QUESTION 1:

Present the Just Swap platform in your own way, demonstrating its importance within the Tron ecosystem blockchain.

WHAT IS JUST SWAP:

First of all, we need to know what is DEX consists of on which Just swap is based, A DEX consists of a set of smart contracts deployed on a blockchain. In simple terms, it's a collection of automated rules that are executed by a network of independent computers without the intervention of a central authority. Since DEXs aren’t controlled by anyone, They can't be regulated, and they're available to anybody. There's no need to create an account or go through an identification procedure that requires you to provide personal information while utilizing a DEX. DEXs also lets users trade straight from their wallets, giving them complete control over their cash. The way transactions are performed and how pricing is decided distinguishes a DEX from a typical exchange.

So, basically, just swap is a decentralized TRON-based exchange protocol for exchanges(DEX) between TRC20 tokens. Conversion between any two TRC20 tokens is simple and dependent on the system pricing. It enables users to conduct fast swaps between any TRC20 tokens while also earning trading fees by providing liquidity without charging them commissions. Instead of going to the protocol itself, all trading costs will go straight to the protocol's liquidity providers.

Just swap promises instant swaps, more convenience, generous returns, a Decentralized system(openness), unlimited liquidity. It also offers its users a more convenient and transparent digital asset financial service.

TRON's DeFi ecosystem is accessed through JustSwap. On top of enabling the instant exchange between TRC tokens users could become liquidity providers to earn trading fees and mining rewards therefore on one hand traders can swap arbitrary TRC 20 tokens with infinite liquidity there is unstoppable liquidity for thousands of traders and hundreds of applications the instant execution is fast and convenient without waiting for an order match in the queue on the other hand market makers can get profit without entry barriers just swap is accessible to all empowering any user to participate in an open financial marketplace and is the profitable permanent trading fee will be paid to you with zero commission charge from the protocol.

.png)

QUESTION 2:

What tokens does JustSwap support trading? How is the price of a JustSwap token determined (how it works)? Use an illustration to explain it.

HOW JUST SWAP WORKS?:

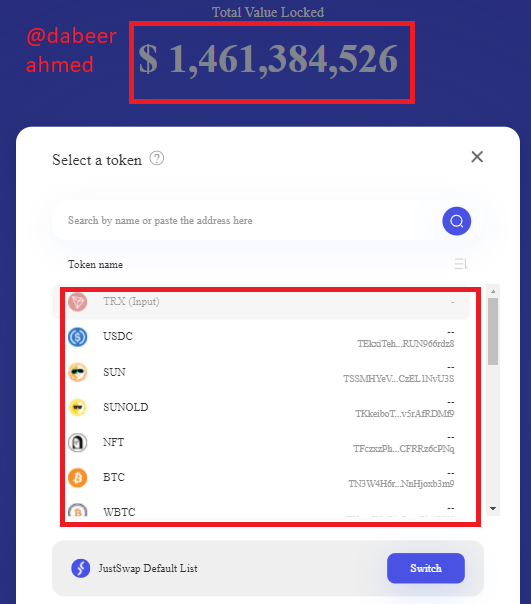

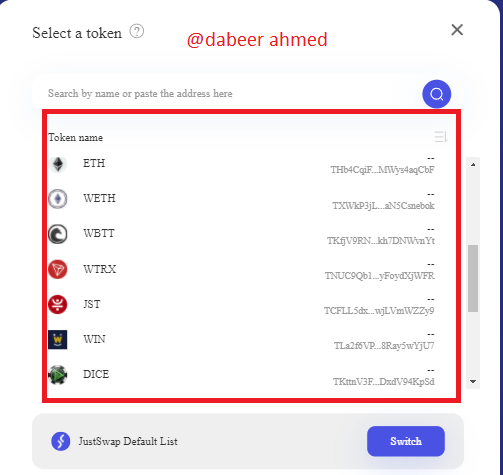

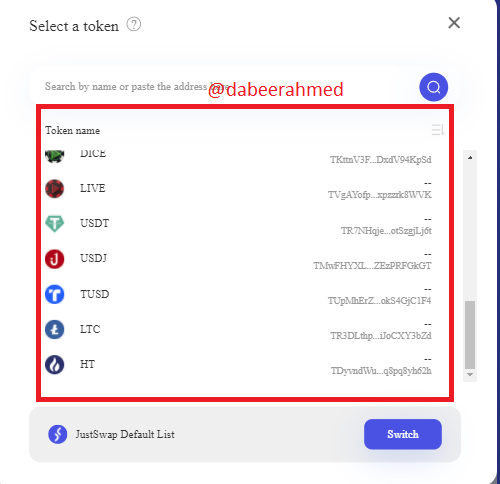

Tokens that are supported by Justswap include TRC20 tokens which are the coins generated on the Tron blockchain.

Here is the list of tokens that are ready to be swapped with Tron:

In the followng images, We have by default tokens, TRX,USDC,SUN,SUNFOLD,NFT,BTC,WBTC,ETH,WETH,WBTT,WTRX,JST,WIN,DICE,LIVE,USDT,USDJ,TUSD,LTC,HT

How is the price of a JustSwap token determined (how it works)? Use an illustration to explain it. (screenshot required)?

Unlike the Centralized exchange system like Binance, where supply and demand work in which the buyer offers his request and the seller has to meet it in order to complete the order.

Here the user is not going to face any trader to swap any token but is going to use a liquidity pool instead without consuming any time to meet the order match.

THE MAIN FORMULA:

The Justswap platform uses the simple formula X * Y=K to determine the price of the token:

Price Determination Formula = (X)(Y)=K

Now, Let's suppose the token number 1 is denoted by "X",

While token number 2 is denoted by "Y".

where "K" represents the total liquidity in the liquidity pool which remains constant.

Let's take the example of two tokens swapping TRX and USDT, where X=TRX and Y=USDT. Now if the user bought a bunch of USDT it is automatically going to reduce the amount of USDT in the liquidity pool and eventually increase the price of USDT but to buy the USDT he needed to give the same worth of TRX in return and it will increase the quantity of TRX in the pool and reduce the price of TRX. The vice versa would happen if TRX was bought instead of USDT with a decrease in the quantity of TRX in the liquidity pool.

So as the formula says, The product of the two tokens should remain constant no matter how large is the quantity. The balance of the liquidity pool remains the same since the purchase and sale of the pairs balance the pool with an equal quantity of the two tokens to give the resulting constant value.

Also, the platform charges 0.3% for swapping trades, Which is rewarded to those who provide liquidity to the platform.

Consider a situation where there are just two buyers and two sellers on a certain exchange.

Any trade would be extremely difficult to complete because it is doubtful that two parties would agree on a price. Because no deals can be conducted without liquidity, the exchange is effectively dead. It's the equivalent of having a shopping mall with a small number of stores and customers. There isn't going to be much business done there. In fact, liquidity is such a crucial criterion for determining an exchange's quality that some exchanges use external services known as "market makers" who are willing to buy and sell at all times, ensuring that the exchange has consistent liquidity. DEXs, on the other hand, do not keep track of any user funds and have no order book. Liquidity pools are used to create liquidity on DEXs. DEXs employ liquidity pools to fulfil "buy" and "sell" orders. Liquidity pools are a common amount of funds deposited by the general public. Liquidity providers, or LPs, are people who put money into liquidity pools. Liquidity mining is a method in which LPs receive a portion of the DEX's trading fees in exchange for the locked funds. Now that we've gone over the differences in how standard and decentralized exchanges provide liquidity, let's move on to the next step.

Let's have a look at how a coin's value is calculated. Trade is conducted on a standard exchange when a seller and buyer come to an agreement through matching orders in the exchange order book. The coin's price is determined at that instant until another deal is made at a different price. In other words, the current price on the exchange is the price of the most recent trade. On the other side, a decentralised exchange does not have an order book. Users trade within a liquidity pool rather than with one another. Instead of using the price from the previous trade, a mathematical formula is applied. An Automated Macro is the name given to this formula or method.To decide the price of coins on its exchange, Just Swap uses an AMM called the "Constant Product Market Maker Model." The X times Y equals K formula is used in this AMM. This means that when trading Ether for DAI on Justswap's Ether/DAI liquidity pool, the amount of Ether available times the amount of DAI accessible should always equal a constant value.

.png)

QUESTION 3

How to Connect my Wallet to JustSwap.io?Is there a mobile app? (Screenshots needed).

CONNECTING THE WALLET TO JUST SWAP:

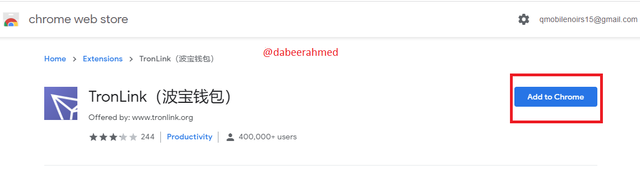

In order to connect the wallet to justSwap.io includes some of the steps to follow, I will be using the Tronlink extension:

STEP#1:

First of all, Search on google Tronlink extension, and then after that click on the first website as shown in the picture below:

STEP#2:

After clicking on the website it will ask you if you want the extension of Tronlink to be added to the chrome extension, As shown in the picture below:

STEP#3:

In the third step, you need to go to the extension of the chrome and click on the Tronlink, after opening the Tron link, it will ask you if you are willing to create a new account of Tron or you want to restore your existing account?

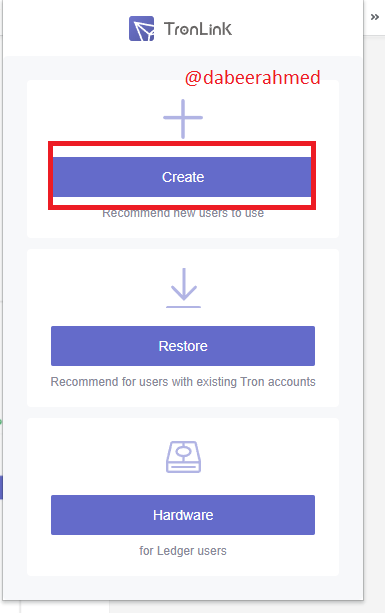

STEP#4:

Since I am new to the website I will be making a new account for myself. For this, it will ask me my username and password, After entering the username and password it will make an account for me as you can see in the picture below:

STEP#5:

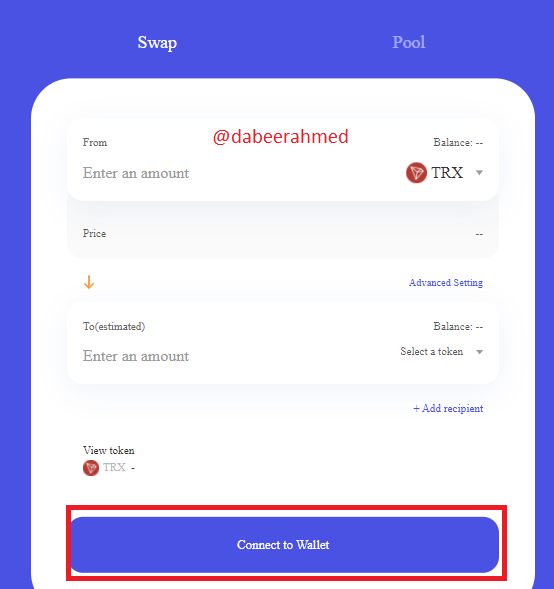

Now, On the just swap landing page, I will be connecting my wallet as shown in the picture below:

STEP#6:

Now, It will ask you to connect the wallet to your account, You need to click on the connect button and then it will be successfully connected as shown below:

.png)

QUESTION 4

Include a real example of your interaction with Just Swap, demonstrate how you can trade on the platform. (screenshots required)

HOW TO TRADE ON JUST SWAP PLATFORM:

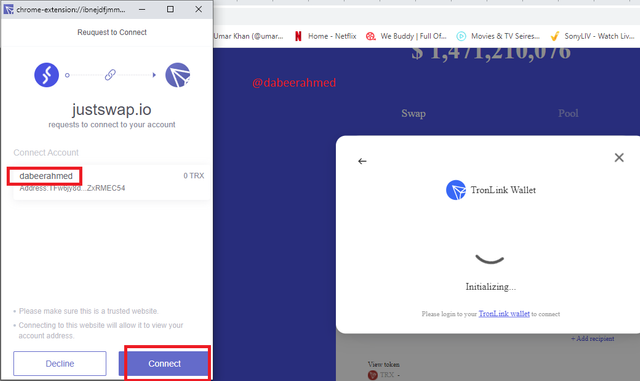

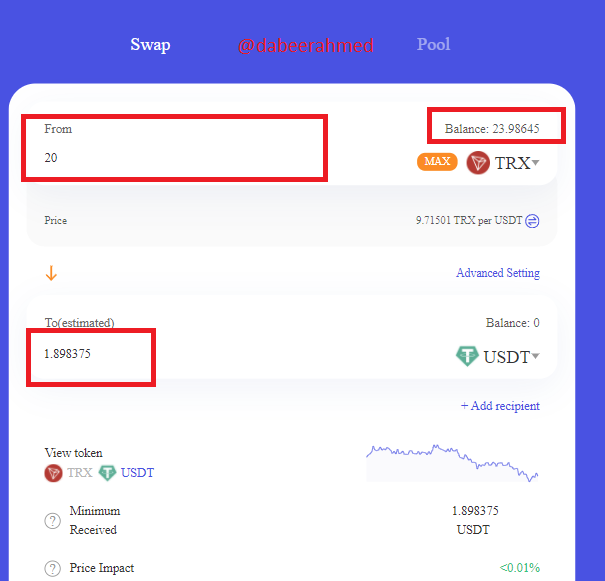

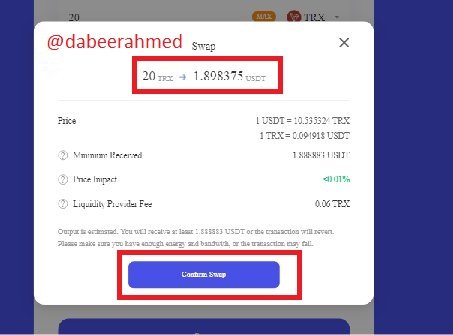

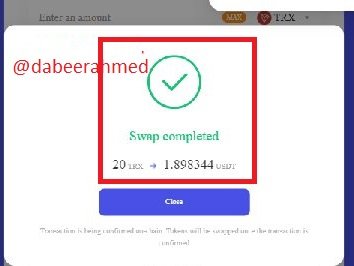

Now in this section, I am going to transact some of the TRX swaps with USDT,

In the first image, I entered 20 TRX swaps with 1.898375 USDT in return,

After clicking on the swap button it asked me to confirm the swap with 0.06 TRX liquidity fees,

In the last image, you can see the swap has been done and a total of 1.898344 USDT has been transferred into my Tron account.

.png)

QUESTION 5:

Include a real example of your interaction with Just Swap, explain How to add liquidity to JustSwap. (screenshot

required)

THE LIQUIDITY POOL IN JUSTSWAP:

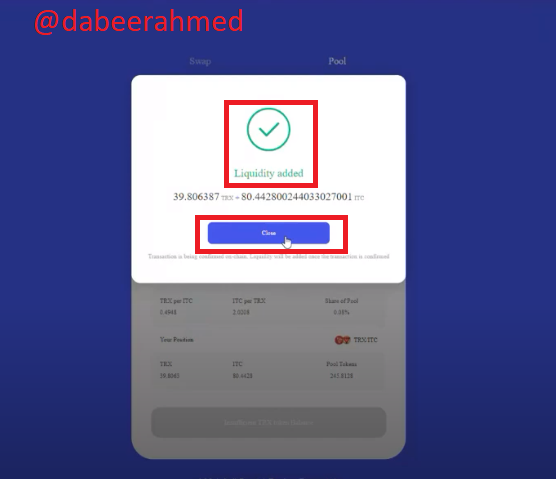

In this section, we are assigned to add liquidity into the liquidity pool on Just swap, Here are the steps that you need to follow in order to add liquidity successfully.

STEP#1:

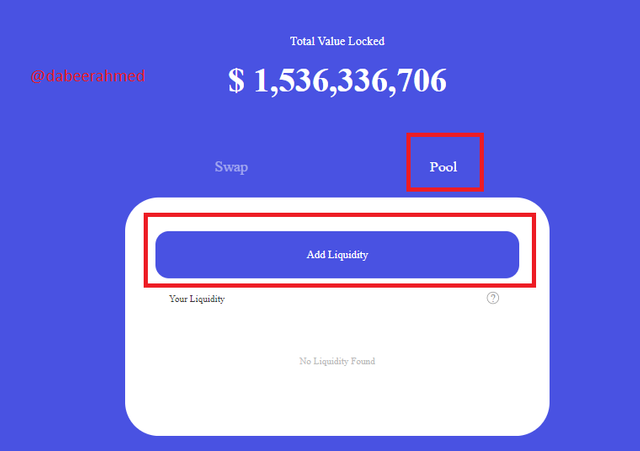

First of all, You need to go to the pool tab of just swap and click on the liquidity button,

Step#2:

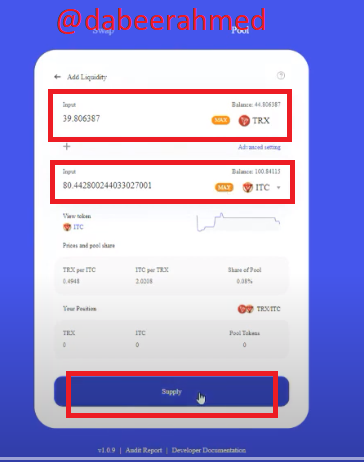

Then after clicking on the liquidity button, It will ask you to pool a pair I will be using ITC /TRX pool pair.

Step:3

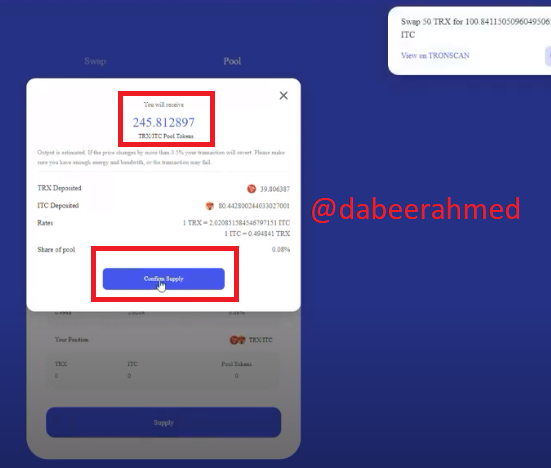

After selecting the pool pair I clicked on the supply button, and then I will require a confirmation for your supply, you need to confirm the supply,

STEP:4

In the last image, you can see the liquidity has successfully

added.

.png)

CONLCLUSION:

In conclusion, we can say with certainty that the Just swap team was not lazy when creating their exchange not only do they offer cheaper and faster transactions thanks to Binance's smart contracts but they also feature diverse tools and products, the DEX brings practically everything that a centralized exchange does so it isn't really a surprise why Justswap is the Fourth-largest exchange by volume in the DEFI sector.However, keep in mind that Just Swap is not a clone and that it practically offers way more features than its competitor. One major drawback is that some members of the community refuse to use Just Swap because it is based on the Binance smart chain, partly because the smart chain is not truly decentralised, which violates a fundamental Defi rule, but as long as users are willing to look past that, pancake swap turns into a fast economic annuity.

In the end, I would like to thanks professor @kouba01 for providing such a wonderful and beneficial lecture in which we got the idea of earning profit by investing in a practical approach.

.png)

Hello @dabeerahmed,

Thank you for participating in the 5th Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|6/10 rating, according to the following scale:

My review :

Generally acceptable work in which you succeeded in answering some questions and did not delve into other answers.

An explanation of the JustSwap platform and its importance in the Tron ecosystem lacks a clear methodology in writing, which makes the answer lose its sequence in reading it.

In determining the price of the JustSwap token, you are asked to provide an illustration to explain it.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit