Introduction.

Image designed by me on Snappa.

I am excited to be a part of professor @imagen's class this week on the waves platform. I have found a lot of prof's classes this season very exciting and informative and this particular topic is no different.

I will now present my work to the task given.

Describe The Leased Proof-of-Stake (LPoS) Consensus Mechanism. What Are The Differences With Proof-of-Stake (PoS)?

What Is The Leased Proof of Stake?

The Leased Proof of Stake is a consensus mechanism that is used by the waves blockchain. It is an advanced version of the proof of stake mechanism that allows token holders to "lease" out or give out their tokens to full nodes and earn rewards.

The Leased proof of stake is decentralized like proof of stake and rewards miners with transaction fees charged for transactions.

It is a way of earning without taking part in mining activities but rather leasing your tokens to the full nodes who are responsible for mining to mine.

The proof of stake mechanism generally allows users to earn by staking in other words leasing their tokens. The tokens leased are fixed and are locked foe the duration of the mining process. The leased tokens are released once the mining comes to an end.

In the Leased proof of stake mechanism, nodes are chosen to validate blocks and transactions. The higher your tokens or holdings, the higher your chances of being token to validate blocks. In some respect, this favors the rich or the wealthy and not very much in favor of the less privileged or users with less tokens.

To address this problem and remove the idea of centralization or control by the rich, the waves networks use the leased proof of stake (LPoS) to address this by allowing small token holders to lease out their tokens to other users. This can help a group have a say in governance or other activities and also allows the users who leased their tokens to earn rewards from their tokens.

One advantage of blockchains that use Leased Proof of Stake is that there is higher and faster processing speed. This has solved the problem of blockchain scalability because just a few number of nodes are responsible for validating transactions instead of it having to go through long processes.

Also, the Leased proof of stake is eco-friendly and consumes less energy. Unlike proof of work mechanism, LPoS uses and consumes less energy and can be mined even with a mobile. Hence, it does not require special advanced technology and uses so much less energy.

Differences Between Leased Proof Of Stake And Proof of Stake.

| Leased Proof of Stake (LPoS) | Proof of Stake (PoS) |

|---|---|

| Only full nodes are allowed to validate blocks | Anyone with a certain amount of tokens can validate and create new blocks |

| Mining is not the only way to earn since leasing out of tokens allows you to earn | Mining is the only way to earn |

| Leased Proof of stake offers more decentralized | Proof of stake offers less decentralization |

| Rewards are distributed between the nodes and the users who have leased out their tokens | The block validator takes all the rewards. |

Login And Explore Waves.Exchange. Indicate Your Functionalities Or Options. What Are The Investment Modalities That You Offer To Your Users?

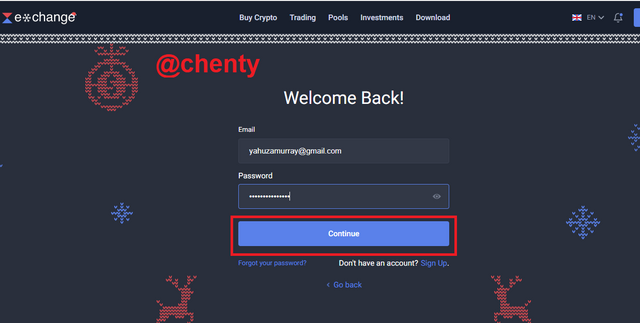

Logging Into Waves.Exchange.

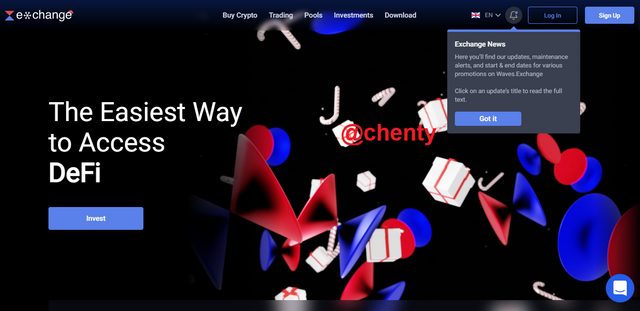

- Visit waves.exchange

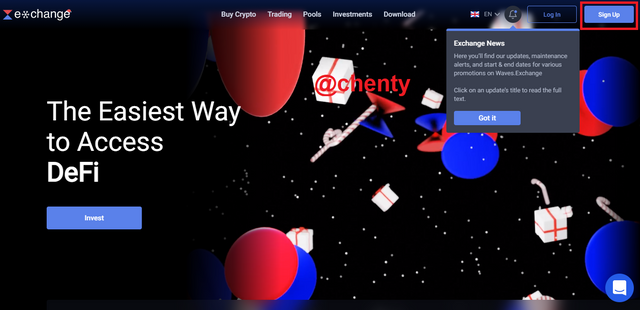

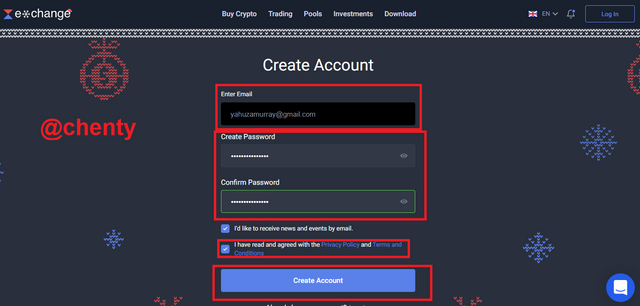

- Since it's my first time visiting the platform, I had to sign up. Click on sign up at the top right corner.

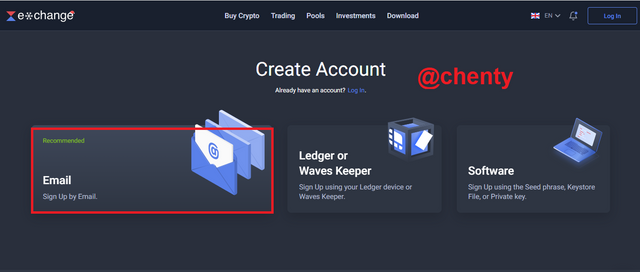

- Click on "email".

- Enter email, password and tick "I have read and agree with the Privacy policy, terms and conditions. Click on "Create Account".

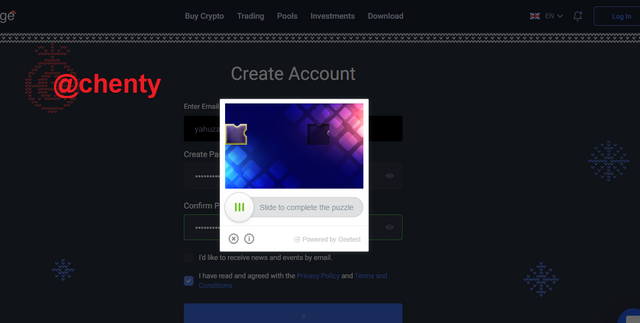

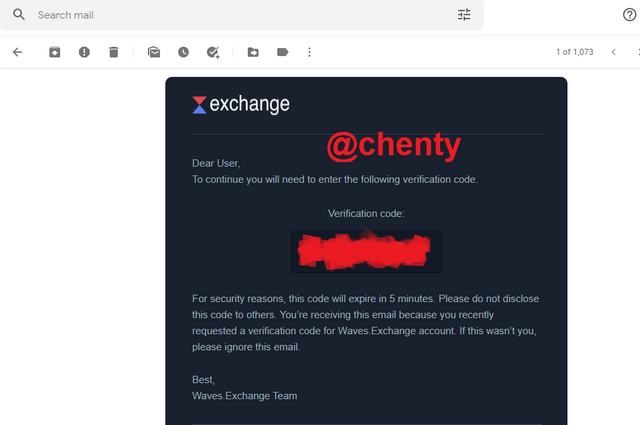

- Slide to verify sign up. Verify the account by entering the code sent to your email.

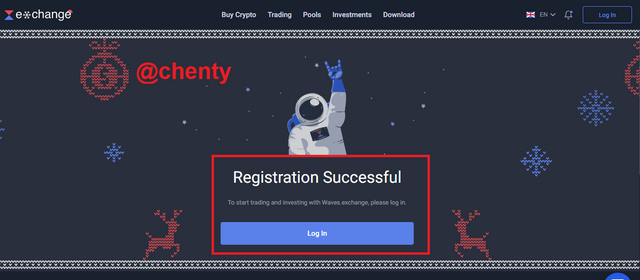

- Registration is successful. Click on "login".

- Enter password and click on "continue".

- Complete the puzzle. Login to waves.exchange is complete.

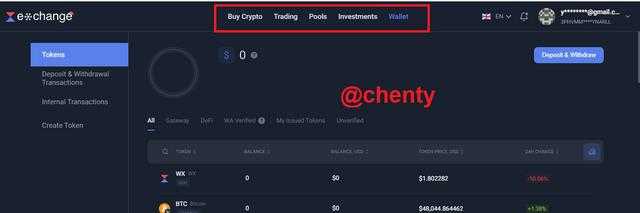

Functionalities Of Waves.Exchange.

There are 5 functionalities of the waves platform. These are'; Buy Crypto, Trading, Pools, Investments and Wallet. I will explore these features in the next paragraphs.

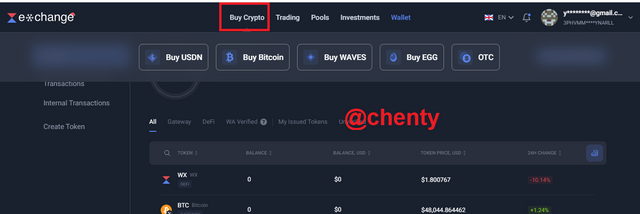

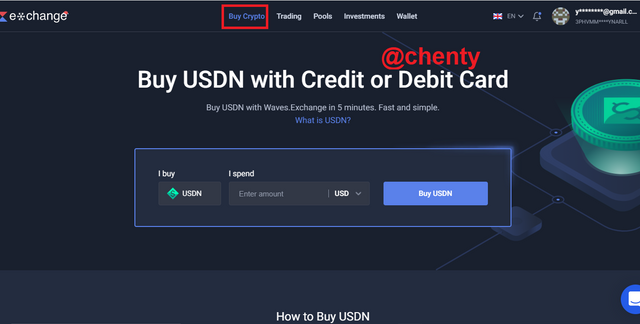

Buy Crypto.

The first feature I will talk about is the Buy Crypto. Buy crypto allows users to buy or purchase USDN, Bitcoin, Waves, EDG and OTC. Buy Crypto gives users information on how to buy USDN, OTC service, and information on what you can do with USDN

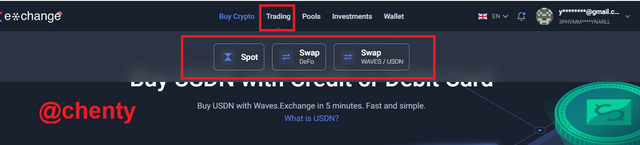

Trading

Trading allows users to trade their assets in spot and swap trading. Trading is the marketplace of the waves platform and here you can trade your waves token for usdn and vice versa. Users have access to charts on Waves, its trading volume, open orders etc.

There are 2 other options in trading like Swap; DeFo. DeFo is short for Decentralized ForEX for Stable Crypto Assets. Here, we can swap one of ten stable crypto assets for the other. These are USDN, EURN, JPYN, UAHN, GBPN, TRYN, RUBN, NGNN, CNYN and BRLN.

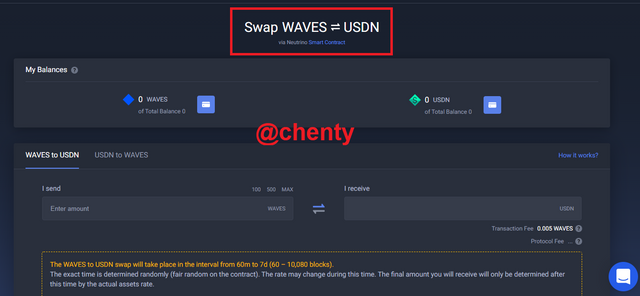

The final option in trading is Swap; Waves/USDN. Here, users can swap their Waves assets for USDN and vice versa.

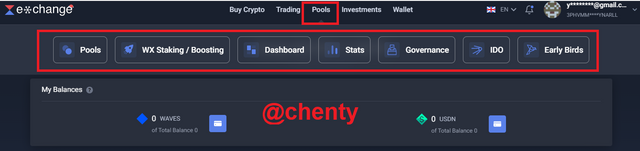

Pools.

<center<source

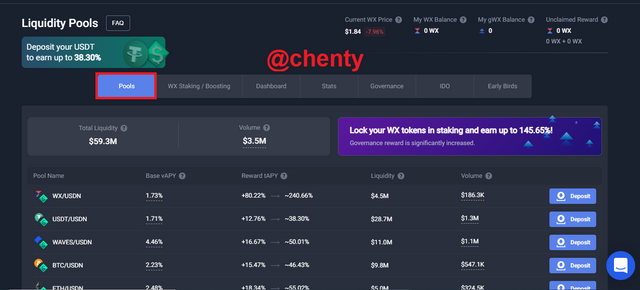

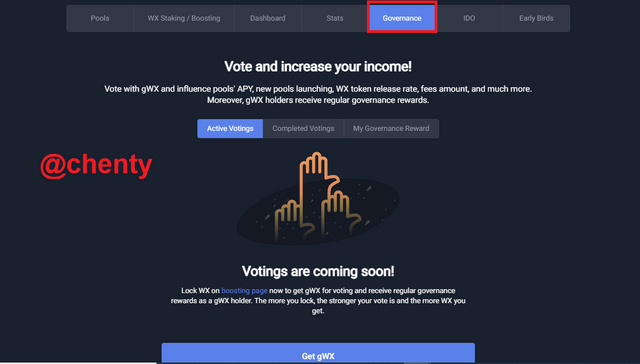

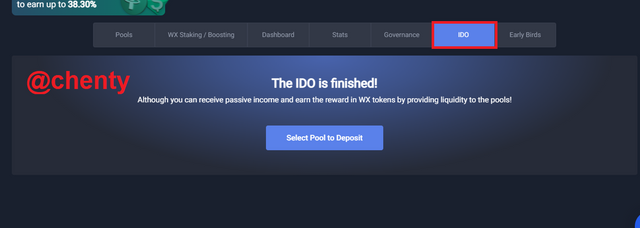

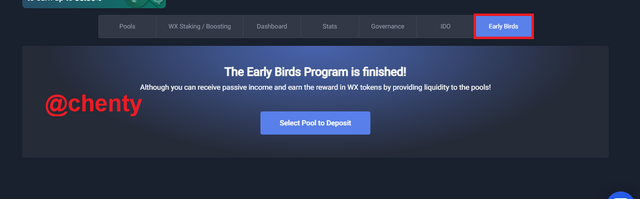

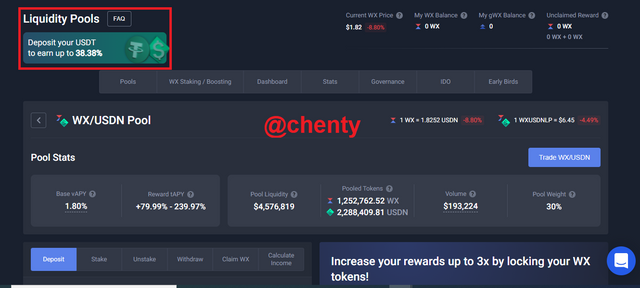

The Pools feature houses 7 other features; pools, governance, dashboard, WX staking/boosting, stats, IDO, early birds.

The pools feature is basically a feature that gives users access to the platform's liquidity pools like WX/USDN, WAVES/USDN, BTC/USDN, etc.

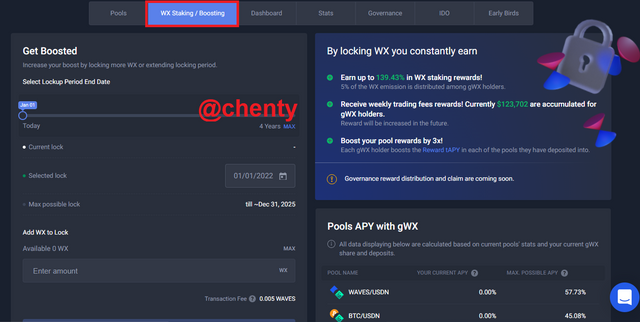

There's WX Staking/Boosting that allows users to lock WX tokens and "earn up to 145.71% in WX staking rewards", receive rewards from trading fees, increasing pool boost to up to 3x.

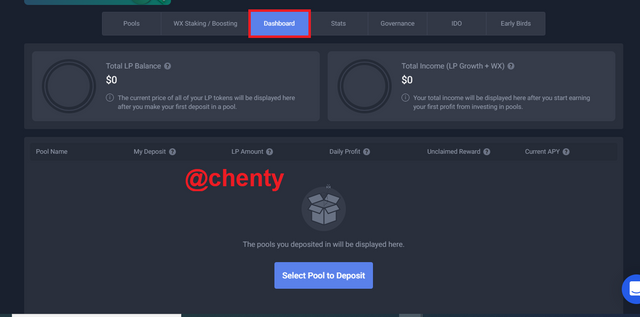

The dashboard gives users information on the total balance of their LP tokens, the total income earned on the locked assets, pool names, LP amounts, etc.

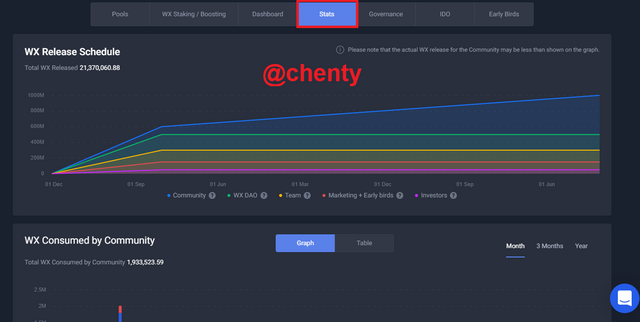

Stats help users to get information on the release schedule of WX, the WX locked, the WX consumed by the community and the WX price.

Governance allows users to vote and increase their income and influence on the platform. Users who take part in governance must hold gWX tokens.

I could not obtain information on IDO and Early Birds because those programs had finished.

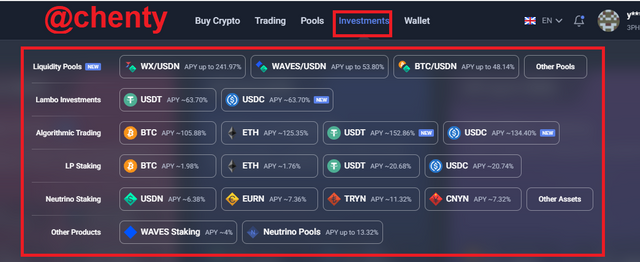

Investments.

The investments feature houses a lot of investment opportunities for users to take part in.

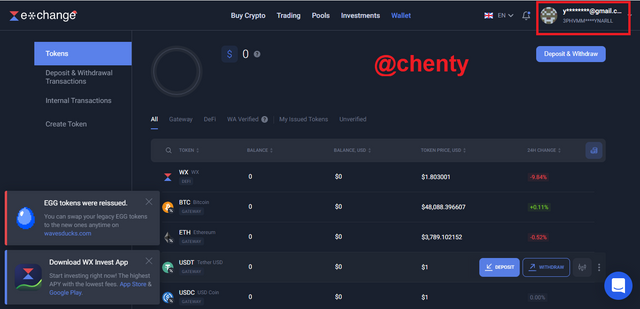

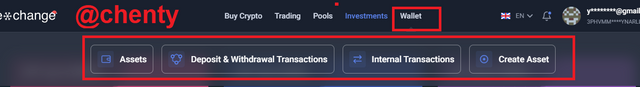

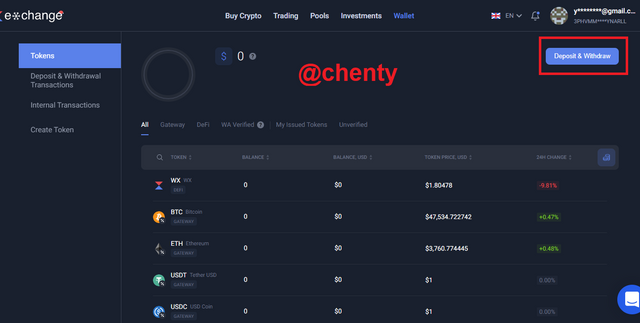

Wallet.

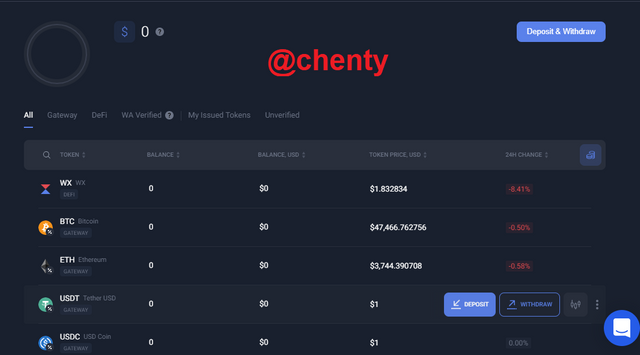

The wallet feature allows users to deposit, withdraw transactions and manage their assets, perform internal transactions and create tokens.

The Assets feature entails all the users holdings or assets and give the user an updated amount of asset balance as and when the prices of the assets change. Users can withdraw and deposit assets from here.

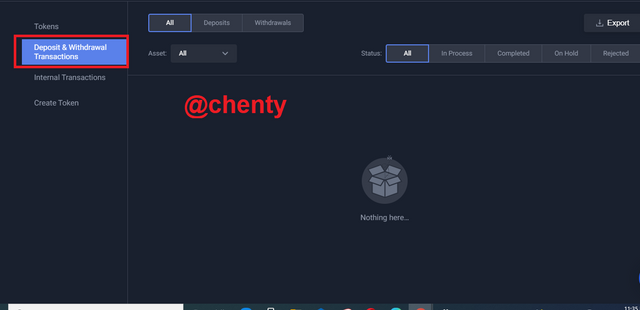

The deposits and withdraw allows users to access a history of transactions involving depositing and withdrawing of assets.

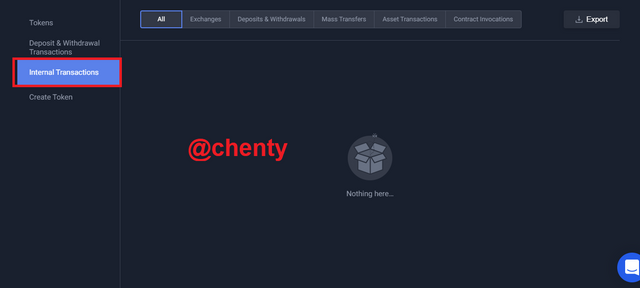

Internal transactions gives the user information on the internal transactions he or she has performed on the platform.

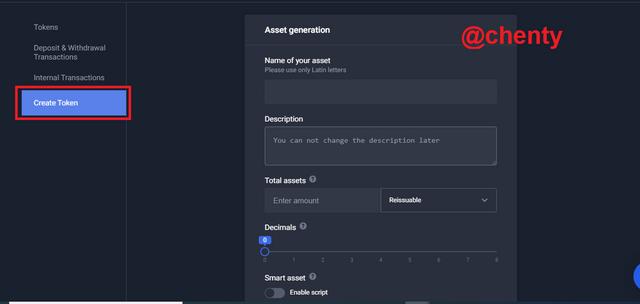

Create token is a very interesting feature under the wallet feature of waves.exchange that allows users to easily create their own crypto tokens by just simply entering the token name, giving it a description, entering a decimal, etc and paying fees of 1WAVE.

Investment Modalities Of Waves.Exchange.

The waves exchange offers quite a number of investment modalities. To gain information on them, click on Investments from the waves platform.

The Investment opportunities are 8 which are; Neutrino Pools, LP staking, Neutrino staking, Waves staking, Neutrino governance, liquidity pools, lambo investments and algorithmic trading.

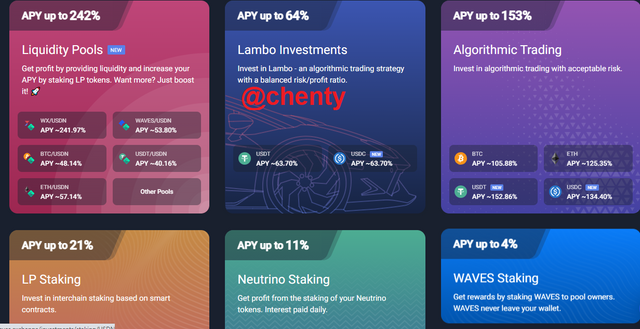

Liquidity Pools.

Liquidity pools allows users to make APY profit of up to 242% by providing liquidity through staking of LP tokens.

Lambo Investments.

Lambo investments allows users to earn APY up to 64% by investing their stable coins in a balanced risk/profit ratio.

Algorithmic Trading.

Algorithmic trading helps users to invest in trading with acceptable risk using their assets like BTC, USDT, etc.

LP staking.

LP staking allows users to stake assets in interchain staking which uses smart contracts. Users get APY rewards of up to 21%.

Neutrino Staking.

Neutrino staking is staking of Neutrino tokens like TRYN, USDn, etc to get profit of APY up to 11%.

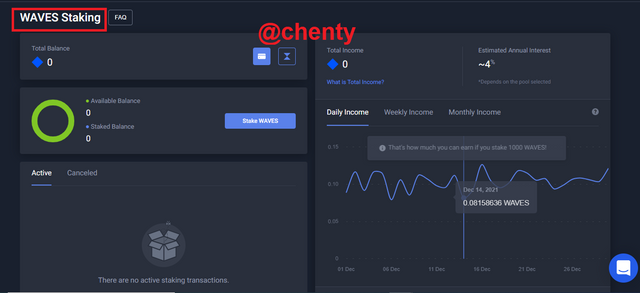

Waves Staking.

Waves staking involves staking Waves to earn rewards of APY of up to 4%.

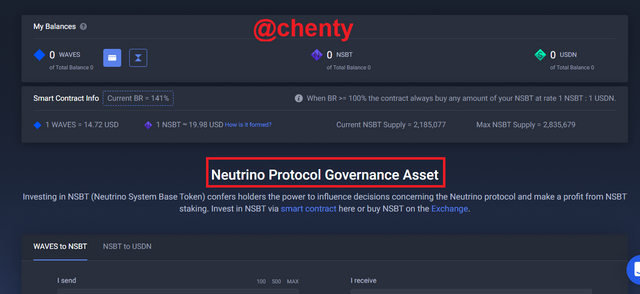

Neutrino Governance.

Neutrino governance allows users with NSBTto take part in decision making of matters concerning the Neutrino protocol, products, etc.

Neutrino Pools.

Neutrino pools allows users to invest in neutrino pools but with stable tokens. Users get rewards in APY worth 13%.

Make from your account a purchase of WAVES for an equivalent amount of 10 USD from an available exchange.

For the purpose of this task, I will show how to purchase WAVES from huobi exchange.

Process In Purchasing Waves From Huobi Exchange.

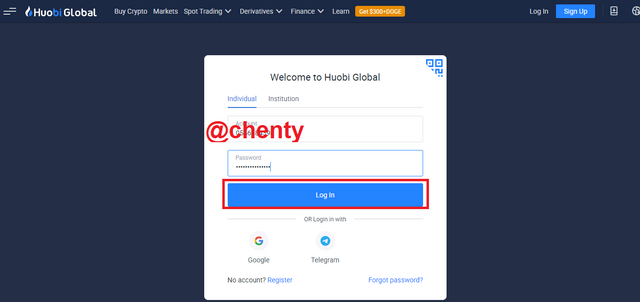

- Login to your huobi account.

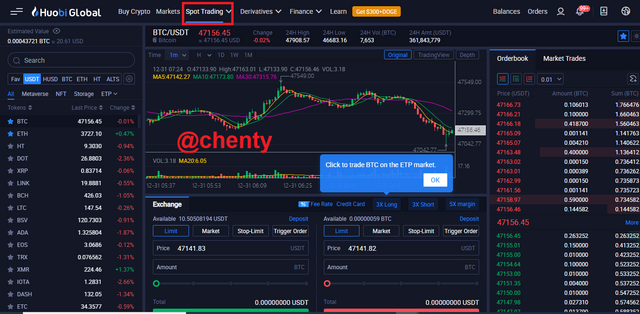

- When you login with your pc to the huobi site, you are immediately taken to huobi's spot trading.

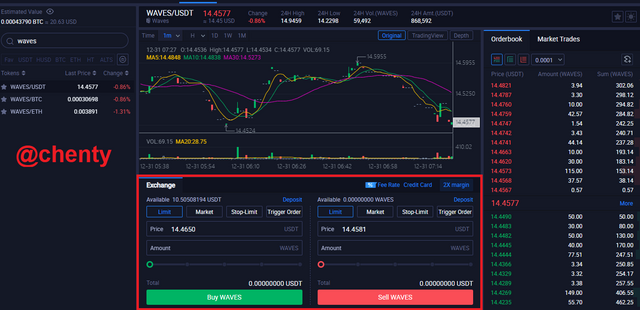

- At the top left, search for Waves. Click on WAVES/USDT.

- WAVES/USDT market is opened. Scroll to the buy and sell section. There are a list of open orders you can use and you can choose to use any of the order types.

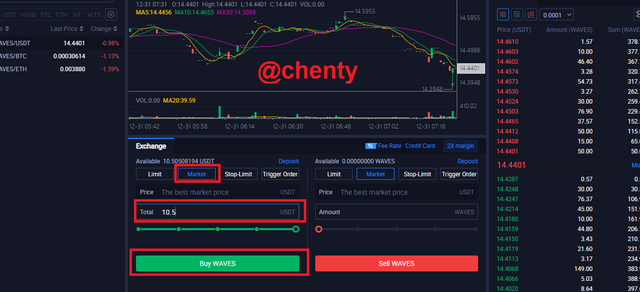

- I will be making a $10.5 purchase of WAVES using the market order. Change order type to market and enter 10.5 USDT in the total box of the buy section. Click on Buy WAVES.

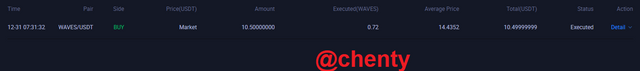

- Order is immediately filed since it is a market order. I received 0.72 WAVES for 10.5 USDT at an executed price of 14.4352USDT.

- 0.72 WAVES which is equal to $10.42 has been added to my assets as shown.

Transferring WAVES from Houbi To Waves Platform.

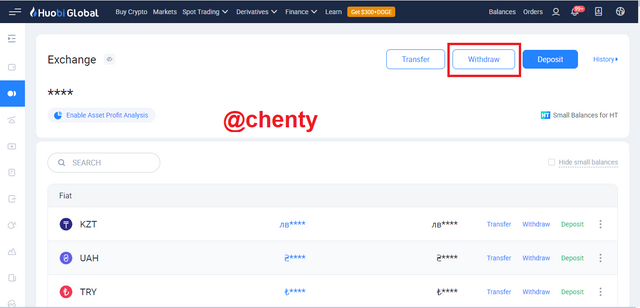

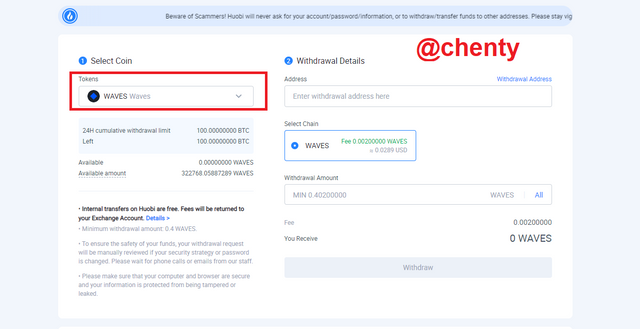

- Login to huobi and from the exchange page of huobi, click on "withdraw".

- The withdrawal page is opened.

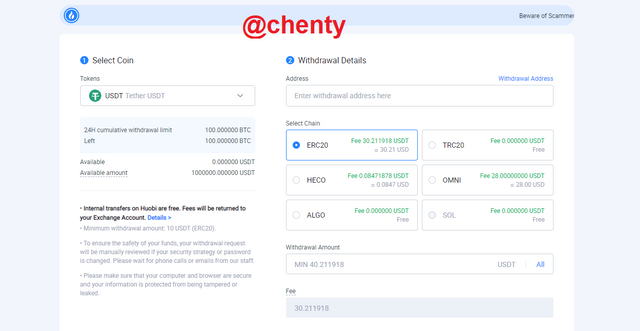

- From the select coin section, select WAVES.

- Login to the waves platform and click on "deposit and withdraw".

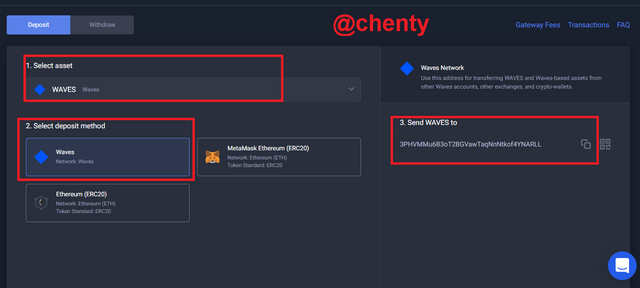

- The deposit page is opened and from there enter WAVES as asset name. Select waves as deposit method. Copy the deposit address at the right hand of the page.

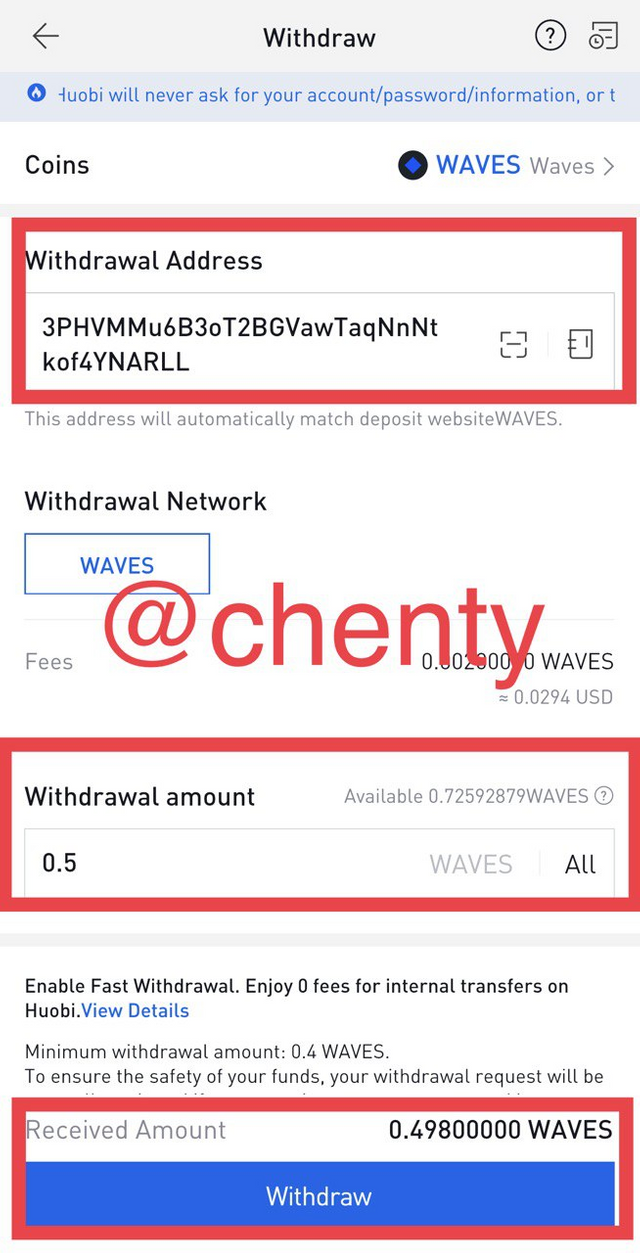

- Go back to huobi withdraw page and paste the copied address. Enter the withdrawal amount and click on "Withdraw".

- WAVES will be deposited to the waves platform. A fee of 0.002WAVES is charged and so I will receive 0.498 WAVES for 0.5WAVES.

What Is The WX Token? What Are Its Functions Within The Waves Ecosystem? What Is Your Value And Market Capitalization At The Time Of Writing Your Post?

What Is WX Token?

The WX token developed by a team of more than 60 individuals is the native token of Waves.Exchange introduced in 2021. It is used in the waves ecosystem created as a native token for people to be able to hold it and use as a means to take part in the ecosystem's governance.

So basically, the WX token is a governance token that gives users the chance to have influence over the waves ecosystem by voting on important matters about projects, investment tools, and others.

The Waves.Exchange is a decentralized platform introduced in 2017 and to increase decentralization and remove possibilities of centralization, the WX token was created and released so that users can acquire and use it to take part in decisions involving the waves ecosystem.

The WX token can be acquired from the waves.exchange by staking usdn and other tokens to receive wx tokens as rewards. The WX token aside used as governance was released to settle or resolve problems with listings, liquidity, etc.

Functions Of WX Token In The Waves Ecosystem.

WX token holders can take part in governance.

WX token can be traded for other tokens like USDN in the waves ecosystem.

WX token is used to pay trading fees within the waves ecosystem.

WX token can be used to earn rewards by staking in liquidity pools.

Value And Market Capitalization Of WX Token At The Time Of Writing.

I will use coinmarketcap to get the value and market cap of the wx token at the time of writing this post.

As at the time of writing according to coinmarketcap, the value of the WX token is $1.78 and the market capitalization is $11,391,043.

The 24hr trading volume is $237,868.38, volume/market cap is 0.02088 and a market rank of #3814 and a 0 market dominance. WX token at the time of writing had a fully diluted market cap of $1,785,233,409.98.

Describe Waves Ducks. What Is This Project About? How Is It Accessed? Be As Explicit As Possible.

Waves Ducks is an NFT game built on the waves network. Waves ducks like other NFT games is a form of investment opportunity found in the waves ecosystem where users use their funds to purchase or collect ducks. The ducks in the waves ducks are tokens with value.

Users or players get the chance to collect he ducks, breed them and sell them yo other players on the waves ducks marketplace when they want to. The waves ducks game also allows players to farm the platform's native token; EGG tokens. Players are also rewarded with this token which can be used to purchase more ducks .

Aside using EGG tokens to buy or collect ducks, players can trade EGG in secondary markets. Waves ducks has become so popular in the NFT world that it is one of the top 10 NFT markets.

The ducks on waves ducks have value and their value depend on how rare they are. In this regard, the more its scarcity, the higher its farming rewards and vice versa. Ducks owe their availability and appearance to their "genotype" made up of 8 letters.

Players can earn on the waves ducks in 3 ways;

Buying ducks and breeding them.

Building a farm by buying perches for bought birds and having the earn you EGG tokens and

Selling bought ducks.

What The Project Is About.

Waves ducks is a decentralized application on the waves blockchain that is run by smart contracts and hence has no third parties.

Waves ducks aims to be a better and more appealing game than the other NFT games out there by allowing their users to collect ducks and also get rewarded with EGG tokens by staking them.

The main aim and what waves ducks is about is realizing or fulfilling the primary aim of cryptocurrencies and that is financial freedom. Waves ducks allows every player to completely own their assets and they fulfill this by allowing them to sell and buy ducks whenever they want on the waves ducks marketplace.

What waves ducks project is also about is that it allows players to grow NFT ducks and expand their collection. These collections are used to earn more and the different ducks can be "mixed" through breeding. Mixing of these ducks allows players to get or have more rare NFTs which in turn results into higher prices.

The waves ducks project also allows players to "enter the metaverse" by giving them cross game benefits.

How Waves Ducks Is Accessed.

To access waves ducks, you must first have an account on the waves.exchange. Visit waves.exchange and follow the steps the sign up process to create your account.

However, I have already shown how to create and have created my account on waves.exchange so I will go directly to show how waves ducks can be accessed.

- Visit wavesducks.

- Click on "start playing".

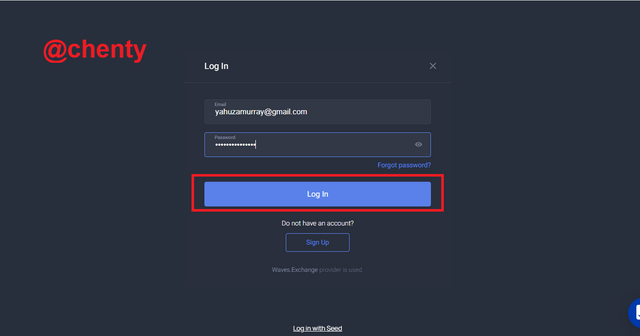

- You're directed to a new page where you can login. Enter the email and password you used in signing up for waves.exchange account. Click on "Login".

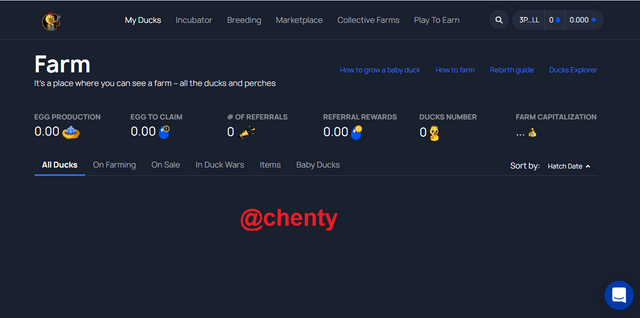

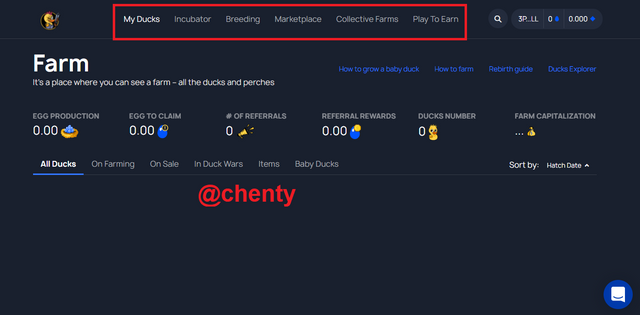

- If login requirements are authentic, the waves ducks page will look like this.

- From here, players can start playing the game, collecting ducks, breeding them and trading them with the features displayed at the top.

Conclusion.

I will like to say thank you to professor @imagen for this lecture.

The Leased Proof of Stake (LPoS) is more advantageous and advanced than the Proof of Stake (PoS) because unlike PoS, LPoS allows users with small holdings to lease out their tokens and earnn rewards although they cannot validate blocks.

LPoS is currently used on the Waves network.

Waves ducks is an NFT game on the waves network that allows users or payers to collect NFT ducks, breed them on the platform and traded for higher returns.

What differentiates waves ducks with other NFT games is that waves ducks reward their players with EGG tokens which can be traded. The waves.exchange platform is a decentralized platform that uses can store their assets on and engage in alot of investment opportunities like Lambo investments, etc.

Thank you.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit