Hello everyone!!! I hope you are doing well! In this opportunity I want to share with you my homework from the teacher @kouba01 , which I submit below.

Resource

What is a cryptocurrency CFD?

CFD, Contract of Difference, is mainly a Contract or an agreement between 2 parties, where the difference of a value of an underlying asset that is obtained in the range that exists since the contract is opened and when it is closed is exchanged, that is, the gains or losses obtained when buying or selling an asset. In this case the exchange is done through a Broker, and we can operate with a financial product such as Cryptocurrency, thus being able to take advantage of the ups or downs of the asset depending on the CFD that has been made.

To operate with CFD's, two situations must be taken into account: Buying, which is done when we believe that the value of the cryptocurrency is going to increase, that is to say that the points will move in ascending order. But in the opposite case, when we believe that the value of the Cryptocurrency will have a drop due to some recognized financial crisis or other situation. We can Sell, before this starts to affect the value of the cryptocurrency downwards and then wait for it to have a significant decline, and thus get more cryptocurrencies, at the time of buying again.

It is important to search and inquire which are the best brokers (Reliable and safe) to create these contracts, then the exchange agreement is made where the investor chooses between the stock options offered by the Broker, when opening the process, you will have the option to withdraw when you have reached a profit or even a margin of loss.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

First of all, it must be taken into account that working with this type of agreements has its risks. To say that they are suitable for my trading strategy would be to resort to a thorough investigation of pros and cons before making a deal, since one option is to resort to leverage, even with little capital, taking into account, that my amount of cryptocurrency, in case of having losses and not profits as I would have planned, the margin of loss is tolerable. I should know if my trade would tolerate this, as cryptocurrencies are generally volatile.

Are CFDs risky financial products?

Definitely yes, the volatility of cryptocurrencies means that the opposite of what is expected can happen, therefore the probability of losing is present at all times. If you are inexperienced, it is preferable not to participate, but if you like risks, welcome. Leverage is not for everyone. There are people who have done CFDs for large amounts and the losses have been overwhelming. But when there is the probability of winning, why not dare?

Do all brokers offer cryptocurrency CFDs?

NO, many brokers offer these contracts (CFD) through deposits of fiat money, in fact they have an agreement with one or more banks where there is a signed agreement to be able to make transactions. BUT nowadays there are many that operates with Cryptocurrencies, according to my research, several sources have lists of suggested Brokers according to: The initial amount, leverage, operations and platforms.

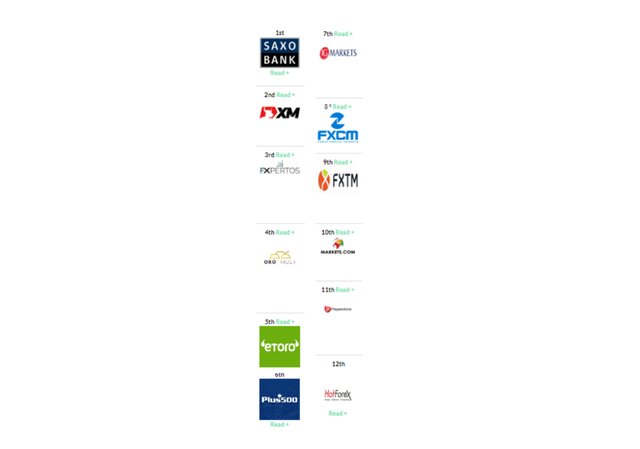

Here is an image showing a list of 12 best Borokers, Image and source were obtained from the following link || Best Brokers

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

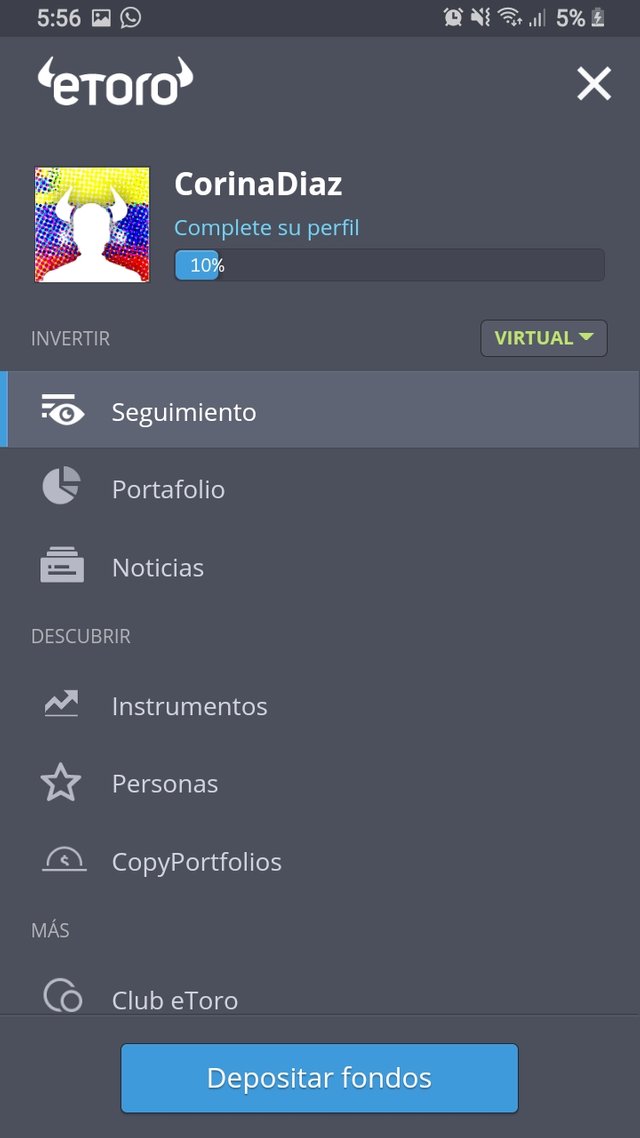

The Demo I used was eToro, since the other brokers did not allow me to access easily, or I did not know how to do it, but I always got out of obstacle the Nation (Venezuela), then, although eToro did not allow me to register the profile completely for this reason, it did allow me to use the Demo to perform the task.

I was able to change the option from Real Wallet to Virtual Wallet

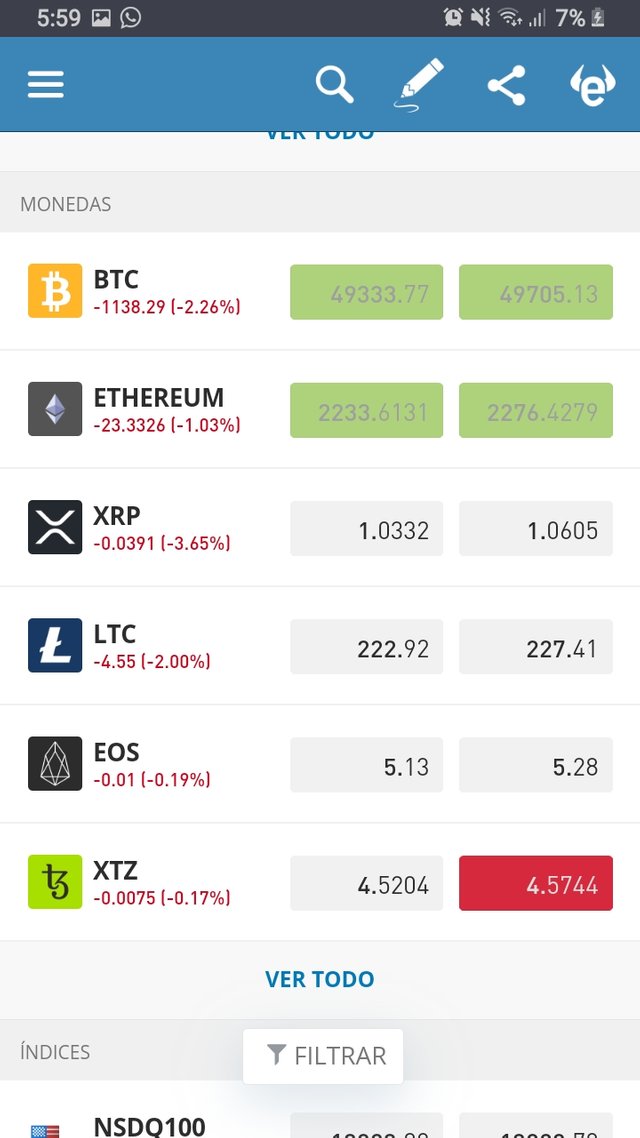

In this same screen, I click on instruments and a list of stocks and cryptocurrencies appears.

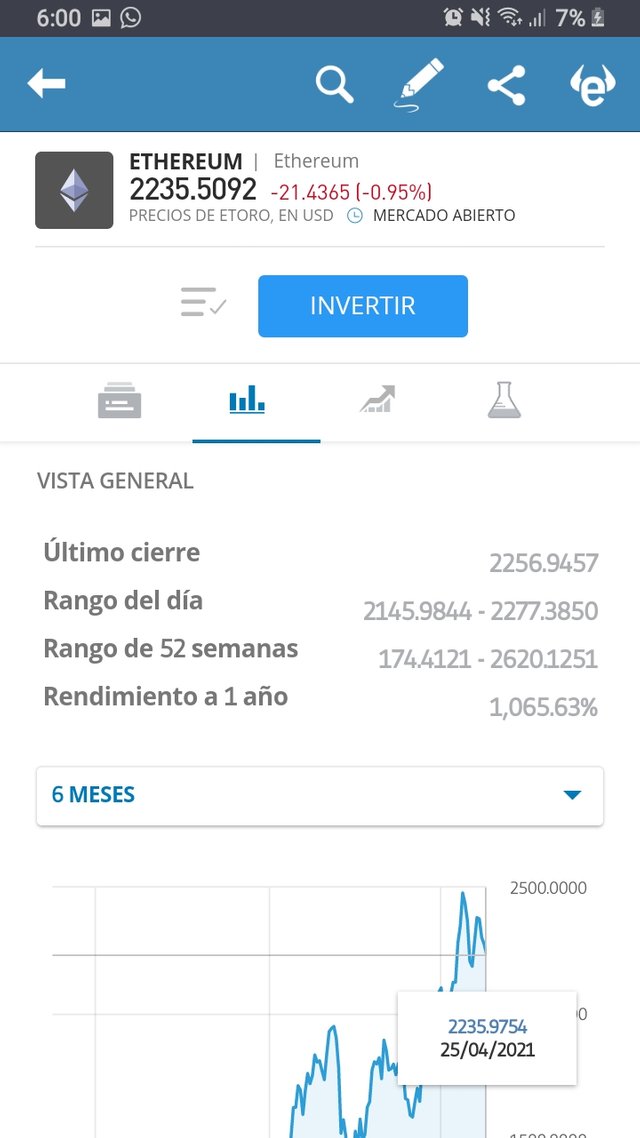

Select Ethereum. and I get the option Invest.

Here I choose the amount ($5000) and then proceed to execute the transaction.

I will conclude with a message that I found in every Brokers I opened looking for one to show you... More than a message, it was a piece of advice. To be able to make a CFD, you must take into account the risk and before trading, it is necessary to have knowledge of how it is handled, advantages and disadvantages. At first glance it seems easy, but it is a capital that will be put at stake.

Until the next Lesson!

Hello @corinadiaz,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

Good writing, in which you successfully answer the questions clearly. What is lacking in the work is the experience of another broker until we discover it with you and increase the benefit for everyone.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit