1.In your own words, give an explanation of the ROC indicator with an example of how to calculate its value?And comment on the result obtained.

The Rate of change indicator is also known as the ROC oscillator. It is a momentum-based technical indicator that measures the percentage difference in price between the current market price and a previous price. Where the size of the real price and the preceding period's relationship is more important than the explanation of the exchange rate itself. It's a kind of oscillator. It's also one of the oscillators capable of detecting overbought and oversold conditions.

The ROC Indicator assists traders in determining the next trend, the strength of the current or ongoing trend, or the probability of a market reversal or correction, as well as the continuity of the existing trend.

The Rate of Change (ROC) Indicator has a very basic notion or comprehension; the ROC indicator is set on “ 0 ”. When the ROC indicator's value rises over the zero line in the positive(+) region, it indicates that the asset price is moving higher, giving a strong side. When the ROC indicator's value falls below zero in the negative zone, it indicates that the asset price is moving downward, indicating a negative(-) side.

HOW TO CALCULATE ITS VALUE:

The Value of the ROC Indicator is calculated using a specific formula. As a result,

- ROC = [(Current Closing Price - Closing Price number of previous periods) / (Closing number of previous periods)] X 100.

EXAMPLE:

Let's say I am going to use DOT coin, and I am going to calculate the rate of change of price of it in the last 5 days i.e from 24 October to 29 October.

Current Price(29 Oct)-43.33

Previous Price(24 Oct)-41.29

ROC = |(41.29-43.33)/43.33 |× 100

ROC = |-2.04/43.33| × 100

ROC= 4.708%

As can be seen, the result is 4.708 percent, indicating that the graph of the current range established in the ROC indicator is positive and around zero midpoints 0.

2.Demonstrate how to add the indicator to the chart on a platform other than the tradingview, highlighting how to modify the settings of the period(best setting).(screenshot required)

The Rate Of Change (ROC) Indicator is virtually universally available on charting platforms; however, I'll be using www.investing.com to demonstrate how to use it on a chart.

Follow the steps below in order to add the indicator:

STEP#1: First of all search investing.com on google search or click on the link SOURCE

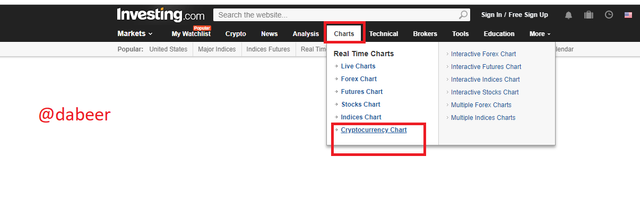

STEP#2:After getting into the website click on the charts section.In the section of chart click on the cryptocurrency chart.

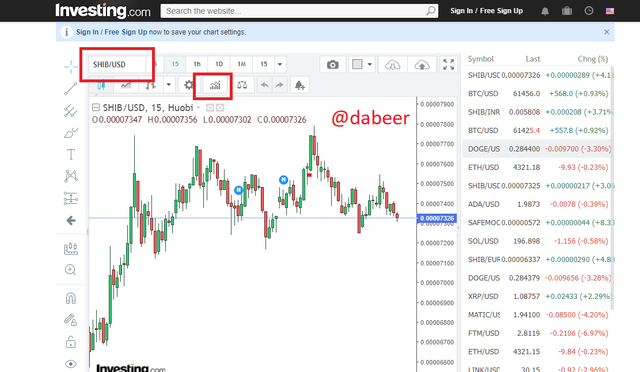

STEP#3:After clicking on the cryptocurrency chart, It will open the coin view. Now for adding the indicator press the indicator icon that appears on the top of the chart.

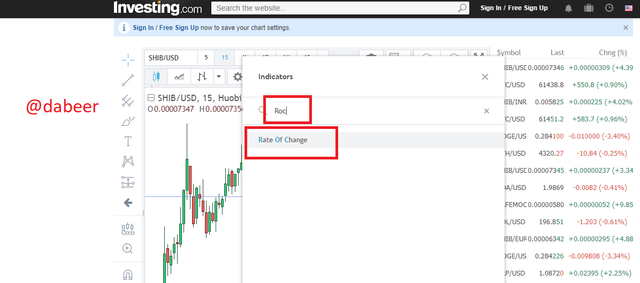

STEP#4:After pressing the indicator icon, it will ask you to enter the indicator name. In order to add the Rate Of Change indicator, type ROC and it will suggest you Rate of change in the suggestion section. Click on it

STEP#5: As you can see in the below Screenshot, The ROC indicator is successfully added.

CONFIGURATION OF THE INDICATOR:

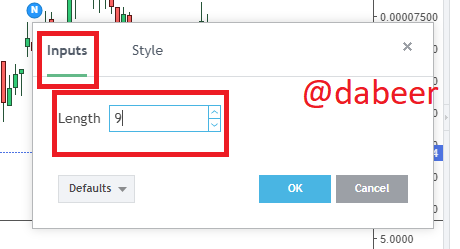

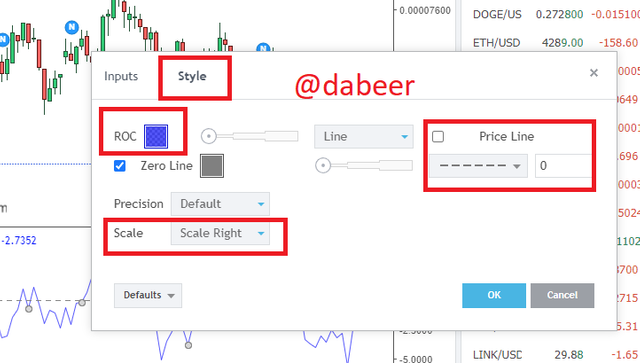

Click on Settings of ROC Indicator to configure it.

The first option is Input, where you may change the Length of this Indicator to anything you want. This indicator's default length is 9.

Thereafter, go to Style and change the color of the ROC Indicator and the Zero Line.

BEST SETTINGS:

A 12-day period would be the finest configuration for the ROC indication, as many investors have utilized and suggested it as one of the strongest periods to employ in the ROC. However, everything will rely on the traders' methods; they can employ it for periods of 9 to 12 days, allowing them to benefit in the market.

3.What is the ROC trend confirmation strategy? And what are the signals that detect a trend reversal? (Screenshot required)

The ROC Indicator displays the percent change in the price of a crypto asset over a specified time period. The ROC Indicator can also confirm the trajectory of a future trend.

When the Rate Of Change (ROC) Indicator's value began to rise from below, it was a sign of a reversal trend and a bullish trend. However, this bullish trend will be verified when the Rate Of Change (ROC) Indicator's value crosses 0 levels from below and begins to rise above 0.

When the Rate Of Change (ROC) Indicator's value began to fall from its high point, it was a sign of a reversed trend and a bearish trend. However, this bearish trend will be verified when the Rate Of Change (ROC) Indicator's value crosses 0 levels from above and begins to fall below 0.

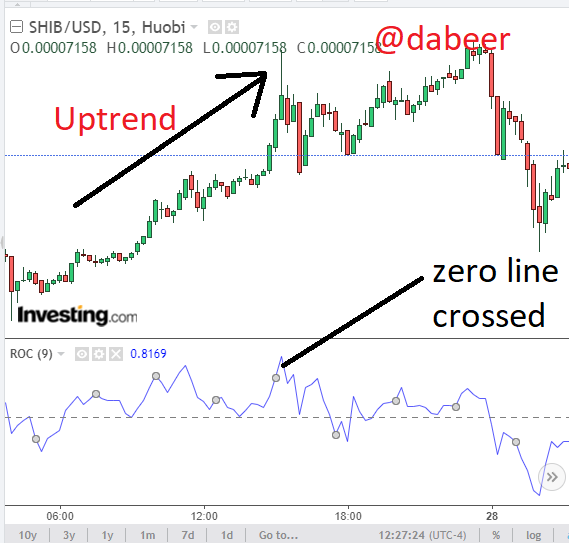

UPTREND:

In the case of an uptrend, it verifies the uptrend by moving over the 0 line from below, followed by upward or positive price values, and so confirming the bull run.

DOWNTREND:

In the case of a downtrend, it confirms the downtrend by passing below the 0 line from above, followed by downward or negative price values, and thereby confirming the downtrend.

TREND REVERSAL:

We may use the ROC Indicator to spot a trend reversal from Overbought and Oversold situations.The indicator operates with a 0 percent centreline, as previously mentioned. A bullish trend is indicated by a cross of this line upwards, while a bearish trend is indicated by a cross of this line downwards.

When the price begins to move away from the Overbought condition and crosses the midpoint ZERO line from above to below, we may conclude that a trend reversal is about to occur, which will be a Downtrend Reversal.

When the price begins to move from an Oversold or Overbought situation and crosses the midpoint ZERO line from below to above, we may conclude that a trend reversal is about to occur, which will be an Uptrend Reversal.

4.What is the indicator’s role in determining buy and sell decicions and identifying signals of overbought and oversold؟(screenshot required)

The ROC indicator's purpose is to find buying and selling opportunities by determining the current trend's momentum. As a result, if the ROC line crosses the zero line, it shows that the uptrend is advancing strongly hourly; but, if the ROC line begins to halt or decrease, it signals that the present uptrend is getting weaker, and here is where you should be cautious of any potential trend shifts. In the identical approach, the value of the ROC decreases and then decreases again in a negative fashion.

As a result, if the ROC indicator line reaches the middle Zero from bottom to top, it is a strong indication to purchase, and if the ROC line passes the middle Zero from top to bottom, it is a clear signal to sell.

BUY SIGNAL:

Check at the indicator line for a Buy Signal. When it crosses the centerline 0 traveling straight from below to above, it is indicated a Buy Signal.

As you can see in the screenshot below when the line crosses the middle line from below to above, I consider that point to be a Buy Point, and from there, you can plainly see that a bullish move has been initiated or that the price has surged upward.

SELL SIGNAL:

When the Indicator line crosses the centerline moving straight from above to below in a Sell Signal, that point is regarded to be a Sell Signal.

In the screenshot below, we could see when the line crosses the centerline from above to below, I consider that point to be a Sell Point, and you can easily see that a bearish move has begun or that the price has fallen lower.

In short and medium-term periods, the ROC indicator is one of the strongest indicators for identifying overbought and oversold indications. To detect overbought and oversold situations, keep in mind that the ROC indicator is just made up of a centerline, with no lines below or above it. As a result, when the ROC indicator is set at a lower high, it is called an oversold signal, which is a trader's warning and a technical analysis warning in the case of a likely market transition from a bearish to a positive trend retracement.

5.How to trade with divergence between the ROC and the price line? Does this trading strategy produce false signals?(screenshot required))

When there is a certain divergence in the indicator but the price moves in the other way, such as when there is a Bullish Divergence in the indicator but the price moves in the opposite direction, we can identify the Divergence. The divergence could be positive or negative in nature. Positive divergence implies that the asset's price may grow, and negative divergence indicates that the asset's price may fall.

BULLISH DIVERGENCE:

It is a Bullish Divergence of the ROC Indicator when the ROC Indicator line is moving higher and the price is moving in the opposite direction, i.e. price is falling downward.

As stated above, we can see in the chart below how the asset price is moving down while the value of the Rate Of Change (ROC) Indicator began to move upward, indicating the end of the negative trend. We can also see how the asset price climbed upward, indicating a reversal.

BEARISH DIVERGENCE:

When the ROC Indicator line moves downwards while the price of the asset moves in the other direction i.e upward direction, we call it a Bearish Divergence.

FALSE SIGNALS:

Because we are determining the next trend at an early stage, it is probable that the divergence trading technique will create false signals. Additionally, the market might play an emotional role, causing traders to lose patience. Other technical indicators, such as EMA and RSI, can be used in conjunction with the ROC Indicator to filter out these False Signals. It will aid in the detection of false signals.

6.How to Identify and Confirm Breakouts using ROC indicator?(screenshot required)

A breakout occurs when the price of an asset moves outside of a predetermined support or resistance level as volume increases. After the asset price breaks over resistance, a breakout trader opens a long position, whereas a breakout trader enters a short position after the stock breaks below support.

Before judging if it's a breakout or a fakeout, it's essential to receive confirmation. Fakeouts occur when prices open above or below a support or resistance level, but subsequently, return to their previous trading range. As a result, if you act quickly, there is no guarantee of the direction in which prices will move.

CONFIRMATION OF BREAKOUTS USING ROC INDICATOR:

ROC Indicator is a tool that allows you to calculate the probability of a certain event This indicator is in an accumulation or stabilization zone when it moves around the zero line. When this indicator moves away from the zero line to a significant degree, there is a chance of a Breakout.

Moreover, a breakout occurs when the price is held for an extended amount of time below a resistance level or above a support level. The resistance or support level is frequently used by traders to assign or define entry goals or stop-loss levels. As a result, traders who were anticipating the price breaking through the support or resistance level rush in, while those who did not want the price to break through stop their bets to avoid further losses.

As You can see in the above images, That ROC Indicator moving around the Zero line for some time and that region will be considered as an accumulation zone. There may have been a Breakout established when this Indicator started moving away from the zero line. As you can see in the preceding photos, the Breakout Moment is the point at which the Indicator began to move away from the Zero line.

Breakouts have two key disadvantages as trading methods. The most important problem is failed breakouts. When the market goes almost beyond a resistance or support level, breakout traders are frequently drawn in. The price may then revert and fail to continue in the breakout direction. This can occur multiple times until a real breakthrough occurs. This could take a long time.

(7)Review the chart of any crypto pair and present the various signals giving by ROC trading strategy. (Screenshot required)

The Rate Of Change (ROC) Indicator could be used to read current charts and define numerous indications.I will be reading the chart for DOT/USD.

TIME TO BUY:

To begin, I've underlined the moment where this indicator passed the 0 line from above to below, indicating that the price would go upward, and you can see that after passing the 0 line, an uptrend has begun.

Furthermore, I've identified a Bearish Divergence when the price is moving in a Bullish direction, implying that there will be a downward trend after some time.

After that, I've identified the Consolidation Zone or Accumulation Zone, which implies that the indicator is moving about the Zero Line, and when it starts moving away from it, a Breakout occurs, as I've indicated in the chart.

At that point, I've also indicated Buy Point since the indicator is passing the Zero line in the upward direction, signaling the commencement of an uptrend.

It will be proven positive if the value of the Rate Of Change (ROC) Indicator shows a breakout upward, as well as resistance shown on the asset price. However, if it does not break out, the Rate Of Change (ROC) number will revert to the swing trend. If it breaks down to the downside in the future, bearishness will be verified.

CONCLUSION:

The ROC Indicator is undeniably the finest indicator for predicting the next trend, its strength, and its continuance. because of its capacity to identify a new trend as soon as it emerges in a trade, as well as to indicate its momentum or strength when a market correction or reversal is expected. It makes it simple to calculate the percentage changes in an asset's current price over a specific period of time. For short-term traders and long-term investors, the ROC indicator estimates this by setting the short-term periods to 12 and the long-term periods to 25.

When sudden swings in the value of the Rate Of Change (ROC) Indicator occur, some patterns in the Rate Of Change (ROC) Indicator may be untrustworthy, and traders must exercise extreme caution.

Moreover, the Rate Of Change (ROC) Indicator value approaches zero levels based on the asset price. In such cases, care is advised because multiple false signals may arise.

Special thanks to Professor @kouba01

Hello @dabeerahmed,

Thank you for participating in the 8th Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|8.5/10 rating, according to the following scale:

My review :

Good work in general in which the answers differed in their analysis and interpretation, and these are some notes.

Good explanation of the indicator by clarifying its uses and caracterics.

You have not deepened your analysis to interpret the best parameters of the chosen period option.

Identifying trend reversals were not deep in their interpretation.

The rest of the questions and I was somewhat satisfied with your answers.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit