Theory Questions

Question No 1 - Define and explain in detail in your own words, what is Trading Plan ?

Before jumping into Trading Plan, I would like to tell you what is Plan and how it helps us in making right decisions or achieving our desire destinations. Plan is something which we make or set in order to achieve our goals, By making and following our plan based on reality we can achieve our goals whether in trade market or in our personal life.

A trading plan is a road map of how to trade. Digital market could be a hazardous figure and; in this way, requires knowledge, having plan can save you from a much of monetary harm. Most exchanging specialists prescribe that no capital is gambled until a trading plan is made. An efficient strategy for trad ing securities that takes into thought a few factors include time, risk, and the investor’s goals. Trading plan is basically a few sets of rules and strategies that we set up for ourselves to stand in market without confronting much loss it can be nitty gritty or brief; least ought to be how, what, and when to purchase when and how to exit positions both productive and unrewarding and it ought to cover how chance will be overseen.These rules removed all the greedy investor and made trading easier and beneficial.

Question No 2 - Why is it important in this profession to have a trading plan ?

Digital marketing is kind of hazardous and thus a few legitimate sets of methods are required. Trading plan offers effective way of exchanging subsequently decreasing chance of misfortune. What planning do is that it helps to plan a rule; on how to preserve and reach objectives that we have set up for ourselves, similar to an outline; one can guarantee that their accounts are well tracked to avoid any overspending. This permits for appropriate investing and sparing of one’s cash and accomplishing one’s long term and brief financial goals.

Now talking briefly somebody made a botch the person had misfortune due to certain activity and once more by doing the same action he/she had to confront lament presently there is a need to realize his/her activities and where he/she is off-base hence that person requires a plan to know when to perform particular action and when not. Following are some direct benefits of Trading Plan ;

Trading Plan keep us motivated in the trade market.

Trading Plan increase our knowledge about present and upcoming market, So we can invest with low risk.

Trading Plan lowers our risk chances.

Trading Plan increases our profit chances.

Help us to reach our desired goals.

Question No 3 - Explain in detail each of the fundamental elements of trading plan?

RISK MANAGMENT:

Risk management is basically getting prepared for any kind of circumstance, the more you'll be able to predict an occasion, the less risk is included. The benefits of risk program ought to result in reserve the funds. To clarify this figure let's accept I have decided on my section and exit rules presently when entering market, I have as of now chosen how much greatest misfortune or benefit I can manage for a day, on the off chance that I reach that specific sum of benefit or misfortune I will instantly move out in order I don't lose more.

CAPITAL MANAGMENT:

Capital management is analyzing and recognizing out how much advantage or mishap you are competent to confront. Capital and risk management are some way or another connected presently we have a sum we want to risk and not more or less the thing to be beyond any doubt is benefit must continuously surpass loss.

Let us assume, Im contributing 500$ and so I have chosen of as I can lose 2% of total I.e. 10$ and picking up a benefit of 4% I.e. 40$ so when I lose or pick up the sum I have accepted sick halt the exchange and consequently it can spare me from a misfortune of much huge sum.

TRAIDING PSYCOLOGY:

Digital marketing is a kind of profession which offers victory because of who you're and what you think of yourself. And this is why trading psychology is foremost, it is risky you confront benefits and loses at the same time hence keeping your mind adjusted may be a enormous need being prepared to confront your activities. on the off chance that you are giving your time to digital market. It ought to be important not to be included In other exercises one ought to attempt to maintain a strategic distance from marketing if confronting individual issues and most important the rules one made to trade ought to not be neglected.

PLANNING AND CONTROL:

Always plan to trade, a fundamental trade that will assist you to manage along with your day-by-day challenges, make the moment day ventures depend on past day. For example, I contributed 20$ yesterday and picked up 0.8$ benefit today I will contribute all of my 20.8$, by doing so at the conclusion of month my speculation will increment and subsequently with appropriate arranging and control I can make my trade effective.

Practice Question

This is my trading plan, I would like to define all this terms separately because of better understanding of this assignments. As I have already shared what I have learned from Professor @lenonmc21. And this part is really interesting to attempt.

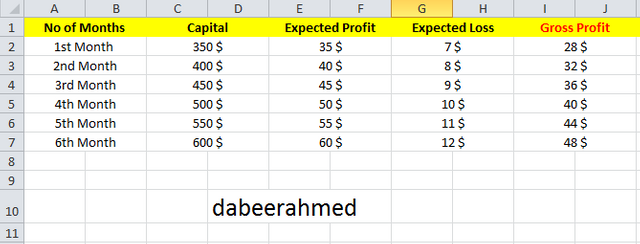

As you can see in the above chart(made with microsoft excel). I am increasing my capital every month by 50 dollars. Let me explain you this table ;

Column AB : Here you can see the number of months, As professor ask in the question to make table of at least 6 months.

Column CD : Here you can see the capital of every month, which is increasing by 50 $ everymonth.

Column EF : Here is the expected profit of my trading which is 10% of the total amount of capital.

Column GH : This is the expected loss which I might face during trading which is 2% of the total amount of capital.

Column IJ : This is the gross profit which I am sure that i will earn on trading.

My Risk Management :

As I am saving money for a long time, So I invest a little in the market, My ratio is never affecting my profit ratio because it is 2:10 in the ratio. I make 10 transaction a day and stop on 2nd failure because i was not able to cover my loss more than 2 failure.

My Capital Management :

My capital is 11.66 per day with loss ratio of 0.1166 per day. So I am glad to be working in effective way.

Capital Planning :

As I have told mentioned in the 2nd column that my capital is increasing, and with a loss ratio of 0.115 a day so i am satisfied with that.

My Psychology :

Trading is not like other job or something, without proper analysis you can not make any profit and might loss all your capital. So I choose to work 6 days a week and one day for rest, I work with no greed and the best thing is that It is increasing my knowledge of upcoming world, It also increases my spirit to work with all my dedications. I am not going to work with out reading daily news, not even gonna work in any excitement not in any pressure as well.

That is all for my assignment, Thanks for reading it, This lecture really helped me to increase my knowledge about Trading Plan, and Capital Management. I wish everyone a very best of luck, Thanks Professor @lenonmc21 for this great lecture, I want to hear more from you, Greetings