Hello every one welcome to my blog once again this time am writing in response to the home work task given by the professor about CFDs I appreciate your dedicated time on this post.

professor - @kouba01

week - Week 2

course - steemitcrytoacademy

topic cryptocurrency for difference trading (CFDs)

CFD is the short form of writing cryptocurrency difference for trading its a way to venture on monetary market which includes forex, stocks, precious metals, cryptocurrency, raw materials etc.. in these monetary market they are known as commodities.

CFD permit you to postulate whether if the price of assets will go up or down without you owning the asset you can carry out all kinds of trading without you having the assets in your account just by speculating (expecting price to go up vice versa). The interesting thing about CFD is that their are two ways to earn which is buying and selling and it gives you the chance to earn in both ways.

In CFD one can open a buy or sell position which is also known as long position or short position position. Traders earn as the price moves either by increase or decrease. Some of the features that CFD possesses are listed below and I will explain two

- short and long trading

- hedging

- margins

- leverage

hedging

With hedging you can hold more than two position the same time this was as a result of preventing loss from the previous position due to how market moves sometimes are unfavorable. So traders hedge because they want to reduce loss not just only to create profit.

long and short trade.

Long trade : in this CFD feature a trader buys commodities with the belief that the price will go higher in future so it can make huge profit when sold.

short trade

Short trade: here an investor or trader will sell before buying having in mind to re buy the commodity again at a lower price and make profits too.

When using CFD to trade their are some benefit that are attached to it which are

offering the potential to earn in both bear and bull markets.

hedging option (explained above)

what it will cost you to trade is low

durability, it has no expiration date your commodities can be kept for long and sell any time you want.

- Rigid margin requirements

- absence of ownership

- also risk of over trading is high

CFD may be risky, and may not be appreciated by all. Because price movement may be fast against you. Secondly you can loose more than what you deposit and may need you to make another payments.

how do I known if cryptocurrency CFDs are suitable for my trading

To know if cryptocurrency CFDs will fit your type of trading strategies them the following are necessary to think about before proceeding

- I have to make research and understand how margin and leveraged trading works

Because of the risk attached with cryptocurrency so I’ll advice my self to trade with the capital I have budget to loose because anything can happen in the market.

I don’t like to hodl for long so I advice my to go for short term trading

another important thing is for me to look for a broker that is secure

Ha

are CFDs risky financial products

From what I have learnt so far in today lesson I’ll say that it’s CFDs are risky because due to the price of cryptocurrency that is not stable in the market so giving room for loss and profit as well. You can lose your money you invested to place a trade that is why it’s advisable to put money you can afford to loose just in case it turned negative. In other words, to avoid losing huge money you have to first understand how cfds works and them also check your self very well if you can take risk of loosing money because if price goes opposite to what you forecast or predicted it will amount to lose. Taking of risk in trading doesn’t kill or will say is inevitable as it can still turn to your favour.

do all brokers offers cryptocurrency cfds ?

All brokers do not buy free cryptocurrency cfds base on my research I found out few brokers and that offers cryptocurrency cfds which are listed below before you choose a broker for trading check of the fees are okay with you and also if to open and account with it is easy.

1 etoro

2 xbt

3 spreadex

explain how you can trade with cryptocurrency cfds on one of brokers (using a demo account )

Some newbies reading this post might wonder what a demo account is all about in simple words a demo account is used by traders who want to start trading but lack experience to get knowledge on how the trade and platform works In demo account you don’t fund real money as it mostly for trial and its 100% free to use.

First of all visit the website www.etoro.com and a page like this will display

Them you click on them the three lines at the top left corner

After that you click on join now

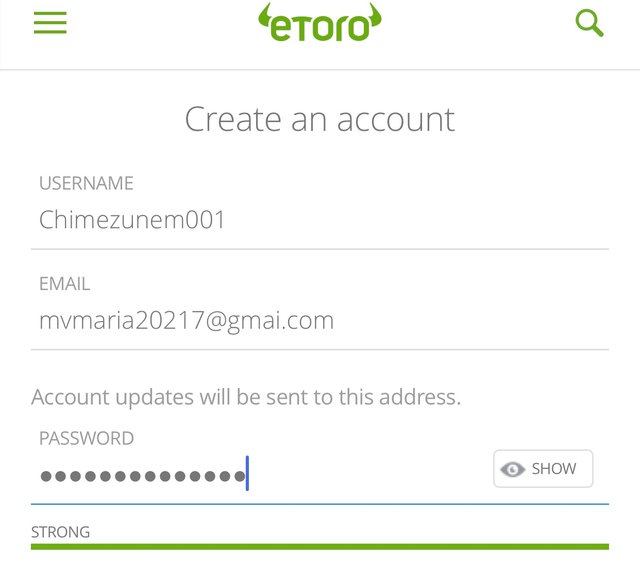

A crate account will display were you set up your email and password after that your account have been created.

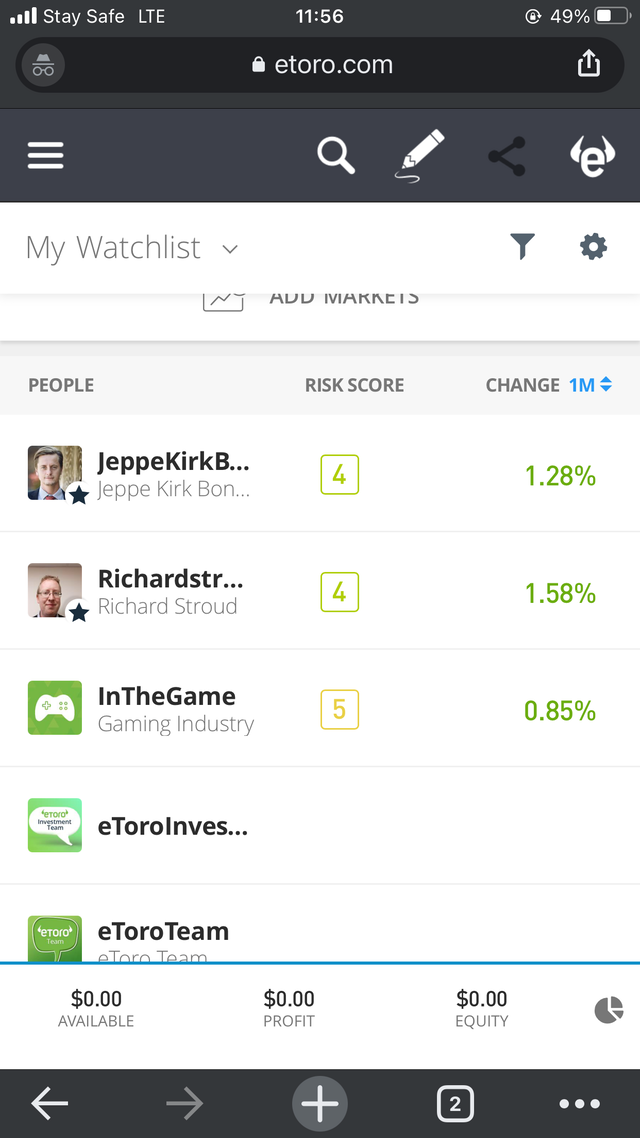

After that you click at the three lines at the top left corner again

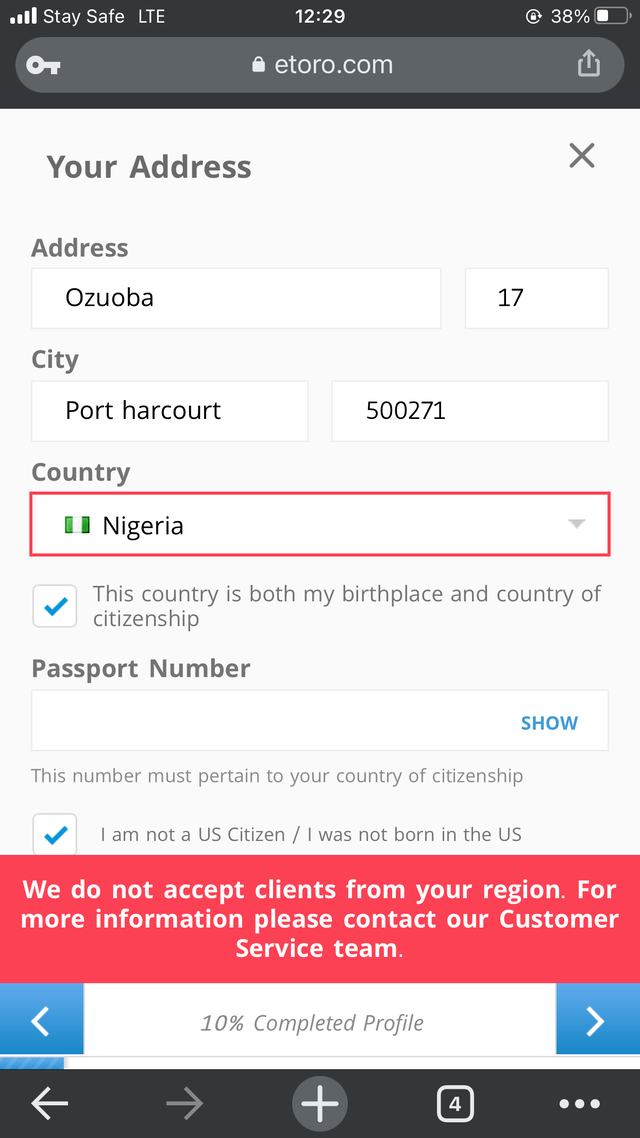

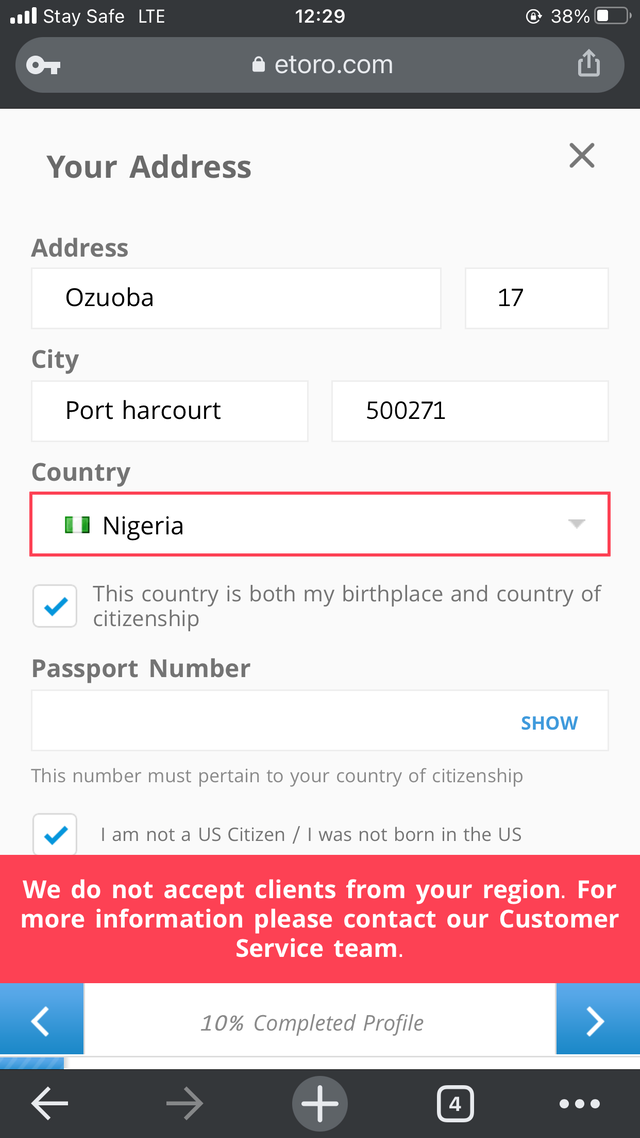

After setting up your profile, it was not accepted in my country

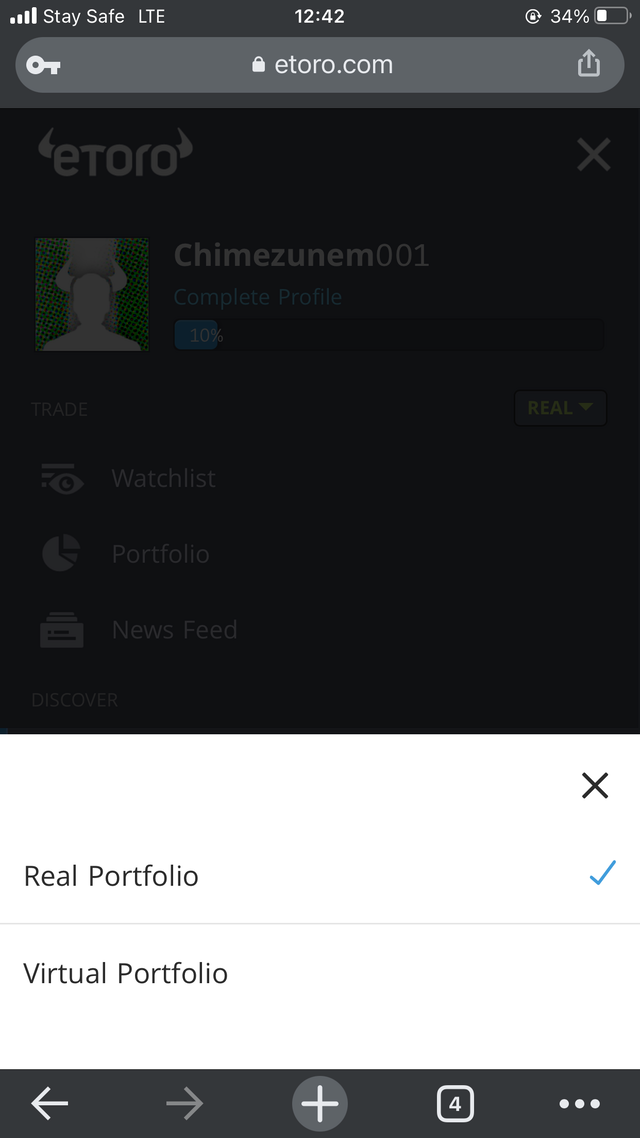

After setting up your profile and it’s accepted in your country you click on real and this will display real and virtual portfolio click on virtual portfolio

After that you click on go to

After that your demo account have been created successfully.

The next step to take after the above once is to. Click on trade market , choose the asset of your choice , then click on trade , enter the amount you want to trade and them click on open trade.

Thanks once again for reading through my blog

I couldn’t complete the screenshot of opening the demo trade account due to the reply I got that client are not accepted from my region which stoped me from setting up my profile completely.

I have to use write up to finish it up. Thanks for understanding.

Hi @chimezunem001

Thanks for your participation in the Steemit Crypto Academy

Feedback

This is good work. Well done with your research study on CFD trading.

Homework task

7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you prof@yohan2on for the feed back

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit