Image designed by me on Snappa

Introduction.

I am excited to be partaking in professor @kouba01's class this week on crypto trading using the zig zag indicator. Professor @kouba01 explained what the zig zag indicator, how it is calculated and how it can be effectively used with other indicators.

I would like to present my entry to the task given.

Show Your Understanding Of The Zig Zag As A Trading Indicator And How It Is Calculated?

What Is The Zig Zag Indicator?

The Zig Zag indicator is one of the technical indicators used by analysts to keep track of an asset's current or existing trend. This indicator unlike others cannot predict the future trends of an assets but can only inform traders on the continuing trend of assets.

Although, the zig zag indicator does not give future prediction of trends, it does very well to filter or remove the noise or price fluctuations from an asset. The zig zag indicator is used to identify and determine support and resistance levels.

The Zig zag indicator is characterized by the trend lines it displays that is in zig zag. The lines of this indicator move up and down to display uptrends and downtrends. By default, the indicator is set to a 5% deviation value which can be adjusted depending on the user's preferences.

Whatever deviation value the indicator is set to plays a part in the amount of noise removed. A 5% value means the zig zag indicator does not record fluctuations less than 5% and a 10% or 15% value means the indicator will not record noises less than 10 and 15%.

The Zig zag indicator makes use of swing highs and swing lows on an asset's chart. When there is enough price movement in the asset, the zig zag indicator produces the zig zag lines. If the price movement is not significant, there's no production of lines hence the removal of market noises.

We are aware that we use technical indicators to enable us find proper or best trade entry positions. However, the zig zag indicator because it does it give future trends, is not used for trading. To be used for trading, it is necessary that we combine the zig zag indicator with other indicators like Fibonacci retracements, CCI, Elliot waves, among others.

One concern with the zig zig indicator is that it is a lagging indicator. The indicator values are drawn based on the closed prices of the assets within a period. Only permanent zig zag lines are drawn which are drawn only after the trend reaches the designated time the indicator allows. The Zig zag indicator has it's own time frame within which trend lines can be drawn.

This implies that if the trend formed does not reach the indicator's allocated time and there's a change in trend, the first trend which was temporarily drawn is permanently erased and the new lines for the new trend is drawn.

How The Zig Zag Indicator Is Calculated.

ZIgzag (HL, %change = X, retrace = FALSE, LastExtreme = TRUE)

If %change >= X, plot zigzag.

Where,

HL = High - Low price series or

HL = High - Close price series,

%change = minimum price movement obtained in %

LastExtreme = The changing variable.

For the calculation,

A swing high or swing low is chosen as starting point, a %price movement is chosen and the next thing to do is identify a next swing high or low that is different from the one you chose as starting point. Preferably, it should be greater or equal to the %price movement. After this new point is chosen, a trend line is drawn from the initial starting point to the new point.

A new swing high or swing low is identified again and a trend line is drawn. This process is repeated until the recent swing high or swing low.

What Are The Main Parameters Of The Zig Zag Indicator And How To Configure Them And Is It Advisable To Change Its Default Settings?

What Are The Main Parameters Of The Zig Zag Indicator?

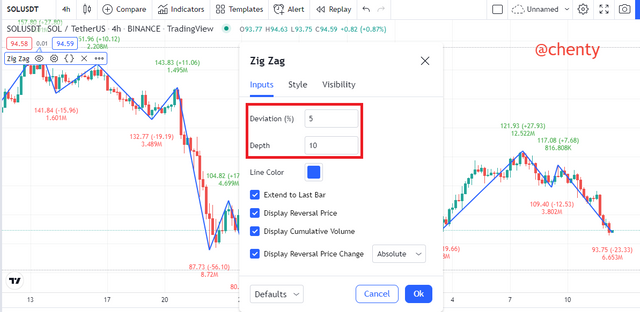

The zig zag indicator is mainly made of 2 parameters; depth and deviation.

The depth parameter of the zig zag indicator is a minimum distance or number of periods the indicator uses. The depth parameter has a default setting of 10 periods and its function is to not allow the indicator plot or record a new swing high or swing low that is different to the previous high or low at least equal to the deviation. Depth is measured or read in candles.

The deviation parameter of the zig zag indicator is a minimum price percentage movement. The deviation has a swing high or swing low from the previous swing high or swing low for the zig zig indicator to identify a new point. At default, it is set at 5%.

Configuration Of The Zig Zag Indicator.

Before I show how to configure the zig zag indicator, I would like to show how the indicator is added on tradingview.

- Visit tradingview and click on charts.

- The charts are launched. Select a crypto chart to use.

- Click on fx indicators at the top of the page.

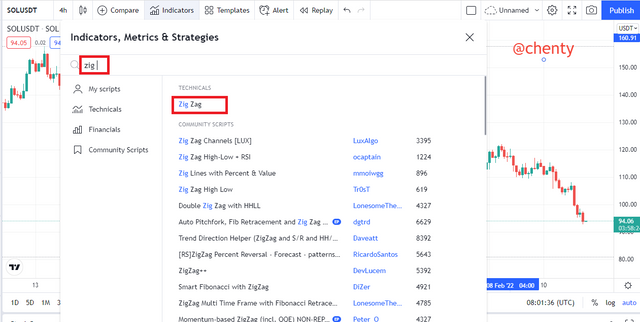

- Search for zig zag and click on Zig zag from the results.

- The zig zag indicator is added as shown.

The customization of the indicator will be based on styles and input.

Click on gear or settings icon to display the indicator's settings menu.

- Input.

From the inputs menu, the 2 indicator parameters are found; depth and deviation.

By default, depth is set to 10 and deviation is set to 5.

Changing these default settings depends solely on the trader and the kind of trading system the trader wants to use.

Traders must however take note that when the parameters are increased too much, more noise is removed but even sensitive information is removed. It is advisable to change the settings based on the asset being analyzed and the time frame used.

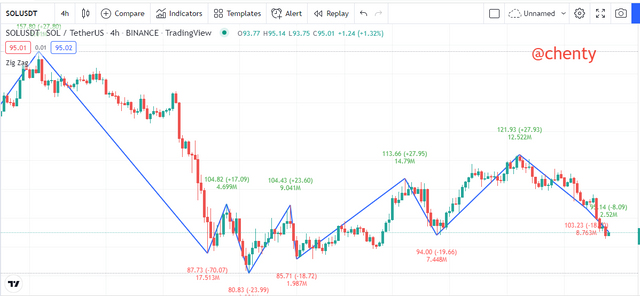

The images below compare the zigzag indicator with it's default setting and changed settings.

Zig zag indicator with depth 5 and deviation 10

Zig zag indicator with depth 10 and deviation 5.

From the 2 images above, we realize that when the depth is set to 5 and deviation is 10, noise is removed and we have longer lines forming resulting in formation of fewer peaks. However, set to depth 10 and deviation 5, there is formation of more peaks because it has become more sensitive to price changes.

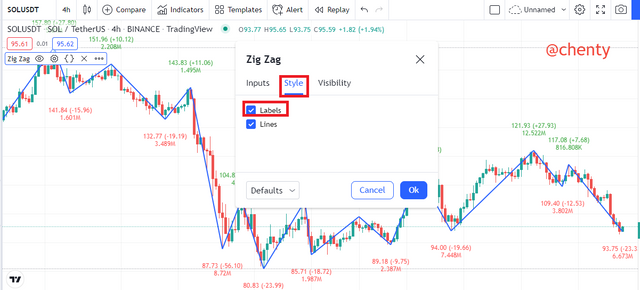

- Style.

From the settings menu, we can access styles. Styles mainly has to do with the appearance of the indicator. When you first launch the indicator, it is represented in blue color. By default, the zig zag indicator is displayed with labels which are price labels and volume. To make the indicator look easier or clearer, you can opt to remove the labels by unticking ** labels**.

The zig zag indicator with price labels

The zig zag indicator without price labels

Based On The Use Of The Zig Zag Indicator, How Can One Predict Whether The Trend Will Be Bullish Or Bearish And Determine The Buy/Sell Points

The zig zag indicator uses swing highs and swing lows to draw the zig zag ( diagonal ) lines and show trends.

The Zig Zag Indicator In An Uptrend.

In an uptrend, the price of the asset is rising and new highs are formed. The zig zag indicator depicts an uptrend by following a rising order.

The new high is higher than the previous one and new low is higher than the previous low as well. The new highs or peaks and new lows are connected with diagonal lines or zig zags which are rising. This confirms an uptrend.

Identifying Buy Signals With The Zig Zag Indicator.

To place a buy order, the asset must first be in an uptrend and buy order should be placed after the price forms the next low that is higher than the previous low. The stop loss is placed below the new low as support.

The trade is left to gain profit until the indicator hints for a trend reversal.

The Zig Zag Indicator In A Downtrend.

In an downtrend, the price of the asset is falling and new lows are constantly formed. The zig zag indicator depicts a downtrend by following a decreasing order.

The new low is lower than the previous one and new high is lower than the previous high as well. The new lows and new highs are connected with diagonal lines or zig zags which are falling. This confirms a downtrend.

Identifying Sell Signals With The Zig Zag Indicator.

To place a sell order, the asset must first be in an downtrend and sell order should be placed after the price forms the next high that is lower than the previous high. The stop loss is placed above the new high as resistance.

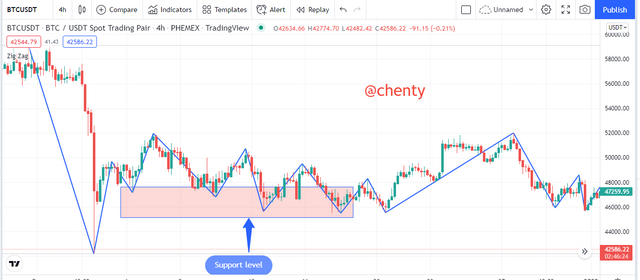

Explain How The Zig Zag Indicator Is Also Used To Understand Support/Resistance Levels, By Analyzing Its Different Movements.

Resistance and support levels are the points at which prices are tested and rejected. The swing highs and lows are used in the identification of support and resistance levels. At these levels, prices cannot either go up or down over a period. The prices keep bouncing up and down till they are eventually broken.

The Zig Zag Indicator And Resistance Level.

For resistance levels, the price stays at a certain range over a period and cannot go higher than that. There are multiple times the price gets tested at tat range and it keeps bouncing off till it finally gets broken. At resistance levels, buyers are no longer able to push prices high and are good points to set sell orders.

Using the zig zag indicator, the resistance level is identified by multiple previous swing highs that are on the same level horizontally. Prices are rejected at those levels.

The Zig Zag Indicator And Support Level.

For support levels, the price stays at a certain range over a period and cannot go below that. There are multiple times the price gets tested at tat range and it keeps bouncing off till it finally gets broken.

At support levels, sellers are no longer able to push prices below and are good points to set buy orders and accumulate assets. Usually when they get broken, prices surge and can even result into formation of new price highs and all time highs.

Using the zig zag indicator, the support levels are identified by multiple previous swing lows that are on the same level horizontally. Prices are rejected at those levels as they keep bouncing off at those ranges.

How Can We Determine Different Points Using Zig Zag And CCI Indicators In Intraday Trading Strategy? Explain This Based On A Clear Example.

The CCI, Commodity Channel Index is an oscillation based indicator that helps traders determine the condition or emotion of the, market. CCI indicator is used to determine overbought and oversold zones that help traders make decisions.

When the indicator is above the 100 range, it indicates an overbought state or zone and therefore a good time to sell assets but when it is below -100, it indicates an oversold zone meaning a good time to buy assets.

CCI Indicator In Uptrends.

In uptrends, intraday buying opportunities using zigzag and CCI is valid when the price closes above the previous high and the CCI indicator is above 100 level. Let's consider the chart below;

From the chart above, the price closed above previous high and the CCI confirmed this by staying above the 100 level. This is an indication a buy signal.

The Stop loss is placed below the previous low.

CCI Indicator In Downtrends.

In downtrends, intraday selling opportunities using zigzag and CCI is valid when the price closes below the previous low and the CCI indicator is below -100 level. Let's consider the chart below;

From the chart above, the price closed below the previous low and the CCI confirmed this by staying below the 100 level. This is an indication of a sell signal.

The Stop loss is placed above the previous low.

Is There A Need To Pair Another Indicator To Make This Indicator Work Better As A Filter And Help Get Rid Of False Signals? Give More Than One Example (Indicator) To Support Your Answer.

The zig zag indicator is a good indicator that traders can use to identify trends but it works best when it is combined with other indicators like RSI, MA and Fibonacci retracements. So to answer the question yes, I do think there's a need to pair other indicators to make the zig zag indicator work better.

The Zig Zag Indicator And The RSI.

The RSI is a volatility based indicator that helps traders determine the direction of the market by identifying when assets have been overbought and oversold known as overbought and oversold zones.

When the price of the asset is above the 70 level on the RSI indicator, it means the asset has been overbought and so sellers are ready to take over the market. At this point, the asset is at a very high price and a very good time to sell your asset. It is an indication of a trend reversal from bullish to bearish.

However, when the price of the asset is below the 30 level on the RSI indicator, it means the asset has been oversold and so buyers are ready to take over the market. At this point, the asset is at a very low price and a very good time to buy the asset. This is known as accumulation time. It is an indication of a trend reversal from bearish to bullish.

Using the zig zag indicator with the RSI indicator, price breakouts are used. Using the chart below, I will explain how the RSI is used with zig zag indicator to determine buy signals.

From the chart above, the price closed above the previous high signifying a breakout. When the RSI indicator is above the 70 level, there's indication of a buy signal.

The Stop loss can be placed below the previous low.

The Zig Zag Indicator And The MA .

The Moving Average indicator is a trading strategy that works on the crossing of two simple moving averages with different period settings. When a Moving Average (MA) with a smaller period usually set to 20 periods crosses above the MA with the higher period usually set to 50 is considered a bullish signal.

When the MA with a higher period usually 50 crosses above the MA with the smaller period usually 20, it is considered a bearish signal and a good time to sell.

Using the zig zag indicator with the Moving averages indicator, the crossing of the 2 lines are used. Using the chart below, I will explain how the MA is used with zig zag indicator to determine buy trading signal.

From the chart above, the 20 MA is in yellow color and the 50 MA is black in color. The 20MA crossed above the 50MA as shown in the chart and a buy entry position was confirmed after 3 candlestick confirmations.

List The Advantages And Disadvantages Of The Zig Zag Indicator.

Advantages Of The Zig Zag Indicator.

It is easy to use the zig zag indicator to identify the current trends.

Can be used to identify support and resistance levels.

Zig zag indicator can be easily used in other trading strategies like intraday trading.

The zig zag indicator is easy to use and understand.

Disadvantages Of The Zig Zag Indicator.

It is not a standalone indicator. You need to combine with other indicators to get better trading opportunities.

It is not reliable for lower timeframes.

It cannot be used to determine future trends because it identifies current trends.

Conclusion.

I would like to say a big thank you to professor @kouba01 for this very educative lecture on crypto trading with the zig zag indicator.

The Zig Zag indicator is a technical indicator used by analysts to keep track of an asset's current or existing trend. At default, it is set to values of deviation 5 and depth 20.

The zig zag indicator can be used to determine bullish and bearish trends and also to identify support and resistance levels. These can also help traders identify good buying and selling positions.

The zig zag indicator uses swing highs and swig lows to help identify the trends. In uptrends, there's continuous confirmation of swing highs and new highs and vice versa for downtrends.

Although the indicator is quite easy to use and understand, it is advisable to use it with other indicators like CCI, RSI and MA to confirm the trends and identify good trading positions.

The zig zag indicator as a stand alone cannot be used to identify or predict future trends but to confirm current trends.

Thank you.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit