Background

Good afternoon respected professor @yousafharoonkhan , Thank you for such a useful content of your class, I present you my homework.

Question # 1

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

The order book, is a list where we can observe the record of buying and selling that is in the trade, we can also see the price offered by sellers and buyers to be able to make the decision to make a purchase or sale transaction. There are 2 types of order books, the local market order book and the cryptographic order book.

Crypto order books are mainly characterized by the exchange between pairs of assets, i.e. one cryptocurrency is exchanged for another. We can mention a couple of examples to make this exchange understandable: (BTC/BTT). Also by a cryptocurrency for cryptocurrency that is known as USDT, Example (BTC/USDT).

This exchange is achieved through buy orders and sell orders, We can buy BTT with BTC or sell BTC to get BTT, these buy or sell orders are the ones that are recorded in the ledger.

The differences that exist between an Order Book of a local market and a Cryptocurrency one are the following.

Cryptographic Order Book:

It is a fundamental tool that allows to observe in real time the buy and sell orders made by different traders.

It works the exchanges by pairs.

You can enter the market and choose the best offer or the one that suits you.

It is decentralized.

Local Market order book:

Buy and sell orders are not observed, and cannot be accessed by anyone.

Does not work in pairs.

No variety of prices to choose from.

It is centralized.

Question # 2

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

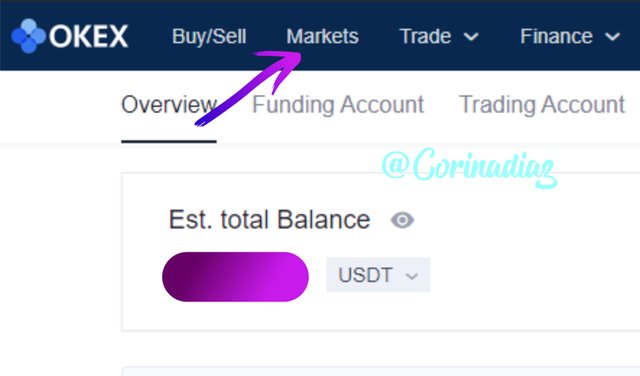

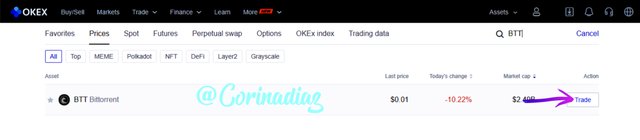

To find the order, once logged into my Okex exchange wallet, at the top, (PC View), I select the Market option.

Fuente Okex

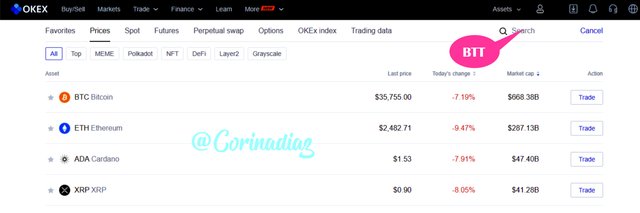

The list of Cryptocurrencies available for exchange appears, so we type in the search engine, the currency of our interest. When we type the Cryptocurrency, it appears in the list to be able to choose it and we select Trade on the right side as we see in the screenshot sequence.

In this way I find the order book, where I can see the flow of the market, the volatile way it fluctuates, I also see the current market price, the trend and the call and put options.

Fuente Okex

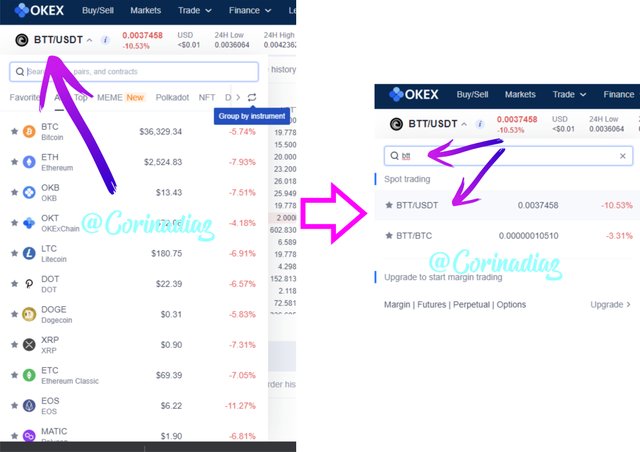

But how do I choose my trading pair? By default in my order form it shows me the BTT/USDT pair, which is the one I will work with but if I want to change it, I must select where the current pair appears and there appears a list with the options of pairs in the wallet, in case I want to change it I also have the option of BTT/BTC.

Fuente Okex

I hope this part of the order book has been understood.

Now let's define:

Pairs

Support and Resistance

Limit Order

market order

Pairs

These are 2 currencies or cryptocurrencies chosen by the user to trade with each other. For example, if you want to exchange BTC for BTT, a buy or sell order is issued. That is, if I want to buy BTT, a purchase order is placed and I pay with this cryptocurrency with BTC or If I want to sell BTT to receive BTC, a sell order is placed, for this it is necessary to know the market price and the behavior of the price of this pair in the market.

Support and Resistance

Support:

It is the lowest price level in a downtrend, which occurs when the buying demand is high and Stops to start an uptrend. That low level, where it is observed that more buyers than sellers appear and the curve slows down before starting to rise, is called, support.

Resistance:

It is a price level where an uptrend stops, this occurs when traders accumulate profits and sales predominate causing a fall in the price of the asset, this maximum level reached during an uptrend, is called Resistance.

Image

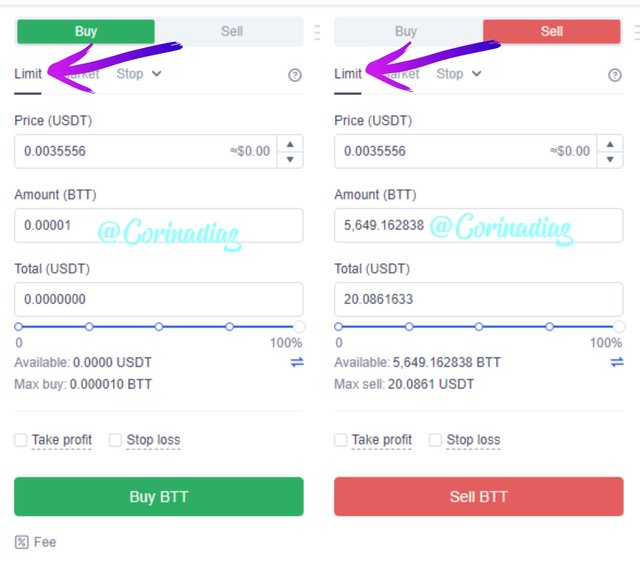

Limit Order

It is the instruction to buy or sell at a favorable price taking into account the market price as a reference. This order to buy or sell will only be carried out when the market price reaches the established price.

For the Buy Order, after choosing a trading pair, we place a price below the current price to buy our asset for a good price, the price we are willing to pay for the asset would be our Limit price for the buy order.

For the sell order, we set a price that is above the market price in order to make a profit, this sale will only be executed when the market price matches our limit price.

Fuente Okex

Market Order

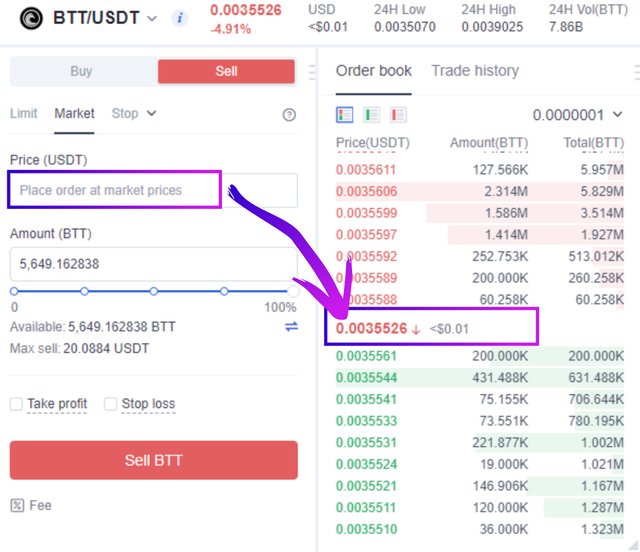

It is the buy or sell order whose price matches the current market, therefore this order is executed immediately. Example: if the market price is at 0.0035526 USDT, by issuing the sell order, as the example in the picture below, this sell order will be filled instantly.

Fuente Okex

Question# 3

Explain the important feature of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

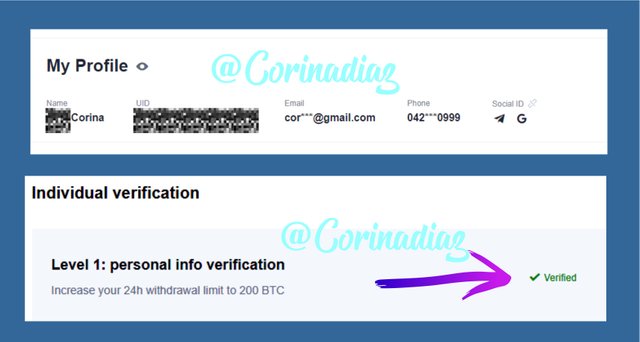

First, as the assignment indicates, I will show the verified profile of my account:

Fuente Okex

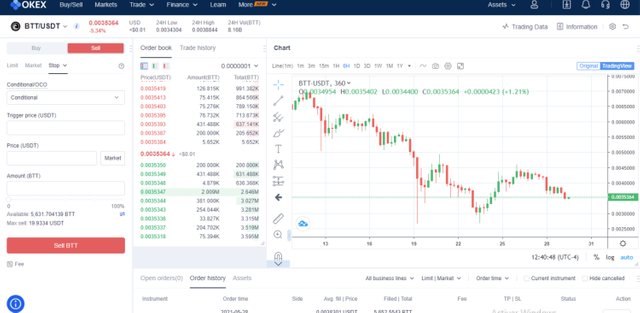

Now in order to mention the features of the order book, I will show you an overview, after logging into my Okex wallet and choosing the BTT/USDT pair.

Fuente Okex

Within the order book we find the records of the buy and sell orders of the different users, their price in USDT and the amount of Cryptocurrencies they offer to sell or buy.

Fuente Okex

We also have the buy panel where the assets exchanges are made, these have different options to make the purchases, the user chooses the most convenient at the time of placing the order. We will use the following screenshot as an example of a buy order. It is characterized by its green color

for this example I used a buy at market price

Fuente Okex

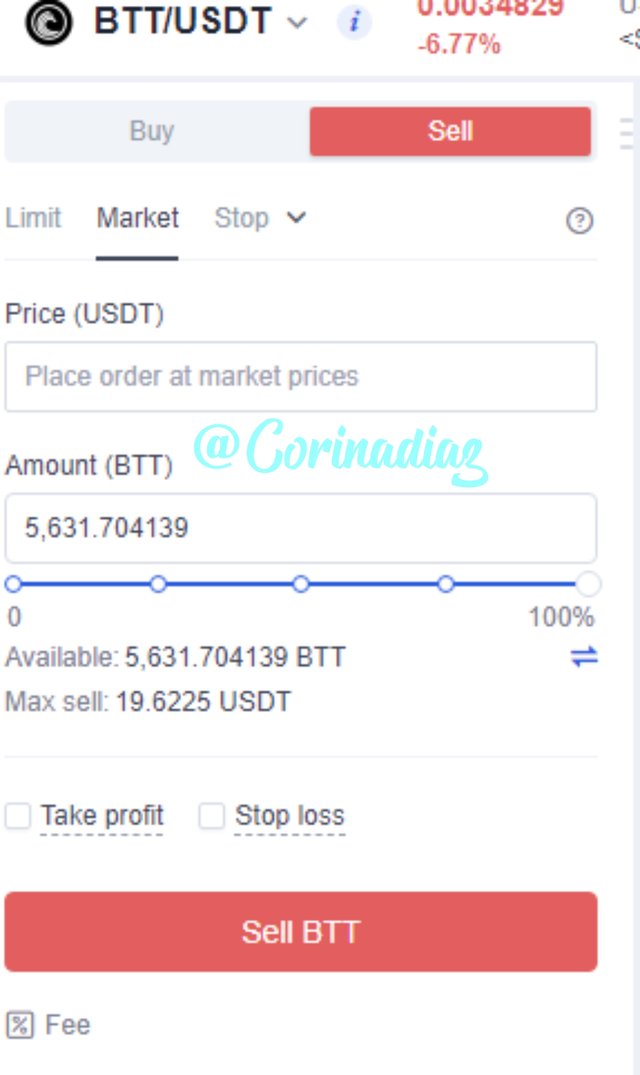

For the sale we have the red panel, where you can choose the option of sale at the user's convenience, after making the decision to sell taking into account the market price as a reference and set the price, the sale is made and will be completed according to the type of sales order chosen.

To make a sale we only need to select "sell".

Fuente Okex

The Purchase and Sale Order options offered by the platform are as follows: Limit Order, Market Order, Stop-Limit and OCO.

Fuente Okex

Question # 4

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

Stop-Limit

The stop-limit order is an option that allows you to set the price at which a buy or sell order can be executed, which is known as a "stop order" and the price at which you wish to buy or sell, also called a "limit order".

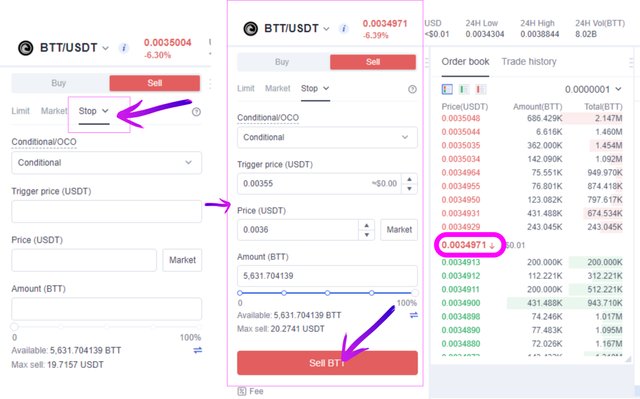

Sell Order, (Stop-Limit):

To place a sell order, first select the pair I am going to work with (BTT,USDT).

Then we select the option "Stop" in the "sell" field, the options appear: Trigger Price, Price and Amount.

Trigger Price: This is where we will place our price where we want to activate the sell order, for this to happen it is necessary that the market price reaches that price, taking into account that the price must be above the market price. For the purpose of this example the market price is 0.034971 USDT. So I want my activation price to be when the market price reaches 0.0355 USDT.

In the Price box, we will place the limit price, that is, the price at which we want to sell and I want to sell when after the sell order is activated, the market price reaches 0.036 USDT.

For this task I will place the order with 100% of my BTT to exchange for USDT and then select "Sell" to complete the order.

Buy Order (Stop-Limit)

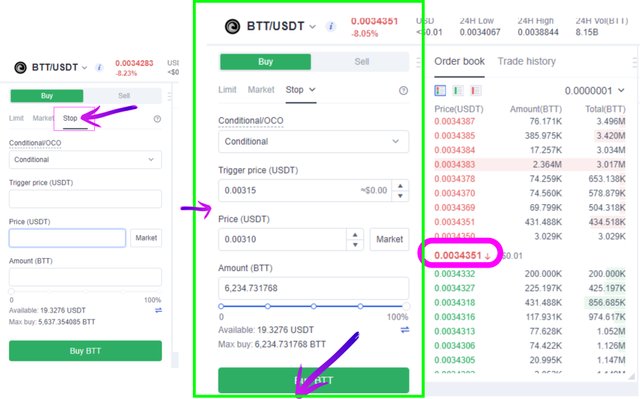

To place a buy order with Stop-Limit, I choose my pair for the exchange, (BTT/USDT), then we select the "Stop" option in the "sell" field, and again we see the options: Trigger Price, Price and Amount.

In Trigger Price, as we saw before is where we will place the price to activate the buy order, but for this occasion, it must be below the market price, which for this order was at 0.0034351 USDT, . So I want my activation price to be when the market price reaches 0.0315 USDT.

In the Price box, we will place the limit price, that is, the price at which I want to buy, after the purchase order is activated, I want it to be placed when the market price reaches 0.0310 USDT.

Fuente Okex

Order of Purchase and Sales with OCO

First of all we must know that OCO means "One Cancels the Other", this means that we can make 2 orders simultaneously, where when one is activated, when the market price reaches the activation price of one of the 2 orders, the other one is automatically cancelled. This is definitely a fabulous tool.

In the case of Purchases the TP Activation Price is lower than the market price and the SL Activation Price is higher than the market price, making a range of probability of profit or minimum loss.

In the case of Sales it is the other way around, the Activation Price is higher than the market price to opt for profit while the SL Activation Price is lower than the market price.

Wonderful isn't it? Now let's see examples with screenshot.

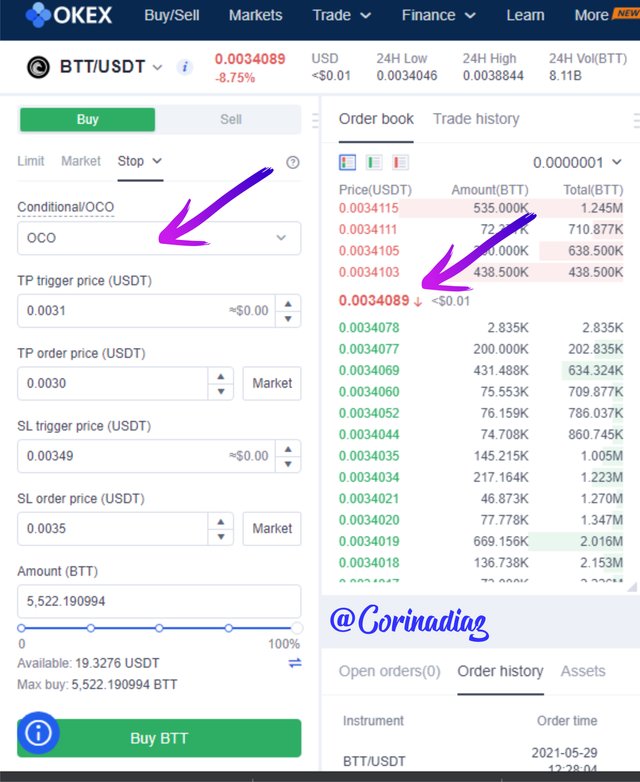

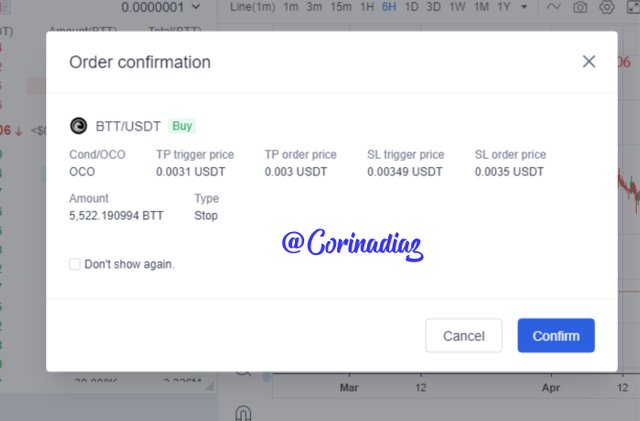

Buy Order with OCO

I am still working with the BTT/USDT pair.

For the purpose of buying in OCO, taking into account the current market price of 0.0034089 USDT, I set my TP trigger price (0.0031 USDT) to execute the purchase at my limit price (0.0030 USDT). To avoid losses, I activate my SL at position 0.00349 USDT and my limit at 0.0035 USDT.

In my case I use 100% of my USDT to buy BTT I confirm the trade and that's it. Completed the buy order.

Fuente Okex

Fuente Okex

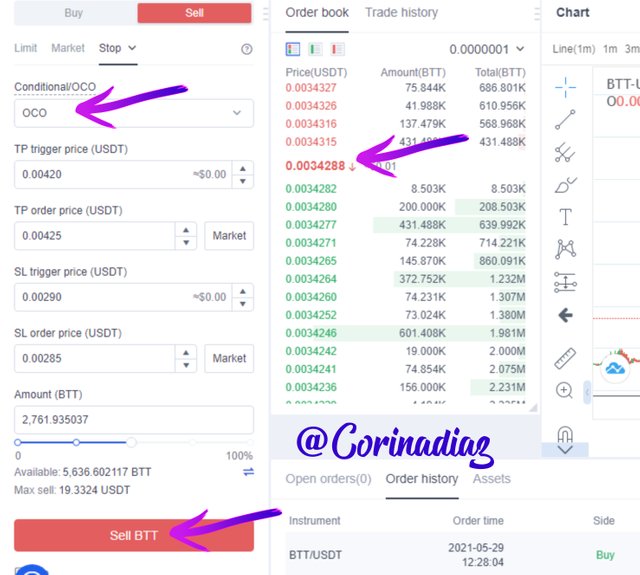

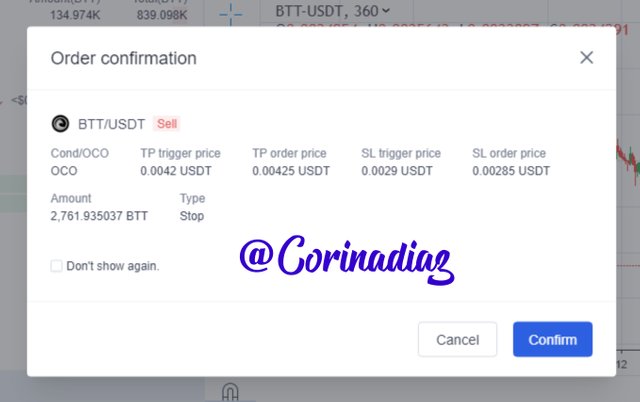

Sell Order with OCO

For the purpose of selling in OCO, taking into account the current market price of 0.0034288 USDT, I set my TP trigger price (0.00420 USDT) to execute the sale at my limit price (0.0025 USDT). Then, I activate my SL at position 0.00290 USDT and my limit at 0.00285 USDT.

To make it different, I place the order with 50% of my BTT and trade for USDT, select "Sell", confirm the trade and that's it. Completed the sell order.

Fuente Okex

Fuente Okex

Question # 5

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

For trading to protect yourself from losses during your cryptocurrency buying and selling you should use the order book which presents many options for trading such as limit order, market order, stop limit order and OCO. The knowledge of these orders allows you to profit in the market and minimize your losses in the short, medium or long term. These orders of the order book give us confidence at the time of the investment, due to its operation, so with the limit order you can set a price that will be executed automatically when the market price reaches the set amount and thus profit will be obtained.

With the order book we can know what the market trend is at the moment we want to buy or sell. This allows us to see all the details of buy orders and sell orders and we can estimate at what price the buying and selling trend is being executed and helps us to protect the assets from losses that could be generated, that is, it would help us to make profit.

It was investigated on support and resistance in the order book and it is observed that once we know all the buy and sell orders and amount of prices we can decide where to place the support level and be able to make purchase of assets at low prices and then sell with profits because the support level tells you the minimum level that the asset can reach, while at the resistance level you can sell cryptoassets and make profits , because the resistance level indicates the maximum point that the cryptoasset reaches.

It is also worth mentioning technical indicators such as: MA, BOLL, TRIX, VOI and KDI, they help to make profits, which is what we all want, and save losses.

For trading it is also very important to use the OCO (One Order Cancels the Other). The OCO works with a group of orders linked together, and allows better management of this group of orders. It is used to minimize the risk of loss and optimize profits.

Conclusions

The order book helps to optimize profits in cryptocurrency investment.

OCO allows you to manage orders when you have a group of them.

Trading benefits from the order book. It offers orders and technical indicators that help your profits.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

need more detail to explore the question 5

look fine homework , keep continue good work, best of luck

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit