Image with imarkup

INTRODUCTION

It is another lovely week to engage myself in this task with the topic "Trading Strategy for Head and Shoulders and Inverted Head and Shoulders Pattern." which was exhaustively discussed by Professor@utsavsaxena11.

QUESTION 1

Explain Head and Shoulder and Inverse Head and Shoulders patterns in details with the help of real examples. What is the importance of volume in these patterns(Screenshot needed and try to explain in details)

HEAD AND SHOULDER PATTERN

Head and Shoulders is a chart structure with three peaks, with the middle peak being the highest of the three peaks and the other two peaks being below the middle peak.

This example gives a sign to a market inversion after a break over the neck area joined by high volume. An indent is a flat line interfacing two valleys together.

The chance of breakdown increments assuming the incline of the neck area is level to descending slanting and the right shoulder is moderately more modest or equivalent to the left shoulder.

The Head and Shoulders design is one of the most confided in pattern inversion designs. This example development will anticipate that a vertical pattern is going to end and beginning of a negative pattern has a high likelihood.

One more significant angle to recollect is that post breakdown from the example, there might be plausible of retest to the neck area.

The further breakdown is additionally went with weighty volume which gives affirmation of the shortcoming.

The example can be framed in any time span from few moments to week after week and month to month outline.

Nonetheless, higher the time period, higher is the likelihood of coming out on top.

Before we proceed, remember that this example is rarely awesome, which means, there will probably be little value variances in the middle of the shoulders and the head, and the example development is once in a while impeccably formed in its appearance.

Trading view.com

Investors usually buy when the price rises above the neckline resistance. The first and third valleys are considered shoulders and the second peak forms the head.

The reversed head and shoulders design comprises of three parts. After a long negative pattern, the value reaches as far down as possible and afterward ascends to frame a high.

This example is something contrary to the well known head and shoulders design however is utilized to foresee shifts in a downtrend rather than an upswing.

Formation of the pattern

Left shoulder: Its formed when Price increase followed by a high price then a drop.

Head: This occurs when the Price increase again to form an advanced peak

Right shoulder:It declines again and then rises to form a peak on the right below the head.

INVERSE HEAD AND SHOULDERS PATTERN

Backwards or Inverse Head and Shoulders designs are actually inverse of Head and Shoulders designs as the name proposes. The converse Head and Shoulders design is likewise probably the best example for pattern inversion.

Also incase of Inverted example which is by and large a perfect representation of the first example however is framed after an earlier downtrend and is normally a bullish inversion design.

In reverse Head and Shoulders is an incredibly principal fire development of specific assessment, this plan advancement predicts a negative to-bullish example reversal.

Trading view.com

In reverse Head and Shoulders configuration is used to recognize a negative to a bullish example reversal. Using this model we can make extraordinary buy side trades.

How to Trade This Pattern

Since the converse head and shoulders are a lining design when it finishes, you should zero in on purchasing or taking long positions (possessing the stock). The example finishes when the resource's value rallies over the example's neck area or gets through the obstruction line.

On the imagined outline, the value rallies over the neck area following the right shoulder. Brokers call this a breakout, and it flags a finish of the reverse head and shoulders.

Customarily, you would exchange the backwards head and shoulders by entering a long position when the value moves over the neck area. You would likewise submit a stop-misfortune request (exchange stop at a set point) beneath the right shoulder's depressed spot.

The neck area functions admirably as a section point if the two retracements (the short stretches in the pattern or the more modest box) in the example arrived at comparative levels, or the subsequent retracement hit marginally lower than the first.

On the off chance that the right shoulder is higher than the first, the trendline will point upwards and hence will not give a decent passage point (it's excessively high). All things considered, purchase or enter long when the value moves over the high of the subsequent retracement (between the head and right shoulder).

Inverse Head and Shoulders

Left shoulder: price down, bottom, then up.

Head: The price drops again, forming a lower bottom.

Right Shoulder: The price rises again and then falls to form a bottom right.

Significance or Important of Volume on head and inverted head and shoulders pattern.

It declines again and then rises to form a peak on the right below the head. Volume plays an important role in shaping these patterns. For the Head and Shoulders pattern, a left shoulder formation was observed with very high volume, indicating that buying momentum is declining as buyers are still very aggressive in momentum but decreasing in volume as the heads form. The right shoulder also shows some volume, indicating that the buyer is tired. However, if the neckline is broken, the volume must be very loud.

The inverted hair, on the other hand, has a lot of volume for the inverted head and shoulders pattern. When the seller exits the market, the inverted head volume decreases. A rise in this inverted head should indicate that volume is recovering, but it also indicates that buyers are in charge of the market. Even the inverted right shoulder has little volume, and when the neckline is broken, there is a lot of volume.

Trading view.com

QUESTION 2

What is the psychology of market in Head and Shoulder pattern and in Inverse Head and Shoulder pattern (Screenshot needed).

I will quickly explain the psychology behind the patterns but i will start with inverse Head and shoulder Pattern.

Psychology Behind the Formation of Inverse Head and Shoulders Pattern.

Trading view.com

For the inverted head and shoulders pattern, the inverted hair shows a lot of volume. However, the inverted head volume is not so great when the seller leaves the market. A rise in this inverted head should show that volume is recovering, but it is a sign that buyers are in control of the market. Even the inverted right shoulder shows little volume, and when the neckline is broken, a very large volume appears.

The inverted head and shoulders pattern is a reversal pattern at the bottom of a bearish trend. This is a stable pattern that traders often look for to enter a bullish trend.

When this pattern forms, the price should be bearish and the first to form is the inverted left shoulder. It is formed as a result of sellers lowering prices very quickly. But soon the buyer's influence is felt and the price goes up, which is often the beginning of a neckline. The seller then intercepted the price and the downtrend continued. This movement converges below the inverted left shoulder, creating an inverted head.

When this pattern forms, the price should be bearish and the first to form is the inverted left shoulder. It is formed as a result of sellers lowering prices very quickly. But soon the buyer's influence is felt and the price goes up, which is often the beginning of a neckline. The seller then intercepted the price and the downtrend continued. This movement converges below the inverted left shoulder, creating an inverted head.The generated inverted head shows very low volume. At this stage, buyers are already entering the market. So they increase the price to reach the peak of completing the price cut. However, the sellers were reluctant to agree and subsequently lowered the price. However, that time cannot be lower than the inverted head, so the inverted right shoulder, which corresponds to the left inverted shoulder, is formed. The resulting inverted head shows a very low volume. At this stage, buyers are already entering the market. So they increase the price to reach the peak of completing the price cut. However, the seller did not want to agree and subsequently lowered the price. However, in his time it cannot be lower than the inverted head, so the inverted right shoulder is formed, which corresponds to the left inverted.

Psychology Behind the Formation of Head and Shoulders Pattern.

Head and shoulders pattern is a pattern that is formed in a bullish trend and it often at the close of this trend.

The consist of three peaks which are left shoulder, head and right shoulder.

When there is a pullback of the prevailing leg of the main trend in a bullish trend, buyers push the price of an asset up and sellers have little influence. As a result, when the price of an asset rises, buyers gain control.

The left shoulder is the first thing that forms in the head and shoulders pattern. It forms when buyers are still very aggressive in the market. Buyers push the price up, forming the first peak (left shoulder). However, as soon as this peak forms, sellers enter the market and drive the price downward, forming the beginning of the neckline.

The buyers then resume and drive the price higher than the left shoulder with great momentum. This is the second peak, also known as the head. Then, the sellers continue to drive the price downward, resulting in the low, which is frequently joined with the first low. Later, buyers return with the intention of driving the price higher, but they are limited to driving it higher than the head before they are exhausted. The right shoulder is formed by the third peak.

Trading view.com*

QUESTION 3

Explain 1 demo trade for Head and Shoulder and 1 demo trade for Inverse Head and shoulder pattern. Explain proper trading strategy in both patterns separately. Explain how you identified different levels in the trades in each pattern(Screenshot needed and you can use previous price charts in this question)

Trade for Head and Shoulder

This strategy is one of the easiest for traders. To trade this strategy, identify head and shoulder patterns. Draw a notch to cut the bottom of the visor. Wait for a clear bullish candlestick to break through the neckline. When a clear bullish candle is identified, place a sell order. Put your stop loss just above your right shoulder. Set appropriate take-profit. It is desirable to be proportional to the stop loss.

Trading view.com

Trade for inverted Head and Shoulder

Similarly, an inverted head and shoulders works the same way as the head and shoulders strategy.

Defines an inverted head and shoulders model. Draw a cutout along the bottom edge of the visor. Wait for a clear bearish candlestick to clear the neckline. Enter when a clear bullish candlestick breaks the neckline. Place a Stop Loss order under your right shoulder. Place the appropriate take profit ratio.

Trading view.com

QUESTION 4

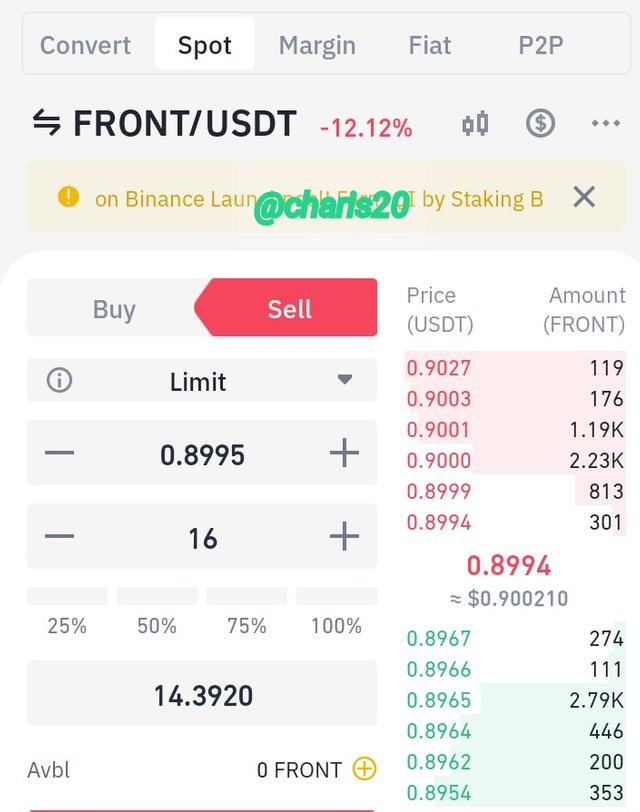

Place 1 real trade for Head and Shoulder(atleast $10) OR 1 trade for Inverse Head and Shoulder pattern(atleast $10) in your verified exchange account. Explain proper trading strategy and provide screenshots of price chart at the entry and at the end of trade also provide screenshot of trade details.(Screenshot needed.)

After defining the head and shoulders, I drew cutouts to cut the bottom vertices. After drawing the neckline, I waited for a clear bearish candle before entering the trade. I ordered exactly where the price breaks the neckline.

Binance app.

We were able to narrow the Take Profit and Stop Loss range, but unfortunately the trade ended in a loss. In cryptocurrency trading, it's not worth investing as much as you don't want to lose. On the other hand, using a smaller period carries a higher risk. So, you can use a few technical indicators along with your strategy to get better results.

Binance app

CONCLUSION

Most professional traders in the cryptocurrency ecosystem recommend these specific technical strategies rather than technical indicators.

One of the most important technical tools for analyzing asset prices is chart patterns. Trend reversal patterns and trend continuation patterns exist. Reversal and Head and Shoulders Head and Shoulders patterns form during extreme bullish and bearish patterns.

This course is highly expository. I have learned more about the usage of the indicators, the head and shoulder pattern and inverse hand and shoulder pattern.

Finally special thanks to Professor @utsavsaxena11 for the in-depth drilling in this course.

CC: Professor @utsavsaxena11

Regards From

@charis20