Cover image designed by me using Canva.

What is Cryptocurrency Trading.

All of us here have heard of the words trading and cryptocurrency. Even if you’re not a crypto enthusiast or you’re just starting in the world of cryptocurrencies, you at least know what the word trading means.

Trading as a generic term means buying and selling. There’s trading in our everyday lives in the real world. Business men buy and sell products or stocks all the time, we as individuals buy stuff from sellers too and as well exchange stuff with friends or family on the regular. All these form part of trading.

Cryptocurrencies as most of us may know is a digital currency with value with a lot of market volatility because it’s actual or true price isn’t exactly known or cannot be exactly measured. Its price therefore relies on the interest of people from time to time. When there’s a lot of interest or when interest in a cryptocurrency has peaked, you realize it has a high value but when its internet has fallen, it has a low value.

Cryptocurrency trading is therefore simply buying and selling of these digital currencies like steem, bitcoin (BTC), tron (TRX), dogecoin (DOGE), shiba inu (SHIB), Ethereum (ETH) , litecoin (LTC) , lunc, Luna, fantom (FTM) , helium (HNT), cake, solana (SOL) and so much more called cryptocurrencies.

Before something or an asset regardless of what it is can be traded, it needs a buyer, a seller and a marketplace. A marketplace is where you go to buy what you want. The cryptocurrency world has a marketplace where you can purchase and sell your crypto assets.

These marketplaces can be referred to as crypto exchanges, crypto wallets and crypto platforms. Crypto platforms like steem have in built marketplaces where you can trade your steem for sbd tokens and vice versa. Binance exchange has a marketplace which allows you to trade a lot of cryptocurrencies. Crypto wallets like the trust wallet also gives you the chance to connect to dApps and trade your assets.

If you’re following you will realize so far I haven’t said anything about the price of the assets because in crypto trading whether you profit or lose, it’s all considered as crypto trading.

Ideally, the major aim of trading is to make profits. That is, to buy low and sell high but that isn’t always the case. Like I mentioned earlier, the crypto market is very volatile which means it is very difficult for the price of an asset to be stable for long periods.

Due to this you can buy lower now and after 30 minutes to an hour, you sell the asset at an even lower price or at a higher price and if you’re very fortunate or maybe unfortunate, your asset price remains as you bought it.😅

Crypto trading can be very technical if you want to have the best chance possible to maximize profits. To do this, some people use technical analysis where they use technical tools to study the market and open trading positions. Teadingview is an example of platform that has helped users make technical analysis and take advantage of the market.

So basically, cryptocurrency trading is the act of buying and selling of cryptocurrencies.

What Kind of Trader Am I?

—-

Here, cryptocurrency’s volatility plays a role. Due to volatility all trades are done to get the best out of it. There are position traders, intraday traders, scalp traders, swing traders, range traders and day traders.

Scalp traders are the crypto traded that are always on the lookout for quick profits. When they identify there’s potential to make profit from an asset, they quickly invest and in a matter of minutes or hours exit the trade.

Position traders are the crypto traders that invest long term.

Intraday traders are the crypto traders that trade over a the course of the day in an attempt to make profit. This means a trader during the day opens and closes multiple trading positions in a day.

Day traders trade within the day and exit trades when the day closes.

Looking at what every trader does, I can call myself a position trader. Position trading is the form of trading where you invest in an asset and leave it for long periods in an attempt to make huge periods when an asset finally rises.

Position trading are known and described by some people as the real form or definition of holding. In the crypto space you’ll always hear the term hold or HoDL. This just means you hold or keep your asset for very long periods hoping the coin eventually breaks its all time high or you stick with it to leave its bear run and enter into a bull run.

Position traders are supposed to be calm and very patient. If you’re not patient you end up losing your investment because when the asset enters into a bear period you can lose your cool and sell to make losses.

I like to think I’m patient enough and so I engage more in the position trading. I buy my assets and leave them to mature.

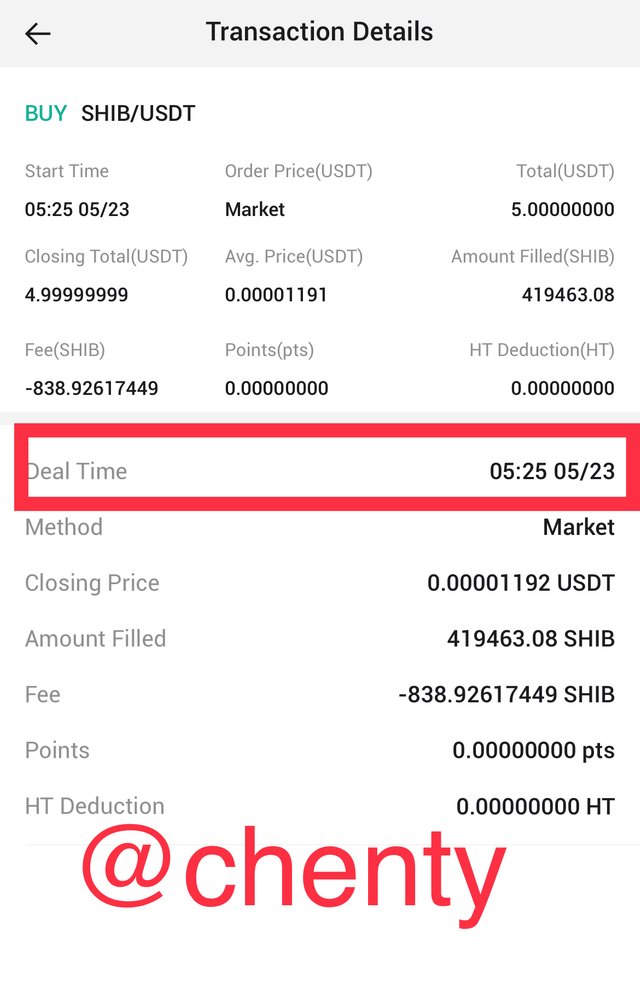

Image from huobi app.

To choose which type of trading or trader is more effective will entirely depend on the individuals or traders. I for one can call position trading the most effective because it doesn’t involve a lot of stress but is the core of cryptocurrency and has proven to yield a lot of profit.

Others like the scalp traders can say scalping is the best because they study the market and attempt to make instant profits. There are ups and downs to all trading styles and so will entirely depend on the people engaging in those type of trades to decide which is more effective.

Have You Tested Several Time Units?

——

I have on multiple occasions tried and used several time frames or time units. Time frames or units include 5 minutes, 1 minute, 1 hour, 3 hours, 1 day, 5 days, etc.

I’m pretty sure before you determine the kind of trade you are you would have one point in your crypto journey used some or all of these time frames.

Unfortunately I can’t boast of using all the time frames but I’ve used a significant number.

The type of time frame you use influences your trades a lot because it is what reacts to the volatile in the market and presents you with data to analyze and set your trades.

A good crypto traders used technical analysis which involves using time frames to help him or her get the best of their trading style.

The Best TimeFrames and Crypto Asset Pairs for Me.

—-

Time frames speaks a lot about a trader. It tells what you’re ok with, your risk tolerance and probably the time you have available for trading.

It influences you trades. Time units or frames allow the technical analysis tool you’ve selected react to the market and present you with data and signals.

For the more frequent traders or full time traders, they can go with any of the time units since trading is their job and they have all the time at their disposal unless unforeseen circumstances.

For traders who look to make quick profits and benefit now, they swing trade. It means they will require very very time frames. Those traders use time units from the very minimum to about 5 minutes. They require very minute time units because they need to get all the possible signals during that period. This is sometimes very bad because there’s a lot of noise and can produce too much false signals. But to counter this trader use multiple signals to filter the noise to the nearest minimum.

For us position traders, longer time units are best for us. Time frames ranging from weeks to months. These time units allow us to get data for several weeks or months and inform us on a possible profit future.

To answer the question “what time frame is best for me?”, I would say 30 days or 1 month time unit is best for me. This is because I’m a long term trader or a position trader. I also do not have the time to sit and open short trades. I believe in holding.

Crypto pairs include so many of them that makes it very difficult to trade. Basically, I like usdt because it’s stable and isn’t influenced by volatility. With this, I would say any token or coin that has the usdt paid is my favorite but that would be very false.😅

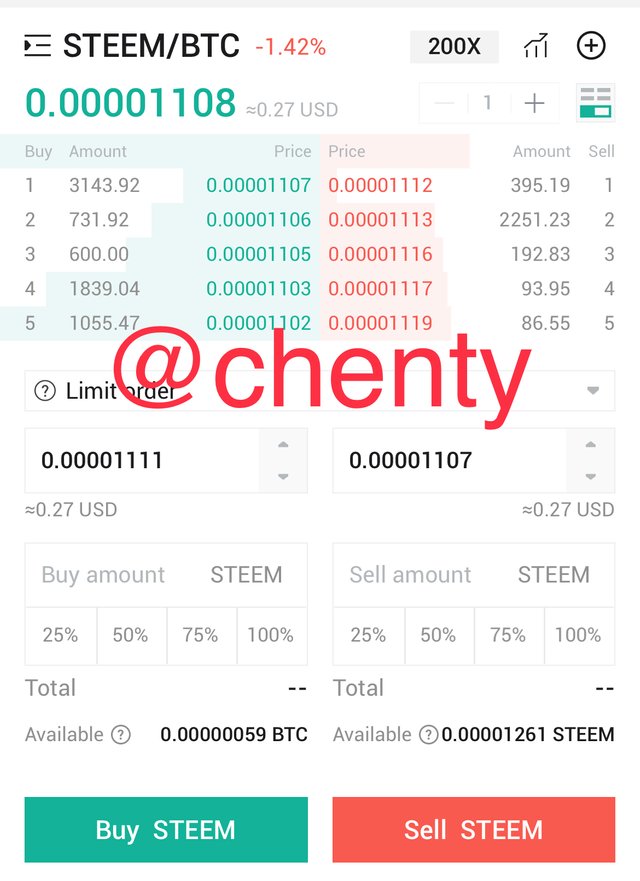

However, I think my best pair would be the STEEM/BTC pair. I’ve found myself recently to be more vested in keeping usdt in my huobi wallet. We know that before you transfer usdt out of exchanges like huobi and Binance you pay a 1usdt fee. Due to this, I change my assets to steem anytime I want to transfer it out.

Screenshot from huobi.

Although there are fees, it’s significantly lower than that of usdt. I use the p2p functionality of Binance so anytime I require it I just exchange my usdt to steem transfer it to Binance. For those that use p2p in Africa or Ghana in particular know steem p2p is not supported. About six coins which include btc, usdt, doge, eth, etc are supported.

So when I bring my steem from huobi into my wallet, I convert or trade to btc and sell. I prefer btc because bo matter the quantity of the steem tokens, it can still be trader for btc. If you’re to convert steem to usdt, you need to have steem worth more than $10.

Have You Had Regular Trading Activity Over The Last Few Months.

—-

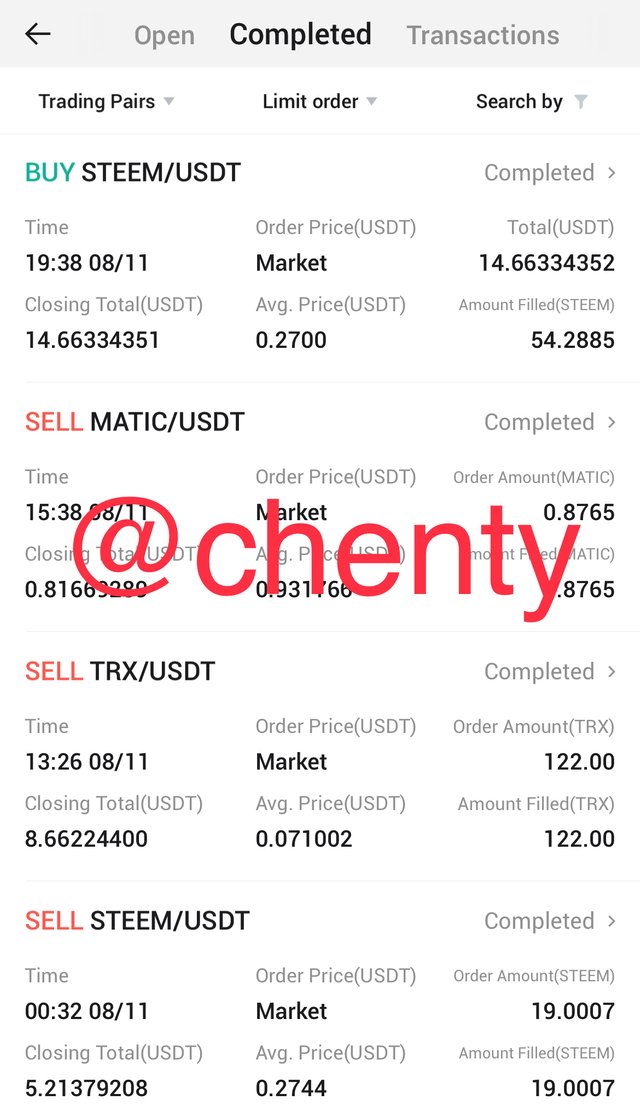

By now, anyone reading this entry would know the kind of trader I am. I’m a long term trader but I’ve had some short term trades in the last month or so.

Some of my recent trades.

Prior to that I had a lot of long time assets I had held for over 3 months. During the Luna crash when every other asset was basically on a free ride to doom, I made losses on all assets I was holding. So yes, I’ve made significant losses.

Just 2 days ago, I traded my trx tokens short term. The price was quite good for me and so I traded about 140 trx tokens for usdt.

Steem which has looked like breaking the $0.30 mark is an asset I’ve traded a lot over the last week. I haven’t made any loss yet because I’m always lucky to trade at $0.27.

What I’ve learnt is that no matter what never trade FOMO. FOMO is dear of missing out which is something I did during the Luna crash. I bought into the “buy the dip” narrative even though it was very evident the coin was in doom.

I lost during that time and I feel disappointed in myself anytime I remember.

Having a trading plan is also something I’ve learnt in my trading journey. Without a plan you just trade when you want and how you want. Without a plan any profit looks significant or unsatisfactory. If you have a trading plan, regardless of how huge or small the profit is once it meets your plan you exit the trade.

Do You Have A Method of Recording And Reviewing Your Trades To Improve Your Performance?

—-

One way I record and review my performances is by occasionally entering into my trade history to calculate. Aside that because I trade long term, I at least 10 times a day check the progress of my asset. Because of that I always know the value of my portfolio in the last hour or two.

And so when I launch my wallet and see a difference in value I can tell.

What Impact Does Artificial Intelligence Have On Crypto Trading In The Short And Long Term?

——

Every day, there are new thoughts, ideas and initiatives to improve the crypto world and the trading experience of people. One of those has been the introduction of AI.

Smart contracts isn’t Artificial Intelligence but we’ve seen how beneficial they’ve been since their inception. Try help us have third party free transactions and so much more.

AI, Artificial Intelligence is thought to be the “future” of cryptocurrencies. AI is very advanced technology that aims to make crypto trading so much easier and lucrative. One of such ways is to be able to scan or present users with all the data of assets like it’s metrics for use.

AI can help users place trades on a more regular basis. They can do this on already determined price by the user or trader.

AI has helped in providing more time conscious and accurate price alerts.

AI has helped in providing more security for assets.

AI has helped in obtaining all or a lot of data on an asset especially the metric data.

AI has helped in predicting trends and movement of assets.

Have you used before or want to handle an automatic trading robot?

—-

To be honest, I haven’t really taken the time to research on trading bots or AI in crypto except for this assignment. I don’t have any experience in a trading bot.

Till I use one and is convinced of it’s advantages I think I’ll stick to the manual or traditional methods. The idea of letting AI predict trends for me just seems too much of a risk. It’s seems to be same as paying “an experienced crypto trade” to give me signals for traders but only without the payment.

However I’m going to keep an open mind till I use one.

Conclusion.

——

Crypto trading is buying and selling of cryptocurrencies. Intraday, day, position, swing traders and other traders all use market volatility in their attempt to take advantage of the market and make profits.

Position trades are more or less believers of the crypto market because they hold their trading positions long term and believe assets will rise in the future.

After all the losses we’ve made in crypt, it’s very important not to trade on FOMO and always have a trading plan.

These are all ways that can help you minimize your losses in crypto world.

Thank you.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We've shared and upvoted your post on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looking at the type of trader that you are it is of no doubt to me that you are a very good trader who knows how to minimize his risk.

Honestly friend FOMO is what is killing some traders making them to loss their money for nothing. Indeed, I am happy to see that you have move out of the stage of Fomo. Best of luck to you friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love your beautiful explanation about cryptocurrency trading, the types of traders, and the time frames. I'm also an investor/position holder and as you said I don't panic when the asset is dumping rather I remain calm and wait till it rises back. Thank you for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You definitely rock the contest, great publication, I enjoyed every bit of the article and here are what I have observed about your trading strategy.

You are a position trader, which mean you hold for a long period of time and expect return, this is quite amazing as you don't need to necessarily watch the trade over and over.

You use the Monthly time frame, from this, you get to view all markets direction and as well not fall victim of the market trap, you find a lower position to enter your trade, and then sold when it is.

Great composition, and I wish you best of luck in the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The buyer and the seller are the two basic entities in order for any successful trade to complete. Both parties help to keep prices of assets in check. When one of them trades excessively it can affect the price of an asset.

For example, if the seller sells too much, it can cause the price of an asset to reduce or decrease in value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for publishing an article in the Crypto Academy community today. We have accessed your article and we present the result of the assessment below

Comments/Recommendation

Overall,you have done great by sharing your trading experience with us. Position and swing trading type of trading is cool and less risky. This method of trading helps you avoid the market manipulations and noise in the market. The profit is also massive but not everyone has that patience to hold a position for months . Thank you for participating in this contest.

Total|8/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your review prof.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow from the type of time frame i see you using, it shows you are a very patient trader. You use a month time frame which absolutely very good and commendable because within this period, all noise and fake out will be removed. Higher time frame gives one more clear opportunity of the movement of the asset. I wish you success

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit