1. Define TD Sequential Indicator in your own words?

TD Sequential Indicator is commonly known as a trend base indicator it use to identify trend exhaustion and reversal by indicating turning points of asset prices. This Sequential indicator was developed by a well known technical analyst Tom Demark and this indicator is usually use by traders in order to carry out a trade.

For instance, in a chart, let's say if an asset moves downtrend over a long period of time, the asset price will have to stop for a little time time frame by making a small retracement before continuing in the same direction or it may eventually reverse completely by turning from downtrend to uptrend movement. We see here that traders will look for a point in other to enter a trade by either joining the trend or simply trade with the retracement

This indicator are made up of 9 TD count numbers labeled 1 - 9 for a set up phase. It also extend to 13 indicating the countdown phase which usually indicates both uptrend and downtrend above and below the candle respectively

a: the set-up phase usually occurs emmidiately after when prices suddenly turn rapidly in a fast movement. When this is done, 9 TD counts will be seen above the candle for an uptrend and below the candle for a downtrend which indicates trading signals fot for traders.

b: the countdown phase is always dependent of of the set-up phase and it's usually valid only when a setup occur by comprising 13 counts From 9 to 13

We can now say that the TD Sequential Indicator is an excellent tool to help identify reversal of prices or points at which trend of an asset that got exhausted in the market. Another importants of This TD Sequential Indicator is that It be use to trade at higher time frame in the market to obtain very good results but it can also be use to trade in shorter time frame with little or no problem

2. Explain the psychology behind TD Sequential. (Screenshots required)

Screenshot from Tradingview.com

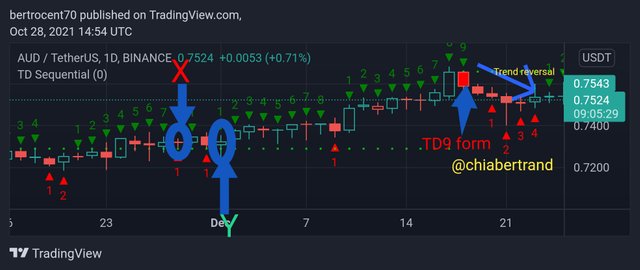

Screenshot from Tradingview.comThe TD Sequential is fixed with special counts which is numbered from 1 to 9 usually seen below and above each candle stick and this is usually use to identify price reversal or the exhaustion of trend

We see that these counts are usually fixed by each candles in a chart and the formation is usually base only on the number that is modified with which consist of 2 phase of distinction namely countdown phase and set-up phase. We can see clearly that due to this reason, the Japanese candle stick is best suitable for this TD Sequential Indicator

The set-up phase usually known as the momentum phas always occur against a powerful trend of an asset emmidiately after a rapid movement of a price. A reversal may likely be established at the completion of 9 counts of TD numbers

For a Set-up phase, both buy and sell set-up will solely depend on a trend Because a sell setup order is usually achieve when ever the market goes up and a buy order set-up is in a scenario achieve when ever prices move downtrend for a long period of time

For a Count-down phase, the TD Sequential Indicator is usually depending mainly on the set-up phase and it has a total of 13 counts and a resistance or a support level is usually established emmidiately when the counts are also established

3. Explain the TD setup during a bull and bear market. (Screenshots required)

TD Setup during a bullish

Screenshot from Tradingview.com

Screenshot from Tradingview.comWe do bullish set-up when we want to buy place a buy order when ever prices are low implying that we most go down.

So we can only set-up the indicator only when there is a a certain turn over in quick movement of prices that have been in an uptrend for sometime then suddenly change quickly in the direction of that price making it to movement in a downtrend. When this scenario is done, we can start counting to see if the count is valid and the first note emmidiately after the flip in it's price is known as the number 1 TD which is highly significant to the Count and it most have a close below the last fourth candle which is the starting point of the candle

When the condition is well balance, we see that the second TD will have a close just below the fourth candle period and this actively goes thesame from 3 to 9 TD

TD Setup during a Bearish

Screenshot from Tradingview.com

Screenshot from Tradingview.comWe do Bearish set-up when we want to place a sell order when ever prices are high implying that we will have to go up when prices are in a downtrend

So we can only set-up the indicator only when there is a a certain turn over in quick movement of prices that have been in a downtrend for sometime then suddenly change quickly in the direction of that price making it to movement in an uptrend. When this scenario is done, we can start counting to see if the count is valid and the first note emmidiately after the flip in it's price is known as the number 1 TD which is highly significant to the Count and it most have a close above the last fourth candle which is the starting point of the candle

When the condition is well balance, we see that the second TD will have a close just below the fourth candle period and this actively goes thesame from 3 to 9 TD

4. Explain graphically how to identify a trend reversal using TD Sequential Indicator on a chart. (Screenshots required)Screenshot from Tradingview.com

Screenshot from Tradingview.com

Screenshot from Tradingview.comWe can see that a TD Sequential Indicator was added to the chart of ETHUSD in a 1 day time frame and we can also see that the asset is moving downtrend and we also see how the price is forming lower lows and lower highs by simply forming what we call market structures and cycles with the candles. We could also see that at some points, the market rapidly moves up and the TD9 count was now shown. I have circled it with a blow circle.

Emmidiately I plotted this TD9 was plotted, it moved downtrend for a very short time before rapidly moving moving uptrend for a very long Period of time.

A Bullish reversal is the scenario of a Bearish reversal because from the screenshot above, the TD Sequential Indicator was use to Also identify a Bearish reversal as well and the TD Sequential also helped In identifying the bearish reversal as seen from the screenshot above as TD 9 was formed there after, a rapid trend reversal move downtrend for a long period

5. Using the knowledge acquired in previous lessons, perform a better Technical Analysis by combining TD Sequential Indicator and make a real purchase of a coin at a point where the TD 9 or 8 count occurs. Then sell it before the next line resistance. (It should demonstrate all relevant details, including entry point, exit point, resistance lines, support lines, or any other trading patterns such as double bottom, falling wedge, and reverse head and shoulders patterns)

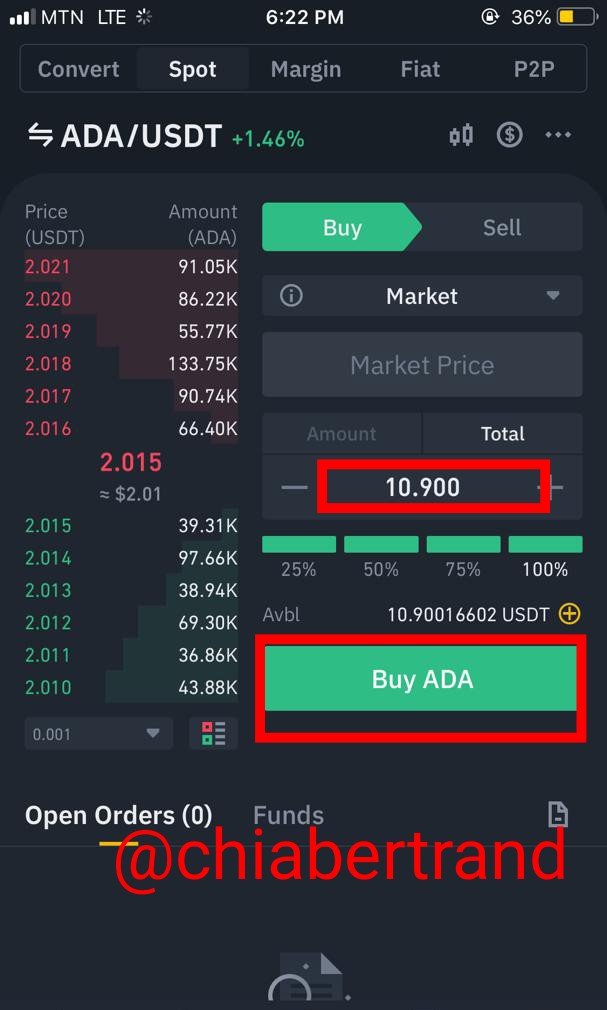

I will be performing this task task by using Tradingview.com and Binance Binance to analyst my pair of ADAUSDT as I will be analysing it using tradingview then place both buy and sell order inside my verified Binance account.

Analysis of ADAUSDT For Buy Order

Chart1 Screenshot from Tradingview.com

Chart1 Screenshot from Tradingview.com Chart2 Screenshot from Tradingview.com

Chart2 Screenshot from Tradingview.comAfter adding choosing a pair of ADAUSDT on trading view, I added a TD Sequential Indicator to my chart and the pair of ADAUSDT is forming Bullish trend but had a retracement at some points on my chart and I have mark out the points as A, B, C, D, E. This point form a Chanel. But before point D was Form, I had to met the price by waiting for sometime at that point then finally place my Buy Order because I had two major confluence in the "D" point which are the Support levels and the Count Down if TD Sequential Indicator which I will be explaining it in detail using the second Chart above.

--

In Chart2 above, "D" point had confluence very well because it was in a support level position which had to make me place my Buy order Because if we take a critical look at my chart, I had identify the support level by drawing a Whit horizontal line across it. I consider this as my first confluence

Still in chart2 above, it also had a count down of TD Sequential Indicator as TD count 8 had already form but we see that TD count 9 was formed but at the level of support which was seen exactly seen somewhere where point "D" was predicted to occure. So when I had to realize this, I then immediately place my Buy order at an entry price of $2.015and my lost at 2.016 and my take profit was set at $2.229and I was targeting resistance Level. After the analysis, I immediately log into my verified Binance account then bought the ADA which was almost $11 worth of ADA with my USDT

Screenshot from Binance

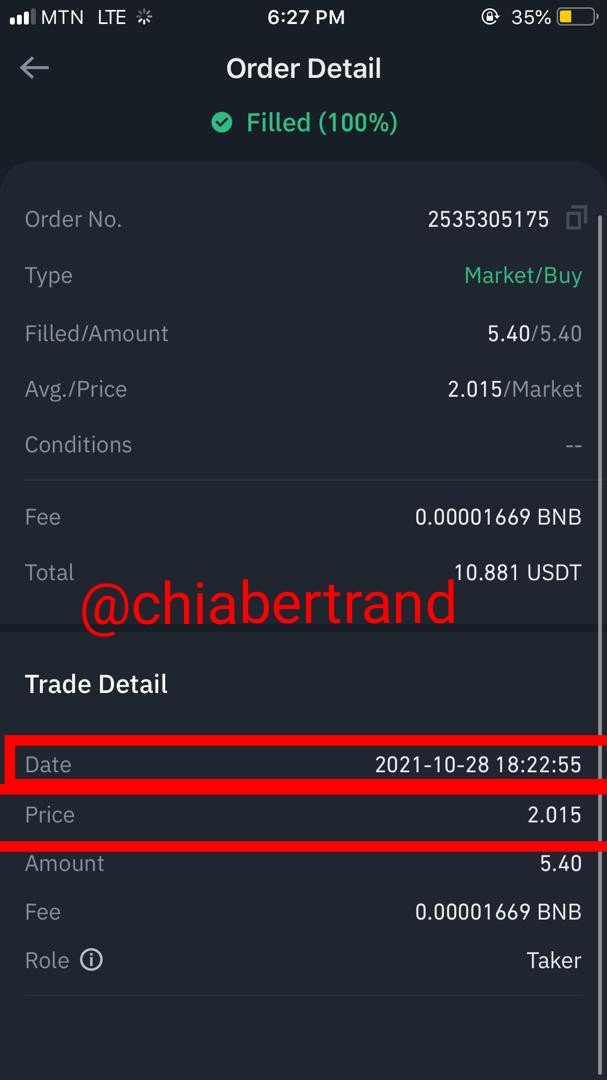

Screenshot from BinanceAfter Purchasing $11 worth of ADA, I then had to Check out both my trading and buy details and I discovered that the price was filled at $2.015 as seen in the screenshot below

Screenshot from Binance

Screenshot from Binance Analysis of ADAUSDT For Sell Order

Screenshot from Tradingview.com

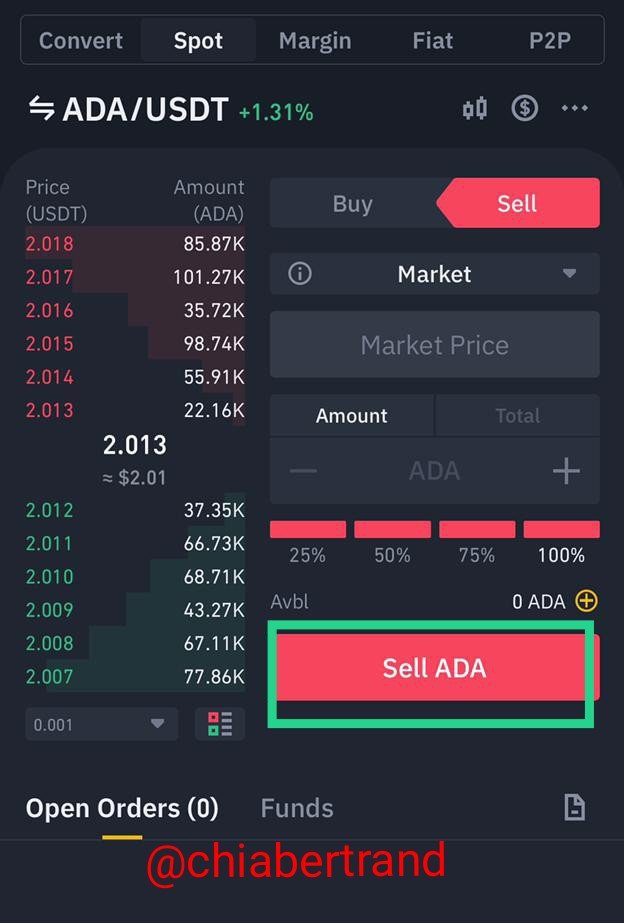

Screenshot from Tradingview.com This order went through exactly as predicted since the resistance Level was my target, emmidiately it reached that resistance Level, I had to place a sell order at an exact price of $2.015 which was the market price. Below is the screenshot of my sell order

Screenshot from Binance

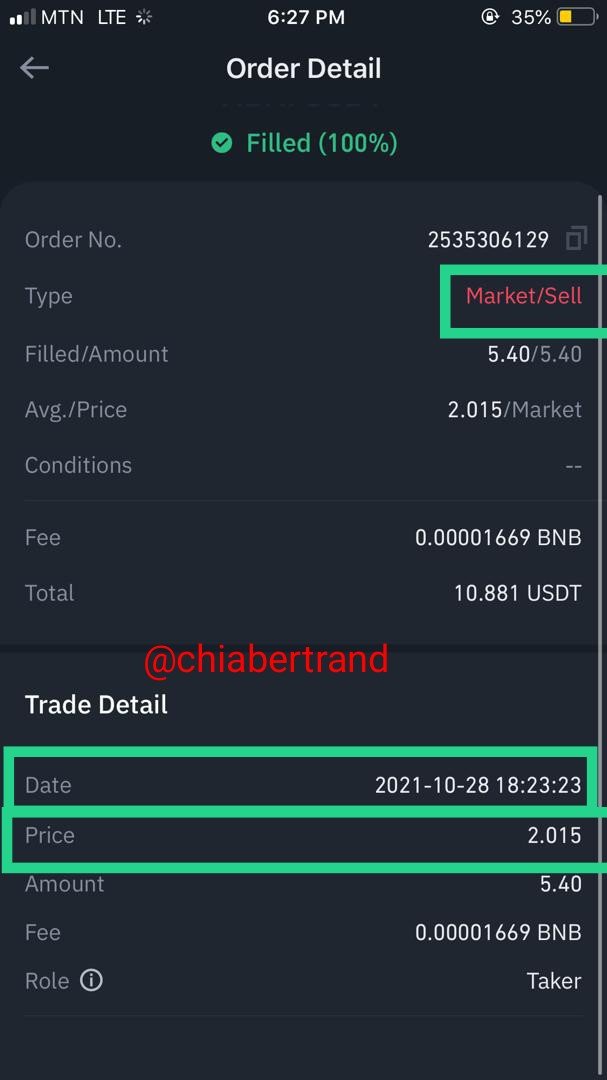

Screenshot from BinanceAfter selling back ADA which was $11 worth of ADA, I then had to Check out both my trading and sell details and I discovered that the price was filled at $2.015 as seen in the screenshot below with both it's date and time

Screenshot from Binance

Screenshot from Binance

So far we have learn much about profitable trading using a TD Sequential Indicator and we have seen how important it is to traders because it is an excellent tool to help identify reversal of prices or points at which trend of an asset that got exhausted in the market. This tell us why traders can gain a lot of profit when using this indicator to trade because we have seen the psychology behind this indicator as it comprises of two spacial phases called set-up phase and countdown phase

Thanks so much Professor @reddileep for this great lessons for I'm far off better now than before and I think this indicator will really help me a lot in my future trading

CC:

@reddileep

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit