.png)

1. Meaning of Fibonacci Retracement (with examples and screenshots)

Fibonacci retracement levels are lines drawn horizontally that show potential areas of support and resistance. It is a tool for technical analysis. Each Fibonacci level corresponds to a percentage. The percentages (Fibonacci levels) are representations of the amount of a previous move that the price of the traded asset has retraced. The Fibonacci levels of retracement are 23.6 percent, 38.2 percent, 61.8 percent, and 78.6 percent.

A Fibonacci retracement forecast is made by dividing the vertical distance between two extreme points on a chart by essential Fibonacci ratios. 0 percent is considered the commencement of the retracement, while 100 percent indicates a complete reversal to the initial price before the move.

Fib retracement (uptrend); Source - TradingView

With the fibonacci retracement a trader can effectively select market entry and exit positions as well as map out trading strategies including variables like stop loss and take profit based on the identified retracement level. The screenshot above shows Fibonacci retracement during an uptrend. However, it is important to note that Fibonacci retracement can be applied to a downtrend as shown here:

Fib retracement (downtrend); Source - TradingView

2. Meaning of Fibonacci Extension (with examples and screenshots)

When the market is advancing into an area where other ways of discovering support or resistance are not relevant or visible, Fibonacci extensions are a tool to set price objectives or find anticipated regions of support or resistance. If somehow the price moves by one extension level, it is possible that it will continue to move toward the next. If a trader is long on a cryptocurrency and the price makes a new high, the trader can utilize Fibonacci extension levels to forecast where the price will go next, and vice versa.

Fib extension; Source - TradingView

From the chart above, a fibonacci extension has been applied and using it, the peak extension in the uptrend movement has been identified.

3. Calculation of the Fibonacci retracement, for the levels of: 0.618 and 0.236. Pick a crypto pair of your choice. Show a screenshot and explain the calculation you made.

I will be taking a shortcut for this calculation by using the Fibonacci retracement calculator available on Omnicalculator. Calculating with an online calculator is recommended as it saves time.

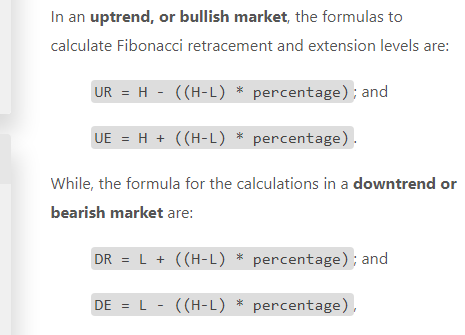

Above is the formula that is adopted by Omnicalculator for the calculation of Fibonacci retracement.

Using the above formula for uptrend retracement, we will calculate the retracement levels for BTC/USDT at 0.618 and 0.236. I have picked the highest and lowest price points respectively.

Fib retracement calculation; Source - Omnicalculator

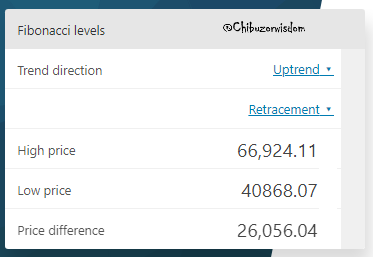

Now I will enter price data into the Omni calculator software:

Fib retracement calculation; Source - Omnicalculator

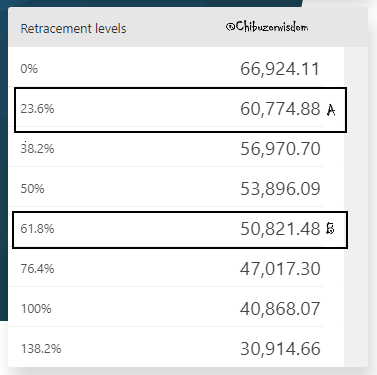

The calculator automatically generates the values for all Fibonacci levels as shown below:

Fib retracement calculation; Source - Omnicalculator

As shown above, the Fibonacci levels corresponds with the figures generated by the chart. Thus, by correctly identifying peak and lowest price points, we can either identify Fibonacci levels manually using the fib retracement formula or identify them using the Fibonacci tool in Tradingview app.

4. Live Trade using the Fibonacci retracement

Here is the live trade for AXS/USDT. After performing the technical analysis using the Fibonacci retracement as shown below, I placed a buy order and set the stop loss and take profit zones.

The details of this order is shown in the screenshot below.

5. Demo Trade using the Fibonacci extension

To perform this trade (MATIC/USDT), I will perform my technical analysis using the Fibonacci extension tool. I have applied Fibonacci extension to the chart below. Also, indicated in the chart below are the relevant trading parameters namely the Profit and Loss zones and market entry.

On the MATIC/USDT chart, I executed a long trade using Fibonacci extension signals. The price was initially in an uptrend until a trend reversal occurred from A to B. Following the recovery, I placed my stop loss just below the 1.618 Fibonacci extension level and my take profit just above it.

Shown above is the technical analysis and demo trade details.

@steemcurator02 please vote my assignment...

It took me so much time to do 😭😭😭

I only transfered 5 steem within the last 5 weeks and now I powered up 85 steem because of this assignment.

Please reconsider boss 👏👏👏👏👏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit