Hello everyone and welcome to this week’s lecture. It’s another week and our Professor has explained about Decentralised exchange platforms. It’s exciting learning new ideas and concepts which will help shape our thoughts and minds about Decentralised financial exchange platforms. When we talk of Decentralized systems on crypto exchange, we mean that transactions are done by individuals without the interference of a central authority. That is on these systems, you can stake, buy, sell, and swap your assets without interruption from a third party. Today, I am going to explore and explain some of the exchange platforms such as pancakeSwap, and metamask, and more.

Question no 1:

What is Liquidity in PancakeSwap Explain with examples ?and add Liquidity in PancakeSwap and explain all the steps with screenshot.(explain in your own words)

To begin with, I am going to first give an overview of what liquidity is all about. In a general note, liquidity in crypto world refers to assets that can easily be used to exchange with another crypto assets of your choice. It can equally be exchanged with a fiat currency. With regards to pancakeSwap, liquidity refers to the coins in liquidity pool which can be used to carried out transactions using “Automated Market Maker” (AMM). The AMM is used to determine prices in the pool.

The liquidity pool in pancakeSwap helps to utilised assets provided in the pool by users. Users who provided liquidity in the pool have rewards earned from exchange fees on the pancakeSwap. So, Liquidity in PancakeSwap is a decentralised system whereby prices are quoted automatically, and permit users to transact easily, and earn rewards from the transactions.

Examples

In order to do Liquidity in PancakeSwap, the first thing to note is that it is done in pairs, meaning that users are required to choose 2 assets, and then supply to the liquidity pool. This is set on a percentage of 50/ 50. That is in case I intended to transact, on the liquidity pool using BUSD/CAKE pairs, i need to provide liquidity for instance worth $5 each. This corresponds to the 50%/50% set up. This applies to any other pairs you decided to provide liquidity for on the pool.

How to add liquidity in PancakeSwap

I am going to show the various steps to be used to add liquidity on PancakeSwap. I am using a virtual account as I do not have coins in my wallet.

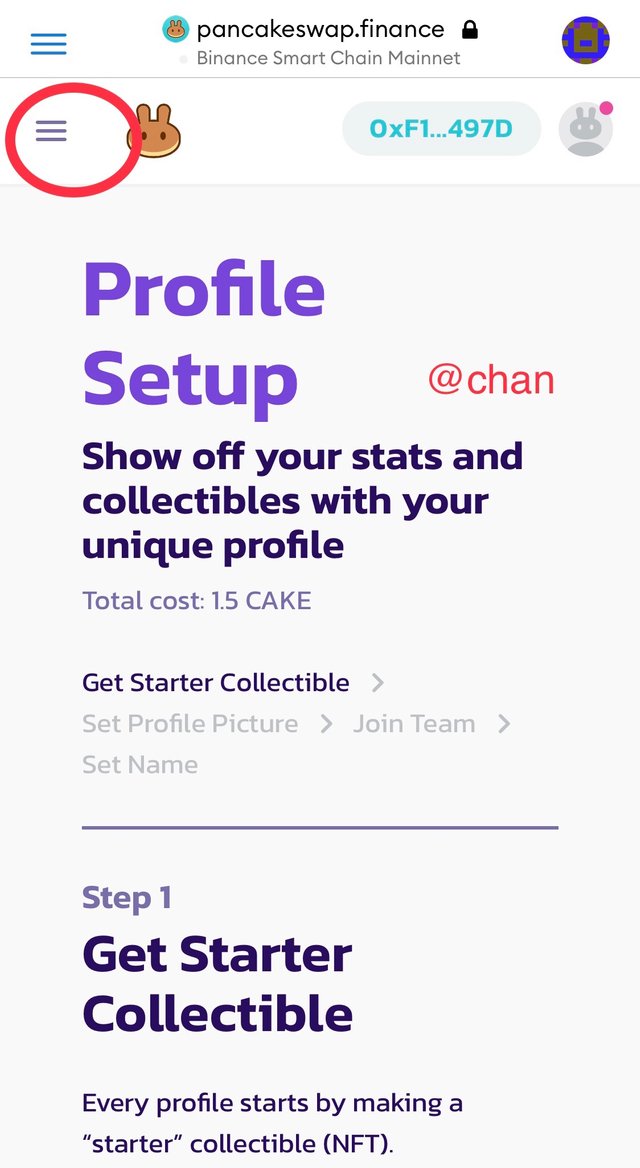

Step 1: I login to my PancakeSwap wallet, click on menu bar at the top left of the screen’ and click on trade. Some drop downs will appear on the liquidity page, in order to select the pairs.

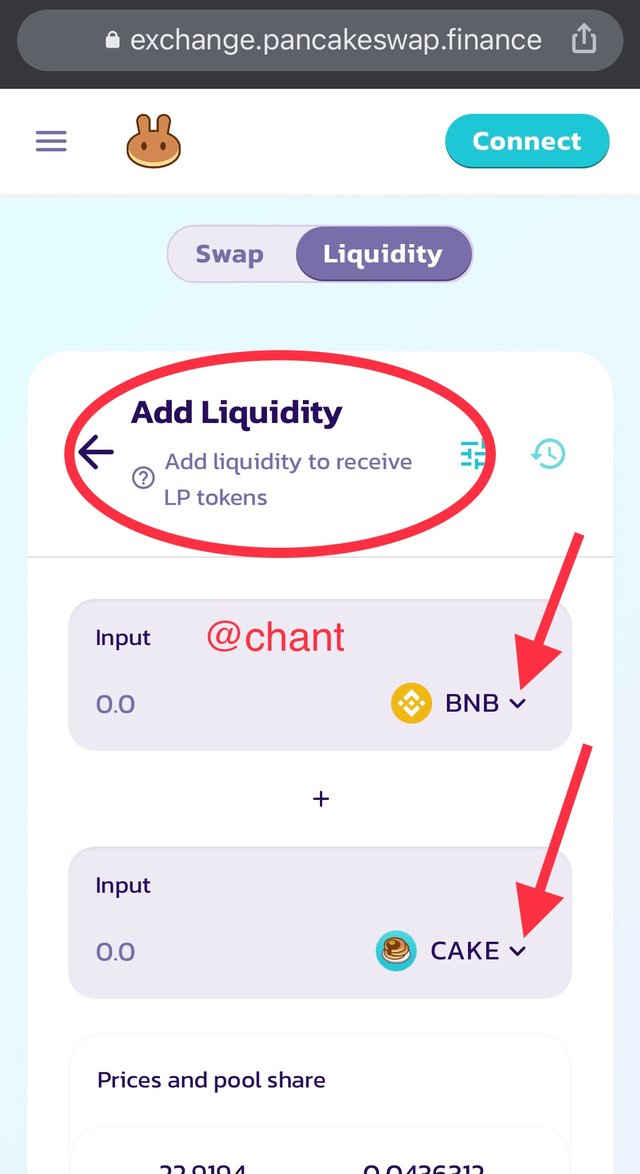

Step 2: Click on “add liquidity” icon, a new interface opens, then select the two pairs of coins to be added on the liquidity pool as seen below. Here I’m going to select BNB/CAKE and placed on a percentage of 50/50.

Step 3: Proceed and approved the transaction.

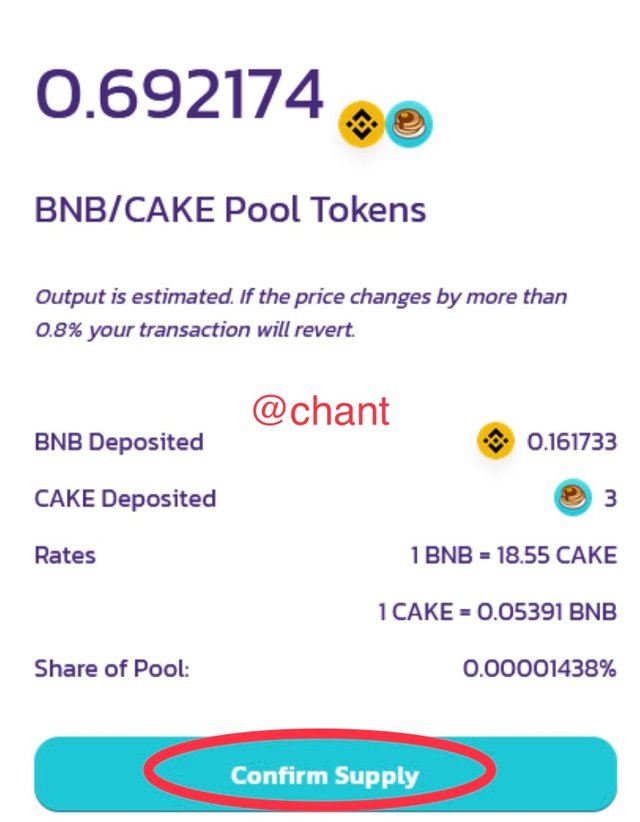

Step 4: Click on the “supply” icon in order to provide liquidity for the pairs selected.

Step 5: Once you click the supply icon, a new page opens, then click on the “confirm supply”. Here the transaction is completed.

Question no 2:

How to connect Binance exchange account with Binance smart chain or trust wallet. Explain all the steps through screenshot. And transfer any coin from Binance exchange to Binance smart chain.

Here I am going to demonstrate a step by step process to connect Binance exchange with Binance smart chain wallet.

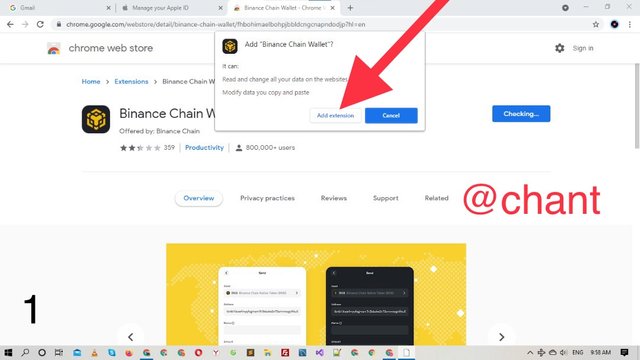

Step 1: Open google chrome and search binance smart chain extension, and add to your desktop. Create an account in case you don’t yet have one or login of you already have an account.

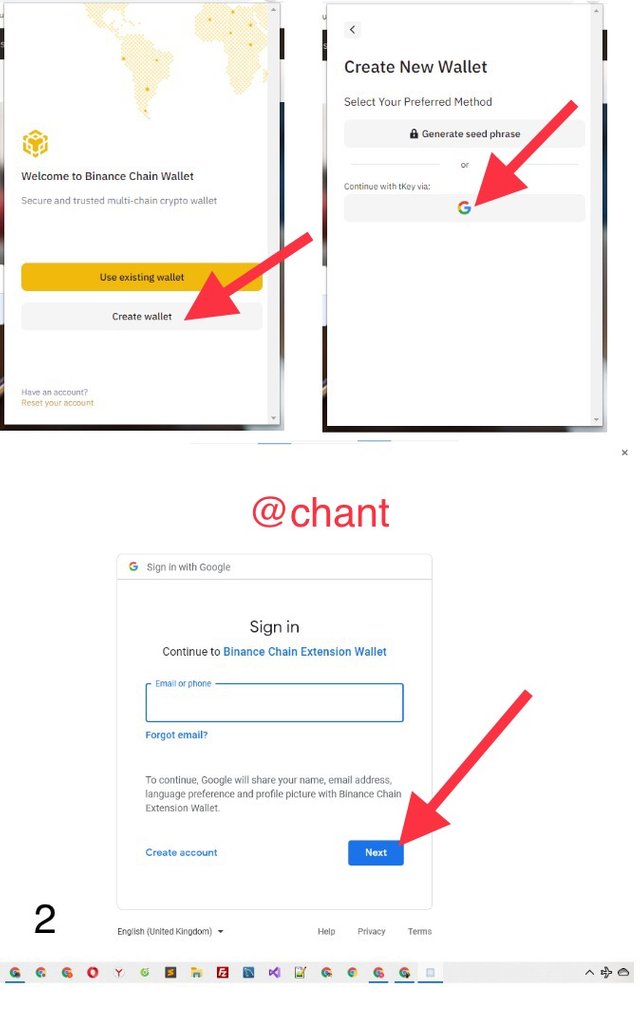

Step 2: Since I do not have an account, I’m going to create an account using google account. So I’m going to click on “create wallet”, then continue with my google account, input my details and click on “next” as seen below.

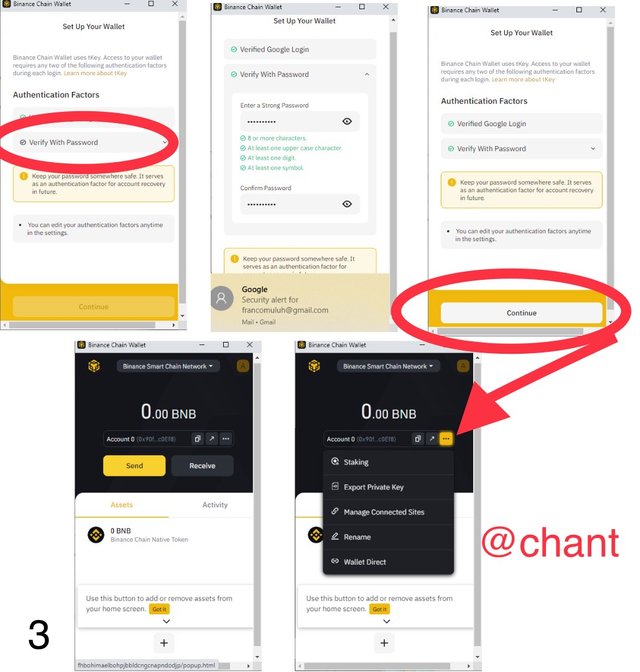

Step 3: Verify the account using a password and then click on “continue”. This takes you to the Binacnce chain wallet. Then click on the three dots and select wallet direct as indicated on the screenshots below.

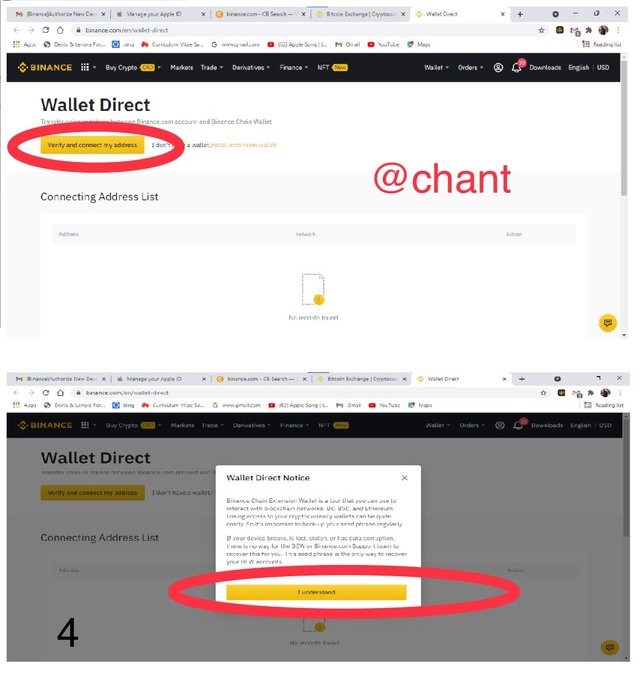

Step 4: Verify your account using your address. Once this is done, click on “I understand” to show that you understood the notice to enable you proceed.

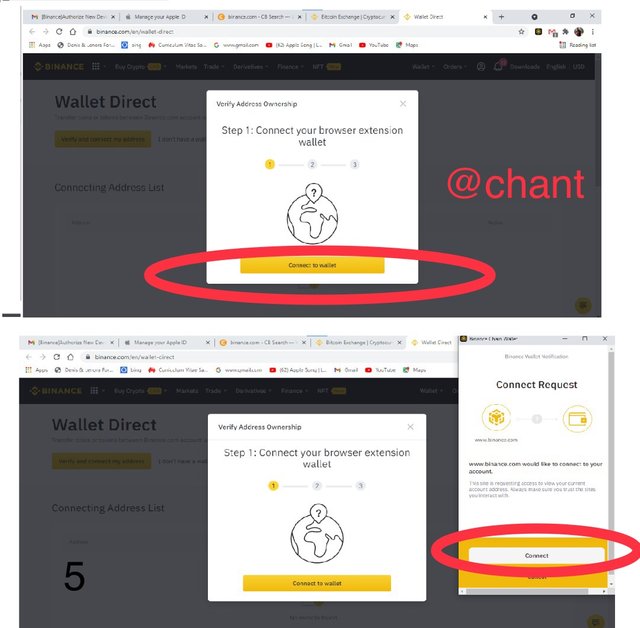

Step 5: Once you click on “I understand”, a new page opens where you will have to connect your browser extension wallet. Click on “connect to wallet” and then click “connect”.

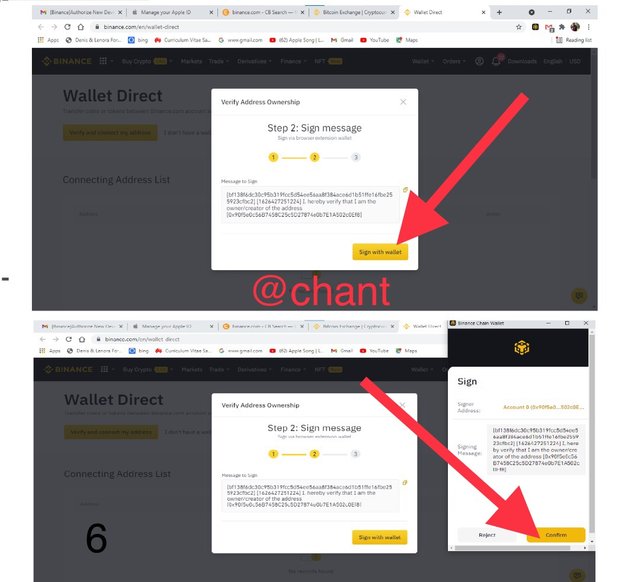

Step 6: I need to verify my account address ownership, after I click on connect as seen on the screenshot above, it takes me to a new page, click on “sign with wallet”, and then click on confirm as seen below.

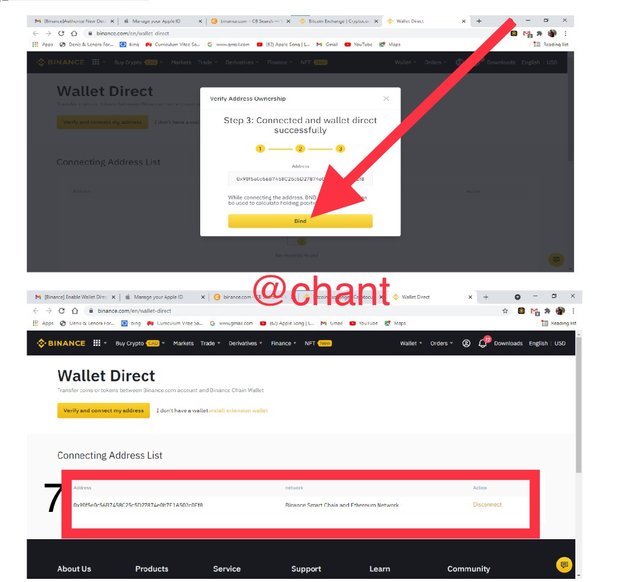

Step 7: Proceed to the next interface and click on “bind”. Once this is initiated, the binance exchange connect to your binance smart chain wallet.

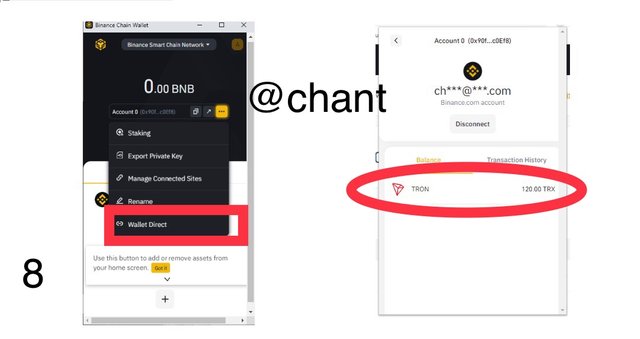

Step 8: click on “wallet direct” in order to see your exchange balance.

Transfer from Binance Exchange to Binance Smart Chain wallet

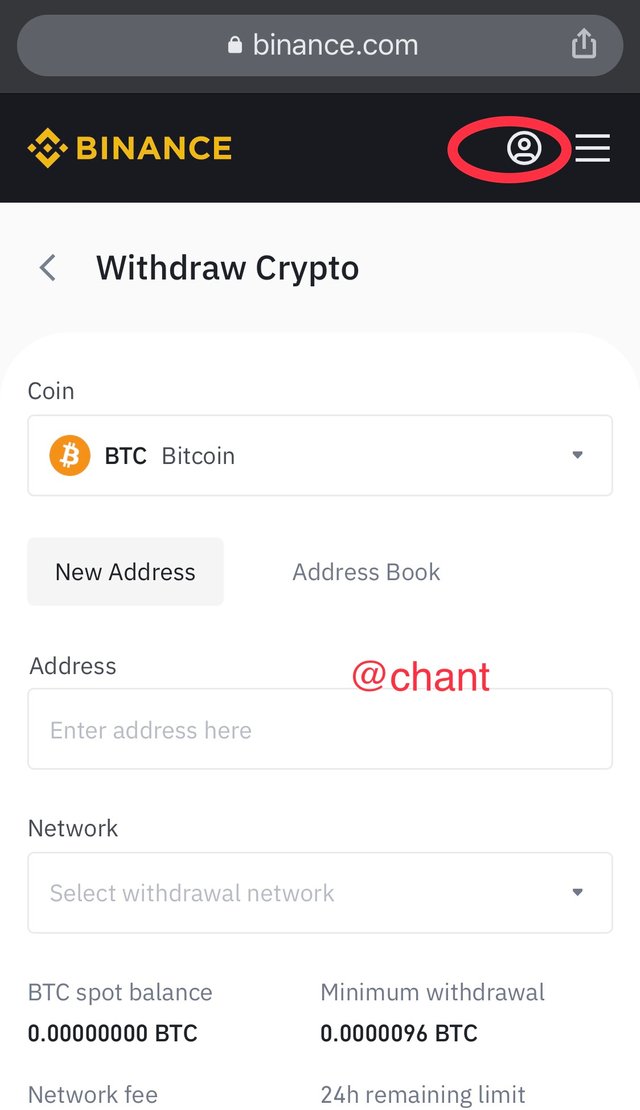

Step 1: Sign into your binance exchange wallet, and click on your profile at the top right hand of the screen beside the menu bar.

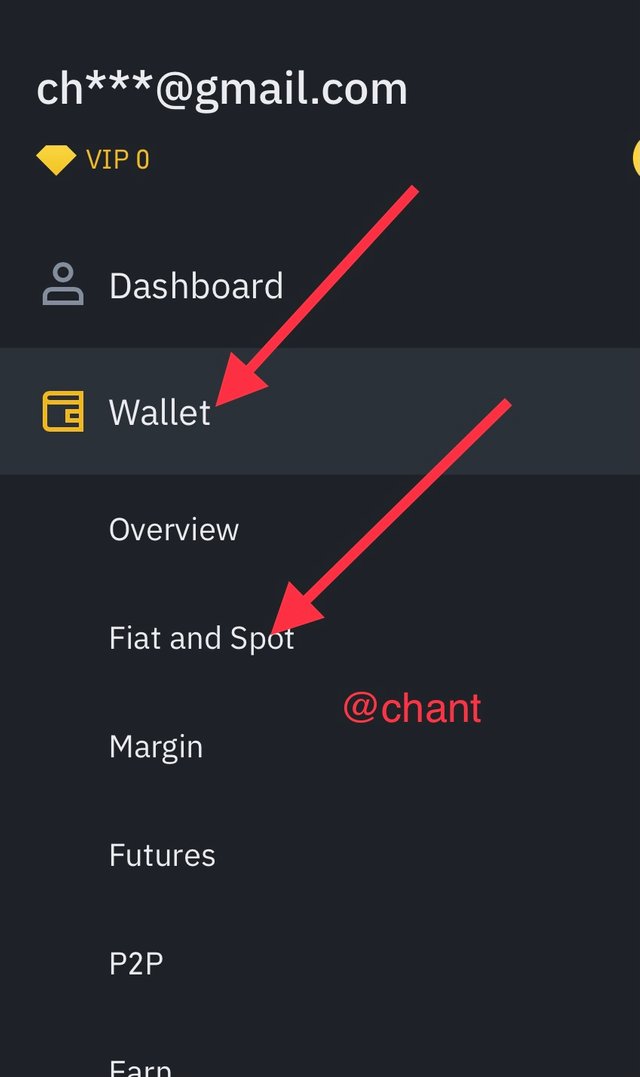

Step 2: Click on “wallet”, a drop down appears, then click on “fiat and spot”. This now takes you to the withdrawal page.

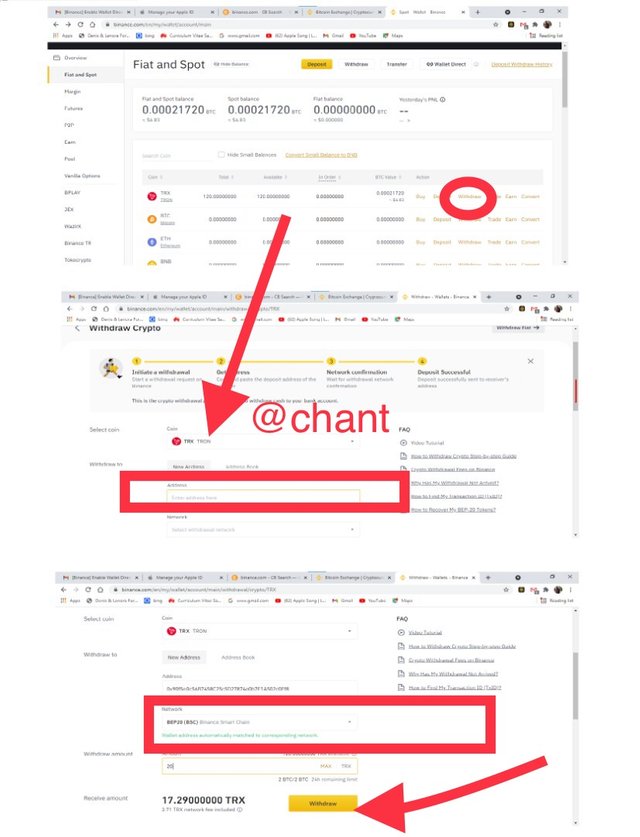

Step 3: On the new page input the address of the smart chain, and input the amount of coin to be withdrawn. Proceed and click on “withdraw”.

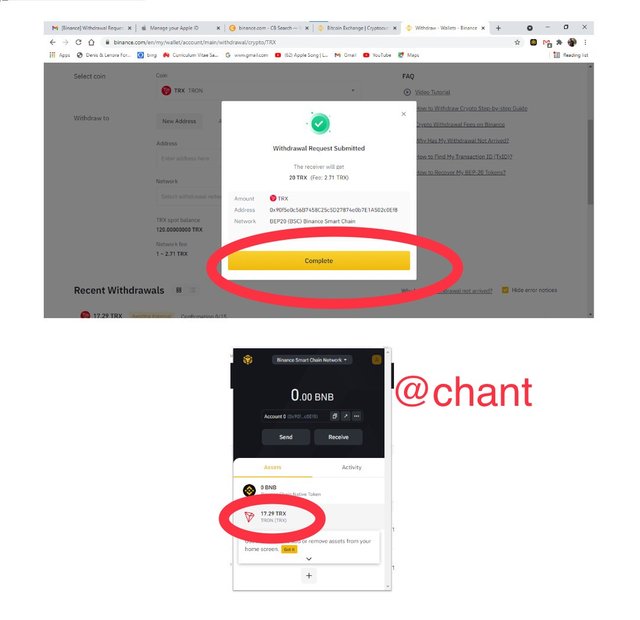

Step 4: Click on “complete” then, the transaction is submitted. A new page will show the details of the transaction completed as seen below.

NB: In order to see the transaction on “Smart Chain, you have to open Binance Smart Chain extension. Then click on “activities” in order to see the transaction.

Question no 3:

What is the difference between Trust Wallet and Metamask and which of them is better and why? Explain in your own words.

These are crypto wallets which users are permitted to buy/sell, stake, provide liquidity, and store assets etc. One thing to note with the wallets is that they are decentralised wallets. Meaning that users are in full control of their assets. There is no third party interference in to users transactions.

Differences of Trust Wallet and Metamask

Trust Wallet is connected to Binance Smart Chain. While Metamask is connected to Ethereum blockchain.

Trust Wallet can be found only on mobile device. While Metamask can be accessible both on mobile, and desktop/PC devices by using wallet's extension.

In terms of transaction fee, Trust wallet is more cheaper as compared to other exchange wallets. Metamask transaction fee is high due to the fact that the gas fee used by Ethereum technology is high.

With Trust wallet, there is no quick customised token to enable users add tokens easily except you search before adding the token. With metamask wallet, there exist customised token button on the platform which enable users to add tokens easily.

Transactions speed on Trust Wallet is faster. While transactions speed on Metasmask is slow as compared to Trust Wallet.

Which one is better and Why? - Trust Wallet or Metamask

Transaction Fees: In terms of transaction fee, Trust wallet transactions fee is cost effective, making one to maximise profits. Thus, a good reason for one to go with Trust Wallet than MetaMask.

Transaction Speed: Trust wallet transactions speed are faster unlike MetaMask wallet transactions. The fact that Trust wallet transaction speed is faster is a reason for me to take it over MetaMask.

In terms of Compatibility: With Trust Wallet, it can only be used with mobile devices such as Android and IOS. But Metamask wallet is supported by both mobile and desktop devices. In this regard, a user will choose MetaMask because it is compatible éborgnas mobile and desktop devices.

Question no 4:

What is meant by PancakeSwap and Uniswap?

And what is the main difference between them?

Explain the different futures of both.

Which of these exchanges is better and why? Explain in your own words.

Understanding PancakeSwap and Uniswap

PancakeSwap is a decentralised exchange platform which gives users the opportunity to trade their assets by doing coin swap with other coins of their choice. Furthermore, PancakeSwap is located on the Binance Smart Chain network. It allow users to carryout transactions without the interference of third parties. The prices on PancakeSwap is determined through the AMM system. This permits users to do their transactions independently. This is done using smart contract codes written purposely for that.

With regards to Uniswap, it is equally a decentralised exchange platform which permits its users to stake, buy/sell, and swap assets at their convenience without being interrupted or inferred by a third party. Unlike pancakeSwap that is stationed on Binance Smart Chain network, Uniswap is stationed on the Ethereum blockchain network. Here the ERC20 tokens can be swapped with other tokens of your choice through the liquidity pool. The only thing needed by users to initiate the process is to connect supported wallet to Uniswap, and swap any asset of their choice. Worthy of note is the fact that AMM is equally used to quote prices.

In sum, Both PancakeSwap and Uniswap are decentralised exchanges platforms used purposely to transact assets, and uses AMM to determined prices for smooth trading.

Contrast PancakeSwap and Uniswap

- PancakeSwap is located on the Binance Smart Chain. Uniswap is located on the Ethereum blockchain network.

- In terms of Exchange fees on PancakeSwap, it is cost effective. This means that the fees are low and makes it cheaper to transact. On Uniswap, the transaction fees are costly when compared to pancakeSwap.

- The number of tokens available for users to trade on Uniswap is small. Meanwhile, on PancakeSwap, there are good number of tokens available for trading.

- On pancakeSwap, there is opportunity for users to make income through Yield farming While Uniswap gives users the opportunity to earn passive income through the liquidity pool by adding liquidity.

Features of PancakeSwap

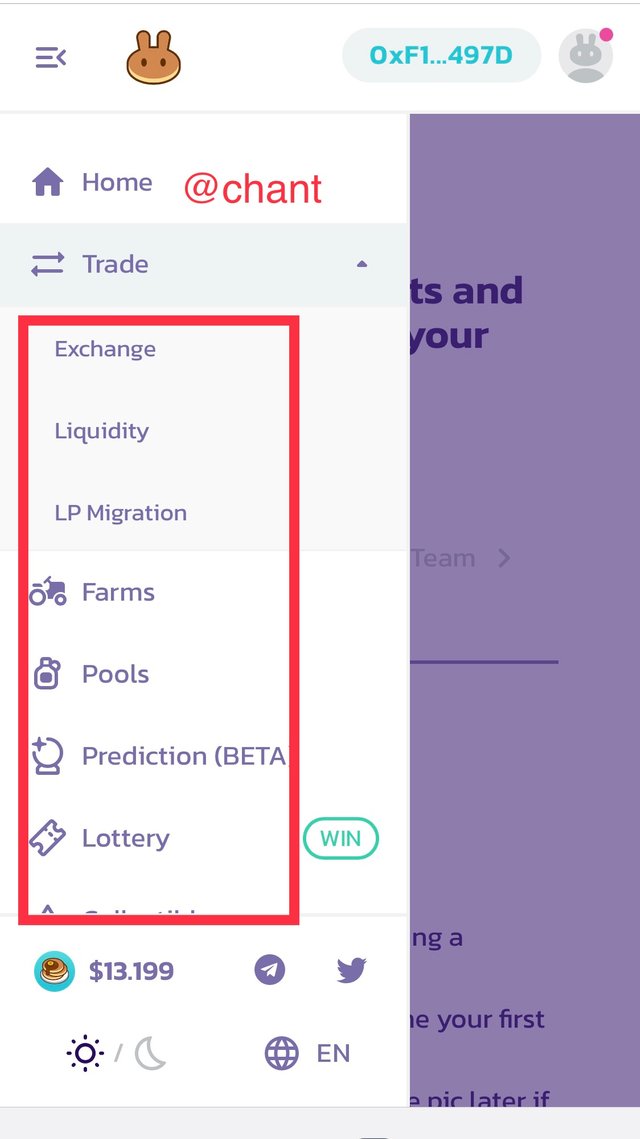

Core features of PancakeSwap include; Trade, Farms, Pools, Prediction, Lottery, NFT, Teams etc. These features will be discussed below.

Exchange: This section permits users to swap their assets to other coins of their choice.

Liquidity: This feature permits its users to provide liquidity. Users who provide liquidity are then called “liquidity providers” . The liquidity providers earn passive income from transaction fees.

Farms: Here users can stake their assets and in the process earn other assets over a given period of time.

Pool: Here rather than keeping assets without earning, users can use this feature to stake using a pool and earn passive income.

Prediction: With regards to this feature, users can used it to predict prices of assets on PancakeSwap. If it works correctly, then it favours the user to earn more coins.

Lottery: It’s another feature that allow users to earn extra coins by buying a lottery ticket. Once selected for the lottery, you have the opportunity to earn extra coins.

NFT: Known in full as Non fungible tokens. It is still undergoing development on PancakeSwap.

Teams and Profile: Here the crew under pancakeSwap is presented with their profiles.

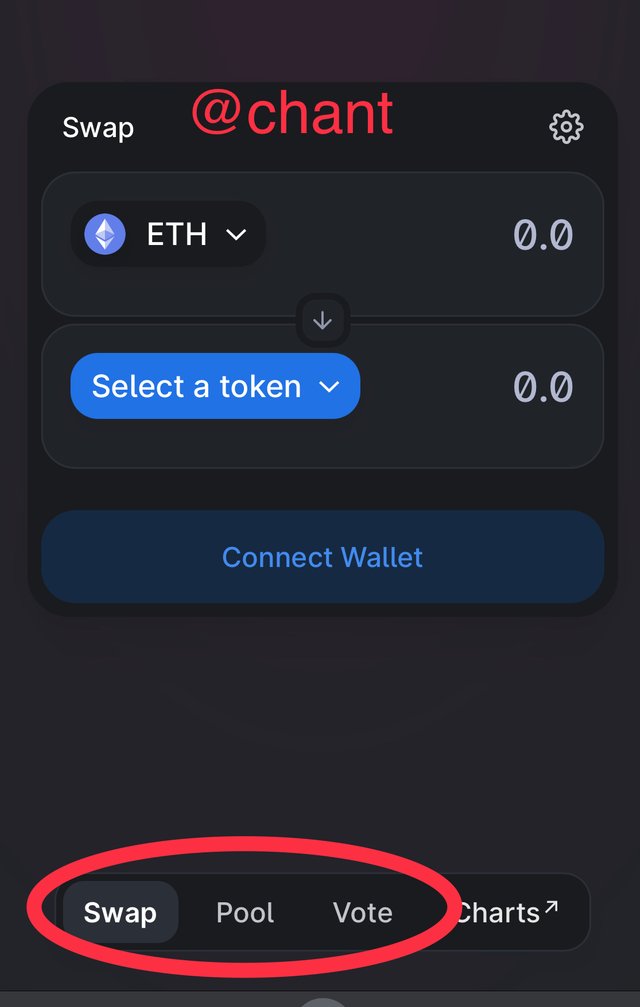

Features of Uniswap

The core features of Uniswap are; Swap, Pool, and Vote. This will be further discussed below.

Swap: Here users are permitted to swap Ethereum blockchain tokens. To complete the swap process, users select the coins they wish to swap.

Pool: Here users can provide liquidity and earn passive income from the exchange fees.

Vote: Here UNI holders which is a form of native coin to Uniswap, gives power to the UNI holders to vote before any development takes place on Uniswap. Voting is done depending on the amount of UNI token a UNI holder has.

Which one (PancakeSwap or Uniswap) is better and why?

In terms of transaction fees: The transaction fee on PancakeSwap is cost effective, which implies that the cost is cheaper when compared with transaction fees on Uniswap. Thus, pancakeSwap is preferred to Uniswap.

With regards to trading Volume: There are more tokens, and trading pairs when it comes to PancakeSwap. But with Uniswap, there are limited token pairs. The numerous token pairs on pancakeSwap makes it easier for users to select and swap their tokens. Thus, pancakeSwap to me is better than Uniswap.

In terms of earning rewards: I will choose PancakeSwap because it has more opportunity for users to earn rewards through lottery, predictions, and farms. But Uniswap has limited opportunity for users to earn rewards.

Question no 5:

How to connect PancakeSwap with Metamask. Explain this with a screenshot.

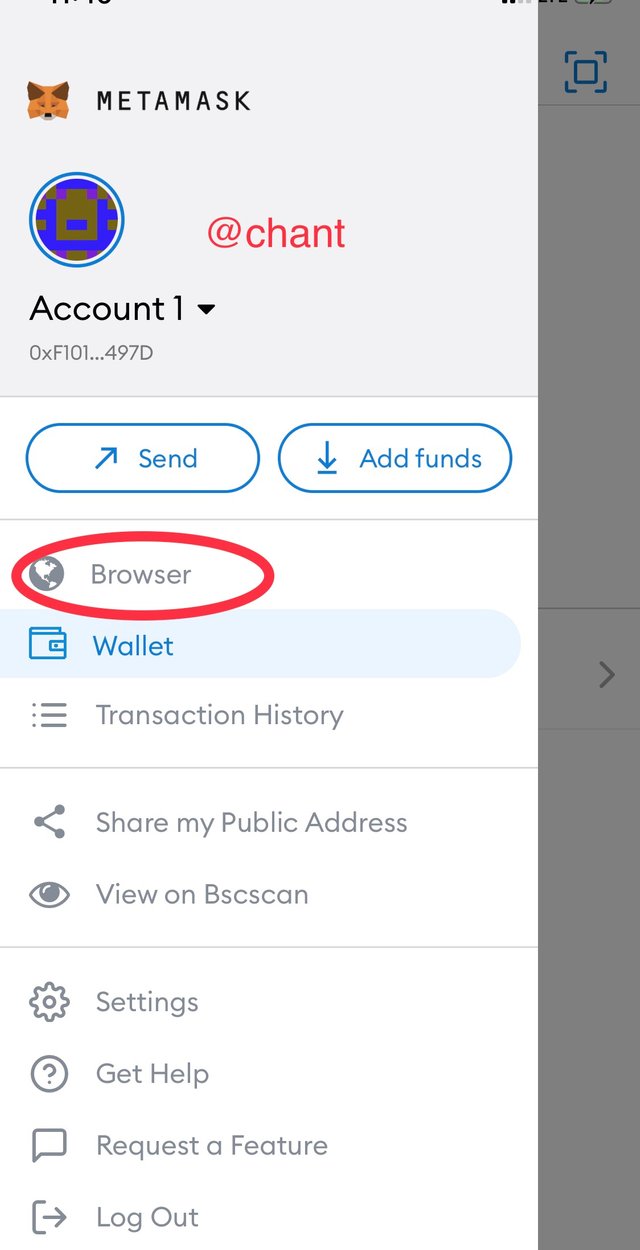

Below is a step by step process to connect Metamask wallet with PancakeSwap using dApp.

Step 1: Open Metamask wallet, and click on menu bar, and a new interface opens. Proceed and click on “browser” on the left hand of the screen.

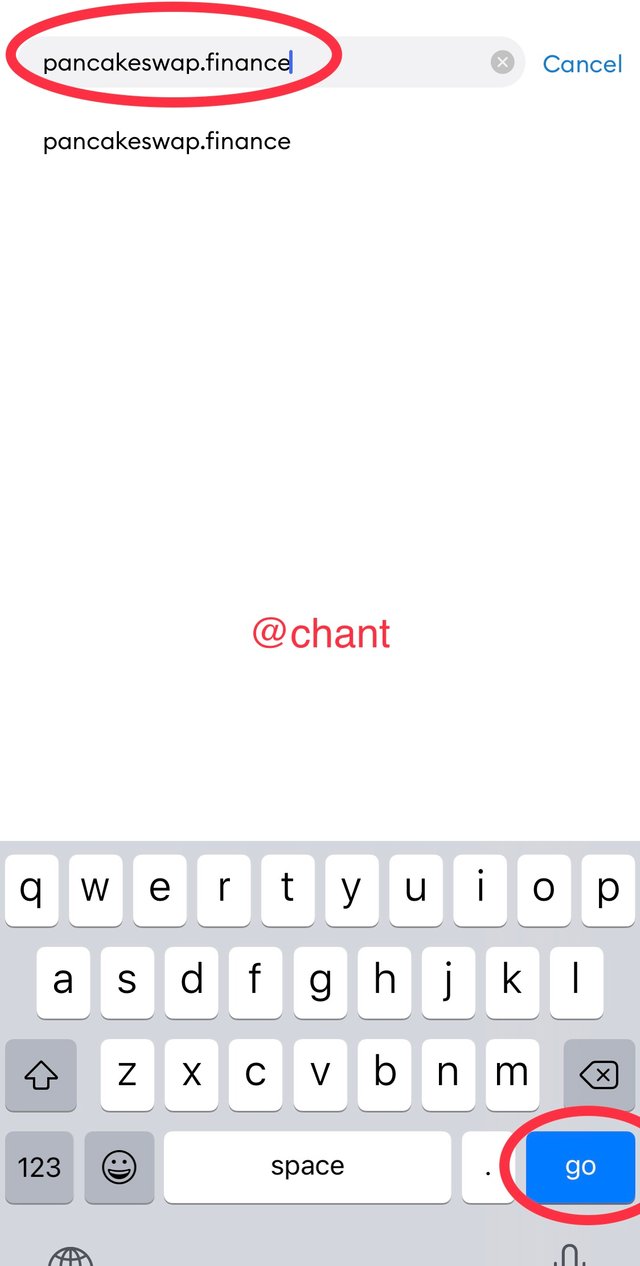

Step 2: On the search bar of the browser, input pancakeswap.finance/ as seen below, and click on “go”. This lead you to the PancakeSwap page.

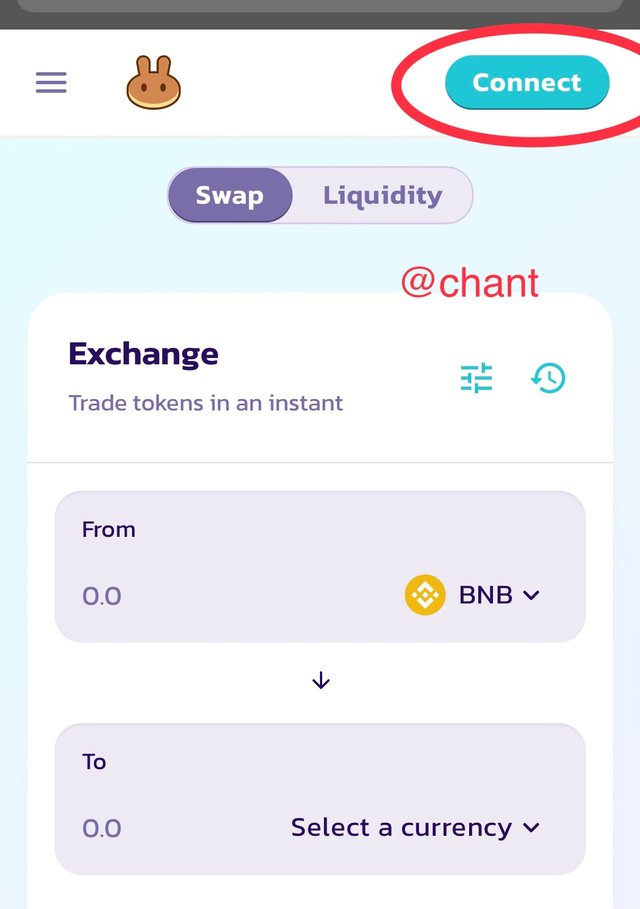

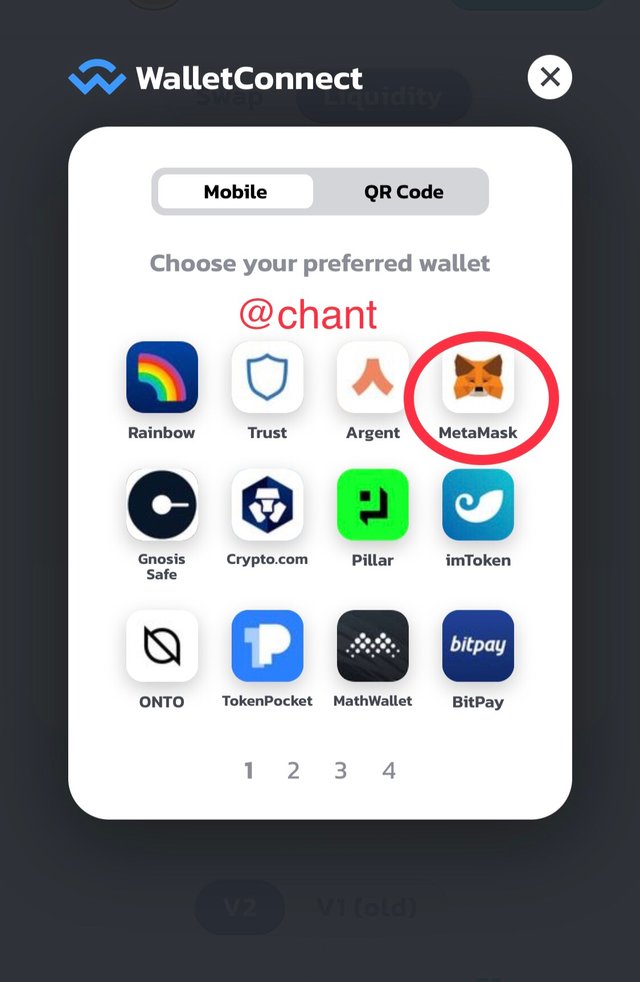

Step 3: Click on “Connect” on the top right hand of the page, and select Metamask wallet.

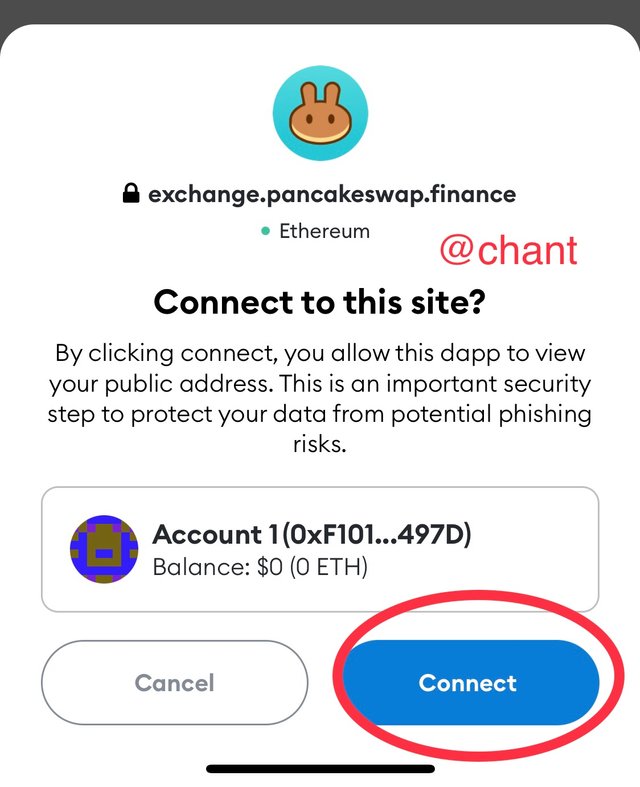

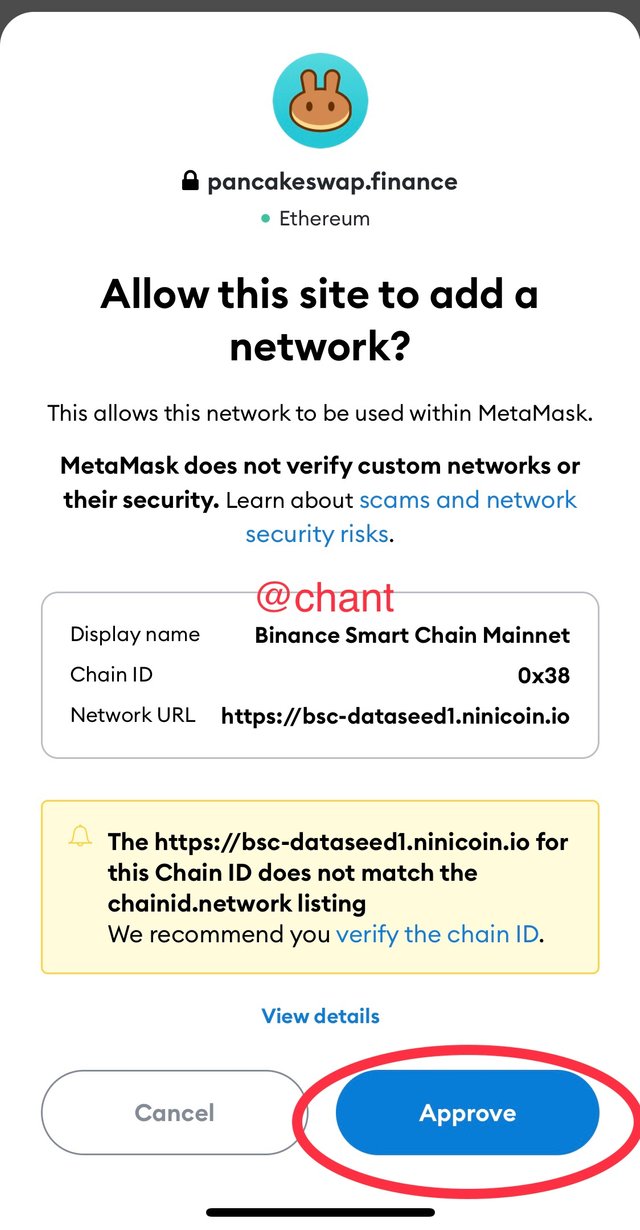

Step 4: After you select Metamask wallet, Click on “Connect”, and then click “Approve”. This now connect PancakeSwap to MetaMask.

Conclusion

In sum, decentralised finance systems have given crypto enthusiast the privilege to transact freely without the interference of a central authority. I have learned that there are some of the platforms that has lower transaction fees, and some of the exchange platforms whose transaction speed is high. This made me to select which of them to trade my assets.

Amongst these platforms, I was able to learn the PancakeSwap as one of the decentralised exchange platform where I can do my transactions at a lower cost rate. I used this opportunity to say kudos to our reputable professor for the lectures, and opportunity for me to learn new ideas and concepts with respect to crypto exchange.

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 23 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 7 SBD worth and should receive 23 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePigDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 3

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit