Basis V2 was officially launched on February 9th: the migration from BAS V1 to BAS V2 began. So, how did BAS V2 migrate, and what impact did it have on existing liquidity providers and BAS V1 holders? Changes in BAS rewards during the migration process. First, the total amount of BAS tokens remains unchanged at 1,000,001 tokens. Before the end of the migration period (before February 22), providing liquidity to the BAS V1/DAI pool on Uniswap can still get BAS V1 token rewards. After the migration, the BAS V1/DAI pool will not be rewarded. The Basis team hopes that liquidity providers will transfer their liquidity to the BAS V2/DAI pool as much as possible.

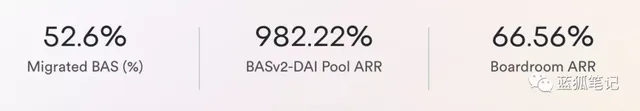

After users migrate their BAS V1 to BAS V2, they can provide liquidity for the BAS V2/DAI pool on Uniswap, and at the same time, they can pledge their LP tokens to the BAS V2 BANK to obtain BAS V2 rewards . In addition, you can also pledge BAS V2 to Boardroom to earn income. At present, as of the writing of Blue Fox Notes, the migration rate of BAS has reached 52.6%, and more than half of BAS V1 has been migrated to BAS V2. In addition, from the current point of view, providing liquidity for the BAS V2/DAI pool has a higher return than providing liquidity for the BAS V1/DAI pool, but as the liquidity increases, its return will also decrease:

(The mobility of BAS, Basis)

(The mobility of BAS, Basis)

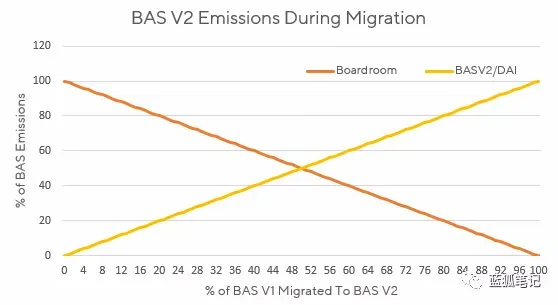

Therefore, during the migration of BAS from V1 to V2, the BAS V1/DAI pool will reward approximately 684 BAS per day, and during the migration process, 684 BAS V2 tokens will be dynamically distributed every day, as shown in the figure below:

(The release of BAS V2 during the migration, Basis)

(The release of BAS V2 during the migration, Basis)

In addition, users who provide liquidity for BAC/DAI on Uniswap will also receive BAS V1 rewards as usual during the migration period. Finally, when the migration is over, the reward plan of BAS V2 will be adjusted accordingly. The specific operation of the migration BAS V2 was migrated from the current BAS V1, the migration address: https://app.basis.cash/migrate, according to the announcement of the Basis project party:

- If you hold BAS in your wallet (such as metamask), enter its migration portal and exchange it;

- If BAS is in CEX, it depends on whether CEX will be exchanged. If CEX exchanges, the user does not need to operate. If not, the user needs to redeem by himself.

- If BAS is pledged in the Boardroom, the pledge must also be released and exchanged through the migration portal.

- If you are providing BAS/DAI with liquidity and pledged, you need to first release the pledge, withdraw its liquidity from Uniswap, enter the migration portal to migrate it to BAS V2, and then provide liquidity for BAS V2/DAI, thereby Earn the benefits of BAS V2.

- If the user is using a third-party Vault, such as Harvest or Pickle, they need to withdraw from the vault and release the pledge, withdraw from the liquidity, and migrate to BAS V2.

- If the user is a liquidity provider or BAC holder of the BAC/DAI pool, no operation is required. If it is BAB/BAC, BAC/ETH pools to provide liquidity or hold BAB, there is no need to operate temporarily.

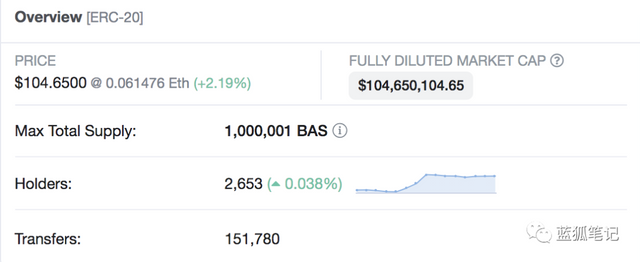

Postponement of BAC/DAI liquidity migration Due to the yearn incident of lightning loan attacks, the Basis team believes that there are certain risks in transferring BAC liquidity to crv.finance under the current circumstances. Currently, basis relies on Uniswap's TWAP to determine the BAC issuance, BAB bond issuance and BAB redemption under the Basis protocol. But the StableSwap pool on crv.finance does not have native TWAP. Therefore, an external oracle is required, such as relying on chainlink to feed prices. The Basis team is currently discussing solutions with chainlink and other defi teams. Therefore, the migration plan to the StableSwap pool is temporarily postponed, and the project team plans to make substantial progress by February 22. The distribution status of Basis tokens As of the writing of Blue Fox Notes, there are currently 2,516 BAC holders, 2,653 BAS holders, and 6,70 BAB holders.

(The holder of BAS, etherscan)

(The holder of BAS, etherscan)

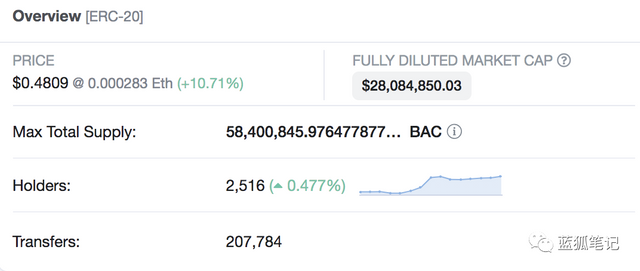

(BAC holder, Etherscan)

(BAC holder, Etherscan)

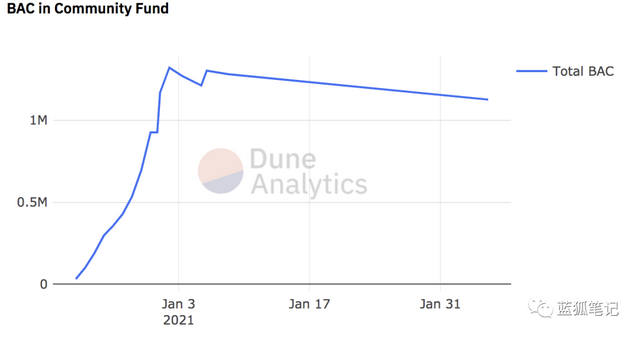

The stability of BAC is relatively balanced. *The amount of BAC is gradually decreasing. BAC's circulation reached 89,481,284 BACs at its peak. As of the writing of Blue Fox Notes, the total amount of BACs has dropped to 58,292,165 BACs. That is, during this period, BACs have been reduced by 31,189,119 BACs. . In addition, among 58,292,165 BACs, 35,350,000 BACs are pledged, with a pledge rate of 60%. *The number of BACs in the community fund There are currently 1,125,931 BACs in the BAC community fund.

(Number of BAC community funds, DuneAnalytics)

(Number of BAC community funds, DuneAnalytics)

BAB holders are further dispersed. BAB holders have increased rapidly recently. The users who hold the most BAB even hold up to 8.2 million BACs. The second-ranked holders also have more than 4.5 million BABs, holding 1 million. There are more than 7 users of one BAB, and the number of users holding more than 10,000 BABs has reached 210. From the current point of view, hundreds of users are relatively loyal supporters of Basis.

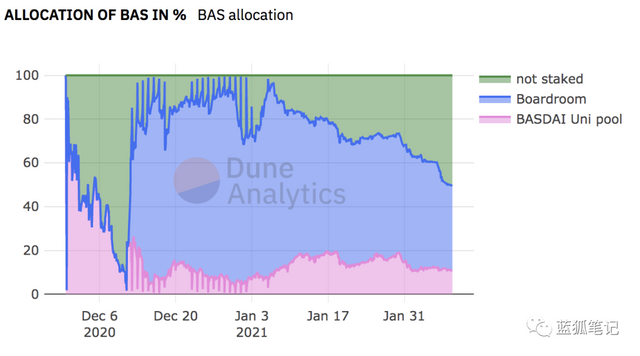

(BAS distribution, DuneAnalytics)

(BAS distribution, DuneAnalytics)

50% of BAS are in an unsecured state, about 38% of BAS are deposited in Boardroom, and about 10% of BAS are provided with liquidity on Uniswap.