What is a cryptocurrency CFD

CFD means Contract For Difference. It is an arrangement made in financial contracts where the settlement prices are paid based on the difference between the trades from the point of opening to when it is closed. CFDs allow investors to trade using the movement of securities and financial investments from underlying assets.

Basically, CFDs are used by investors to forecast prices if an asset will rise or fall. When a buyer who is also known as a trader chooses to trade CFDs, it means they are entering a contract with the seller also known as a broker.

Here is how it works; a trader who expects a rise in price will buy the CFD while the other who expects a downward movement will sell an opening position. Peradventure the price increases, the trader will offer his holding for sale and the net difference between the purchase price and the sale price will be paid.

How do I know if cryptocurrency CFDs are suitable for my trading strategy

There is no measure of suitability to know if it meets your trading strategy or not but before you begin trading, you must do your due diligence by making some researches and getting a good understanding of it.

There are a few points to consider and they are as follows;

• You must understand that this is a very volatile market with many fluctuations and hence, trade with only spare money that won’t mind losing.

• You must have a good knowledge of leverage trading and margins.

• CFD helps users with low capital to leverage trading so if you do not have so much to purchase cryptocurrencies which are relatively expensive, then CFDs is for you.

• CFD is mainly for short term trading as traders have the flexibility to shorten the trading instruments without having

to worry about more costs.

Are CFDs risky financial products

Yes, CFDs are risky financial products. It comes with a high level of risk because it is leveraged and the investor may lose all his initial deposits. It is quite evident that cryptocurrency fluctuates a lot so if the price goes west as forecasted by the trader, he would be running on a loss. Due to the high risk, it may not be suitable for everybody and it is advised that only spare money be invested.

Do all brokers offer cryptocurrency CFDs

No, all brokers do not offer cryptocurrency CFDs. There is a list of the best brokers and they include:

eToro

Swissquote

IG

City Index

AvaTrade and a list of others.

How can you trade with cryptocurrency CFDs on one of the brokers using a demo account.

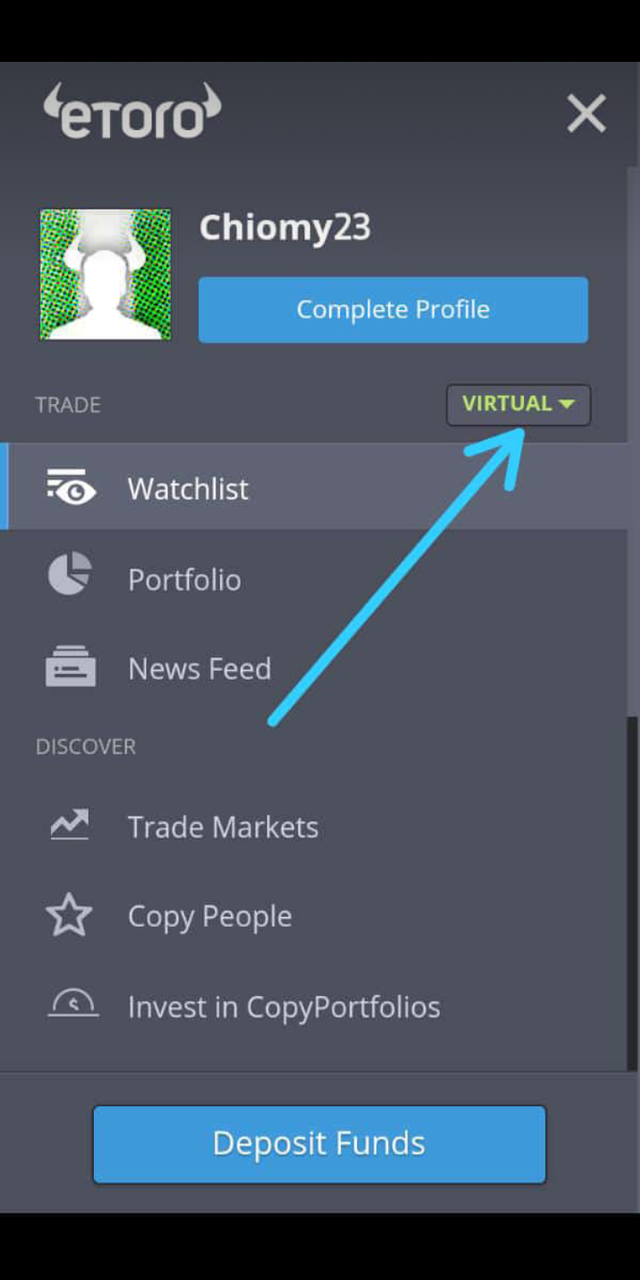

I opened an account on eToro. I set up the account on virtual which means it is a demo account.

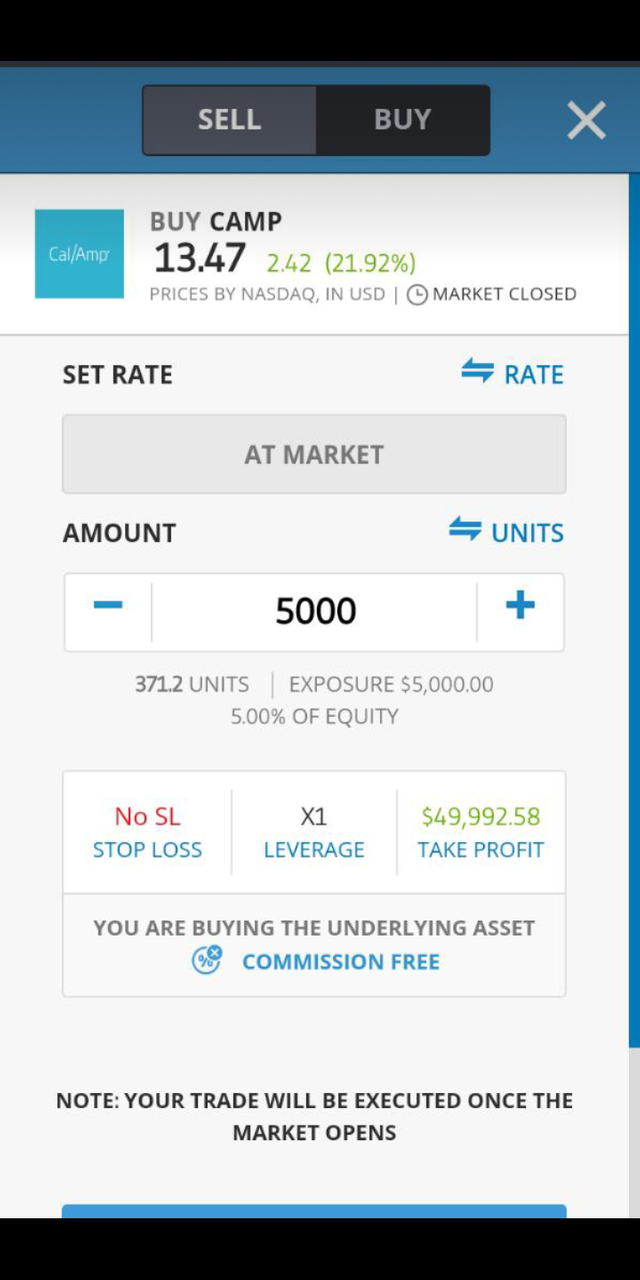

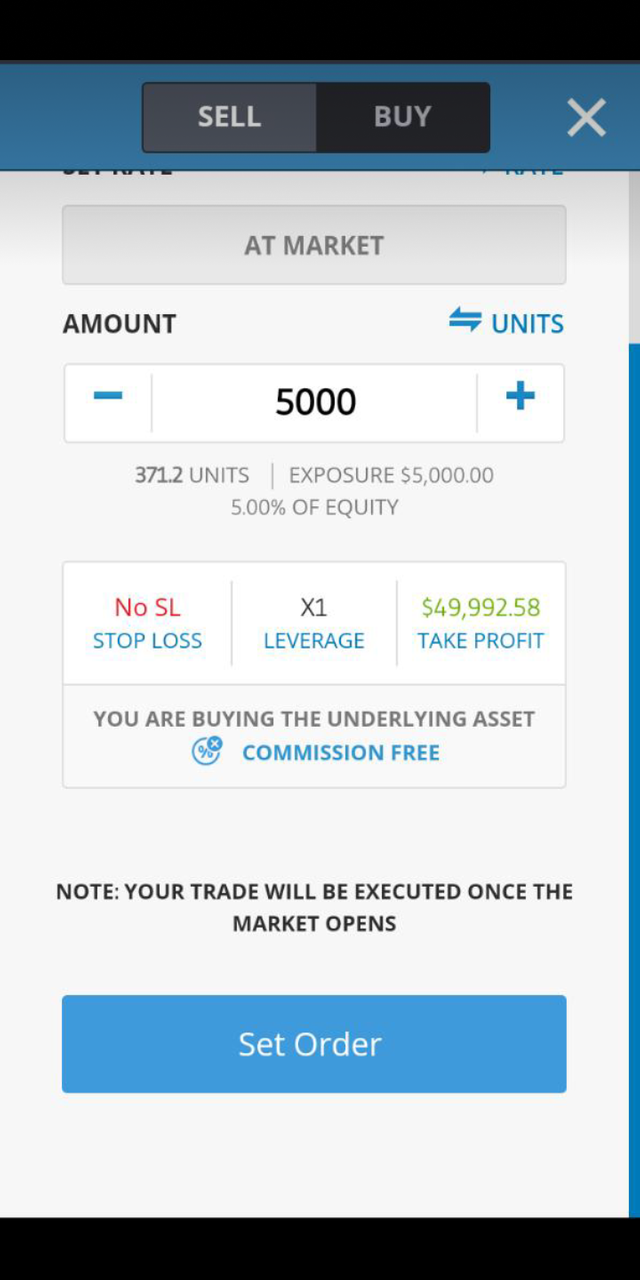

I am going to buy CAMP so I buy #5000 worth which gives me a total of 371.2units at a price of 13.47.

Thereafter, I set the order and if the prices increase above my opening price which was 13.47, I will be making profits and if it decreases, there will be a loss.

Note that the trade couldn't be executed because the market is closed (this is because I did this today being Sunday).

All unsourced photos are my screenshots from my eToro account.

Conclusion

CFDs are high risk and very volatile hence investors much to take risks they can bear and trade with spare money. A huge profit can be made as well as a huge loss so one must tread cautiously.

Hello @chiomy,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 5/10 rating, according to the following scale:

My review :

It is just average work done. Please put more effort into your work.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit