Properly explain the Bid-Ask Spread.

Why is the Bid-Ask Spread important in a market?

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

In one statement, which of the assets above has the higher liquidity and why?

Explain Slippage.

Explain Positive Slippage and Negative slippage with price illustrations for each

Properly explain the Bid-Ask Spread.

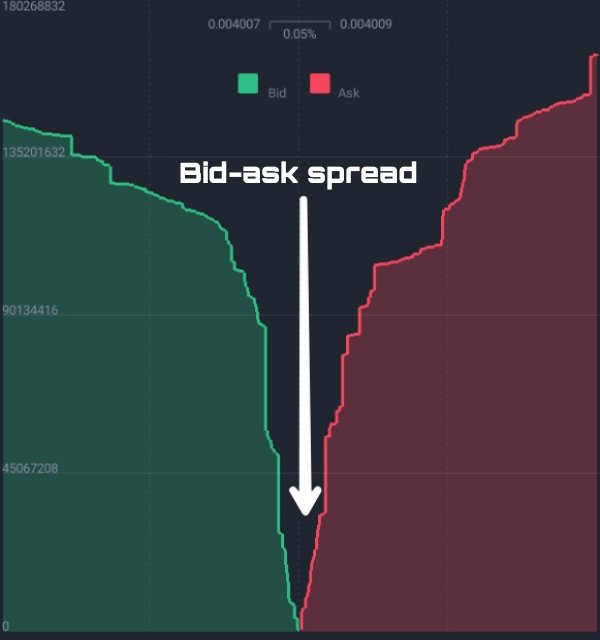

By bid price, we mean the highest price a buyer is willing to pay for an asset while the ask price in contrast is the lowest price in which a seller is willing to sell his assets. In simple terms, Bid price is the buying price while Ask price is the selling price.

That being said, I would also like to say that no matter the kind of consensus both the buyer and seller had reach in the course of their negotiation, there must come a time when a difference will exist between those parties... Even the tiniest difference. This is what we refer to as the Bid-ask spread. Bid-ask spread is there gap or lacuna between the ask price and the bid price. In other words, it is always the difference between buying price and the selling price.

The green is the bid price and the Red is the ask price. The gap between the two prices is called the Bid-ask spread.

Let's give a simple mathematical demonstration:

If the Ask price is $100

And theBid price is $98

The formula is: Ask price -Bid price

We have $100-$98=$2

Therefore, $2 becomes the Bid-ask spread which is the difference between the Bid price and the ask price.

Why is the Bid-Ask Spread important in a market?

Bid price andAsk price is a concept that is practised everyday even in our traditional trading and at some point or the other a gap comes to be between the seller's wish and the buyer's desire.

There is a general rule to this concept of Bid-ask spread which states that the higher the Bid-ask spread, the lower the liquidity and vice versa. In expanding this more, it entails that when the bid price and the ask price are at close proximity, the bid-ask spread will be low.

The concept of Bid-ask spread is very important in the market particularly the crypto market as it aids in striking balance between the party's desires.

The list of importance of Bid-ask spread in a market include but is not limited to:

- It helps to understand the liquidity of market: with the knowledge of Bid-ask spread, it will help the buyers and sellers to understand when the liquidity is gravitating to the high side or otherwise and if need be to take a stand.

- It also help both the buyer and seller to determine a price in the equilibrium stand that will benefit both parties.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

As mentioned earlier, the formula for this is:

Bid-ask spread=Ask price-Bid price

So, we have $5.20-$5

Bid-ask spread=$0.2

The Bid-ask spread of crypto X is 0.2.

b.) Calculate the Bid-Ask spread in percentage.

Let's say the formula for this is:

Bid-ask spread % is equal to (spread/ask price)×100

Remember we have Bid-ask spread as $0.2 from answer (a) above

Now, Bid-ask spread %=(0.2×5.20)×100

0.2×5.20=0.03846153

Therefore, Bid-ask spread=0.0385 to 3s.f

So, 0.0385×100=3.85

Bid-ask spread %= 3.85.

The Bid-ask spread % of crypto X is 3.85.

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

Bid-ask spread= Ask price-Bid price

Ask price=8.80

Bid price=8.40

Therefore, $8.80-$8.40=$0.4

Bid-ask spread= 0.4

The Bid-ask spread of crypto Y is $0.4

b.) Calculate the Bid-Ask spread in percentage.

Bid-ask spread % is equal to (spread/ask price)×100

Remember we have Bid-ask spread as $0.4 from answer (a) above

Bid-ask spread %=(0.4/8.80)×100

0.4/8.80=0.04545454

Therefore, the Bid-ask spread= 0.0455 to 3s.f

0.0455×100=4.55

Bid-ask spread % is 4.55.

TheBid-ask spread % of crypto Y is 4.55.

In one statement, which of the assets above has the higher liquidity and why?

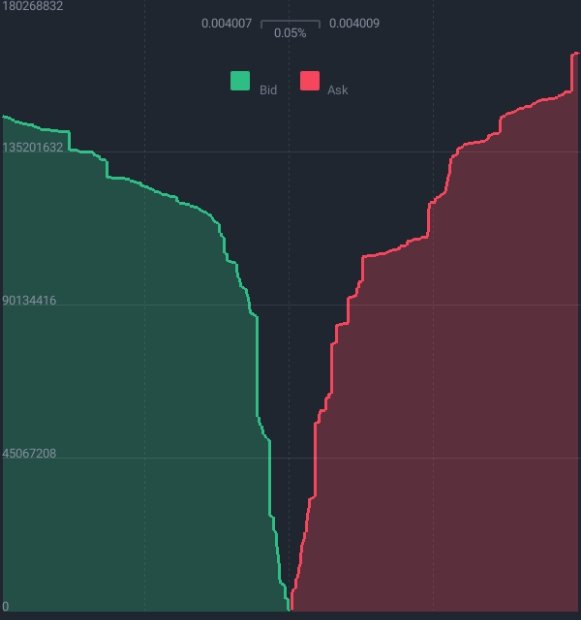

From the above calculations, crypto X has the higher liquidity.

Remember I said earlier that when the spread is smaller, there is a higher liquidity... Let me explain. When the buying and selling price are at close proximity, more transactions are carried out.

The Bid-ask spread of crypto X happens to be $0.2 which is the lowest and this makes it has a higher liquidity.

Refer to the screenshots below for more elaboration.

If for instance this spread here is $0.2, you will find out that there is no much difference between the buying price and the selling price hence, there will be more trade and higher liquidity... Let's see the next image.

If for instance the spread here is $0.4, you will find out that the spread is more wider than the first image and the implication of this is that the much distance between the prices will produce a lower liquidity.

Explain Slippage.

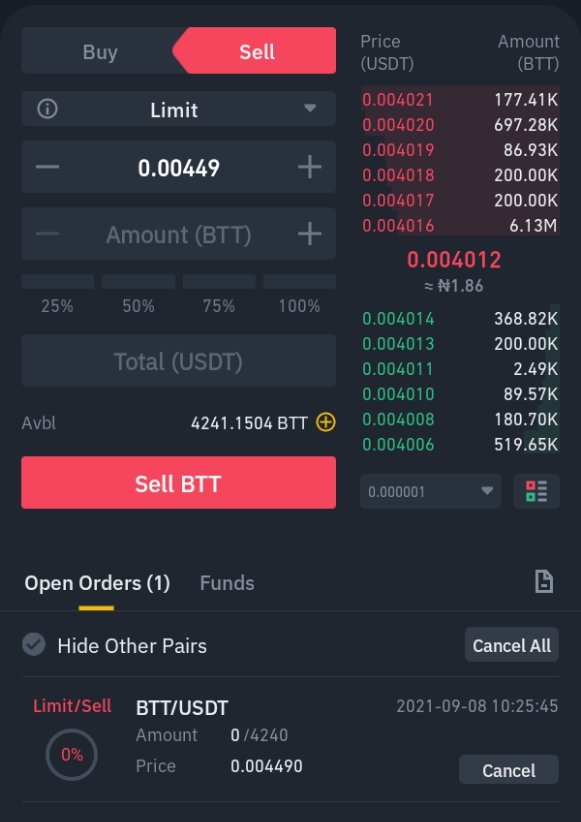

The crypto market is a volatile market and because of this, the future prices of assets are almost impossible to predict. It happens that whenever a trader places an order based on his intended price to either buy or sell an asset, there is a likelihood that his intended price and the market price will not be the same.

Spillage is a crypto term used to refer to a situation where the intended buying price is different from the executed price. Let me explain better... When a trader sets his assets to buy or sell, a change in the market price might set the order open for a while until the market price aligns with the trader's price, the order will then be executed.

From the image above, you will see an open order with a difference in the market price because of a change in the market. The order will be executed as soon as the both prices are the same.

Because of the volatility of the crypto market, a trader's market order may be placed in a waiting list to be executed whenever the difference in both prices ceases to exist. In other words, spillage occurs due to low liquidity.

Explain Positive Slippage and Negative slippage with price illustrations for each

Positive spillage

This is the kind of spillage that is advantageous to the trader. This occurs when a change in the market price of an asset favours the trader. It is so because the market price reduces below the trader's initiated price.

(Bid) For instance, if Trader A intends buying a Bittorent token worth $2 at the rate of $0.0041 (the total token to be acquired with this price would be 487.8) but if for any change in the market price, the price slipped to $0.0040 (making the total number of tokens to be acquired 500) the market change is favourable to the Trader as he has extra 13 tokens added to him as a result of positive spillage with the same amount of money.

(Ask) If Trader A intends selling a Bittorent token to sell at $0.0041 but a change occurred in the stead of positive spillage and he sold at $0.0042.

Here there is a positive spillage in favour of the seller

We have $0.0042-$0.0041=$0.0001

The seller has additional profit of $0.0001 on each of those tokens.

Negative spillage

This type of spillage is in contrast to positive spillage. In other words, this type of spillage is not favourable to the trader. Negative spillage occurs when the change in the market price of an asset is higher than the trader's initiated price.

(Bid) For instance, if Trader B intends buying a Holo token Worth $2 at the rate of $0.009903 (the intended number of tokens to be acquired would be 201.9), but if because of a change in the market price of that asset, the price changed above the trader's initiated price to be $0.010099 ( making the number of tokens to be acquired 99). The market change is unfavourable to the trader with the loss of $102.9 tokens.

(Ask) If trader B intends selling a Holo token at the rate of $0.010099 but ended up selling at the rate of $0.009903.

Here, there is a negative spillage unfavourable to the seller.

We have $0.010099-$0.009903=$0.000196

The seller will incur a loss of $0.000196 on each of the Holo tokens sold.

Conclusion

Thanks to Prof. @awesononso. Before now, I have known about the bid price and ask price but often confused about the gap in between until today, having attended this class I got to understand the spread between the prices and why such occurrence exist. I also got to understand what happens when there is high liquidity and low liquidity.