Hello everyone, this is week 3 of season 4 of the steemit crypto academy. This week’s lecture was on The part two of Bid Ask Spread. The class was delivered by professor @awesononso. I have decided to try my hands on the given task after carefully reading through the lecture.

1- Define the Order Book and explain its components with Screenshots from Binance.

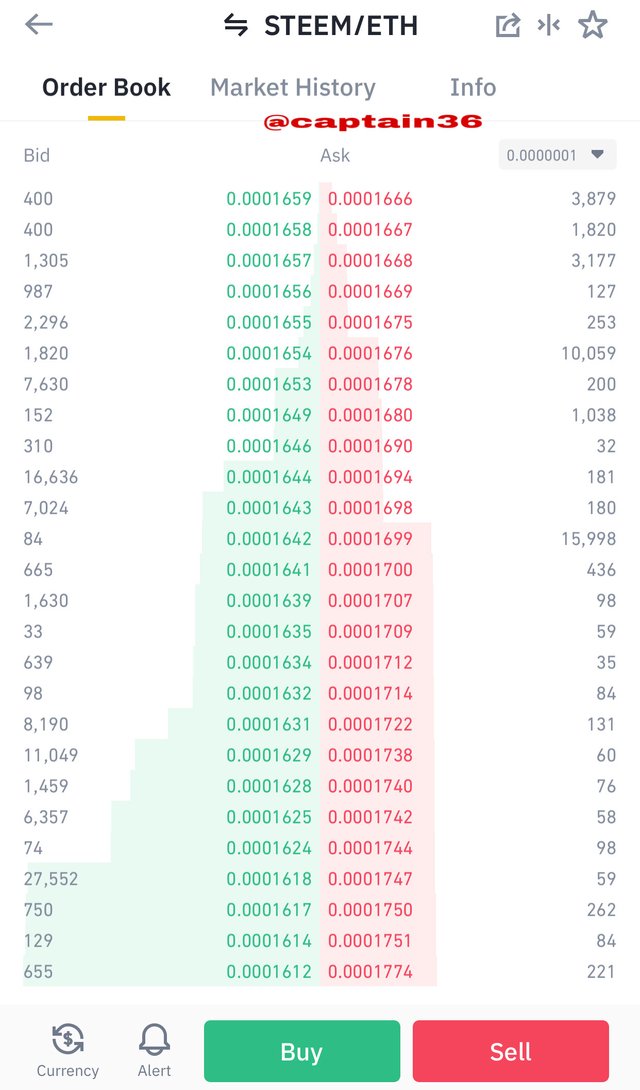

The current price, buy/sell orders, movements, instant transactions and the quantities of transactions can all be seen in the order book. The transactions that appear on the order book haven’t been executed yet. The execution will only be done if the price riches the target set by the seller/buyer. Below is a screenshot of an order book of STEEM/ETH.

Sell Orders: This is where the selling price of the asset is displayed. The amount of assets at this particular price can also be seen here as well as the sales amount.

Buy Orders: This is where the buy options can be seen. The buy prices of the asset can be seen here. The buy amount and the total asset that can be bought at that particular price can all be seen here.

How to access order book on Binance

open the Binance app or visit the Binance website.

open your verified account or better still you can access it without verification.

click on advanced settings at the top right of the trade section.

The order book will be displayed for you to see.

2- Who are Market Makers and Market Takers?

Market Makers:

Market makers are individuals that set their own price limits when selling or buying assets. These people will only buy at the price they set for the market. They buy at a price of their choice which they chose for the cryptocurrency they want to buy or sell. Basically the market makers set the price at their preferred limit and the market is executed when the price reaches that limit.

Market takers:

Market takers don’t set their own price limits when buying or selling an asset. They buy the asset at the current price in the market and they act as if there’s no other option apart from the current price. The exchange price available at any time is what they follow. Market takers take whatever exchange rate available and execute their markets.

3- What is a Market Order and a Limit Order?

Market order

Market order is the type of orders the market takers use. In this type of order, the trader cannot set a price to be executed. The trader executes at the current price of the asset at that particular period. This type of order does not need any time to be executed as it is done immediately after been placed. No limits are set for the market as the trader follows the current price to buy/sell the asset.

Limit Order

This is also another order type in the cryptocurrency market. This is type of order used by market makers discussed above. The orders that are seen in the order book are executed with limit orders. In this type of order, the buyer or seller sets the limits at prices of his choice and they are executed at his own price of choice. The trader can also set the quantity of assets he wants the price to be executed.

4- Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

As we discussed earlier, the market makers set their own price and trade at that price so the market makers are directly related to limit orders. The main objective of limit orders is to sell or buy at your own preferred price and that’s exactly what the market makers do.

The market takers and market order are also directly related because the traders sell or buy assets at the current price but not the price of their choice. The market order does not involve setting of prices and that’s how market takers execute their transactions.

I have made some observations on liquidity with regard to market makers and market takers. The orders given by market makers helps to increase liquidity in the market.

Market takers on the order hand follows the current limits of the market and this helps to reduce liquidity in the market. The limit order that is pending is filled when the market takers execute their prices. This stabilizes the market and buying/selling goes on smoothly. The transactions of the market takers makes up for the space in the transaction of market makers which makes overall transactions move smoothly.

5-Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

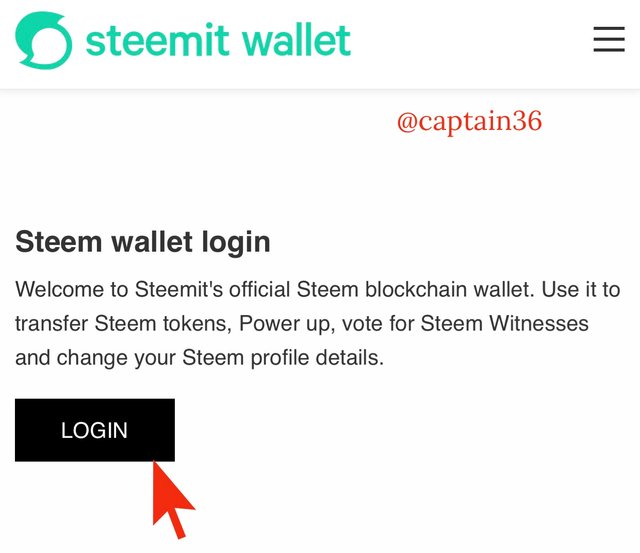

To perform a transaction using the lowest ask, visit the https://steemitwallet.com/ and then login.

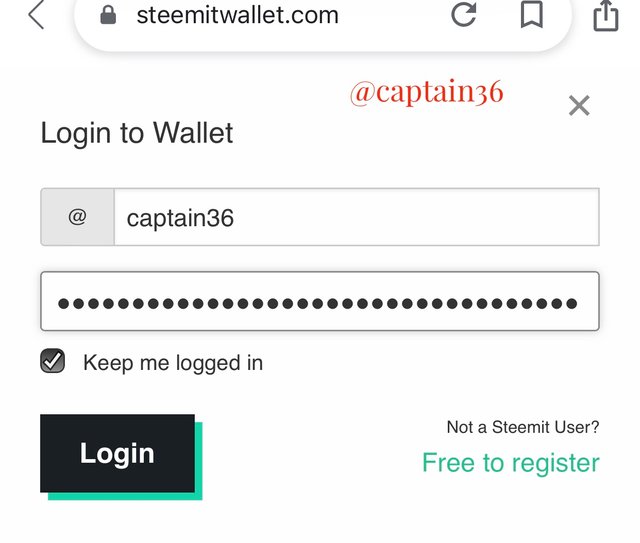

Then log in by filling your username and a private key.

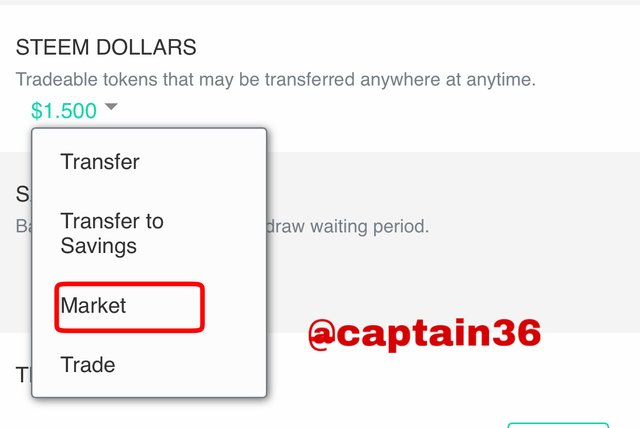

Then click on amount of Steem Dollars and then click on market.

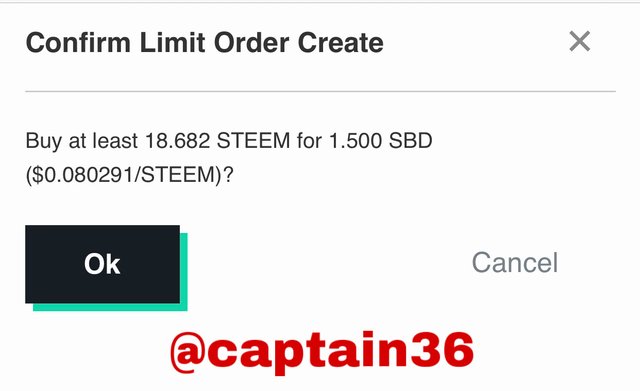

I went to the Buy Steem section and entered 1.5 SBD in the total section. I used the lowest price given as shown below.

I then confirm the transaction after executing the buy option.

My transaction was executed at the same lowest limit that was given because no changes occurred during the period of execution.

b)

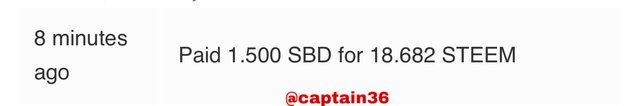

In this part, I changed the lowest ask and performed the transaction.

You can confirm the transaction.

When I set my own price, the order was listed in the open orders section. This is because I used a limit order and not a market order and for that market my order will be executed when it reaches the limit I set.

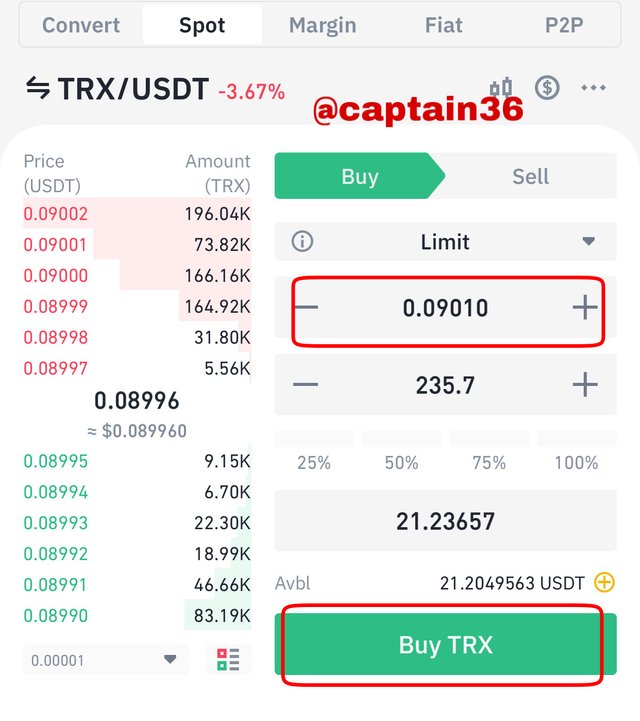

6- Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

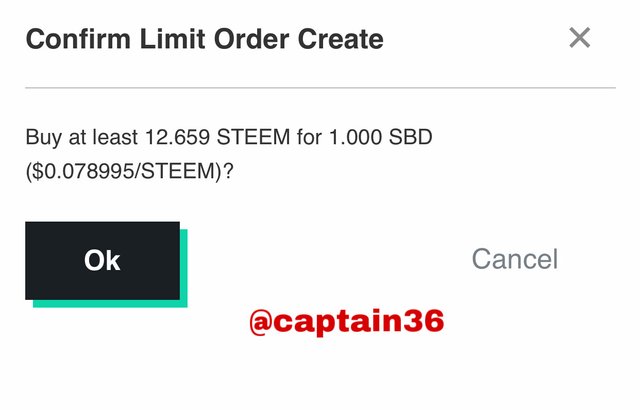

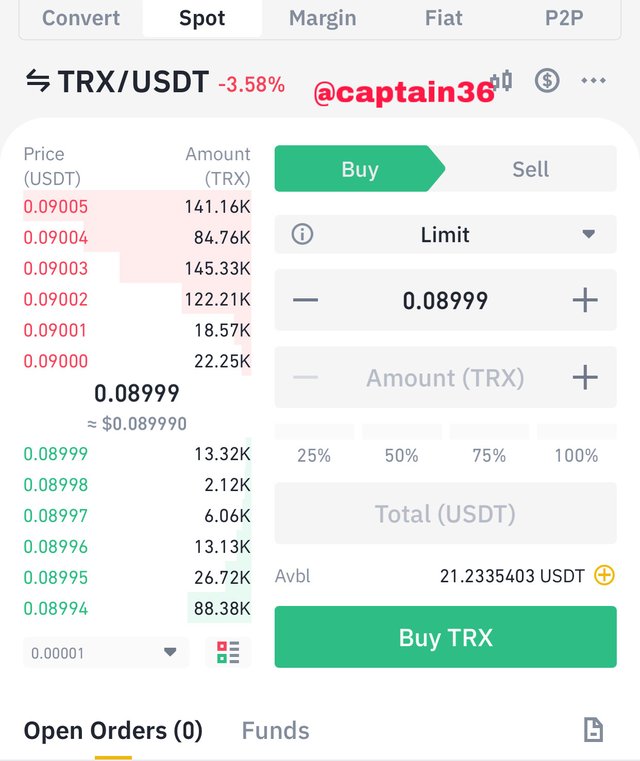

First of all login to the Binance app or the Binance website. In my case I decided to use the app. Then choose spot trade which is found below after opening the app. Then we can select a pair of TRX/USDT and place a buy limit order.

After setting my limit order, I set the price and click on buy TRX.

The transaction was executed at the price I set.

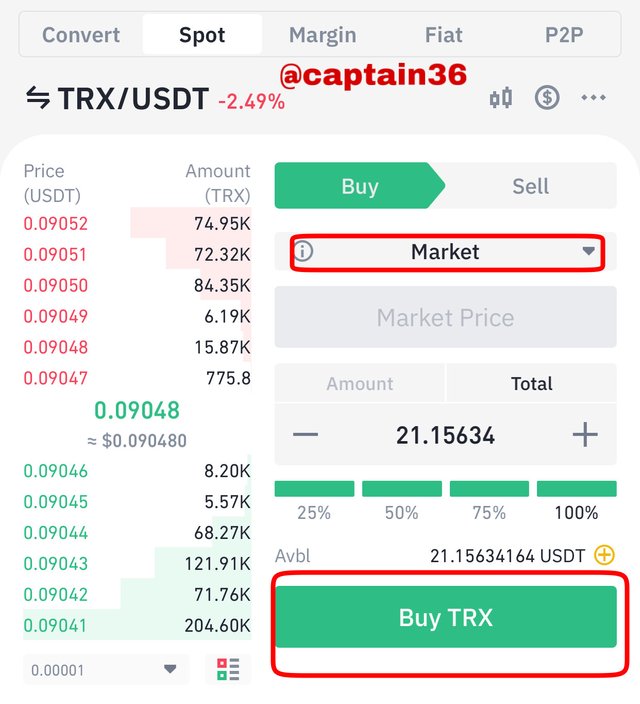

7- Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

I go to spot trade and follow the same procedure as the previous question but this time I use market order. Then I click on Buy TRX.

The market order was placed and the TRX was bought. This is shown below.

This execution was done immediately after I placed the market order. In this scenario I acted as a market taker and for that matter liquidity was reduced in this case.

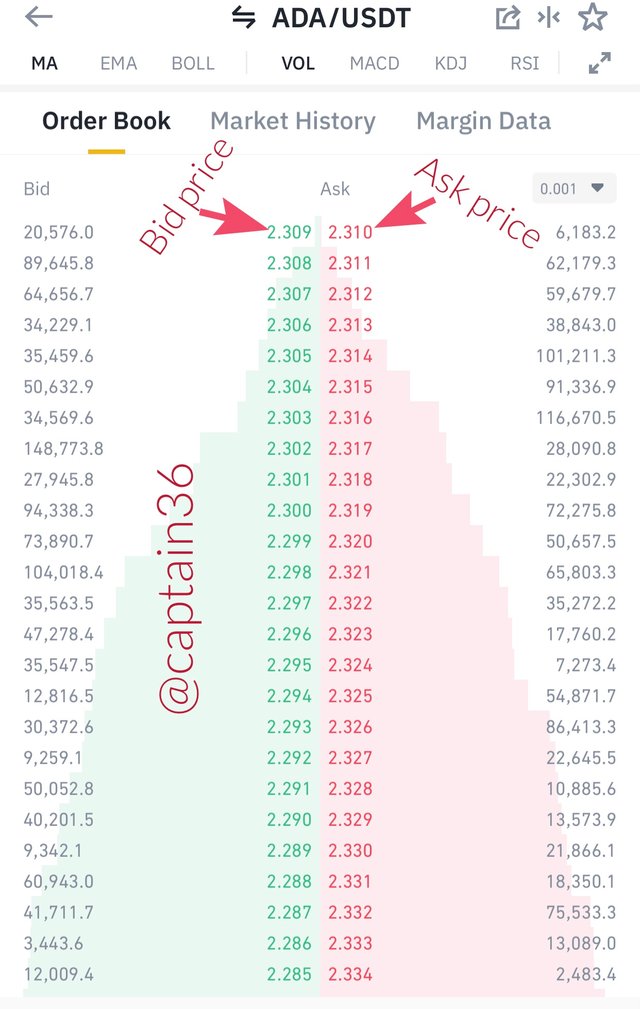

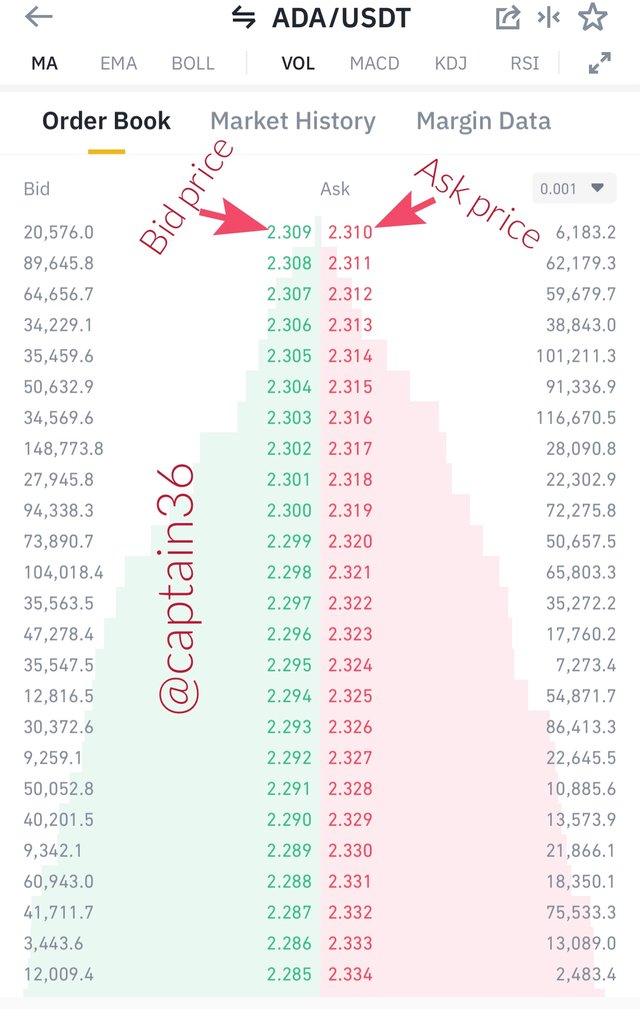

8-Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

a)

Bid-Ask Spread = Ask price - Bid price

Bid-Ask Spread = 2.310 - 2.309

Bid-Ask Spread = 0.001 USDT

b)

Mid-Market price = (Bid price + Ask price)/2

Mid-Market price = ( 2.309 + 2.310)/2

Mid-Market price = 2.309 USDT

Orders placed by traders are recorded in the order book and they keep on updating as new orders come in to fill the old executed ones. This makes us appreciate the trend of the market and also highlights most of the phenomena we discussed in this lesson.

Thank you once again professor @awesononso for this detailed lecture.