.png)

Solona is an open-source platform that was mainly introduced to improve scalability, speed, and transaction cost. it uses the POS and POH mechanism to maintain and process data on its network. Though it has other mechanisms in place, the POH is seen as the main power accompanied with the POS before other mechanism serves as a buttress. The transaction power of the solona blockchain is exceptional compared to other blockchains

Question 1

Explain in detail the PoH of Solana

Solona has made it possible to solve the problem most blockchains are facing. Most blockchains use only the proof of work, proof of stake, but the solona blockchain uses the proof of history and other mechanisms to enhance scalability for faster transactions. Solona was founded in 2017 by the former Qualcomm, intel and dropbox engineer. the concept of POH was pioneered by the engineers, and the poh is found to address scalability, and security

How does the solona poh works

The solona proof of history has access to connect and compute to all nodes on the blockchain and since it has the picture of all the networks, it would be easy to reduce the overhead messages and enable the blockchain to carry out massive throughput. All these are done using the delay verifiable function. This delay function hashes transactions. Every event have their hash numbers and they are all verified sequentially

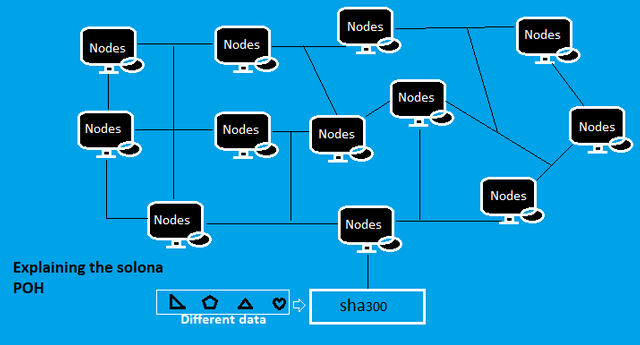

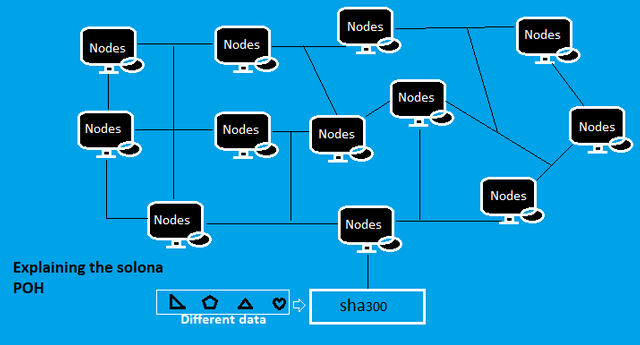

image: my design

From the above image, we can see many nodes all connected. All these nodes are capable to cryptographically create an ordering of transactions that would be stored in the ledger and time would be verified instantly because all the nodes have a cryptographic clock that makes them form an agreement on the time the transaction is ordered

As the data (as shown in the image) enters, as incoming events, they are all given a hash number, and as such, the nodes verifies the transactions immediately because the delay function that is used would allow the network to know which data comes first, and they are ordered, and the passage of time of an event is recorded. This makes the solona blockchain capable of ordering more than 50,000 events per second

Question 2

Explain at least 2 cases of use of Solana

1st use case. Serum

1st use case. Serum

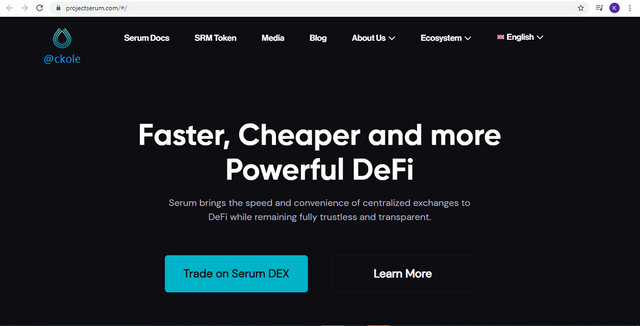

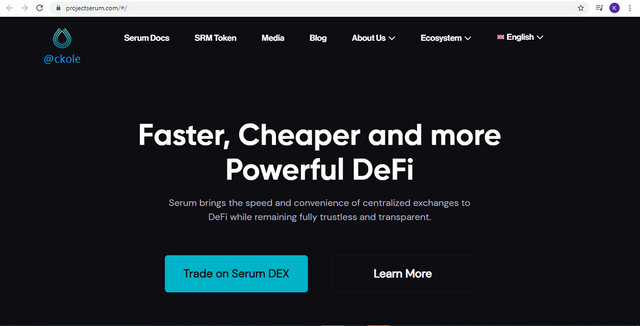

Serum is a decentralized platform created by Bankman Fried and other of his associates, but he's the face of the project. The serum platform was geared due to the complaint made by various users of Defi projects on Dexe's created on the Ethereum platform. High cost of transactions, low scalability, and speed level which made users skeptical of transacting the way they would have if all these are put in place

The serum platform which happens to be the first project on the solona blockchain came to address these issues. That's why they chose the solona blockchain which is the fastest blockchain with high scalability in the world. It's no news that the solona blockchain can perform over 50,000 transactions in a second because of the cryptographic architecture used in making sure that every node works without waiting for one node to validate before another

The serum exchange offers many features. First, let's see the serum interface

The serum interface

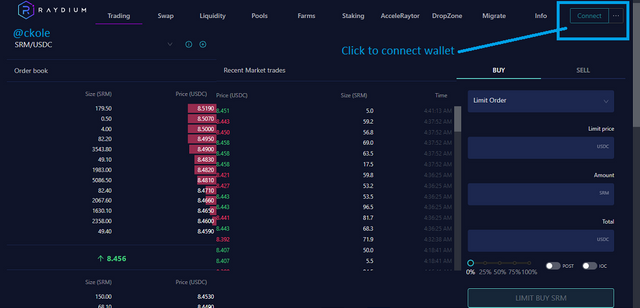

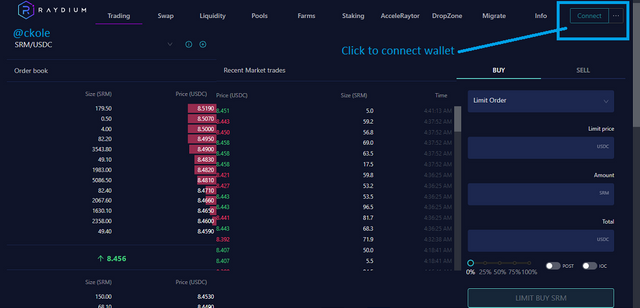

To transact on serum, you would click the connect button as shown below to connect your wallet with the exchange

.png)

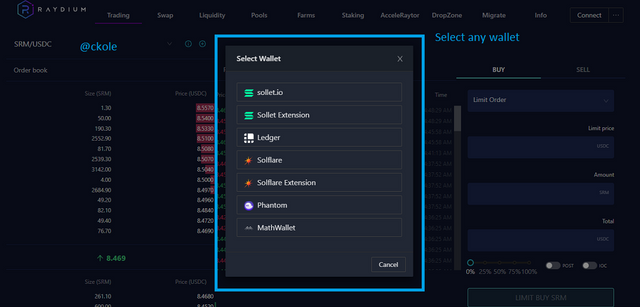

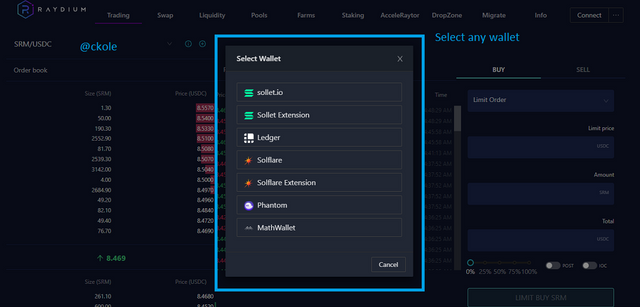

you can connect to any wallet here, and you can buy SRM (the exchange coin)

.png)

The decentralized exchange has many features that traders can utilize. It has swap, liquidity, pool, farm, staking, and so on.

<center*What are the things serum offers8

Speed: Because it's built on solona network, it offers great speed compared to other dexe's on ethereum

Low cost: The cost of transacting on serum is very low. it offers $0.00001 per transaction

The order book provides users the opportunity to transact in various ways

Let's look at the serum token (srm)

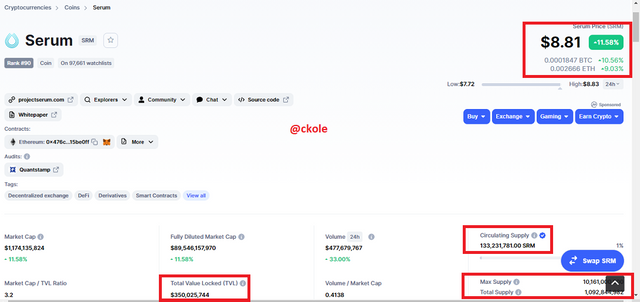

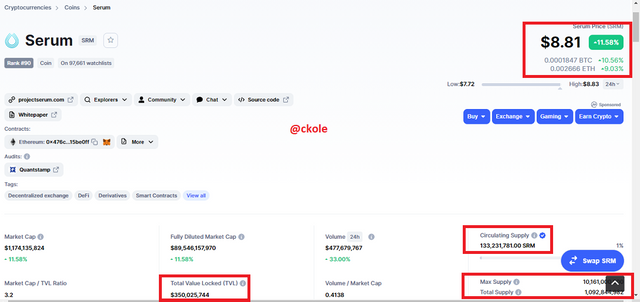

The serum token is the native token of the serum platform. It has a total supply of 1,092,844,982, circulating supply of 133,231,781.00, and max supply of 10,161,000,000. On coin market cap, the total value (TVL) of CRM locked as at when this post is published is $350,025,744, and $722.84m overall on defillima

.png)

coin market cap image of serum token info

.png)

2nd use case. Parrot protocol

Parrot is a stable coin created on the solona blockchain. Imagine the numbers of LP tokens we have in existence used to mine on different platforms, but there are limitations to their uses. Let's look at the staking pools, derivatives, yield optimizer, money markets and so on that uses different protocols. All these Lp tokens on uniswap, pancake swap, AAVE, and so on. They can be used as collateral to mint PIA on the parrot protocol and the minted PIA can be used for any purpose maybe buy more tokens or provide more liquidity and so on

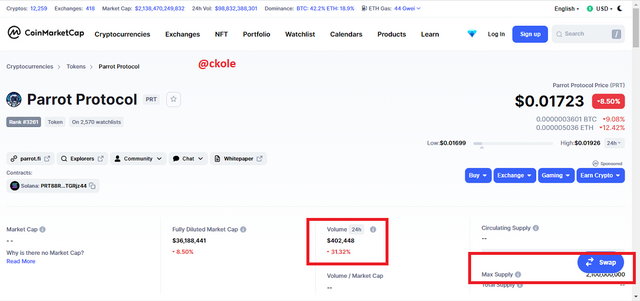

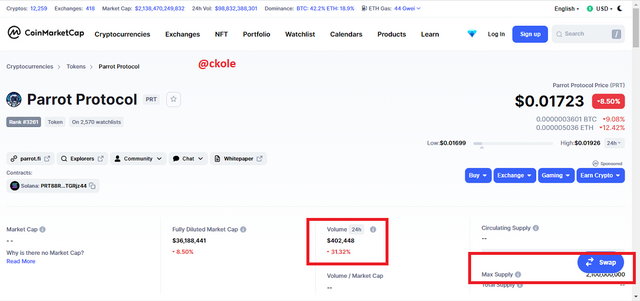

Let's see some info about parrot token (PAR) on the coin market cap and defillimo before I explain further.

.png)

.png)

The parrot token has a max supply of 2,100,000,000, and 24 hr volume of $402,448 (as of when this content is created).

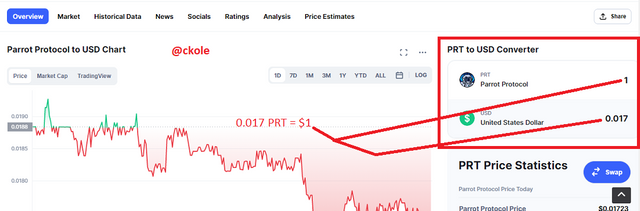

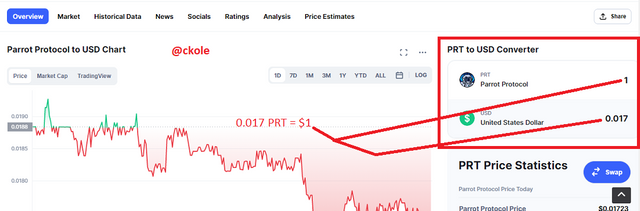

.png)

From the above image, 1 PRT is pegged to a dollar, and as we know that stable coins have ways of stabilizing their coin, parrot has not failed in that aspect

Now let me explain further where the stable coin has brought goodies into the crypto system

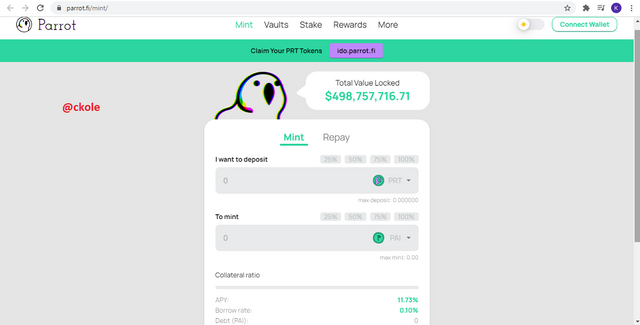

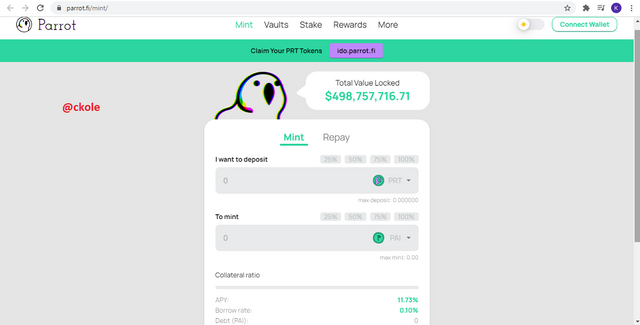

.png)

The image above shows the parrot platform where lp tokens can be used as collateral to mint PAI (Also equivalent to $1).

This is to solve the problems encountered on other platforms. and that is making the tokens locked on other defi platforms accessible, and used for other purposes. So the parrot protocol created a lending and a lending network where these tokens can be used as collateral to mint PAI, which can be used to a maximum level because of its use cases designed by the parrot protocol

To buttress this, the parrot protocol create

the PAI stablecoin, backed by LP tokens as collaterals. This creates a common unit of account to make it easy for holders of different types of LP tokens to transact with each other.

Create the Parrot Lending market, taking LP tokens as collateral. This allows LP holders to access their locked value by borrowing against lender liquidity.

Create a margin trading product (virtual AMM) using PAI as the common unit of account. This allows the Parrot community to collect fees, and feed the family.

Link to PAI token on coin market cap

Question 3

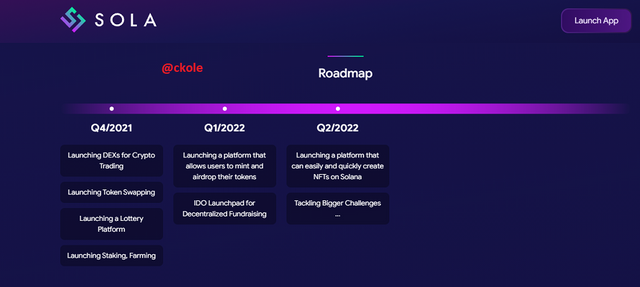

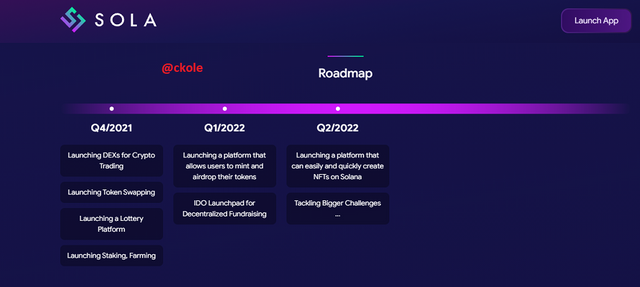

Detail and explain the SOLA token

Sola is the native token of the solana blockchain. From the explanation of solona from the beginning of this content, we would see that the solona blockchain has many things in stock for every crypto user. The sola token was created to enable

Quick swap and trade with minimum charges

Easy passive income

Easy way to create NFT on the blockchain

Lotteries in a decentralized way

Though the last three are on the way, they've made waves because of how much they've invested into making sure they stick to their plans and road map with consistent updates

.png)

From the road map, we can see that what they anticipated in the fourth quarter is already on the move. The first two on the list (Dex for crypto trading and swapping)has been worked on

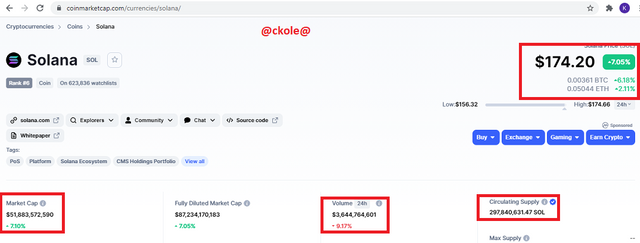

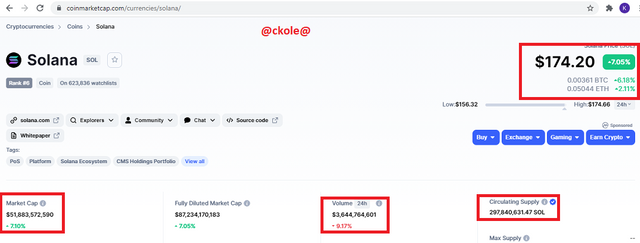

Let's see what the coin market cap say about sol

.png)

From the image above, the sola coin has a circulating supply of 297,840,631.47, with a 24 hr volume of $3,644,764,601, and a market cap of $51,883,572,590. All with respect to the time I took the screen shot from the coin market cap, and one sol coin was $174.20

All the dapps built on the solona blockchain rely on the solona blockchain and the sol coin because it has to do with a smart contract. And what is a smart contract? They are written programs that run on the blockchain when some parameters or conditions are met and this causes automatic execution of a condition. The solona protocol have many use case, but to mention but a few, the two is one of the best I mention is not far behind

Question 4

When did Solana Blockchain see its operations interrupted? Why? Explain

Just as many prominent blockchains have had a downtime one time or the other, solona also bit from the cake. Solona that was doing 50,000 transactions per second had a sudden increase of transaction load up to 400,000 per seconds, of which the network has not reached that capacity, so what do we expect

There would definitely be a break down. It's just like carrying a load bigger than what you can lift. This interruption made the sol coin drop by 15% over the period (like 45 minutes) of the incidence from $215 to $145. Tuesday at 12:38 pm UTC would ever be a memento in the history of the solana blockchain that they can never forget, however, that did not go a long way with them after they came back and the system was stable

The validators had to restart the entire network to put things in place and later regained their stability. There's always a time in life when this things would seems to fall apart, but they will get back to normal if the right thing is done, and that was what the solana blockchain did to remain the fastest and scalable blockchain that ever existed

Question 5

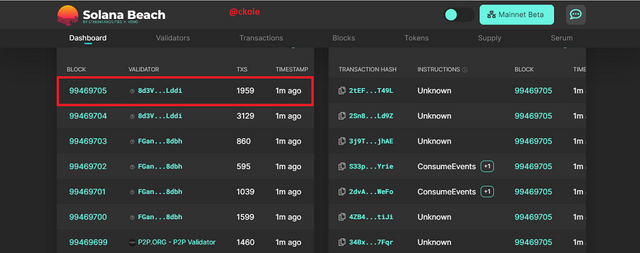

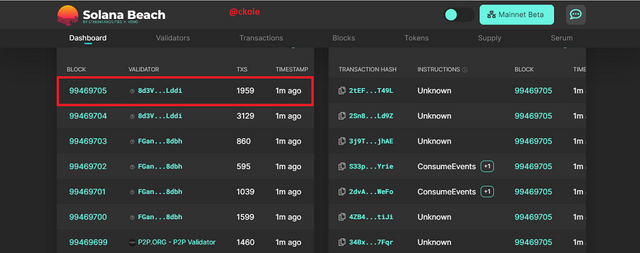

Check the last block generated in Solana and make an approximate calculation of How many blocks per second have been generated in Solana, taking into account from the initial block to the current one? Justify your answer and show screenshots

calculating how many blocks were generated goes thus.

And from the image above, the recent block I snapshot was 99469705

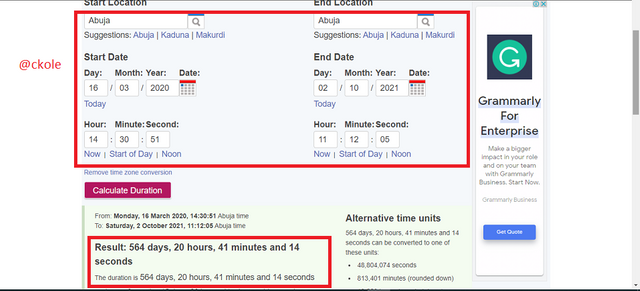

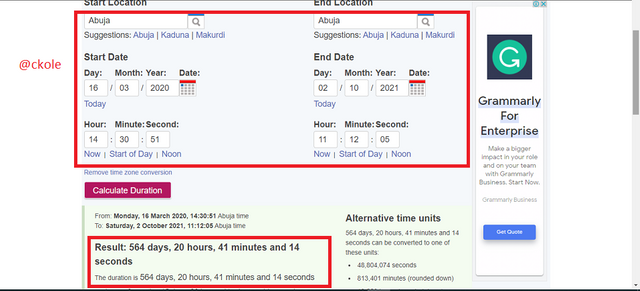

So from the calculation made via the time zone in the image below, we have

.png)

From: Monday, 16 March 2020, 14:30:51 Abuja time

To: Saturday, 2 October 2021, 11:12:05 Abuja time

Result: 564 days, 20 hours, 41 minutes, and 14 seconds

The total seconds gotten is as follows

First, let's calculate the 564 days and break it into hours

We know that 24 hrs = 1 day, so

564 x 24 = 13536 hrs

Now let's break it into minutes

And since 60 minutes = 1 hr, we have

13536 x 60 minutes = 812160 minutes.

Breaking it down further, we still need to convert it to seconds and 60 seconds = 1 minute, so

812160 min x 60 sec = 48729600 seconds

Therefore, 564 days = 48729600 seconds.

To deal with the 20 hours, we would need to break it down into minutes and seconds. Here we go

20 hrs X 60 mins = 120 minutes

Breaking 120 mins to seconds

120 mins x 60 secs = 7200 secs

The next is 41 minutes. we would convert it to seconds in one hand. So we have

41 mins x 60 secs = 2460 secs

But not the least is 14 seconds, and we don't have anywhere to convert it to. It will wait for the addition.

Now, let's add all the seconds converted

48729600 secs + 7200 secs + 2460 secs + 14 secs = 48739274

therefore we have 99469705/48739274 = 2.0408

which turns to be approximately 0.5 sec per block. I've done an accurate calculation here, and I believe the lagging time to swiftly take some readings is the cause

Conclusion

The solona blockchain has been a great platform for many traders because of its maximum scalability, speed, and low transaction fee to mention but a few. If we explore the solona blockchain, we would notice countless dapps doing wonders. This is a good opportunity for traders to explore more and invest in potential projects of choice. Thanks to our prof for bringing us this excellent opportunity. I've gained more than what anyone would expect from this lecture that put me in this homework. This is a great learning opportunity for all

Thanks for reading

This is ckole the laughing gas.

One love.

CC: @pelon53

All images are screen shot from the solona blockchain. They are all original images

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)