- What is Zethyr Finance?

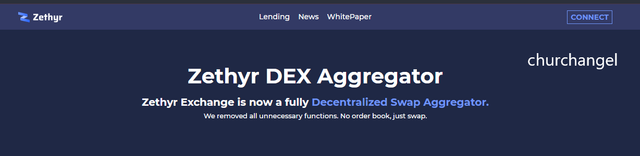

Zethyr finance is a fully decentralized exchange founded on the 8th of August 2019 built on the Tron blockchain to facilitate features such as swaps, exchanges and loans of assets to be paid back or to pay back With a certain interest or APY.

On the Tron blockchain, Zethyr finance stands out for its features such as lending and being lent assets although it is not the first it had a predecessor like the

⁃ Cred

⁃ Just lend e.t.c

The Zethyr finance stands out for its use of its own token Ztoken and its interoperability with other exchanges, for instance, the Zethyr platform can be linked with Binance exchange via APIs, and transactions from Binance can be verified if connected to other exchanges, it also features an outstanding 0.1% transactions fee of the transactions.

Zethyr finance accepts assets such as USDT, TRON, BTT e.t.c to be used as collateral by lenders on the platform which is switched for Zethyr Tokens of equivalent value on the platform. The Zethyr doesn't connect the lender and the borrower together they interact with each other having the Zethyr Smart contract act as the middle man, The lender deposits assets to smart contract while the borrower borrows from the smart contract with conditions attached

What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Zethyr Finance houses a number of features some of which include

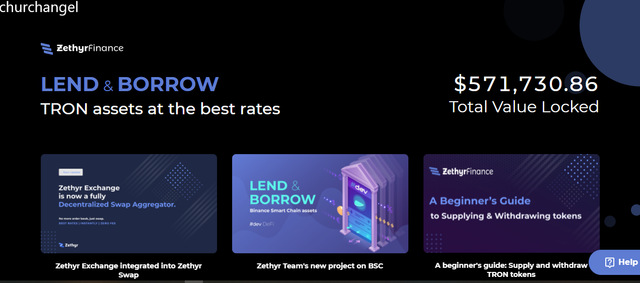

- LENDING

- EXCHANGE

- OWN TOKEN

- LENDING

Although it’s primary purpose was to serve as a Decentralized exchange alternative for Tron blockchain users but it’s Lending feature is what I believe it is most known for. Individual can lend assets such as Trx, USDT, BTT e.t.c to other users in need by supplying liquidity to its pools and interacting with smart contracts to earn a certain portion of their initial lent asset after a certain period of time. Those looking to borrow would of course have to have a certain amount of staked away in the blockchain as collaterals which can be used to rebalance and liquidate in case of delayed or no payment which is set to occur once in every 24 hours so as to ensure the lenders get their interests not daily or immediately but eventually.

- Z-Tokens

The Zethyr platform makes huge use of its Token for most transactions performed in the blockchain, For instance users who lend out their asset usually accure interest and are paid via the Platforms official native tokens, Some of the official tokens include

- Ztrx

- Zwin

- Zbtt

- Zusdt e.t.c

transactions on the platform usually accure very low or no charges at all hence most transactions performed are done in the platforms native tokens including collaterals. These tokens were built to the ERC-20 Standard so their useability is not just limited to the zethyr platform.

- EXCHANGE

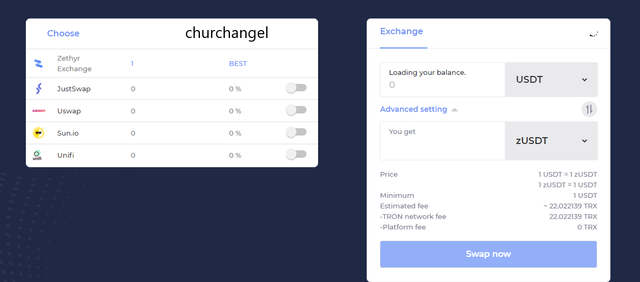

The Zethyr platform features an instant exchange where one can swap or exchange asset for Z tokens or other tokens and vice versa as they have a pegged value equivalent to each other i.e 1zUSDT = 1USDT, 100 trx is = to 100zTRX .

Stable swap

Although the zethyr finance has a limited number of stable coins that can be swapped, this feature enables cross chain swap of asset for instance one can swap between the ERC20 USDT to a TRC20 USDT, the assets are pegged at the same value so one doesn’t end up will loss when swapping cross chain

What's your understanding about DEX Aggregator?

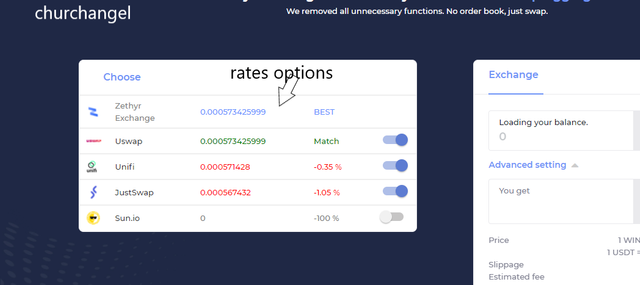

DEX AGGREGATOR

To the best of my knowledge a dex aggregator is seen when different exchange rates or market offers are placed in one place and the best is used, the dex aggregator sources liquidity from top exchanges out there and provide a user willing to exchange with the best exchange rate for that asset.

This implies that different exchanges information is bieng combined and presented via a single medium to avoid or reduce stress of having to go back and forth looking for the a better rate than the one your usual exchange is not offering. The Zethyr financial plaid a typical example of a dex aggregator as you can see from the image below it displays a list of rates and gives you the best and the ones close to the top tier in rates

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

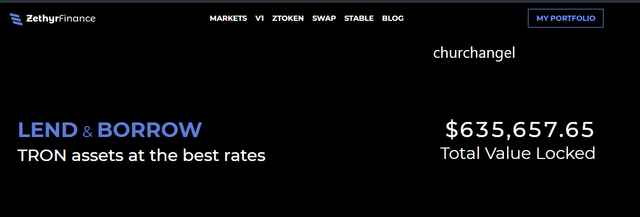

In order to be able to properly explore the market one has to add the tronlink extention and connect it to the platform after which full access to the platform would be possible.

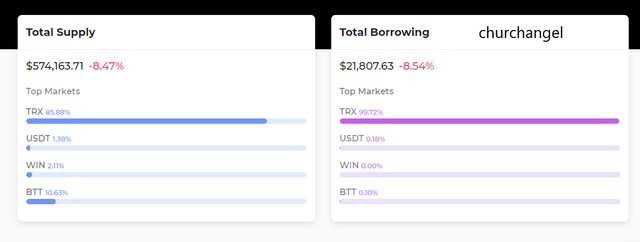

Zethyr

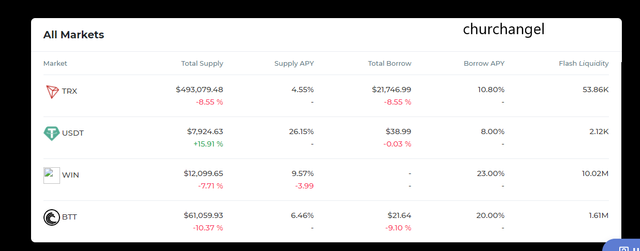

The platform has a total supply of $574,163.71 worth of assets with tron accounting for 85.88 percent of the assets and a total borrowing supply of $21,807.63 worth of assets of which tron accounts for 99% of the assets borrowed.

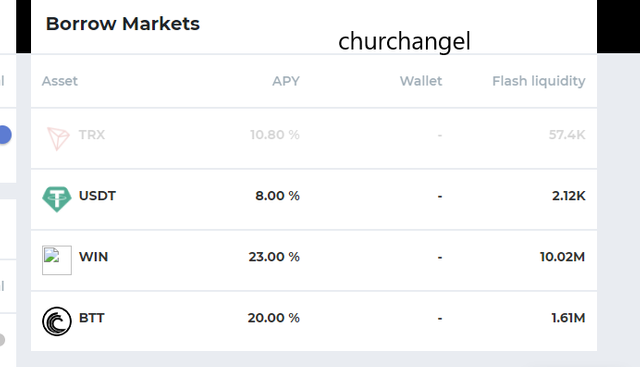

At my point of exploraton of the market the assets with the highest liquidity happened to be WIN with a flash liquidity of 10.02MIllion and a whooping 23% Borrow Annual Percentage Yeild and a total supply worth 12,099.65$. The USDT asset has the highest supply Annual percentage yield of 26.15% with a total supply worth 7,924$ and a borrow annual percentage yeild of 8%

- Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

I will be guiding you on how to link the Zethyr platform via Google Chrome

- Step 1

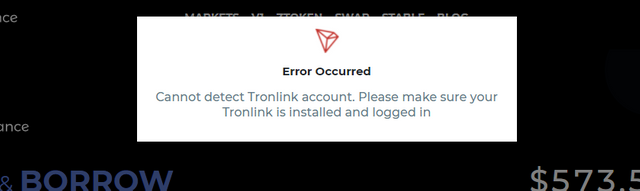

So if you attempvto link your account without the tronlink extention installed you wuld get this error

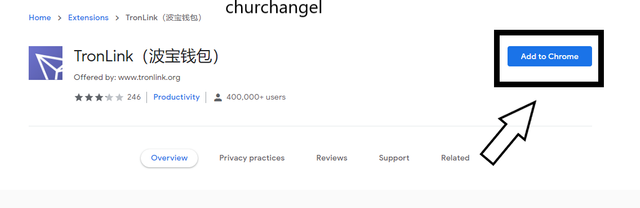

To install or add the tron link Extention click the link below to download it from the google chrome webstore

link and click install as indicated below

- STEP 2

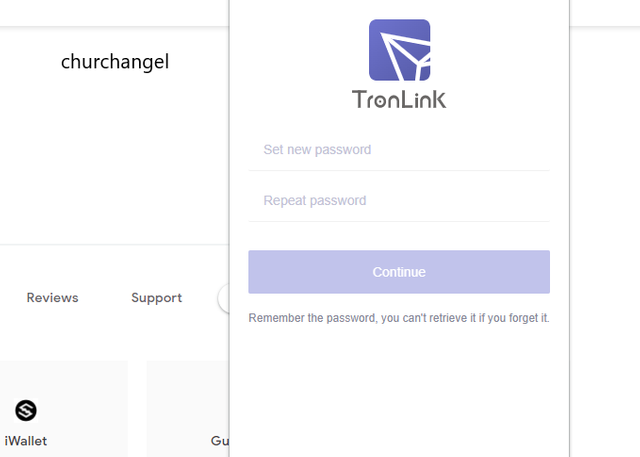

After succesfully adding the Tronlink to your extentions . YOu would be required to enter your account security password for verification before log in or transactions

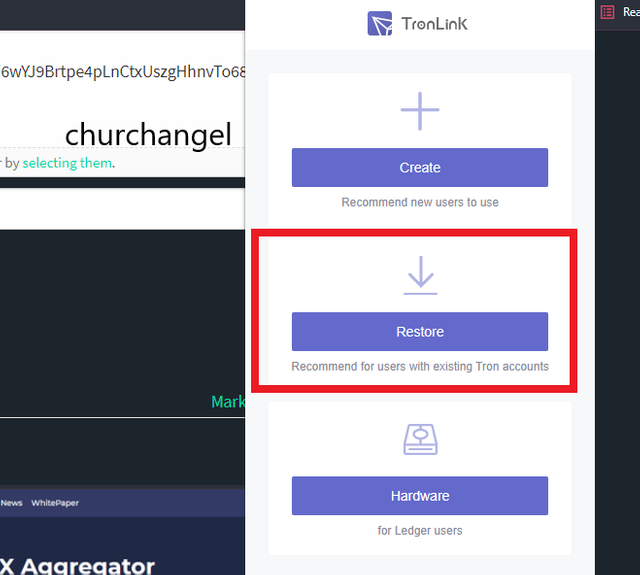

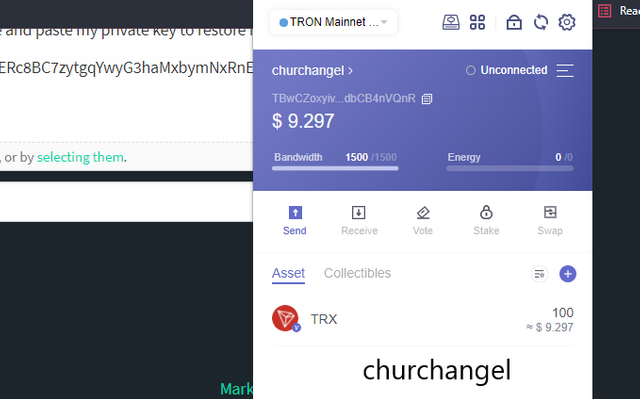

Since I had an account already I would select the restore and paste my private key to restore my account as seen below

after pasting my key my account was restored

- Step 3

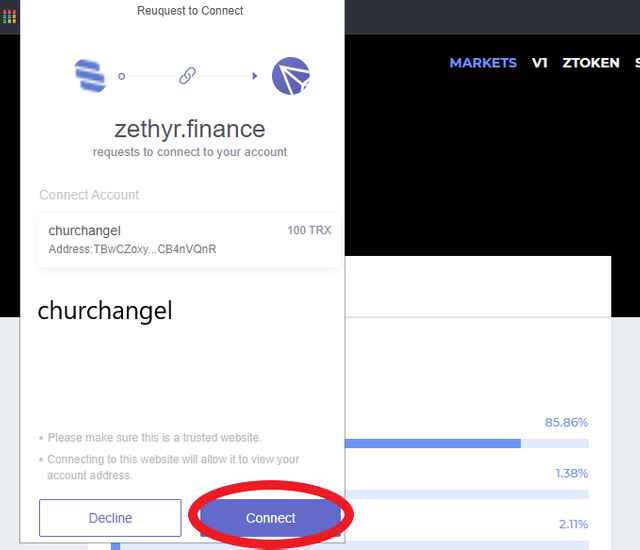

This last step would simply require you to go back to Zethyr page and click on connect on the prompt that will appear. as shown in the images below

For confirmation, your wallet address will appear on the zethyr homepage

- Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

The Zethyr token conforms with the Tron blockchain TRC-20 standard, it was developed to serve as the Zethyr platform native token which can be used by its users for transactions back and forth with minimal transaction fees. The Z-token is minted upon deposit with a value equivalent to the initial deposit asset I.e value is pegged on a ratio 1:1, 10 USDT Is equivalent to 10 ZUSDT, 10 TRX is equivalent to 10 ZTRX e.t.c the Z-tokens are minted when a user deposits his asset for minting and when a user wants to reverse the token back to its original form the Z-token get burned and are converted back its initial form with an equivalent value

Actions such as providing liquidity, lending out, borrowing e.t.c are done by the Z-tokens and interest accumulated over time is paid directly by the Zethyr platform to the benefactors wallet only in Z-token

ANOTHER TOKEN

JToken/Just lend

source

The Just-lend token is a TRC-20 token which is built and functions on the Tron blockchain,like the Zethyr platform the objective of the protocol is borrowing and supplying. The Just lend protocol supplies borrowers asset from their pools and is done via the platform native token J-token and interest are paid to the suppliers in the native token.

Borrowing on the platform requires the borrower to first of all has done Jtokens which will serve as a collateral and interest rate for payback will be depending on the market, if a user on the Just lend platform exceeds his amount the platform will liquidate his collateral via smart contract hence ensuring suppliers will always get their interest

- Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

To perform a transaction like supply on the blockchain click on the link which will take you to your portfolio page

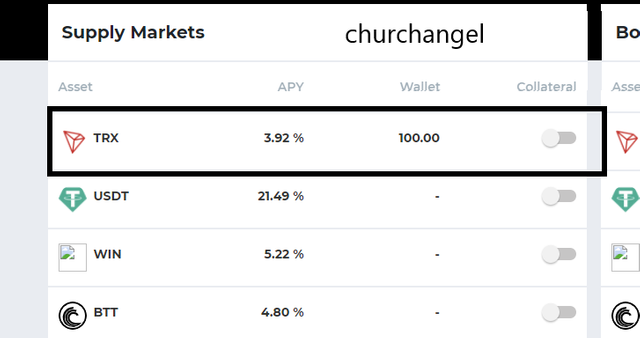

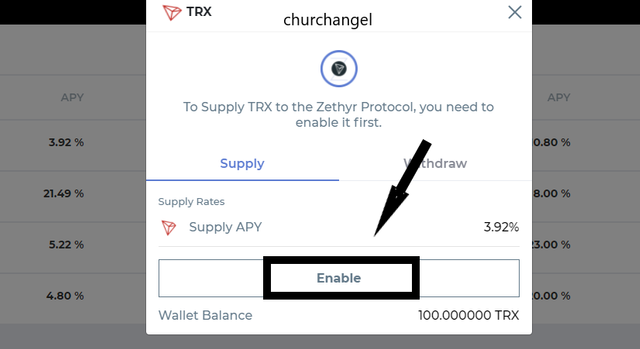

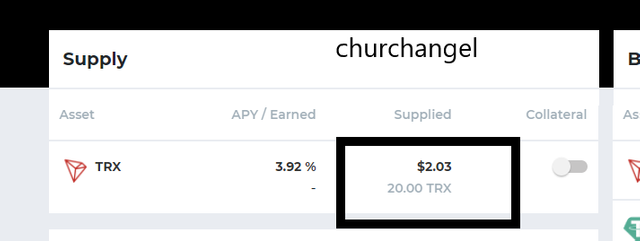

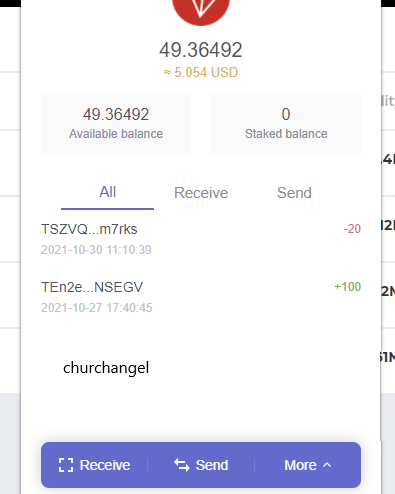

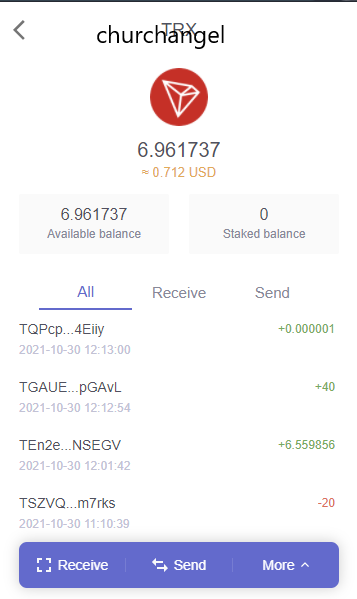

- Select the asset you want to supply or borrow from. in my case I will be supplying 20 trx to the market

- After which I had a prompt page to confirm that I want to supply to the protocol.

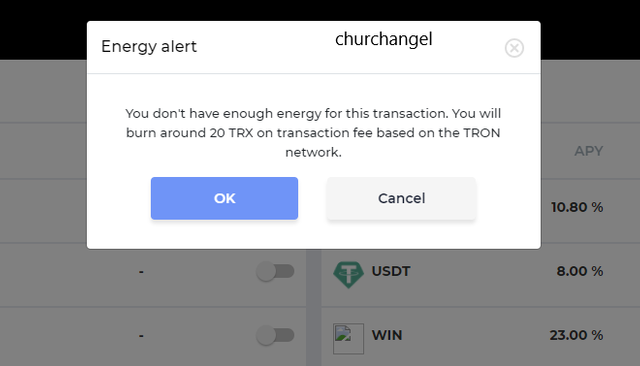

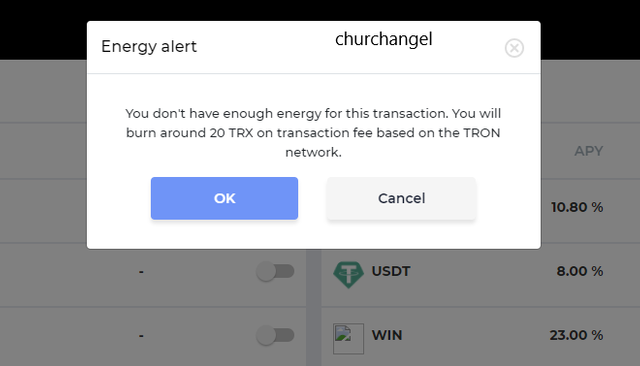

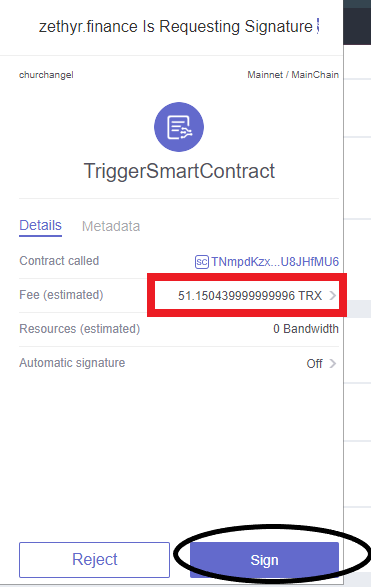

- A prompt for energy came up to confirm if I want to burn 20 trx for the transaction. Altough I was charged 31 trx for the action

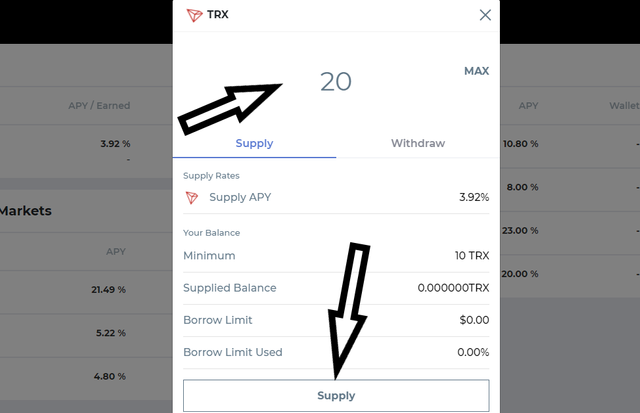

- After confirming I inputed the number of trx I wanted to supply and confirmed

Screenshots provided below

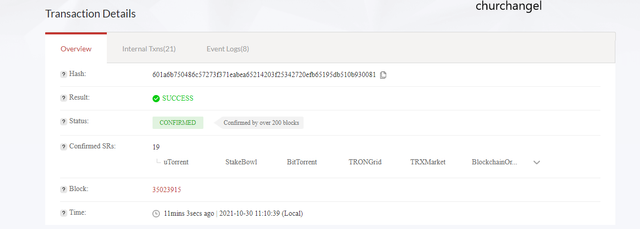

The transaction carried out had a hash

601a6b750486c57273f371eabea65214203f25342720efb65195db510b930081

- Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

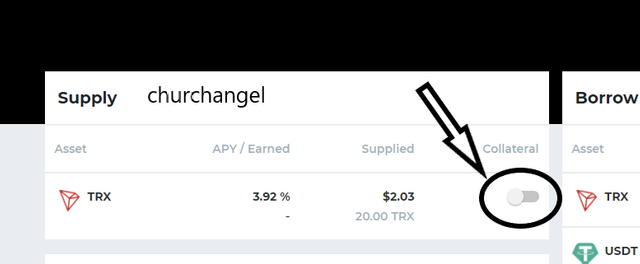

- COLLATERALIZING

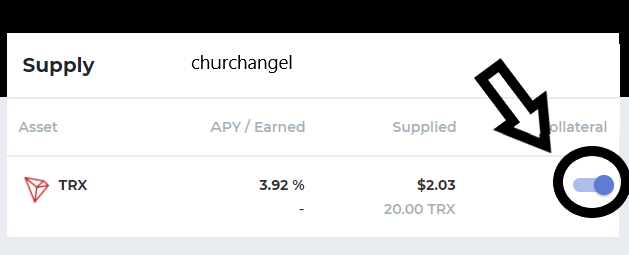

Collaterizing of assets on the zethyr platform can only be done after one has some amount of asset supplied to the platform.

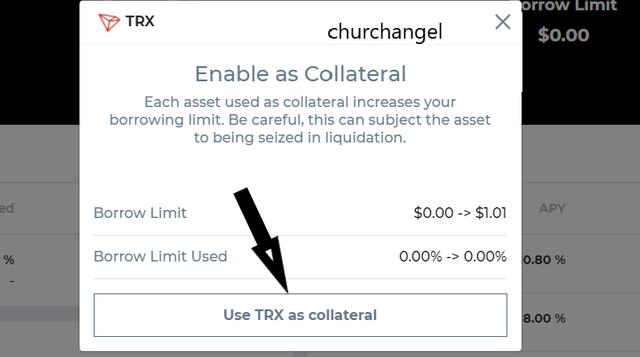

- Go to your portfolio and click collateralize a pop-up page will appear to approve that you want to use your supplied asset as collateral, in my case I approved that I wanted to use the supplied trx as collateral

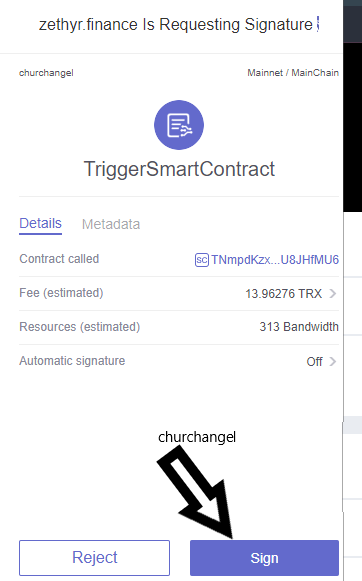

- I got a prompt for energy consumption which was supposed to consume to Trx but only took 13 trx

- After which I had to sign the transaction on my wallet extension steps as indicated in the image below

- BORROWING

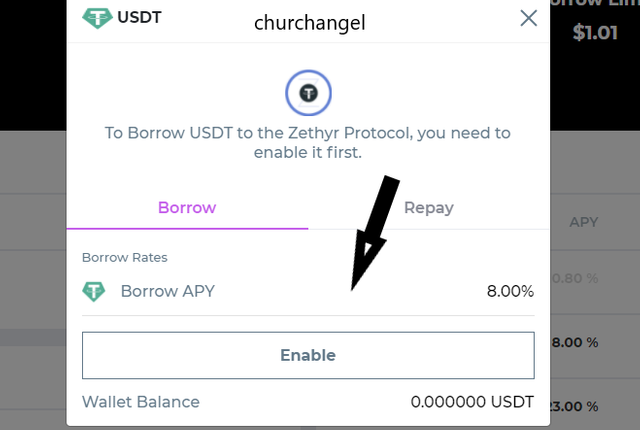

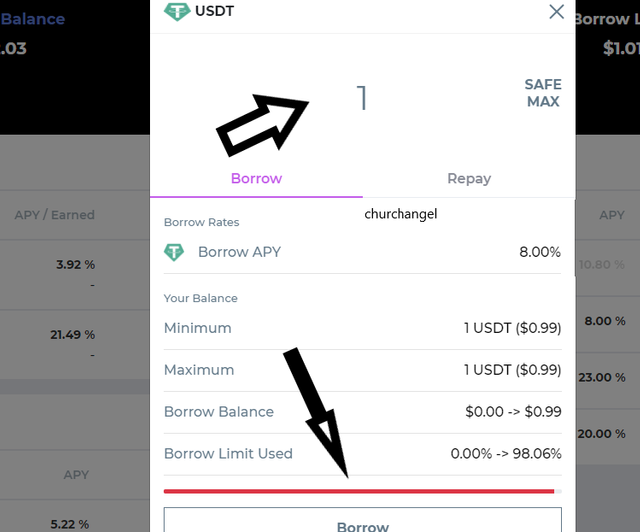

To borrow on the zethyr platform one would have to first collateralize an asset and the asset used as collateral cannot be borrowed. In my case, since I am using TRX as collateral I can not borrow TRX again, so I would be borrowing the USDT since it has the lowest APY of just 8%

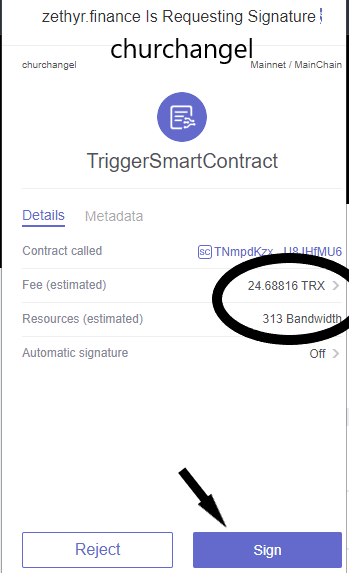

After repeating the steps up to 3 times burning 153 trx on this phase I was still not borrowed the asset. i initially started with 100 added an extra 90 then 6 trx and lastly, 40 all were burnt in the last phase and I still was not borrowed the USDT asset.

8- What do you think of Zethyr Finance? Is it great or not? State your reasons.

The Zethyr finance is a great platform for reasons such as

⁃ interest up to over 20% APY can be accumulated by an asset supplier over time which is a typical example of earning passively while you sit and do nothing.

⁃ The Zethyr platform unlike other platforms features an outstanding minimal transaction fee of 0.1% for practically almost all transactions carried out in the platform ( buying and selling )especially does carried out in the native token

⁃ Users in the platform who are in urgent need of assets can lend from the platform smart contracts and pay back after some period of time with a certain percentage of APY attached depending on the assets borrowed and how long.

⁃ The platform has a feature called rebalancing which is usually carried out every 24hours, this feature allows the platform to provide liquidity, to ensure paid interests to suppliers and provide maximal output of yields

⁃ The Zethyr platform to automatically monetize users who have tokens who are just sitting there to provide interest to the holder by staking such assets in the pool to provide liquidity and yield interest to the asset holder

CONCLUSION

It’s perfectly normal for one to run out of assets to urgently use to undertake some necessary transactions and would be some coins short, the Zethyr finance provides its users with assets on the go but along with some conditions like some certain percent additional asset on repayment. Although I performed a transaction thrice at a cost of 51 trx per and was not granted the asset I requested for I want to believe this is not a norm as I followed the professor's exact steps.

cc: @fredquantum

cc: @churchangel

All screenshots except indicated otherwise were gotten from Zethyr

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit