1- Define the following Trading terminologies;

- Buy stop

- Sell stop

- Buy limit

- Sell limit

- Trailing stop loss

- Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)

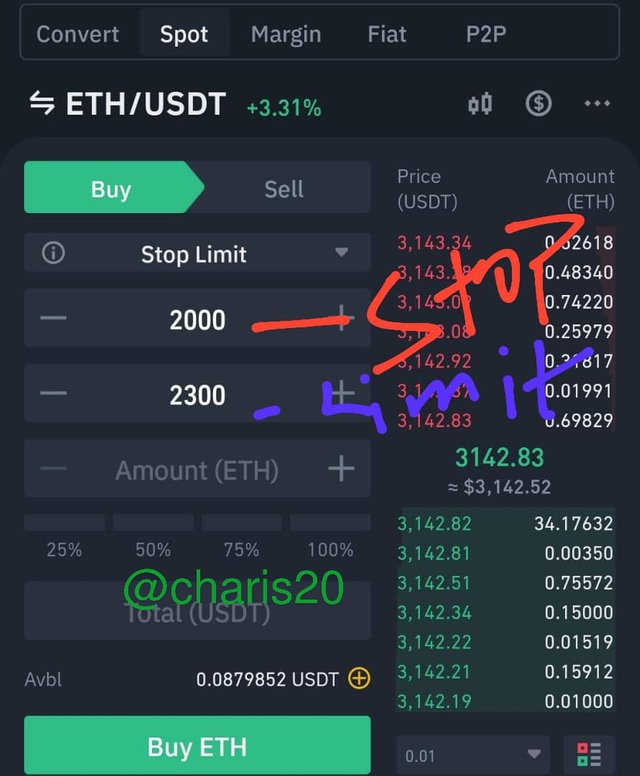

- Buy Stop

This is a procedure to buy a coin or crypto asset giving command to a certain price you want the crypto asset to buy to for instance, if Eth is at a currentt price of $2,100, you can initiate a buy stop to a range of $2,200.

From Binance App

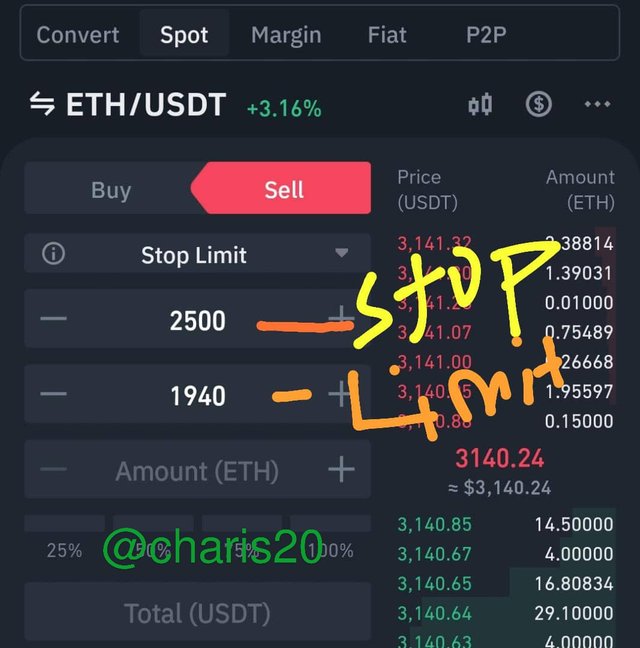

Sell Stop

It can be called take profit, trading target. The point at which you want your crypto asset to sell.

For instance if you bought Eth at $2,000 you may want to sell at a stop of $2,500 so once Eth gets to 2,500 the command to sale stop will be initiatedBuy Limit

This is a trading strategy where by you may want to buy a certain crypto asset within a certain limit when the crypto asset is increasing or decreasing in price

For instance, if the current price of Eth is at $2,100 you may want to set a buy limit of $2,300 so when Eth gets to $2,300 or above the buy stop will be initiated. The buy stop is the lowest price or point in which you want to get your crypto asset why the buy limit is the highest point of which you want to get your crypto asset.

Buy stop is always set below the current price of the crypto asset why buy limit is set a little above the current price of the crypto set

- Sell Limit

It is a strategy. It is also know as stop loss. It is used for trading risk management or it is a trading management tool which is the opposite of buy limit. It does almost the same function with buy limit. It is used to mitigate or manage losses for instance, if your buy stop is at $2,000 you can have a sale limit of -3% of your buy stop which is $1,940,now if the trade is going negative when it gets to 1940 it will stop. Sell stop will be placed 2,500. Sell stop is the main take profit

From Binance App

Trading stop plus

It is a technique of bringing closer your stop plus after a corresponding sale order has been made. For instance, If your sale target of Eth hits $2,500 and the initial stop plus was at $1,940 I will shift my stop plus to 2,000 which was my initially entry. It is used to mitigate losses in trading. It helps you to have some profit when the trade is on the reversal stage. Trading stop is often used when the market is on the reversal with or almost hitting your sale target. So increase your stop plus from 1940 to 2100 so that you can book some profits when the market is on reverse mode.Margin Call

Margin Cal happens a time when the value of an account goes below the maintenance requirements which involves the trader to add up some money to secure his account from total loss. It is a trading call to avoid traders liquidity.

2 - Practically demonstrate your understanding of Risk management in Trading.

- Briefly talk about Risk management

- Be creative (I will expect some illustrations)

- Use a Moving averages trading strategy on any >of the crypto trading charts to demonstrate >your understanding of Risk management.

(screenshots needed)

Financial Risk Management perhaps the most questionable points in exchanging. Traders need to lessen the danger and expected misfortune, however then again, these traders likewise need simultaneously to get the best benefits. It is realized that to get more noteworthy returns, you additionally need to face more prominent challenges.

Different risk management techniques used in trading?

Long term Trading

Securities exchange dealers utilize verifiable information to settle on long term vital business choices. The drawn out digital money methodology relies upon current action, and you will be more disposed towards confident data instead of solid data and more reasonable for digital currencies.Short Term Trading

Momentary dealers advantage from the unpredictable digital money market by utilizing swing exchanging when the value contrasts in short eruptions of development.Technical Analysis

Specialized investigation of digital forms of money requires examination into project that influence the market dependent on cost and volume information accessible through logical innovation.

- Fundamental analysis

Dealers regularly hope to web journals and data locales and study the whitepaper for digital currencies or cryptographic money local area gatherings.

For what reason would it be advisable for you to adhere to hazard the board?

You can get a progression of effective arrangements dependent on amazing good fortune. You can likewise get a progression of awful arrangements that rely upon karma and feel.

|  |

|---|

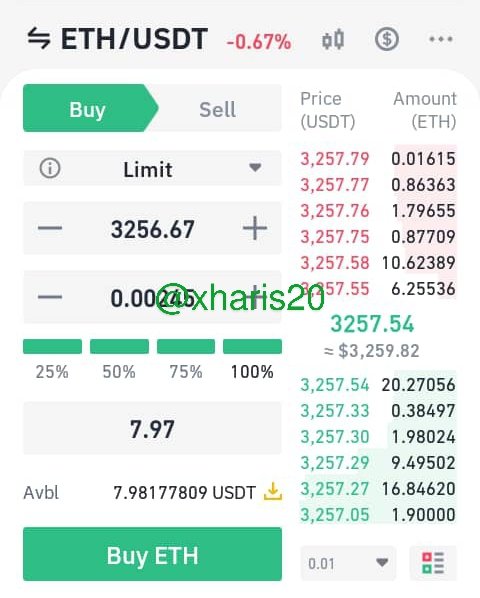

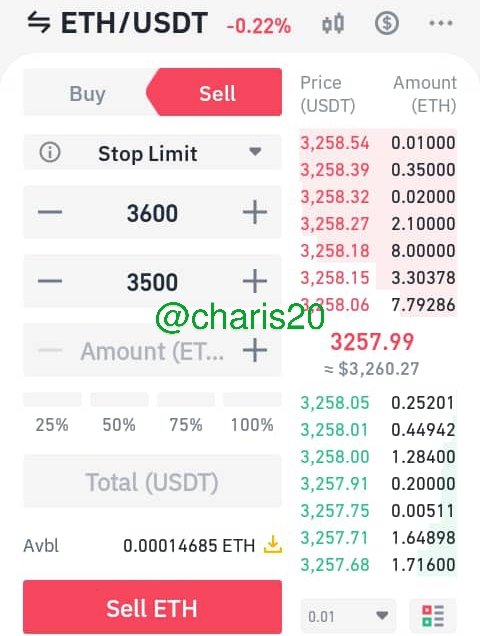

In this I am buying Eth vs USDT at 3,256.67. So the 3% will be at 3,158.97. So the moment the market gets to the loss average it from cut. I set the call to sell at 3,600, but in case the market gets bad and the indication gets to 3,500 it will initiate the sell order.

Conclusion

As a trader it is good to have a proper knowledge of risk management to avoid loss in the system.

It is also advisable not to trade with anxiety so as not to loss money. Do not put all your egg in one basket, that is to say distribute your coins into different orders coins so that when one is not moving well you will still have orders that are moving.

It is very necessary to make the calculation before the beginning of any trade so that you will know whether the trade is viable or not.

Thank you Professor @yahon2on for the lessons, I do appreciate.

Best Regards

@charis20

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is under-average work. You need to take time and research so that you clearly understand the trading terminologies and everything about Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit