Hello everyone, accept warm greetings from this end of the globe 🌍. It’s always a pleasure to partake in this community and gain more knowledge. This week it is all about be an employer and don’t be an employee because you end up working for money. Crypto currencies have made it easy for us to invest and let our money work for us.

Notwithstanding, in every business adventure, remember risk should be one of the first thing to consider before investing. There is a popular saying that “the higher the risk, the higher the profits”. However it could be minimized to an extent to reduce loses.

A)-Understanding Risk Aversion

In every business, be it crypto business, the major priority is to make profits and minimize loses. Thus, as a business person, it is always good to check your market and be able to know if your investments are long term or short term investments. This way it will be easy to calculate risk and minimize loses. So, your return should not be lower than your initial capital invested.

To me, it is not good to go in to higher risk businesses with the aim of making higher profits because it might lead to downfall of your investments.

Nonetheless, it is practically impossible to calculate your rewards without including risk. I am someone who cannot bear long term uncertainties or risk, thus, I always prefer to invest were risk is minimal and grow gradually.

Looking at Coinbase, there are a good projects for investors with short term uncertainties to invest in. However, those who can bear long term risk, can still get into such projects but be conscious that anything can happen.

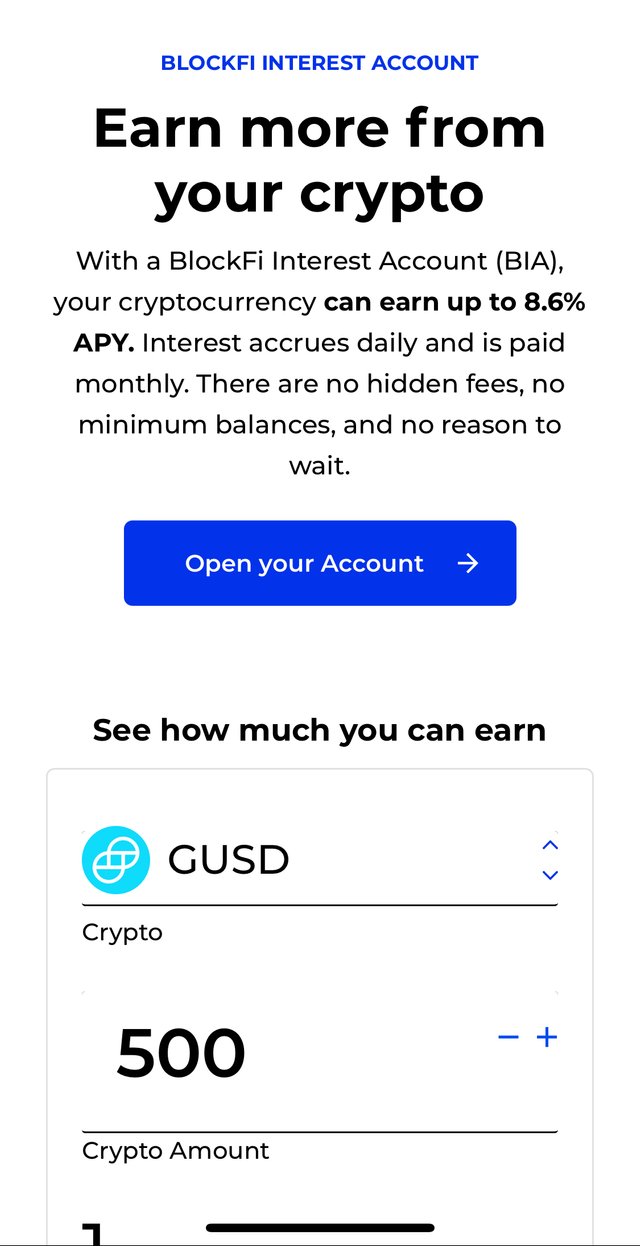

i) BlockFi Project Backed by Coinbase, a Safe place for Conservative Investors.

To me, this is one of the safest place to invest with lower risk because you only put in your crypto currency and earn rewards from that. Here the interest rate of your Annual Payment Yield (APY) is about 8.6%. The interest has to accumulate daily but payout monthly.

Screenshot from Phone

Screenshot from Phone

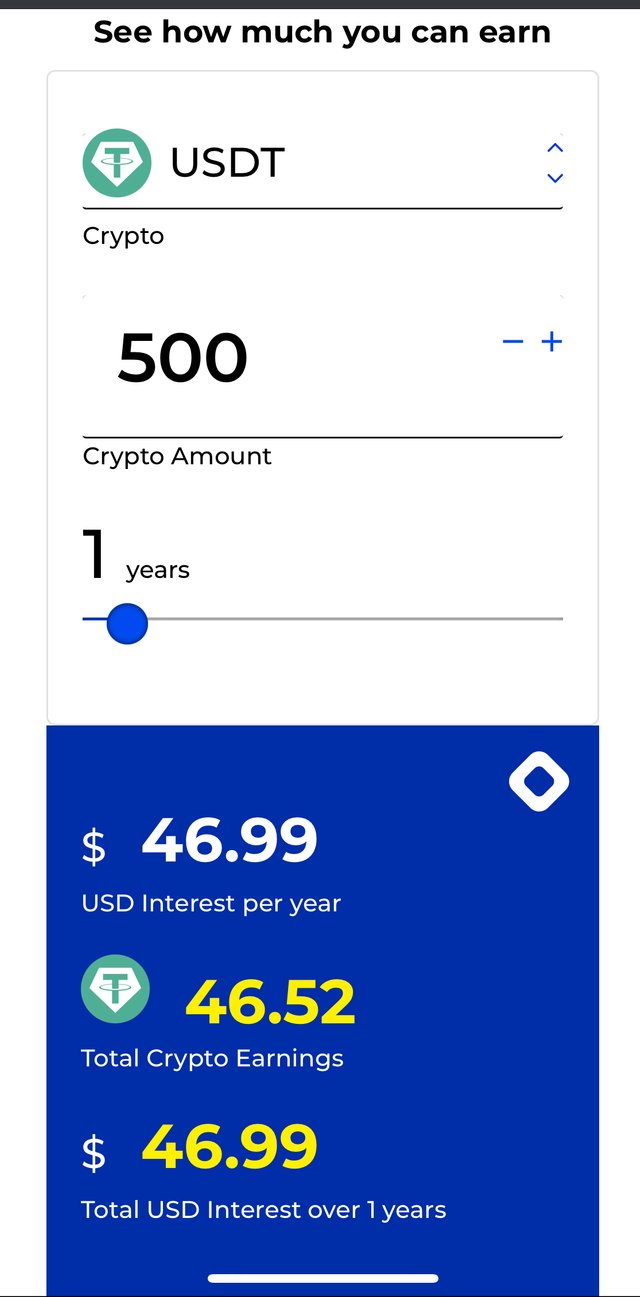

Here, there are a good number of crypto assets that can be staked for example Ether, BTC, Litecoin etc. So, if I invest for example 500USDT, over a period of 1 year, I will be able to make profits of about $46 as seen on the screenshot below. This allows me to minimize higher risk and still make profits.

Screenshot from Phone

Screenshot from Phone

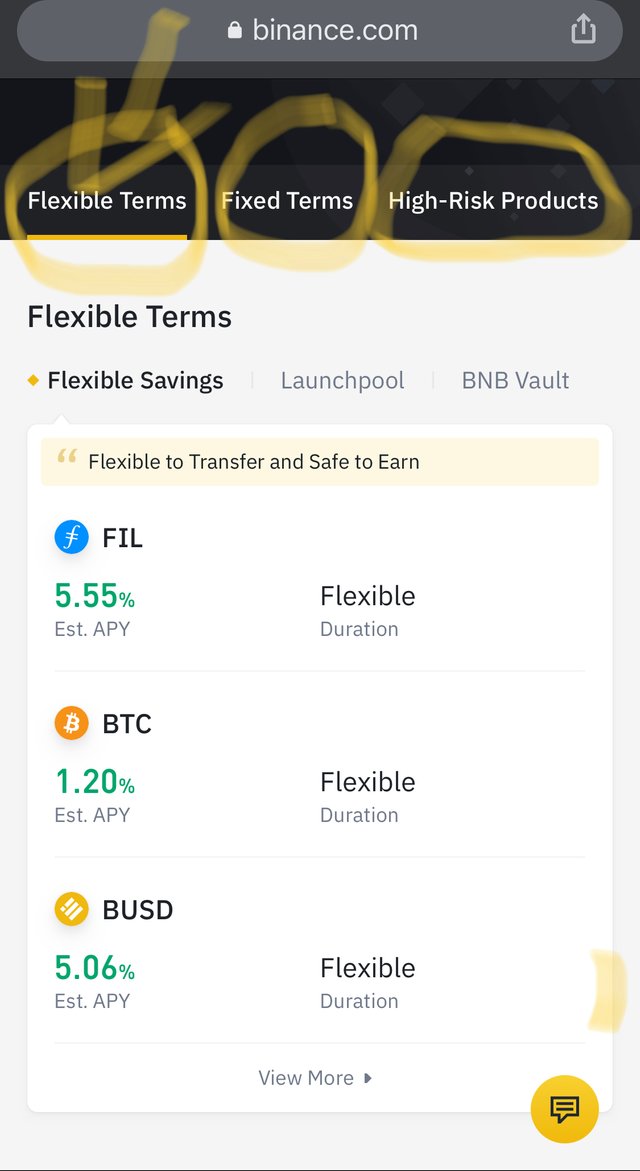

B) Fixed and Flexible Savings, High Risk Products, and Launch Pools

i) Fixed Savings: This is when you invest and stake for a fixed period of time, cannot be withdrawn anytime in case of arising needs which require the investor to withdraw. This is good to go for those who can tolerate risk for a longer period of time. With fixed savings, you can stake for over a year before withdrawing your APY. My advice is that for any investor who intend to go in with fixed savings should do that with assets that he or she has no intention of withdrawing when it’s not yet time. For example if I want to invest with fixed savings, I will go in with tokens as Tezos on Coinbase. Here, it takes approximately 35-40 days before rewards are paid.

ii)-Flexible Savings: Here it is easy for an investor to add or withdraw funds anytime you deemed necessary. However, the interest rates on flexible savings are low as compared to fixed savings. With flexible savings, it is easier for an investor to minimize risk and loses.

iii)-Higher Risk Products: Just as the name goes, this imply that the risk level here is high. On Binance one of the high risk product one could think of is Dual investments. To invest in such products, you just need to deposit a coin, and at the end of the year, your APY is paid with two crypto currencies.

However, you need to bear in mind that prices are highly volatile, reason why it is considered high risk. Thus, if there is high fluctuation in prices or a fall in prices, this will affect your investments but if prices are stable, you can therefore earn good rewards on your investments.

iv)- Launchpools: This is a platform on Binance whereby new projects are advertised in order to get liquidity, and reward users with new tokens after staking BNB, BUSD over a particular period of time. This usually takes 30 days. This means that when a new project is launched, the project need liquidity to go operational. The liquidity is generated from coins staked by users over a farming period. The users can get back their token with a new token as reward at the end of the farming period.

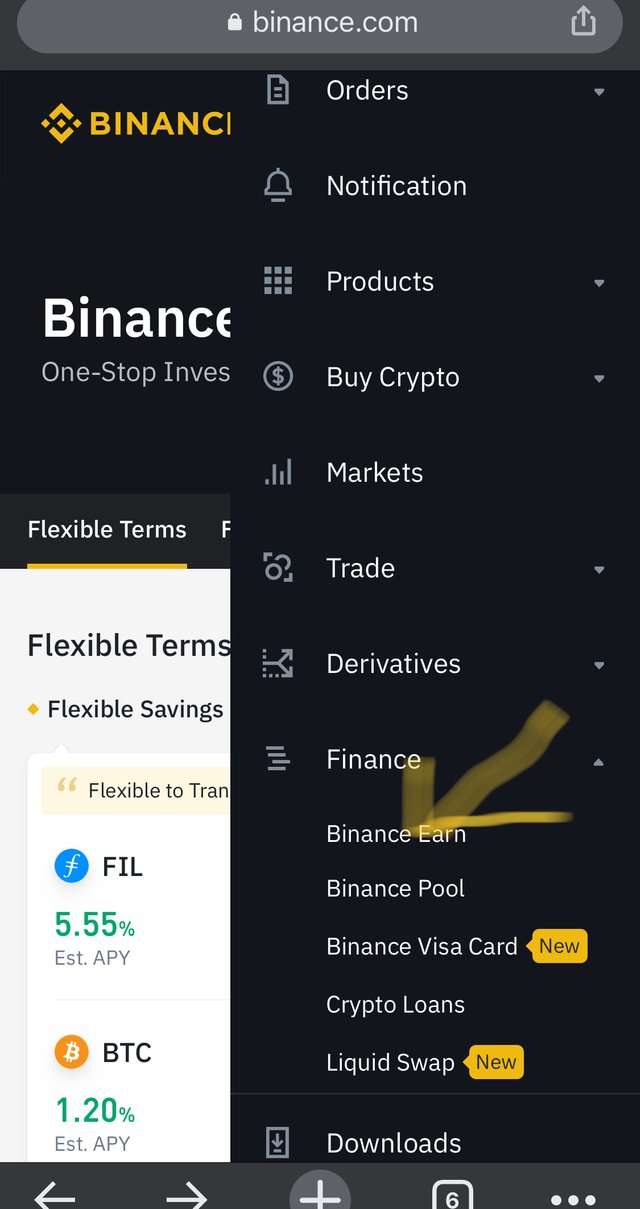

C) How to Set Investments on Binance

There are different types of savings as already explained above. Thus, the steps below will show how to set your investments on Binance. I’m using an apple device.

Step 1- Open your Binance App and on the menu on the top right hand of your screen, click on finance icon. Under finance, you will find various finances, then click on ‘Binance Earn’.

Screenshot from Phone

Screenshot from Phone

Step 2- The page on ‘Binance Earn’ will open and show the different investments on the top of the screen such as flexible, fixed and high risk. In case you decide to go in with flexible savings, click on flexible terms, a new page will open showing the various coins to be used for flexible savings.

Screenshot from Phone

Screenshot from Phone

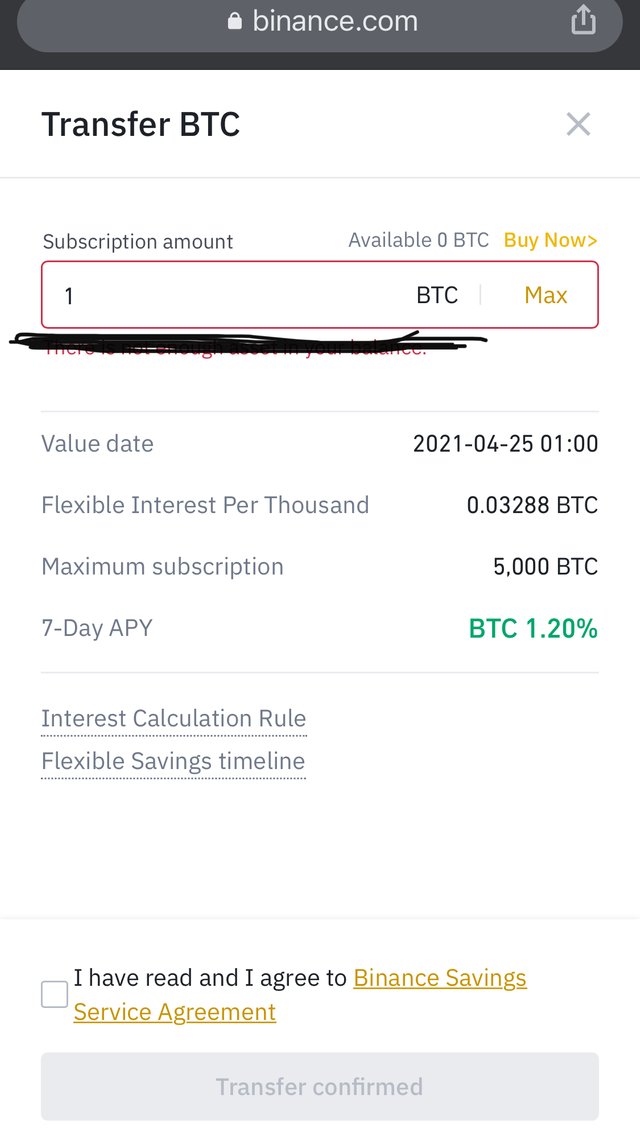

Step 3- Proceed and click on BTC for example, a new page will open. Enter the amount of BTC you intend to invest, read and accept the service agreement. Click on “Transfer confirmed”. A message will appear showing all subscription details.

Screenshot from Phone

Screenshot from Phone

From here, you can now go into your wallet and see all the details and what you should get as rewards at the end.

In sum, crypto currencies are best to make one be a boss on your own. You just need to invest wisely and watch your investments work more profits for you. Kudos to our professors for impacting knowledge of crypto currencies in us. This will definitely reduce the rate of unemployment in the world. While waiting for your feedback, remain blessed.

Cc: @fendit

Thank you for being part of my lecture and completing the task!

My comments:

Some explanations on the second task were a bit brief, for instance in the high risk products, you didn't get to explain dual inversions.

Still, nice work, focus a bit more on applying markdowns for next time!

Overall score:

6/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the feedback prof @fendit, will definitely do better next time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit