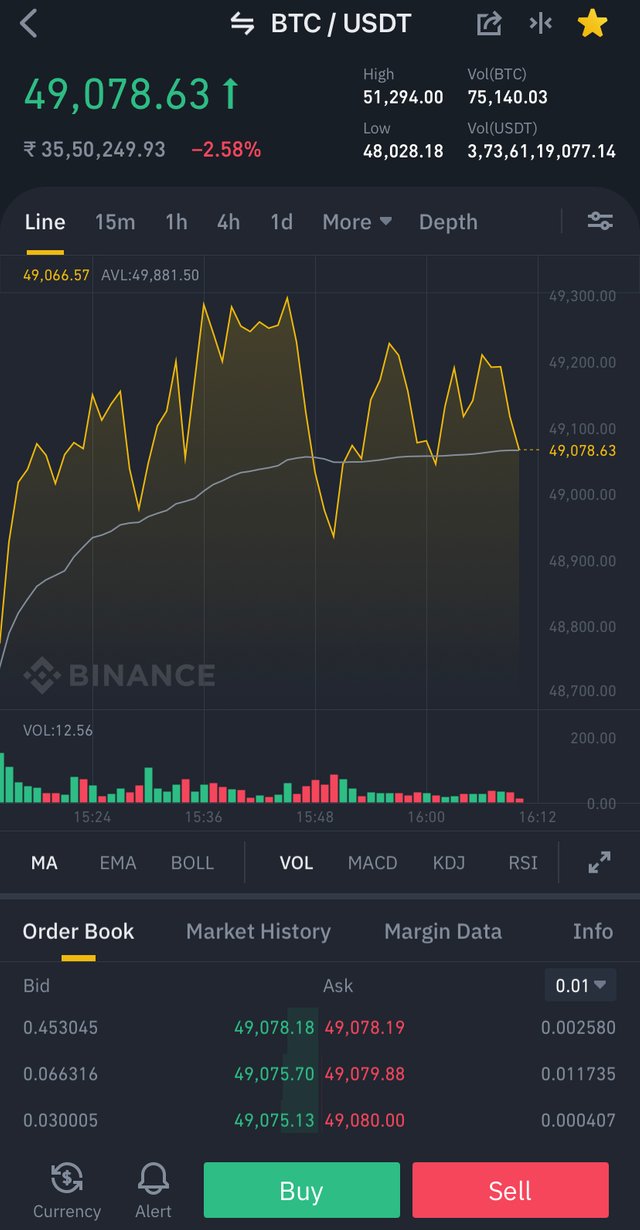

Screenshot of Binance Spot Trading Chart

What is Spot Trading?

A spot market is any place where you can trade (Buy or Sell) your cryptocurrencies with different users. Each transaction are settled at once or “on the spot” and this is why it's called the name spot trade. All spot markets are composed of buyers, sellers, and an order book. Buyers input the marketplace with a selected bid or buy rate, that is the most amount they want to spend. Conversely, sellers enter the market with a particular ask or sell price, the lowest amount they want to sell their asset for. The order book is the listing of all of those bids.

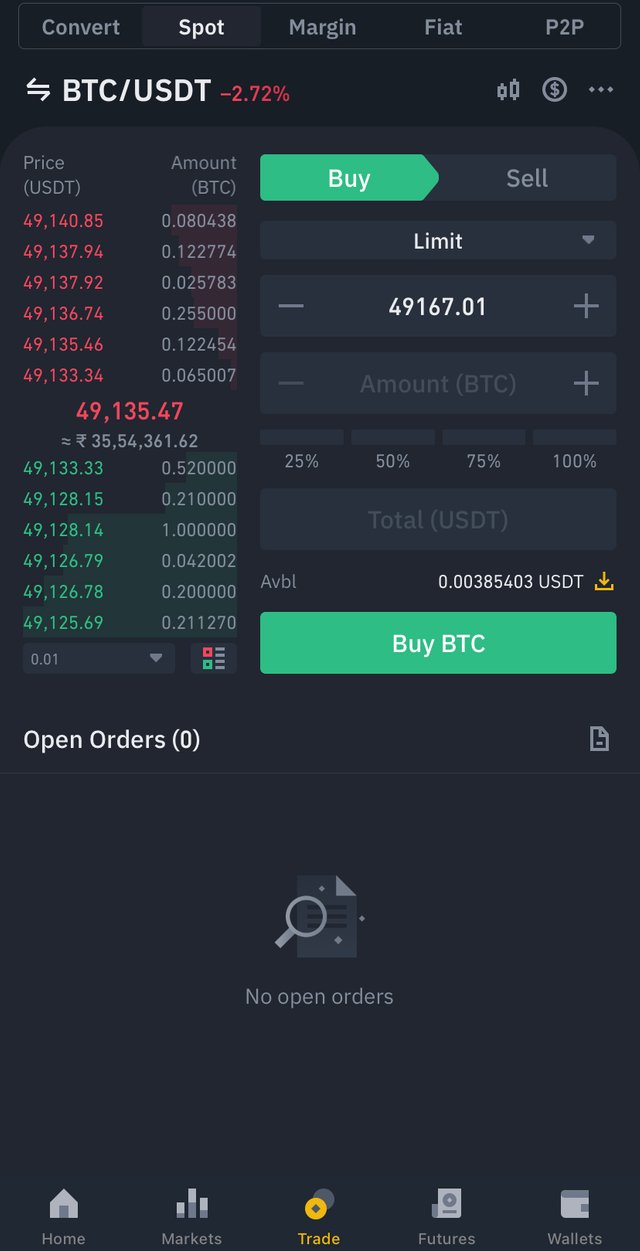

Screenshot of Binance Spot Trading Order Book

Bitcoin Spot Trading Order Book

The photo above is a snapshot of the BTC/USDT spot market order book. In this particular market, you could buy BTC with USDT or you may sell BTC for USDT. You may see BTC for buy on the nice charges that sellers are currently willing to sell for. In green, you can see the maximum fees that customers are ready to buy BTC, once more bid in value in BTC. The BTC column suggests how many BTC is supplied for each fee, at the same time as the price of USDT column suggests you the way each amount is well worth in.

In simple terms, you can consider a spot market as a place wherein trades are made immediately. Since the trades are settled at once, the cutting-edge market rate of an asset is regularly known as the spot price. As soon as your orders are filled, your cash can be swapped right away. Spot Trading is one of the easiest methods of buying and selling cryptocurrencies.

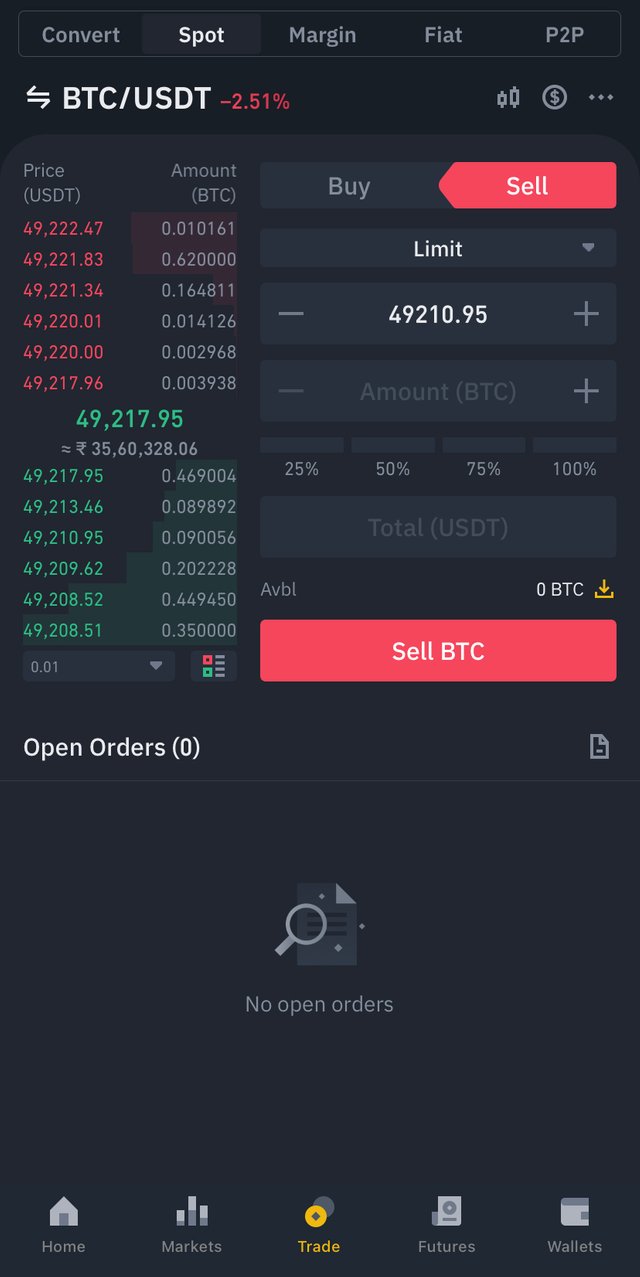

Screenshot Buying on Spot Trading

Takers and Makers

Taker

If you place an order that trades right away, by means of filling partially or fully, before occurring on the order book, those trades are called taker because it takes quantity off of the order book, and consequently known as the "taker."

Maker

Whilst you place an order that goes into the order book partly or fully, any subsequent trades coming from that order will be called maker, because it upload quantity to the order book, supporting to "make the marketplace," and are therefore termed the "maker" for any subsequent trades.

When you place an offer, its remain in the order book until sellers accept to sell their BTC to you at your choice price. It is called limit order.

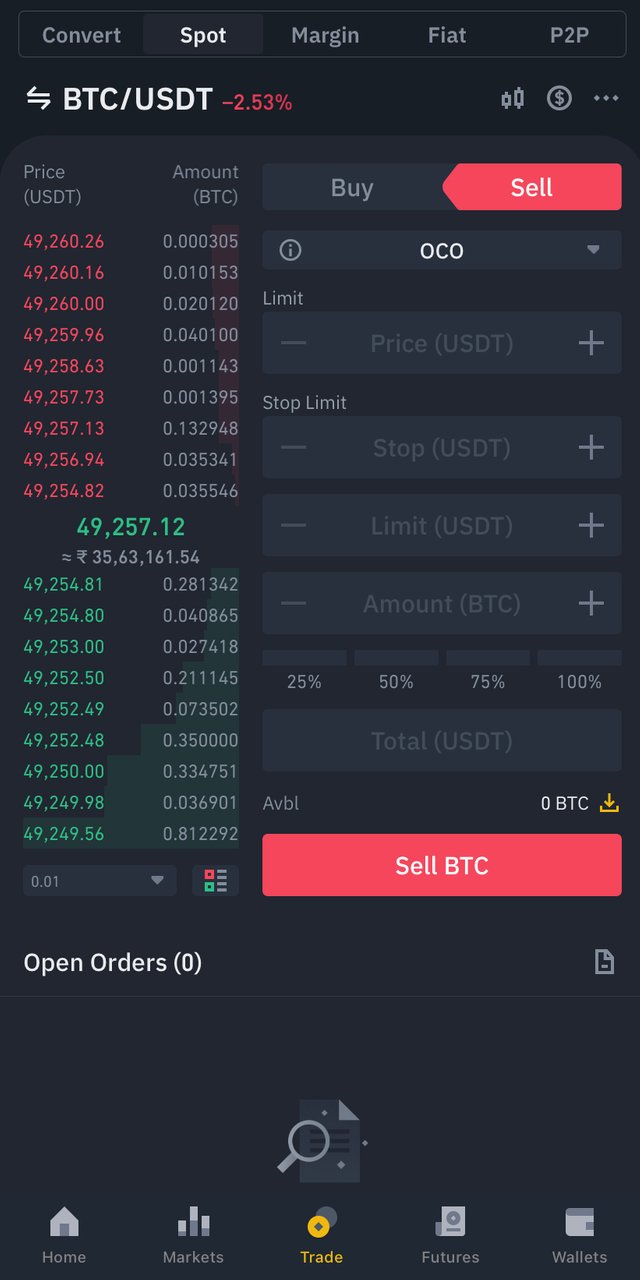

Screenshot of Selling on Spot Trading

Limit Order

A Limit Order will be carried out at a set or better price, after a set stop price has been achieved. When the stop price have been is achieved, the prevent-limit order will become a limit order to shop for or sell on the limit price or higher.

Stop price If the market asset price gets to the set stop price, the stop-limit order will proceed to buy or sell the asset at the set limit price or better.

Limit price The set price that the stop-limit order is to be performed.

Market Order

Market order provide you with the opportunity to make a transaction immediately at the current market price.

OCO

This a process where by One-Cancels-the-Other (OCO), for example two orders are combined together, a stop-limit order and a limit order. If any of them is executed then stop price will be triggered for stop limit order,and the other will be automatically canceled.

Advantage of Spot Trading

It provides opportunity for lower value buying. it is a good place for those who want to buy right now. Assets are delivery and the transfer takes place immediately transaction is completed. The spot price is the actual market price.

Disadvantages of Spot Trading

This greatest disadvantage of spot trading is the rate of price fluctuation that have always created panic in the market

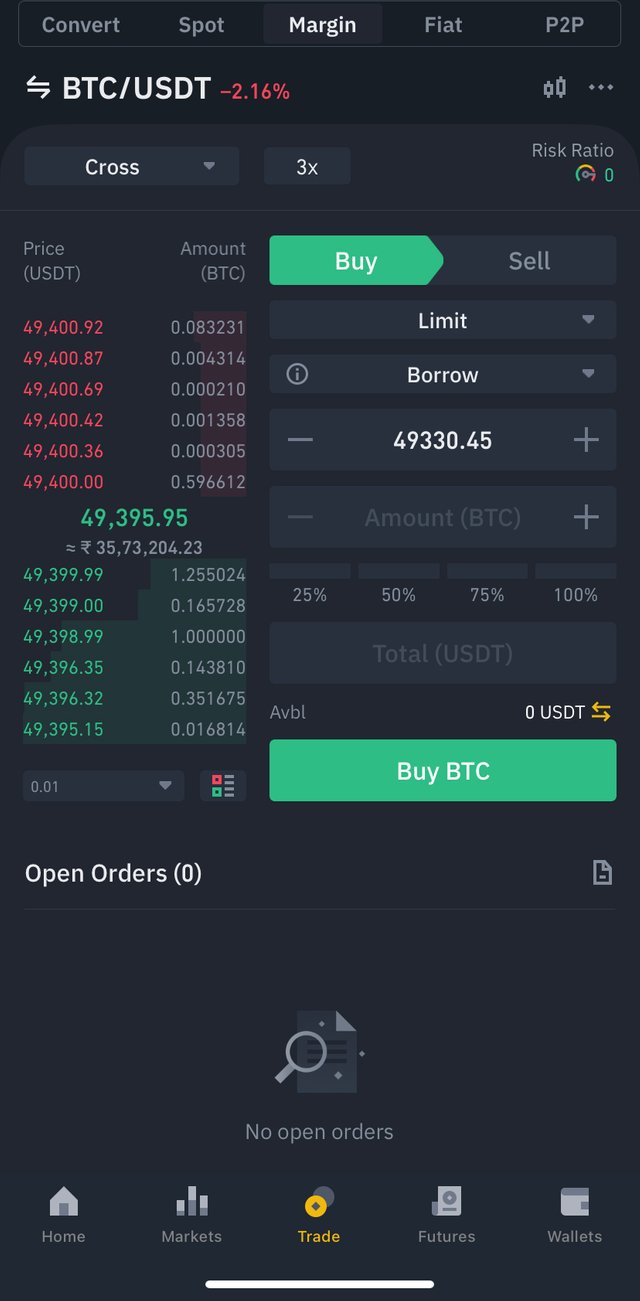

Screenshot_20210223-001806.png Binance Margin Trading

MARGIN TRADING

Margin trading is a system of trading crypto assets with borrowed funds after providing a collaterals, which is to be pay back with interest. It also allows you to get huge capital to leverage positions. Margin trading also multiples your trading so that you can get greater profits on your trades.

Markets & Trading

In Margin Tading, Traders orders to buy or sell assets from spot trading. This margin orders are put together with orders in the spot trading. It's of great important that you understand that margin orders are also spot orders.

Leverage

The good thing about Margin Trading is that traders are provided with atleast 3X~10X leverage assets. Depending on the platform you are trading on and also base on your mode of Margin Trading (Isolated margin or Cross margin mode).

Advantages of Margin Trading

One of the greatest advantage of margin trading is that you can make larger profits because of the greater value of your trading positions. It can also help you to diversification, as you will have the option to open different positions with little investment capital. Margin Trading makes it easier to open positions without having to move large sums of money to your accounts.

Disadvantages of Margin Trading

One of the greatest disadvantage of Margin Trading is that it increases losses just as it can increase gains. In Margin trading, there is a possibility that your losses could exceed you trading investment. It can be called a high-risk trading format. A drop in market price can result huge losses, based on leverage in that trade. It's also of great important that before you invest in margin trading, you must use risk management tool such as stop-limit orders.

This my Introduction post here

I thank you @besticofinder for this Lecture

NOTE: All images here are screenshots by me from my Binance wallet app

Thank You

Cc:-

@besticofinder

@steemcurator01

@steemcurator02

Hello @chotu1 ,

Thanks for submitting the homework task 3 ! This is a perfect work ! Everything is well explained with screenshots ! A good guide for anyone !

[8]

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks professor but sir professor steemcurator02 is miss my post to check what can i do for that

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit