Discuss any crypto exchange that offers a dark pool. How does its dark pool work

Kraken was founded by Jesse Powell in 2011 and was launched in 2013 after the test net. As they proceed with their activities, they began to make waves and became the first bitcoin exchange listed on Bloomberg in 2014. In other to meet up with some demand of traders in the crypto world, Kraken created the dark pool for higher financial institutions

Kraken was the first cryptocurrency exchange to launch dark pool trading, and they made their order book not visible to other market traders. It's only the traders involved in the dark pool trading that know their order. This was done in other to allow the traders to place huge orders (buy or sell) anonymously. There's a particular platform for dark pool traders. It's just like a VIP arrangement for anyone that qualifies to join

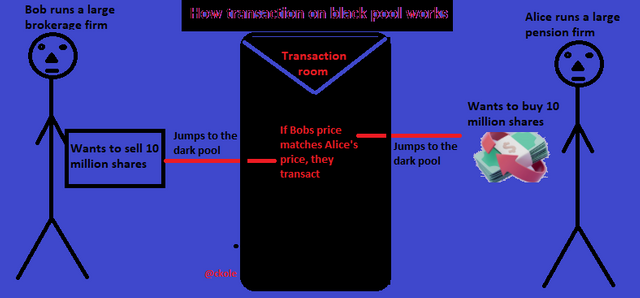

How does the Kraken dark pool works

The first thing a trader needs to do is to verify both simple and advanced levels. After the certification, a trader can opt-in for dark pool trading if he qualifies. The features can be seen on the advanced page. (That would be explained later in another question.)

.png)

screenshot taken from kraken

So to transact using the Kraken dark pool, qualified/verified users (buyers and sellers) are always ready to transact using the limit order. A buyer sets the price and waits for a buyer to accept it. Since it's a huge amount of money, a trader would like to sell at his own price in other to make more profit. It might not fill instantly, but you as a trader determine the price you want to sell

This is unlike market order where a trader can see countless market orders and instantly transact, but the difference is that there's slippage in transacting using the market order. So, when a buyer accepts the limit order (As in dark pool trade), the transaction is carried out in hours

Question 3

What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

There are various assets that can be traded on the Kraken dark pool. They have the Bitcoin pairs, Ethereum pairs, and Bitcoin/Ethereum as pairs. These pairs made it easy to trade multiple coins on the Kraken dark pool exchange

| Bitcoin pairs | Ethereum pairs | Ethereum/Bitcoin |

|---|

| BTC/GBP | ETH/GBP | ETH/BTC |

| BTC/EUR | ETH/EUR | - |

| BTC/USD | ETH/USD | - |

| BTC/CAD | ETH/CAD | - |

| BTC/JPY | ETH/JPY | - |

What are the requirements for getting involved in Kraken dark pool

To get involved in the Kraken dark pool, a trader needs to first understand that the dark pool is not a platform where pennies are traded. A huge amount of assets is displayed, and that's why it's meant for huge financial institutions that can afford to carry out a trade in the dark pool. A trader must merit the following

1. He needs to be certified as a professional on the Kraken network, which means he must acquire the pro tag

2. He needs to understand that no less than $100,000 can be transacted on the Bitcoin pairs and a minimum of $50,000 on Ethereum pairs. If a trader cannot afford that amount, he can't be qualified to trade the dark pool

3. Unlike the public exchanges, dark pool only offer order book where the trader can sell at any price he wants but the time the order would fill is never guaranteed, because the flexibility of choosing any price is there

Is there any fee attracted? Explain

Of course there is. Even on the public exchange, there's a fee between 0.00% and 0.16%. The fees depend on the volume of the transaction made by the trader monthly. In the case of dark pool trading, the fee is between 0.20% and 0.36%. It all still depends on the volume traded within 30 days. If a trader pulls many trades, the fees would be low. So the more the trade, the lesser the charges. It's just like when you buy products in bulk as a wholesaler. A retailer would get it at a higher price. Quantity matters

Question 4

For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required)

To transact on Kraken is not difficult. Whether it's on a public exchange or the dark pool. As I explained previously, a trader needs to be certified before embarking on the journey of using the dark pool for transactions. There are many features on the Kraken platform, but to carry out the black pool transaction, you need to log in

.png)

screenshot taken from kraken

After logging in, click on trade as shown below

.png)

screenshot taken from kraken

The next step is to click on advanced.

.png)

screenshot taken from kraken

After this step, you select the pair you want to trade in the dark pool and start filling other boxes, then complete the transaction, and wait for a match

.png)

screenshot taken from kraken

Question 5

What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs

A decentralized dark pool is a platform where large quantity of cryptocurrency is traded. Since one of the reasons for creating a dark pool is to avoid price slippage in the market, a decentralized dark pool helps in this regard because of the huge transaction takes place in the main market, there would be price slippage

And in a decentralized dark pool, when a trader places and order, those orders would be broken down into stratas, and executed one after the other

How does the decentralized dark pool work

When a trader put an order, surely, it would be received and be broken into fragments. Then a multi-party computation occurs and each node that verifies orders is rewarded. A multiparty computation happens within various parties that place an order, and their private data would not be revealed in the computation process because privacy, and accuracy is ensured

To verify the integrity of the transaction, a zero knowledge proof is used and the unused fragments from the order is cycle until it's matched

What do you understand by zero-knowledge proofs

Zero knowledge proof is a technology used to interact with another party cryptographically, proofing that the information is true without the other part revealing it. This means with zero knowledge, one party can get the answer to a question without the other party revealing the underlying information

Let me give an example.

If I claim that I can solve a maze puzzle, and I'm given the puzzle by a verifier. All he needs to do is to see me solve it. He can stay at the exit of the maze and verify whether I made it out through the exit or not. He's not concerned about what I did in the maze to have my way but only cares about verifying whether I can truly solve the puzzle or not. So every other information about how the puzzle is solved is unknown to the verifier, but he confirms that truly, I can solve the puzzle. And if on the other hand, I could not make it out through the exit, then the verifier would not be convinced that I can solve the puzzle

That's exactly how the zero-knowledge proof works. It verifies the completeness of the claim by the parties, without caring about the details. If it's true, it would be verified and if it's false, it remains unconvinced

Many cryptocurrencies like zcash uses this same proof, and that is what is also used in the dark pool to secure information, and still verify that the outcome is true without having access to the underlying information

Question 6

State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

RenEx was launched by republic protocol from Singapore, with the aim of making transactions anonymous using a hidden order book. With this implementation, traders can transact a large volume of digital assets without anyone knowing about it

With the dark pool, traders can have access to a high volume of liquidity without the consent of the public market. And what does decentralize mean in this context? It means the market is controlled by the traders and no other institutions have the right to dictate what and what not to do in trade, except that a trader must merit the criteria to trade in the dark pool. There's no KYC nor further detailed verification process to use a decentralized dark pool exchange. That's why a crossed chain integration was included to achieve that purpose of a decentralized nature in the dark pool

How does it work

It works in a simple way. Since the black pool is meant for large trades, a buy or sell order is created, and the creator waits until it's matched. And all these transactions happen without any of the parties having access to any information

As a decentralized dark pool exchange, Atomic swap, which was integrated as a cross-chain is used to settle the transaction without any third party involved

Question 7

Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

There are several differences between centralized and decentralized dark pool. They are listed in a tabular form below

| Centralized dark pool | Decentralized dark pool |

|---|

| On a centralized platform, traders need to do some verifications before being allowed to trade the dark pool. KYC is compulsory | There's no need for KYC on a decentralized dark pool platform |

| Even though the dark pool on centralized exchange is anonymous, transactions are not completed via SMT | But in the case of the decentralized dark pool, Smart contracts are used to complete the transaction between two parties, so no third party is involved. |

| Since it's centralized, the order book can still be viewed because the exchange has access to trader's data | In a decentralized system, there's no way that can happen. If I have no information with you, how can you check my transactions? Difficult right? |

| Fraudulent activities might be to some extent easily traced here because of its centralized nature | But on a decentralized platform like this, it would be difficult to trace any fowl play. |

All in all, both centralized and decentralized dark pool plays similar roles. Traders can trade a huge amount of assets freely without affecting the market, or scaring holders of the assets or shares. They both reduce market volatility and makes the institutions remain liquid by not exposing huge funds leaving the system

Question 8

Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales

Shiba Inu happens to be a very popular meme coin, and I think it's still trending till now. When the coin came out in August 2020, there were many early adopters, but still, a couple of anonymous people happens to be the whale. As the price of the coin soared, many people started buying (I also did), and the price kept going bullish. Although people sell, take profit, rebuy, and so on but it doesn't affect the market

The huge sale that affected the market happened around December 2021. The overall high of Shiba Inu was $0.000088, but when the whales sold a large portion of what they held, the market crashed by more than 100%, and many holders started selling their coin due to panic

.png)

Image from coinmarket cap

It all started when $2.3 billion worth of Shiba Inu was transferred from the wallet to various accounts. It was believed that almost 70 trillion Shiba Inu was purchased by these whales with $8,000 and as the price soared, they were ready to bag their gain. This affected the market

On October 27 2021, Shiba Inu opened at $0.00004795 and reached an all time high of 0.00008685, with a volume of $30,053,846.018, and a market cap of $31,584,857,463

.png)

Image from coinmarket cap

After this massive price boom, the coin started making its way down, which was tagged to the millions of coins transferred across wallets. This simply means that huge holders sold a huge amount of coins to bag profit, and threw the market into confusion

Right now, the price of Shiba Inu has gone down even more trading between 0.00002 and 0.00003. The huge dump affected the market

If the whales used a dark pool for the transaction, what would have happened

We all know that the market cannot be certainly predicted, but some things drive the market. When people hear positive news, the market would be in good condition. Any bad news would make the market be in disorder

If the whales had secretly used the dark pool for their transactions, no one would understand what happened. They will sell to another buyer, and no information would leak. The hype and the ginger that people have for the coin would continue and there is a probability of the coin going more higher than its all-time high

Question 9

In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words)

In my opinion, I think the impact of trades carried out in the dark pool on the market price is fair. I can imagine the god and the bad side

It's no news that dark pool is meant for people with huge assets or finances. No average trader can partake in the dark pool. So this is the first point I deduced

The dark pool was created to make the rich richer. Yes. I believe every trader trade to make a profit, so there's no doubt that the institutions are making profits from using the dark pool for transactions

Also, I think the reason for the dark pool is to hide their financial solvency. If transactions are made via the public exchange, people would begin to know what and what they are worth on a particular investment, so they feel like being secretive, and I don't think that's bad, because that's one of the main purposes of using the blockchain

Another thing I want to chip in is that from the research I made, I discovered that almost 30% of trades are carried out on the dark pool platforms, while the remaining percentage is for the regular traders like us

I think if there's no dark pool, there would always be a way to use the same market and transact, which we've been using before the dark pool was created. (After the dark pool was created, we are made to believe that huge market order might crash the market, which is true, but as large investors are buying, large investors are selling, so I believe there would still be a somehow reasonable market) Left for me, I see no much difference in using the regular exchanges from using the dark pool. Huge buy order would rice the market, and vice versal

Afterall, we all understand that the market is volatile, so I think even if the same exchange is used, the effect on the price of the asset will keep fluctuating as ever

By and large, the privacy part kills it all, and no one should be deprived of that fact. Lastly, Now that the dark pool exists, if huge assets is sold in the dark pool instead of the traditional exchanges, the market would remain as it is because there's no information leakage. The only way this can have an impact is when an institution announces the purchase of $10M coin/shares. People can start buying more. But mostly, sellers don't broadcast

Question 10

What are the advantages and disadvantages of Dark pool in Cryptocurrency?

There's nothing with advantage that doesn't have its disadvantages. Below are the advantages and disadvantages of dark pool

Advantages

1. The crypto industry has gone through a series of challenges and it's still in progress. Many people find it difficult to adopt crypto because of its transparency. That's why people keep stressing on privacy. One of the major advantages of the dark pool is privacy. It attracts big investors to join the crypto train because they understand that they can transact without anyone knowing about it

2. Traders (institutions/large investors) can sell at desired price compared to the market price of the asset

3. there's no slippage

Disdvantages

1. There's is lack of transparency

2. The assets that is supposed to be traded in the market is traded in the dark pool, thereby reducing the market liquidity

3. The whales can manipulate the market, buy low from the market in bits over time, and sell high in the dark pool

Conclusion

The dark pool has helped many investors in many ways to manage their business. Not everybody detests privacy. In fact, I can say many people love it. The privacy incorporated into the blockchain system makes it unique and it made more people adopt the new technology because of the ease and freedom

moreso, from all my research, dark pool happens to be available on many platforms that deal with stocks and the likes. Various platforms offer dark pool trading but they are almost all centralized. A decentralized system of dark pool is far from the reach

All in all, the dark pool introduction to the blockchain system is a very good approach that allow more privacy among big investors and high institutions

Thanks for reading

This is ckole the laughing gas

One love

CC: @fredquantum

.png)

.png)

.png)

.png)

.png)

.png)

.png)