I was once like jane. Yes, I’m talking about a few years ago when I was new to cryptocurrency trading. Just as Jane had psychology issue, it affected me too. I bought an asset on bittrex for $20 dollars and it went as far as $100. With excitement, I decided to hold as I watched the price plummet. I didn’t know about any analysis to check how market moves. I trade based on info from friends and sometimes, I just follow the trend blindly, and I lost heavily in the process because I always sell at a loss

Thanks to professor @asaj for the wonderful lecture. As I begin to answer the questions one after another, please grab a glass of water and follow me closely.

Part A (Case Study)

The case study given is an example of what type of psychology? Explain the reason for your answer

The case study (Jane’s action) is an example of trading psychology. From the explanation given by professor

@asaj, Jane traded based on her mindset. She said to herself,

Now, I have a chance to get this coin at a price cheaper than what was initially posted on the group."

She thought of this when the market was in a bearish trend, and she kept acquiring more asset. She made an individual decision while trading. Though, everything Jane was doing was to make profit, the reverse was the case because she averaged down the position, which caused her to lose some dosh

Using the case study above, list and explain at least 5 biases that influenced Jane's trading behaviour with examples of how it affected her behavior?

The biases that influenced Jane’s behavior are

- Confirmation bias

- Self-attribution bias

- Disposition bias

- Emotional bias

- Herd mantality bias

Confirmation bias: bias It’s never a bad thing to seek information to justify or support our actions or our desired beliefs, however, being bias caused us to have a limited information which may lead to getting a false outcome.

Jane got her confirmation from the fact that the asset was dropped in the group (as a signal) a month back which was trading at $9. So when the asset went up to $15, and posted in the group the second time, she concluded that asset will boom. She focused on initial success of the asset and applied the outcome to a generalized principle, based on the belief she previously digested, and lo! Her asset went down the drain

Self-attribution bias: Most times, traders attribute success of trade to themselves whenever they make a move, irrespective of how they get the signal. However, any poor result is seen as another person’s fault maybe from a group or a friend they got the signal. But the fact is this: They fail to look at the bigger picture. They so much rely on info from other sources without doing their personal findings

Just as Jane reacted, she got the info and followed it. When everything went wrong, she lost, but she attributed the intelligence of stopping the loss at $5 to herself as she watched the asset go below $5 and see the reaction of others in the telegram group chart. She was happy she exit the market, but when the market bounced back, she thought she would have left the asset and never have sold it in the first place. So who is to blame here? Jane of course. Individual holds the responsibility of his trade and no one should be blamed for any loss incurred

Disposition bias: Every trader wants to be successful in their trades, but even at that, many still fail. Why? There are many reasons and one of them is the disposition bias. Once a trader holds unto a loosing stock and decided to sell off the winning ones to compensate the loosing stock, he has practiced what is called disposition bias. Jane kept holding, and never stopped buying more asset as the price goes bearish. Apart from the first trade she made, she added more and more money to buy more thinking he would get more gain. Though, Jane didn’t sell off another winning asset to buy the loosing ones, she took money from her savings

Emotional bias: Jane traded based on her emotion because she hold the coin she bought with the hope that it would go up. Secondly, she was overconfident and she kept buying as the price goes down and that can be refered to as greed. Now, she felt the pain that she was loosing. She regret her actions, and at the same time was't patient because she lack self control. Based on her emotion, she traded too often as the price plummet because she she thought she was doing the right thing. Emotional bias can make you think you are doing the right thing, but at the end, you might come out disappointed

Herd mentality bias: Jane belong to a telegram group, and they all do the same thing together. Herd mentality bias has to do with a group of people doing the same thing together in other to achieve a goal. We see that larger amount of people including jane act in the same manner by following the information dropped in the group to buy a certain asset. Most times in trading, herd mentality bias manifest in form of volatility, because many people enter or exit the market at the same time, causing a forward or backward swing. Jane also acted like others to buy the asset as it was dropped in the group because she lack personal information, and also believe that following the crowd would lead to a desired outcome. So instead of doing independent analysis, she believed in the masses ways and followed them, because she was influenced by her emotion and instincts, which lead to her loss.

List and explain how each bias you have mentioned can be avoided

Confirmation bias: This is more or less easy to tackle in my opinion because it's easy to confirm something as it doesn't deal with emotions and not deeply rooted with attitude. Just imagine: Mr. A told me to slap Jane because he said she called me a goat, and without any further enquiry, I walked up and give Jane a dirty slap. Hoops! Jane yelled! And at the end of the day, Mr. A took off and while I was trying to explain why I slapped Jane, I realized that he has zoomed. Eventually, Jane didn't say anything like that. (I wonder what Jane would do to me. Smiles) Why didn't I confirm before my actions? It would have helped me to tackle the matter intelligently. So in a nut shell, patience, personal research using any analysis you understand can help avoid confirmation bias

Self attribution bias: The first thing I think is best is to desist from putting the blame on any body. When you start to blame people for your failure, you will definitely ascribe glory to yourself when it comes. Understanding the fact of taking responsibility for any action you take will help self attribution bias. If you accept your weaknesses and build yourself to grow better with your analysis and self intelligence, you will go a long way. Jane smiled when she discovered that the price of the asset went below $5, which was the stop loss she set, and smiled at others misfortune in the group. She was glad she did the right thing by stopping the loss at $5. And of course, she ate her words when the asset began to spin up. Understanding the fact of not praising yourself for your success and condemning others for your failure would give you that peace of mind, and when you trade, you do it without fear, and proper scrutiny because you are always ready to take responsibility for your actions

Disposition bias: Someone once told me. He said "boy, cut your loss and let your profit run" At first, I didn't understand until I suffered. It's just simple. Don't hold unto your loss and sell off the asset giving you green light to compensate your loosing trade. Erase the fear of loosing your minimum profit, and stop closing your profitable position when it's not yet time to do so. These will help you make a logical decision

Emotional bias: Every body have emotions because it's human nature. How we react to a big loss is greater than the loss itself. The way we tackle it is the difference. IMHO, emotional bias is superior to others because no matter how much you understand the market, with the lack of emotional control, failure is imminent. I think setting a goal and beign desciplined about it can help tackle emotional bias problem. If for instance, I did my analysis well, and forecast that an asset would rise by 8% in days, and it started coming down within 24 hours, I wouldn't give a damn because I already understand that the market is volatile, so I wouldn't fret because of the downward movement because I've done my analysis and I believe it would take me to the right destination even though I'm not 100% certain. Do your analysis. Set a goal. set aside your feelings and trade confidently, and also, don't trade in revenge to recover your losses

Herd mentality bias: There is always a gap created as a result of herd mentality bias, so to avoid herd mentality bias, it's important to ask yourself why you want to enter a trade. To first consider the reason for doing something is important. Is it because majority are placing the same trade, or because I've done my assignment and confirm that the trade is worth risking. Does the asset have inherent value that matches the quantity of order? After looking in to all these, taking time to decide on what to do would help avoid herd mentality bias. Sometimes, following the crowd helps but if not well scrutinized, it may lead to financial doom

Part B

What type of analysis can be used to monitor market psychology and trading psychology, and why? Identify the differences between trading psychology and market psychology

Either market or trading psychology, the best analysis to monitor the market is technical analysis. The crypto, and other volatile market put more weight on technical analysis that fundamental and sentimental analysis because, you can forecast the movement of an asset in a 5, 10, 15, 20 minutes chart and so on. Individually, you can use any indicator like MACD, RSI, STOCHRSI, MOVING AVERERAGES, ICHIMOKU INDICATOR, and so on to monitor the market to know your entry and exit point. Trading psychology is different from market psychology. How

- Trading psychology wraps around human behavior. It deals with individual attitudes/behavior compared to market psychology.

- Only a person can exhibit trading psychology, while market psychology involves multiple behavior in a trading environment.

- In Market psychology, the entire market is affected. It's what happens in the ,market that would affect the individual decision in trading, so Market psychology is more of a vacuum that traders would fill with their personal trading arsenal.

How can you measure market psychology using a crypto chart? Select 5 trading biases and explain with screenshots of any cryptocurrency chart how the biases can cause a coin to be oversold and overbought. (Add watermark of your username)

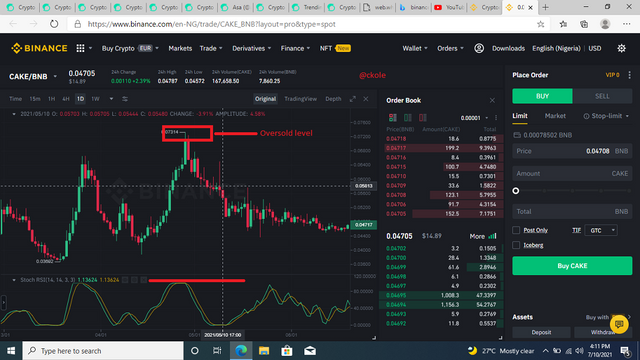

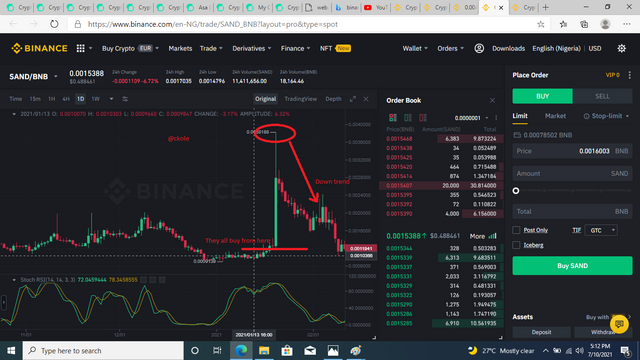

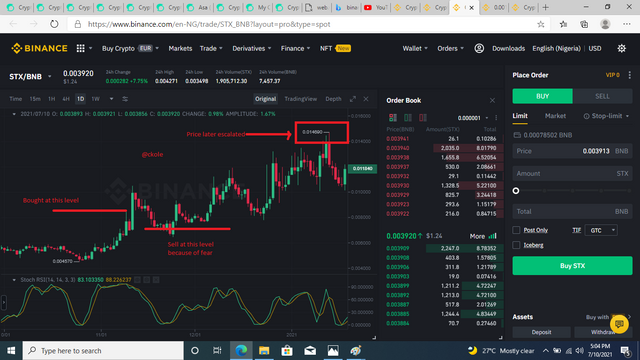

Let's look at confirmation bias as the first one

Using the stochastic RSI, we can see that the market has reached the oversold level because it's already beyond the 80% mark. The bullish signal it has signified is a confirmation that the market would keep going up, but as it reaches the overbought level, it retrenched. If the STOCHRSI isn't used here, trader would be optimistic that the price of the asset would keep going up. However, it has reached the level where reversal is possible to happen

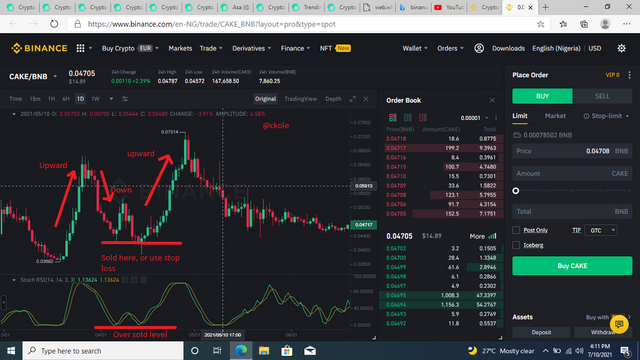

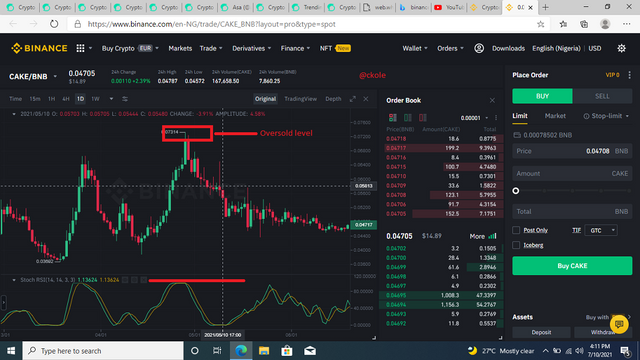

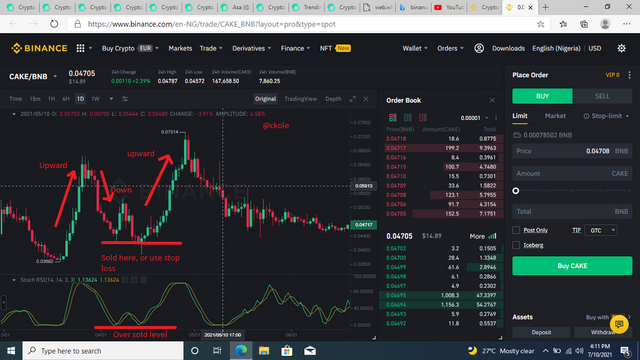

Self Attribution

Still using CAKE/BNB. As we can see that when the price go bullish, there was a positive reaction. A trader was given a signal of a bullish trend and he followed it, but at a point, the market start retrenching. Maybe because of fear, the trader sell off his asset at a particular level and quit the market. He saw the ,market coming down more and he was happy because he exit on time attributing the smartness to himself. Later, the market reversed, and start moving upward again after it has hit the oversold level. We can see this from the image above

Disposition bias

When you hold unto a loosing trade and you sell the winning one, you are beckoning to trading disaster. From these images. the trader didn't pay much attention to the market. He rather looks at the market trend and justified his action by selling the wining trade to buy the loosing ones because he did't want to lose his money

.png)

But after buying more of the asset, it started going bearish more and more. He sold the good trade and invested in the bad one thinking it would go up. Hope has killed the trader and he's on a loss.

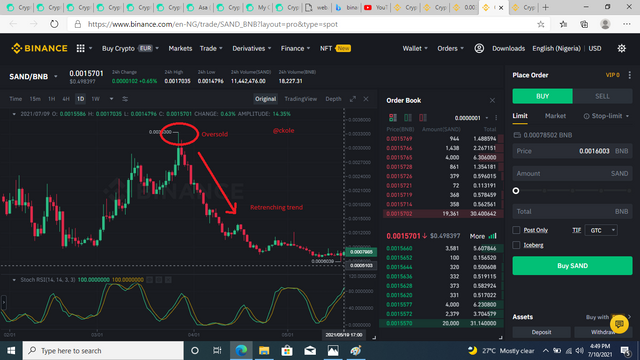

Emotional bias

Fear! Fear!! Fear!!! I don't want to lose my money says John. He entered a trade and kept monitoring it like a monitoring spirit. The market started going up and he was happy. At a point, it retrenched and John wasn't comfortable anymore, forgetting that the crypto market is volatile, and it fluctuate easily. He was scared and wasn't patient enough. He didn't use any technical tool to analyze the market before jumping in and at the same time, he didn't check to know why the price dropped at that point in time may be it has hit the over bought level. He just sold at a loss trying to cut his loss, but later, the price escalated. He was disturbed by his emotions and it affected his trading journey

.png)

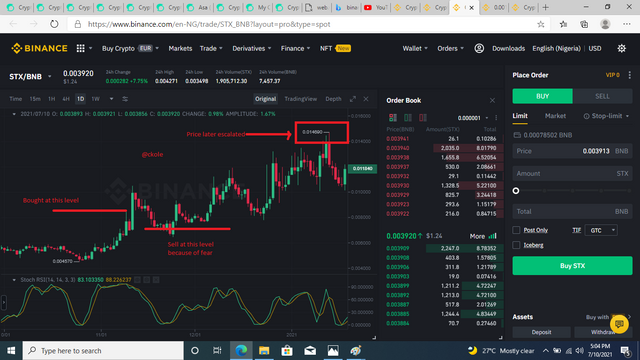

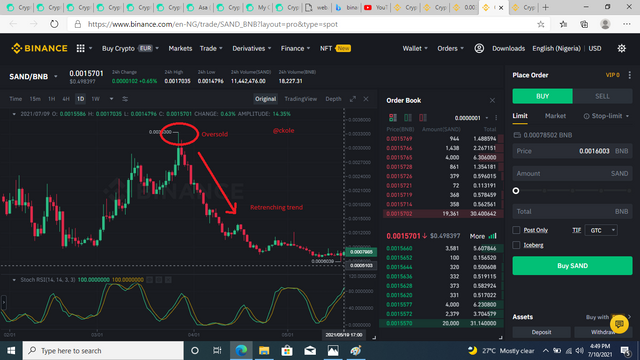

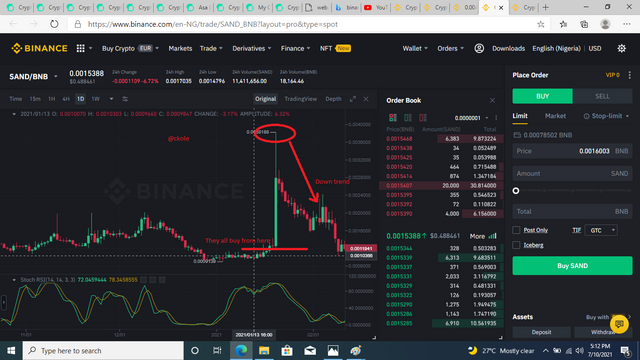

Herd mentality bias

.png)

And they said, let's all buy STX today at 0.0038183, and they all entered the market to buy. Sure, the price would go up because many people are buying, but John(a trader) never pay attention to the market. The over sold level wasn't checked, and before anyone could say Jack Robinson, reversal started and John was surprised, as if he mis-interpreted the signal given to him. He should have checked for himself before following the masses. He got the info and acted on it. Following the majority is not advised in trading. Doing personal findings helps. If he had done his analysis, he would have known the right point to exit before the bearish trend sets in. The STOCHRSI would help in this case to spot the over sold and overbought level

In your own words, define the term efficient market hypothesis (emh). List and explain the advantages and disadvantages of efficient market hypothesis (emh)

This can be seen as the extent at which every market market price reflects all market information available. Here, all stocks/assets are traded at equilibrium, so only lucky investors can beat the market, because there's information symmetry, which means both buyers and traders have the same information, so every party is informed. But the question is: Are market efficient? To answer this question, let's look at the three forms of market efficiency we have

- Weak form efficiency

- Semi-strong form efficiency

- Strong form efficiency

Weak form efficiency

The weak form of efficiency happens in a scenario where information do not flow freely or easily. Only the insiders know about the information before it's circulated. In a case like this, only a knowledgeable trader that understands the fundamental analysis can predict the price movement of an asset, because fundamental analysis is about the public information of a company. Technical analysis don't work here, because it's based on past prices which everyone have access to unlike updated public information which is relatively new

Semi-strong form efficiency

Information here flows semi quickly, which means not too quickly, but better than the weak form. In this case, some insiders know a bit about the information, but not all. Notwithstanding, they get the slight information early before the public gets to know about it, and therefore have slight advantage over other investors.

Strong form efficiency

This can be said to be an open heaven where every one is informed. Information is received by the public at the same time. In strong form efficiency, nothing is hidden. There is no way to use any hidden information to benefit from the market.

Advantages and disadvantages

It saves time pretty well. Once one understands that the market is efficient from the information gathered, there is no need doing any further analysis.

It's not easy to beat the market because all information that could predict performance is already built into the stock price

In a situation where some people gets to know about the right information before others, profit is made

On the other hand, those that gets the information late buys at higher price when the price has gone high.

Thanks for reading

Cc: @asaj

.png)

.png)

.png)

Good job @ckole!

Thanks for performing the above task in the second week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 8 out of 10. Here are the details:

Remarks:

You have shown an excellent understanding of the topic and have maintained a consistent level of excellence through your work. I particularly was impressed with the way you answered Question 5.

However, you did not end your article with a conclusion. A conclusion serves as a summary of what you have discussed. Additionally, you didn't discuss greed and fear index which is an important component when measuring market psychology.

Conclusively, we appreciate your contribution to the academy and we look forward to your posts in the coming weeks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks professor @asaj for the review. Actually, this is the first homework I submitted without a conclusion. I was almost out of time, that's why I couldn't round it up. However, I appreciate your good work prof. Looking forward to participating in the next homework. One love.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit