DEFINE AND EXPLAIN IN DETAIL IN YOUR OWN WORDS, WHAT IS A "TRADING PLAN"?

By way of definition, a trading plan is a personal, written and practical guide which a trader must follow incessantly until he has achieved his objective behind the plan. One exciting thing about a trading plan is keeps the trader focus on his trading strategy and when walking in tandem with a trading plan it helps a trader minimize a lot of profit.

Now applying trading plan concept to cryptocurrency trading is a very important strategy every which every investor must not do without being that the crypto market is a volatile one that keeps fluctuating at every point in time. With regards to the volatile nature of a cryptocurrency, it becomes very pertinent for investors not to deviate from their trading plan as well as sticking to his risk management level. The main essence of having a Trading plan is so that the trader can be properly guided so as to maximize his profits and reduce his loss to the barest minimum.

Every trader has a Trading plan peculiar to him as well as his training strategy. By this, i mean that a long term investor cannot employ the same trading plan peculiar to short term investors and for that reason, there are so many questions to be considered before mapping a trading plan such as:

What is his trading plan?

What is the initial capital?

What timeframe could be suitable for his teasing plan?

What is his risk management level?

What time limit to achieve the goal?

Mapping a trading plan does not mean that the trader can not incur loss but it tends to reduce loss to a great extent. By virtue of a Trading plan, investors get to understand the Trading strategy that works for them and stick to it. He also make his Trading decisions as to when to enter or exit the market, take profit or stop loss relying on his Trading plan.

EXPLAIN IN YOUR OWN WORDS WHY IT IS ESSENTIAL IN THIS PROFESSION TO HAVE A "TRADING PLAN"?

There importance of trading plan is not only important to cryptocurrency traders. It is all encompassing having plan irrespective of what field or profession. I will be outlining the importance of trading plan in this profession.

Trading plan keeps a trader focus on profit thereby limiting his entries per time: traders who have trading plans tends to trade relying on their plans so he does not run around looking for promising trades to embark on since he has his achievement written down to follow.

A trading plan streamlines a trader to his strategy: So imagine a trader whose trading strategy is short who goes around employing technical and fundamental analysis most favourable to long term investor, he will end losing his assets as a result of losing focus on his plans.

The success of every trader can be attributed to his trading plan. A trader who refuses to be backed up by Trading plan will likely be susceptible to the the emotions of buyers and sellers replicated on the price chart.

The trading plan is not just a concept, it is a guide to the investors which helps them know when to place orders, exit and enter the market, take profit and stop loss. With this guide, the trader don't get to suffer huge loss like he ought to.

Trading plan gives the trader a clearer picture of what trade is most favourable to him and the strategy that most suit his risk management level.

A trading plan allows the trader to establish a framework that will govern his operations. So that a long term investor don't adjust his trades as a short term investor.

When a trader follows his teasing plan consistently, he stands a better chance of managing his Capital which will make him stands out on his worst trading days.

EXPLAIN AND DEFINE IN DETAIL EACH OF THE FUNDAMENTAL ELEMENTS OF A "TRADING PLAN"

Any trader who lacks a trading plan is equivalent to a gambler who practically uses his capital to place luck in the market. And if that be the case, then the crypto currency market is not what it claims to be.

For this operation, I would have to vividly detail the fundamental elements of trading plan which include:

Risk management

Capital management

Trading psychology

Account control.

Risk management

Loss is inevitable as far as the crypto market is concerned, but the end point is to limit our losses to a reasonable extent. Now if we must profit from crypto trading, it involves the existence or our vulnerability to risks. In other words, success is not 100% guaranteed and with this consciousness, it becomes very Paramount for traders to understand how to manage risk within his level.

The essence of risk management element in our Trading plan is to curtail the amount of loss a trader may possibly incur knowing that losses must occur in trading a well as profit. So for a trader to secure a good risk management plan, it must be drafted in such a way that his profits must reasonably exceed his losses. So in risk management, one of the things a trader should consider before taking trades is his initial capital. In this way, he understands the kind of investment to secure, the number of operation to carry out and monitor how long he lasts in the market.

Capital management

This is another basic element in trading plan. By this I understand that an investor in trading shouldn't invest more than he can bear to lose. Basically, I think that this whole thing about capital management is dependent on the traders investment. So, that Trader A does not invest $100 and losses 20% . In this scenario, Trader A lacks the basic knowledge of capital management.

A more suitable illustration to describe capital management is having a trader let's say Trader X who carries out only but one operation daily and losses 4% out of his said capital of $2000. Now, Trader X is only risking 4% out of the operation will not so much affect Trader X reason being that that particular percentage is what he is willing to lose in the market. This do called trader has the tendency of remaining in the market for so long a time without going bankrupt.

Account control

If there's need to plan trading, there's equally a great need to analyze the outcome of practicalizing these plans. This means record keeping or taking statistics of how the plan worked and how his account developed within those periods. And if not, the investor can restrategize to put in more effort.

The investor has the account and he ought to be in full control of the account as it is his responsibility to take statistics on weekly or monthly basis to track his account performance. This act helps the trader identify his strength and weakness over there time and help him increase his capacity and sobriety on his trading plan.

Trading psychology

When we talk about psychology, we are simply referring to the mental states or emotions of crypto investors and is this emotions that is replicated in a graphical chart. This is what we refer as the fear and greed index. When there is too much greed in the market, investors accumulate as many assets as possible simply because they don't want to lose out of the next big move in the market. But there comes a time when sellers take over the market and supply exceeds demand. At this point, the fear index creeps in as every investor wants to sell and take their profits.

These emotions tends to affect investors trading plan to a great extent because the greed and fear index technical analysis could be detrimental to the trader at times being that it is not 100% accurate. So maintaining a good trading psychology is very important so that investors don't easily get swayed by the majority opinion at all times. Instead, he clinges to his own psychology of what the market offers for the day

]

]

PRACTICE (Remember to use your own images and put your username)

1. Build a “Trading Plan” and cover all the basic elements discussed in the class. For this, you should NOT take the examples that I put in my class (Including the example amounts), use your own examples and your own images to make said plan, you must also base this "Trading Plan" as if you were operating on the platform of " Binance ”, taking into account that the minimum amount of exchange or investment is $ 10.

Remember the plan you build should have the following:

• Your own Risk Management

• Your own Capital Management

• Say in detail, what are the rules or Psychology that you yourself would use to fully comply with said plan and be able to operate the cryptocurrency market

• Finally, make a table with the strategic planning of your capital, covering at least 6 months.

(

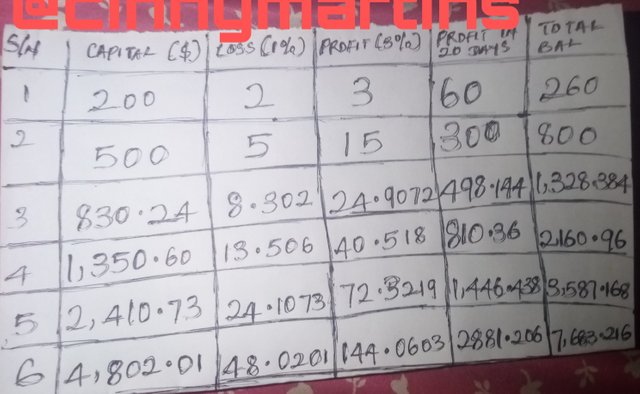

Column1: This is where I had the serial number 1-6 which is used to represent the 6 months as requested in the assignment.

Column 2: THIS is where I have the amount of capital I used to start for each month and for my first month, it was $200.

Column 3: This column contains the amount which I graded as 1% and mapped out as the amount I will be risking from my initial capital from each trade.

Column 4: This column contains my daily profit for each day. And for this, I used 3%.

Column 5: I make trades 5 times weekly which is total of 20 days in a month. This column contains the total profits made in 20days.

Column 6: This column contains the total balance which was incurred by adding up the initial capital with my profits in 20days.

capital management

Having gone through this assignment and had a clearer view of what risk management is all about, I have decided to fund my account with nothing above $200. In this way, I forego my loss of 3% without regrets knowing that success is not 100% guaranteed in cryptocurrency trading.

Trading psychology

I have resolved within me that in other not to be away by emotions in my trading plan, I will not trade

When I am sick

When I am depressed

With the intention of revenging my loss overtime.

Risk management

I will be taking nothing above 3 trades per day so I can be able to manage risks as it pertains to my level.

Cc.

@lenonmc21