Hello Everyone,

In this last week of crypto academy lessons, professor @reddileep introduces us to the technical analysis in trading Fractals which has to do with identifying market reversal points by observing repetitive patterns.

I am eager to try my hands on this technical analysis trade and hope you enjoy reading my submission on the homework task.

We have observed that, though the crypto market is volatile, there tend to be some patterns that can be marked out as repetitive. Chart patterns are widely adopted by traders in technical analysis, examples are triangles, rectangles, and wedges. Such patterns predict a trend with their formation and position.

The idea of Fractals is similar to that of repetitive patterns formed on price charts. Fractals mark turning points of price action and trigger a market reversal. Traders observe fractal formation to predict the direction in which security will take in a given timeframe.

With the help of indicators, traders can find entry points, exit, and take profit targets for the repetitive patterns of Fractals for both bullish and bearish trends.

For properly trading technical analysis with patterns, rules and certain criteria have to be met for correct trades. To properly trade Fractals, the following major rules are to be observed.

Fractals are recognized for consisting of 5 or more candlesticks in a definite formation. Any less number of candlesticks or price bars that assume Fractal formation is considered as a risky move, thus traders who acknowledge them as Fractals do so at their peril. The accuracy of Fractals is favored to increase with a greater number of bars in the formation

Fractals can either be bullish or bearish and can either mark a trend continuation or market reversal depending on its formation and direction of the market. It is, therefore, necessary to compare the formation of any fractal to the previous market trends for proper confirmation.

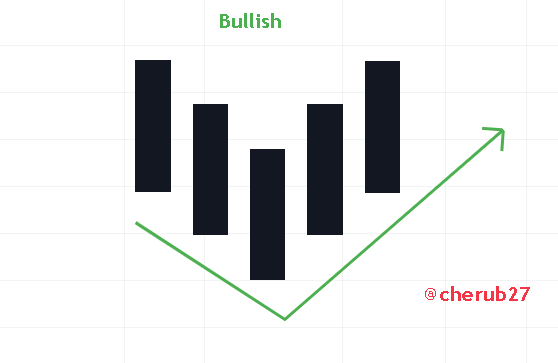

Bullish fractal is formed when a middle candle is lower low enclosed by at least two higher low candles on both sides. Thus two candles make higher lows to the left of a lower low candle and two other candles make higher lows to its right.

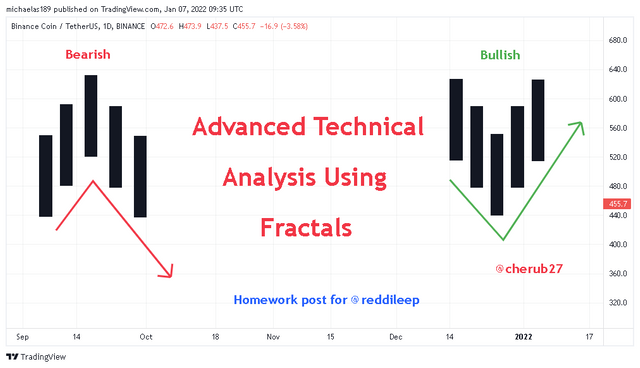

The chart below shows a bullish fractal formation which leads to bullish trend continuation after a period of market indecision.

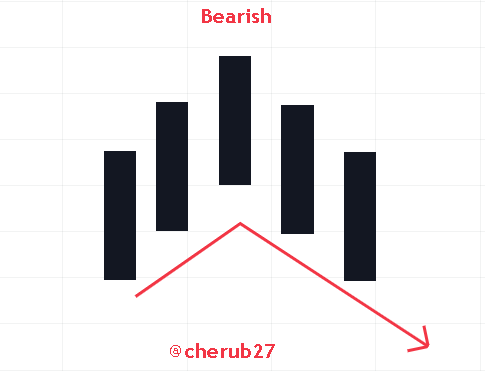

- Bearish Fractals form when a higher high middle candle is enclosed by at least two lower highs candles on both sides. Thus two candles make lower highs to the left of the higher high candle and two other candles make lower highs to its right.

Illustration of Bearish Fractal Designed In TradingView

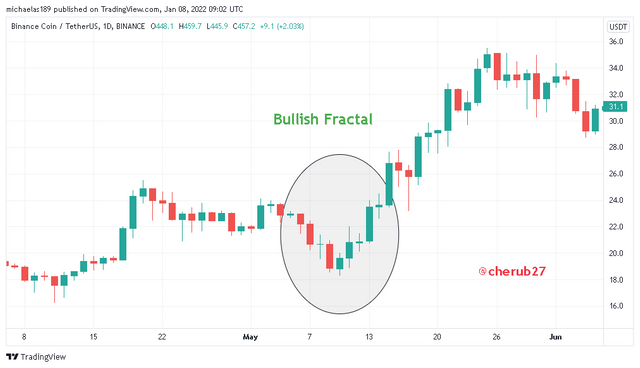

The chart below shows a bearish fractal for a downtrend continuation of price movement.

Fractals are best traded in conjunction with other indicators for trend identification. Famous amongst them is the Williams Fractal indicator. For this session, I will touch on the use of Williams Fractal indicator, Fractal Support Resistance, and Fractal Breakout indicators for identifying fractals.

For this illustration, I will be applying these indicators to charts on TradingView.

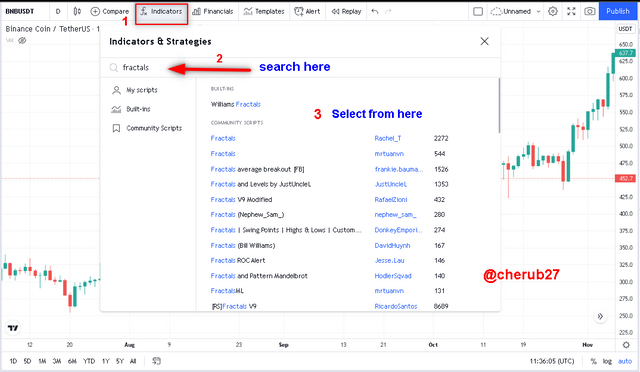

To add an indicator to any chart on TradingView, click the indicator icon fx at the top left of the chart. Type the name of the indicator into the search box and select the indicator to apply to the chart

Williams Fractals

The principle of the William Fractals indicator is very simple. It identifies bullish or bearish fractals with the simple display of arrows, positioning, and color.

From the chart above, red and green arrows can be observed on the chart. Each arrow represents a fractal which is already computed by the indicator. The red arrows pointing downwards represent bullish fractals where traders look to take but trades. The green arrows pointing upwards identify bearish fractals where traders look to take sell positions. We do observe that not all the fractal signals identified are clear to trade, thus the need of using any indicator in conjunction can help filter false signals.

Fractal Support and Resistance

As the name suggests, the Fractal Support and Resistance indicator operate upon the principle of support and resistance. Support and resistance levels serve as predicted turning points based on price data. Once an asset breaks the support level, a sell signal is anticipated. Likewise, when the price of an asset breaks the resistance level, a buy trade is anticipated. This indicator samples out support and resistance levels by joining higher highs and higher lows of previous chart patterns. On the chart above, the support levels are marked out in red horizontal lines while the resistance levels are marked in green horizontal lines.

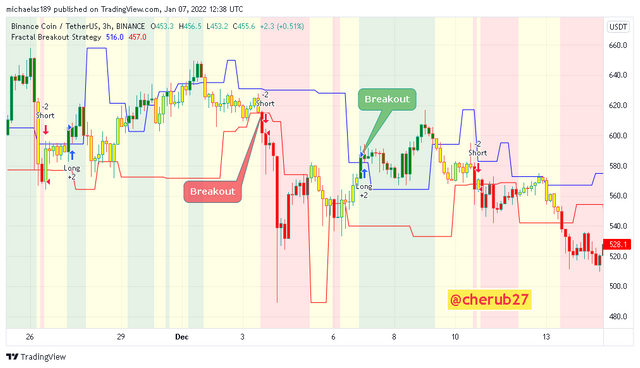

Fractal Breakout Strategy Indicator

Fractal Breakout Strategy Indicator focuses primarily on identifying fractal breakouts in any market. The indicator has two trend lines in blue and red, enclosing the price action of an asset. The blue line trends above while the red line trends below the price movement.

Price candles trending within the boundary of the indicator are marked yellow while the boundary serves as support and resistance levels for the price action. The indicator generates a short or long trade once the price breaks any of the boundaries. Breakout at the blue line above signals a long position while breakout at the red line below signals a short position.

This task requires a graphical observation of fractals without the use of any indicator. We understand that fractals are repetitive patterns that form on price charts and thus, we can compare historical data on fractals to emerging fractal formations to check the eligibility of the pattern being formed. This can help traders plan their trades when the market takes a similar turn as the previous move.

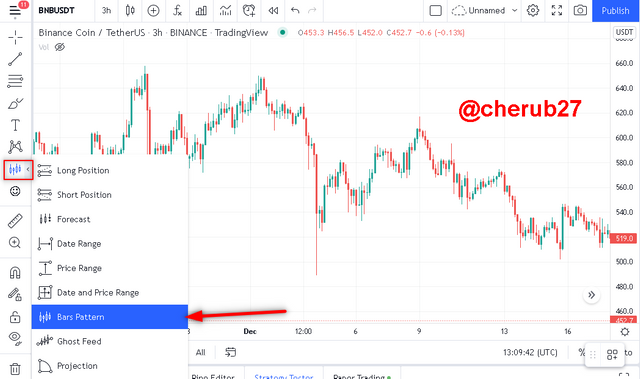

The Bar Pattern tool in TradingView is a handy tool for this type of exploration. To apply it to any chart, navigate to the Prediction and Measurement Tools icon on the left side of the chart menu and select Bar Patterns from the lists generated.

I will illustration how to explore fractals through charts using the Bar Pattern tool with BNB/USDT trading pair

Select the Bar Patterns tool and draw a line from left to right on your preferred chart pattern. Your outlined pattern will be transformed into a movable pattern

Drag the highlighted pattern into a suitable position

In the chart above, we can see that the previous chart is an almost 80% match with the current price action. With the high portion of resemblance to the current trend, the probability of the reversal happening at the end of the pattern is high and can be seen to follow through on the chart.

The Fibonacci Retracement tool amongst other tools can be added to the chart to confirm the price action or market reversal. The market is still volatile and the price action can change anytime, thus the need to adopt proper risk management for the trade setup.

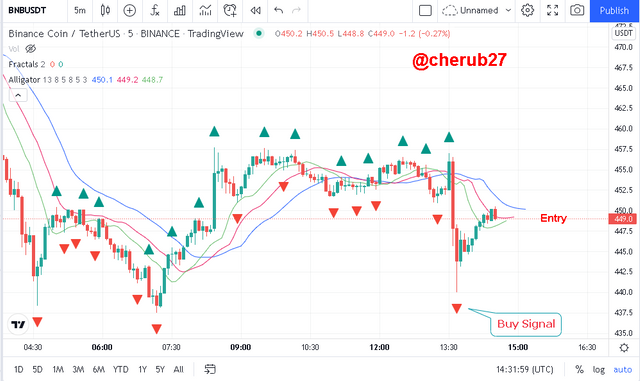

I will be using the Williams Fractal in conjunction with the Williams Alligator to perform a real trade on BNB/USDT. The Williams alligator will serve as a confirmation tool for the William Fractal indicator. I will perform the technical analysis on TradingView and purchase in my verified Binance account

The history of the chart above shows the price trading predominately above the alligator's teeth(middle moving average) which signals a significant long-term uptrend, thus we will be looking out for a buy signal. All we needed was to wait for the buy signal on the Williams Fractal indicator which has signaled in the chart above. I set my entry price @$449.9 after the price settled on the alligator as support.

I placed my stop loss at the recent low price and take-profit target at the resistance line marked above. In all, my stop-loss and take-profit target are in a 1:1 ratio.

My stop loss was triggered an hour and 18mins later as the price is observed to hit a new lower low.

Conclusion

Fractals are good for identifying potential reversal points in markets but just like any other technical analysis with price pattern, there is the need to apply other indicators to serve as confirmation tools for you to enter a trade.

Indicators like EMA, Alligator, or the Fibonacci Retracement tool can come in handy as confirmation tools for price continuation or market reversal with proper risk management set in place

Thanks to professor @reddileep for the introduction to this lecture.

Hello @cherub27,

Thank you for participating in the 8th Week Crypto Course in its 5th season and for your efforts to complete the suggested tasks, you deserve a Total|8.5/10 rating, according to the following scale:

My review :

You have tried to answer all the questions asked in your efforts. Some of your explanations lacked some depth of analysis compared to the level required. However, in general your work is good. I invite you to avoid all these mistakes in the following courses.

You demonstrated an understanding of fractals as a trading indicator for cryptocurrencies but did not provide a deep explanation based on your own words.

In the second question, you have provided clear screenshots to explain the main rules.

In the third question, you did a good job based on which you discovered several indicators with which you can easily identify fractals.

In the fourth question, an answer in which you provided clear graphs that enabled us to understand the exploration of fractals in a graphic way with the possibility of digging deeper into some of the details.

In the fifth question, you managed a good technical analysis to identify the fractals and was followed by a real purchase of a currency at a suitable entry point.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit