I am in trading and investment for several years but never learned from a well informed formal tutorial like this, till now learned only by experience. But after reading this lesson so many doubts have cleared.

Here I am submitting homework after going through the lesson.

.png)

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy-paste or from other source copy will be not accepted)

Answer

Order Book

The order book is a live electronic/manual record of the buy and sell price of any commodity/share/currency/bonds or cryptocurrency, in any exchange. It changes when new order placed or any order executed.

Orderbook in any exchange provides various information like price, availability, depth of trade, and who initiates transactions.

Orderbook consists of three parts viz. buy order i.e. bid price, sell order i.e. ask price and order executed i.e. order history.

How crypto order book differs from our local market?

The order book of the local market is the record of the buy and sell price of any commodity in which any item can be bought or sell against local currency, i.e. commodity can differ but the currency will be the same. Only one type of pair is formed commodity-local currency pair.

In the crypto market, there is a lot of different pair in which one can sell or buy any cryptocurrency.

I.e. Tron can be traded against BTC, USDT, BNB, BUSD etc

The local market order book doesn't show the depth of the market while the crypto market shows the volume and depth of the market.

In the Crypto order book we can place limit and OCO orders while in the local market order book there are no such options available.

Question no 2 :

Explain how to find an order book in any exchange through a screenshot and also describe every step with text and also explain the words that are given below. (Answer must be written in own words)

Pairs

Support and Resistance

Limit Order

market order

Answer

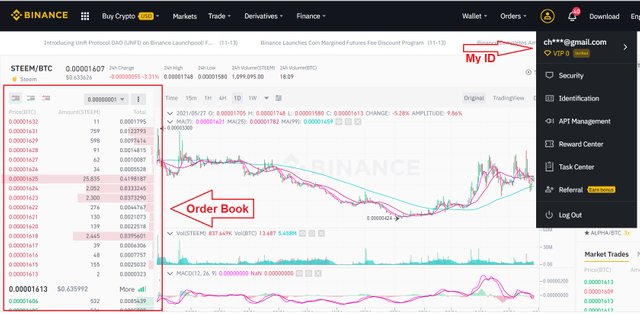

To demonstrate how I find an order book in any exchange I will explore Binance exchange. logged in with my ID and Password then clicked on market on the main menu.

On the market page, I selected STEEM/BTC pair to check the order book.

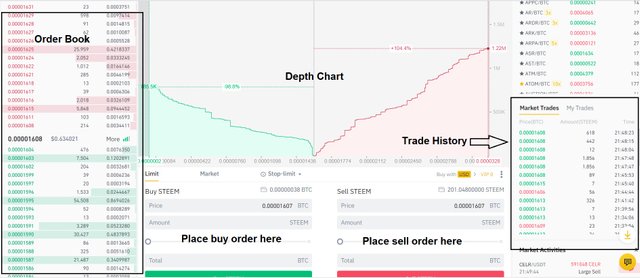

As shown in the above screenshots on the left there is an order book in which orders shown in red colour are sell order(Ask price) and in order in green are buy order(Bid price)

Pairs

Pairs are the combination of two assets that traded against each other. Initially, there was BTC a common asset to trade any cryptocurrency but nowadays traders and investors prefer stable coin pair like USDT-BTC, BUSD-TRX etc to trade any coin.

Support and Resistance

Support is a price from where the price can take a u-turn and resistance is the price above that point strong momentum required to cross that price.

Limit Order

In such an order, a limit price is set and the order will be executed only when any buyer is willing to buy at that price(Ask price) in case of sell order and any seller wants to sell at that price in case of buy order(Bid price).

Market Order

If anybody wants to buy or sell their asset immediately, a market order is placed. In such a case sell order will be executed at the highest bid price and the buy order will be executed at the lowest ask price.

Question no 3 :

Explain the important future of the order book with the help of a screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

Answer

An order book is very useful for traders and analysts and investors because it provides instant and valuable market pricing information on any particular asset.

Important features of the order book

- Buyer(Bid) and Seller(Ask) side

These two are the main part of any order book. Buyers pud bid to buy an asset and Sellers ask the price for their asset to sell in the market. The difference between the highest bid and the lowest ask price is known as the spread.

- Depth Chart

In the middle, there is a depth chart that shows buy and sell orders for a particular asset at varied prices. The chart illustrates both sides of supply and demand to show exactly how much of an asset you can sell at a particular price point.

Order book also shows the volume of order at particular bid and ask price, it is clearly visible in the book.

- Trade History

As shown in the above screenshot latest trade shown in the trade history.

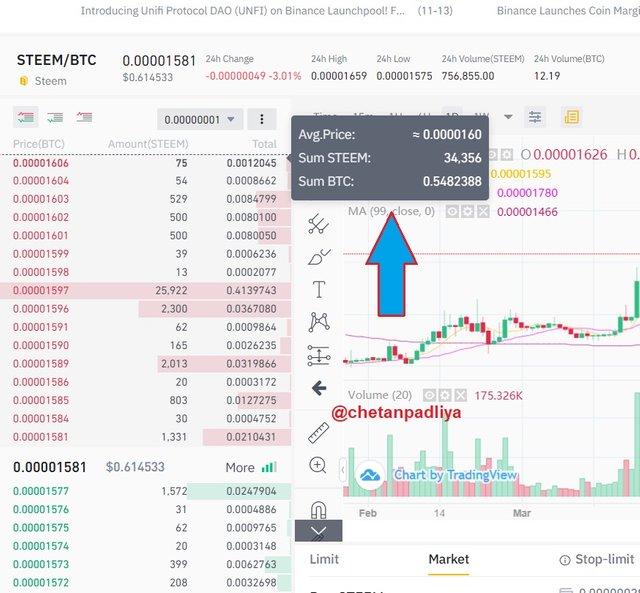

- Average price to buy or sell the asset

If anyone wants to buy or sell a big quantity the average price can be checked as shown in the screenshot below.

Question no 4 :

How to place Buy and Sell orders in Stop-limit trade and OCO,? explain through screenshots with a verified exchange account. you can use any verified exchange account. (Answer must be written in own words)

Answer

Buy and Sell order with stop limit trade

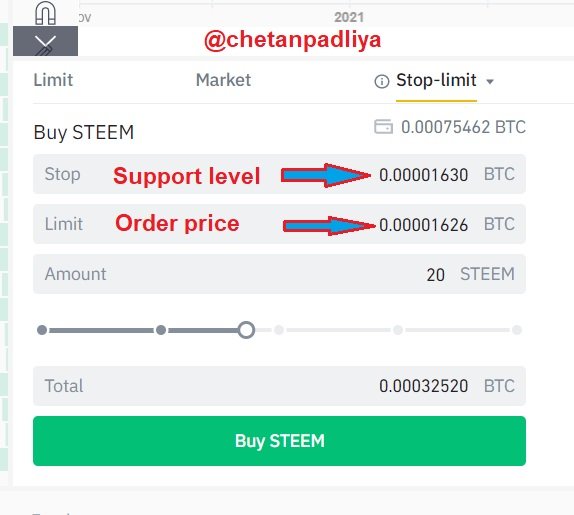

This feature of placing an order is useful when we initiate any trade by keeping some technicals in mind like support and resistance. If we want to buy anything at the support level order should be placed as shown in the screenshots below.

|  |

|---|---|

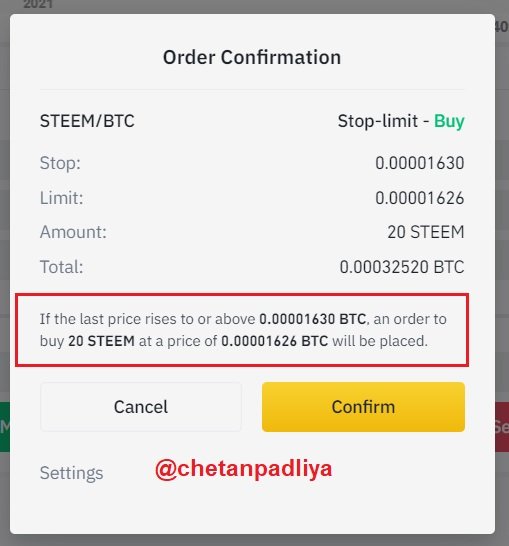

Assuming 0.00001630BTC is a support level I placed a limit order at 0.00001626BTC, which means when the price of Steem will fall below or at stop price my order will be placed and will be executed at a limit price I entered i.e 0.00001626BTC.

Same we can apply to sell any coin. For that we have to find out the resistance level and put that price as stop price i.e our order will be placed at that resistance level and slightly above that price will be our buy price on that our order will be executed.

Placing OCO orders

OCO i.e One-Cancels-the-Other Order is a set of multiple orders placed together. These orders are a combination of stop-limit order and a limit order with the same order quantity. In such a set of orders if one order executes another order automatically get cancelled. These type of orders generally used by traders for any stock/crypto which is volatile and trade within a range. We can try to understand it with one example.

In OCO we place two buy or two sell order simultaneously. Here I placed buy OCO in which there are two conditions, either my order will be executed below 0.00001450BTC or 0.00001545BTC it means I could buy when it touches support level or cross the resistance level.

If any order executed another will be cancelled automatically. So If buying at support is executed my buying at resistance will be cancelled and if I want to avoid loss have to place stop loss manually after execution of the order.

Question no 5 :

How order book help in trading to gain profit and protect from loss? share a technical viewpoint, that helps to explore the answer (answer should be written in own words that show your experience and understanding)

Answer

An order book has some important features which help us to manage our trade. With the help of limit order we can buy or sell our asset at our price. I.e if Steem is trading at 0.60$ but we want to buy at 0.55$ then a limit order is extremely helpful to execute this trade, even there is no guarantee that our order will be executed but if executed it will be a good deal. The same applies when we want to sell our asset at our price.

Order book shows the quantity of buyer and seller side so we can know the trend of the market and make our trading decision accordingly. The supply and demand differences that are showed on the order book can provide traders with signals to short-term price changes. This indicator can be extremely helpful for day traders and scalpers. So, the order book is more useful for shorter time frame.

One more important feature of order book is OCO order as I explained in previous question how we can place two buy or sell order at different level simultaneously in OCO order option. How it can be helpful this we can understand by one example. Suppose I have 100 Steem and my buying price is $0.50 and it is trading in the range of $0.45 to $0.60. Now in this case I will place a OCO order with stop-loss order to sell 100 Steem at $0.45 and and a simultaneous limit order to sell 100 Steem at $0.60, whichever occurs first.

If the Steem trades up to $0.60, the limit order to sell executes, and my holding of 100 Steem gets sold at $0.60. Same time, the $0.45 stop-loss order gets automatically canceled by the trading platform. This is a win-win situation for me.

Conclusion

In crypto market an order book is extremely helpful to initiate any trade. It not only shows the depth of the market but also allows us to place limit order and OCO orders.

With the help of limit order we can sell or buy asset at our desired price and by using OCO option not only we can sell/buy at our price but also place stop loss and book profit.

I am extremely thankful to the Prof @yousafharoonkhan for delivering such an informative and interesting lecture.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

How an order book can help a trader make a profit , your answer was very much short , need more detail to explore this question۔

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your valuable feedback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Prof @yousafharoonkhan for your relentless desire to transfer knowledge.

I observed that this post from 2 days ago by @pangoli is yet to get an assessment from you. Having read through it, I've been looking forward to seeing the grade score. I believe he's expecting to see how much grade his work will worth too. Please help clarify this, thank you.

#steemitcryptoacademy #yousafharoonkhan-s2week7 #cryptoacademy #steemexclusive

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit