My Aversion To Risk?

Well judging from the class i think personally i have a moderate tolerance to risk, yes i do accept or welcome trading in a violatile market with huge amount of asset if available because we want the profit and knows that no "risk no reward". But inasmuch as i have the stomach to enter a violatile markets there is limit to how far i go or how much i may be willing to invest in an extreme violatile markets. So my risk aversion is moderate tolerance to risk.

The product That Most Appeals To Me

Being a kind of person who has moderate risk tolerance i would go for fixed savings. Yes with fixed savings i think it offers much more returns than flexible savings. Yes there is much interest rate and it also comes with it own risks in that one can't access his asset locked away until the alloted time unlike in flexible savings. And while also asset is locked away we can't sell it or set stop losses which means even though the market is going sideways or down we can't be able to take back control of our asset until the appointed time which may lead to depreciation in the value of our asset which if it was in flexible savings which though offer little returns we could access our asset at will.

So generally fixed savings offers much return and much risk as well but for someone like me who has a moderate risk tolerance i find it more appealing.

What is Flexible savings

Flexible savings lets us earn interest on our funds.

Yes as the name entails "flexible" it indeed offers great flexibility in that while we could easily deposit our funds and earn interest we can as well easily access or redeem it.

It's just to me a seeming ideal way to hold our asset than keeping it on spot wallet where no interest is added.

What Is Fixed Savings

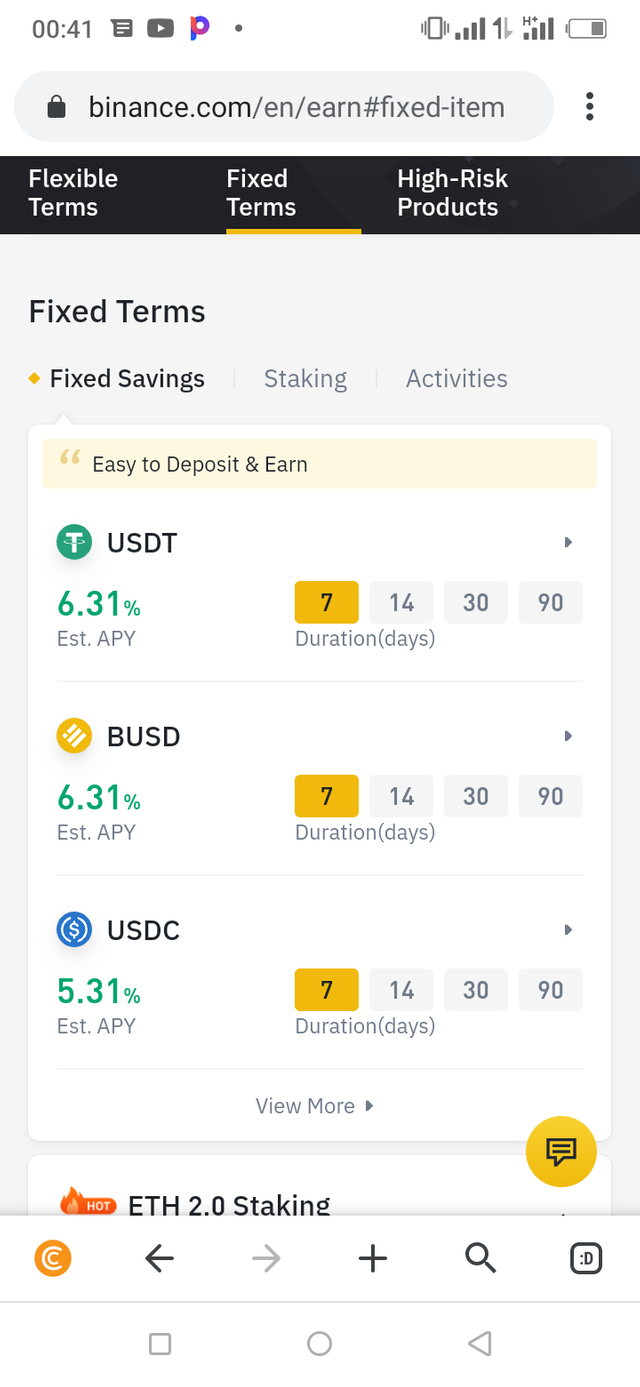

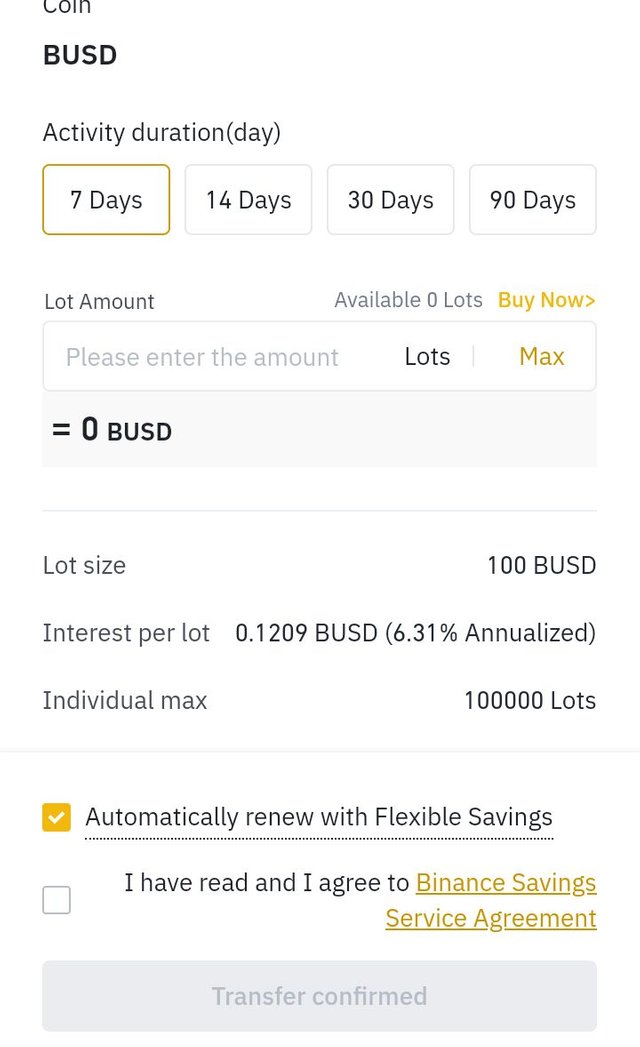

Well fixed savings is just like flexible savings in that it offers us interest on our funds. The only difference is that the interest returns on fixed savings is much higher than with flexible savings. It is no suprising then since with fixed savings there is a set upon time we could only access our funds after it has accrued interest which is why the interest rate is more attractive than that of flexible savings.

But in fixed savings we can't access our funds easily like we would on flexible savings until the appointed time or date which generally span from 7 to 90days depending on which plan we subscribe to? But then the higher the days the higher the interest rate being accumulated.

High Risk Products

One on such product is Dual Investment which offers higher risk and higher reward unlike fixed and flexible savings. These type of product for me are for people who has an aggressive risk tolerance.

Now this deals with two underlying asset. It offers opportunity to earn no matter the price movements. This one works in a way that we deposit our crpto, locked away like in fixed savings but unlike in fixed savings if the value of our asset inceases we stand a good chance to make more returns i think.

Launchpool

In my own simple understanding or words as the case may be. Launchpool is a way of locking up crptocurrency which Could be BNB or BUSD or USDT etc, to be able to get a share on new tokens being launched on binance. It's a geat way to earn income passively.

My Choiced Investment

Now my choiced investment is fixed savings, to set it up we open binance

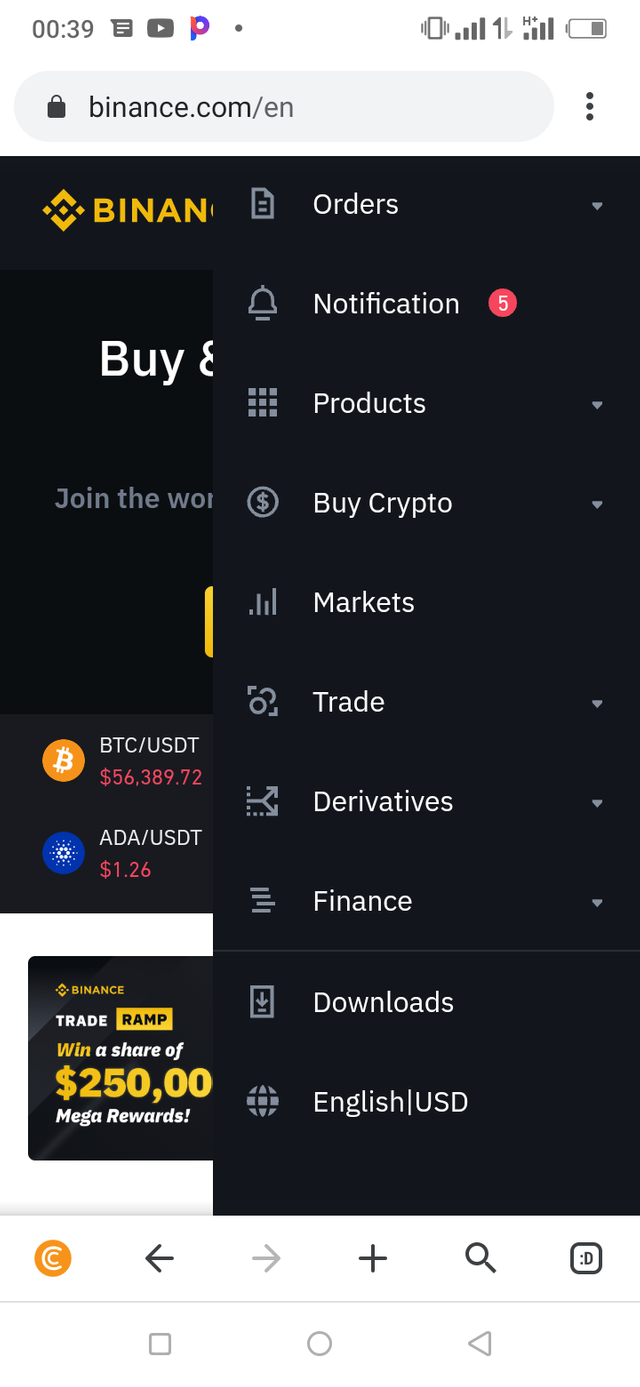

Now we click on the three dotted lines on the top right corner.

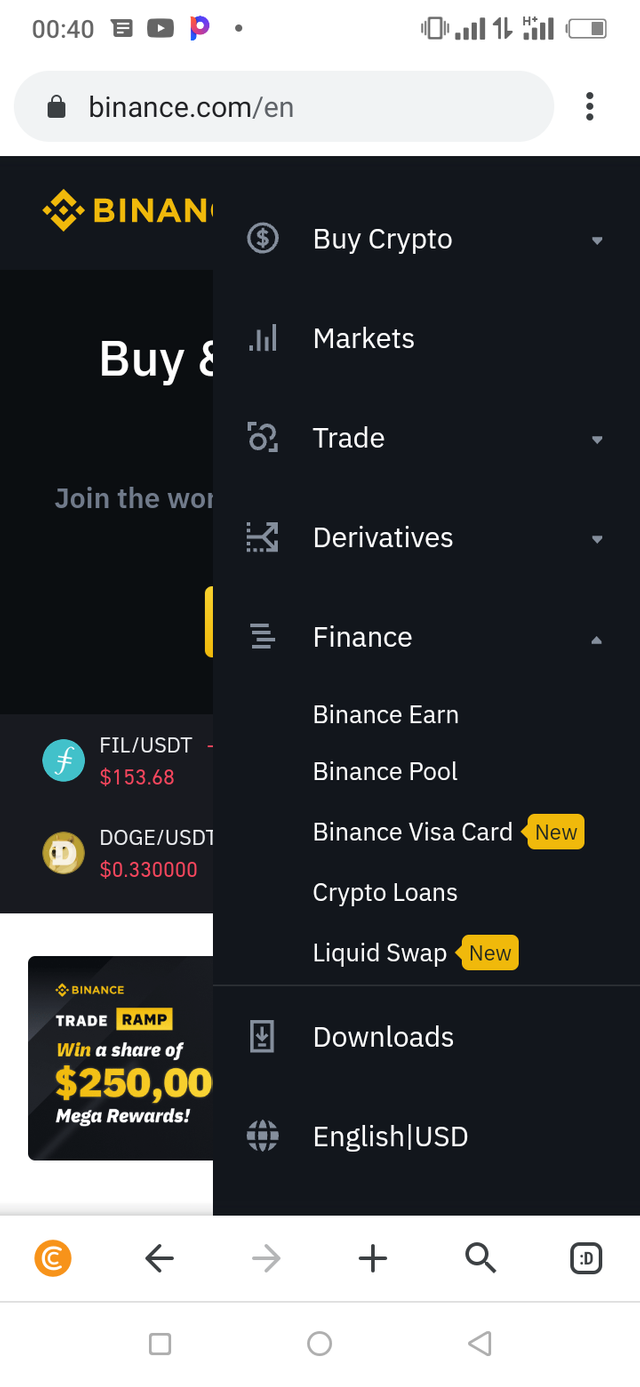

Then we click on finance, a drop down menu will show then we click on binance earn.

When we do the we would arrive here

Then we chose fixed terms, chose fixed savings. Click on our desired asset and transfer funds the we

Input the amount we are saving and duration. Click comfirm.

Thank you for being part of my lecture and completing the task!

My comments on your work:

First task was ok and well explained your position on investments.

Second and thirk task were a bit brief and, when it comes to high-risk products, I'm not that sure if you completelly understood the essence of it!

General comment:

It was ok, but some senteces were too twisted to understand, try to make it more simple for next time. Also, it'd be nice if you paid some attention to markdowns, as it helps you polish your work!

Still, it was good!

Overall score:

5/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks alot, it means alot that overall atleast i got a pass mark

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit