In the context of loans, interest rates do not endear as much to the borrower as they do to the lender; after all, understandably enough, who enjoys paying a premium on top of the principal amount of a loan? That is, until, the concept of negative interest rates come into the picture! Yes, it is not impossible to take up a loan and get paid for it! This article features an interesting case study of such a phenomenon occurring unconventionally in the blockchain.

An Introduction To Negative Interest Rates

The concept of negative interest rates was first introduced in the 1970s by the economist Silvio Gesell, who argued that a negative interest rate could be used to encourage spending and discourage hoarding of money. Negative interest rates for loans occur when lenders charge borrowers less than zero interest on their loans. This means that rather than paying interest on their loans, borrowers receive money from the lender. By incentivizing borrowers to take up loans and spend money, negative interest rates can stimulate economic activity and increase consumer confidence, which in turn can lead to higher economic growth.

However, it wasn't until the 21st century that negative interest rates were actually implemented by central banks around the world. The first major country to implement negative interest rates was Sweden in 2009, in response to the global financial crisis. The Swedish central bank, the Riksbank, lowered its benchmark interest rate to -0.25% in an effort to boost economic growth and prevent deflation. Following Sweden's lead, several other central banks around the world began experimenting with negative interest rates. In 2014, the European Central Bank (ECB) became the first major central bank to implement negative interest rates on a large scale, lowering its deposit rate to -0.1%. Other central banks that have implemented negative interest rates include the Bank of Japan, the Swiss National Bank, and the Danish National Bank. In each case, negative interest rates were seen as a tool to stimulate economic growth and combat deflation, which had become a concern in the wake of the global financial crisis.

With a similar utility to that in TradFi, negative interest rates have begun surfacing in the field of cryptocurrency, heralding an earning potential for the investor.

The Interesting Case of DeFiChain DUSD

DUSD (DeFiChain USD) is a stablecoin that runs on the DeFiChain blockchain, which is a decentralized finance (DeFi) platform operating on top of the Bitcoin network, allowing users access to various financial services and applications in a decentralized manner.

Taken from the official DeFiChain YouTube Channel

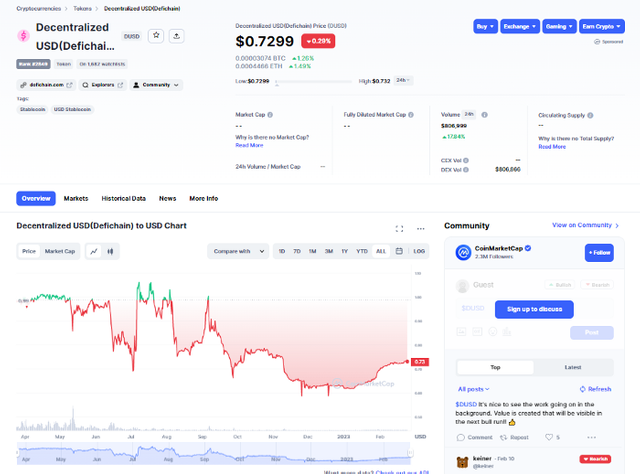

DUSD was originally designed to maintain a stable value of one United States dollar (USD) per token. However, an unfortunate series of black swan events occurring in 2022 have rendered the peg to be broken, as a massive selloff led to an excess amount of DUSD in the DeFiChain ecosystem.

Screenshot taken from coinmarketcap

Various initiatives have since been tried by the DeFiChain community, with limited success --- this includes the introduction of negative interest rates for DUSD loans. Under a recent proposal, DFIP #245, a portion of the DUSD purchased by the DUSD-burn-bot will now be channeled towards increasing the negative interest rate on DUSD loans, which aims to further incentivize borrowing and spending of DUSD to remove the excessive DUSD in the ecosystem.

How To Take Advantage of This Negative Interest Rate?

With a negative interest rate loan, you are essentially being paid to take up the loan; in other words, it is as if the loan was self-paying!

If you would like to test these waters in the realm of cryptocurrency, here is an excellent article featuring a step-by-step guide on taking up a negative interest rate loan on the DeFiChain.

If the concept of vaults and loans appear intimidating, CakeDeFi offers a simplified solution to generate passive cashflow on your crypto! In fact, an upcoming new feature --- YieldVault, will allow you to generate competitive returns of up to 20% on your crypto assets in a secure and easy-to-use manner, by leveraging negative DUSD interest rates to generate yields that will be paid in the native tokens --- BTC, ETH, USDC, USDT, or DFI, without any lock-up period. To learn more about Cake DeFi, feel free to check out my previous article here. Click here to sign up for Cake DeFi and earn an upsized signup bonus exclusively for new users!

My Results

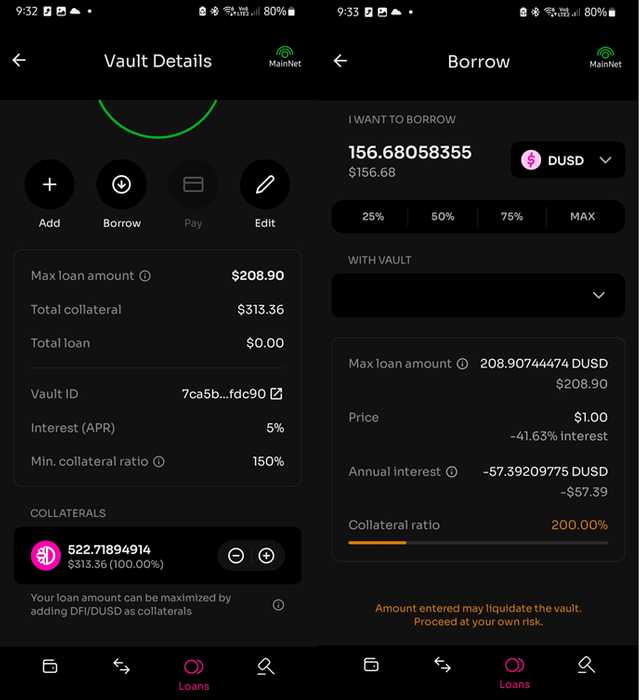

Screenshot taken from the DeFiChain android app

With a collateral of 522 DFI, I created a vault from which I took up a loan of 156 DUSD, with a negative interest rate of -41.63% APY as shown above, about a day ago. The DUSD that is borrowed can either be simply held, or entered into liquidity mining pools to further generate yields.

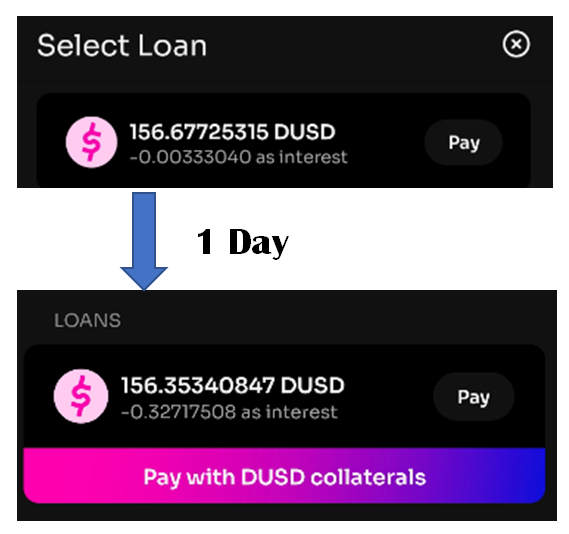

Thanks to the hefty negative interest rates, in a matter of slightly more than 24 hours, the principal amount of my loan has decreased from 156.67 DUSD to 156.35 DUSD, effectively earning me a free 0.32 DUSD!

If the negative interest rate was maintained at the current rate, this loan would (theoretically) be fully self-paid in a matter of 2 years!

Important Caveats

- Watch out for the collateralization ratio! Vaults with different degrees of minimum collateralization ratio can be created; in my case, my vault had a minimum collateralization ratio of 150%. In other words, my loan must be at least 150% collateralized with the value of DFI at all times. I did not take up a full loan with my vault, leaving my collateralization ratio at 200%. If the value of DFI depreciates, so does the collateralization ratio of your vault, falling below which the minimum would bring about liquidation! Hence, always keep a close eye on current market situations, and add collaterals accordingly to your vault if your collateral depreciates in value. Pro-tip: 50% of your collateral can be the DUSD which you loaned --- in other words, you can use your borrowed money as collateral for the loan, and earn yields from taking up the loan thanks to the negative interest rates!

- DUSD has not yet restored its $1 peg to the USD --- investing in DUSD is risky as such in view of uncertainty of its future with regards to the peg.

- A hefty 30% DEX stabilization fee: Things become tricky when you want to cash out on the DUSD that you have borrowed, as there is currently a 30% penalty fee for selling DUSD. However, you can still use the borrowed DUSD for applications within the DeFiChain to generate passive cashflow via liquidity mining; or wait out until the DEX stabilization fee is lowered/ removed before selling your DUSD.

- Sustainability: As DUSD regains its peg, the negative interest rates would be gradually lifted off. In other words, do not sit on the hope that the loan would indeed be fully self-repaying. Whatever principal amount of the loan that is left at the end of this sweet period would still have to be repaid manually, in order to settle the loan and free your collaterals.

Final Thoughts

There are many ways to generate passive income on your cryptocurrency --- taking out a negative interest loan is perhaps a novel and interesting way to do so! To learn more about DeFiChain, check out the official DeFiChain blog here; or embark on a journey with Cake DeFi, some services of which are based on the DeFiChain, to start generating passive income on your crypto today!

If you are new to cryptocurrency or would prefer dabbling with platforms that require no initial investment, feel free to check out the article below!

*** This article was originally published on my Medium page

★Free apps to earn money without any capital!★

🎁 HoneygainA passive income app to earn money off your unused internet bandwidth. Get $5 for free, no investment required.

*🎁 *Peer2Profit A passive income app to earn money off your unused internet bandwidth.

*🎁 *IPRoyal Pawns A passive income app to earn money off your unused internet bandwidth.

*🎁 *EarnApp A passive income app to earn money off your unused internet bandwidth.

★Cryptocurrency Investment Platforms★

🎁 Cake DefiA one-stop investment platform that bakes passive cashflow at APYs of up to 100%! Get a $50 bonus in DFI with a $50 deposit.

*🎁 NexoAn advanced, regulated digital assets institution offering instant crypto loans, daily earning on assets with APYs of up to 36%, an exchange, with services in 40+ fiat currencies in more than 200 jurisdictions. **Get a $25 *bonus with a $100 deposit.

🎁 Binance The world's largest cryptocurrency exchange that needs no introduction!

🎁 Kucoin An expansive cryptocurrency exchange, with interesting offerings like staking, free trading bots and bitcoin cloud mining services.

🎁 Huobi A cryptocurrency exchange with diverse offerings, free airdrops and trading bots.

🎁 MEXC A cryptocurrency exchange with interesting listings and frequent airdrops from holding the MX token.

🎁 Crypto.com A cryptocurrency exchange based in Singapore. Get $25 in CRO on staking for a Ruby card.

★Cryptocurrency Trading Bots★

🎁 3Commas A cryptocurrency trade management platform offering DCA bots, Grid bots, Options bots, Futures bots, HODL bots, Scalper Terminal, and full Portfolio management all from a single convenient interface.

🎁 Jet-bot An advanced spot and futures trading bot with Copy Trading functionality. 3-day trial period available with demo account.

🎁 Pionex A free multifunctional arbitrage trading bot that automates the process of buying low and selling high, 24/7.

*🎁 *One Click Crypto An AI bot powered by neural networks that manage your cryptocurrency portfolio on autopilot.

★For Malaysian investors★

🎁 Luno Get a RM25 bonus in BTC with a RM100 purchase of BTC!

🎁 StashawayGet free investing for 6 months!

🎁 Wahed code 'KENLIE1' RM10 signup bonus

🎁 Capbay P2P code '8879c6' RM100 signup bonus

🎁 Versa Get a RM10 bonus with a RM100 deposit!

🎁 KDI Get a RM10 bonus with a RM250 deposit!

Hey friend is this your blog, give me proof if yes

https://www.publish0x.com/the-passive-cashflow/get-paid-to-take-up-a-loan-an-interesting-case-of-negative-i-xeexlql

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @cyberyy your article has considered as an abuse on steemit, Plagiarized content has been detected on your post. With immediate effect I would advise you to stop such abusive act by creating unique content on steemit.

Ok

But you should only create unique content on steemit, this is also classified as self-plagarisim.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit