Introduction.

I am very excited to be a part of a part of professor @pelon's class once again this week as I have the opportunity to learn something new. This week prof has introduced us to what wrapped tokens are, their functionality as well as advantages and disadvantages.

I would now like to present my work to the task given.

Two (2) Blockchains That Use Wrapped BTC, Excluding Ethereum.

The different blockchains of the crypto world have their unique or specific or native tokens that the blockchain uses to perform transactions and blockchain activities like governance. The bitcoin blockchain uses BTC, Ethereum blockchain uses ETH, Solana blockchain uses SOL, The Fantom blockchain uses FTM, etc. SOL cannot be used on the Ethereum blockchain because it is not its native token and hence not supported. ETH cannot also be used on Solana, steem cannot be used on Solana, Ethereum, Hive, Doge, etc.

Before the different tokens apart from the native tokens of a blockchain can be used on that blockchain, something needs to be done about them which is known as wrapping.

Token or cryptocurrency wrapping is the process of locking cryptocurrencies in a vault or wrap so that they can get the support to be used on other blockchains. These wrapped tokens are still of the same value as their unwrapped ( original ) tokens. Wrapping the cryptocurrencies therefore allows or enables a cryptocurrency like SOL to be used on Bitcoin's blockchain system to carry out activities.

A very popular wrapped token is the Wrapped BTC ( wBTC ). Wrapped BTC launched in 2019 on January 31st is a tokenized version of BTC that runs mainly on the Ethereum blockchain co-founded by organizations; BitGo, Ren and Kyber Network.

The wrapped BTC is an ERC-20 token that gives BTC holders the advantage to use the DeFi services of Ethereum. Ethereum has some DeFi services that are beneficial and exclusive to the blockchain but with the help of the wrapped BTC, BTC holders can make use of these services. Some of these services are lending, insurance, staking, etc.

Blockchains aside Ethereum that use wrapped BTC include; binance smart chain, tron, hive blockchains, etc.

- Tron blockchain.

The Tron blockchain was founded by Justin Sun in 2018 on July 25th. The trx token is the native token of the tron blockchain used for the blockchain's transactions. The tron blockchain supports TRC-20 tokens.

To allow BTC holders explore the usefulness of the tron network and realize other potentials of btc, a wrapped token of BTC known as Bitcoin-TRC20 (BCTC) has been introduced. This token allows BTC to act as as TRC-20 token and hence can be used by btc holders on tron network for transactions and other activities like staking and liquidity provision. However BCTC and BTCT were created by the same company and hence are both centralized.

To get our BTC locked for the bitcoin-trc20, the wrapped is minted, sent to an address created by the centralized company which is the same value as that in your public address. This action where the company sends the minted token to an address blocks or locks your owned btc meaning you can now use the wrapped btc on tron network.

When you are satisfied with the use of your bitcoin-trc20 token on the tron network and want your "original" btc back, a process known as burning occurs.

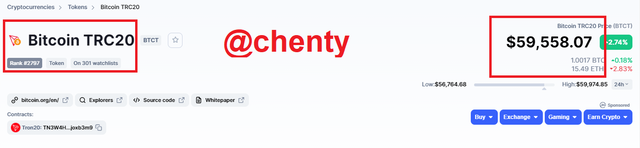

As at the time of writing, the value of Bitcoin-trc20 is $59,558.07 on coinmarketcap

The wrapped bitcoin token used by the tron network is the Bitcoin TRC20 ( BTCT ) token.

- Binance Smart Chain Blockchain.

The Binance Smart Chain ( BSC ) blockchain is a blockchain platform or network running parallel to the Binance Chain and is used to run smart contracts dApps. Although the BSC is used to run dApps, it supports the Ethereum Virtual Machine that allows bsc to run apps like Ethereum's Metamask.

The native token of this platform is the binance coin (BNB) launched in 2017 formally as an ERC-20 token now a BEP-20 token to run transactions on the blockchain.

To fully explore the use of Bitcoin and to make binance chain used by the larger crypto world, a wrapped token of bitcoin known as BTCB ( Bitcoin BEP2 ) was introduced to be used by BTC holders on the binance chain or smart chain network. The value of 1 BTC is same as the value of 1 BTCB and so the wrapped BTC on the bsc blockchain is is 1:1 pegged with BTC on the bitcoin blockchain.

The importance of having a wrapped BTC token on the bsc is that it allows you to have access to the DeFi services bsc blockchain provides. The possession of this BTCB means that your actual BTC is locked while you are in possession of the pegged BTCB which also means that you have not sold your BTC for BTCB. When you are satisfied or okay with the use of your BTCB on the blockchain, you can get your locked BTC by just simply redeeming the BTCB and them claiming your locked BTC.

It must be noted that even though you hold BTCB, if there is an increase in price value of BTC, your BTCB increases corresponding and if BTC goes down, your BTCB value decreases. BTCB can be used to provide liquidity, used on lending services and making transactions faster at low fees on dApps and DeFi services like PancakeSwap , UniFI, AnySwap, ForTube, Cream.Finance, etc. BTCB is also a good token for stable coins; Venus.

The binance bridge allows btcb and btc holders to lock, redeem and claim assets.

At the time of writing the value of BTCB ( Bitcoin BEP20 ) according to coinmarketcap is $59,639.11 as shown in the screenshot below.

The Differences Between The wETH of Ethereum Platform And The wETH Of The Tron Platform.

| wETH of Ethereum | wETH of Tron |

|---|---|

| Created and controlled by Ethereum network | Created and controlled by a different company BitGO |

| Works on the Ethereum blockchain | Works on the tron blockchain |

| A Form of ERC-20 token | A form of TRC-20 token |

| To change wETH of the Ethereum blockchain back to "original" Ethereum, burning is not required | Burning is required to change wETH of the tron blockchain back to Ethereum |

| Acts as a stable coin on the Ethereum network so burning is not required to stabilize price and reduce inflation | Since it works on the tron network, burning is required to reduce inflation and maintain the original value of ETH |

An Investment Of At Least $5 Of A Wrapped Token.

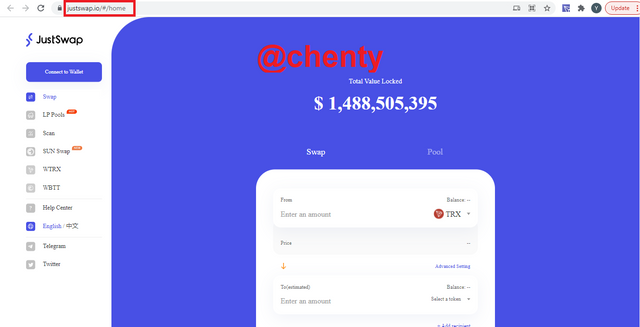

For the purpose of this task I would be using the JustSwap platform to invest in WBTC

The steps below are used to invest in a wrapped token (WBTC) on the tron network using JustSwap.

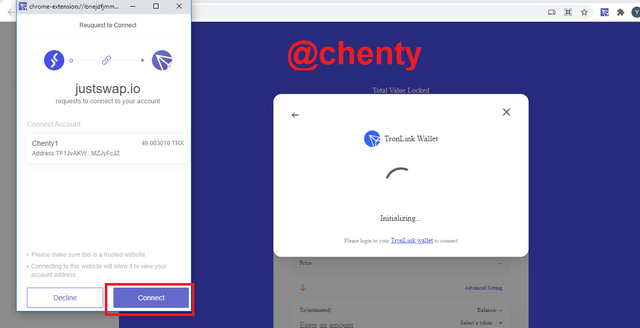

- Launch the official website of JustSwap or visit JustSwap

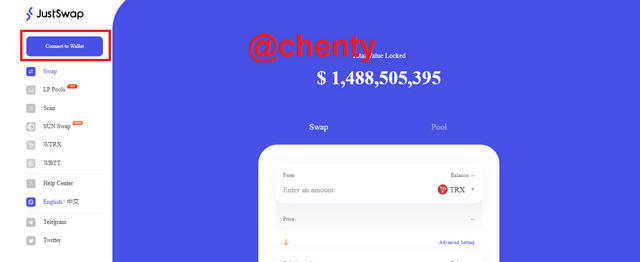

- At the top left corner, click on connect to wallet.

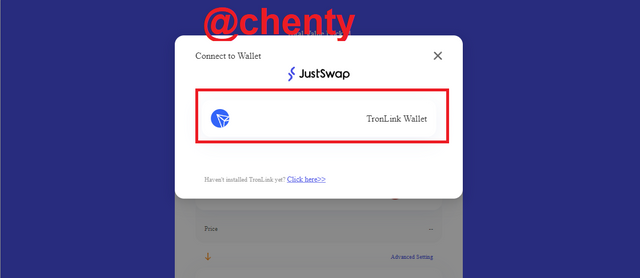

- Click on TronLlink wallet.

- Click on connect.

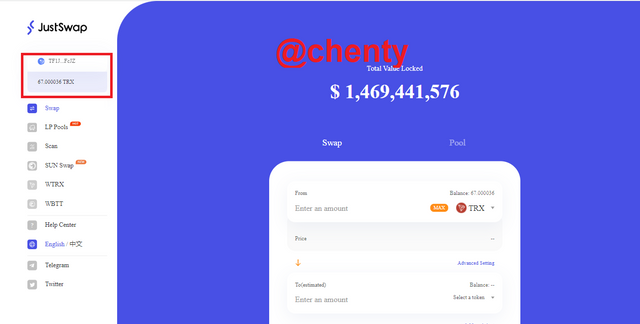

- Wallet is connected.

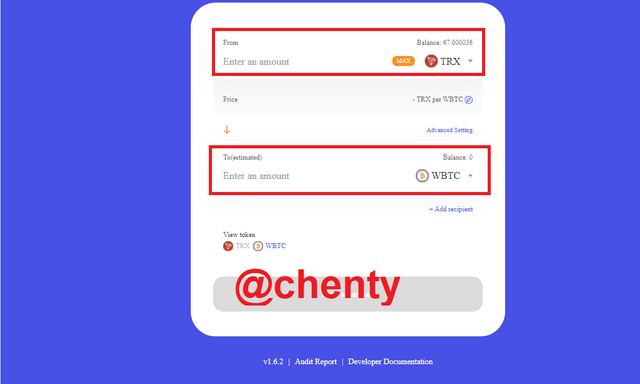

- On the swap page, there is from and to sections. Select trx in the from section and WBTC in the to section.

This means you're swapping trx for wbtc.

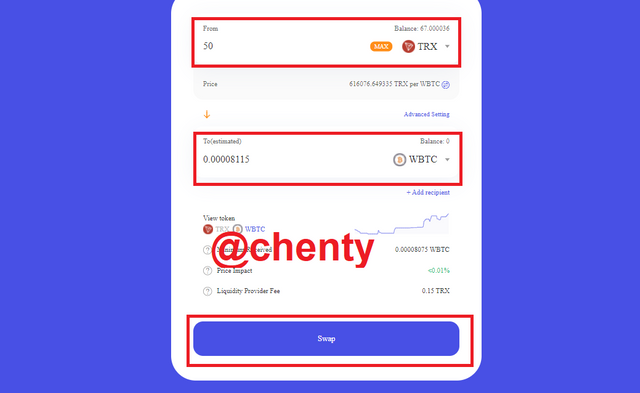

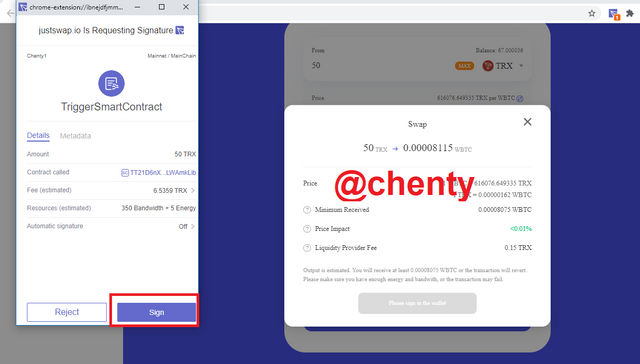

- Enter the amount of trx you want to swap. I entered 50 trx and would be receiving 0.00008115 WBTC. Click on swap.

- Click on confirm swap.

- Click on sign to confirm transaction.

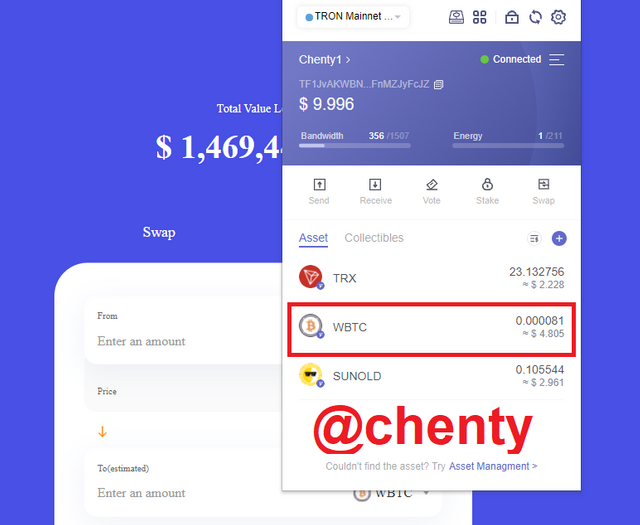

- Transaction is confirmed as shown below.

The Wrapped Token Of The Tron Blockchain.

Currently, the tron blockchain supports four (4) wrapped tokens. Out of these 4 tokens, 2 have been created and is controlled by BitGo the same company that created the wETH of the tron network where as the other 2 have been created by the tron network hence is controlled by the tron network. These tokens include;

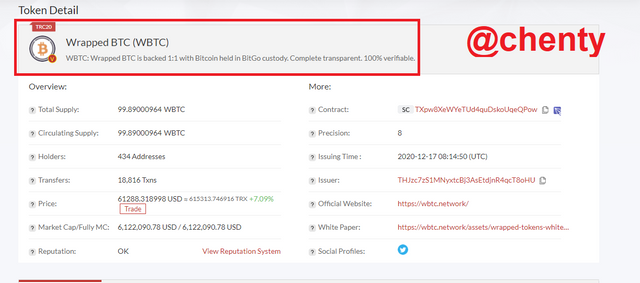

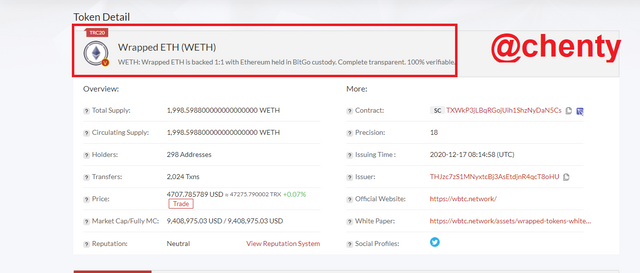

- Wrapped tokens created by BitGo on the tron network; wBTC and wETH.

Like already stated these wBTC and wETH wrapped tokens have been created by the company BitGo. wBTC is the wrapped token for bitcoin and wETH is the wrapped token for Ethereum. Because they were created from outside the blockchain of tron, they are controlled, minted and burnt by the company BitGo.

The wBTC of the tron network was created by BitGo to function as a TRC-20 token on the tron blockchain where BTC holders can lock their BTC and mint wBTC of the same value as their locked BTC to fully use the DeFi services of the tron blockchain. This means if I have $5 worth of BTC and do not own trx but want to use the tron blockchain for transactions or other activities, I would have to place an order where my $5 worth of BTC is locked by the company and I mint wBTC given to me by BitGo worth $5.

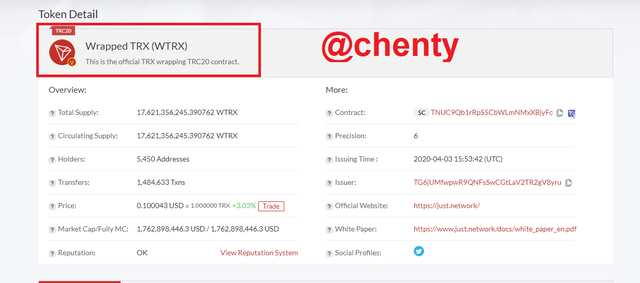

The screenshot above is the token detail of the wrapped BTC of the tron blockchain.

With this same idea Ethereum has been wrapped as a trc-20 token which allows ethereum holders to mint wETH and use it on the ethereum blockchain. The screenshot below shows the token detail of the wrapped ETH on the tron blockchain.

- Wrapped tokens created by the tron network; wBTT and wTRX.

The blockchain tron has come out on its own to introduce wrapped tokens for BTT and TRX. First of all the native token is trx which is already a trc-20 token supported by trx and so to see tron network introduce a wrapped token of trx is very surprising and confusing since the whole idea behind wrapped tokens is to introduce tokens of different blockchains.

It is possible that tron is trying to replicate the success of wETH of the Ethereum blockchain created by Ethereum and used on their on blockchain. It has been received quite well and its good performances could be a reason tron decided to wrapped its native token as well.

Another reason could be that tron wants users to swap the wtrx for other trc-20 tokens which brings more questions because trx itself can be used to swap for other trc-20 tokens on the JustSwap platform. However that being said, there are certainly reasons for introducing wtrx and we might get a better understanding of it in the near future.

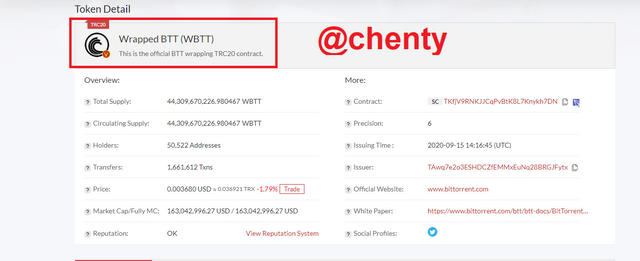

The screenshot above is a token detail of wTRX.

On the other hand, Bittorent (BTT) is a TRC-10 token which is supported by the tron blockchain. BTT being a TRC-10 token limits it to only some of the blockchain's uses and functions because some of the DeFi services of the network support only TRC-20 tokens. So unlike the trx the wrapping of BTT as wBTT is understandable.

The wBTT is created by tron and hence minted and controlled by the network and doesn't need to be burnt to revert back to BTT trc-10 token. The wrapped token of BTT (wBTT) brings faster transactions with lower fees on the tron network.

Explaining What It Means To Mint A Wrapped Token, Burn A Wrapped Token And Your Function In The Process Using An Example.

First of all I would like to present a situation or illustration where I chenty want to perform a transaction on the tron blockchain.

Let's say I have seen an investment opportunity on the tron blockchain like JustSwap platform which supports trc-20 tokens of which trx is its native token. So I like this investment opportunity but I do not hold any trx or trc-20 tokens instead, I hold only BTC worth $200.

Instead of having to sell my btc for trx and then transferring to a trx wallet like tron link pro which would take up commission fees and gas fees, I can swap it for a wrapped trc-20 token (wBTC) that the tron blockchain supports. The process it takes to swap my btc tokens for the wrapped btc is known as minting a wrapped token.

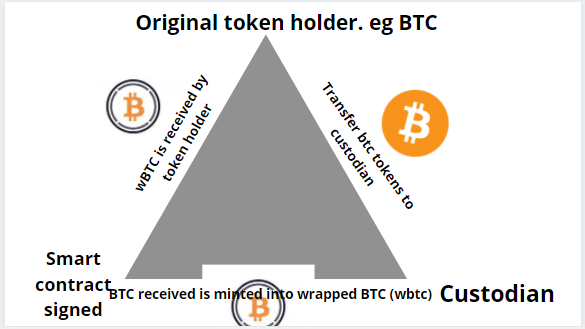

Minting can therefore be explained as a process where a token holder contacts a wrapped token holder or the creator of the wrapped token holder in this case BitGo where the token holder deposits his/her token into the address of the wrapped token holder known as custodian to be given the wrapped token.

The process that takes place here is that when I the $ 200BTC token holder deposits my btc to the custodian's public address, the btc is locked or blocked and the wrapped token (wBTC) is minted or created which is also of $200. This minted wBTC token allows me to perform transactions ad other activities on the tron blockchain although I do not holder any trc-20 token.

The Illustration below indicates the process of minting a wrapped token.

Illustration designed by me on Canva

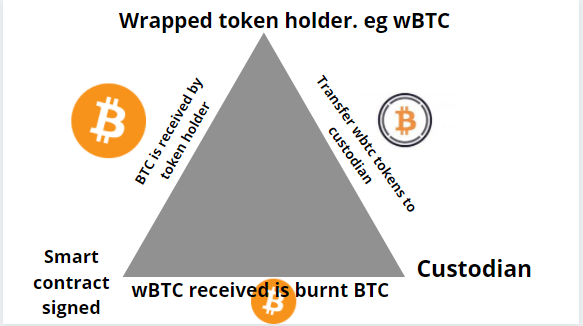

In addition, when I chenty is done with my activities on the tron blockchain and want my btc back, a process known as burning takes place. Wrapped tokens created by a blockchain and used by the same bockchain like the wETH of the Ethereum blockchain do not undergo burning.

Wrapped token burning is the reverse or opposite of wrapped token minting. Here, I would send an order to the custodian and the custodian would send the equal amount of whatever wBTC I have left or have managed to add to the exisiting. The wBTC is burnt by the company BitGo to avoid double spending; a situation where a user uses the same tokens to perform 2 different transactions or activities before 1 is confirmed thereby making profits from the same tokens.

The illustration below explains the wrapped token burning process.

Illustration designed by me on Canva

# Conclusion.

I must say thank you to professor @pelon 53 for this very informative lecture.

Wrapped tokens are tokens of different blockchains that have been transferred into other blockchains to and made in such a way that these blockchains can support the non native tokens. An example is of the tron blockchain where the company BitGo has created the wrapped token of btc (wBTC) and made it as a trc-20 token so that btc holders can access the DeFi services of the tron blockchain.

Token wrapping is cost effective as it results in the use of lower transaction and gas fees and increases interoperability. The downside of wrapped tokens is that they are usually created by companies outside the blockchain and hence are centralized tokens. Although these companies boast of high security and transparency, it still defeats the purpose of cryptocurrencies which is meant to be decentralized.

From the lecture I realized that the Ethereum network, tron and the bsc blockchaina all support the wrapped token of BTC (wBTC). Wrapped tokens are pegged at a 1:1 ratio of their original tokens and so are of the same value of their original coins.

Two important terms are used in token wrapping which are minting and burning. To mint a token means that you send your original tokens to an address of a custodian or wrapped token provider where your asset is locked and the wrapped token is created and sent to you.

Burning comes into place when you want to revert to your original tokens and hence you send your wrapped tokens to the custodian and the equal amount of the original tokens are sent to you. once received, the wrapped tokens are burnt ( destroyed ) to maintain the value of the tokens and prevent attacks like double spending.

Thank you.