QUESTION 1

Perform a complete analysis of the currency of some exchanges. Not allowed; BNB, Kucoin, cake and uniswap.

Analysing the Gate Token

The gate token is the native token of the gate.io exchange which happens to be one of the most popular exchanges in the world.

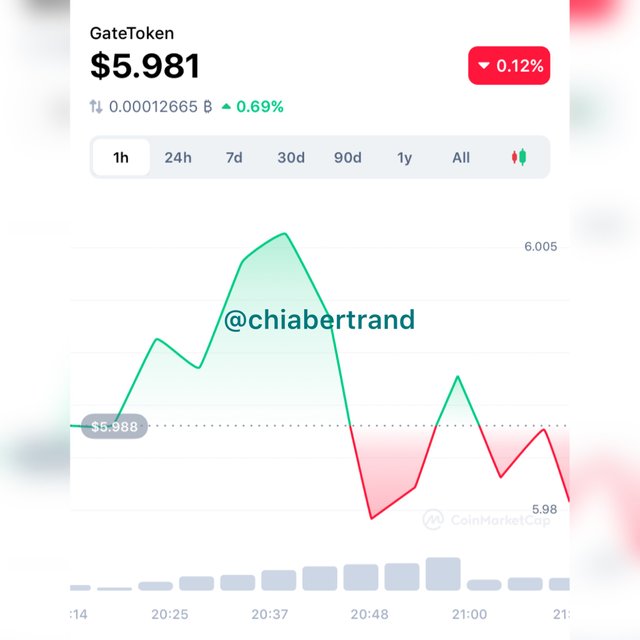

The gate token with symbol GT, and a current value of 5.9 usd at the time of writing this post is ranked on the 152 position on the coinmarketcap. The gate token in its white paper is described as a public chain dedicated asset. this is further simplified to explain that the gate token is meant to be an onchain safety account with the feature of customize time delay recovery purposely designed to assets of Blockchain more safety especially in situation of private key compromise.

The gate token is built on the ethereum network and can be found on the decentralized metamask wallet as well.

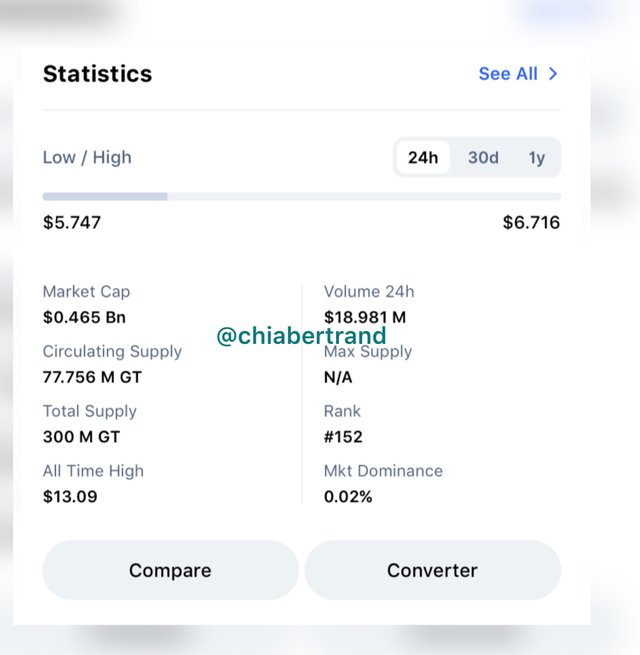

Going now to the statisics of the gate token, the gate token has a market capitalization of $0.465 billion and a current circulating supply of 77.756 million.

The total supply of the gate token is 300 million which shows an all time high of $13. When we compare this all time high to the current value, we see the gate token has had above 50% fall since its all time high. The 24 hour trading volume of the token stands at $18.9 million and it has a very low market dorminance with potrays at 0.02%.

QUESTION 2

Make a purchase equal to at least 10$ of the currency you explained above. You must make some movement with that currency within the exchange that created that currency. Show screenshots and explain in detail the steps to follow. Example; transfer of funds, staking, participation in a Launchpad, trading in futures etc. indicate the reason why you chose that option on that platform.

Purchasing the Gate token

I will demonstrate the purchase of the token in the following steps, as I will explain below.

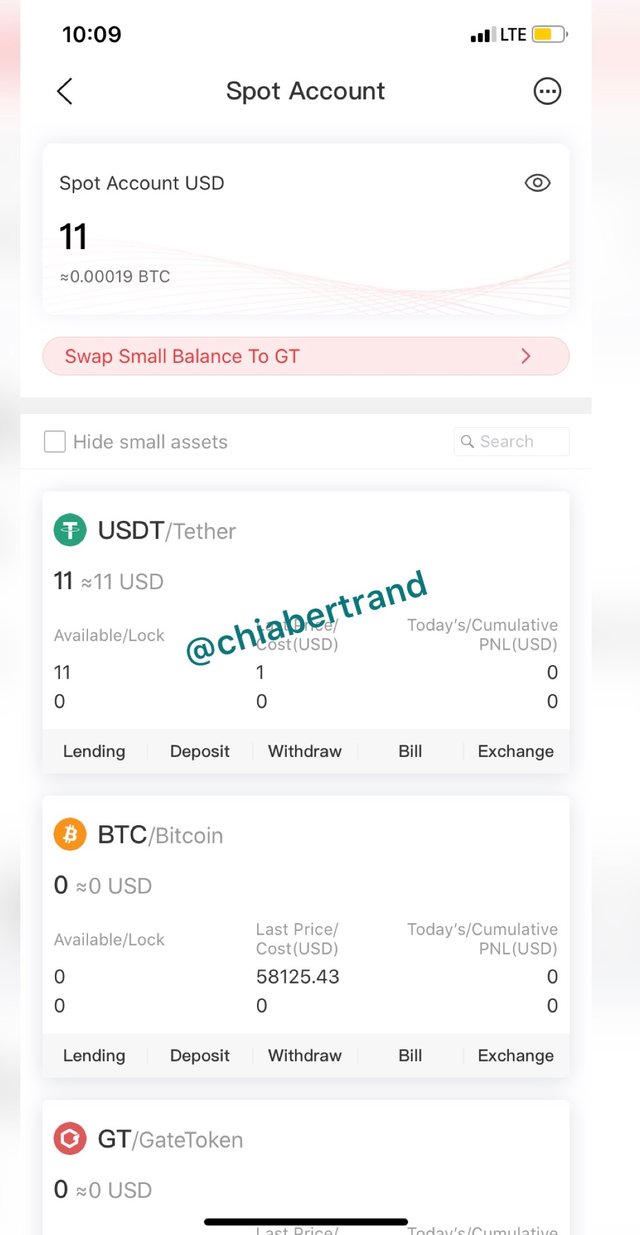

Before beginning, I have funded my gate.io wallet already with some usdt which I will be using to purchase the token.

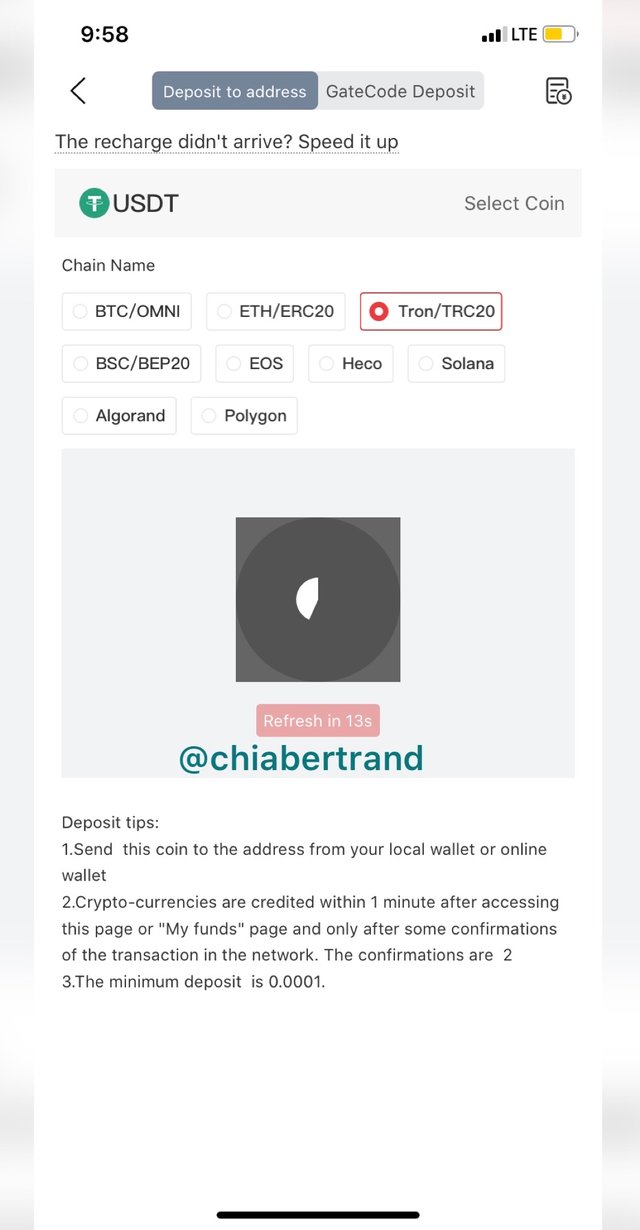

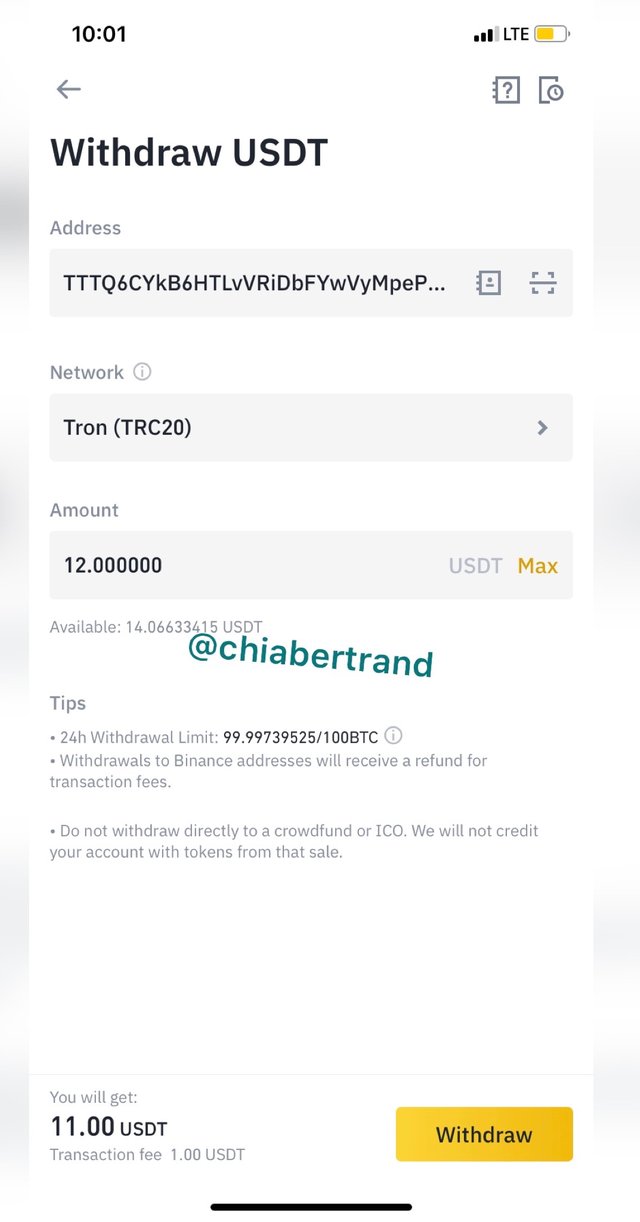

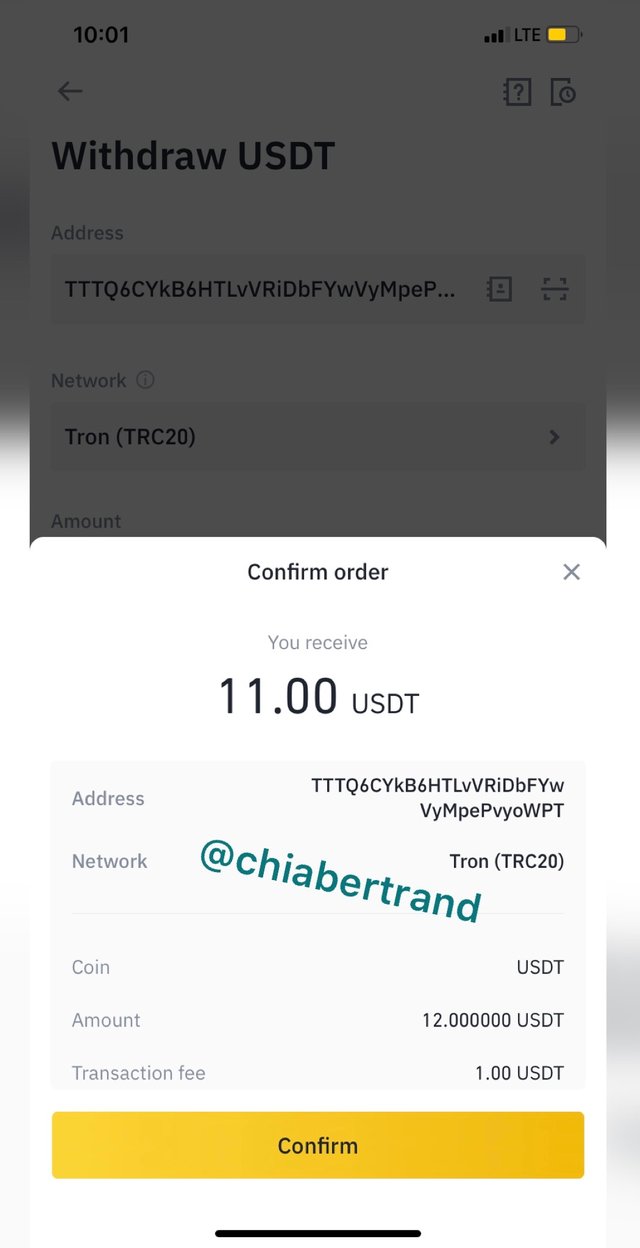

Step 1: transfer of funds

For the transfer of funds, we see that we can easily transfer funds from one exchange to another with the gate.io inclusive. My transfer will be done from the binance exchange to the gate.io exchange. We can see in the screenshots below how I transfer 11 usdt from the binance to the gate.io exchange which I will be using for my transactions in the exchange.

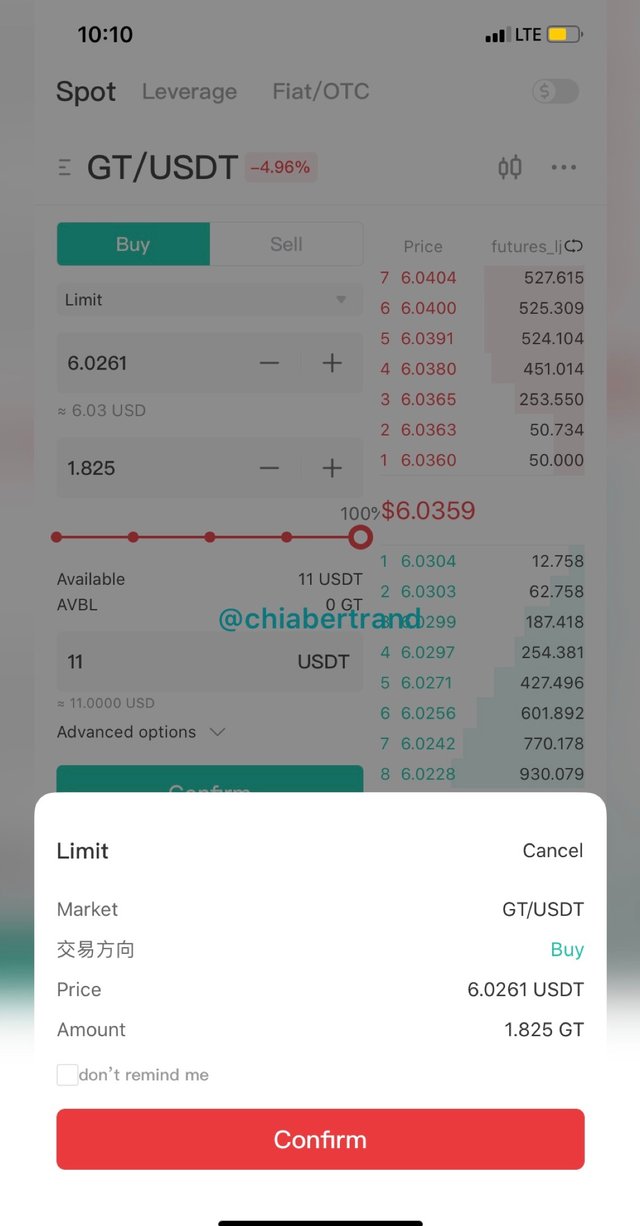

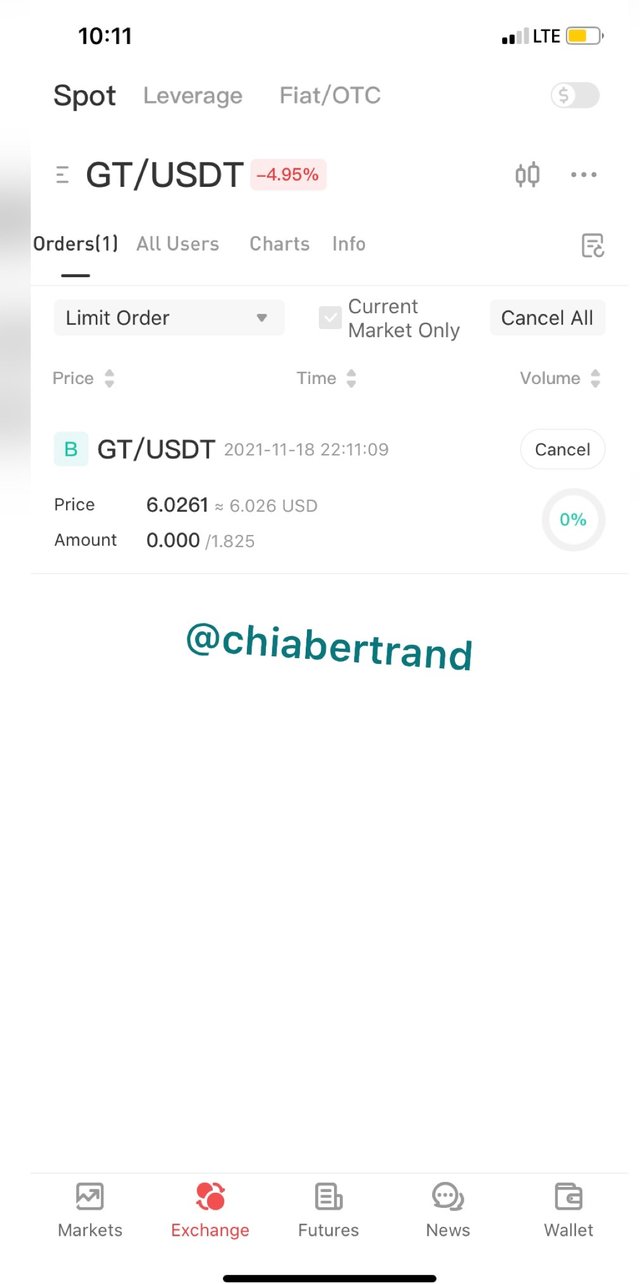

Step 2: Spot trading

I will be purchasing the gate token on spot trading since the future trading requires much skills in its transactions. The spot market shows a lower return in its profits which of course has lesser risk as well. I will be purchasing the gate token for 11 usdt.

I will begin by clicking on the market tab, which from there I will I click on the buy order and input the amount I want to purchase and sign in with my password.

Talking about the staking and the lauchpad, just in binance we had the recent lauchpad which was lauching the porto fan token with a total 1 million of the token given out on presale.

QUESTION 3

Show the return on investment in time frame of 0, 24, 48 hours form the moment you bought. Take screenshots where you can see the price of the asset and the date of capture. Has the assets price acted independently or does its price strictly follow the correlation with bitcoin.

Returns on Investment

I will explaning the various data of the gate token in its rise for the 24 and the 48 hour period in accordance with the bitcoin.

24 hour return

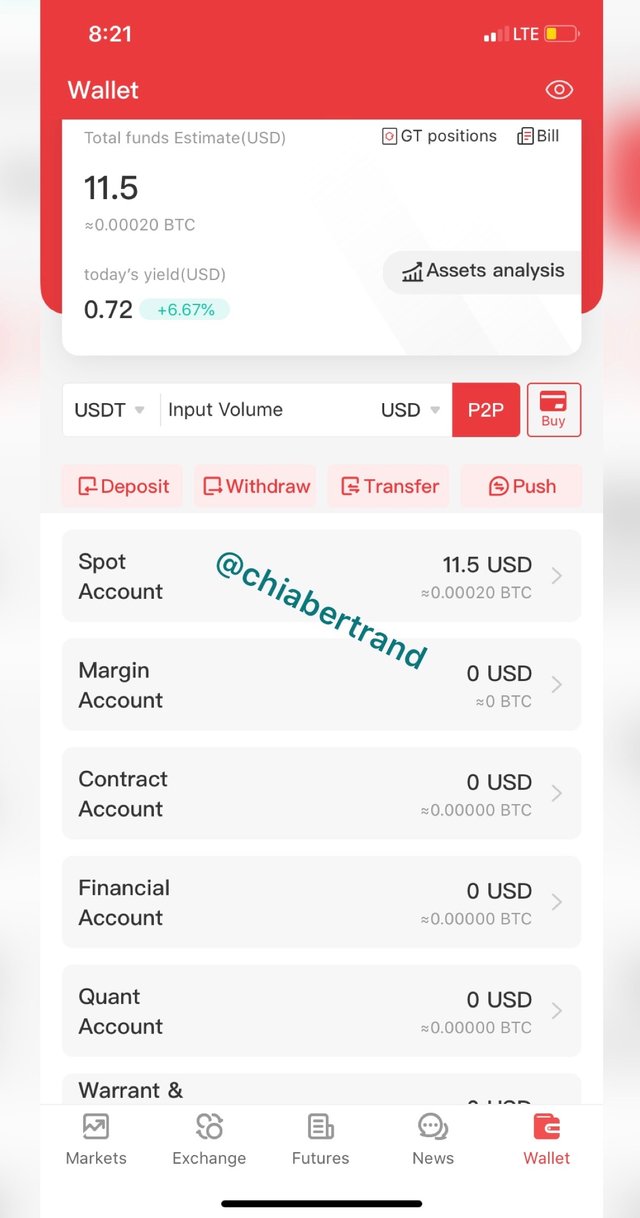

From the screenshot below, we saw the rise in the gate token 6.67%, which is valued at $0.72.

We can see that in the screenshot below.

In correlation to the bitcoin for the 24 hour timeframe, we see that the btc has fallen 0.5% which indicates that the dorminance of btc in relation to the gate token is really low. The gate token show its unique movement, as the btc falls the gate token rosed,

48 hour return

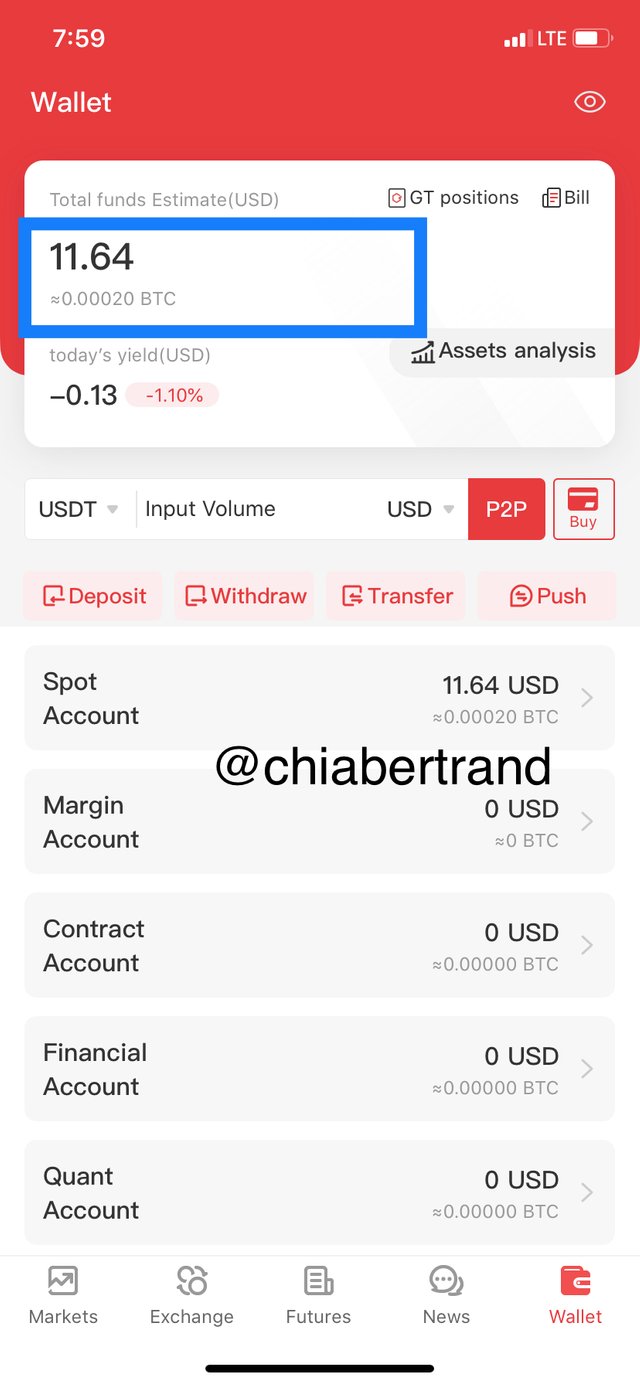

Prior to the last check, the gate token has fallen 1.1% meanwhile the btc has rose above 2%.

This clearly shows a fall in the dominance of btc when compared to the gate token.

We can see that in the screenshot below.

QUESTION 4

What are future trading

Future trading

It is quite evident from the name future that the trading is made for those who have gone advanced in the trading field. The future trading is a type of trading that allows traders to open orders greater than their initial deposits.

This is done in relation to the leverage offered by the exchange which some like the Binance exchange.

The future trading has characteristics such as the stop loss and the take profit levels, where we can set to close positions for us once specific levels are reached.

The stop loss and the take profit levels can be set manually using the currencies rates or could be set in terms of percentages.

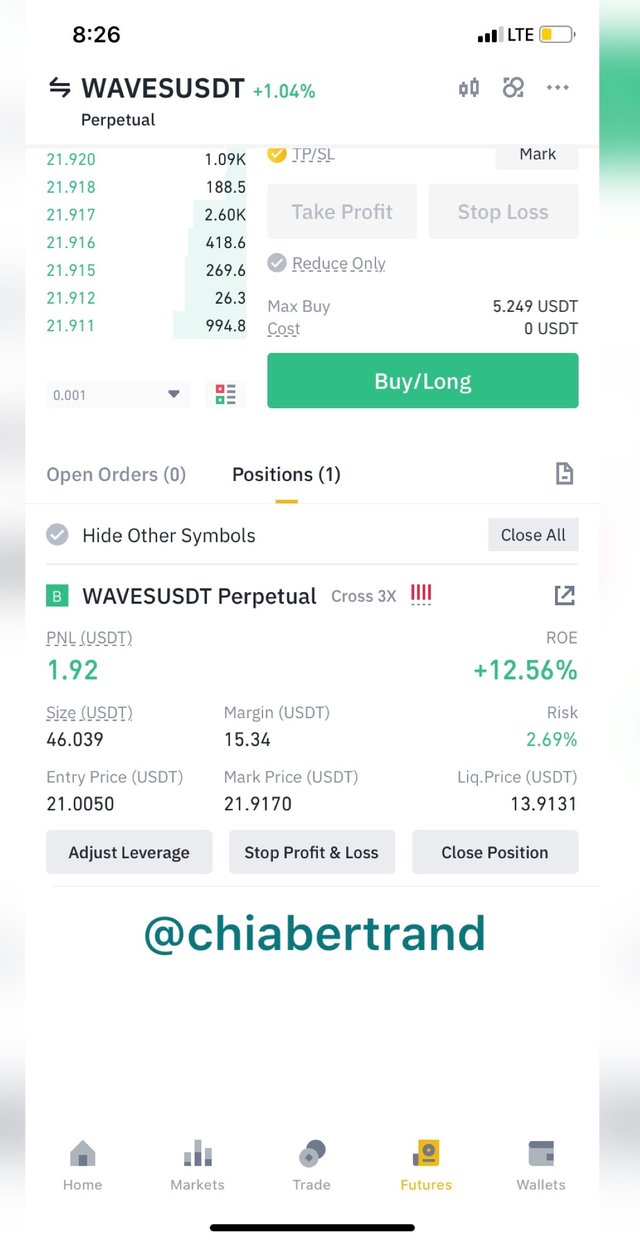

We also have the possibility to adjust leverage with the future trading. With this, we see that we can adjust the leverage from 2 up to 50X.. we can see that in the screenshot below.

QUESTION 5

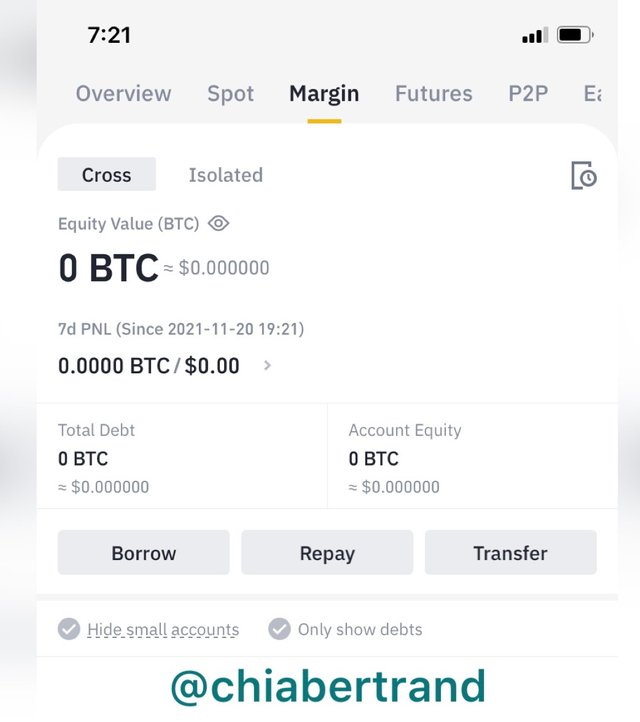

What is the margin market?

Still trying to do a contrast with the spot trading type of trading, we see that the margin has better advantages over the spot market though the margin trading turn to possess some level of risk,

The margin trading allows traders to trade in such a way that they make use of borrowed funds. The funds are actually borrowed from third party which will allow you use capital higher than your deposit.

In as much as we see it to be profitable it also has a level of risk in which it can be liquidated in the market at any time if the trade goes against our prediction.

Let take for instance you open a trade for $1000, with a leverage of 1:50, this means the you will remit an amount of $100 as margin to access the trade.

QUESTION 6

What happens to the cryptocurrencies of an exchange when they suffer from a hack or it turns out to be a fraud, present at least two real life example

It is normally the responsibility of the exchange to refund 100% or In some cases 50% of the currencies of the exchange when they suffer from a hack, or in case of a fraud. In this light, we see that the have some use cases which I will be explaining below. This include the upbit exchange and the bitfinex exchange. We can see the explainations below.

The Upbit Exchange

The upbit happens to be a well famous exchange which suffered a hack on the 27th of November at exactly 1:06 PM. This was a very tragic experience for the upbit exchange as they suffer a loss of approximately 58 billion won. It was transferred from the upbit ethereum hot wallet to an unknown wallet as explained by the officials of the upbit exchange.

Meaning a total of about 342,000 eth was lost to the hands of hackers and it was worth about $51 million ast that time. If we are to calculate the 342000 to the current exchange rate now, you can imagine how much has been lost espiecially to the current rise of the ethereum cryptocurrency.

Well, the upbit did promise its clients to cover their losses particularly using the companies asset.

The Bitfinex exchange

I will be explaining the $500000 hack from the bitfinex exchange. This was really a tragic experience for the bitfinex exchange as the exchange has actually suffered two major hacks. The said hacks occurred in may 2015, with a total of 1500 btc which was actually worth $400000 at the time was removed from the exchange. The second occurred in 2016 in the month of august, as hackers loted keys of clients and were able to get away with the sum of 119756 btc. This total btc was worth about $72000000 at that time. You can just imaging the worth at the time of writing of this article.

Well, the users of the bitfinex exchange were fortunate enough as the exchange refunded those who lost their btc in the form of their token which is the btx token.

Conclusion

We have seen the numerous problems faced by exchanges in terms of hacks, and also it is also seen that in such tragic scenarios, most of the exchanges refund 100% or at least 50% of the lost coins which is actually not that bad.

I have also explained the cased of future and magin trading which happens to be trading method to earn more through leverage and lended funds, though it requires some level of understanding before engaging.

I have also explained and carried out a trade on the gate.io token which is the gate token with symbol gt and taken its relation to rise and fall with that of bitcoin.

CC:

@imagen

NB: it should be noted that all screenshots were taken from Binance, BitFinex, gate.io, Upbit and coinmarketcap

Gracias por participar en la Quinta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review and feedbacks professor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit