Hi friends, welcome to another Crypto Academy task, here we will be exploring the median indicator in line with the homework task shared by Prof. @Abdu.navi03 following his detailed and structured lesson on this. Let's begin.

1-Explain your understanding with the median indicator.

The Median indicator is a trend-oriented technical indicator that shows the directional bias of an asset price as well as the volatility associated with it. As a trend-based indicator, just like other trend-based indicators, the median indicator can help traders identify and establish trends in the market.

The Median indicator is made up of a channel made up of the Average True Range (ATR) value and the mid value of a range within a given time, as well as parallel bands made up of the ATR value, which reflect price volatility.

Source: TradingView

The screenshot above shows the median indicator applied to a BTC/USDT chart. From the above, we can get a clearer understanding of the median indicator. First, you will observe that the median indicator is colour coded and this colour is usually changing along with the trend. The median indicator, which defines bullish and bearish trends, generates a cloud on the indicator. This cloud changes color from purple to green, indicating whether the market is bullish or bearish. A green cloud can be used to identify a bullish move. A purple cloud is used to identify a bearish trend.

2-Parameters and Calculations of Median indicator

Parameters of the Median Indicator

Source: TradingView

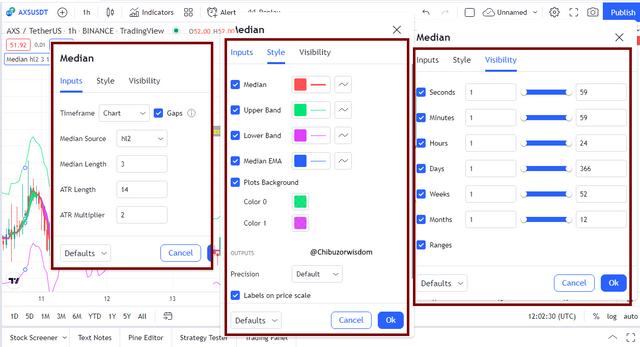

As shown from the screenshot above, like other indicators on TradingView, the Median indicator can be configured through the "Input tab", such parameters like timeframe, median source, median length, ATR length and ATR multiplier can be configured here.

The Median length (usually 3 by default) is the amount of data points to be considered when calculating and plotting the median graph; ATR length (14 by default) is the period considered in calculating the ATR of the median; ATR Multiplier is the result of the value ATR times the ATR in the formation of lower and upper bands.

We can go further in the style section to modify the median indicator styles, here you can make changes to colours that represents one or more parameters.

Calculation of the Median Indicator

To calculate and generate the median indicator, calculations for the median value (MV) and the Estimated Moving Average (EMA) is done. The results of this calculation are then used to compute for the median indicator and plot the median indicator graph.

With MV and EMA obtained, median indicator is calculated thus:

3-Uptrend with Median Indicator

The median indicator is a trend-based indicator. Bullish and bearish trends are defined by the difference between the median line and an EMA of the same length. Whenever the median line is well above the EMA, the cloud becomes green, indicating an uptrend. When this occurs, a trader can hunt for a positive market position and make buy entries. The screenshot below illustrates this:

Source: TradingView

4-Downtrend with Median Indicator

In a bearish market, when utilizing the median indicator to detect a downtrend, one can clearly recognize it when the median value falls below the EMA value of the same length. When this criteria is established, we can conclude that there is a downtrend, and a confirmation of this is frequently evident in the formation of purple cloud. The appearance of the purple cloud in the market is an indication of a bullish movement and at this stage, traders best take sell orders. This is illustrated in the chart below:

Source: TradingView

5-Identifying Fake Signals with Median Indicator

It is not a good idea to put your faith on an indicator because none of them is 100 percent effective. It is best advised two or more indicators be utilized to validate the trend movement appropriately in order to be safe while trading. Indicators aren't always 100% correct. Because they use previous price data points, they are prone to false indications. The median indicator is also capable of producing false indications.

To rule out false signals, we will be using the Relative Strength Index (RSI) indicator in line with the median indicator. The RSI indicator can be used to help a trader validate market positions as well as screening out erroneous signals. When the RSI value is 70 or higher, the asset is considered overbought, and a trend reversal is likely. Similarly, when the RSI value falls below 30, it indicates that the asset is oversold and a trend reversal is likely. If the RSI is in the overbought or oversold zone and the median indicator is not indicating a trend reversal, it is most likely a false signal.

Here is an example:

Source: TradingView

6-Demo trade using median indicator

Buy Order (Long Position)

Source: TradingView

Source: TradingView

As shown in the screenshots above, the trend was confirmed as an uptrend with the formation of green the median indicator cloud confirmed by the RSI indicator that is approaching 70 mark. With that the buy (long) order was placed and the trade for LUNAUSDT was properly set up.

Sell Order (Short Position)

Source: TradingView

Source: TradingView

From the screenshots above, a sell (short position) order has been placed for BINANCE:RUNEUSDTPERP, the market was clearly in a downtrend for this asset confirmed by the purple cloud of the median indicator and the RSI indicator approach oversold zone. The sell order was placed, and relevant trading parameters were set.

Conclusion

The median indicator is a useful trend-based technical indicator that could be utilized by traders. However, like other indicators, the possibility of a false signal is true, so traders should use this with caution. The RSI indicator is a recommended pair for the median indicator. Thanks Prof. @abdu.navi03 for sharing insights on this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit