Good day everyone, and welcome to another crypto homework. It's my pleasure to participate in another exciting episode. We are going to tackle the homework on Cefi and defi yield. Please, stay tuned

Overview

We all know that Bitcoin is not controlled by anyone so also other altcoins. No government has the power to control it neither do any banks. All these cryptocurrencies can be sent to anyone around the world without the need of banks or any other financial institutions because they are all decentralized money. However, transferring money is the first of many building blocks in the financial system. Apart from sending money, there are countless services we carry out today. Some of them are insurance, saving plans, loans, stock market, and all other services built around money

All these are what created the financial system. It is no doubt that before now, all our services and financial system are centralized. Every financial institution like insurance, banks, stock market, and every other company has someone in charge managing them which is referred to as a central authority. This centralized system is prone to mismanagement, fraud, corruption, etcetera. But what if the financial system can work the way bitcoin operates (people thought), and that's what brought about Defi (Decentralized finance)

Question 1

What Is the Importance Of the DeFi System?

Defi also known as decentralized finance is a global system of storing and transferring assets without the structure, restriction, and cost of a traditional centralized banking system. It has to do with financial services that have no central authority. With the use of decentralized money like bitcoin and other cryptocurrencies that can be programmed for other automated activities, we can build several projects like lending services, insurance companies, and other organizations that don't have anyone controlling it

Before we can create a decentralized financial system, we need infrastructure for programming and running the decentralized services, and we have ETHEREUM as the first to do that through a DIY platform for decentralized programs which we can call Dapps. Through ethereum, we can write automated codes called SMT (Smart contracts). It's the SMT that manages any financial service created in a decentralized manner. We can only determine how certain services would work and deploy them on the ethereum network, and once that is done, we no longer have control over it because the network is immutable. So with the ethereum network, anyone can build a decentralized financial system

There are much importance of Defi system, let's look at a few

One of the major importance of the defi system is the autonomous operation where there is no one controlling the system. The use of smart contracts has eliminated intermediaries, which makes the system act independently without human control

No one would like to bath in a bathroom built with transparent glass naked while others are watching. Everyone would try to cover their shame with cloth. The transparent protocol used to build the decentralized system doesn't allow anyone to hide under any transaction made on the blockchain, thereby ensuring that everyone's personal interest is guided and respected

- Verification processes not needed:

The decentralized system does not need any form of verification before it can be used. There's no barrier to who can transact provided there's access to the services provided by these decentralized systems. Unlike in some scenarios where KYC is used on cefi, it's is never a problem in the case of defi. Without doing any form of KYC, you can use defi to the fullest

- Third party is eliminated:

There is no third party involve here. Transaction is done without anyone controlling your fund. This makes the defi system much more reliable because if there is a third party in anything you are doing, the reliability is not guaranteed

The first thing we need to understand is that defi services work in conjunction with one another, making it possible to merge with different services to create exciting opportunities. There is no need to go the extra mile before you can use defi platforms, as things are arranged in a way that users would find every step easy to comprehend

Question 2

Flaws in Centralized Finance

There are some centralized finance flaws. Below are some

In every settings, no one like to be totally controlled. But the centralized system with its rules leaves many people no choice but to adhere to it because there's no other way to bridge it. They control activities with some set of rules and dictate the procedure of processes. They have authority over users and anything that has to do with what binds them together. Many people dislike the processes, but what can they do if that's the only option available. Banks fall into this category and many people are still operating it to date

Transactions in a centralized system has to go through the third party before it can be executed. Users cannot send or receive from another end without the intermediaries knowing about the transaction details. There's no freedom here, and at the same time, the transaction can be altered because it's controlled by some set of people

- Verification is a problem:

No one can operate in a centralized system effectively without verifying his or her account. Recently, I'm having an issue with a telecommunication company, as their system refused to validate my data before I misplaced my sim card, which is now difficult to retrieve, even after tendering my international passport. It's a very crazy experience and a great flaw in the centralized finance system

It's not new seeing multiple queues in banks, insurance companies, telecommunication companies, and some other parastatals. In most cases, you would need to be attended to before you can carry out your transactions. Of course, centralized finance uses internet services, however, series of overrides are needed before transactions are executed. No matter how fast, it cannot be compared to the speed defi offers

Question 3

DeFi Products. (Explain any 2 Products in detail)

There are many defi products, but as stated by the prof, I will only talk about two.

Decentralized exchanges

Lending and borrowing

The defi system produced several decentralized exchanges where you can trade cryptocurrencies in several ways. DEX's operates without a third party and that's one of the qualities of decentralized finance. Some examples of DEX's are Uniswap, just swap, 1Inch, pancakes swap, and so on

Let's talk about uniswap

Uniswap is a decentralized exchange built on the Ethereum blockchain. It was founded in 2018 and is considered one of the greatest decentralized exchanges available. It works with all ERC20 tokens and certain wallets, including trust wallet, metamask, and myetherwallet

Uniswap employs smart contracts in other to transact on the platform. It makes use of exchange and a factory contract, both of which play an important role in transaction execution. As it has been designed to fulfill a certain duty, the factory contract contributes additional tokens to the platform, while the exchange contract handles all the token swaps which makes it possible for every ERC20 token to be swapped on uniswap

Liquidity providers on Uniswap earn 0.3% on all trades proportional to their share of the pool. Uniswap is also an AMM base dex, and rather than using order book where there's bid and ask price, algorithm formula is used to determine the price for users, as every AMM already have their own algorithms and how it works in the liquidity pool

As nice as this platform is, one of the things that still serve as a limitation is the permissionless listing of tokens. Anyone can list or add tokens as they wish which encourages many malicious projects to spring and rip people off their fund

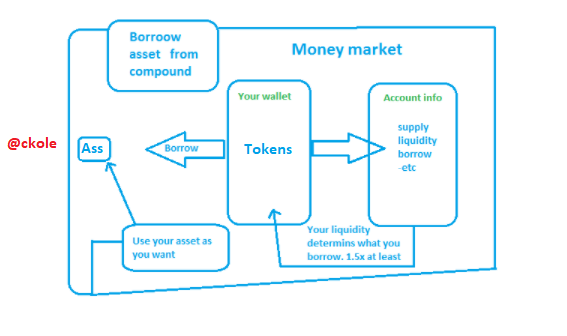

These are one of the important element in any financial system. Lenders are regarded as depositors and they are the one that provides funds to borrowers in a return for interest on the amount they lend the borrower. Defi lending allows users to become lenders and borrowers in a decentralized way where they both maintain full custody of their funds. There are various lending protocols on defi lending, like AAVE, COMPOUND, and so on. They work by creating a money market for some tokens like eth, DAI, USDC, and others

Let's see how the lending and borrowing works in the defi settings

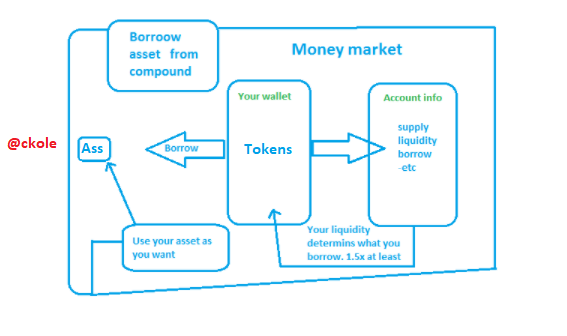

For instance, a user (user A) supplies his token say $2000 to a money market intending to make a profit from it according to the current supply APY of the money market. From the money market, the token is sent to a smart contract where it can be available for other users (User B) to borrow. Once another user borrows the token, user A would get another token in exchange for the supplied token plus interest. It is the smart contract designed for this purpose that issues out this other token to user A. This other token on compound is called CTOKEN, while AAVA calls theirs ATOKEN. And in other, for user B to borrow, he needs to supply a token as collateral worth more than the loan he wants to take

This is the simple formula/criteria that must be met before a user can borrow.

Let's use ABC as parameters

Value of borrowed amount = A

value of collateral = B

Collateral factor = C

A < B x C or B > A x C

This means that the value of the amount to be borrowed must be lower than the value of collateral, and the collateral factor must be met. If these conditions do not hold, users cannot borrow from lenders

Question 4

Risk involved in DeFi

As good as decentralized finance is, there are still some risks involved. Some are listed below

- Defi is very much new

It's glaring that defi is still in its infancy stage and this means there is still a lot to be done to perfect it because things can go wrong at any point in time.

- Smart contract issues

The issue of not properly defining rules for certain services in a smart contract can lead to serious problems on the defi platform. Since all these involve writing of codes to define the rule of services and deploying it to the blockchain, hackers can define a creative way to exploit existing loopholes and steal users fund if not properly implemented

- Risk of finance

Because of the volatility rate of the token, the value of the locked asset can drop drastically if the market is not favorable, though some tokens are generated. I say that a higher reward equals higher risk because of the volatility rate. Of course, investment in defi is profitable, however, it takes a risk taker to invest enormously to reap big. All in all, every amount invested is a risk because of the volatility, but it has been working well for those who know how to leverage reasonably

- phishing attacks

This attack happens on many platforms be it centralized or decentralized network. Hackers know how to lure users into clicking sites that would leak their information. Whenever they give some sensitive information out, some users that don't have the orientation would click the bait and once their info is leaked, the hackers get access to their information and clear their account. There's nothing the platform can do to stop this other than to sensitize and educate users

- Injection attacks

Hackers are always a step ahead. It's just like a thief planning to burg a home. They would do their homework well in other to succeed in their operations. While developers are busy deploying codes, doing updates, and more, hackers are following them back to back looking for any possible loopholes. Once they find one, they can inject some malicious codes to disrupt the system for them to have their ways. The funniest part is that, when they set a trap and they caught something, they swiftly move funds within a twinkle of an eye before the loopholes are blocked by the platform

Question 5

What is Yield Farming

Yield farming is likened to normal farming in real life where you lock a seed in the soil and reap multiple harvests with time. In the crypto world, you lock your fund/asset and get a kind of profit from it. Those that lock their funds in the pools are those that make the platform solvent and they are called the liquidity providers. Every fund/asset is locked into an SMT and a reward is generated. It's just like fixing money in a bank and getting a reward for the amount locked based on the bank percentage per annum

Yield farming is a way to get idle assets operating in the crypto world. If you invest in Bitcoin, Ethereum, or other altcoins, the only time you can get profit is when the price of the asset rises. But in the case of yield farming, your asset will remain (still respecting fluctuation, as it would when you leave it in your wallet or exchange), but with yield farming, more interest would be made on the same asset, so it's better to make use of it than allow it lie fallow without yielding anything. So once your asset is supplied to a particular pool, you get a reward concerning their APY/APR calculations

Question 6

How does Yield Farming Work

When we talk about how yield farming works, we are said to discuss some processes involved. As explained earlier that it works in such a way that users deposit their asset and lock it in a smart contract and in return get a reward depending on the apy/apr of the pool where the asset is deposited. Now to see how yield farming works, let's look at pancakeswap and explore a little to see how this feature works on it.

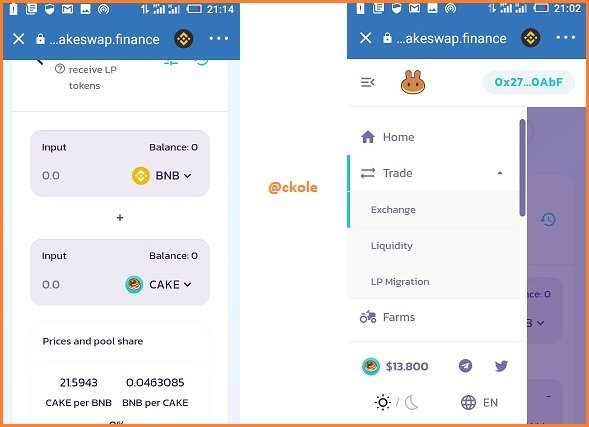

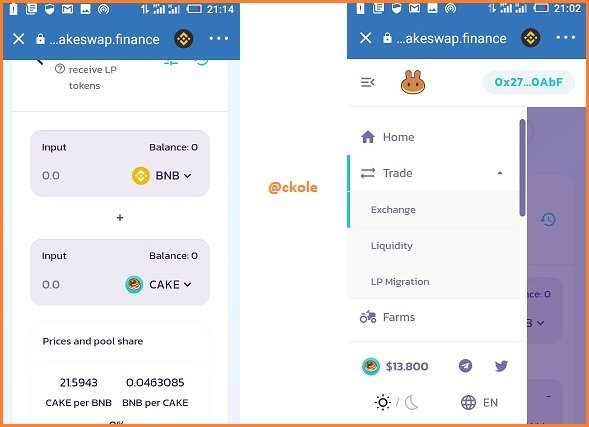

Below is the pancake swap interface

from the image, let's click the liquidity feature as shown.

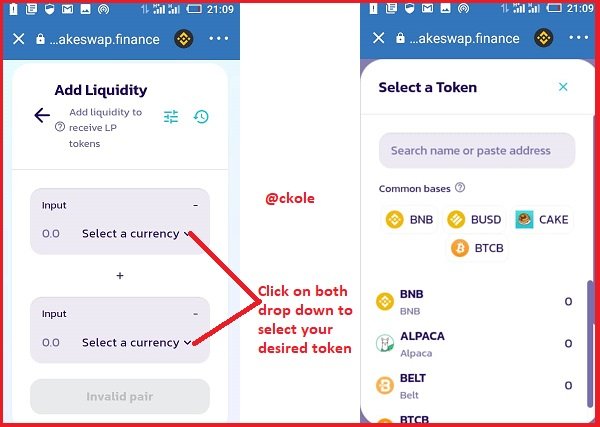

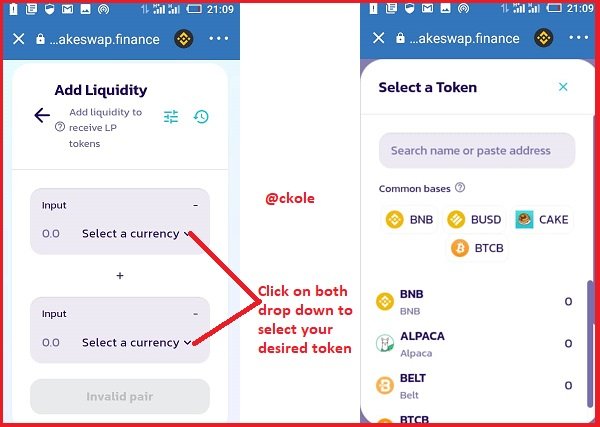

Then click to add liquidity. To add liquidity, you must select the token you want to use, so click on the select currency. the drop-down would show something like this below, then click on the token you wish to provide as liquidity

As you can see that I'm having zero balance. But if there are funds in the wallet, I would have to specify the amount on both ends. according to the CAKE per BNB price pool share which is 21;5927 and BNB per CAKE which is 0.0463138 all at the percentage of the share of the pool according to my input. From here, I can then confirm and complete my processes.

Question 7

What Are the best Yield Farming Platforms and why they are best? (Explain any 2 in detail)

Explaining Pancake swap and why I think it's the best yield farming platform

Pancake swap is a decentralized exchange built on the Binance chain working as a decentralized service provider. As we all know that Binance competes with ethereum with its own smart contract ecosystem called the Binance smart chain, and this is mainly to capture a portion of defi rising liquidity. It's interesting that Ethereum and Binance have the same goal and blockchain infrastructure because most projects that they both maintain have a lot in common

Pancake swap is a decentralized exchange that offers standard defi opportunities, which involves yield farming, token farming, and various forms of liquidity pools. It is regarded as the third largest exchange by volume in the defi sector, and they directly compete with uniswap, which is a good thing to see in the defi sector. On pancake swap, users have access to lots of digital collectibles in form of non-fungible tokens and so on.

There are two essential tokens used on pancake. They are CAKE and SYRUP. These two tokens are based on the BEP-20 token standard. On pancake swap, CAKE is used as the utility cryptocurrency that is used to swap tokens, purchase NFT's and more

Pancake staking: In pancake staking, the syrup is distributed as an LP token, and in return, holders of this token earn 25% of cake emission as long as they still hold the token

Why pancake swap is the best

On pancake swap, users can do yield farming and join various liquidity pools for cryptocurrencies hosted on the Binance smart chain. Most of all these liquidity pairs are tied to BNB, and transactions can be carried out using minimum fees compared to the ethereum blockchain

Let's talk about compound as number 2

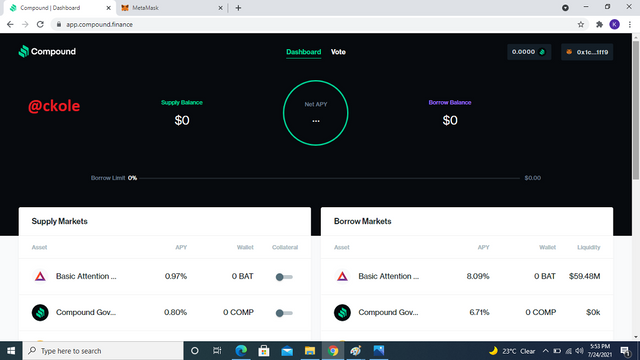

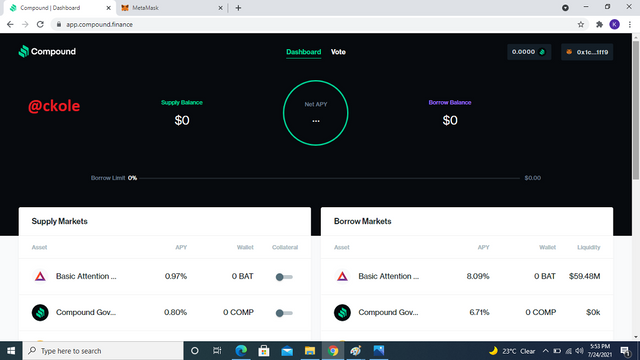

Compound is an open-source project built on the ethereum blockchain creating a money market. These money market are assets deposited by individuals and it is algorithmically by the system. The compound came to eliminate the peer-to-peer borrowing and lending of an asset. For instance, Margin deals with peer to peer lending of assets, but in the case of a compound, users interact directly with the protocol without having to negotiate terms like collateral, interest rate, or maturity with anyone

What is the use case of Compound?

As far as I know, compound doesn't have much use case, but the few it has comes with heavy importance. Compound is made to allow holders of Ether, Argur, and other valuable ERC20 tokens to supply their tokens to the protocol and reap profit without the fear of losing their funds. If someone with 20 Ether holds his or her coin in the wallet, the only advantage it could have is when the coin rises. And if it depreciates, that's a disadvantage. The compound protocol has made it possible for holders to hold their assets on the compound protocol and generate more income. Even if the asset in question depreciates in value, the interest generated would cover it. So in this wise, it's always a winning case

Also, the compound protocol allow users to borrow asset. What the user needs to do is to specify the asset to be borrowed and cToken is used as collateral. cToken on compound means user's balance. It is this balance that would determine the number of assets to be borrowed. Everything on the compound protocol is set algorithmically, so if any transaction carried out by a user conforms with the programmed system, the transaction would incline

What makes compound stand out

One of the things that I consider to pick compound as one of the best yield farming platforms is because it is implemented on other cryptocurrency platforms like coinbase as you can earn the platform’s COMP token by assets saved in your Coinbase or Ledger wallets, which is rear in the case of other farm yielding platforms. Also, the integration with crypto tax platforms like Tokentax and Cointracker is unique way to help users have a smooth access to insuring their funds, thereby making their insurance life easier

Question 8

The Calculation method in Yield Farming Returns

There are different ways to calculate the yield farming return. However, the return is based on the amount invested. The APR and APY are the two ways in which the yield farming return is calculated. So how is these two different?

When you invest in yield farming, and you refuse to add to the initial investment, your calculation will be based on Annual percentage return, which implies that you did not invest further apart from the first fund you ingested into the farm. So here is the calculation.

Note that every farm has a fixed amount of their token being shared among the users that invest in the farm depending on the liquidity.

For instance, if the total liquidity in a pool is $100,000, and my input is $50,000, it means I will get in return half of the amount generated in the farm per annum. Let's see the calculation

From half of the total fund, 50% would be mine so

50/100 x $100,000 = $50,000.

This implies that aside from my $50,000 investment, I would generate another $50,000 in a year, making it a total of $100,000 per annum.

Now let's see the APY calculation

The APR calculation is somehow related to how Geometry progression is calculated. First, let's give parameters

Let r = interest rate

let n = the period of compounding the interest per year

The formula to use would be

APY = (1 + r/n)n – 1

As we have the percentage rate to be 50%, so our calculation goes thus

APY = (1 + 50/365)365 - 1

APY = ( 1 + 0.137)365 - 1

APY = (1.137)365 - 1

APY = 2.252 - 1

APY = 1.252

Therefore, the initial investment + the total APY for a year = $50,000 x 1.252 = $62,600

Profit = $62,000 - 50,000 = $12,000.

Question 9

Advantages & Disadvantages Of Yield Farming

Advantages

Users lock their assets in the pool and earn passive income with respect to the amount locked and the APR/APY specified by the pool.

Yield farming allows users to leverage their tokens. Instead of allowing it to lie fallow, the platform allows users to make a turnover in other to balance up due to the volatility of the crypto space.

Huge profit is also one of the advantages that yield farming offers. If you happen to be an early adopter in a certain farm, and the farm yield a better harvest, a lot of profit can be made from this. Yield farming has helped many users to generate profit and it keeps working well to date.

Users can participate in the governance and join to make decisions. However, there's is a particular yardstick involved. If a user does not hold the required amount of token allotted for that purpose, he won't be authorized to participate in the governance.

Every user is in charge of their fund, and they can unlock their asset whenever they dim fit.

Anyone can participate in yield farming because there is no age limit, neither are their intermediaries to checkmate your transactions. So far you understand how to go about it, you are good to go.

Disadvantages

Transaction fee: Especially on the Ethereum blockchain, the transaction fee is out of bound. This alone has discouraged many users from performing yield farming especially those with little funds. The gas fee alone is enough to chase a potential user away if his fund is not much. Only those who have a larger amount can profit well from yield farming.

Volatility: The price of assets fluctuates every time, and there is no doubt about that because the crypto sphere is meant and designed to be like that. Therefore, the price of the asset supplied for farm yielding purposes is at risk of fluctuation, either way.

Decrease in multiplier: The return rate can reduce as more people join the platform. Since the concept works algorithmically, there might be a decrease in the return as the number of people joining the pool increase, and this is always obvious when the price of the asset itself goes down.

Smart contract risk: The smart contract is the major strength of defi. It has a long role to play in the yield farming system. If there's a problem while defining how the yield farming would operate and it's deployed to the smart contract, the loophole created would serve as the starting point for hackers to penetrate and suck users' accounts dry, which can wreck the system and put the platform at a loss.

Conclusion

We have been through a lot and we have been held in the centralized world for a long time. Decentralized finance has allowed us to advance and this has allowed us to break some bridges we never thought could be possible. Eliminating third parties from financial transactions, sending funds to another person at the speed of light anonymously, having the freedom to participate in many things on the blockchain without the issue of verification, and so on has been so amazing. I would say that the defi has really shaped the way we do things in the 21st century.

Furthermore, yield finance has been a source of wealth for many. It has helped a lot of users to earn passive income while using their tokens as liquidity on many yielding platforms. The rate at which the protocol has shaped the life of people is overwhelming. Thanks to defi and its products. The sky would be the starting point as the crypto economy soars with time.

Thanks for reading my homework

Much regards to @stream4u and other profs doing a great job to educate us in the academy.

One love.

Hi @ckole

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review. I appreciate the points you mentioned. One love proof

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit