Dear Steemians,

It was a busy week for me doing some promotional activities for Steem and EID festival as well. When I looked at this week lectures by Crypto Professors, I was immediately attracted to the lecture by @yohan2on on Scalping because I like to do it whenever I am free in front of my laptop on my cell phone.

Steemit Crypto Academy Professor @yohan2on has explained the concept and different aspects of scalping and I was able to understand the following thing from this lecture;

- Concept of Scalping

- Merits and Demerits of Scalping

- Difference between Scalping and Other Trading Methods

- Requirement of Scalp Trading

Home Work Task

At the end of the lecture, students were assigned a homework task by Professor @yohan2on to practically demonstrate Finger Trap Scalping Strategy on two Crypto Assets.

Using the finger-trap Scalp trading strategy, practically demonstrate the scalp trading style on at least 2 crypto asset pairs such as BTCUSD, ETHUSD, etc

My expectations

Use a demo account for this exercise. You will need to create one using FXTM or any other trading broker of your choice. You may use an MT5, MT4 or trading view to execute your trades.

I expect you to explain the finger-trap trading strategy as you practically demonstrate all its vital elements on at least 2 crypto assets with clear screenshots.

I am submitting my task through this post by explaining Finger Trap Strategy and trading different setups on my Hugo's Way Demo Account.

I will start by explaining the Finger Trap Strategy and how we can use it to trade any markets.

It is based on two EMA (Exponential Moving Averages) crossover to enter and exit from the market. One EMA period used in 8 called Fast EMA and the second EMA period used is 34 called Slow EMA.

Trade Entry Criteria

The Finger Trap Strategy is based on the concept of taking trades when Fast EMA (8) crosses Slow EMA (34).

Sell Entry - If we are seeing the price going up then these EMAs will be moving up with EMA 8 moving above the EMA 34. So, When the trend starts to change the EMA 8 will start bending and moving down. When EMA 8 will cross down EMA 34, it will be a valid signal for Sell trade entry. We can enter sell whenever price pull back to EMA 8 as long as the trend is continued. You can get an idea of trade entry from the below chart.

- Buy Entry - If we are seeing price going down then these EMAs will be moving down with EMA 8 moving below the EMA 34. So, When the trend starts to change the EMA 8 will start bending and moving up. When EMA 8 will cross Up EMA 34, it will be a valid signal for Buy trade entry. We can enter buy whenever price pullback to EMA 8. You can get an idea of trade entry from the below chart.

Trade Exit Criteria

When it comes to set exit points for your trade, we have to consider two things. First is the Invalidation Area or commonly called Stop Loss and the other thing is Take Profit Level

Invalidation Area or Stop Loss is normally set just above the EMA cross-over level or Recent high in case of Sell trade while it is set just below the EMA cross-over level or Recent Low in case of Buy Trade.

- Taking Profit in EMA cross-over strategies is to exit from the trade when you see the next cross-over in opposite direction BUT it is not a good thing in my personal experience because we are scalping for a quick profit and should not be holding the trade for long no matter if it goes in 10X profit after we take profit. So, I like to take profit at 1:1 level and exit from the trade (discipline is the key in scalping).

Choosing Broker

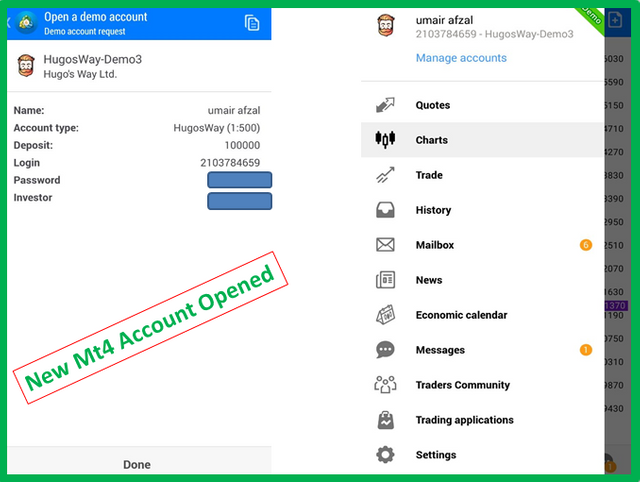

- I have created a new Mt4 demo account on Hugo's Way Broker because it offers most crypto pairs for trading and provides its services during weekends as well.

Setting Up EMAs

I have used my cell phone to setup the EMSs indicators because everyone likes to trade from cell phones, so it will be beneficial for others to know how to do it on cell phones.

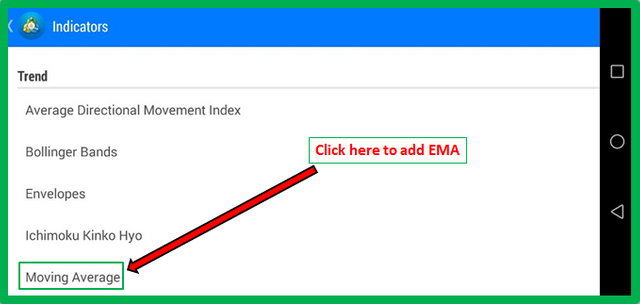

Click on the chart in landscape view and you will see the options on right and left side of the chart screen.

Click on F button to add indicators to charts as shown in the below picture.

- Select Moving Average from the Indicators list and input the indicators parameters.

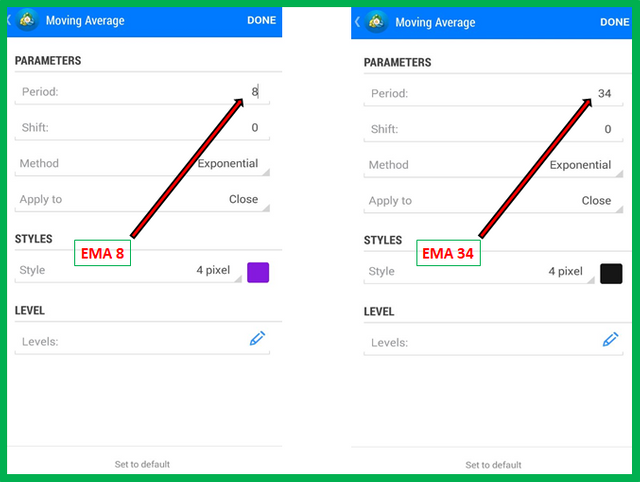

- To load EMA 8, write 8 in Period parameter, and to load EMA 34, write 34 in Period parameter.

- Shift should be set to 0, Method should be Exponential and Apply to should be Close

- Select different colors for both EMAs, so they look different and easier to spot entries.

- Click on Done after setting these parameters and EMAs will be loaded to the chart.

Deciding my Bias for Scalping

The most important thing is to decide your Bias about the direction you will be taking trades because it is all about the probabilities.

Mostly, we used to see the higher time frame for seeing the overall trend but for scalping, we can see the general sentiments of the markets as well. For example, Bitcoin has been dropping since the week start, so it was easier for me to decide that I will be taking sell entries and ignoring the buy signals.

So I selected my bias based on the bitcoin downtrend from the last few days and decided to take Sells only.

Filtering The Fakeouts

The MA Crossover strategies will give you fakeouts sometimes, so we have to use other confluence tools for better entries.

We can use additional indicators like MACD, Stoch or RSI but I am using my favorite tool (Market Structure) to filter out signals especially when taking the crossover trades.

I will explain and show how I use it when describing the trades below.

Trading ETHUSD

I selected 15 min timeframe to take my entry on ETHUSD because there was a great price action structure formed for a reversal.

Price has made a very decent lower high and EMA 8 was crossing the EMA 34, so I took my Sell Entry as the price pulled back to EMA 8.

Whenever price makes a lower high, it is followed trend reversal followed by market structure break. This is used by me as a trade filter to avoid getting into fake signals.

For trade illustration, I am giving tradingview chart showing my Entry, Invalidation and Take Profit Areas.

Here is my real trade chart that I took on my account. The Price has dropped as predicted and reached Take Profit Level giving 1:1 Profit.

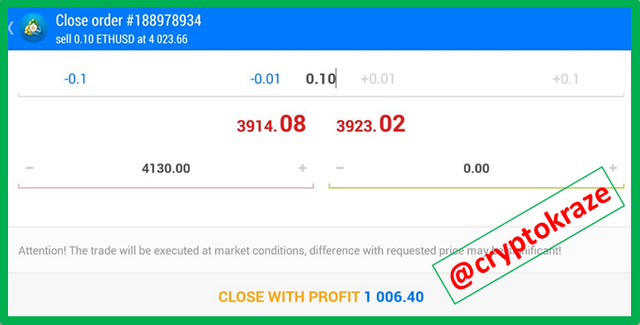

It was time for Exit and I have closed ETHUSD trade in +1000$ Profits.

Trading XRPUSD

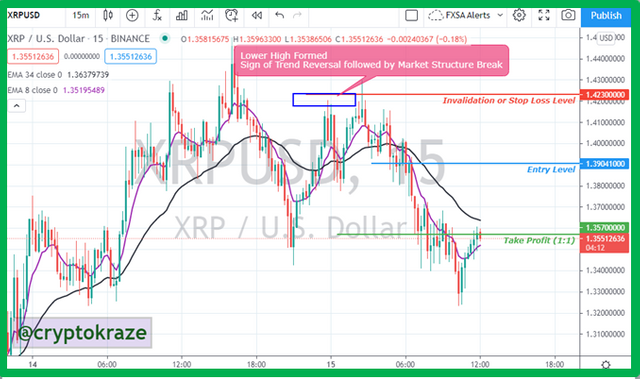

I selected 15 min timeframe to take my entry on XRPUSD because there was a great price action structure formed for a reversal.

Price has made a very decent lower high and EMA 8 was crossing the EMA 34, so I took my Sell Entry when price pulled back to EMA 8.

Whenever price makes a lower high, it is followed trend reversal followed by market structure break. This is used by me as a trade filter to avoid getting into fake signals.

For trade illustration, I am giving tradingview chart showing my Entry, Invalidation and Take Profit Areas.

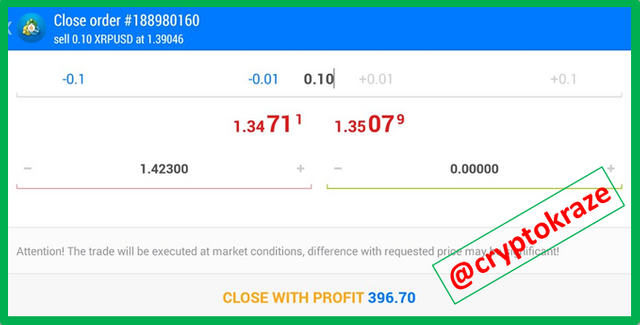

Here is my real trade chart that I took on my account. The Price has dropped as predicted and reached Take Profit Level giving 1:1 Profit.

It was time for Exit and I have closed XRPUSD trade in +396$ Profits.

Note: All Images are screenshots taken from my Tradingview Account and MT4 Mobile App.

Scalping is a trading method that is used on shorter time frame to get quick profits.

Finger Trap Scalping Strategy is based on EMAs cross-over that are 8 and 34.

This method is very simple to understand and newbies can learn it quickly and start taking trades in short span of time.

This strategy is a very good mechanical method and provides very clear entry and exit points.

Like other strategies, there are fakeouts in this strategy as well but we can use other indicators like MACD, Stoch and RSI to filter these signals.

I personally use Market Structure as additional tool to confluence these EMAs cross-over.

I have traded ETHUSD and XRPUSD on 15-minute time frame and made 1:1 profits on both trades.

A suggestion to all newbie traders is to practice and keep discipline if you want to succeed in trading.

Cheers to @yohan2on for giving yet another practical task that will help many who want to learn serious trading.

I would like to pay my thanks to our Crypto Professor @yohan2on for this practical lecture and looking to learn more in the coming weeks.

CC: @kouba01

Discord : FxKraze#2451

Telegram : @FxKraze

Twitter : https://twitter.com/fxkraze

Hi @cryptokraze

Thanks for participating in the Steemit Crypto Academy

Feedback

This is excellent work done. Well done with your research and the practical demonstration of the scalp trading style using the finger trap strategy.

Homework task

10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Respected Professor for the appreciation. I will continue to learn from you and do well in next weeks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@yohan2on how can join Crypto Academy

Lectures and Home work

I am interested.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post friend, it helps a lot to beginners like me. Thanks you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I m glad it helped you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Shared on Twitter

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit