Hello everyone, and welcome to week 8 of season 4 task, given to us by our reputable professor @fredquantum. Accept warm greetings from Cameroon, specifically North West Region capital-Bamenda. This week lecture was focused on zethyr finance. After careful study of the topic, I am going to present my task below.

Question 1

What is Zethyr Finance?

This is one of the decentralized finance application of the Tron blockchain system, that enables users to lend, and borrow TRX assets with other coins such as BTT, USDT, WIN etc. A currency without a robust backing financial system is just like USD without banks, and robust financial services. Without a good financial backing system, a currency remains a store of value, with limited use cases. Therefore, zethyr has come to give TRX the backing it deserves by offering robust financial services to users of the Tron Ecosystem.

Zethyr finance gives the opportunity for users to lend their assets by supplying assets on the network to the supply pool. These assets are lended out to other users and suppliers receive annual profits. On Zethyr finance users can as well borrow assets supplied to the platform, and payback after depositing a collateral.

What makes Zethyr finance unique, and outstanding from other DEFI systems is the fact that it has a decentralized exchange protocol where users can exchange their Tron assets at ease without switching to different exchange platforms.

Question 2

What are the features of Zethyr Finance? Discuss them. What's your understanding of DEX Aggregator?

What makes zethyr finance outstanding is as a result of the good features found on the platform that gives users the opportunity to swap their coins with ease. These features are as follows:

Lend/Borrow Feature: These are one of the features of zethyr finance whereby users of the platform are given the opportunity to lend, and borrow Tron assets. With regards to lending, users supplied their assets to the supply pool in return are rewarded with a percentage of APY. With regards to the borrow function, users can borrow assets from the supply pool after depositing collateralized tokens. Literally, this feature makes it possible for users to gain extra profits, and use the assets held as collateral to borrow, and engaged in other profitable assets.

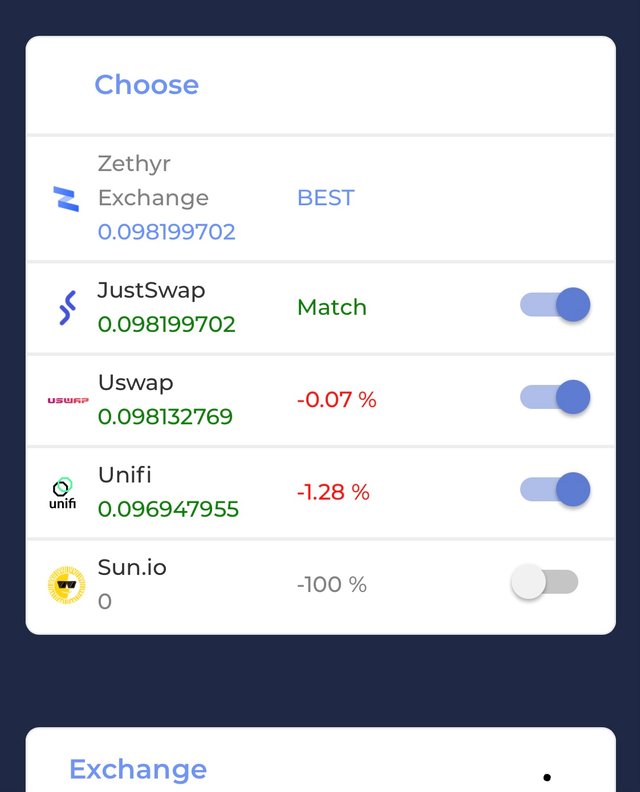

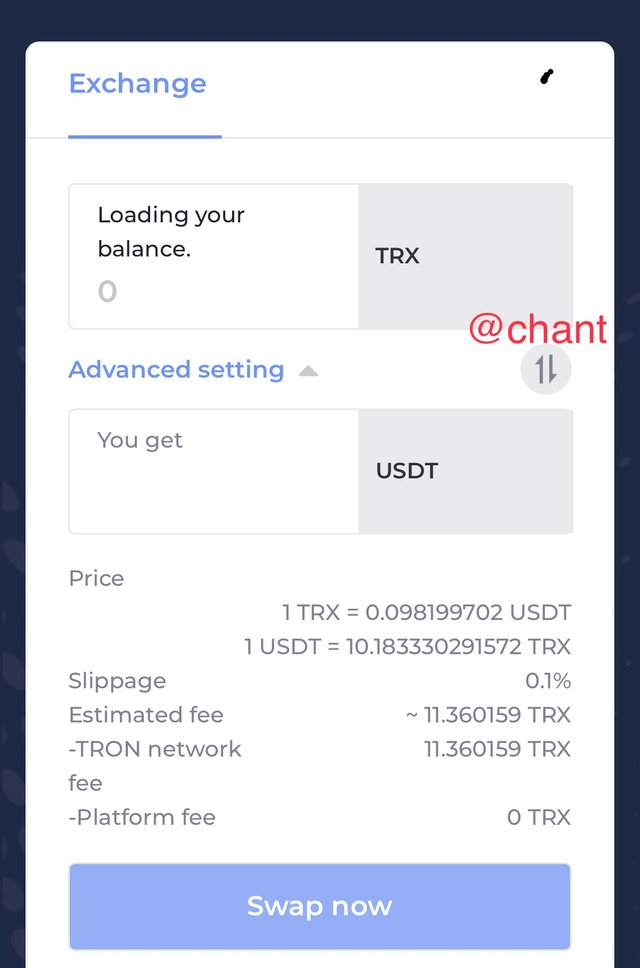

Exchange Feature: This is one of the zethyr feature that makes it unique from other lending/borrowing platforms. It is used to swap Tron assets with other tokens. The exchange feature equally has the DEX aggregator which means that information about liquidity, and prices of assets are compiled, and compare using a smart contract with those of other exchange platforms, and gives out best deals or match pairs. Therefore, DEX aggregator gives best pricing options to user to swap their assets.

Stable Swap Feature:This feature permits users to cross-swap stable coins to other tokens. That is a user can use TRC20 tokens to swap USDT. Notwithstanding, the charges for swapping stable coins is some how costly but if your investments requires you to swap, then use it to swap TRC20 to a stable token.

Ztoken Feature: This feature gives value to the protocol, and increase the number of use cases on the platform. This feature rewards users who supplied their assets with the ztoken. This token can be used by users as collateral which qualifies them to borrow on the platform. Ztoken constitute the sum of all users asset on the platform, including interest raised that has not yet been paid out to users who lend or borrow.

DEX Aggregator as I earlier mentioned is a new service on the blockchain which compiles, and compare prices, and liquidity of crypto currencies, and gives out best deals to traders. This is done using complicated algorithms to select best possible token pairs in terms of liquidity supply, and prices which gives users best swap options of their assets.

The DEX aggregator does all the calculations within seconds which is less time consuming as the manual check by users. DEX aggregator does the calculations taking into consideration swap fees, token price, and optimize slippage, offer better swap pairs with good rates within a shorter time period. DEX aggregator helps to protect users from price impact, thereby reducing the possibility of failed transactions.

Question 3

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

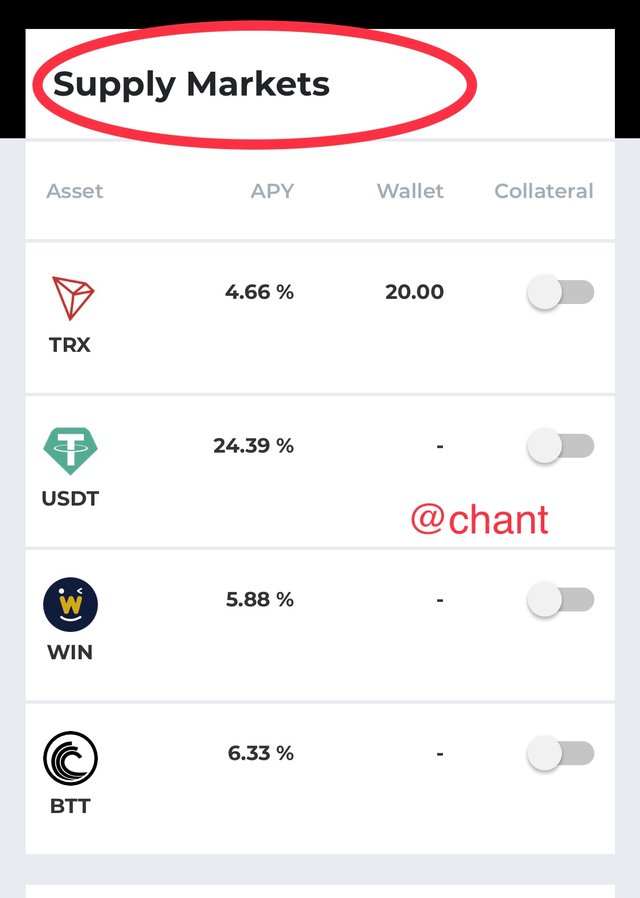

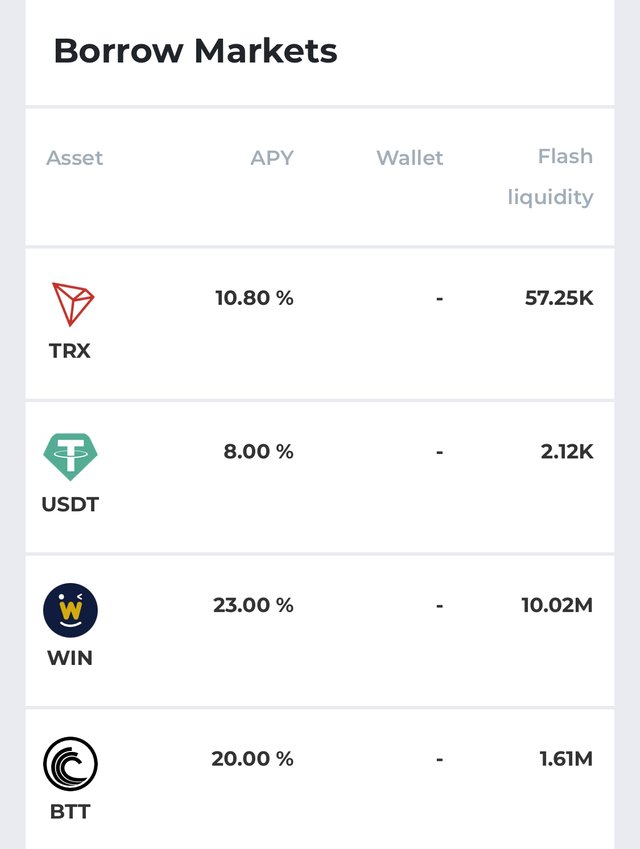

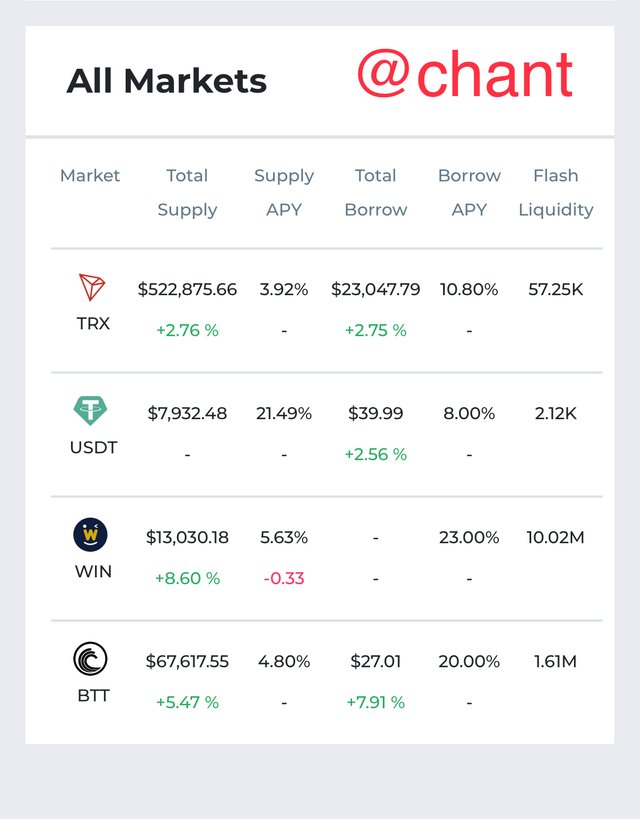

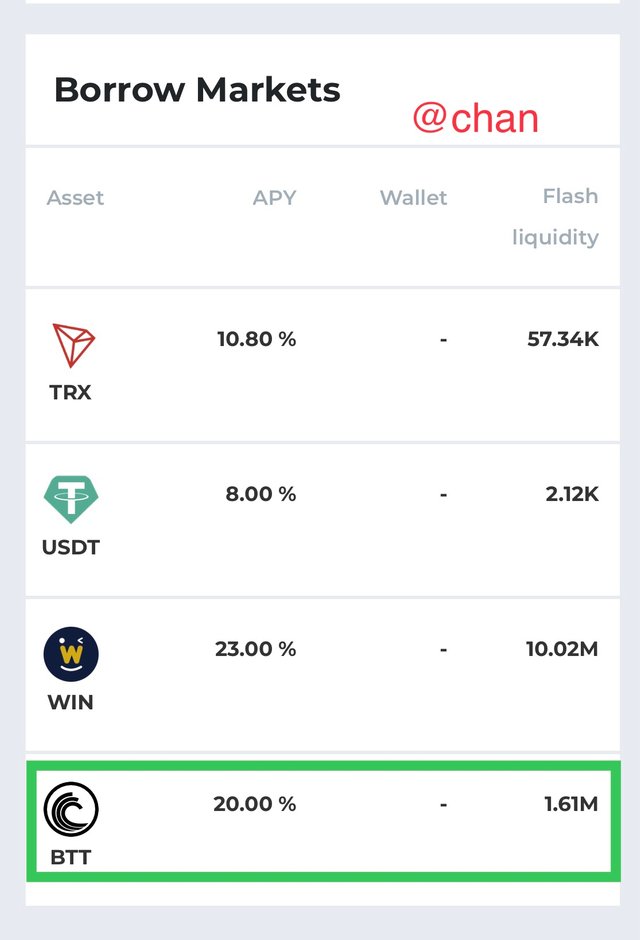

Profitability is the main goal of every marketed product because without profits, the market cannot sustain for long. Therefore income needs to be generated from supply/borrow in order to sustain the product over a longer period of time. Looking at the market on zethyr finance, USDT has high profitability with the highest %APY supply of 21.49% as compared to other assets. This implies that more interest has been raised from the supplied pool.

Looking at profitability in terms of borrow, I think USDT still stand as the best as the borrowed APY stands at 8%. This means that borrowers repaid borrowed assets, which brings in 8% APY. I have observed that when supply of an asset is high, the APY % supply is low, and equally the APY % borrowed. Take the case of TRX which has high asset supplied but the APY % supply and borrowed are lower than USDT, BTT, and WIN as seen on the screenshot above.

Question 4

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

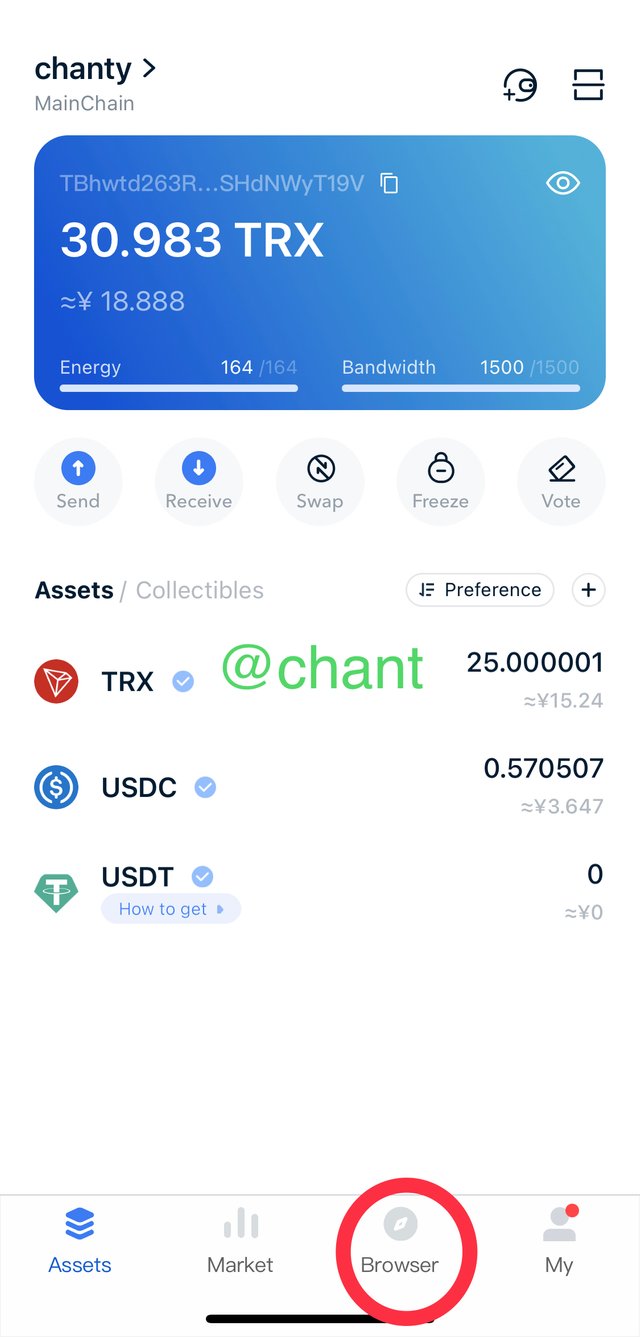

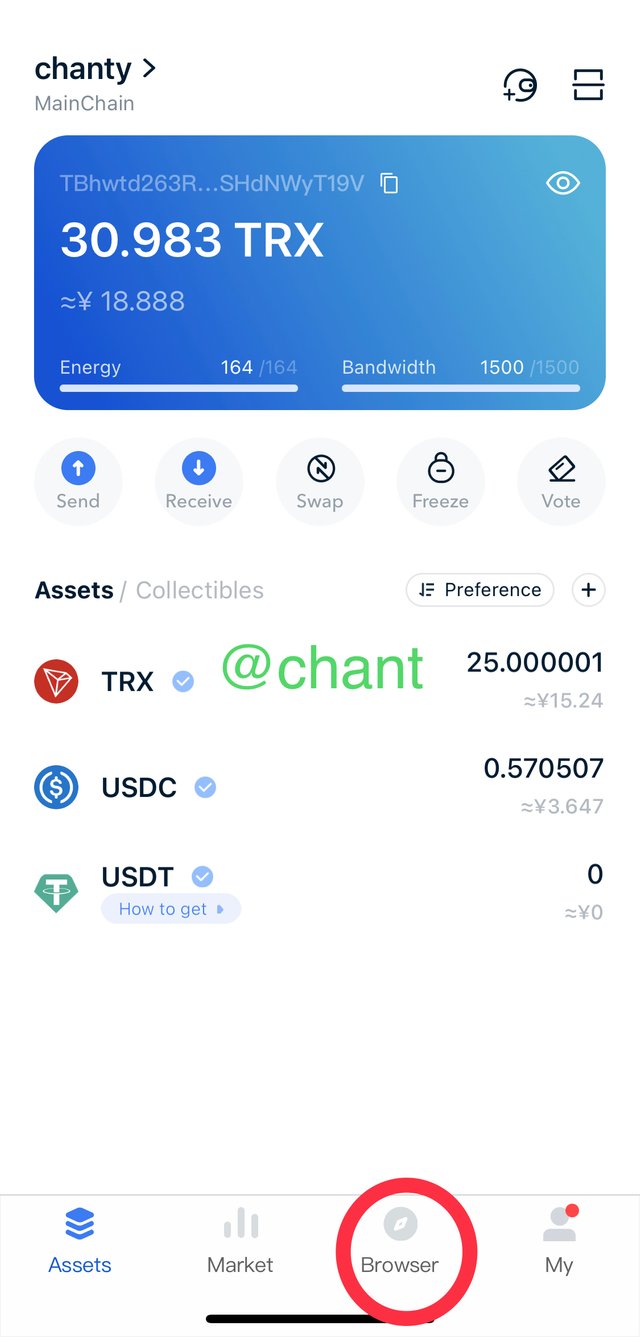

Below are the steps to follow to connect TronLink wallet to zethyr finance. So, this requires me to have a TronLink wallet before connecting to zethyr finance. So incase you do not have a TronLink wallet visit AppStore, download the App, and create a wallet account. I already have an account, so will commence to connect to zethyr finance.

Step 1:

Open TronLink wallet, and click on the browser icon at the bottom of your screen as indicated in the screenshot below.

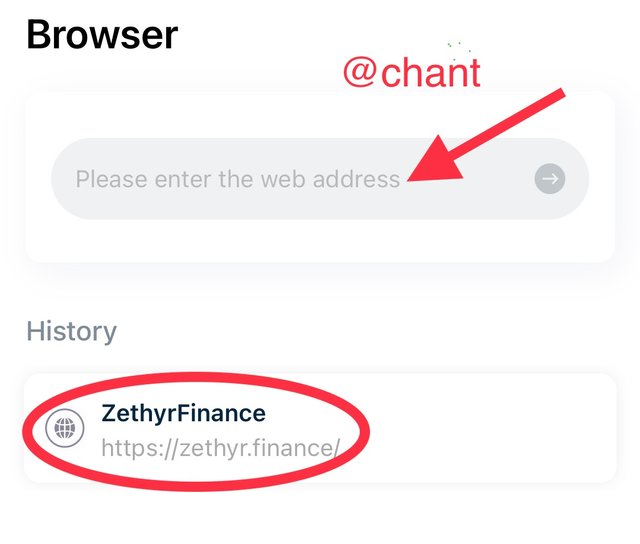

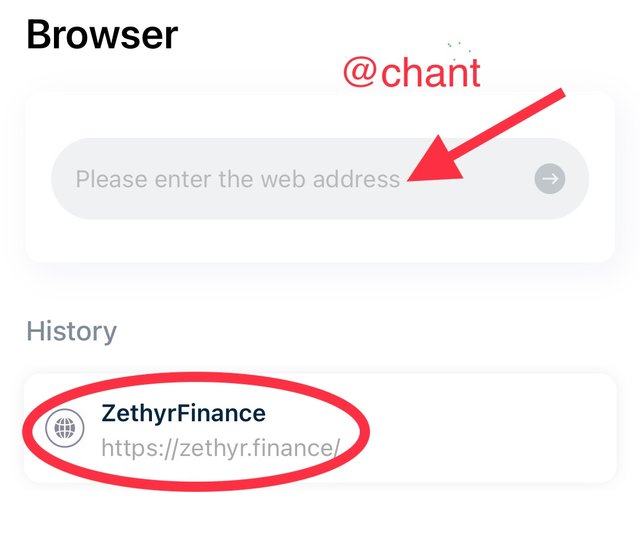

Step 2:

Enter zethyr finance on the search engine, and launch the DApp. Once this is done, your wallet automatically connects to zethyr finance once it is detected.

Step 3:

To confirm if your wallet has successfully connect to the zethyr finance, proceed and click on the menu bar where a drop down will appear, and you click on “my portfolio”. This shows that I have connected TronLink to zethyr finance as seen below.

Question 5

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

Understanding ztoken

As I earlier said, ztoken is an asset that users of zethyr finance are rewarded with after assets are supplied on the platform. This token can be used as collateral to borrow other assets on the Tron blockchain. It equally represents total assets of users including unpaid interest accrued during borrowing, and lending. Therefore, it is a native token on the zethyr system given out to users as reward for supplying assets to the supply pool.

Ztoken is pegged on a ratio 1:1 to the underlying tokens deposited on zethyr finance. Ztoken can be traded freely, stored, and transfer with ease. The token is minted whenever it is deposited, and redeemed when it is burnt.

Another token that has the same purpose as ztoken is AAVE. This is a native coin on the decentralized Ethereum ecosystem. AAVE permits users to borrow, and lend crypto assets, and earn rewards without interference from a middle man.

To borrow on AAVE, the borrower has to post a collateral before you are allowed to borrow. One of the golden rules to borrow is that you cannot borrow more than the amount post as collateral. When you borrow on AAVE, a special token is given to the lender as reward for depositing assets to the pool. The special token is referred to as aToken, pegged to the value of another asset.

Question 6

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

Below is a step by step process to supply assets to the supply pool on zethyr finance. I will begin by showing how to connect wallet to zethyr finance, then enable supply, then perform supply.

Step 1:

Open TronLink wallet App, and click on the browser icon, and a new interface opens.

Step 2:

Enter zethyr finance on the search bar. Once you click on search, the wallet automatically connects to zethyr finance.

Step 3:

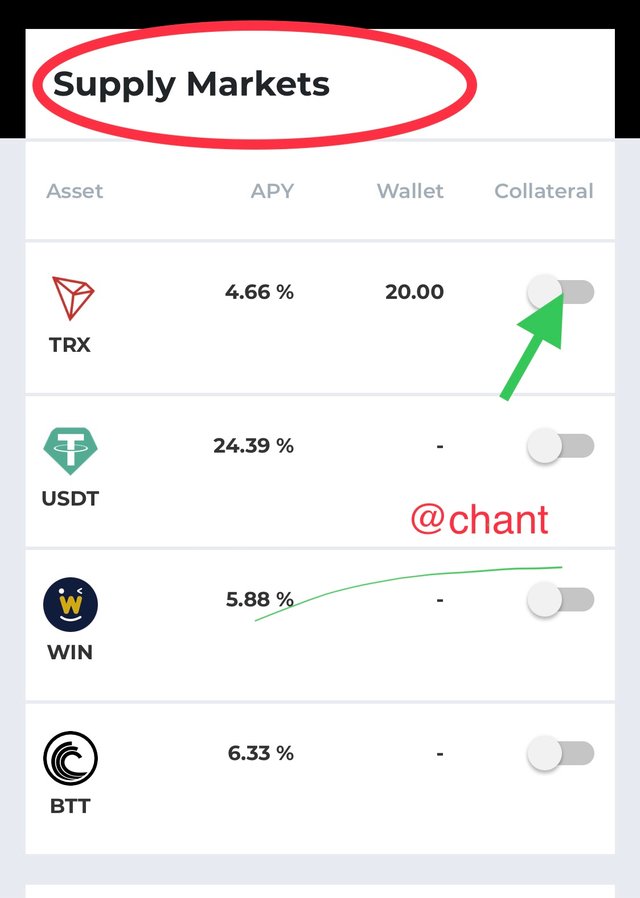

Click on the menu bar at the top right hand of your screen, a drop down appears, select “my portfolio”.

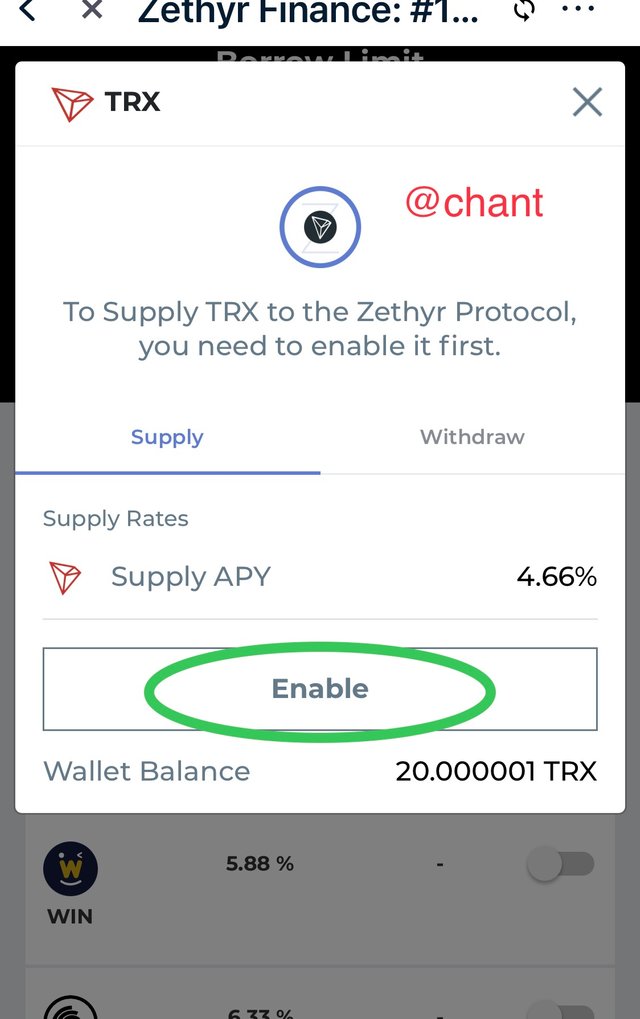

Step 4:

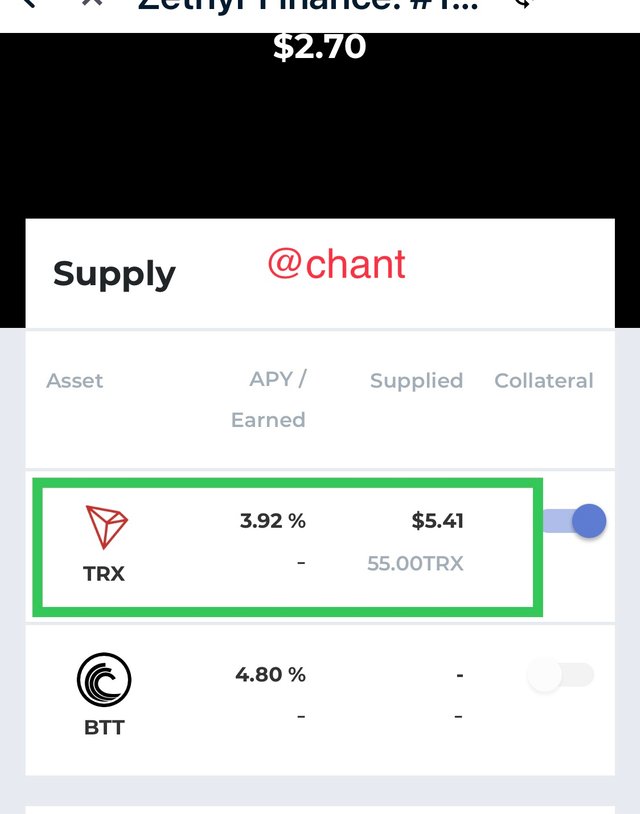

Proceed and click on “Supply”, a new page opens with a list of assets to enable supply. I proceeded and select TRX since I had it in my wallet, and click on “enable” icon.

Step 5:

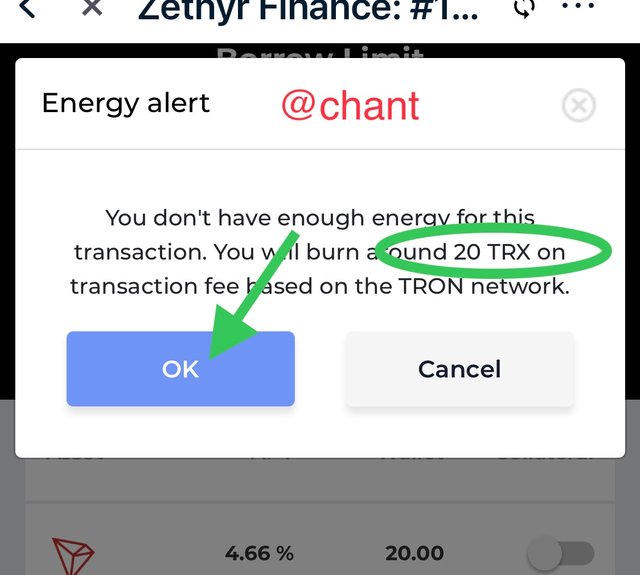

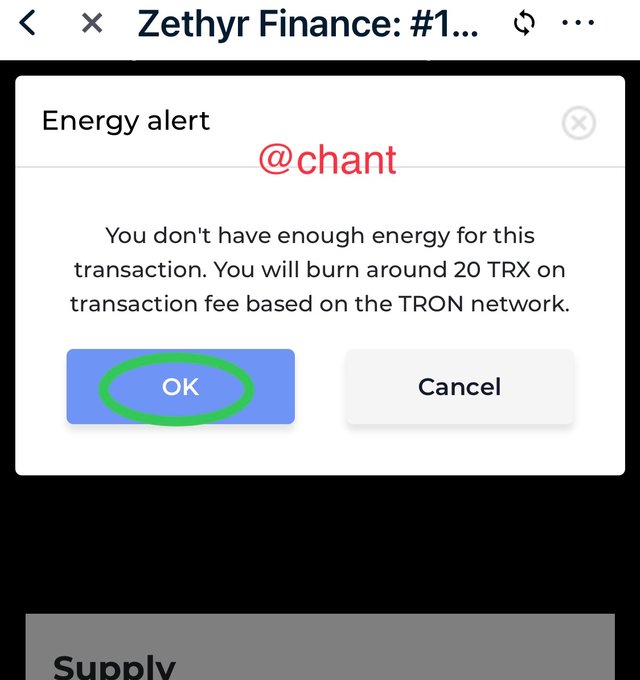

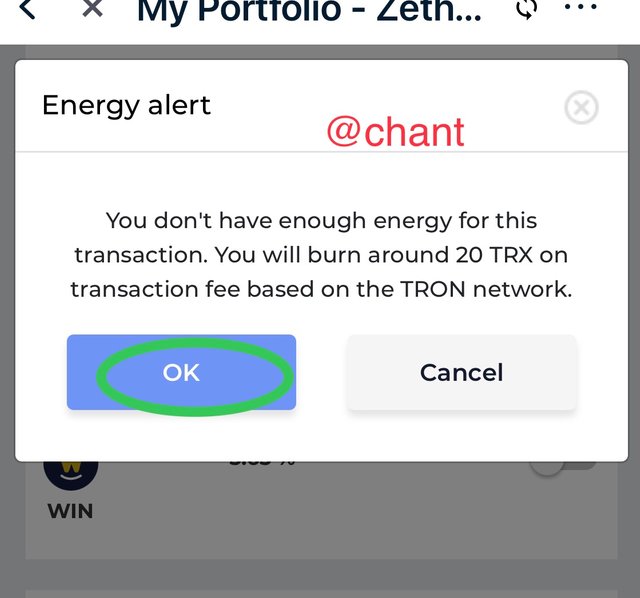

A new interface opens showing the amount of asset to be burned as transaction fee, click on “OK” to confirm the burned alert message.

Step 6:

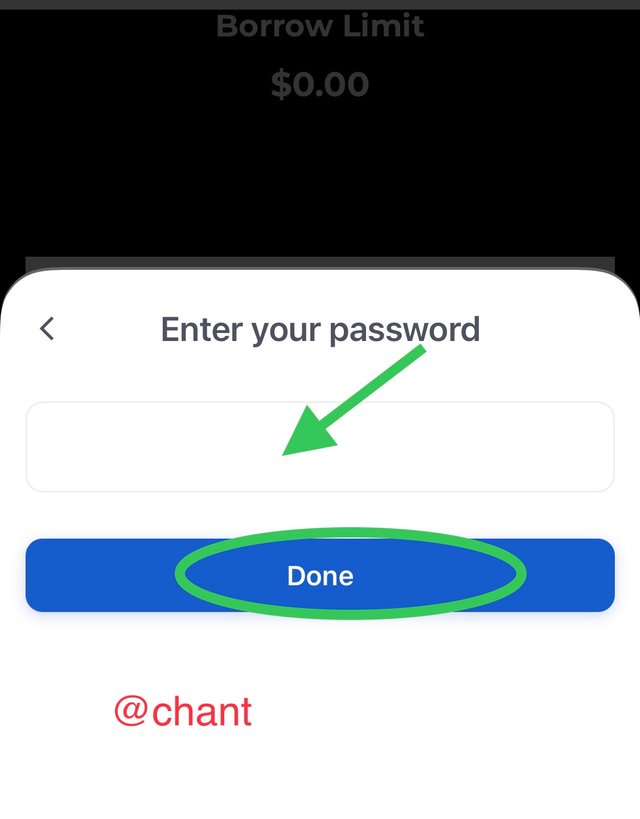

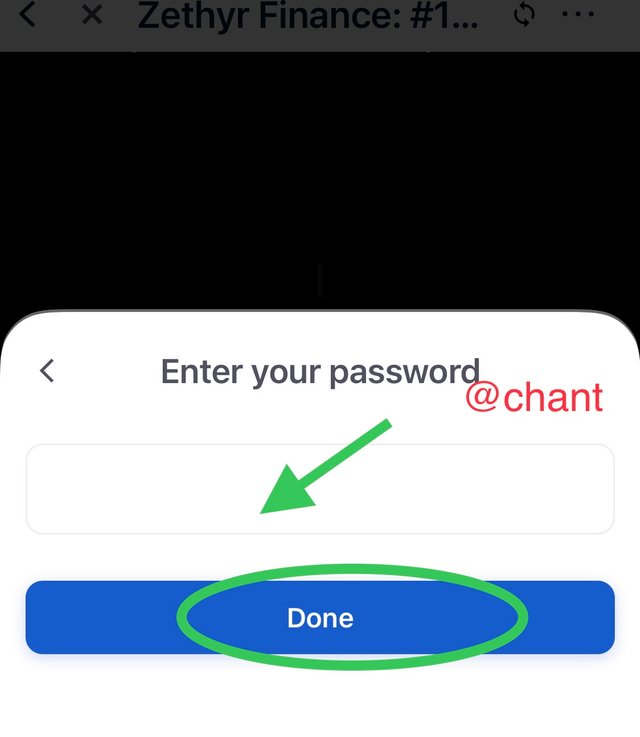

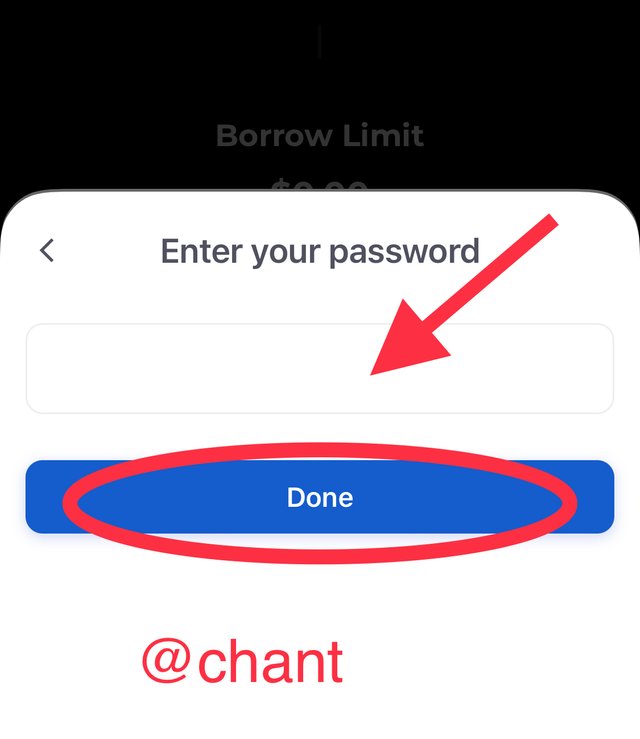

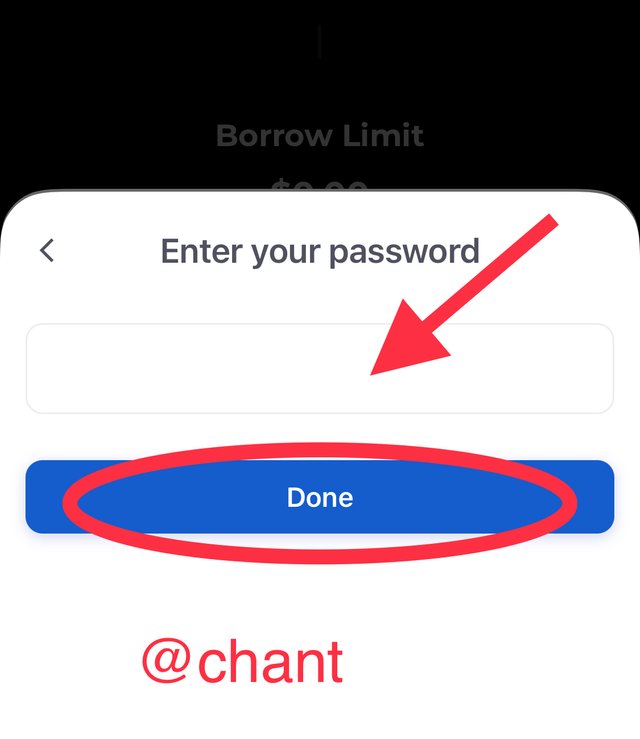

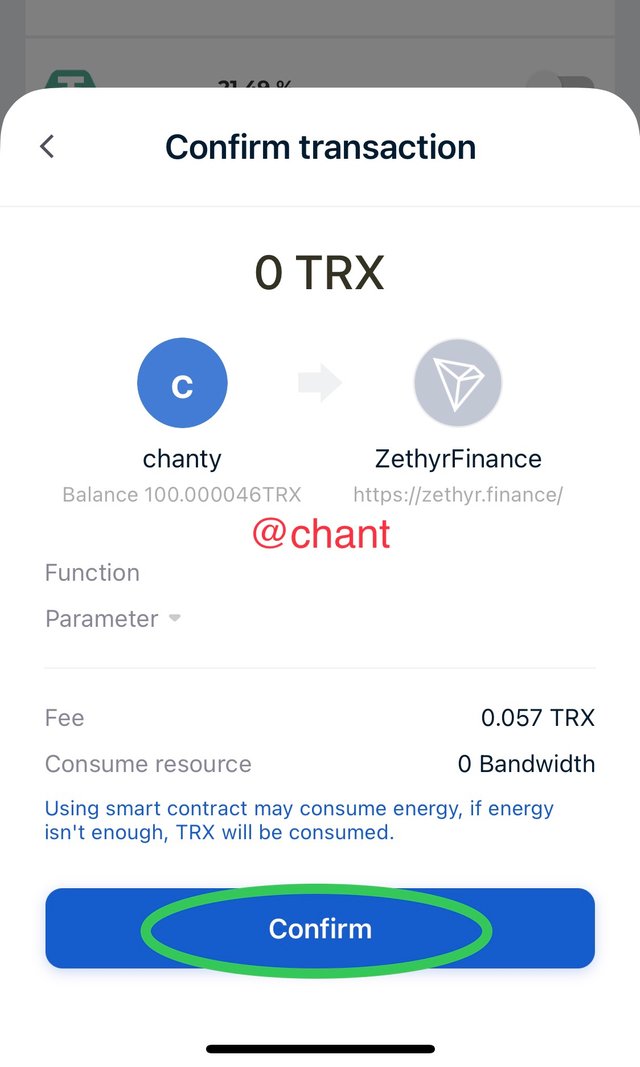

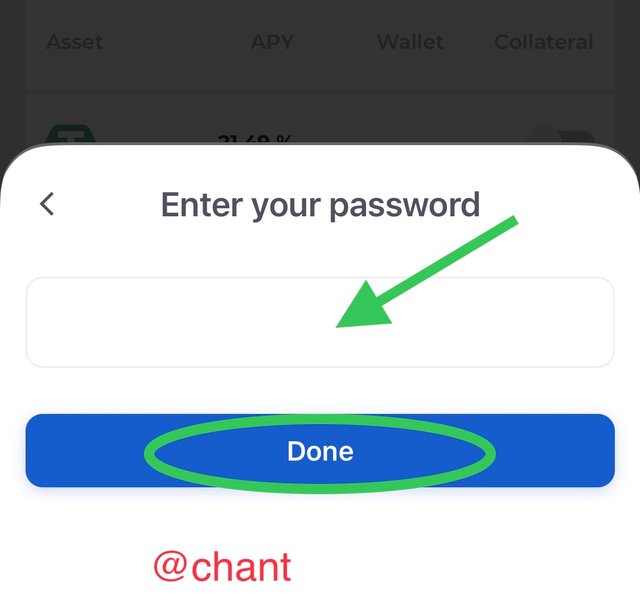

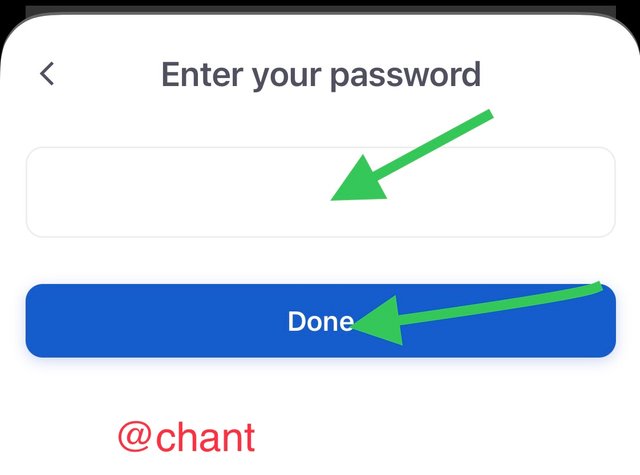

Confirm the transaction by entering your wallet password. Proceed and click on “done”. Once I click on done, I have enable to supply.

Step 7:

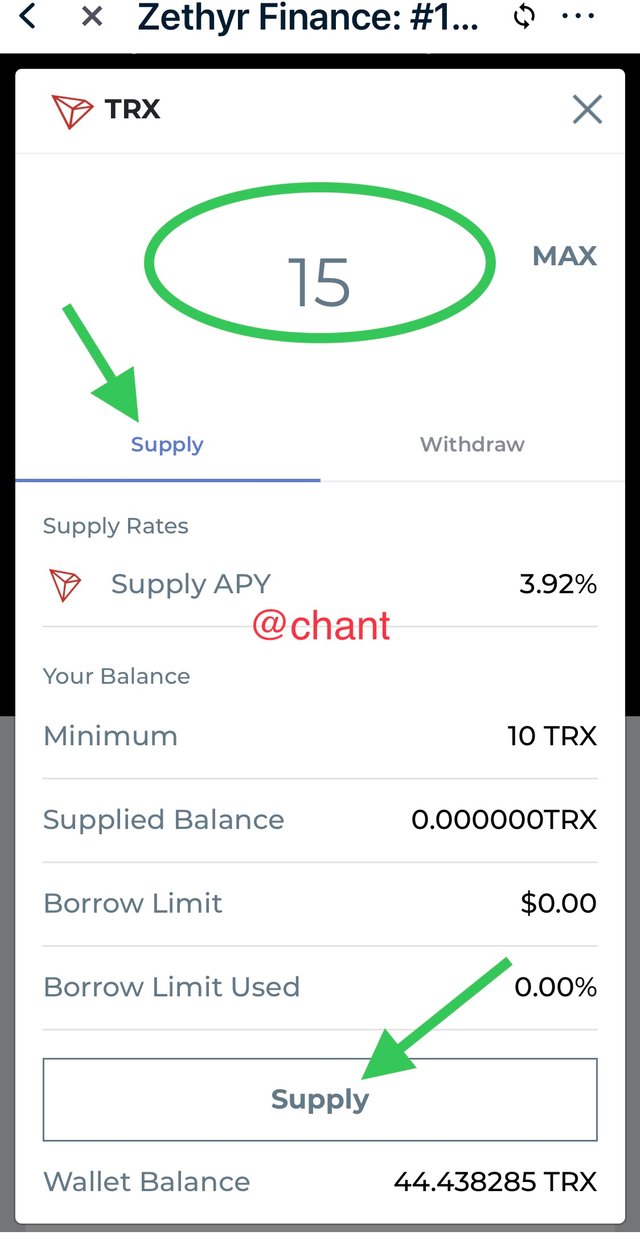

Click on “supply” icon, and the supply page open, input the amount of TRX to be supplied, and click on “supply”.

Step 8:

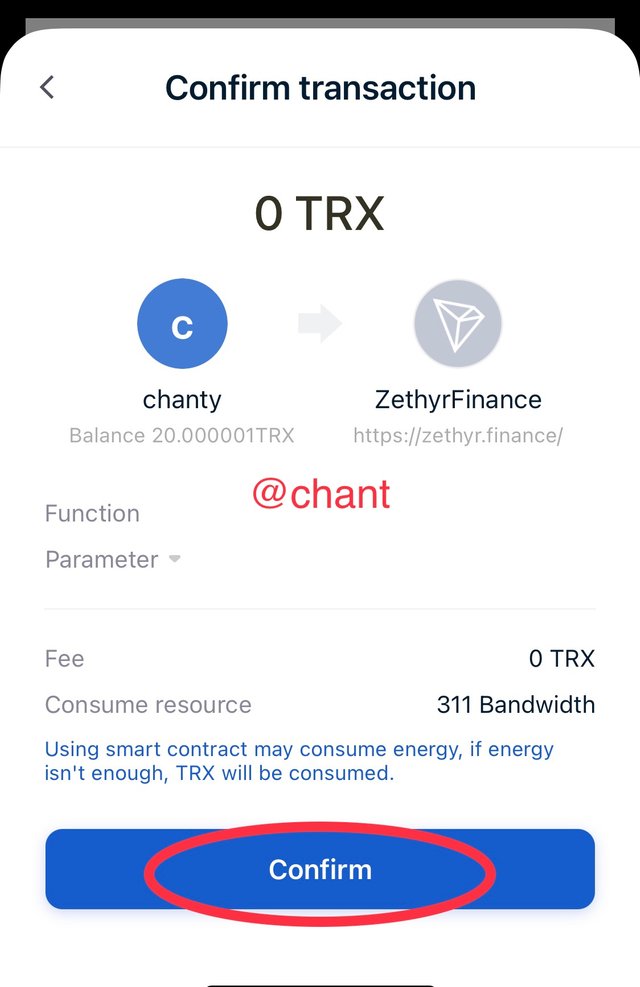

Click “OK” on the energy alert warning message

Step 9:

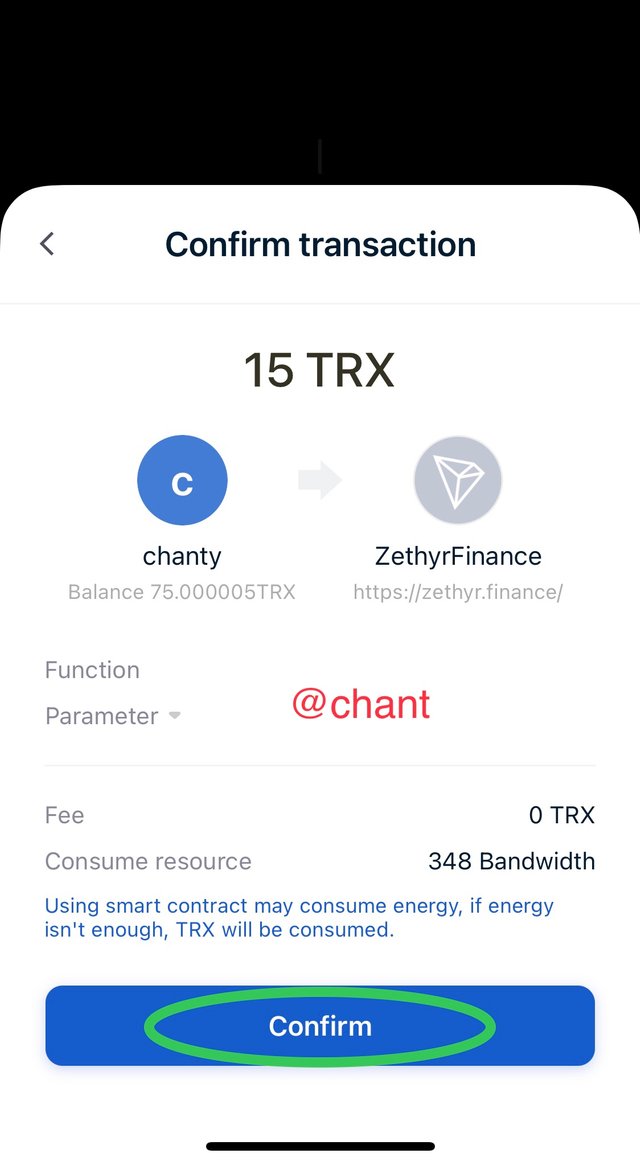

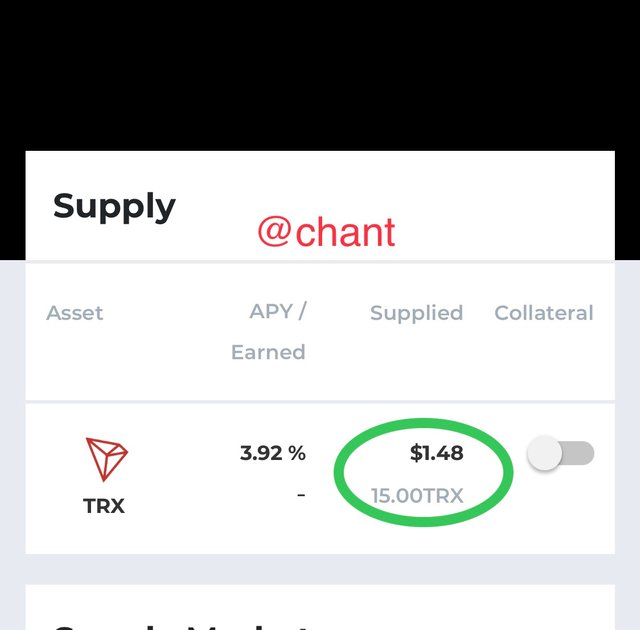

Confirm the transaction by clicking on “confirm”, then proceed and click on “done”. I have successfully supplied 15TRX.

Hash for the transaction https://tronscan.io/#/transaction/43132722170a3eeb6af1afa40e93ee0f34ac3fdd4ddd8673e1f91d9e8b35158e?lang=en

Question 7

Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

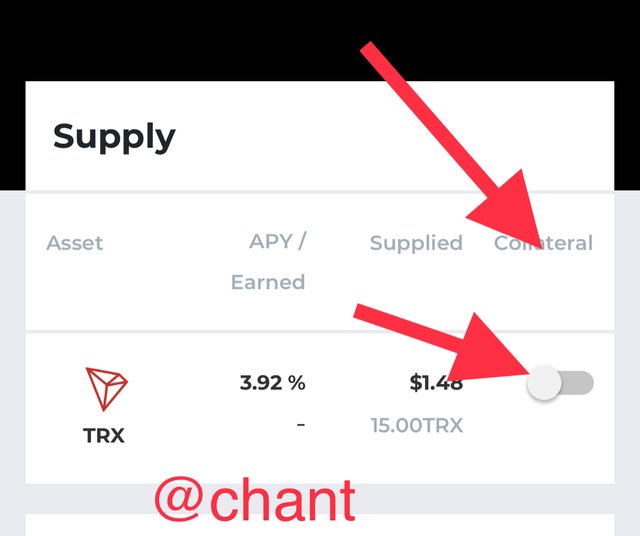

Since I have supplied TRX to the pool, I will have to collateralize it in order to borrow.

Step 1:

On the supply page, I click on the asset supplied, and then slide the line under collateral to the right, and click on “collateral”.

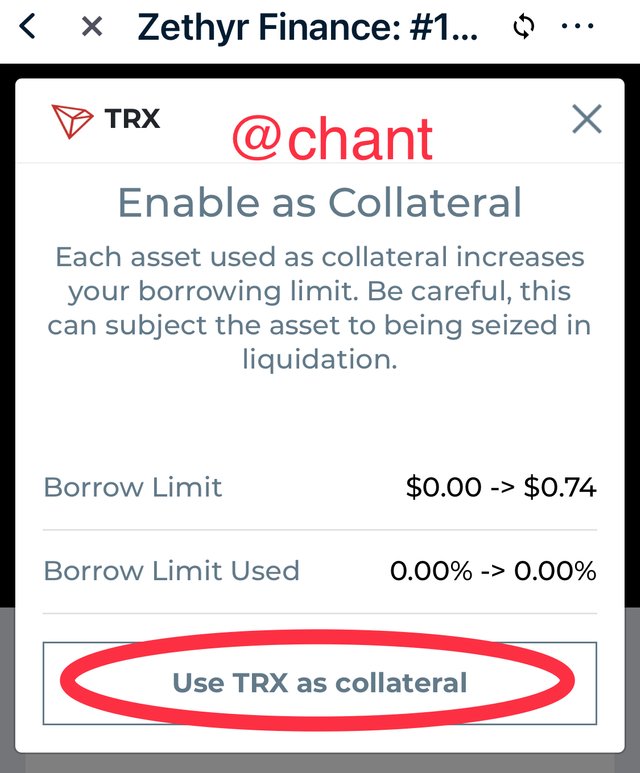

Step 2:

A new interface opens, requesting I confirm to collateralize my TRX. I click on the collateral icon of TRX supplied.

Step 3:

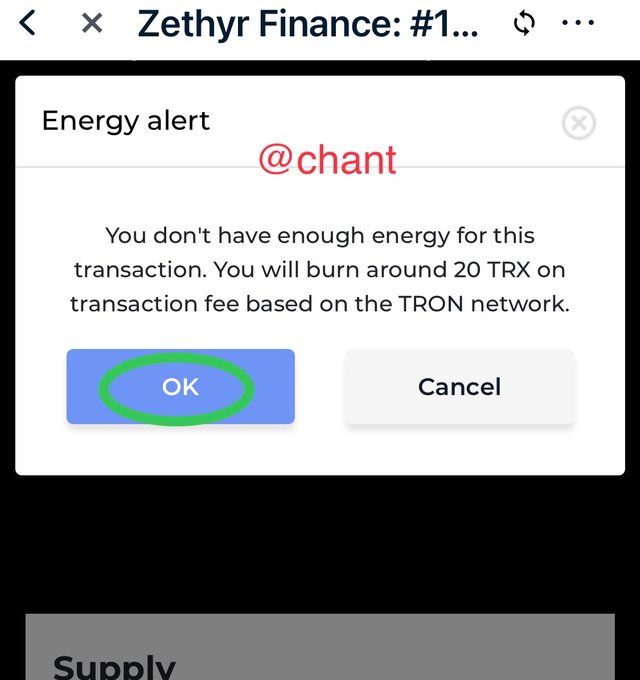

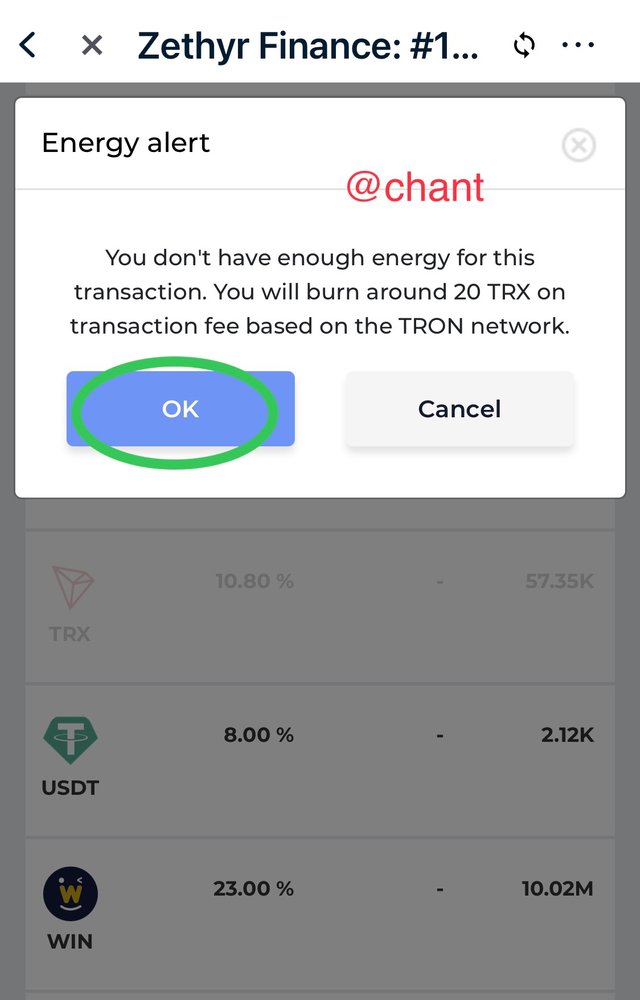

Click on “ok” to confirm the energy warning alert.

Step 4:

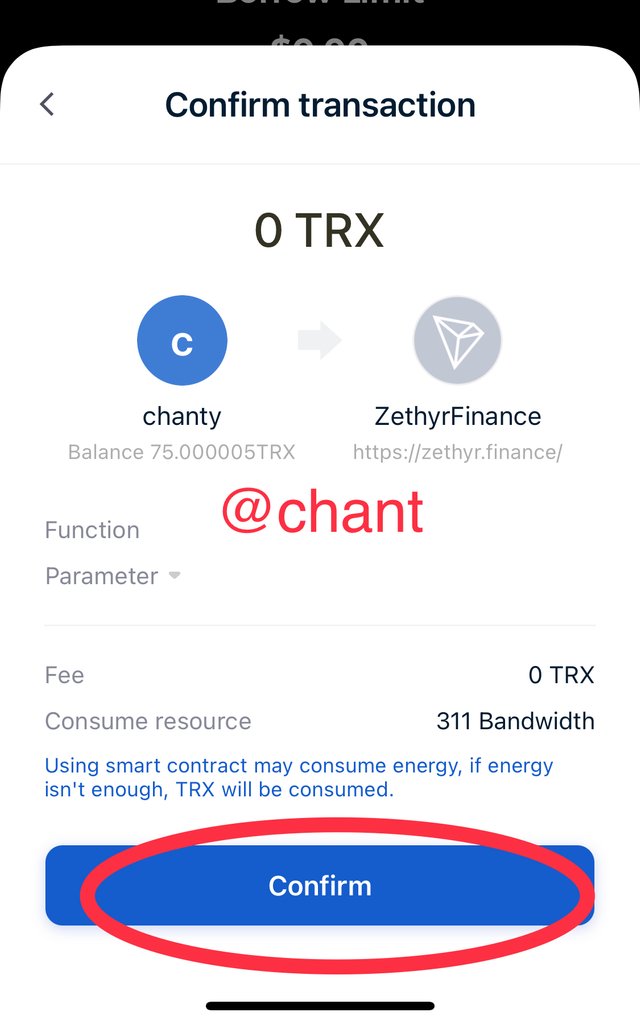

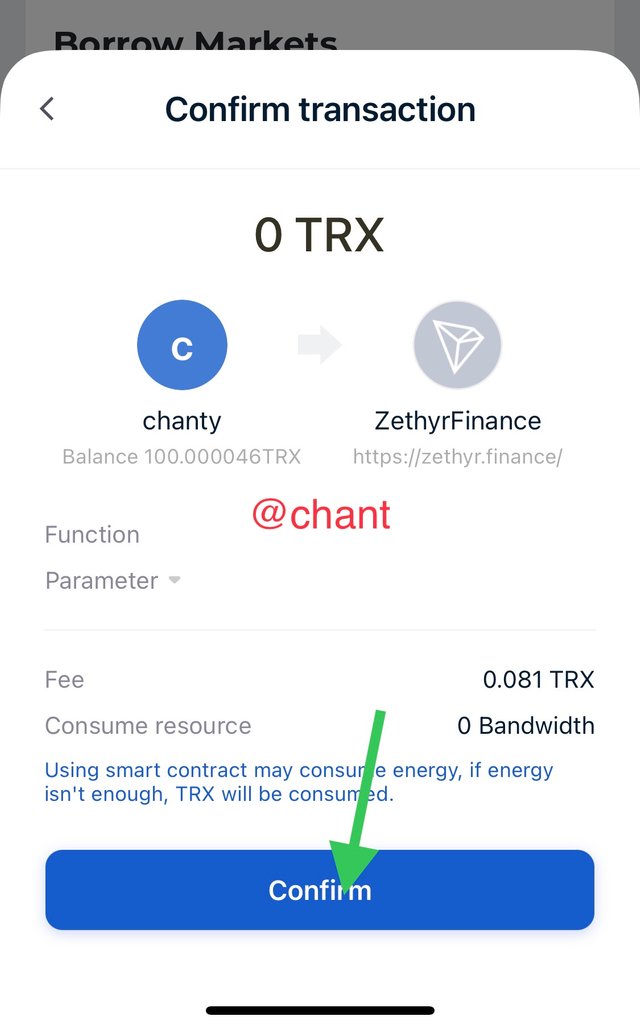

Proceed and click on “confirm”, enter wallet password, and click “done” to confirm TRX asset to be used as collateral to borrow.

Borrow on Zethyr Finance

SteP 1:

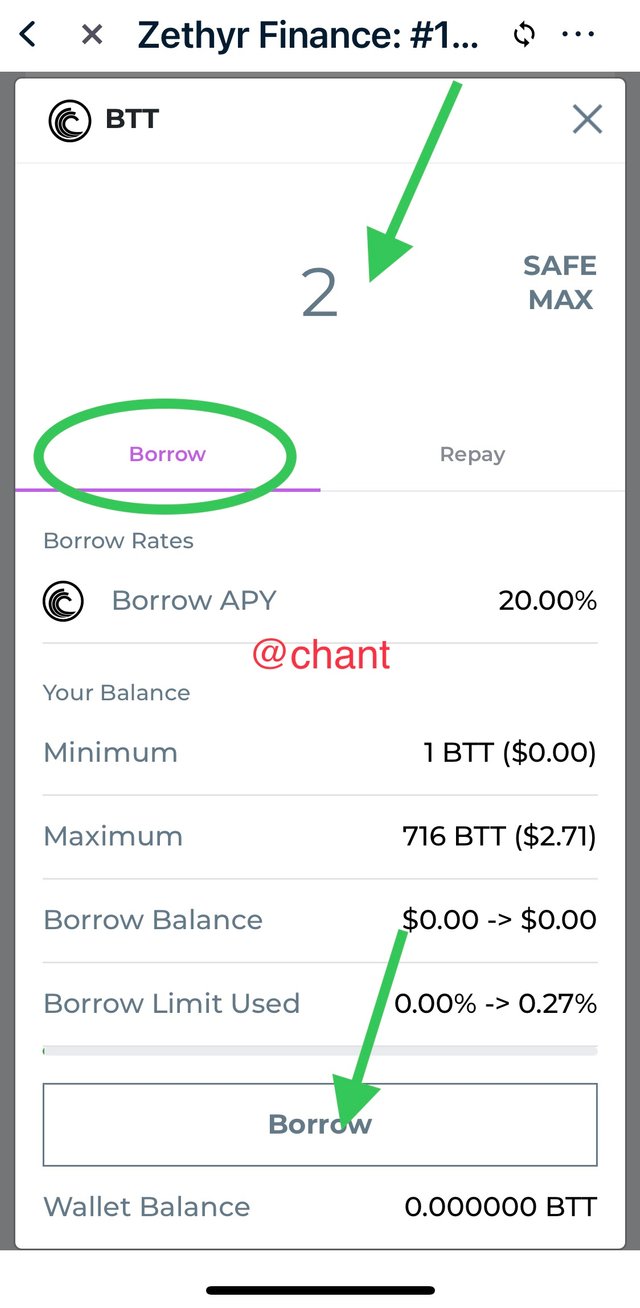

On the borrow page, scroll down to the listed assets, and select the asset you intended to borrow. I will select BTT.

Step 2:

Enter the amount of BTT to be borrowed, and click on “borrow”.

Step 3:

An alert pops up, click on “ok”.

Step 4:

Enter password, and Click on “confirm”.

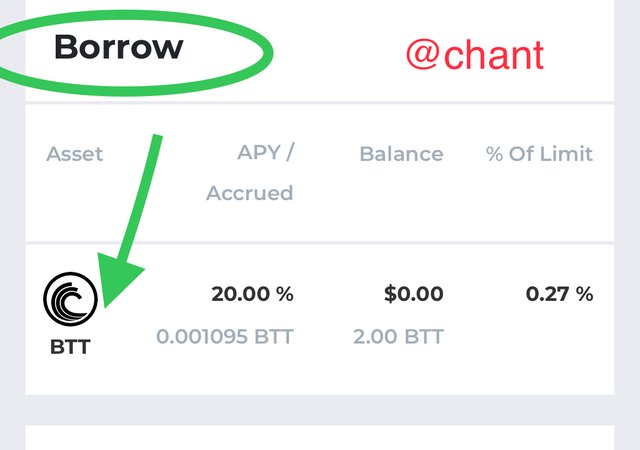

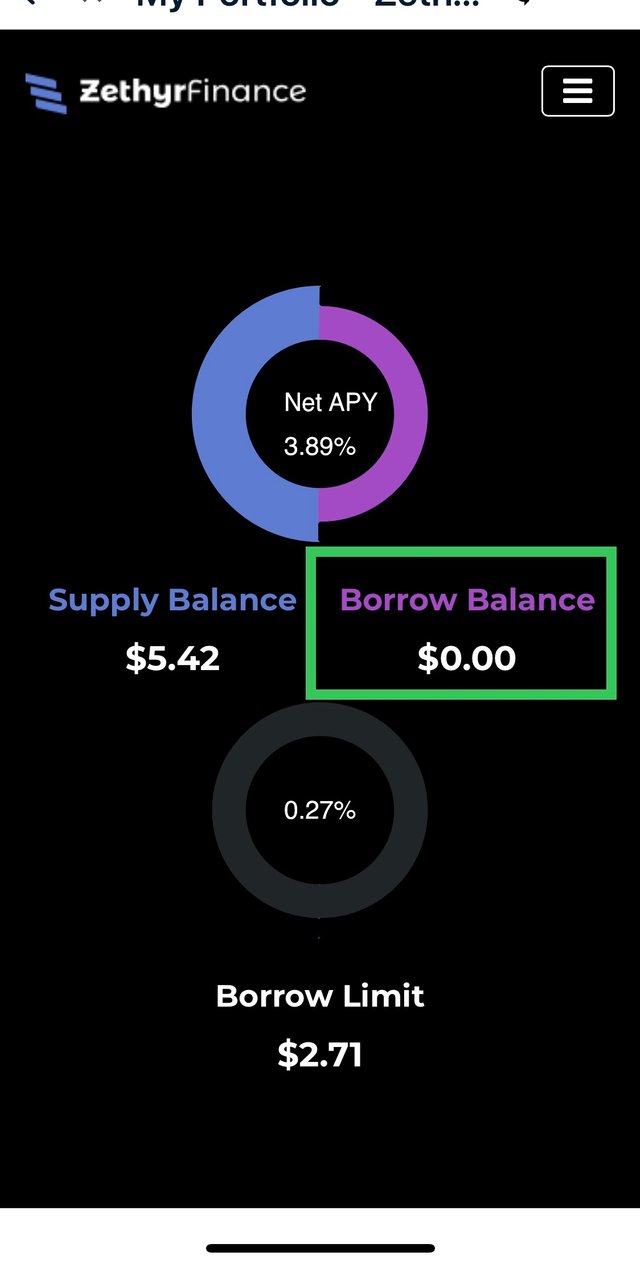

Now, I have successfully completed my borrow process with net APY 3.89%, and borrow limit of $2.71.

Transaction details https://tronscan.io/#/transaction/bcd3a6a422117f1f9a9f48069432d331a5ead5621ad7323b2daa397f1d988320?lang=en

To Repay Borrowed BTT

Step 1:

Open borrow page, and click on the BTT I borrowed.

Step 2:

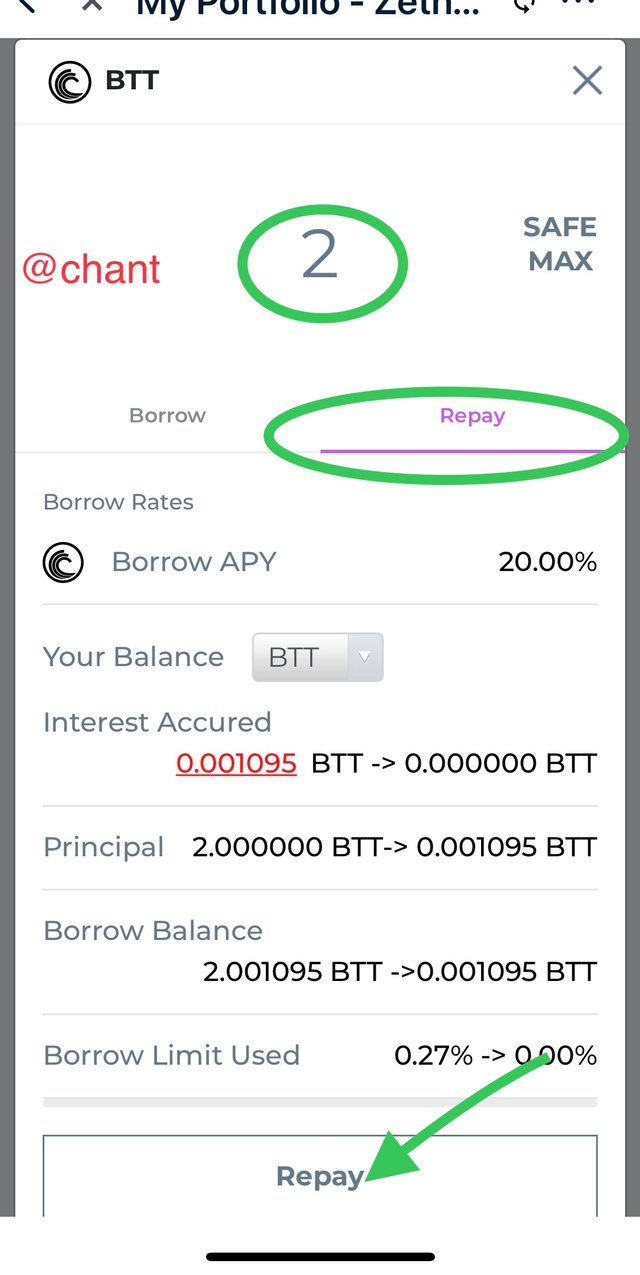

A repay page opens, enter the amount of BTT to be repaid, and click on repay icon.

Step3:

An energy alert message pops up, click on the “OK” icon as seen below.

Step4:

Confirm the transaction by entering your wallet password, and click on “done”, and I have successfully repaid the borrowed BTT.

Transaction details https://tronscan.io/#/transaction/bcd3a6a422117f1f9a9f48069432d331a5ead5621ad7323b2daa397f1d988320?lang=en

To Withdraw Asset from Supply Pool

Step1:

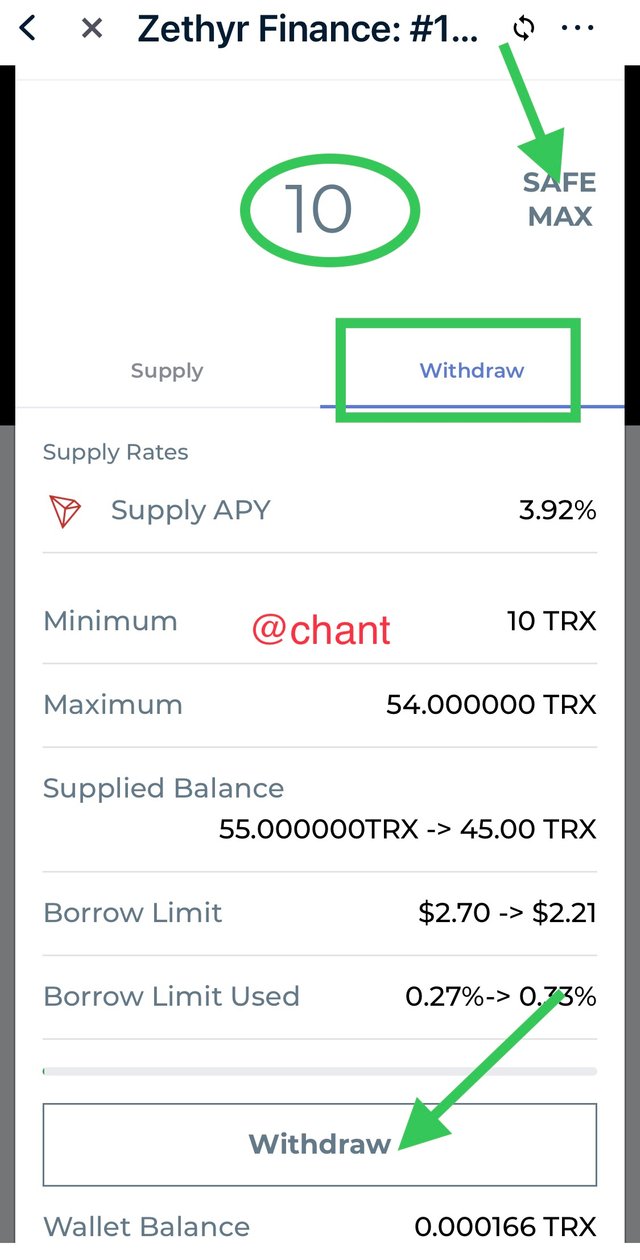

Open supply page, and click on the asset supplied, which takes me to the withdrawal page.

Step 2:

Click on “SAFE MAX” icon, input amount of TRX to be withdrawn, and click on “withdraw” icon.

Step 3:

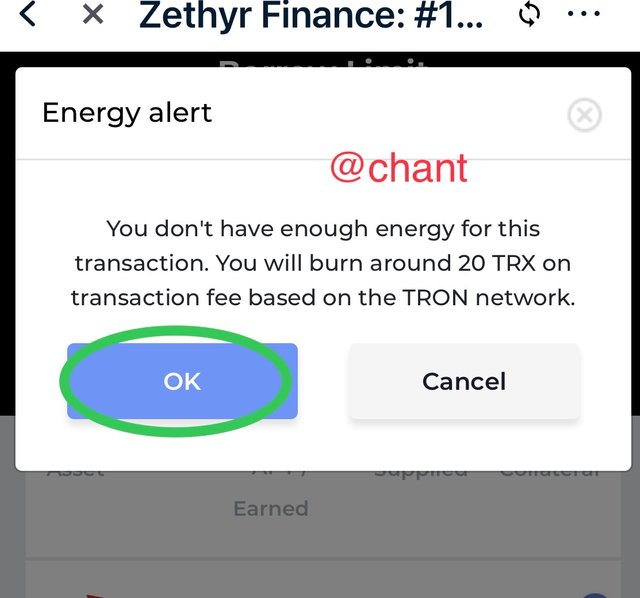

An energy alert pops up, click on “OK”.

Step 4:

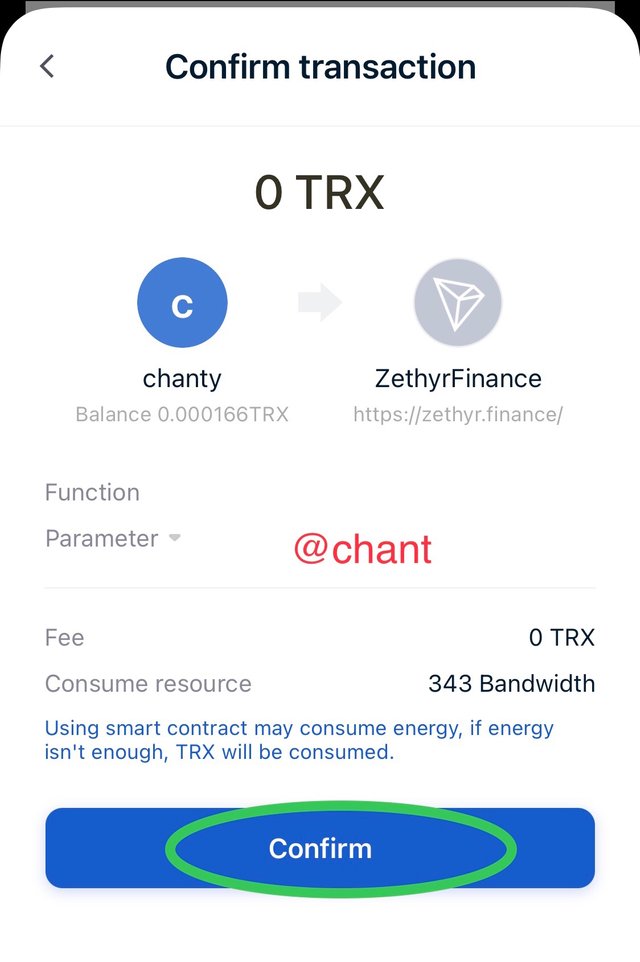

Confirm transaction by entering wallet password and click on “done”. I have successfully completed my withdrawal.

See transaction details https://tronscan.io/#/transaction/afa717dd263c1be6b8b24af33c23a477f136f6b44096a2130c41fe9b2678bae9?lang=en

Question 8

What do you think of Zethyr Finance? Is it great or not? State your reasons.

I think Zethyr finance is the DEX of the future for the following reasons:

- It permit users to borrow/lend without complications. You are eligible to borrow once you have collateral asset to deposit before borrowing. Users earn good yields by supplying assets to the pool. Lenders are offered ztoken as reward for supplying assets to the supply pool.

- Transaction fees on zethyr finance are low as compared to other exchange platforms.

- It is easy for users to select matched token pairs without going through different exchange platforms to compare suitable rates. This is thanks to the DEX aggregator function which uses seconds to compare, and compile list of tokens with good rates, and matched them to exchange platforms.

Conclusion

Zethyr finance with the exchange feature is a unique decentralized platform that facilitates the work of traders by allowing investors and traders to lend/borrow assets from the supply pool. Traders can easily swap their tokens without interference from a central authority.

It’s various features made the platform unique, and I will encourage traders to exploit it, and make more profits.

Do not use the #club5050 tag unless you have made power-ups in the last 7 days that are equal or greater than any amount you have cashed out.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello! 7 days? is the 1 month rule effective on November 1st?)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes - to give people a chance to do their #SPUD4STEEM power-up.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit