designed using canva

1. What is your understanding of Triple Exponential Moving Average (TEMA)?

In January 1994 Patrick G. Mulloy introduce the Triple Exponential Moving Average which was later adopted by the technical analysts in the crypto ecosystem. The TEMA was designed to reduce the latency or lag in a common Moving Average making price smoother by using three Exponential Moving Averages (EMA) and subtracting the lags.

The TEMA is fast to react to any change in price and can be used as support or resistance while analysing a trend.

Before being popularized in crypto technical analysis, the Triple Exponential Moving Average was employed in other financial markets. TEMA is a sort of advanced moving average that aims to reduce the latency and noise that other varieties of MA have. It has superior outputs than other trend-following indicators since it uses three (3) EMAs for computation and subtracts the lag. As a result, it delivers better signals than other trend-following indicators. TEMA, like other MAs, may assist in identifying clearer patterns in the market of an asset with smoothed price swings, as well as identifying support and resistance.

2. How is TEMA calculated? Add TEMA to the crypto chart and explain its settings. (Screenshots required).

TEMA is calculated using three Exponential Moving Averages, EMA1, EMA2 and EMA3 at the same periods:

Where:

EMA¹= Exponential Moving Average(EMA)

EMA²= EMA of EMA¹

EMA³= EMA of EMA²

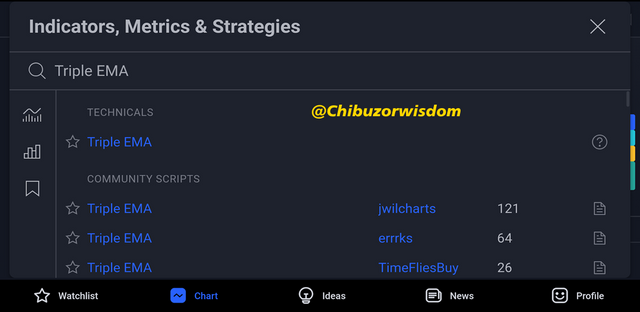

How to add TEMA to a chart & Its Settings

- Enter the Trading view and navigate to the indicators section

- Tap the indicators then search "Triple EMA".

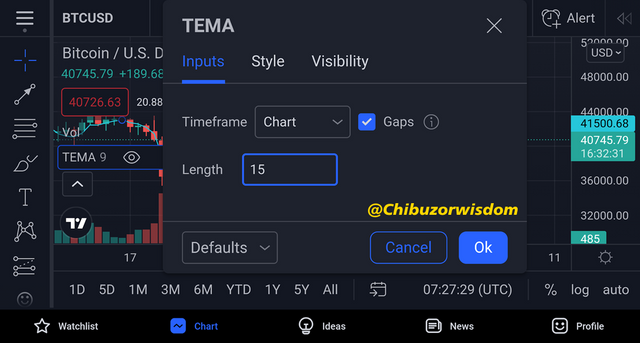

- You can tap the setting in the TEMA to change the period and other settings.

Common settings include configuring its length, colours and some visibility configurations.

3. Compare TEMA with other Moving Averages. You can use one or two Moving Averages for in-depth comparison with TEMA

TEMA and DEMA (Double Exponential Moving Average)

Unlike other Moving Averages (MA) TEMA is more accurate since it relies on three EMAs, it reacts faster to price change and reduces the lag common to other MAs.

Just like TEMA, DEMA is a trend following indicator that reduces lagging and reacts quickly to price. Double Exponential Moving Average is calculated using two EMAs which makes it less effective than TEMA.

TEMA tracks the movements of price more closely than other moving averages including the Double Exponential Moving Average.

TEMA and EMA

The key differentiating factor here is speed; TEMA eliminates market lags faster than EMA, which explains why TEMA responds very quickly to current market changes. TEMA closely follows price action, which is why it provides us with hints about the trend direction, and support and resistance levels.

SMA and TEMA

When compared to TEMA, Simple Moving Averages (SMAs or basically Moving Averages - MA) as a lagging indicator will take longer to generate signals.

4. Explain the Trend Identification/Confirmation in both bearish and bullish trends with TEMA (Use separate charts). Explain Support & Resistance with TEMA (On separate charts). (Screenshots required).

TREND IDENTIFICATION

The Triple Exponential Moving Average is a trend following indicator which is used by traders to analyze the trend of an asset because it is very easy to identify unlike other Moving Averages or trend following indicators. TEMA moves in the same direction as the trend (upwards or downwards)

TREND CONFIRMATION

● TEMA always move in the same direction as the trend, therefore, it follows the trend. In a Bullish trend, the TEMA moves upwards while in a Bearish trend it moves towards.

● The price of the asset always for a downtrend always goes under the TEMA while the price of an asset in an uptrend line or trade above the TEMA

SUPPORT AND RESISTANCE WITH TEMA:

TEMA can act as support and resistance levels, when the price of an asset continue s increasing above the TEMA it might fall back to the TEMA supporting level and vice versa. The TEMA support and resistance levels can also serve as dynamic levels indicating or signalling a trend reversal. In an uptrend when the price bounces off below TEMA (Dynamic Support) it can serve as a signal for a trend reversal in the opposite direction. In a downtrend when the price goes above the TEMA (Dynamic resistance) it serves as a signal for a Bullish reversal. Dynamic Support/resistance helps traders determine when to enter or exit a market.

5. Explain the combination of two TEMAs at different periods and several signals that can be extracted from them. Note: Use another period combination other than the one used in the lecture, explain your choice of the period. (Screenshots required).

Using more than one TEMA to analyze a trend can give stronger signals to traders. And also serve as a confirmation of the signal.

By using two TEMAs with different periods (higher and lower periods) helps generate several signals for the trader. When the higher TEMA crosses the lower TEMA it points to a Bearish trend reversal acting as a Sell signal to the trader. When the Lowe TEMA crosses the higher TEMA it signals a Bullish trend reversal which acts as a buy signal to the trader.

Using shorter periods makes the TEMA react faster to price and it's not that useful to longtime traders but intraday traders.

Using a period of 30 and 50 periods when the higher TEMA (50 periods) crosses the lower TEMA (30 periods) it signals a downtrend. If the 30 periods TEMA crosses the 50 periods TEMA it signals an uptrend.

6. What are the Trade Entry and Exit criteria using TEMA? Explain with Charts. (Screenshots required).

ENTRY USING TEMA

● Add two TEMAs with different periods (high and low periods) in the chart.

● In a bearish trend, when the lower period crosses above the higher TEMA (period) it signals a trend reversal.

● Two to three candlesticks should serve as a confirmation of the trend reversal.

● Place a buy option, set your stop loss below the TEMA and your take profit above the TEMA. A ratio of 1:1 is a good rule of thumb for a saving strategy.

EXIT USING TEMA

● Add two TEMAs to the chart with different periods (higher and lower periods).

● In a Bullish trend when the higher TEMA crosses the lower TEMA, it signals a trend reversal in the opposite direction, which signals traders to place a sell option.

● Place a sell option after confirmation from two or more candlesticks.

● Using a ratio of 1:1 or whatever suits your trading strategy, set your stop loss above the TEMA (crossover) and take profit below the TEMA.

Use an indicator of choice in addition to crossovers between two TEMAs to place at least one demo trade and a real margin trade on an exchange (as little as $1 would do). Ideally, buy and sell positions (Apply proper trade management). Use only a 5 - 15 mins time frame. (Screenshots required).

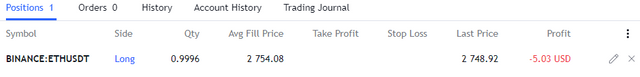

BUY ORDER

From the chart above, a buy order was placed for ETHUSDT with the TEMA 25 and 55 indicators configured on the chart along with the RSI to confirm the trend. Order was placed with risk management strategies implemented as shown above. Below is the order details:

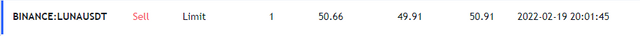

Sell Order

As shown in the chart above a sell order of LUNAUSDT was made after all TEMA sell entry criteria was met and downtrend projected using the RSI. Relevant market points were added on the chart. Order details below:

What are the advantages and disadvantages of TEMA?

The Triple Exponential Moving Average is quite a useful indicator for technical analyst but it has its ups and downs which includes.

ADVANTAGES

● It is very effective in identifying the trend of the market.

● TEMA provide good dynamic support and resistance levels.

● It minimizes or reduces lagging common to other trend-following indicators

DISADVANTAGES

● It is not effective for a ranging market since it is a trend following indicator.

● It is very quick to react to a slight change in price.

Conclusion

When compared to other Moving Average indicators, TEMA is a significant improvement and potentially enhances trading without introduction of an additional learning curve. Thanks to @Fredquantum for his detailed and timely lesson, I hope to remain your student as we move through other weeks in this season of the Steemit Crypto Academy.