Introduction

As a crypto trader, one should be opened to losing some tokens as much as making profits because of the market's volatility. Thus, it is relevant to adopt risk management techniques in the trading of assets. A big thanks to professor @yohan2on for touching on this relevant subject in trading.

Buy Stop is set to buy an asset at a target price in anticipation of an upward trend. When a trader, after analyzing the market trend, anticipates that the price of an asset will increase above its current resistance, the trader sets a specific price to enter the market which is higher than the current market price. The market order only takes place once the asset hits the specific price(Stop Price) which is set.

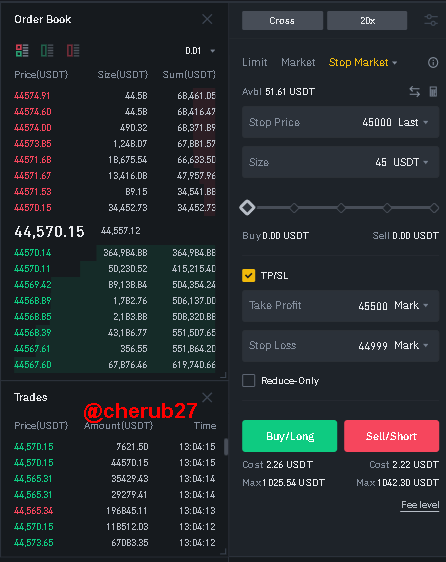

From the chart above, the current BTC market price is $44488. As a trader, I want to set a Stop Price of $45000 to trigger a market order of 45USDT/0.001BTC once the price hits the stop price. I want to take profit at $45500 and set my Stop Loss at $44999

How to configure the Buy Stop on Binance Futures

- Log in to Binance account

- Navigate to Futures (For desktop users, the option is under Derivatives)

- Select your Trade Pair

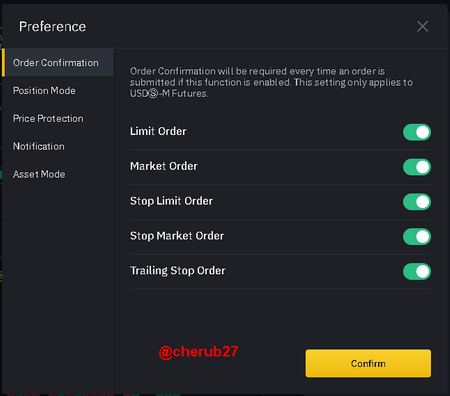

- On the Order page, click on the Settings icon and select Preferences

- Check all order types especially Stop Market Order displayed under Order Confirmation. This is to cater for subsequent illustrations

- Choose Stop Market

- Now, you insert your parameters for Stop Price, Size of Asset

- Check the TP/SL box so you can set your Take Proft and Stop Loss price

- Click on Buy/Long button below to execute the trade

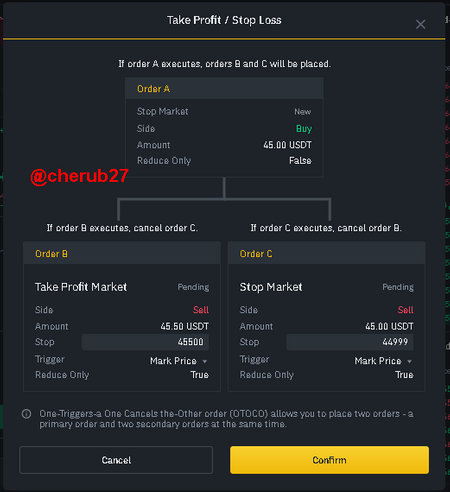

The Buy Stop order is placed successfully. Once the price hits $4500, the market order will be triggered to buy a position. You can be seen, my take profit and stop loss has been set to exit the market taking preferred profit or minimizing my losses in event of a reversal.

Sell Stop is the opposite of Buy Stop as this time around, the trigger price is set below the current market price. This strategy is used by traders to exit markets in time to minimize their losses.

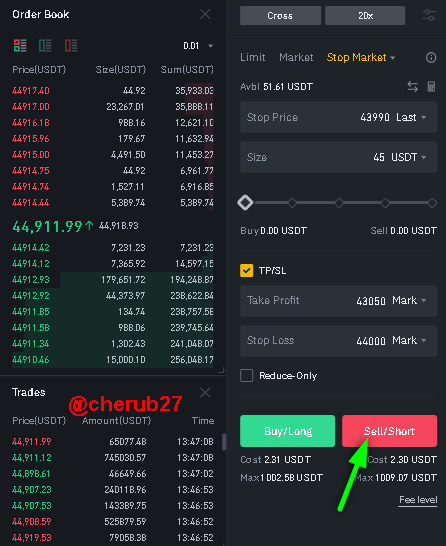

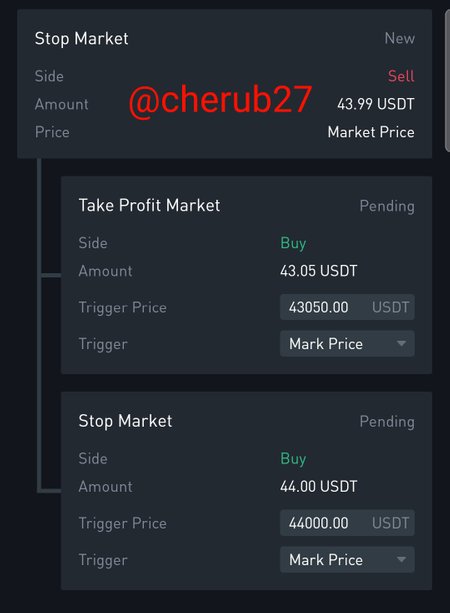

Suppose, this time around I predict the market to fall. I set my stop price at $43990 in anticipation of a bear run which is below the current market price. I want to take profit at $43050 on my 45USDT/0.001BTC investment but do not want to be caught out in a market reversal once the order is placed so I cut my losses(Stop loss) at $44000

Steps to set Sell Stop

The procedure is the same as that of the Buy Stop order. The only difference is the values for the parameters and clicking the Sell/Short button.

Buy Limit order allows traders to enter a long position at the price of the trader's choice. This type of order is only executed once the market price of the asset matches or is lower than the set price of the trader. Traders have the liberty to buy a position at a relatively cool price but there is no guarantee that the order will be filled as conditions have to be met. Thus, the market price has to match or be lesser than the execution of the trader.

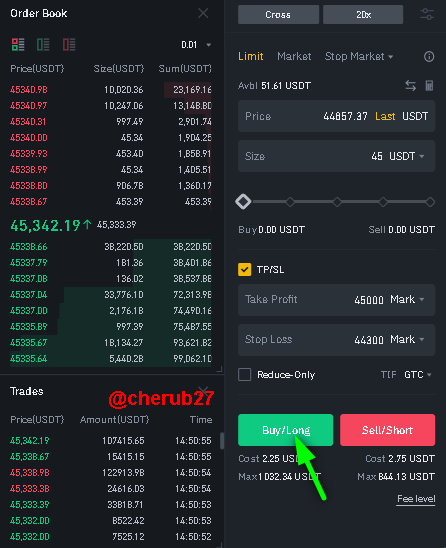

Steps to set Buy Limit

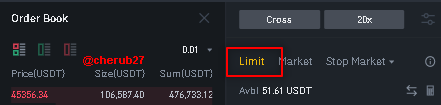

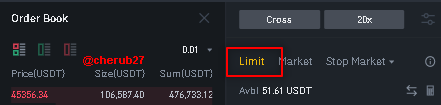

- At the Order page, select Limit as the Order type

- Set your Limit price, Amount to invest as well as Take Profit and Stop loss

- Click on the Buy/Long button in green to place your order

From the above image, I have configured a Buy Limit with my limit price set at $44853 as opposed to the current price of $45342. The order will only be filled once the market price hits the limit price or is lower. As the current price stands at $45342 which is higher than my limit price, the order will not be executed.

Sell Limit executes an order once the market price reaches or is higher than the limit price. Here, the trader wishes to sell his position or enter a short position once the market price exceeds his target price.

Steps to set Sell Stop

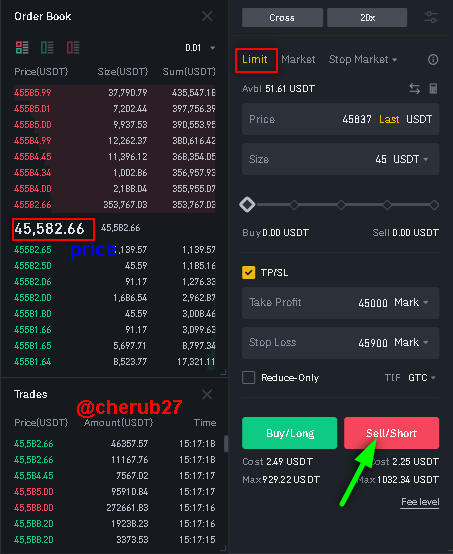

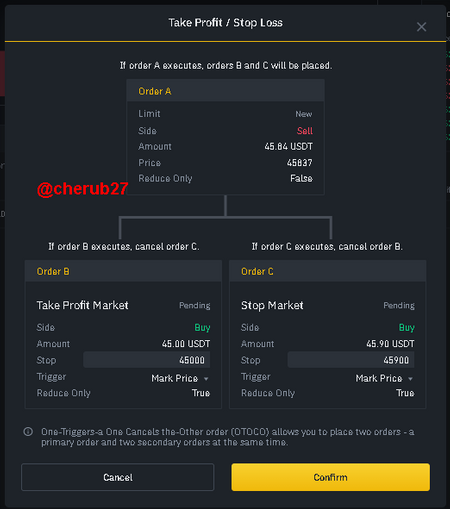

- At the Order page, select Limit as the Order type

- Set your Limit price, Amount to invest as well as Take Profit and Stop loss

- Click on the Sell/Short button in green to place your order

From the image screenshot above, my Sell Limit of $45837 will only be placed if the current market price equals or exceeds the limit price of $45837.

Trailing Stops act as an automatic stop-loss trigger that adjusts in one direction to ensure that a trader locks enough profit as the price continues in the trader's favor. A trader's position is closed at the current market price once the market movement opposes the trader's position as the specified percentage.

The changes take place at a specific percentage of the market price. As useful a trailing stops can be, a very small trailing stop percentage can exit a trader's position with the slightest percentage change in market direction. An unreasonably large trailing percentage can also incur huge losses before the trade stopped out.

For example, when a long position with a 5% trading stop experiences a price drop of 5% of the entry price, a sell order is executed at the current market price. This phenomenon applies same to short trades.

A margin call is a notice to traders which alerts them to either exit a position or add up funds to avoid liquidation of open positions. A trader's position will be liquidated once the margin balance becomes less than or equals the maintenance margin which reflects a margin ratio of 100%.

Margin Balance is the sum of a trader's wallet balance and unrealized profit and loss(PNL).

Unrealized profit and loss on any position is calculated based on the Mark Price, and return on equity percentage

Maintenance Margin is the minimum amount of margin balance required to keep positions open while the Margin ratio is the maintenance margin divided by the margin balance.

Mathematically, Margin Ratio = Maintenance Margin / Margin Balance.

Risk Management

One cannot sail through the financial world without encountering risks. You lose some and win some but it all boils down to the trader prioritize rewards to losses. This can only be done by practicing risk management.

Risk management refers to strategies put in place to minimize losses on a trade. The very first step that a trader ought to take in regards to risk management is psychological stability.

Most traders, especially newbies tend to be swayed by their emotions as to how a market is trending and as a result, make irrational choices that bring losses. The most common phenomenon is the Fear Of Missing Out(FOMO). I have been a victim of emotional trade during my startup. I use to jump into trades just because I felt I was out on bullish trends. That stopped once I lost about $23 on a DOGE trade.

It is also relevant to determine one's aversion to risk to determine how far you are willing to go and how much you are willing to lose on a trader. Remember that the higher the risk, the greater the profit. This can help you plan out your trade to suit what you want.

Once the psychological aspect is tackled, then comes the technical aspects which involve the use of risk management techniques to secure rewards and safeguard against huge losses.

Setting Take Profit and Stop Loss Prices

Having a stop loss in place would help minimize losses once the market reverses. Sometimes traders are so tight in setting stop losses that they tend to miss out on trades with the slightest of market adjustments. A stop-loss must be flexible to allow market adjustments because markets sometimes under swings before they continue their expected trend. You should risk some to win some.

Take profits are also relevant in securing profits. Only that sometimes, traders get carried away by greed and set ridiculous prices to take profit without studying the market trend

Use of Technical Indicators

Indicators such as Moving Averages, Strenght Indexes, Oscillators, and Standard Deviations are around to help traders predict the market trend and spot when to enter or exit a trade. These indicators also help to set stop-loss and take profit prices according to market trends.

Demonstration of Risk management Using Moving Averages Trading strategy

Moving averages highlight market trends while certain time frames can serve as support or resistance for an asset. When using two moving averages, once the shorter time frame crosses the longer time frame downwards, there is an indication of a sell signal. A buy signal is indicated when the shorter length crosses above the longer length in a bull run

I will be using the 20-period and 50-period MA for a 1hr BTC/USDT chart for my illustration. Note that smaller MA periods track the real-time price of an asset and are therefore suitable for trades with small time frames.

For a sell/long position, you can see that market is trading below the 20-period MA. Make sure to mark out the market trend respecting the 20-period MA and bouncing off it downwards. You place your short trade where the 20-period MA is respected as I have at point 1in the chart and put your Stop Loss above the 20-period MA. You can go for a 1:1 or 1:2 Risk/Reward ratio. When the trend continues downward, you can continue to trade down the 20-period MA and set your Stop Loss at a comfortable distance above the 20-period MA. I have illustrated the same trend with the 50-period MA at point 2 with a 1:1 risk/reward ratio

Moving Average on Long Position

Moving Average on Long Position On the same 1hr BTC/USDT chart, you can observe that the 20-period MA(shorter) crosses above the 50-period MA(longer) which indicates a buy trade. The market is moving above the 20-period MA which is serving as support. I set my entry for buy at $45772 to take profit at $46957 and Stop Loss at $45179 at a 1:2 Risk/Reward ratio.

Conclusion

Understanding and applying risk management techniques to trades will help secure adequate profits and minimize losses as they come. Thus, it is relevant for all traders to get knowledge of it before they enter into trades.

Traders must understand the not all trades are to be profitable and should make room for losses. Flexibly applying TP/SL can keep traders in trade for a long.

A big thanks to professor @Yohan2on for enlightening us on risk management and its necessity for traders.

All screenshots are from Binance

Thanks for your attention

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your practical study on Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your review professor @yohan2on

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit