Question 1- Define Arbitrage Trading in your own words.

Arbitrage Trading is a form of making profit In a Cryptocurrency market because it involves the rapid buying of currency at a low rate from an exchange platform and selling it at a different exchange platform at a higher rate. We see here as traders take advantage of the variation of the price of the same asset in different exchange platforms by gaining profit when they Sells it

A good example of Arbitrage Trading is like buying crypto currency at a low rate in Binance ($200) and selling it at a higher rate at Coinbase ($205) then gaining a profit of $5

We can also refer to Arbitrage Trading as a triangular Trading which involves trading between 3 different types of currencies in thesame exchange platform with the Prices not lasting for a long period of time hence enabling it to be extremely very fast

Question 2- Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types

1. Statistical Arbitrage

This is a form of Arbitrage that involves the prediction of a future prices of Cryptocurrencies so as to trade Arbitrage by gaining huge profit because prices of currencies will not have to be known before any trade is perform but once the initial transaction is know by the trader, then others can now predict the price hence enabling the completion of the trade. This type of Arbitrage Trading enables traders to gain large amount of profit

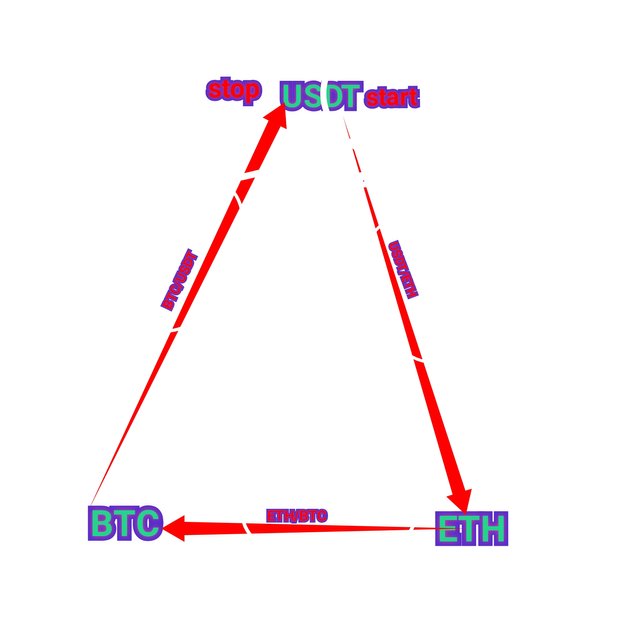

2. Triangular Arbitrage

Here before dealing with the trading, the 3 types of currencies most have a common pair in the exchange involved. The triangular arbitrage can be done by taking the ratio between the 3 types of coins so as to give us the different prices in USD. When the ratio is taken, we can now use it to spot the differences in the 3 types of coins against the USD hence taking out profit according to the ratios by buying and selling of the coins

In other words, triangular arbitrage is the process where by, just within an exchange platform, a trader buy a particular coin and sell it as a different coin then buy it back as an original coin

2. Convergence Arbitrage

This is a type of Arbitrage where traders take into consideration both long and short positions in the various markets in accordance to their differences in asset prices. We see here as traders take advantage of the prices of coins from different markets. They will take advantage of a low rate of a coin then place a long entry position. They will sell the coin Short when the price is high at another exchange medium hence making a profit when the price converge by now selling it long and instead buying it short

A good example is like buying STEEM long at Binance for $0.5 and short on Coinbase at $0.52. Here, the trader makes a huge profit

Question 3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration

Triangular arbitrage is the process where by traders uses three types of coins to take advantage of their prices by taking one Market more important and the other one less important at that particular momment

A typical example, if s trader has ETH in the Wallet and if he notice that USDT is too low but while BTC is relatively the highest at the same time Interval, he then buys USDT with his ETH and still buy again BTC at the same high price, and then sell it to ETH at a very high price.

Let's say his ETH was 25ETH and the price of USDT to ETH was 0.72. therefore 25*0.72= 18ETH

He still proceed by buying his BTC using ETH at a rate of 0.0000305/ETH. That means he have 0.0000305*18= 0.0007625BTC

He finally convert back 0.0007625BTC to USD by 40,700*0.0007625BTC=31.03375USDT

That means his profit now is 31.03375 - 25 = $6.03375

Now his 1st trade was between ETH/USDT then followed by another one which was BTC/ETH, he then finally sell the trade between BTC/USDT and have successfully make a profit of $6.03375 from the trade

image edited from iMarkUp

image edited from iMarkUp

Question 4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices

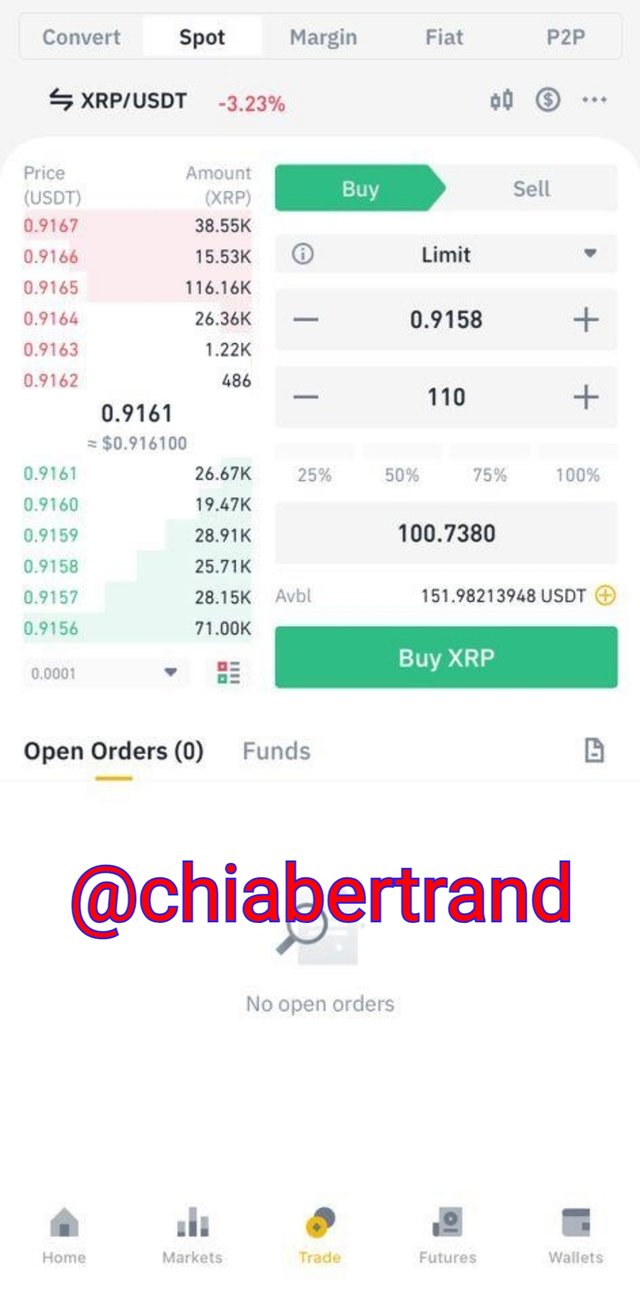

In this task, I will use both Poloniex and Binance to carry out all my transactions.

After logging into my verified Binance account, I then navigate and and click on market icon. After clicking on it, I will search XRP and purchase 110XRP at the current rate of 0.92 which will eventually cost me 100.738USDT as seen on my screenshot below

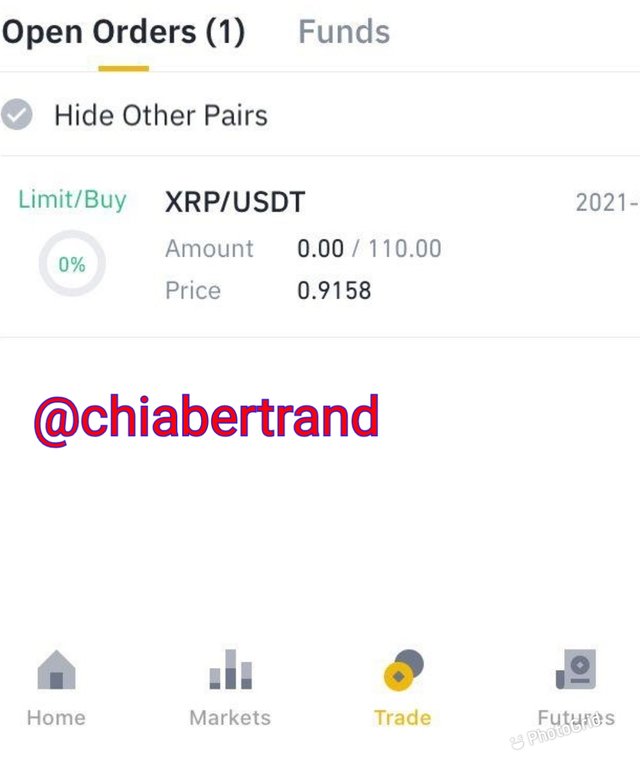

Here is my purchase

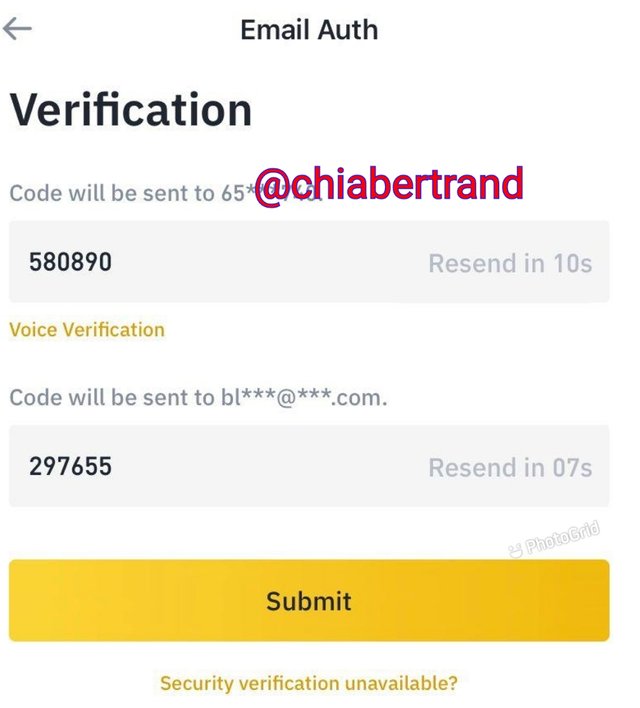

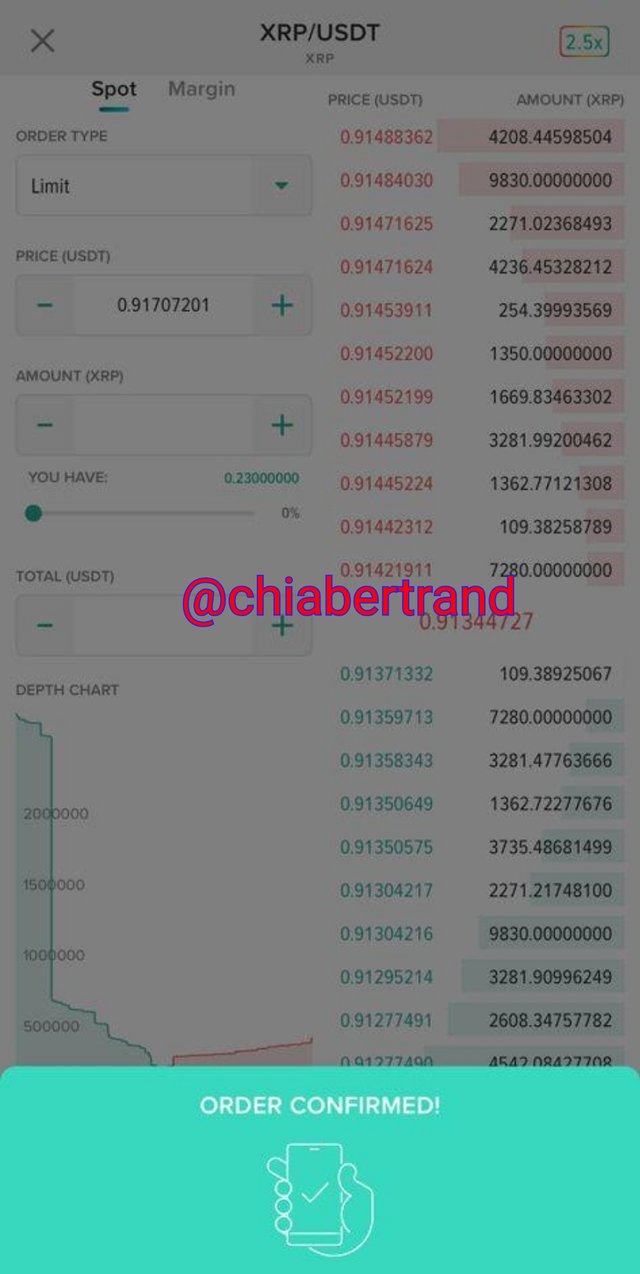

Here is the confirmation

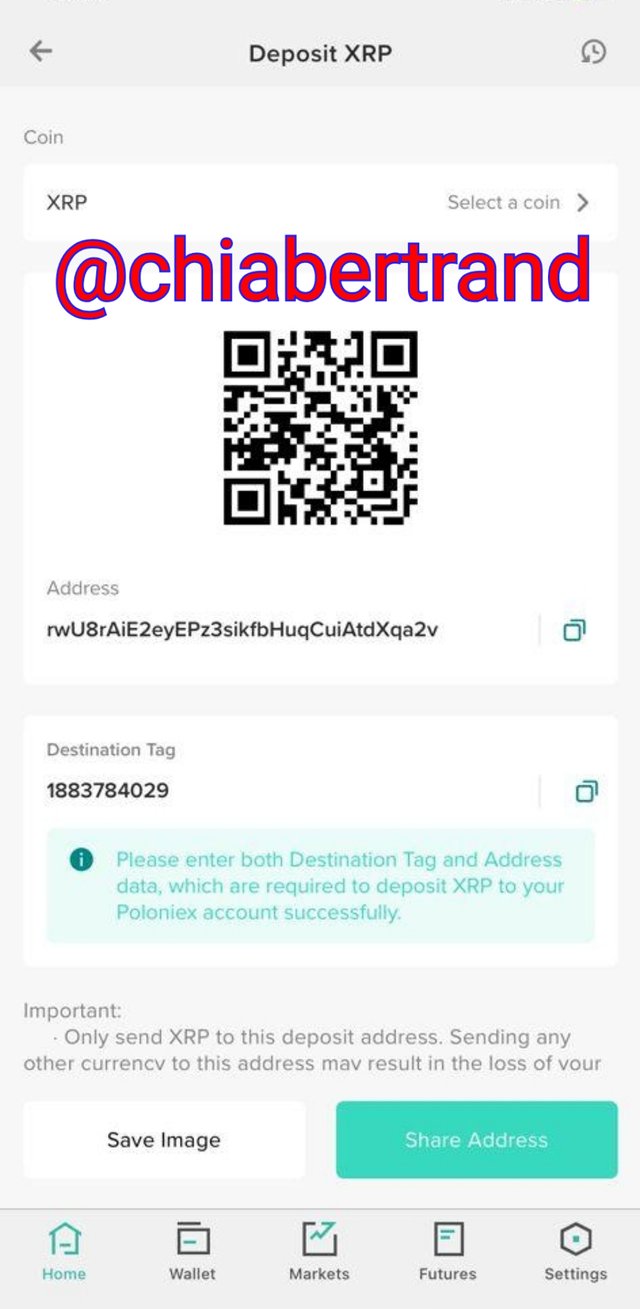

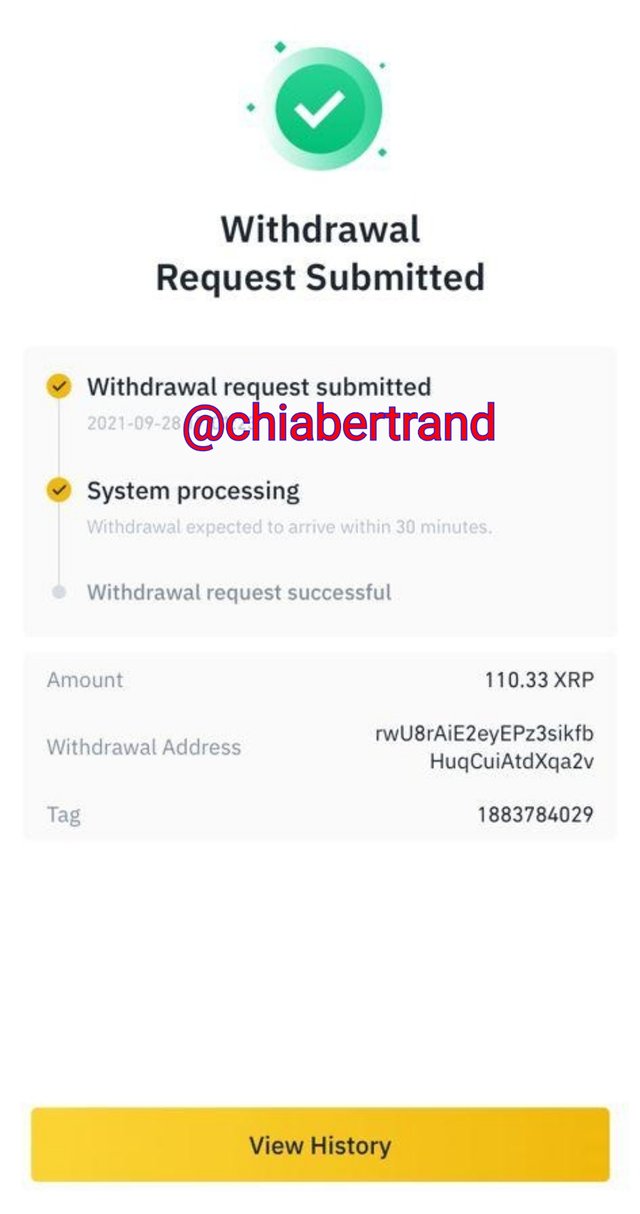

My 2nd step is that I will have to now transfer the XRP very fast to Poloniex since. So I need to fisrt of all login into my Poloniex account then copy the deposit address and send it to my verified Binance account as seen on my screenshot

After opening my Poloniex, I copy the address as shown below

I will send it now to my verified Binance account

My final step here is by selling the XRP as I will proceed by selling the XRP at the available price when I already have my deposit arrival.

So I will sell 110XPR for 100.87USDT at the current of 0.917. This will imply that my profit will 100.877 - 100.72 = $0.157

Question 5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction

I will be demonstrating Triangular Arbitrage by using USDT, XRP and BTC as my 1st, 2nd and 3rd pair of Cryptocurrencies respectively

Now let's get started,

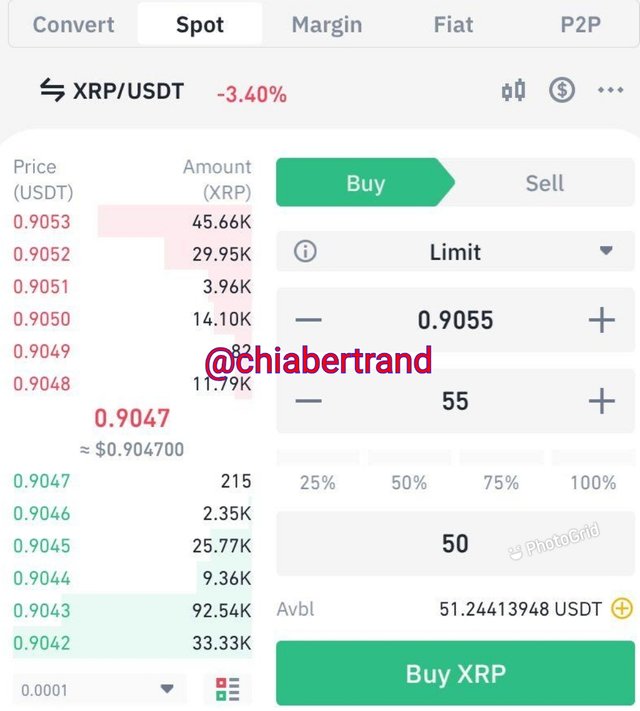

My first purchase is XRP using USDT from my verified Binance account. After logging in, I navigate to to the market icon then search for the pair of XRP/USDT. After doing so, I then place a buy order. I will then be be buying 55XRP for 50USDT at the current price of 0.9055

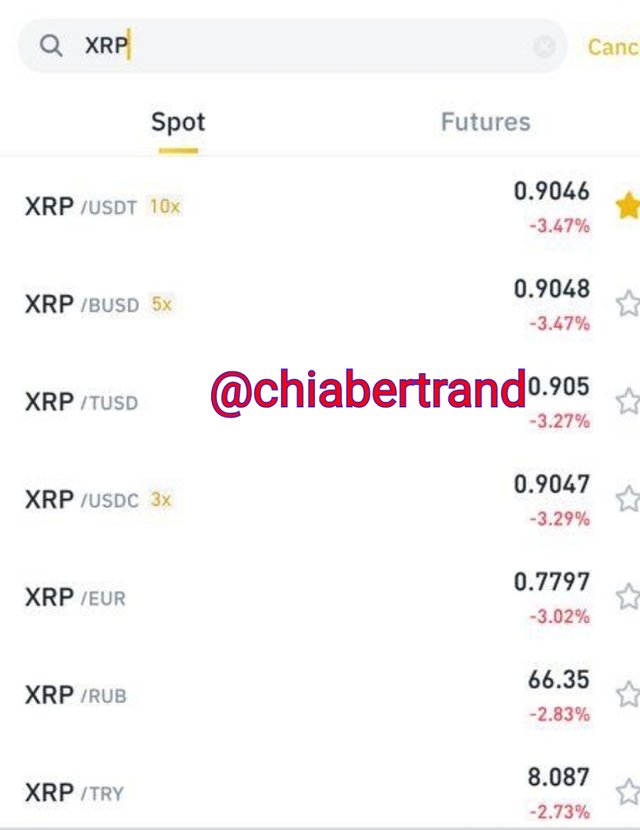

Here, I search for XPR/USDT

I then place a buy order ad seen below

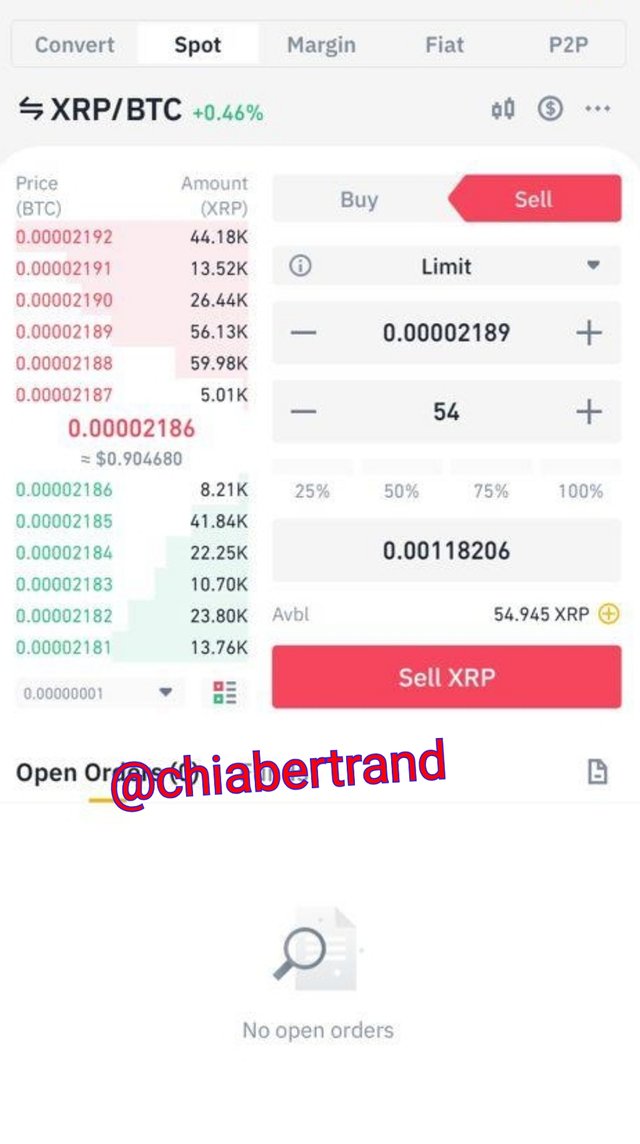

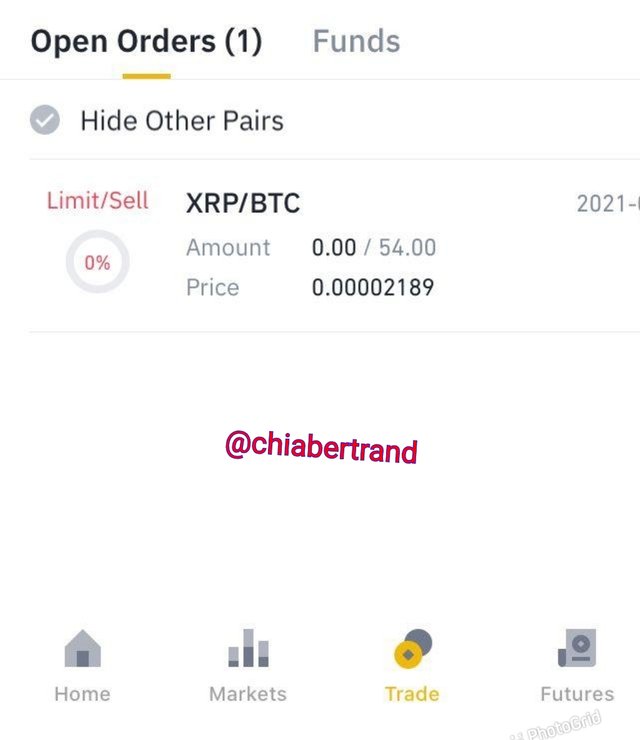

My 2nd Buying is buying BTC with XRP by searching for the pair of XRP/BTC. After searching for the pair of currencies, I then place a sell order.

I then place a sell order as seen below

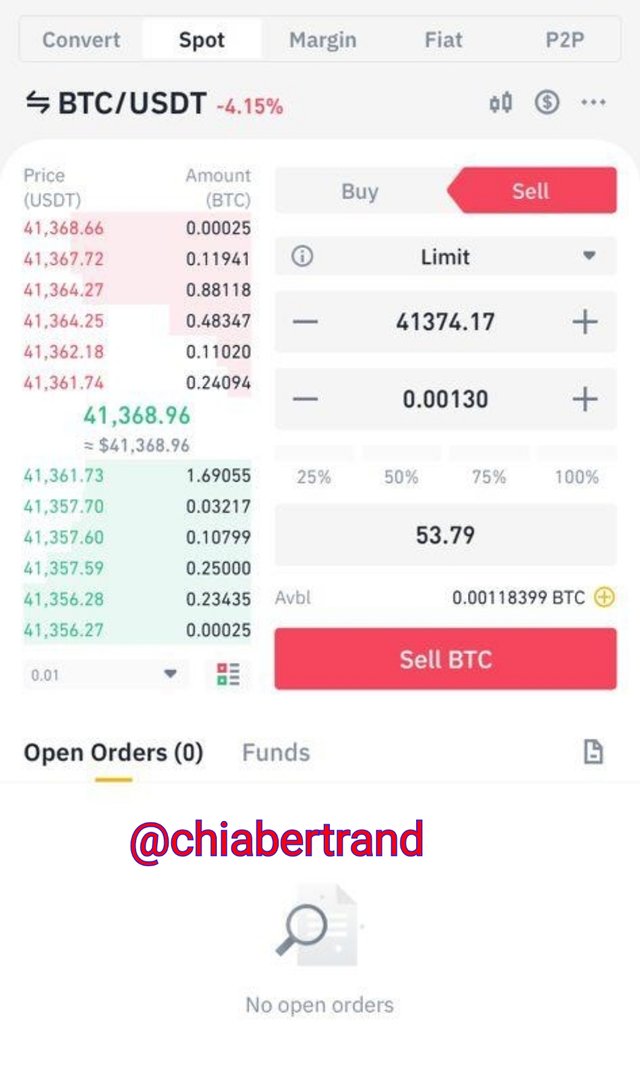

My finally transaction here is done by selling the BTC to get USDT. So I will need to sell back my BTC to have my first currency which was USDT by searching for the pair of BTC/USDT and then placing a sell order. I will then be selling 0.0011839 to have 53.79USDT at the current rate of 41374.17

My Profit now will be 53.79-50 = $3.79 because my initial USDT was 50 and It increase to 53.79

Question 6- Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

ADVANTAGES OF TRIANGULAR ARBITRAGE TRADING

It very little risk or at times no risk since the transaction is very rapid

This type of Trading requires just three pairs of coins which is an advantage to the trader

It is extremely fast and can be traded at a very short period of time

Traders can take an advantage of the pair of currencies in the market and then generate a very huge profit

DISADVANTAGES OF TRIANGULAR ARBITRAGE TRADING

Profit level can be reduced by the fees in the different pairs of Crypto when trading

It requires too much stress in looking for the three pair of coins that will be very good in other to bring out profit after trading with them

Since it's very fast, it may lead to serious mistakes at times and eventual lost of Capital

Price volatility in this type of Trading can cause a slippage during trade execution

I want to thank profesor @reddileep for bringing such an amazing lesson because it has really been of great help to me as I have been able to gain alot of experience in carrying out this task. I had to take into consideration the depth, volatility and the percentage difference of the pair of currencies before having a profit from my trading.

CC: @reddileep

NB: all my screenshots are from Binance and Poloniex accounts