Repost

|  |  |

|---|

INTRODUCTION

The knowledge of technical indicator usage is what every cryptographic trader should acquire. When we get to know about the indicator and how it works it will help to reduce the level of losses that is incurred.

Homework Task

1. a) In your own words, explain Technical indicators and why it is a good technical analysis tool.

b) Are technical indicators good for cryptocurrency analysis? Explain your answer.

c) Illustrate how to add indicators on the chart and also how to configure them. (Screenshot needed).

2. a) Explain the different categories of Technical indicators and give an example of each category. Also, show the indicators used as an example on your chart. (Screenshot needed).

b) Briefly explain the reason why indicators are not advisable to be used as a standalone tool for technical analysis.

c) Explain how an investor can increase the success rate of a technical indicator signal.

Question 1

a) In your own words, explain Technical indicators and why it is a good technical analysis tool.

Technical indicators are one of the tools that is used by traders to identify the trades in the market. Technical inicators do not give you the buy or sell signals rather it keeps the trader informed about what should be expected from the market if he desires to venture into it.

There are several indicators that the traders use to determine the trends that is currently in existence. Using a single indicator is not always advisable as that may be misleading. So it is good to make use of two or more indicators so as to be double sure of the prices before venturing into the trade.

For instance, I have in mind to purchase a laptop. So i will not just go to one shop and bargain and get it. I will make my research online first then go to the open market. So from those i will come up with the best place to get. So also in using indicators, I will have to make use of two or more indicators compare the proves so as not to be mislead by one.

Why is Technical Indicators a good Analysis Tool

Yes, Technical indicator is a good analysis tool. I say so because it gets to inform the trader what to expect from a given market.

b) Are technical indicators good for cryptocurrency analysis? Explain your answer.

Yes technical indicators is good for cryptocurrency analysis.

- Technical indicators gives a cryptocurrency trader an idea of what should be expected from the market.

- Technical indicators helps a trader to know or determine the current trend whether it is a bullish or bearish trend. The knowledge of the trend will help the trader to know how to invest so as not to incure losses.

- Technical indicators helps its user to know or determine when to enter the market and what to expect from the market. In setting of the stop loss and the buy signals or the sell signals will not be a difficult thing to be done.

- Technical indicators helps the cryptographic trader to verify if the prices are what it is said to be.

- Technical indicators also hints the trader of when to enter a market or even sell in a given market.

c) Illustrate how to add indicators on the chart and also how to configure them. (Screenshot needed).

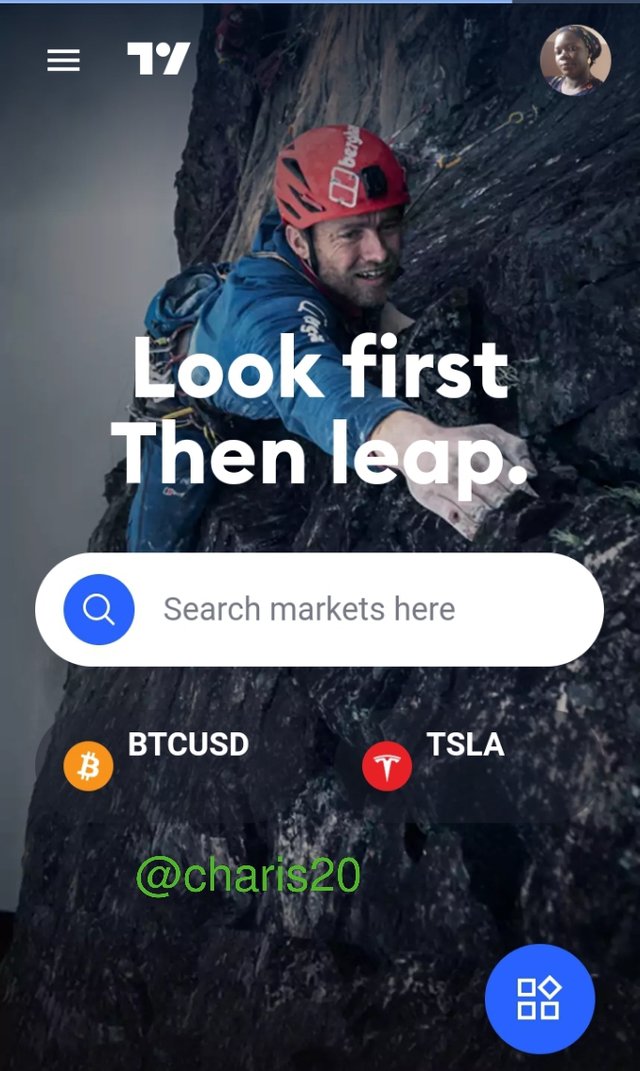

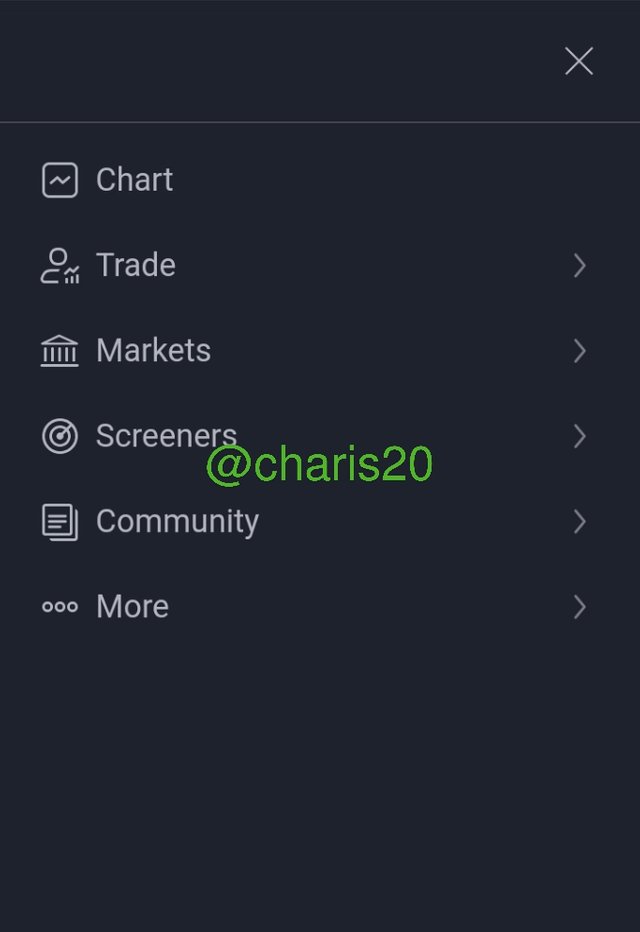

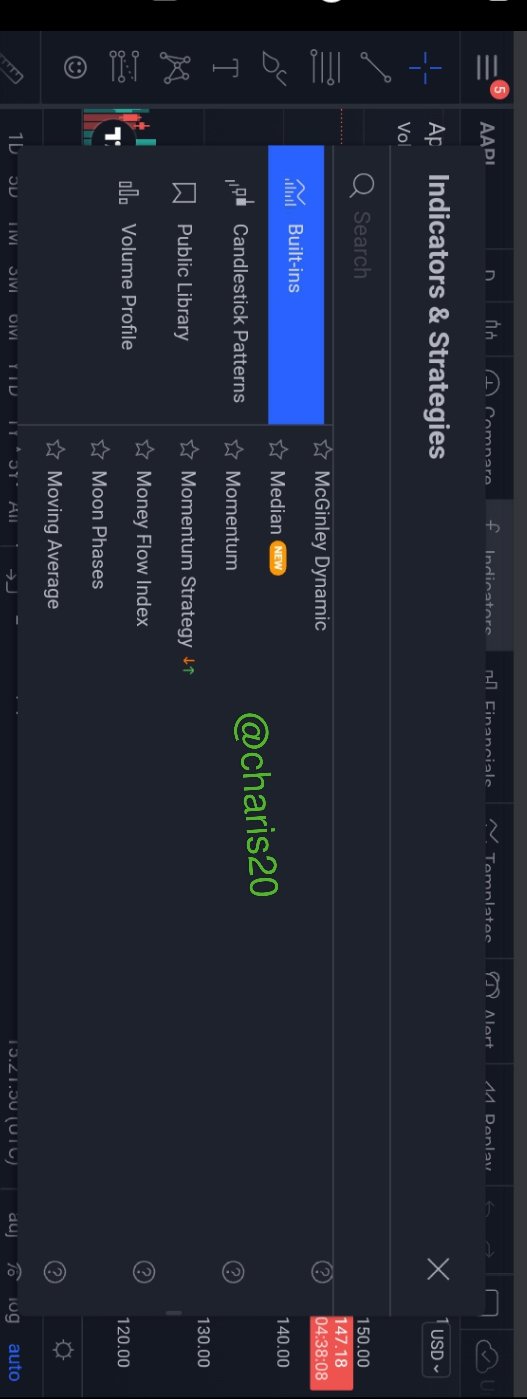

Using the trading the view to add indicators to my chart.

Login to my Portal since i already have an account with tradingview.com

I navigated to the chart region and clicked it

I went and click on indicators(fx)

I searched for the indicator i want to add, i used Momentum strategy

Then I clicked to add

Question 2

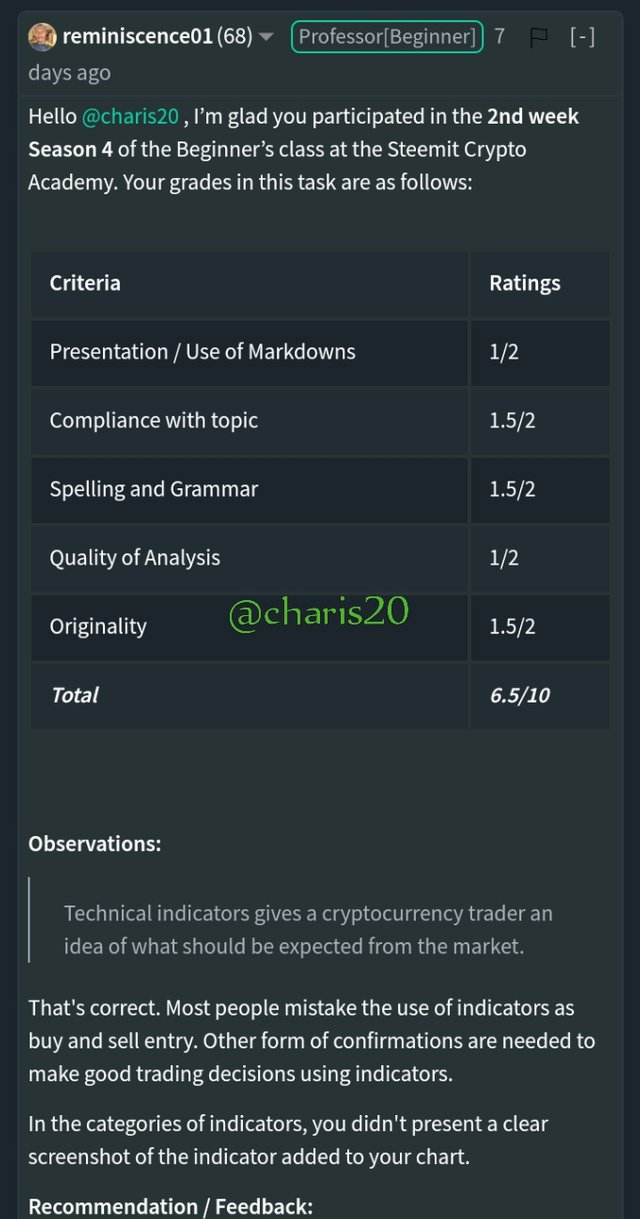

a) Explain the different categories of Technical indicators and give an example of each category. Also, show the indicators used as an example on your chart. (Screenshot needed).

There are different categories of indicators a trader can use to determine the trade. These categories will enable the trader to minimize losses in his trading journey. These categories includes;

Trend-based Indicators

Momentum-based indicators

Volatility-based indicators

Trend-based Indecators: Trend based indicators helps the trader to deduce the current trend that is in play, either the uptrend or the downtrend. When the trend is upward that is to say the market is going to the boom and when it is the downtrend the market is going into the deep. The trader will not incure much losses if he learns to move according to the trend. But if he decides to move against the trend it is very risky.

*Example of Trend based indicator are Supertrend, MACD and Parabolic SAR indicators.

- Momentum-based indicators: This is used to determine the extent the price of a particular coin has gone in the market. It is also know as the Oscillators. Momentum based indicator helps to identify when a particular coin is over bought or under bought. Crypto traders always take advantage of this time to perform transactions based on what will profit them most as no man engages in business to make losses.

Examples of the momentum based indicator include RSI, Stochastics and CCI

- Volatility-based indicators: This indicator is used to determine when the market is in a dangling nature. The market can dangle upward or downwards. The traders buys coins well when the price is downwards. Also for long time investors, when the price of a coin swings low, they buy and store till it swings high in this they harvest a lot of profits.

Example of the volatility based indicator are ADX and Average True Range indicators

b) Briefly explain the reason why indicators are not advisable to be used as a standalone tool for technical analysis.

Sometimes it is missleading not to depend solely on the indicator because a times it can be confusing, as it is said in the mouth of twonor three witnesses a matter is confirmed. So it is better to compare with order trading tools so as not to make terrible mistakes. That is why it is not good for a trader to be nervous. You trade when your eye and mind is well opened and you can engage order tools well whike trading.

c) Explain how an investor can increase the success rate of a technical indicator signal.

For an investor to increase the success rate of a technical indicator, he needs to do the following;

- Have the knowledge of the previou report of the market

- The investor should have a network of order investors too who have a good knowledge so as not to engaging in isolated jugements.

- The investor should also read news letters to know what is currently happening

- The investor should try to get a good training if he is still a novice. Learning about cryptocurrency just the way will do now will help an investor to be successful

- The investor should always try to be in a good state of mind before trading and avoid despiracy.

Conclusion

Technical Indicator study really helps understand what the market looks like and what i can be. With technical indicadors you can predict the market of your choice. Technical indicators can also notify a trader when it is time to buy or sell a coin that he sets in the chart, also it can be used to cross check what has been down already so that you will be double sure of what you are doing.

Special thanks to Professor @reminiscence01 for this wonderful lecture. I really enjoyed it.

Best Regards

@charis20

You didn't add the screenshot of my review. Please kindly do that.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Done

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit