Hello friends, I'm here again to participate in this weeks advance lessons by @cryptokraze on Trading The Dynamic Support & Resistance. Will be putting in my best to upturn last weeks abysmal performance.

What do you understand about the Concept of Dynamic Support and Resistance? Give Chart Examples from Crypto Assets. (Clear Charts Needed)

Price Trends as we know are dependent on several factors and there are no trend that continues in same pattern forever, there are trend distortion usually seen from bearish to bullish and vice versa. But in the course of this price trend movement , they are sometimes controlled by imaginary and unseen market activities at certain levels which are known to us as either Resistance levels or Support levels, hence the concept of Dynamic resistance and Support.

In this contest, this Dynamic Price Resistance and Supports are determined with the use of the Exponential Moving Average model that sees to capture different horizontal lines that cut across resistances or support points. Horizontal lines for resistance levels are seen to run on a downward trend whereas support levels are capture in a upward trend.

I will representing this theory in a more practical way via the screenshots.

The Dynamic Support Concept

Just as lastly mentioned i the concept above, the Dynamic support concept is pictured making an upward trend . This is evident from the fact that each time when trend wants to get bearish, when it gets to the EMA line it acts as a support level and pushes trend upwards. At the different levels where price trend are captured after a rebound is termed the EMA support level. This process is sometimes seen to reoccur and when it does, it gives the trader a clearer picture on when to take the trade.

The Dynamic Resistance Concept

In this concept, price trend is seen to move on the downward trend and each time price tend to move in the contrary positions (upwards) and touches the EMA line, trend is seen to rebound and allow trend continue in its usual downward trend. This trend is seen repeated over a given time and hence the different resistance levels are obtained which are termed the Dynamic Resistance levels.

Make a combination of Two different EMAs other than 50 and 100 and show them on Crypto charts as Support and Resistance. (Clear Charts Needed)

For me, the essence of having a dual EMA line signal is to identify stronger resistance points and Support levesl which will in turn help traders make clearer decisions on buy and sell scenarios. I will be using EMA 40 and 100 periods for the course of this scope.

EMA 40 and 80 Concept for Dynamic Support

What should come to our minds is an upward kind of trend with some kind of supports given to the trend at various levels which would indicate the Dynamic support levels.

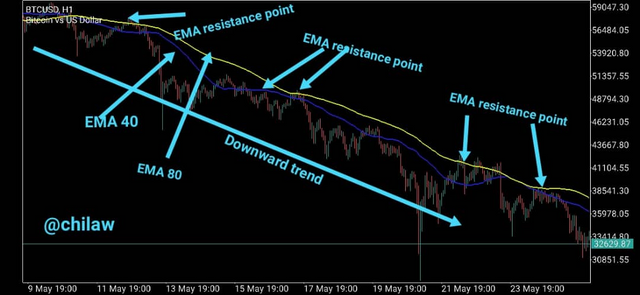

EMA 40 and 80 Concept for Dynamic Resistance

What should come to our minds is an Downward kind of trend with some kind of Resistance given to the trend at various levels which would indicate the Dynamic Resistance levels.

Explain Trade Entry and Exit Criteria for both Buy and Sell Positions using dynamic support and resistance on any Crypto Asset using any time frame of your choice (Clear Charts Needed)

TRADE ENTRY CRITERIA

Criteria for Buy Position:

- I will add my EMA 40 & 80 period by adjusting the settings

- Price should definitely be above the both EMA 40 & 80 period to be sure of a buy entry

- Price trend should be observed to touch the EMA 40 or probably piece through it and likely touch the EMA 80, allow price to rebound before making any Buy entry order.

- When prince is observed to rebound and continue on its uptrend, a valid buy setup should be taken.

This is a typical example as represented in the screenshot below.

Criteria for Sell Position:

- I will add my EMA 40 & 80 period by adjusting the settings

- Price should definitely be below the both EMA 40 & 80 period to be sure of a buy entry

- Price trend should be observed to touch the EMA 40 or probably piece through it and also likely touch the EMA 80, allow price to rebound before making any sell entry order.

- When price is observed to rebound and continue on its uptrend, a valid Sell setup should be taken.

This is a typical example as represented in the screenshot below.

TRADE EXIT CRITERIA

Exit Criteria for Buy Position

- Just as usual, my EMA 40 and 80 period would be in view

- My support levels must have been in place and atleast two different Dynamic Support Levels captured in sequence, also making an uptrend movements.

- The Stop Loss should be placed below the EMA 80 periods. This also represents that the Buy Entry setup should above this level.

- But when price is seen to continue on the path of uptrend, profits should be taken otherwise the Stop Loss should be activated.

- The Take profit should be placed above the EMA 40 and also the buy entry setup.

Exit Criteria for Sell Position

- Just as usual, my EMA 40 and 80 period would be in view

- My Resistance levels must have been in place and atleast two different Dynamic Resistance Levels captured in sequence, also making an Downtrend movements.

- The Stop Loss should be placed above the EMA 80 periods. This also represents that the Buy Entry setup should below this level.

- But when price is seen to continue on the path of Downtrend, profits should be taken otherwise the Stop Loss should be activated.

- The Take profit should be placed below the EMA 40 and also the buy entry setup.

Place 2 demo trades on crypto assets using Dynamic Support and Resistance strategy. You can use lower timeframe for these demo trades (Clear Charts and Actual Trades Needed)

I will be illustrating 2 Demo Trades Using EMA 40 & 80 periods. Trades also are conducted using my Metatrader5 App.

Trade 1 - BTCUSD

Buy entry Setup : 32519.00

Take profit: 33,600.00

Stop Loss at:31,500

Trade 1 - XRPUSD

Sell entry Setup: 0.56500

Take Profit: 0.53300

Stop loss at: 0.58200

CONCLUSION

I will really say that the concept of applying Dynamic Resistance and Support using the EMA is a nice methodology that avails various entry and exit points for traders who leverages on this positions to be proactive in taking their trades.

Thank you respected Prof @cryptokraze for this strategy.

Dear @chilaw

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 8/10 Grade Points according to the following Scale;

Key Notes:

We appreciate your efforts in Crypto academy and look forward for your next homework tasks.

Regards

@cryptokraze

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit