Pivot Points

Pivot Point is a technical indicator used by intraday traders to predict the overall trend of a market. It is derived based on the average of the high, low, and closing price of the previous trade time frame.

It helps to predict the incidence of a bullish or bearish run in a market. This is done by observing the trade trend of the subsequent day. Once the trade is above the pivot point of the previous day, we can anticipate a bull run. The opposite happens when the trade is observed to take place below the previous pivot point.

Pivot points help intraday traders to estimate appropriate periods to enter and exit a market by outlining support and resistance levels.

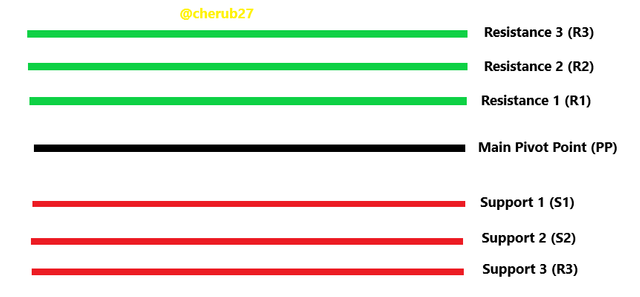

Details About Pivot Point Levels

Pivot Point Levels help to indicate the resistance and support of trade. They assist in decision-making and outline the trade entries and exits for intraday traders.

Pivot point levels are characterized by one main pivot level serving as a base for other pivot levels to outline support and resistance levels for a trade. Pivot point levels above the main pivot point(PP) are termed as resistance levels while those below the PP are termed Support levels.

In a normal sense, prices are expected to revert once they reach these pivot levels. If the prices of an asset continue to rise above a resistance level, we can say there a continuation of a bullish trend. This phenomenon applies to support levels also but vice-versa.

Example of Pivot Levels Representation

| Pivot Levels | Position |

|---|---|

| Main Pivot Level (PP) | Positioned in the middle. Serves as a reference for other pivot levels |

| Support 1 (S1) | First to be positioned below the main pivot point. |

| Support 2 (S2) | Positioned below S1 |

| Support 3 (S3) | Positioned below the main pivot and S2. |

| Resistance 1 (R1) | First to be positioned above the main pivot point. |

| Resistance 2 (R2) | Positioned above both the main pivot and R1 |

| Resistance 3 (R3) | Positioned above R2. |

Pivot Point Calculation and R1 R2 S1 S2 Pivot Levels Calculation

The parameters used in calculating the base pivot point(PP) are the high, low, and closing price of the previous day's trade. PP is calculated by striking the average of the above-mentioned parameters and is given by the formula:

PP= (High + Low + Close) / 3

The value obtained for PP is then used to calculate the value of the other pivot levels.

For

- R1 =(2 * PP) -Low

- R2 = PP + (High - Low)

- S1 = (2 * PP) -High

- S2 = PP + (High - Low)

Where

PP = Main Pivot Point

High = high price of the previous day

Low = low price of the previous day

Close = closing price of the previous day

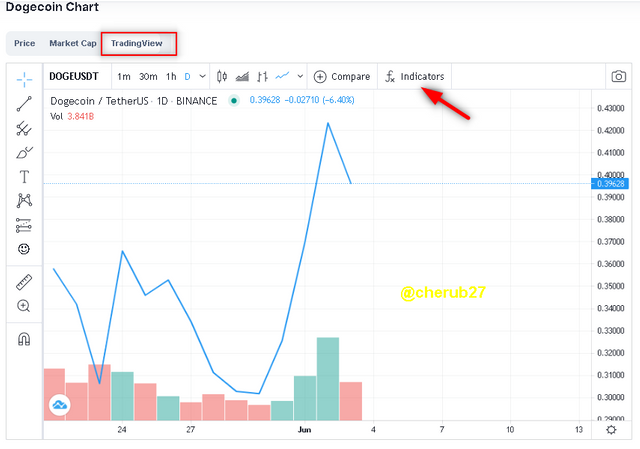

How to Apply Pivot Point on a Chart

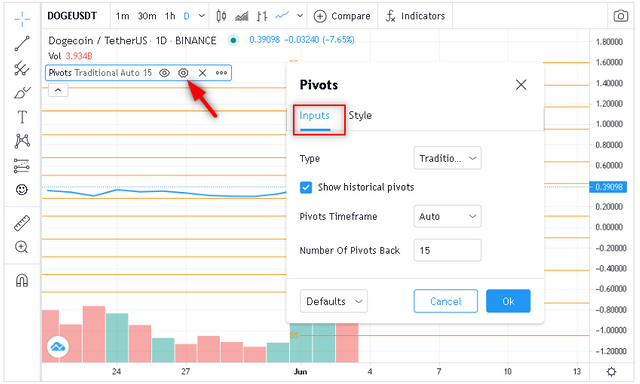

For this tutorial, I will be using the 1D chart of DOGE/USDT using the TradingView feature on CoinMarket Cap

- At the chart interface, click on the 'fx' icon at the top menu

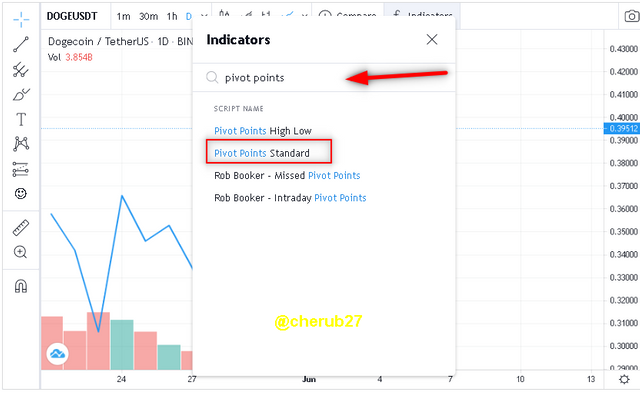

- Type in pivot points in the search bar and select Pivot Point Standard

- The indicator will be added to the chart interface.

Next, click on the setting icon next to the indicator name to open the configuration menu.

At the Input tab select Traditional.

Check the Show historical pivot box

Set Pivot time frame as Auto and Number of Pivot's Back as 15

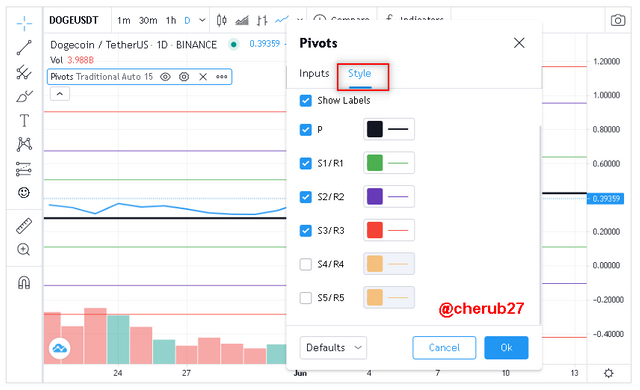

- At the Style tab, uncheck R4/S4 and R5/S5 and choose color codes for the remaining levels. You can adjust the font size to your preference.

How Pivot Points Work

From the lecture, you understand the main pivot point (PP) is constant and shows the market trend.

A pivot level may act as support or resistance once the price reaches it. The price is expected to either revert or continue its trend in what is called Breakout.

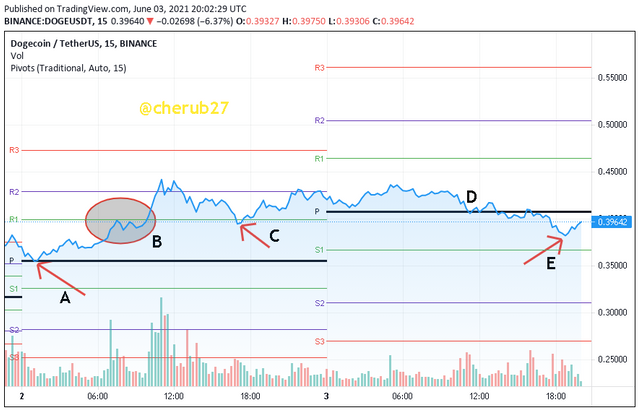

For illustration, I will be using a 15m 15-minute line chart that covers a 2-day trend

The first day starts with the PP acting as our first support level momentarily at a point labeled A. It can be observed that the price revert into its bullish trend since the day started with the price above the PP

At point labeled B, R1 becomes the resistance as the price bounces off it for a while before having a breakthrough and continues the bullish run. the price eventually reacts to R2 which settles as the new resistance. The day ends with R2 as resistance and R1 as support for a bullish trend

With the next day chart, the price comes towards the main pivot level from the upside and then reverses back and continues to the bullish trend. The price repeats the same trend as it keeps reacting to PP as the first resistance as shown in point D

The later part of the day sees the price break through the PP acting as support for a bearish trend. The day ends with S1 as the new support level.

- Intraday traders can buy a position on or below the main pivot level in the bullish trend and take profit at or between R2 and R1 with a stop loss at PP. Long traders can exit to take profit at R2 for the first day

Pivot Point Reverse Trading

We can pivot point reverse trading technique when the price reacts to the support or resistance levels of pivot points and reverts back. In such instances, a breakthrough is often hard to take place. This way, traders can open a buy or short trade when the price moves above or below the PP respectively to take profit.

It is not advisable to enter a market in which the price moves near the main pivot point.

From the screenshot above, the price was first above the PP which indicates bearish but then the price was started going up from the S1. Long traders can open buy at S1 with a stop loss and take profit above PP. Risk takers can explore their options and take profit at R1 instead and open a short trade at this point. The first day ended with PP serving as the last support for price in a bullish trend

The next day, a bullish trend turns bearish as the price breaks the first support of PP before reverting back into a bullish run. Long traders can open a trade at PP and take profit at R1

Common Mistakes in Trading with Pivot Points

First of all, Piont Points is just a simple calculation of the highs, lows and closing of the previous day's chart. It does guarantee that the price of an asset will necessarily react to the levels drawn. Thus using the pivot point as the only indicator for price analysis is not the safest choice to make and show only be used in support to other indicators

The price trend predicated using the pivot points is not 100% accurate, thus traders should adopt setting stop loss

to exit market when the trend back fires.

Pivot points is best adapted to intraday trades. Using them outside trades with longer time frame is not favourable as may be lead to huge loss.

Always looking to take profit at extreme odds is not advisable as the market does not always follow the trend with pivot point in use. There is no guarantee that a price will continues in its bullish or bearish trend so traders ought to adopt taking profit with less risk. always set a stoploss.

Traders should avoid opening a trade when the prices moves near the main pivot point as there is no assurance that a price may take a bearish or bearish trend.

Advantages of Pivot Points

Using Pivot points with other indicators provides a strong basis for trading. When a pivot point overlaps or converges with a 50-period moving average(MA), the support or resistance is assured to hold its grounds.

Pivot points can predict the trading ranges of the next day based on calculations of the previous days trend.

Pivot points provide key inflection point based on simple calculations to provide basis for traders to take long or short buys with adequate information.

Pivot points are widely used by traders. Once all traders spot and buy a short trade when the prices is moving above the main pivot point, the influence of all traders would actually move the market in that same direction.

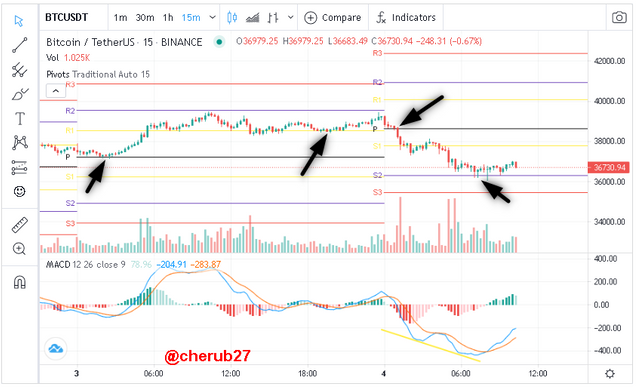

Pivot Points Indicator in the Today Chart of BTC/USDT Pair

source

The previous day started with a bullish trend as the price moved just above the main pivot point serving as first resistance. The bullish trend continuous as the price breaks the R1 resistance which became the new support for the day. The day ends with a bullish trend as the price reacts to the R2 as final resistance.

Today started with a bullish turned bearish trend. The prices breaks the main pivot point as the first support and continues the bearish run as its breaks the S1 support also. It is currently hovering above S2 as support.

I see the price respecting S2 support. the MACD has crossed the MACD signal line indicating a buy signal. Thus this is a possible upward reserve in price trend.

With the S2 holding as support at a price of , I predict the lowest price at the end of the day would be $36,100 as currently there are lot of buyers in the market. The upward rise can only go as far as $37,973 because I don't see any strong buyers entering the market.

Weekly Price Forcast For Crypto Coin: HBAR

Basic Information on HBAR

HBAR is the native token of Hedera Hashgraph which is a decentralized public network offering its users fast, fair and secure DApps. Hedera Hashgraph runs on Hashgraph technology which has proven more efficient than blockchain technology.

HBAR tokens are used as payment for services on the Hedera network and also for securing the network.

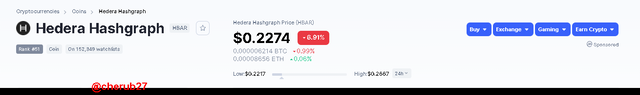

HBAR is currently ranked #51 on CoinMarketCap and has a current price of $0.2274 with a market cap of $1,953,029,439. It has a circulating supply of 8,577,696,946 HBAR coins and a max. supply of 50,000,000,000 HBAR coins.

HBAR can be traded on several exchange platforms like Binance, Bittrex and HitBTC

source

The reason I would like to predict the HBAR

Since its main launch in September, 2019 , Hedera Hashgraph is the first ever decentralized public network to run on hashgraph technology which is a distributed public ledger which offers fast and fair transactions with higher efficiency to blockchains.

Hashgraph improves upon the setbacks of blockchain technology in terms of scalability and speed. Hashgraph can process 10,000 transactions per second with a 3-5 seconds validation time thanks to its Gossip protocol which applies the strategy of gossip-about-gossip to interact with it nodes. The average transaction fee on Hedera network is $0.0001 which is far better than of most blockchain projects.

Hedera Hashgraph is governed by 39 world leading organisations across 13 diffrents sectors. The support is massive for a project which is less than 3 years old . Hedera Hashgraph is known as the 3rd generation technology and would soon be making waves.

Technical Analysis of HBAR/USDT Pair

From the 1d chart analysis, the HBAR price has held a strong resistance for the past 2weeks but initial support of $0.2159 broke to a new support of $0.2036 which is currently holding.

The bullish trend over the week is currently experiencing a bearish reversal. Though, the MACD trend has hit its highest low and taking a turn for the upward move. The MACD has crossed above the MACD signal line indicating a buy in the market. This indicate a good time to buy in my opinion

Possible High and Low

My possible high level for the next 1 week based on my technical analysis would be $0.277 which is at its current resistance with the highest possible at $0.29 which was support for 3weeks ago.

My possible low level would be $0.205which has been the support for the week.

Conclusion

Pivot Point is a technical indicator which applies previous high, low and closing price to estimate the market trend of the next day. It is very useful for intraday trade and best recommended for use alongside other indicators to best outline positions in the market.

Pivot Point best applied on a 15min chart of a 2-day trade but it does not guarantee that the prices will nesecarily react or break through its levels which makes trading risky, thus it is relevant to have a stop loss in place to manage your losses.

Until now, I really had no idea about Pivot Point Indicator and I am grateful to professor @stream4u for introducing this lecture to us. With my own research on the subject matter, I understand how to apply to now.

All screenshots are captured from CoinMarketCap unless stated otherwise

Thank you for your attention

Hi @cherub27

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am also positive on HBAR.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's definitely one to watch out for.

Thank you for the review

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit