Good day friends, i am here to participate in today's homework week6 task by professor @stream4u.

Homework Week6 Task

(a) DIFFERENCES IN LARGE CAPITAL- MID CAPITAL - SMALL CAPITAL & HOW THEY WILL AFFECT THE INVESTMENT

LARGE CAPITAL

These are markets seen to be in the first to tenth ranking of all cryptocurrency capital market with over $10billion worth of capitalization of trades within its platform. Large capital market are markets that offer better and reliable safer investment in all trades. They are markets with long term future given the volume of liquidity involved. Market losses and risks in trade is infinitesimal with low market volatility. This type of market follows a conservative profiteering trend, given to its longer term investment plan vis a vis its' infinitesimal losses.

MID CAPITAL

Unlike the ranking and market capitalization seen in the Large Capital market, MID Capital market is seen behind the large market and its characteristics. It has a capitalization of $1 billion to $10billion volume of liquidity in its trades. Though a little liquid, it still has potentials for additional liquidity which exposes it to more volatility unlike what happens in the large capital market. Due to capacity of more influx of liquidity, it calls for more risks hence the intermediary losses in traded assets and investments. This market is saddled with a generic mix of assets losses, hence the need to research before venturing into it. So many coins are still waxing strong in this category while others have gone down the drain due to the unprecedented market volatility and higher risk seen in its platform unlike the Large capital market.

SMALL CAPITAL

This is the third capital market in this category with less than $1billion worth of capitalization in its traded volume & liquidity. This type of market happens to carry the highest risk rate unlike what is obtainable in the Large and Mid Capital markets. This increased risk or market volatility is associated to its insufficient liquidity issues, unprecedented withdrawal of assets from trade and its gambling style of trade. Products launched today may fizzle out of the exchange platform as soon the initial investors reap off their hourly/daily profits with opportunity to still re-invested assets from the trade. This continuous rotation of low liquidity and frequency of in & out trades makes it a highly risky and poor investment platform to trade in. Though is known to be infested with the highest risk, it is also has capacity to bring in the highest Return On Investment (ROI) amongst the three capital markets.

(b) Which type of Asset market can be more profitable? Why? Advantages & Disadvantages (Explain only 1)

For me I will choose the SMALL CAPITAL MARKET .

There are high tendencies of doubling the amount invested in a twinkle of an eye. Due to the nature if this market platform which is similar to the gambling environment where a smart investor would carefully place & monitor its trade, and within minutes or hours make double of ROI. He's at liberty to withdraw immediately and also reinvest again into the system. Though it comes with a lot of risks, it has potentials to double or triple amount of assets invested with minutes unlike the Mid of Large capital markets.

Merits

- High Possibility of profiteering within minutes of investment and ROI doubled.

- Requires little liquidity to invest. Investors leverage on its low liquidity investment scheme to engage in trades.

Demerits

- It is saddled with insufficient liquidity in it exchange which mostly hampers the trading activities done due to the frequency of in and out trades.

- It has high market volatility and high risk of losses if not well handled and speculated.

(C) THOUGHTS ON RISK CAPITAL AND PENNY CRYPTOCURRENCY

One thing is to have money, the other is to find at genuine investment plan to sow this seed for multiplication. When we decide to cut down on some of the monies we spend on frivolities and leisure into little savings that has the potentials of long run turnaround fortune, I think it is the best thing to ever do for oneself. RISK CAPITAL, are savings/capital made from monies ordinarily that do not have to cost us any fortune or affect our normal saving culture. The risk rate is transferred to that social/status spending that would ordinarily will not add value in any form. Market volatility, bullish or beerish of trades are not tied to any expectation, since the investor's purpose for investing is on a long term basis.

Penny Cryptocurrency are small value assets with a price value of between $0.0004 to $0.02. They are perceived to be undervalued assets, hence the need to use the Risk Capital as a means of investing. It is wisdom to purchase volume of penny cryptocurrency assets through the use of Risk Capital now, since it has tendencies of bringing in life changing returns in future. This can be a game changer financially for any investor.

(d) What is the role of Watchlist //Best way to set up a watchlist. Additionally, For Example, show your watchlist if you have configured it and give a short description of it.

ROLE/BEST WAY TO SET WATCHLIST

Watchlist has help investor to keep tap on accurate tracking and tracing of cryptocurrency assets during trade activities. It gives room for one to align all his favorite or frequently used crypto assets at a glance. This invariably aids him in making detailed and smart responses as regards trade decisions.

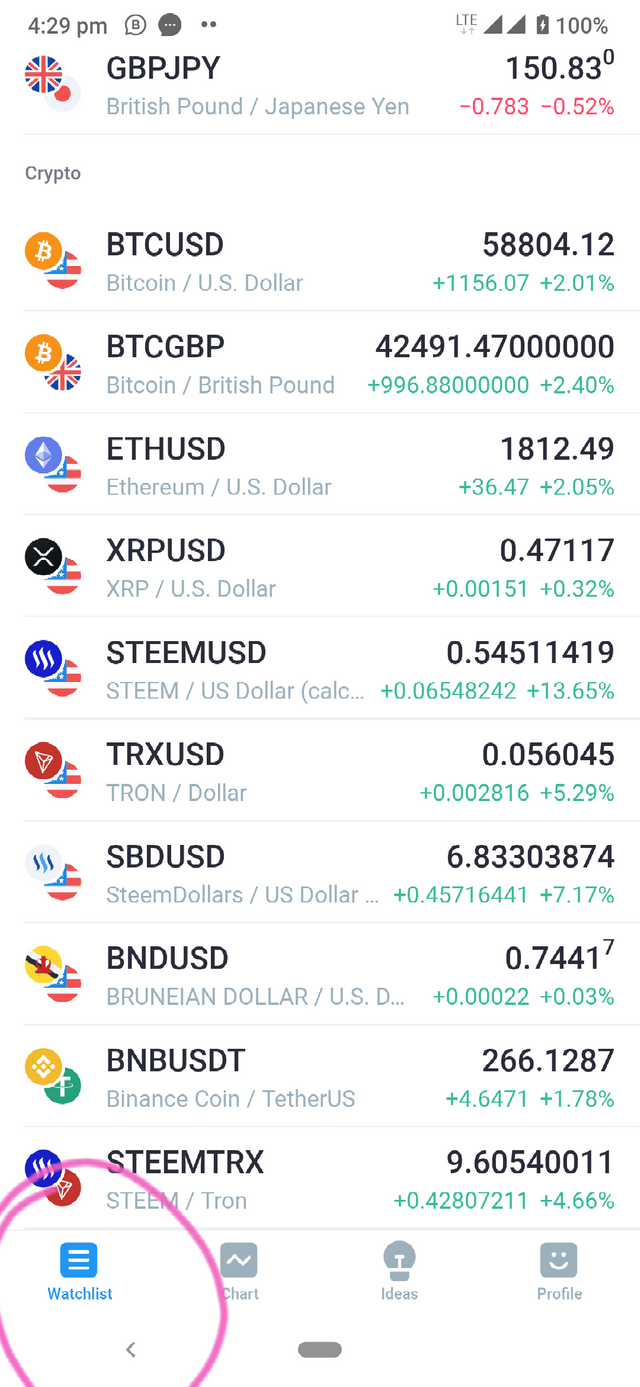

How best to set my watchlist would be strategic to my planning and having a first hand information about my assets. Since we have three categories/Layers of Capital markets (Large, Mid & Small Capital markets), it would be wise to pick at least three(3) from each capital layer. This is to avoid overcrowding or having a cumbersome view of all market assets at once which may be impossible. This is a picture of how my watchlist looks like below.

(Screenshot of a typical Watchlist)

In conclusion, this topic was well impactful by letting us know where exactly to trade with minimal risk and conservative profits, where risk is maximum with potentials of doubling ROI and where risk is at a bearable level with potentials of making good profits too.

On the other hand, watchlist helps to track assets performance with first hand information on all favorite assets. While fortunes could be made via Risk Capital investment in Penny cryptocurrency if properly advised.

Thank you everyone who will find time to go through my post.

Professor @stream4u, this is my week6 homework task.

.jpeg)

Hi @chilaw

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 6.

Your Homework task 6 verification has been done by @Stream4u.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit