Hello everyone to my entry for the first week of the third season of steemit crypto academy on Staking.

Introduction.

I must say I'm very excited to be a part of this class because I have learnt something new on Staking.

I would now like to present my answers to the questions asked.

Question 1: Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion. ( Binance is not allowed ).

What is Staking ?.

Staking can be defined as locking up crypto tokens or assets within an exchange or wallet that allows Staking with the intention to earn rewards.

Usually, Staking is done on proof of stake platforms to help the growth of the platform.

When traders or investors lock their crypto tokens, it's usually for a specific period of time and hence cannot be touched till that period is over.

There are two staking categories which includes the centralised and decentralized staking categories.

The proof of stake consensus algorithm was introduced to solve the scalability problems with the proof of work consensus.

I would now like to do the comparison between two platforms that provide staking services.

I would be comparing staking on Kraken exchange and the Bitfinex exchange.

Kraken Exchange.

Kraken exchange is a cryptocurrency exchange introduced in 2011 for possible trade in multiple crypto tokens.

The Kraken exchange allows services like staking, margin based transactions, among others.

Traders and investors on the Kraken exchange have the chance to earn extra rewards by staking their assets woth varying annual return rates.

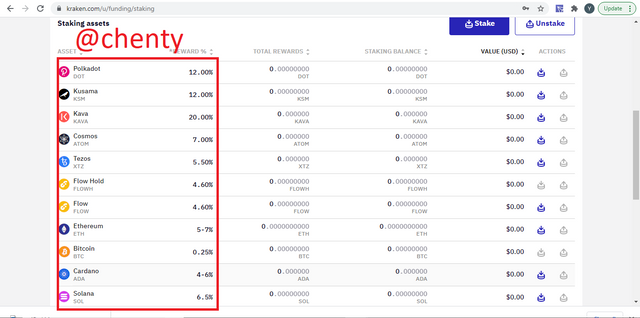

Cryopto assets that can be staked on Kraken include; Polkadot, Cardano, Euro, Cosmos, Ethereum, Bitcoin, among others.

Below is a screenshot of the annual rates of the various stackable tokens on the Kraken exchange.

Bitfinex Exchange.

Bitfinex was introduced in 2012 as a cryptocurrency exchange platform. It has close relationship to tether which has been a topic of concern over the years .

Bitfinex as a crypto exchange allows staking allows traders or investors to stake their tokens and earn rewards.

Crypto tokens that can be staked include; TRX, ETH, EOS, XTZ, ATOM, ADA, among others found the Bitfinex exchange platform.

The ETH annual rate is 10% while the TRX annual return rate is 6-8%, EOS is 0-3%, ATOM is 1.5-3%, XTZ is 3-5%, ALGO is 3-5%.

Comparison between Bitfinex and Kraken Staking Platforms.

- In terms of different number of stackable tokens: A trader can stake up to eleven ( 11 ) different tokens on Kraken market but can only stake up to nine ( 9 ) tokens on Bitfinex exchange platform.

In this regard, Kraken has more stackable token options than Bitfinex.

In terms of annual returns of same crypto tokens: The annual return of the same crypto assets on Kraken exchange is higher than that of Bitfinex exchange with the exception of ETH that has a higher return than Bitfinex.

In terms of return annual rates of crypto assets: The annual return of XTZ on Kraken is 5.5% but 3-5% on Bitfinex.

The annual return rate of DOT on Kraken is 12% but 7% on Bitfinex.

The annual return rate of KSM on Kraken is 12% but 8% on Bitfinex exchange.

My opinion on which is more profitable is the Kraken exchange platform.

This is because there are higher annual return rates on Kraken as compared to Bitfinex.

There are also more available tokens to stake on Kraken than on Bitfinex exchange platform.

Question 2: What is Impermanent Loss?

Impermanent loss can be described as the difference in value of a trader's crypto asset from time of locking funds in liquidity pool to saving the assets in wallet.

As an when the value of the crypto asset falls and rises, impermanent loss occurs.

But when certain conditions are met, the losses made by the traders turn into profits when traders them through commission fees.

When there's high difference, there's more exposure to impermanent loss. This loss is termed impermanent because the trader recovers the value of assets and makes profit at some point and the loss is temporary.

Question 3: What is delegated proof of stake (DPoS)?

Delegated Proof of Stake ( DPoS ) is a form of Proof of Stake ( PoS ) consensus algorithm where network users vote and choose people known as delegates to validate the new blocks.

Other delegates are witnesses and block producers. Network users can vote for delegates using DPoS. This voting is done by locking crypto tokens in a staking pool targeted to a specific delegate.

In Delegated Proof of Stake algorithm, Staking is done through service providers instead. Users that pool their tokens to delegates are rewarded with the transaction fess other traders pay.

The amount of profit you make depends on how much assets you stake.

The Bitshare, Tron, among others are blockchain technologies that use the Delegated Proof of stake ( DPOs ) consensus algorithm.

DPoS consensus algorithm offers fast and usually free transfers.

The DPoS consensus algorithm is an alternative to the proof of work consensus algorithm which aims to be better than the proof of stake consensus algorithm.

In this system or algorithm, witnesses selected by the algorithm must carry out their activities and no one person controls the activities of the network but rather all participants.

The Steemit blockchain is a good example of this where each steemian becomes more effective depending on the steem power.

So therefore, the steemit blockchain is a good example of the Delegated Proof of Stake ( DPoS ) consensus algorithm.

Conclusion.

I would like to say thank you to Prof @imagen for this very informative lecture as I've leant something new.

I have learnt what staking is, compared staking on Kraken and Bitfinex and have talked about Delegated Proof of Stake. I have realised hiw good DPoS is and I think it would be a major consensus algorithm a lot of networks would use in the future.

I have learnt and submitted my answer to what impermanent loss is which is a temporary loss or decrease in crypto asset value which can sometimes become permanent loss.

The Delegated Proof of Stake consensus algorithm is an algorithm that has come to better the proof of work and Proof of Stake consensus algorithms.

Thank you.

Hi @chenty. Thank you for participating in Season 3 of the Steemit Crypto Academy.

I congratulate you, you did a good job and demonstrate mastery of the topics requested in this assignment.

I hope to continue correcting your next assignments.

Grade: 8.5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your kimd review prof. I hope to do better

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit