INTRODUCTION

Happy new year my fellow steemians and welcome to another great lecture delivered by professor @sachin08 on the topic Reading Special Bar Combinations. I trust God to attempt the home task for this week according to my ability.

QUESTION 1

The price bars on the chart can provides a lot of knowledge regarding price action to a merchant upon analyzing a trade. once we have long vertical lines, we all know that we've got a vicinity of high market volatility that indicates heaps of price movement between the highs and lows. On the opposite hand, when we have short bars we know that there’s low market volatility and therefore very little price movement. the worth bars can also be set to any time vary as from minutes to months.

Price bar is one among the chart tools utilized by traders to create analysis regarding this vary of any crypto quality taken into thought among a amount of time. now is also one minute, five minutes or perhaps a month. the value bar has each vertical and horizontal lines that's use to relinquish data to the trader.

The price bar contains the data that's required by bargainers to enter or exit a trade. As we have a tendency to all know the most important aim of the trader is beneath stand to grasp once to enter or exit his or her trade in order that he will minimize loss and maximize profit. therewith been said, you may accept as true with American state that the worth bar graph has bestowed with information that may assist North American country perform this because it offers us information concerning open, close, high and low of the quality under review.

How to add these price bars on Chart

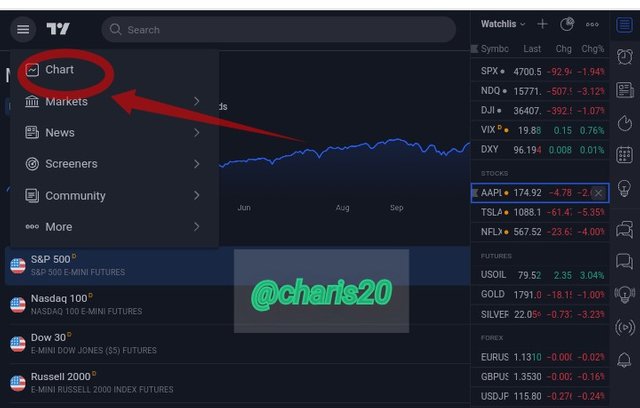

I will make use of Trading View therefore kindly Visit the tradingview.com official website and then click on the candlestick logo marked on the chart below.

Trading view.com

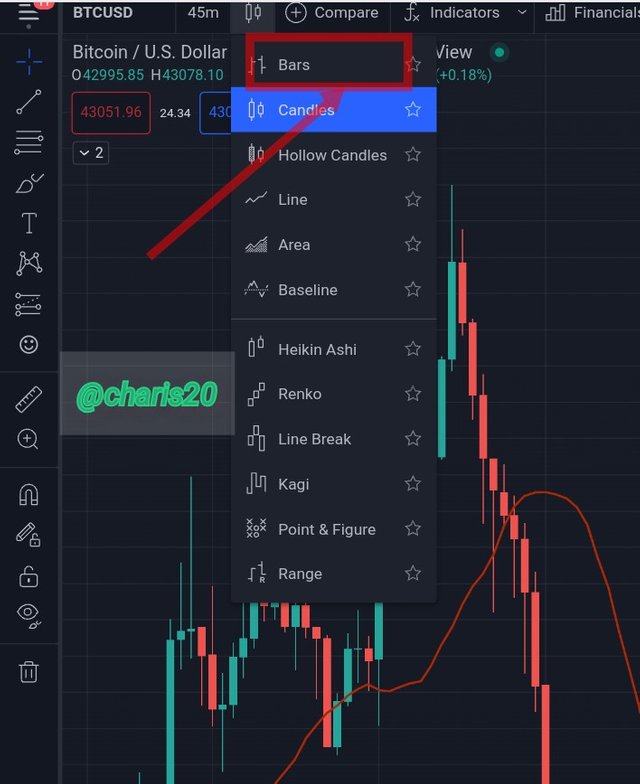

The list of options that will display, just click on the bar option as seen in the screenshot below.

Trading view.com

The bars as I even have aforesaid earlier is used to determine the trend movement of the plus and it may also facilitate traders to understand once to shop for or sell their asset.

Trading view.com

Trading view.com

The screenshot above describes the various parts of a price bar which includes the Open, Close, Low, and High.

This can be explained thus;

OPEN: This is where the price bar usually begins its' formation at this point. This is usually seen because the left horizontal line on the bar.

CLOSE: This it the last price where the formation of a price bar ended. It is identified as the right horizontal line.

LOW: This is the last point of the vertical line in the bottom where the price trades to its lowest during the formation of that price bar.

HIGH: This is the highest point in which the price of the asset can go. It is usually seen at the top of the vertical line.

QUESTION 2

In order to identify trends using price bars one would need the understanding of the various price bars which are open, close, High and low. The combination of this helps the trader interprets and place the bars appropriately.

Uptrend and Downtrends identification are two important ways in interpreting a particular bar price.

UPTREND IDENTIFICATION

An uptrend is normally seen on a price bar chart when we have a series of higher highs together with higher lows.

The aim in identifying trends is so that a trader can know a trend in its juvenile stage so that an entry can be made. Prices will always trade with ups and downs but when the higher highs and lower lows appear consistently, we know that we are in an uptrend. Also, when we have a bearish trend reversal we will know that we are in an uptrend provided the higher highs and lower lows conditions are fulfilled.

Trading view.com

The screenshot above shows an uptrend where there’s a series of higher highs and lower lows day-in and day-out. Most of the days on the above chart, the price makes new highs in a progressive field such that we have a price harmony.

DOWNTREND IDENTIFICATION

This occurs When we have a series of lower lows and lower highs we can say we are in a possible downtrend. Here a close will form lower than the previous day’s close. As a trader, seeing a continuous lower low in progress you can close buy trades and take on sell trades. The appearance of a downtrend signifies that the bulls are taking over the market.

if a trader simply notice the price bar making series of lower highs and lower low and the rate at which higher highs and higher low is formed is small or negligible, we then say that the situation is a situation of downtrend movement of the asset.

Trading view.com

From the screenshot above we can see how there was price harmony with new lower lows and lower highs in a series. At some pints the the cam be higher lows but at the tail end the one considered for the trend is the lower low at the edge.

QUESTION 3

For spending the day inside to occur, there are two conditions that must be met. These conditions are simply described below;

1). The high of the new price bar must be lower than that of the previous price bar

2). The low of the new price bar must be higher than the low of the previous price bar.

The spending the day inside can be bullish or bearish depending on the closing direction.

For the bullish day inside we will have a price bar forming with the open at the low of the previous price bar while the close is up but below with its high below the high of the previous price bar.

For a bearish day inside we will have the open of the price bar close to its high and the close below to the downside but its low higher than the low of the previous price bar. This signifies that we have a bearish move and if the previous price bar is of the same type we can say we are in a bearish market structure but of the previous price bar were to be the opposite then we can be experiencing a possible reversal. The screenshot below describes a simple bearish day out.

Trading view com

QUESTION 4

Exiting the daily bar combination is a possible trend reversal or continuation signal. For this to happen, you will need to notice the open and close bar appearing outside of the day as well as the up and down.

The open and close direction plays a key issue here and might be used as a preliminary level for understanding the reversal direction. an out of doors day merely implies that the value bar forms with its horizontal lines at the open and close that applies here like we've a full candle while not wigs.

For bullish

On a bullish scale we can have the low being the open and the near being the excessive that's indicative of a few type of bullish impulse. In a case in which we've got the near of the preceding fee bar on the excessive and the open of the brand new fee bar at its low, we realize we're in a bullish fashion continuation.

For Bearish

For the bearish, you will notice an open from the high and the close is seen at the low. Here the close is usually lower than the previous price bar of the previous low.

QUESTION 5

According to the professor in his lecture, if you notice a close at the open it can either lead to trend reversal or trend continuation. For an uptrend (where the price combination is to the upper side), the Open and Close being near the high is a signal of uptrend continuation but if they are near the low we know that it’s a signal of a possible reversal from the bull run.

FOR UPTREND

The Open and Close being near the high is a signal of uptrend continuation but if they are near the low we know that it’s a signal of a possible reversal from the bull run.

Trading view.com

FOR DOWNTREND

In the case of downtrend where the price combination are at the downtrend, we can have the open and close near the high which will indicate that we are on a possible trend reversal. On the other hand, when we have the open and close near the low then we have a possible bearish trend continuation.

Trading view.com

CONCLUSION

I have been able to attempt all the home task questions given by the professor. I had difficulty in identifying some of the chart however i really tried my best and hope for better improvement subsequently.

I have learnt how to analyze the market using the two kind of trends and how price can be deduced using the price bar. I will like to express my profound gratitude to professor @sachin08 for putting up this. Thanks so much sir.

God bless you richly.

Warm Regards

@charis20