1. Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

INTRODUCTION

As the world is developing in a more advanced way, so is the world of cryptocurrencies as well as the more development of the Blockchain technology especially as far as privacy is concern simply because every user wants more advancement in terms of privacy is concerned. Why everyone user wants more privacy is simply because the Blockchain technology doesn't hide all the details of some transactions carried out by its users as some of this transaction are widely open in the Blockchain where other users can see. So this has led to the revolution of most Blockchains now our days because majority of users want the advancement of privacy to the initial privacy system that the Blockchain had

As users want more advancement in terms of privacy, they also wish to have a position where they will be able carried out their trading by selling or buying crypto assets at a preset price without having any pretentious slippage because that's where very large trading of cryptocurrencies are carried out which is known as Dark Pools

Image by me via iMarkUp

Dark pools refers to a Decentralized trading platform. Inside the platform, there is a block trading venue where large volume of trading of cryptocurrencies are usually carried out privately without being opened to the general public and this trading of cryptocurrencies are usually done at a preset price without having any pretentious slippage and this pool usually breakdown large volume of cryptocurrencies into numerous bits by rivaling them using the zero-knowledge-proofs

In other words, Dark pools can be referred to as a type of alternative anonymous trading system which gives investors chances to position huge amount of cryptocurrencies and then enable trades of buy/sell without the public knowing about about it and this anonymous trading system happens when ever a high profile stockholder perform trades which are apparent in an order book. The good thing about this anonymous trading is that it's usually revealed in an order book but the identity of the stockholders are always hidden from the general public

Currently it's only crypto assets such as Bitcoin(BTC/CAD, BTC/EUR, BTC/GBP, BTC/JPY and BTC/USD) and Ethereum(ETH/CAD,ETH/EUR, ETH/GBP, ETH/JPY and ETH/USD**) then with BTC/ETH are available inside a Dark Pool

This Dark Pool Works practically in two ways which are the limit orders and the market orders. Normally it Start working with the limit orders where by stockholders carry out block trading by selecting crypto assets at predetermined prices at which they wishes to buy or sell but without any slippage after which market orders is brought in place where by crypto traders will now have to examine and scrutinize all the available limit orders within the exchange. After the examine and scrutinize the limit orders, they will now choose the prices that are predetermined by other traders and before taking this decision, they will need to also know about the slippage cost before finalizing their decision wether to buy or sell the crypto asset.

One good thing about about how dark pools functions is that all the transactions carried out between traders are decentralized and anonymous as I explained earlier. It's Decentralized in the sense that all the exchanges carried out within the platform are directly between the two parties involved and never facilitated by other people or 3rd parties and and interpretative information associating to the exchange between the users involved such as volume and price of the asset at a precise position is never disclose in public

Hence we can conclude that limit orders allows traders to pick the price of the crypto asset while market orders enables traders to pick the time that is convenient for them but in general most dark pools uses but limit orders so that the traders can ensure that they can make a certain amount from each trade even if the trade stays long by taking up to a month to complete.

2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

The Kraken is a platform that has a so many crypto exchanges with close to 60 coins and 7 FIAT currencies with low fee charges during transactions. It is a very good platform that offers dark pool which there is a very high volume investors that can trade anonymously

with lots of advantages such as good security system, range of cryptocurrencies, advanced trading features and low fee charges. This Kraken is a well respected cryptocurrency exchange which has been into existence for over a 10yrs(was created in 2011 but launched In 2013) and there is a lot of information within this platform. In terms of security system, it hasn't been hacked for quit a long time because of the strong security system it offers. Another good thing about this platform is that it function with use of currency pairs and it possesses a very high liquidity level for buying/selling of crypto currencies at a moderate price but unfortunately not all crypto currencies found within this platform can be exchange for other crypto currencies since it offers only few crypto currency pairs which I mentioned above

The only disadvantages of this kraken exchange is that it is extremely difficult for beginners to understand, it is very slow in funding account, has limited starter of accounts, has no wallet and has no tax support system. However, it's still one of the best exchange platform that offers a Dark Pool because of its reputation in the world of crypto trading exchange

The Kraken Exchange platform is extremely very pure and doesn't offer loan or saving account even though it's a centralized on-line exchange and only professional users can have entry to it's crypto short sales, stop orders and margins. However, this platform also enables it's qualified users to to stake their coins in other to earn and have interest even if the qualified users doesn't touched the coins they stake

Since the large orders that are usually seen by traders can cause an unfavorable movement in the market by enabling the market to be more difficult to fill orders at the prices they wish to, it's quit good because a dark pool can be use here in other to avoid this unfavorable movement by reducing the market impact then makes the price to be more desirable for carrying out large trades and this made the dark pool here to eliminate the market orders since this orders are not usually seen with order books when placed simply because dark pool orders are usually only match with other dark pool orders hence allowing only limit orders to be placed here in kraken

The function of the limit order is performed at any moment when the crosses one another. When they crosses each other, the traders will not be able to see easily where the order book is and the lower limits here relatively large. However, limit orders carried out here allows traders to pick their prices of any available crypto asset as the traders always ensure that they can make a certain amount from each trade even if the trade stays long by taking up to a month to complete. Traders here don't know if they are takers or makers, that's why fees distinctions are usually removed between the two dealers as all the two traders involved are charged with equal fees

It's quite simple to creat an account here as users will be able to provide their useful information such birth-date, address and users name. This Dark Pool have three levels of verification such as the starter, intermidiate and the pro level

3. What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain

Currently it's only crypto assets such as Bitcoin(BTC/CAD, BTC/EUR, BTC/GBP, BTC/JPY and BTC/USD) and Ethereum(ETH/CAD,ETH/EUR, ETH/GBP, ETH/JPY and ETH/USD**) then with BTC/ETH are available inside this Dark Pool

The requirements here are quite simple as this pool have four main requirements such as it requires that:-

It requires only limit orders and doesn't support market orders

It is usually available only to users that are at verified pro level

It requires that only the minimum order of BTC pair should be equivalent to about 100k USD

It requires that only the minimum order of ETH pair should be equivalent to about 50k USD

My answer is YES and the rates usually depends on a trader's 30 days trading but within the dark pool orders, the fees usually ranges between 0.20% - 0.36% which has an extra 0.20% as compared to normal limit orders which usually ranges from 0-0.16% and the more users trade here the more their trading fees are reduced since an executed orders usually donate to the 30 days of trading volume by traders.

4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

It's quite simple to carry out block trading here on the kraken exchange platform and I will be explaining it by giving the steps a trader can follow In other to carry out block trading

A trader can be able to have access to a trading pair in the dark pool directly from the advance orders which is usually found in the page of the new order and usually written below the Dark Pool menu and the steps involved in other to carry out the block trading are:-

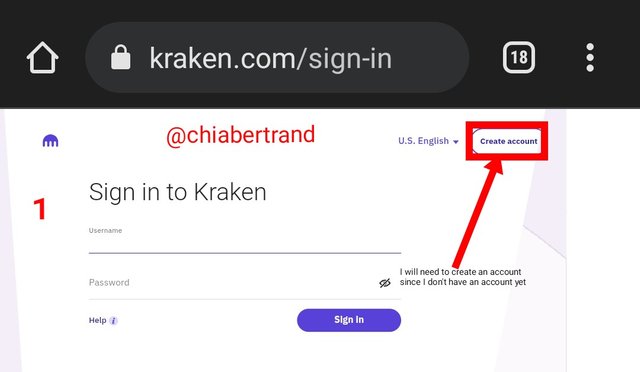

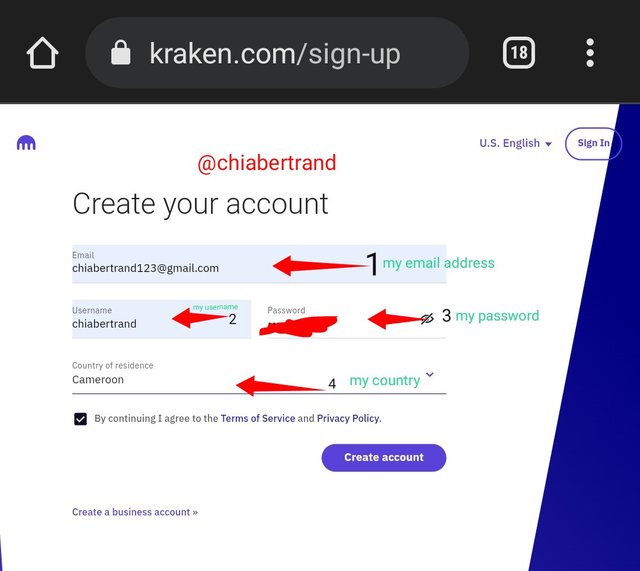

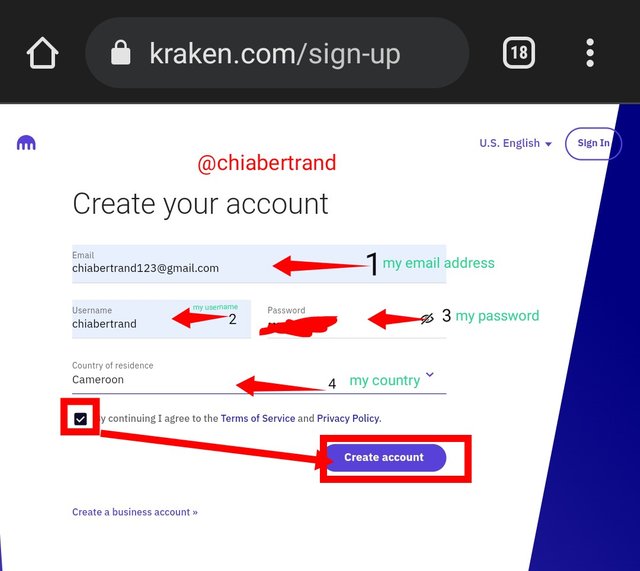

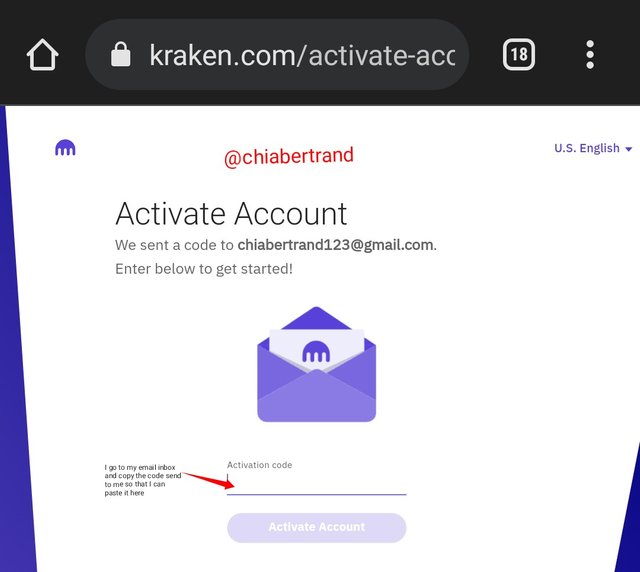

Each new user will need to creat an account on the kraken platform and input his/her useful information such as username, password, email address

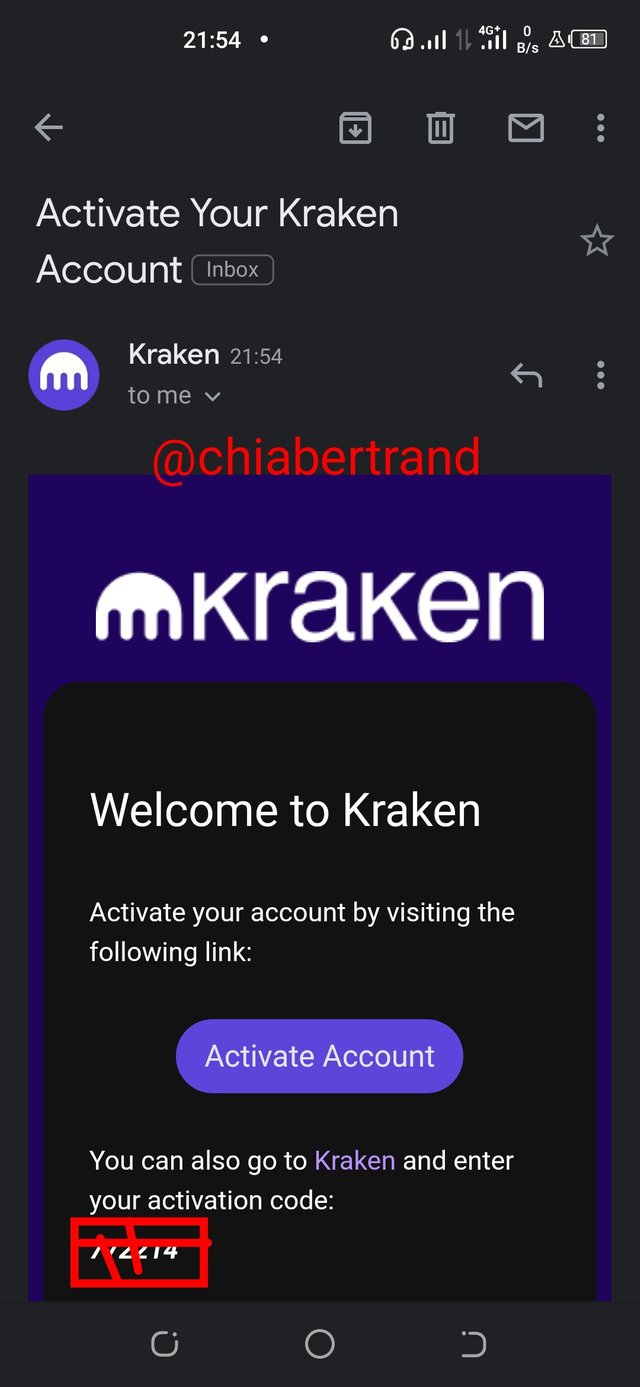

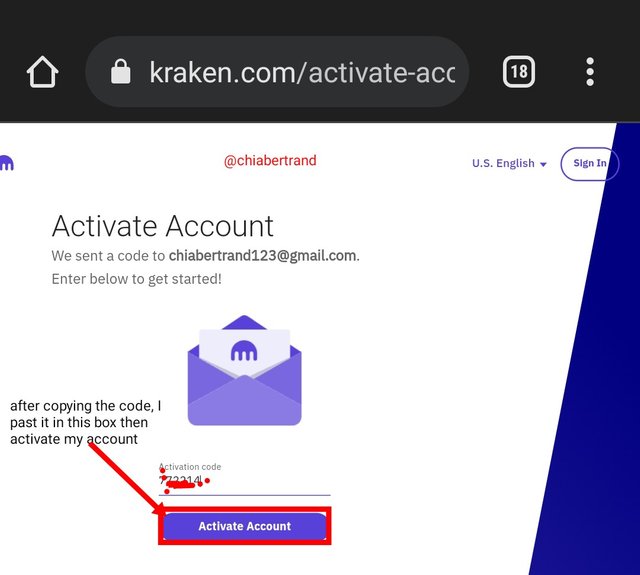

The user will need to verify his/her email address emmidiately after creating an account by going to his email inbox then copy the code send him and go back to the Kraken platform and past the code there then click on activate account. After doing that, the account will now be activated and open for all trading transactions

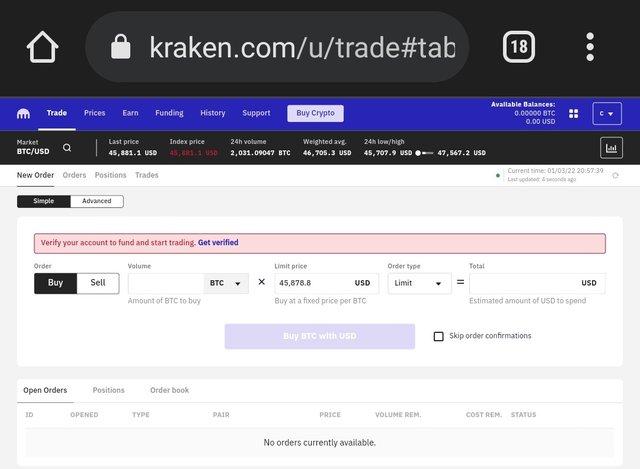

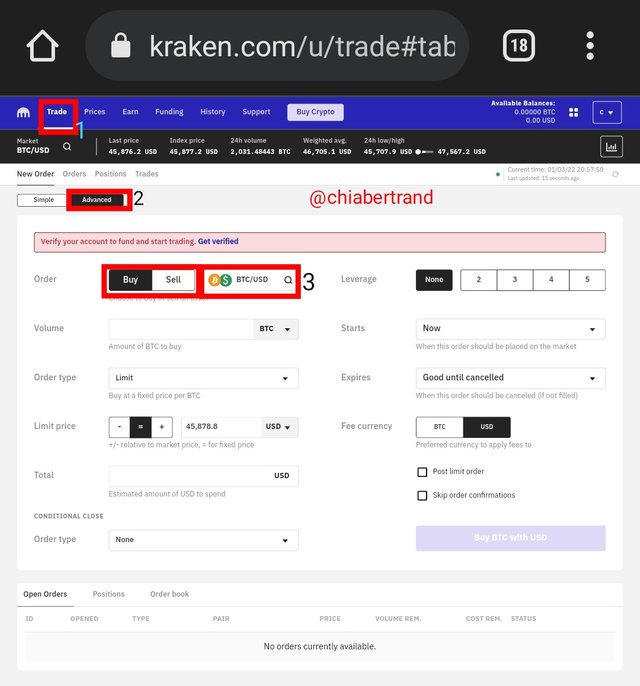

After doing that, the user will need to choose a trade from the captured page and move to new order then emmidiately switch to advanced

After selecting the trading pair, the user will need to navigate further down and then choose dark pool then finally Select the desired dark pool pair

Below are screenshots for the explanation

Screenshot from kraken platform

Screenshot from kraken platform  Screenshot from kraken platform

Screenshot from kraken platform  Screenshot from kraken platform

Screenshot from kraken platform  Screenshot from kraken platform

Screenshot from kraken platform

Screenshot from kraken platform

Screenshot from kraken platform

Screenshot from kraken platform  Screenshot from kraken platform

Screenshot from kraken platform Screenshot from kraken platform

Screenshot from kraken platform

5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

The word decentralized simply means the transfer of both decision making and control from a central committee such as individuals and organization directly to a distributed network where there is greater security, trustless environment and improvement in data reconciliation and everyone have the authority over his/her assets as they can decide to do what ever they wishes to do with at anytime, any place around the world without the intervention of the central committee.

Therefore in a Decentralized Dark pool, all exchanges are usually carried out in the decentralized exchange only by both persons involved in the process there by eliminating the presence of third parties. The transactions are carried out in a trustless environment In a high secured way between the two parties involved

Zero knowledge proofs is a situation where by one party (let's say the sender) can show beyond doubt to another party(let's say the reciever) that the Statement deployed be he(the sender) is true while the reciever will now have to avoid any additional information apart from the giving information from the sender which is usually true and the main idea about this zero knowledge proof is that it tries to prove that one party can have power over of knowledge of a hidden information but reveal it to the other party

6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

Screenshot From Source

One decentralized dark pool in cryptocurrency is the Republic Protocol which was developed in 2017 but had to wait for one year before raising a full amount of $35MM via the initial coin offering (ICO) in February 2018 and this Republic Protocol is an over-the-counter (OTC), open source and a Blockchain Decentralized protocol which facilitates privacy in trading of digital crypto assets. All this are usually carried out but on an order book which is hidden. One good thing about this protocol is that it provides an anonymous order books, engage Smart contract in Eutherum and transfer algorithm of assets with. This Republic Protocol is oftenly traded within small exchanges which usually have just total average volumes between $1 - $4MM daily and it is the first currency decentralized dark pool

This Republic Protocol has assured all it's users an easy access to an inter change liquidity between Decentralized application and it bend in protecting all privacies by its users as they uses the application to work because all inputs in this application are kept as secret to all the participant. So the impact of the privacy of this Republic Protocol is to be in collaboration with it's focus on interactiveness by ensuring that there is a communication between ecosystem of Blockchains and operating a dark pool here can simply be done without necessarily need of a trusted third party

It functions in the sense that, since it's an open source protocol that is use in the construction of a Decentralized network, it is usually made up of nodes order that are use to match the orders but not knowing any information about the orders by cracking the orders into little fragments of cryptography which are then later on distributed over the the entire network. Again, without letting the market objectives, we can see how the nodes functions in a way that it combines little fragments by Matching and rebuilding back the orders and once any matched order is found, it wIll require an atomic swap which is trustless amongs Blockchain for a basic structure of BTC, ETH and the ERC-20 trading cross chain which usually take action between the two traders that are involved in a peer to peer

So we see that it works using three main layers such as the zero knowledge transaction layer, Interoperability layer and the dark pool layer

7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

A crypto centralized exchange dark pool are online platform which are use to eased both buying and selling of crypto currencies assets either by Fiat currency such as USD or between crypto digital assets such as ETH and BTC. This FIAT currency and the digital crypto currencies usually act as custodians by protecting and storing all their users funds hence acting like a trusted intermediary between traders and mostly common now our days as most investors uses this means to buy and sell their cryptocurrency capital

While in a Crypto Decentralized dark pool exchange, they are also online platform which enables their user to have a direct Peer-2-Peer transactions(buying and selling) of crypto currencies without the intervention of an intermediary in a more secured way than that of a centralized system and they act as non-custodial by enabling all their users to have full control of all their private and public keys at anytime when they carry out trading by buying or selling a crypto asset

Differences between the crypto decentralized dark pool exchange and crypto centralized dark pool exchange

| Decentralized dark pool exchange | Centralized Dark Pool exchange |

|---|---|

| users always have full control of their funds as they can carry out operation on the Blockchain at anytime | Users don't have full control of their funds because all assets are held by a central entity such as BTC, ETH and the FIAT currency like the US dollar |

| The presence of an intermediary is not needed and hence generate a trustless environment between the two traders involved in carrying out any trading transaction | There is a high need of a third party which act as an intermediary between the two traders involved in carrying out any transaction |

| There is high level of security here since the traders involved have full control of their private keys | There security level here is guaranteed by the third party involved hence making the security level to be low as compared to a Decentralized system |

| They are less popular and widespread | They are more popular and widespread |

8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

Large sale of the Polkadot ($DOT)

Screenshot from Coinmarketcap

On the 4rd of November 2021, there was a large sell off of Polkadot ($DOT). This sell off was placed with a market order and it caused the price of $DOT to fall from $54.1 on 4/11/2021 to $24 on 20/12/2021 as seen from my screenshot below

Screenshot from Coinmarketcap

Why they was this large of $DOT was simply because a Market order had been placed by the whales so as to execute their trade with ease. When this whales placed the market orders, traders and small retailers began to fear that the price of $DOT might fall drastically hence causing them to sell off the $DOT making the $DOT price to fall drastically from $54.1 to $24 Within that period hence affecting the price of Polkadot very badly because traders were too optimistic about the price of the Polkadot when the large market orders were placed

What difference would the $DOT have made if the dark pool was utilized for such sales?

We should first of all know that in a dark pool, only limit orders are shown and market orders are eliminated and all transactions are usually carried out anonymously. So i think if this dark pool was utilized for the huge sale of $DOT, the price of $DOT wouldn't have changed as in the case in the coinmarketcap where the price dropped drastically. This is because the dark pool is opaque hence hide all it's transactions from the general public, so this traders couldn't be afraid because they won't be able seen the market order that was placed by the whales.

Again in a dark pool, whales usually place only limit orders at a good point but this limit order is never seen by traders. So if they had placed this limit orders here in the Dark Pool for the price of Polkadot, trades will not sell it off simply because they don't know what's happening in the market hence causing the price of Polkadot not to have any significant change.

9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words)

As I have earlier discuss what a dark pool is, now we can see that trading carried out doesn't affect a traders emotions because he/she is unaware of any Whale sells that is going on in the market unlike open exchanges that usually causes emotions to traders since they see how there is high demand or high supply of an asset in the market at that current period which will as well cause them to develope fears by by selling out their assets which will inturn cause the asset price to reduce when there is high demand of the asset or in the same way they will wish to buy their assets when they is high supply causing the asset price to experience a great increase.

This explains why when ever huge orders are placed on an order book, it causes traders to have a thought wether as to sell when they is high demand causing the price of the asset to go down or to buy when they is high supply causing the price of the asset to go up

After seeing what happens to the value of an asset in an open exchange when ever there is a large order on the order book, this same thing doesn't happen in a Dark Pool simply because dark pool is a trading volume which was created by an institutional orders which are usually executed privately on a private exchange hidden from the public since the information about the transactions carried out by traders are usually unavailable to the general public hence operating with little or no transparency.

So we see how opaque this dark pool is. What happen in this Dark Pool is that traders usually carry out bulk trading without any retail investors knowing about the transactions details like the execution price or the trading size, so this will now have a limited market impact by not affecting the price of the asset and the asset price will therefore remain unchanged wether it was over sold or overbought as compared to the Open exchange where a large demand or supply of an asset will have a big impact on the assets price

In conclusion, the dark pool eliminate market order and implement only limit orders for traders and transactions between traders are carried out anonymously

10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Despite the high level of advantages of dark pools in cryptocurrencies, they are as well having some draw backs which I will be explaining below

| Advantages of Dark Pools | Disadvantages of Dar pools |

|---|---|

| There is always a decrease in the leakage of information here as traders will be able to avoid fears of whale selling and then get their average prices | There is usually a potential Conflicts of Interest that use to occur between traders |

| Dark Pool usually avoids any slippage hence decreasing devaluation of crypto prices | There is usually high level of customer segmentation in a dark pool hence making customer to disunite anytime there is a little misunderstanding |

| There is a reduction of market impact and an increase in the liquidity here which is very good for traders | there is lack of transparency and disqualified trading prices at times |

So far I have had a good understanding of what a dark pool is in crypto currency and I have seen that this dark pool in trading is very good because it enable prices of assets not to fall drastically as compared to open exchanges where prices of assets usually fall at times very drastically simply because traders start developing fears anytime the whales place a market order.

On the other side, whales place only limit orders on a dark pool because Market orders are eliminated In the dark pool. This limit orders are not seen by traders and all transactions carried out within the dark pool are hidden from between traders and the general public and this Dark Pool usually avoids any slippage hence decreasing devaluation of crypto prices

Thanks once more Professor @fredquantum for this wanderfull and beautiful lectures because I have been able to grabbed so much knowledge about the about dark pools in cryptocurrency

CC

@fredquantum