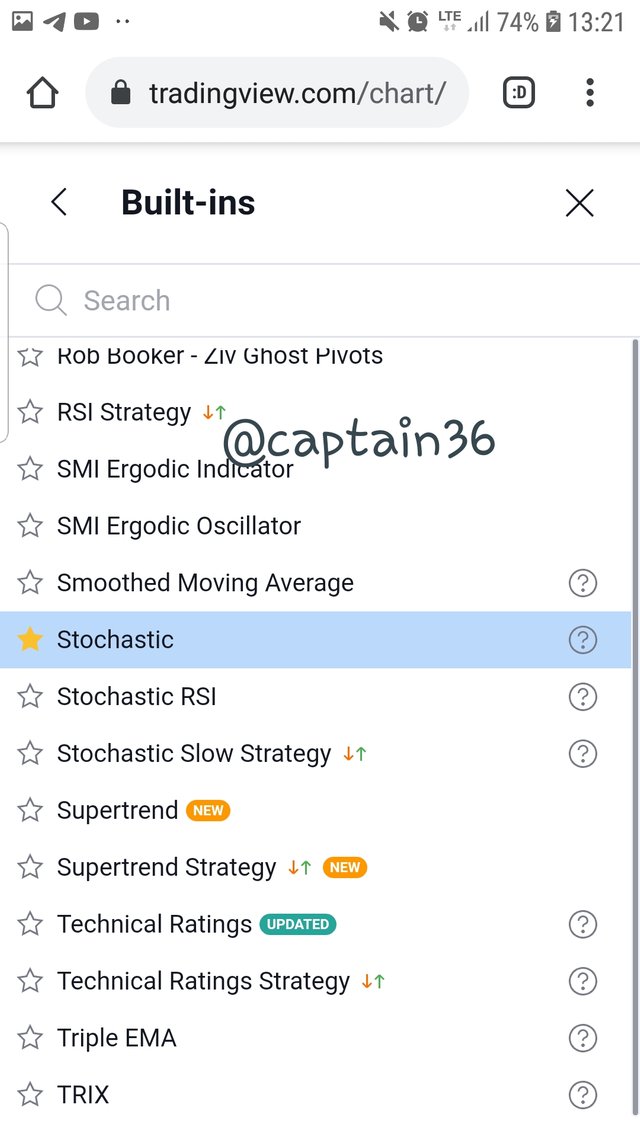

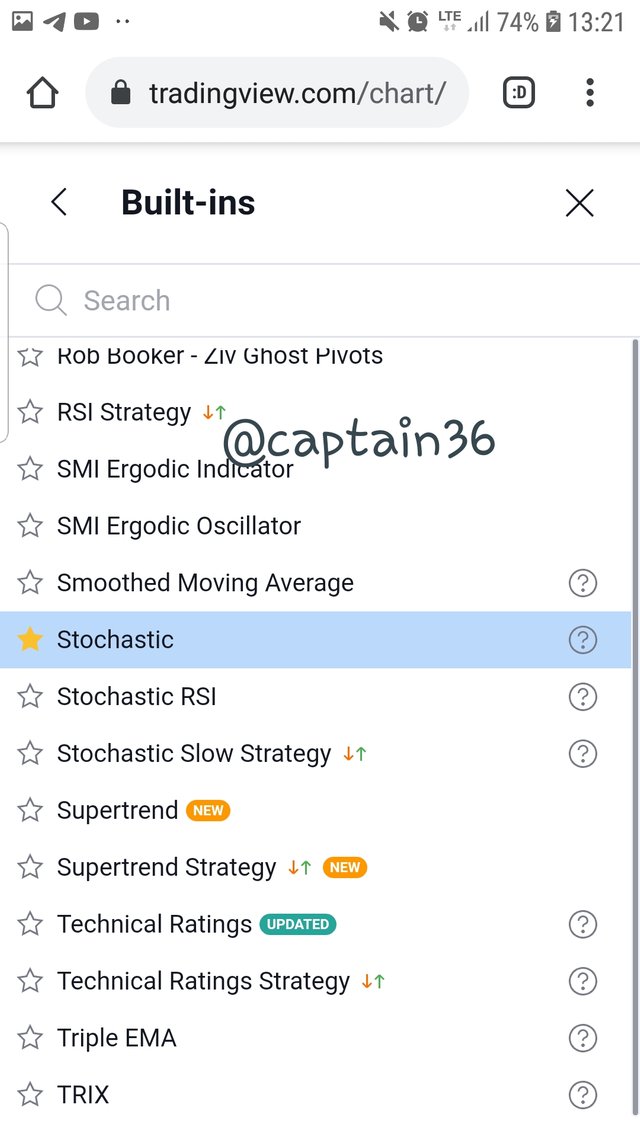

- Search and click on stochastic

- This is how it would appears, it show the %k line and the %D line in different colors.

- This also shows the overbought and oversold zones.

Show step by step how to add Parabolic Sar to the chart and how it looks in an uptrend and in a downtrend.

- Open trading view chart

Click on the three dots in the circled area

Click on add indicators from the pop up menu

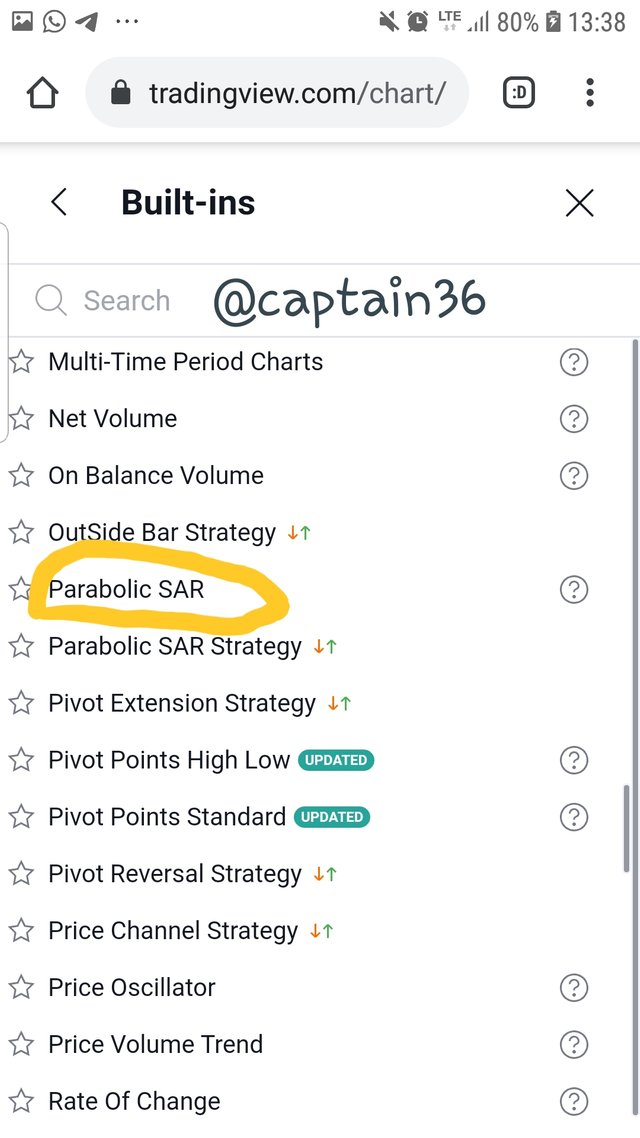

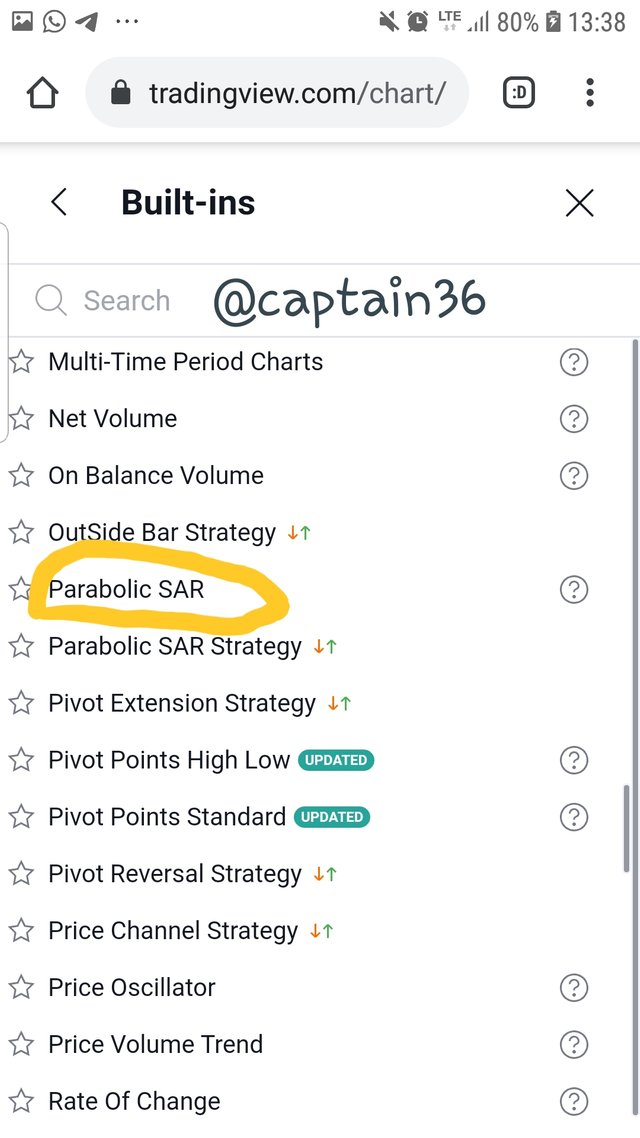

- Click on Built-in from the pop up menu

- Search and click on parabolic Sar

- This is how it appears

- This shows the uptread and downtrend zones

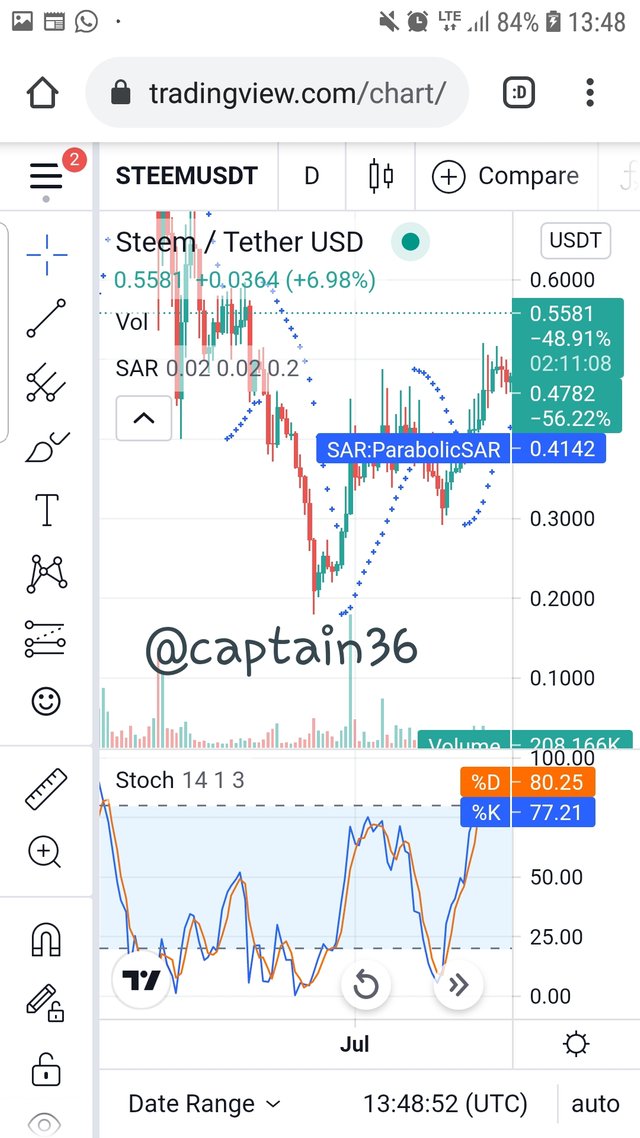

Add the two indicators (Stochastic Oscillator + Parabolic Sar) and simulate a trade in the same trading view, on how a trade would be taken.

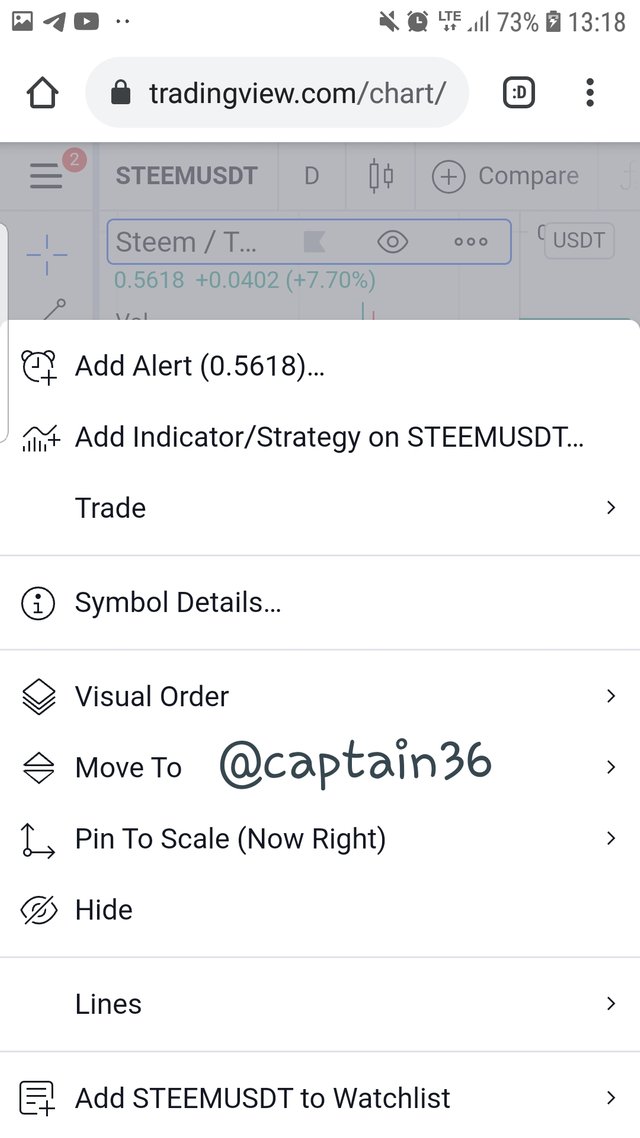

- Open trading view chart

- Click on the three dots in the circled area

- Click on add indicators from the pop up menu

- Click on Built-in from the pop up menu

- Search and click on parabolic Sar

- Search and click on stochastic

- This is how it appears

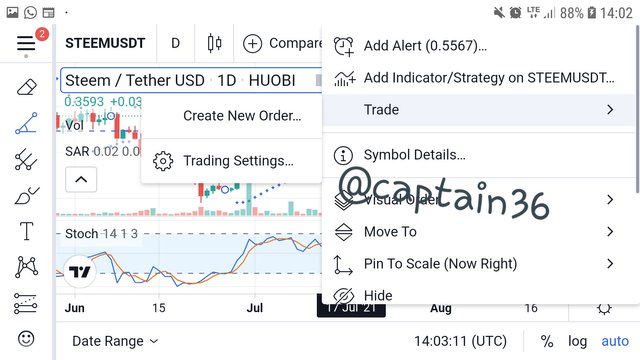

- Click on the three dots

- Select trade from the pop up menu

- Check your trading settings and click on create new order

- Order placed

conclusion

I would say that this is a very good life time experience and have found it very insightful, this is going to in a long way help me in my trading in cryptocurrency and I will make aure that I also teach other people what I have learnt. Thank you very munch