Hi Steemians, Welcome to my blog. Nice having you back to my page as I engage us in week 4 lessons by Prof @reddileep on Triangular Arbitrage.

It was not long when I came across the term Arbitrage in a post sometime last month and here am I attending to it. In simple terms, Arbitrage trading is means a scenario leveraging on the price differences observed between two (2) Exchanges. That is to say, a trader can actually observe the prices of assets listed on different Exchanges, make comparisons and then trade across these platforms based on higher and lower price occurrences. Most likely, assets are purchased from Exchanges where prices are lower and sold where prices are higher. That difference observed between these exchanges is a typical Arbitrage trading.

In addition, Arbitrage trading can as well be observed when assets are exchanged between two (2) other assets in the same platforms and still have positive price variations. This positive price variation is simply known as Arbitrage trading. In this case, we have all trade transactions and asset Exchange done within the Exchange alone. There are other forms of Arbitrage Trading observed in the financial space with the sole purpose of taking advantage of price variations across the board.

Arbitrage Trading is known to have a relatively low risk in trading features. Some experts termed it as a relatively closer guaranteed strategy of assured profit in the financial system. Traders who are exposed to such opportunities when they occur can maximize profit before the window closes. That is to say, they occur in a short period.

There may be different types of Arbitrage Trading in the financial space, but I will be explaining just a few for the scope of this task.

Exchange Arbitrage Trading

This is the very commonest among the different types of arbitrage trading available. The presence of this type of arbitrage occurs in more than exchange platforms. Two different platforms are considered where a given price of an asset is compared and varied between the platforms. And the platform where we have a lower asset price is termed the purchasing platform and this value is sold in another platform where we have a higher asset price.

Though it comes with low risk and higher chances of assured profits, we cannot rule out the fact that the execution of trade should be done promptly before the window opportunity that provides this arbitrage closes. Its closure may emanate from system updates, volumes traded updated as well as price fluctuations.

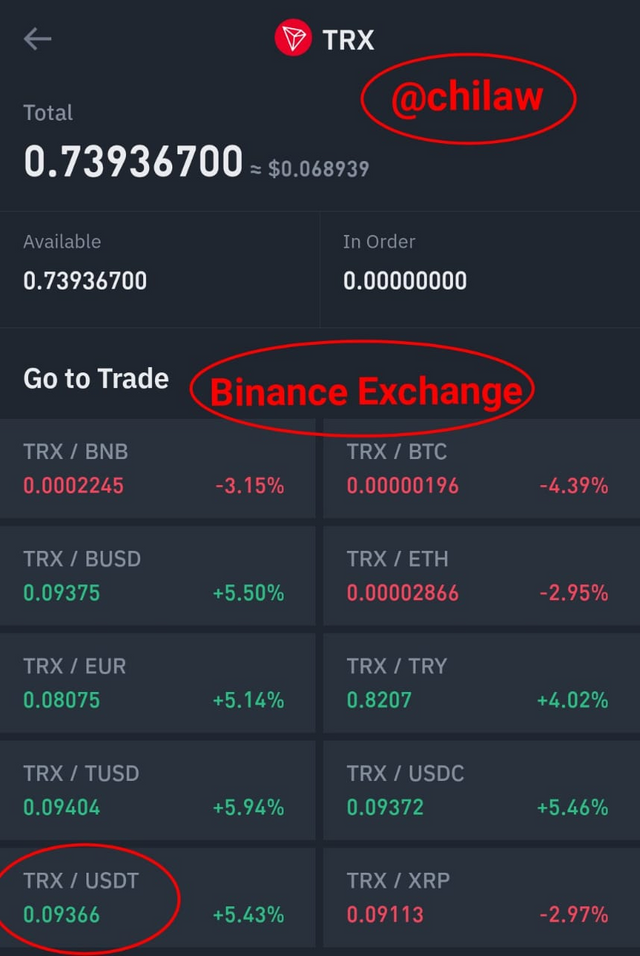

A simple illustration of this type of arbitrage trading can be demonstrated using the Binance and Houbi Exchanges.

Binance Exchange:

TRX/USDT = $0.09366

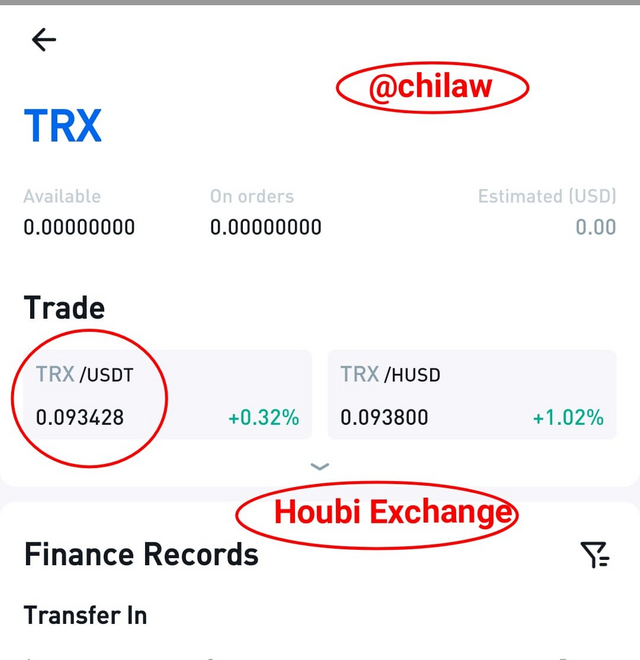

Huobi Exchange:

TRX/USDT = $0.093428

Exchange Arbitrage - $0.000232

Triangular Arbitrage Trading

Another easy trading process in the arbitrage strategy is Triangular Arbitrage Trading which involves a singular Exchange platform to carry out this trading strategy. This strategy simply entails that a given asset is exchanged for two other assets and then back to its original state. This only tries to take advantage of the different price variations obtainable in each of these assets in which this asset exchanges. There may be more comparative advantage to exchange the steem to BTC than exchanging it with ETH.

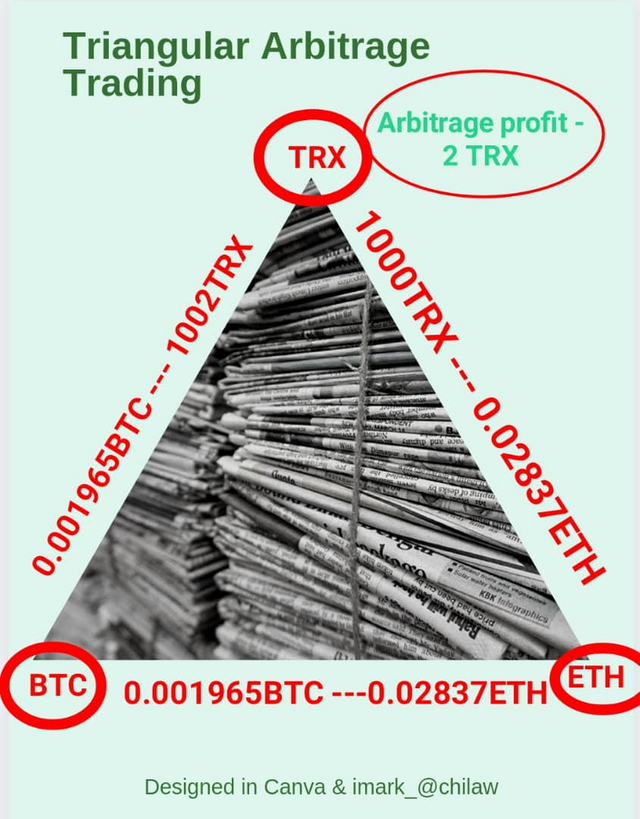

Therefore in the Triangular arbitrage trading measures a three (3) point trading level that sees that a given asset is exchanged from point A to C and then back to Point A. For example, let us illustrate this using a diagram ;

We can see from the illustration that an initial asset value of 1000TRX was used. This was exchanged to ETH with the derived value of 0.02837ETH and this ETH was further exchanged to BTC with a derived value of 0.001965BTC. Finally, I have to exchange the BTC value back to my initial TRX asset and this gave me 1002TRX. Observed Arbitrage profit here is 2 TRX.

Funding Rate Arbitrage

For this, it might sound a little technical because there is this involvement of a leverage instrument. In this scenario, the trader would want to engage his idle asset in the Futures Contract and hence reward through the Funding Rates accrued to its leverage asset. This comes with relatively low risk for the trader as there is high confidence that the funding rates earnings would shore up all negative effects of price volatility/fluctuations in the market.

Triangular Arbitrage Trading

In my explanation on Triangular Arbitrage Trading in the types of Arbitrage Trading above, my exposition remains the same. This strategy simply entails that a given asset is exchanged for two other assets and then back to its original state. This only tries to take advantage of the different price variations obtainable in each of these assets in which this asset exchanges. There may be more comparative advantage to exchange the steem to BTC than exchanging it with ETH.

Therefore in the Triangular arbitrage trading measures a three (3) point trading level that sees that a given asset is exchanged from point A to C and then back to Point A.

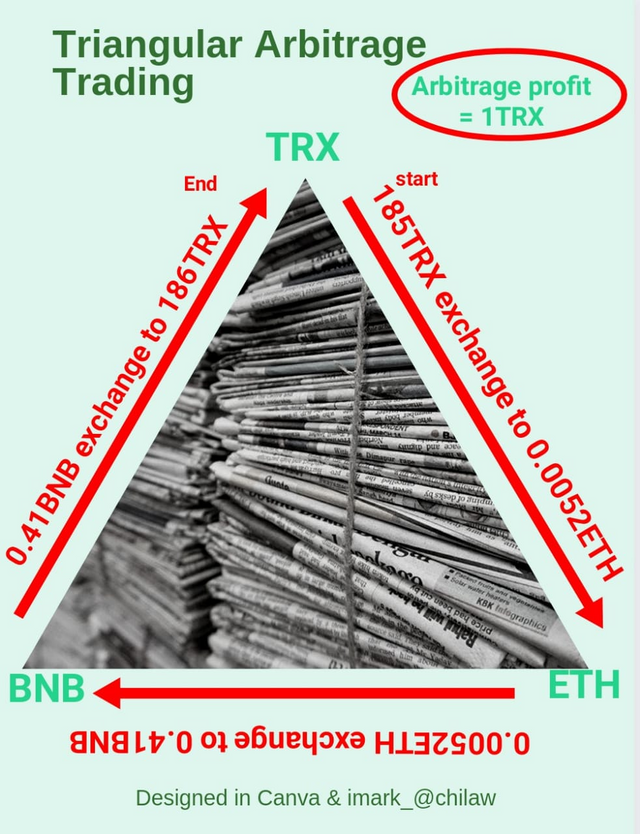

For example, let us illustrate this using a diagram generated from the Spot Trading;

I will be demonstrating this showing us the spot trading involving the different selected assets.

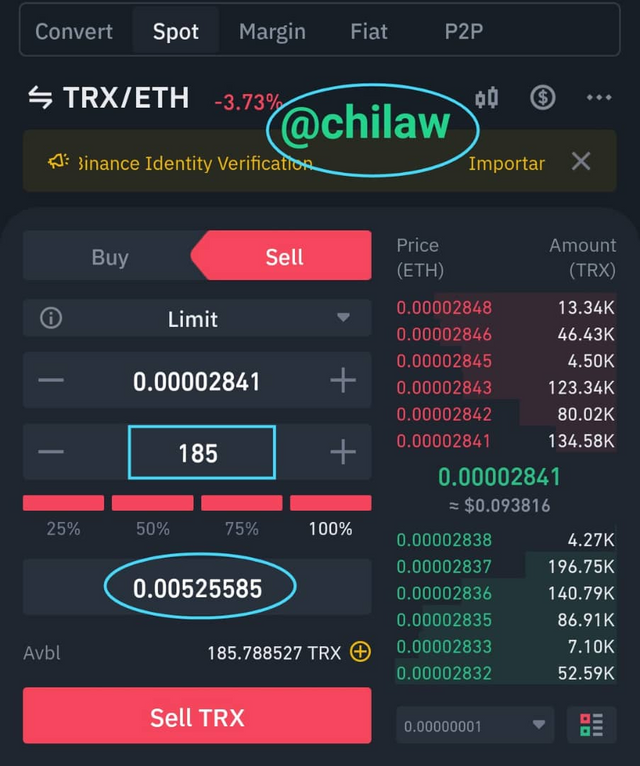

Stage 1:

I have an initial asset value of 185TRX and am to be exchanged for ETH assets. This exchange gave me 0.00525585ETH

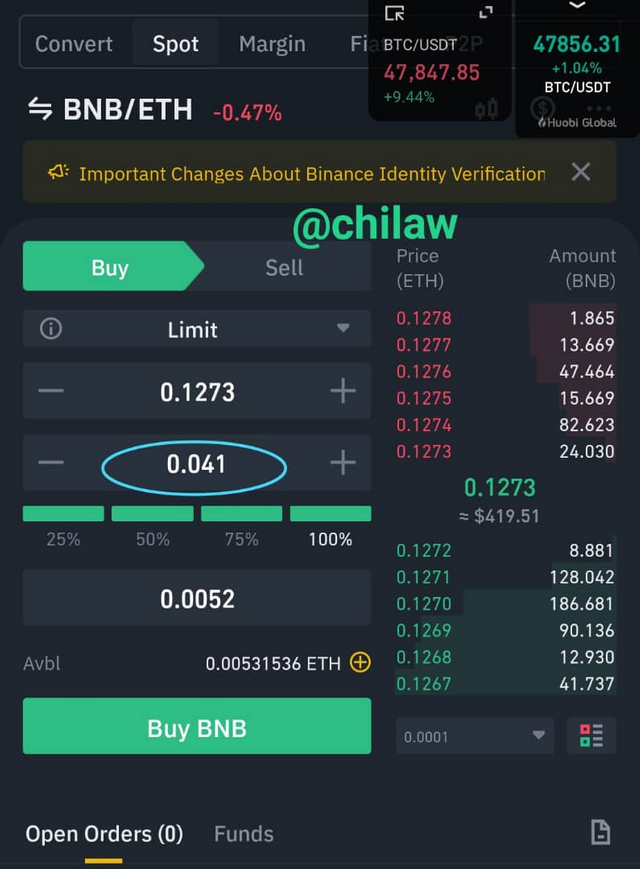

Stage 2:

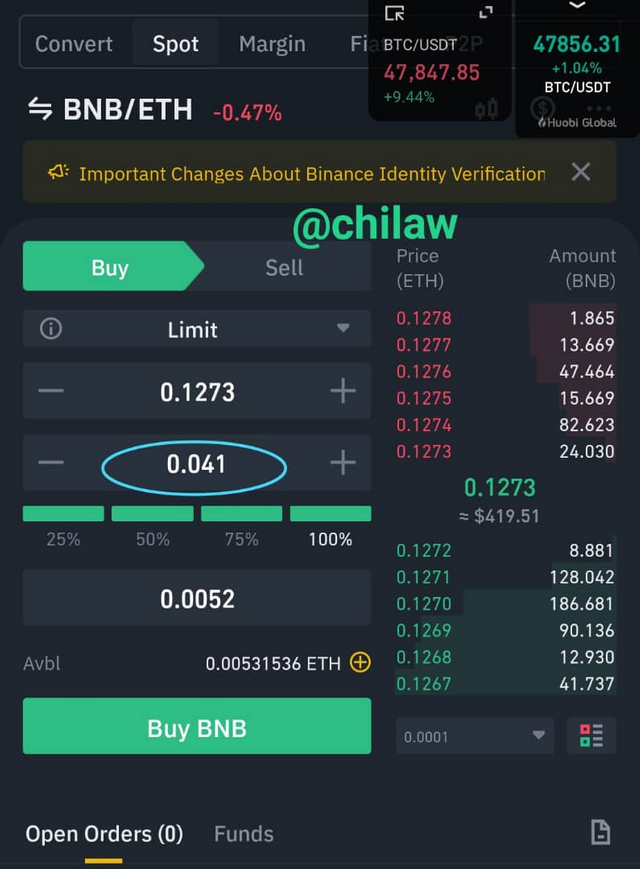

The available asset now is the ETH with a value amount of 0.0052ETH to be exchanged to BNB of value 0.041BNB.

Stage 3:

The purchased BNB asset will now be used to buy back the initial TRX asset. Available BNB asset in use now 0.049200 against the 0.041 initially purchased. These are liquidity and Network fee limitations obtainable during such trade which also have effects on asset quantity anticipated. This is usually noticeable for traders exchanging relatively smaller units of assets. From the fig. below we are only buying back 186TRX assets after the trade.

Initial asset value - 185TRX

Final asset value - 186TRX

Triangular Arbitrage profit - 1TRX

Step 1

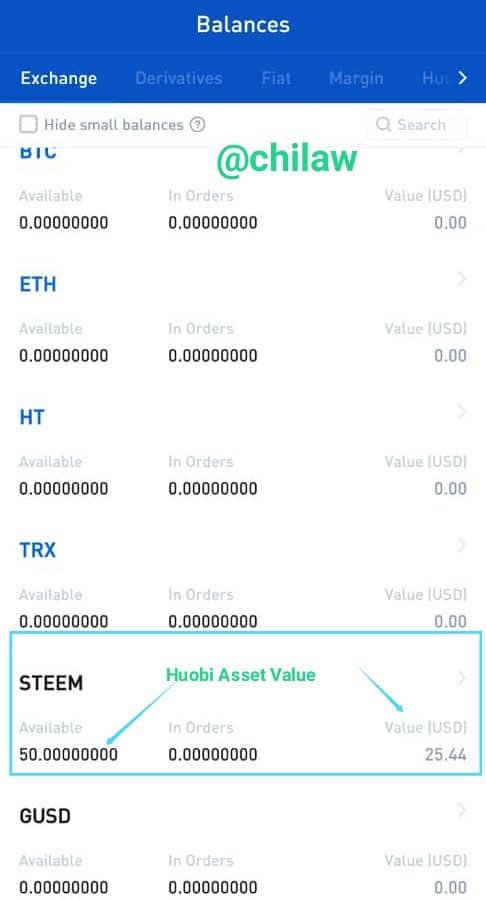

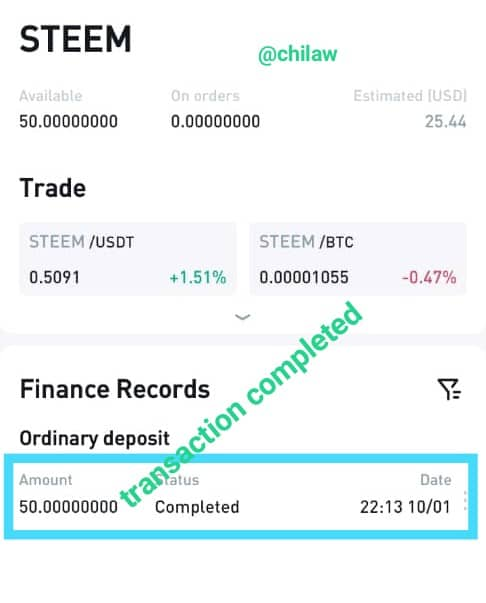

(Funding my Huobi account as well sending to Binance Exchange)

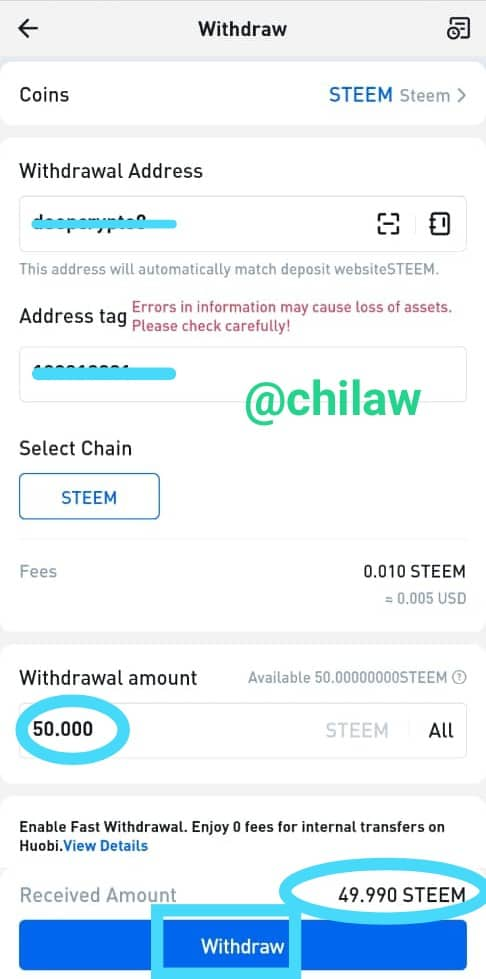

I will be using my verified Binance and Huobi Exchange platforms for this exercise. I have identified my Huobi platform as the exchange with the relatively low asset price of steem. In the wallet, I have 50 Steem worth $25.44 at the time of this post.

I will quickly go to trades to get this trade done by clicking on the Withdraw button to send this asset to my Binance exchange. I have to copy and paste both the receiving address and Memo as required in the spaces provided. This comes with a withdrawal or transaction fee of 0.010steem. Hence I should be receiving less of that value in my steemit wallet in Binance.

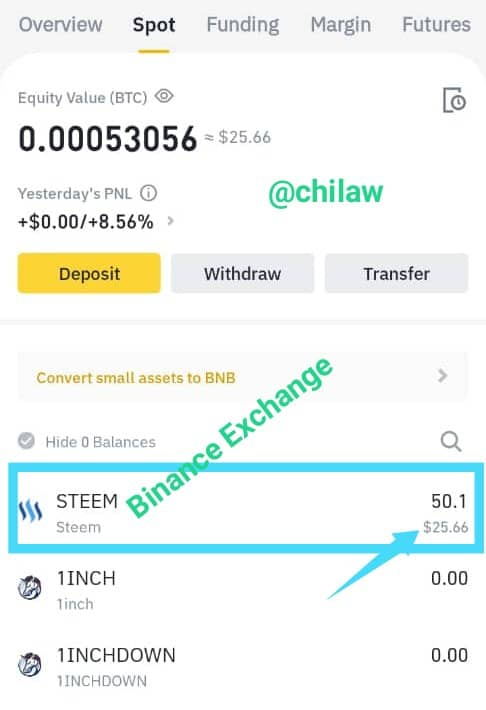

Step 2

(Receiving assets from Huobi and also utilizing assets)

From my Binance Exchange account, Asset value was received with a relatively higher value this time. The asset value is now $25.66 which is $0.22 higher than what was observed in Huobi Exchange.

Therefore, the Exchange Arbitrage Profit is $0.22

Triangular Arbitrage Trading

I will make a further representation of my illustration as demonstrated in the above question in a triangular pattern for more clarity.

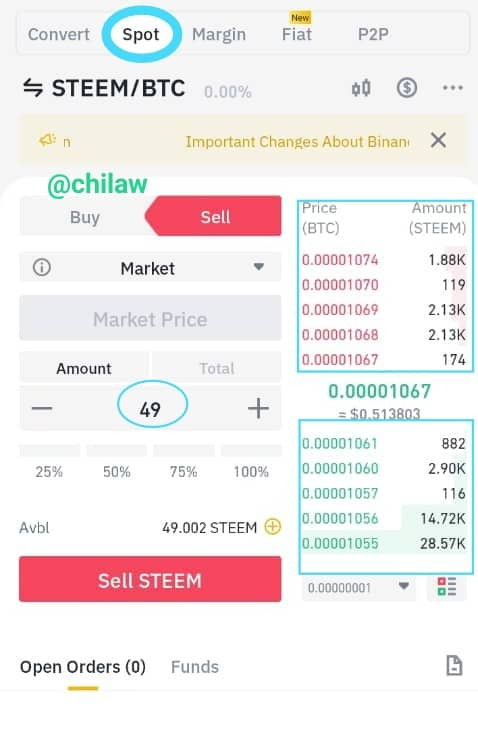

Stage 1:

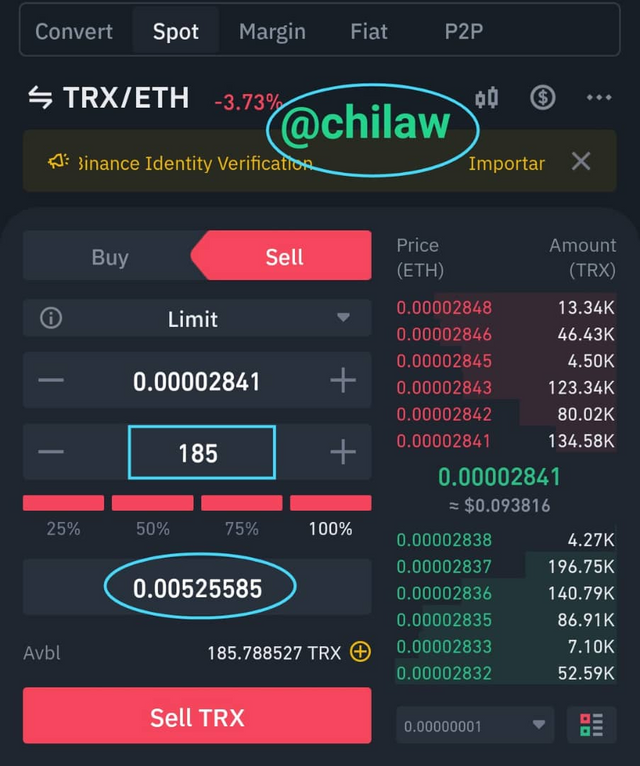

I have an initial asset value of 185TRX and am to be exchanged for ETH assets. This exchange gave me 0.00525585ETH

Stage 2:

The available asset now is the ETH with a value amount of 0.0052ETH to be exchanged to BNB of value 0.041BNB.

Stage 3:

The purchased BNB asset will now be used to buy back the initial TRX asset. Available BNB asset in use now 0.049200 against the 0.041 initially purchased. These are liquidity and Network fee limitations obtainable during such trade which also have effects on asset quantity anticipated. This is usually noticeable for traders exchanging relatively smaller units of assets. From the fig. below we are only buying back 186TRX assets after the trade.

Initial asset value - 185TRX

Final asset value - 186TRX

Triangular Arbitrage profit - 1TRX

< centre>Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words

| No | Advantages | Disadvantages |

|---|---|---|

| 1. | Arbitrage Trading comes with very low risk in its trading strategy | High transaction/Withdrawal fees may inhibit profitability of trade |

| 2. | High level of certainty in making profits compared to other trading strategies | Market volatility and Price fluctuations may jeopardize the profitability of the process |

| 3. | Provides liquidity in the exchanges each time assets are traded or moved | Insufficient liquidity during the process may also inhibit traders execution process. |

| 4. | Source of revenue when done successfully | Slow execution time may throw trader into loss if not quickly processed |

Conclusion

Arbitrage Trading is one of the assured strategies if successfully executed should not only guarantee traders profitability but as well means of generating passive income.

Though It is limited with factors that include the Execution timing, price fluctuations as well as transaction fees which are usually drawbacks to profitability, the Arbitrage trading strategy still stands a more assured position in driving passive incomes given to its low-risk feature.

This is my entry for this very impactful lesson on Arbitrage trading.

Cc: Prof @reddileep