Hello Steemians, I have taken time to read the lecture on How to Trade Cryptocurrencies Profitably Using TD Sequential by professor @reddileep and I am excited to present my submission to the homework task below.

Define TD Sequential Indicator in your own words

In trading cryptocurrencies, a lot of technical indicators have been developed to examine and predict market movement. This helps traders to estimate an appropriate point to enter the market to make profits or exit just in time to minimize losses.

TD (Tom Demark) Sequential is a technical indicator that specializes in analyzing market reversals. In the incidence of a market reversal, there is no telling that the market will continue in its trend or is just undergoing a correction. But one fact is certain, the longer a market goes up or down, the more likely the change in trend.

TD Sequential indicator can predict if a market trend is has reached its life span and is about to change in the opposite direction. In short, TD Sequential is the right tool to predict turning points of markets.

This indicator is ideal for traders trying to capitalize on possible reversal trends in a market and provides a possible support and resistance level to a trader

Explain the Psychology behind TD Sequential

The TD sequential indicator works with two phases as mentioned in the lecture, the TD Setup phase, and TD Countdown phases.

These phases work on the principle of the number of candlestick counts represented on/below a candle in a chart, thus the TD Sequential indicator is only employed in a candlestick chart.

TD Setup phase is characterized by a 9-candle count and is also known as the momentum phase. The counting begins in ascending order from 1 to 9. once the 9th count is confirmed, the TD Setup is established. The TD Setup follows a four-period rule of the closing price which repeats throughout the 1-9 bar count

At this point on the 9-count being recorded, there is a possible market turning point in the opposite direction of the current market trend.

TD Countdown follows once the TD Setup is completed. It continues to a 13-candle count and is a strong indication of a market turning point. TD Countdown follows a two-period closing price rule instead and is not necessarily affected by disruption in the two-period rule.

At this point of the 13-count being recorded, the market trend is said to be exhausted, thus named the Exhaustion phase

Explain the TD Setup during a bullish and a bearish market

Traders intend to either long /short their positions in a trending market. These two instances are the principles the TD Setup follows which are the TD Buy and TD Sell Setup.

For the TD Setup to initiate, the candle being observed has to close higher or lower than the candles that came in four places before it.

TD Buy Setup is looked out for during a bearish market trend. The first count is recorded when the observed candle closes lower than the closing price of the four bars earlier.

Bar 2 is recorded when its closing price is lower than that of the four bars behind it. The same trend follows in ascending order for the remaining bars. Thus, bar 9 needs ought to close lower than bar 5.

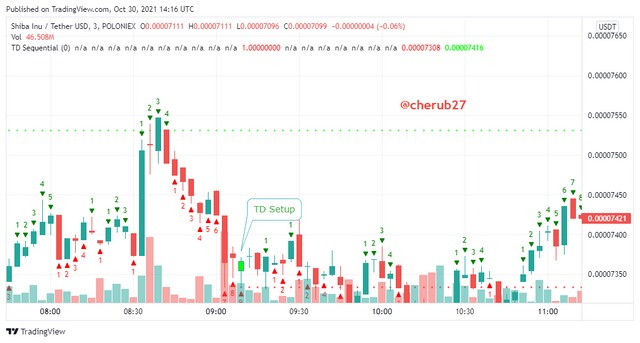

From the chart above, it can be observed that candle bar 1 of the TD Sell Setup marked closes lower than that of the four bars earlier, initiating the Sell Setup. The Setup does not always follow through though. The setup is interrupted once that trend is broken.

The TD Buy Setup is numbered in red and placed below their corresponding bars

The TD Sell Setup is applied in a bullish market trend. Though it shares the same concept with the TD Buy Setup, this time around, the bar in question has to close higher than the four earlier bars.

In the screenshot above, it is observed that bar 1 of the TD Sell Setup closes higher than the bar labeled B in the previous interrupted trend.

Bar 2 is expected to close higher than the previous four bars before it as the count continues. Once the 9th count is achieved, the Sell Setup is said to be established.

The TD Sell Setup is numbered in green and placed above their corresponding bars.

Graphically explain how to identify a trend reversal using TD Sequential Indicator in a chart

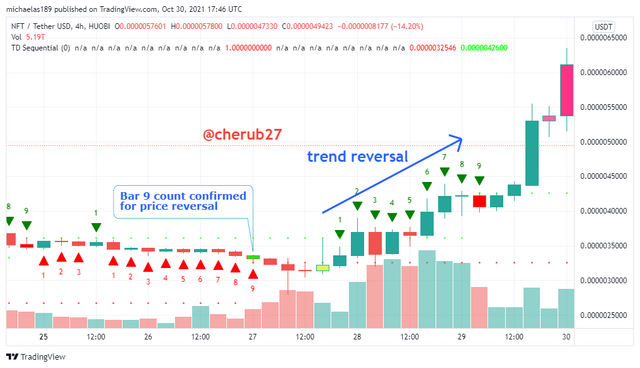

For graphical illustration, I choose to use a 4h chart frame of NFT/USDT trade in TradingView.

A bullish market takes place once a market trend reverses to a significant upward movement. and vice versa for a bullish trend. The market is observed to continue a bullish trend at point A after a just ended bullish trend at point B. The trend is backed by the TD Sell Setup.

To identify a trend reversal using TD Sequential indicator, we have to look out for the completion of the TD9 candle as displayed in the screenshot below. In the screenshot, a TD Sell Setup occurs followed by a TD Buy Setup.

The initiation of the Sell Setup at point A begins with TD1 closing higher than the bar labeled B. The trend must follow up to TD9 as each one closes higher than the four earlier bars. Once bar 8 fulfills the rule, the Sell Setup is considered minimally qualified and when TD9 is recorded, the setup is deemed perfect.

After the completion of TD8 and TD9, a trend reversal is likely expected to occur happen as experienced in the screenshot. Now, the bullish trend is reversed to a downward trend, and a Buy Setup is initiated.

Technical Analysis combining TD Sequential Indicator

For this illustration, I will do a technical analysis of ANKR/USDT using TD Sequential and RSI indicators.

From the chart, a TD Buy Setup has been observed. The asset has shown nine consecutive candles below the closure of four candles before the TD9 bar.

The formation of the TD9 bar indicates a likely market reversal. The RSI indicator read 50.8 above the oversold region and looked to approach the overbought region which was a confirmation of a possible market reversal for a bullish trend

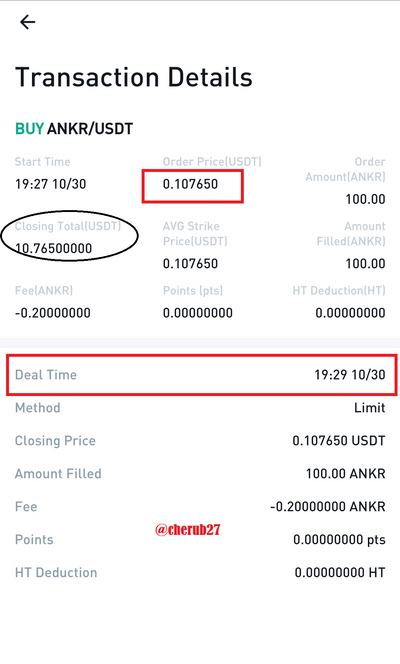

From the screenshot above, it can be seen that I ordered 100ANKR tokens for using a Limit order at $0.10765

- Entry Price -- $0.107650

- Received Amountin ANKR - 100

- Order Amount in USDT - 10.765

- Order time - 7:27 pm Executed time - 7:29pm

- Fee -- 0.2ANKR

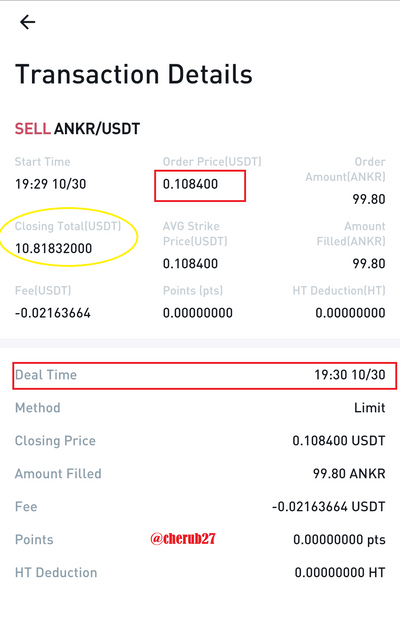

I set to take profit at a market price of $0.10840 after my buy order was executed. This time around, I was selling 99.8ANKR because of the 0.2ANKR fee deduction in the buy order.

- Entry Price -- $0.107650

- Order Amount in ANKR - 99.80

- Received Amount in USDT - 10.81832

- Order time - 7:29 pm Executed time - 7:30pm

- Fee -- 0.02163664 USDT

It can be noticed that, even with the fee of 0.02163664USDT, I still ended up with 10.81832USDT with a profit of 0.05332 for being a conservative trader. A higher buy amount would have resulted in higher profit-taking.

The TD Sequential indicator has proven to be quite effective in catching out market reversals and can be applied to all trading timeframes. Once the TD9 is completed for the TD Sell Setup, a strong likelihood of a market reversal is expected and traders utilize that to take profits.

This lesson on TD Sequential indicator has introduced me to a whole new view of trading assets and I am grateful that professor @reddileep chose to lecture on its use.

I have really learned a lot from this your post.

Keep sharing the good content.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit