In this post, I will answer the questions given by professor @fredquantum in order to finish his homework in the last week of season 5.

1. Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

We have often heard the term Dark pool, because this is not a new term in the world. Before the existence of cryptocurrencies, dark pools already existed. Basically, the dark pool of cryptocurrencies with those of other securities has the same understanding.

Dark pools are specialized trading markets that are separate from general trading, allowing investors institutional to remain anonymous to buy and sell large amounts of cryptocurrency without releasing transaction details to the public market. Dark pool trading is also known as dark pool liquid trading or dark pool trading.

This type of trading allows a large number of investors to trade with each other without causing unfavorable price movements. Investors who wish to sell most of their cryptocurrency assets to the public must first state their intention to sell and risk the value of the cryptocurrency falling as a result of the concentration of mass supply. Dark pool trading eliminates this risk by issuing post-transaction statements and restricting transaction information.

As explained above, dark pools work anonymously behind the scenes. This means that the public will not know about it because the list of orders and sales will not be displayed in public orders. Dark pools allow institutional investors to place limit order, but very large, buy or sell orders. Orders placed by institutional investors in the dark pool will not appear in the public order book, it is separate from the public order book and no one can see. The order book in the dark pool can only be seen by the order maker himself, later the order will be executed when there is a match.

Traders can indeed place orders and prices as they please in the Dark pool, but in most cases they will still match them at the same price, this is considered block trading. In addition, there is a limit order that must be fulfilled by the trader in order to start trading in the dark pool. The limit is definitely not small, because in reality the dark pool is meant for large trades without disturbing the price of the cryptocurrency.

Because the order book is separate from the public order book, this is able to keep the price of the cryptocurrency stable and will not affect trading psychology. Maybe this is a distinct advantage for the cryptocurrency asset, but every advantage has its drawbacks as well.

2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

I spent a few minutes looking for crypto exchanges that provide dark pools, but to no avail, only Kraken.com we could find, so we'll cover that.

Platform Kraken.com is a cryptocurrency exchange that facilitates trading of various cryptocurrencies, platform Kraken.com is based in the US to be exact San Francisco. This allows us to trade various cryptocurrencies. Users can also buy and sell cryptocurrencies using various Fiat currencies, including US dollars, Canadian dollars, euros, etc.

Kraken was founded in 2011, and officially started trading activities in 2013. While the Dark pool feature was only available in 2016, and it is known as the first crypto exchange platform in the world to offer Dark pool. When this feature was launched, only ETH could be traded in the Dark pool, but now we can also trade BTC.

To be able to join the Dark pool, there are several conditions that must be met by traders. However, if we cannot meet these requirements, then we will not be allowed to trade in the dark pool.

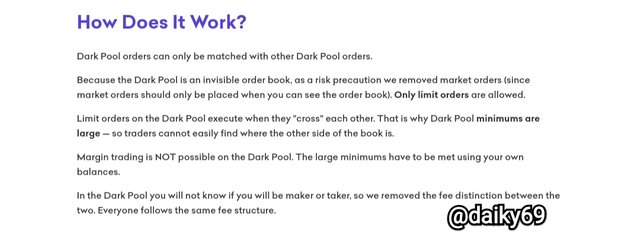

In the Kraken support menu, we can see how the Kraken dark pool works. From this brief explanation, we can see an overview of how dark pools work. Traders can place orders, then orders will be matched with other orders in the dark pool.

And in the dark pool users can only place limit orders, while market orders are removed because it involves user anonymity. Therefore, the order cannot be seen by other users even though it is a fellow dark pool user, the order can only be seen by the order maker himself.

After a buy or sell order is placed, the user must wait until his order matches another dark pool user to complete the block trade. This order matching will be handled by the Kraken platform system. Limit orders will be executed immediately and crossed when there is a price match between buy and sell, therefore historical trades will disappear immediately and will not be recorded anywhere.

Dark pool users also don't have to worry about trading fees, because both market makers and market takers will be charged the same fee. This is related to the anonymity of the dark pool, because no one knows whether someone is a market maker or a market taker so trading costs are leveled.

3. What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

As I explained above, there are only two cryptocurrencies in the Kraken dark pool, the two cryptocurrencies are BTC and ETH. To buy or sell ETH and BTC, we can use the following currency pairs.

BTC

- BTC/CAD

- BTC/EUR

- BTC/GBP

- BTC/JPY

- BTC/USD

ETH

- ETH/CAD

- ETH/EUR

- ETH/GBP

- ETH/JPY

- ETH/USD

BTC/ETH

There are 4 requirements that must be met to join the Kraken dark pool, this is based on the information written on the Kraken support menu.

- To join the dark pool, users must first verify themselves to the pro level.

- Users can only place Limit Orders, market maker orders are not allowed.

- The minimum order to buy/sell BTC should be around $100,000.

- The minimum buy/sell order for ETH should be around $50,000.

The fact is that almost all centralized exchanges charge trading fees, the Kraken platform does the same. Trading fees on the Kraken platform range from 0.20% to 0.36%, the more often we trade in the last 30 days, the lower the trading fees we have to spend. Because the Kraken platform reviews our trading volume in the last 30 days to determine trading fees.

4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

Alright, I'll give you a little illustration of how block trading works on the Kraken platform. For that, we must first login to the Kraken platform assuming you have registered a Kraken exchange account.

- Login to the Kraken exchange using the email and password you created earlier.

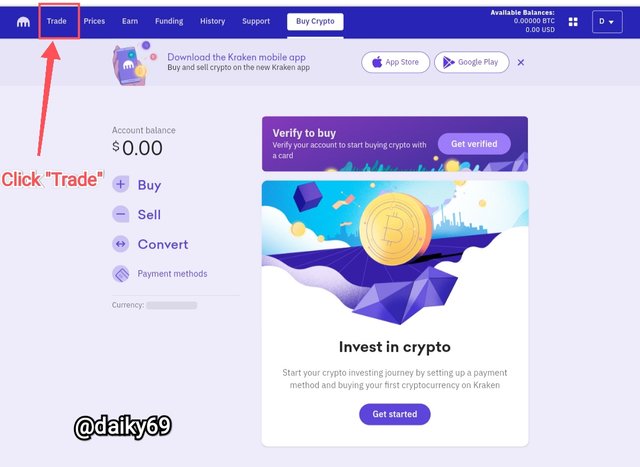

- After we successfully login, we are immediately on the buy crypto menu. To trade the dark pool, we must click on the Trade menu.

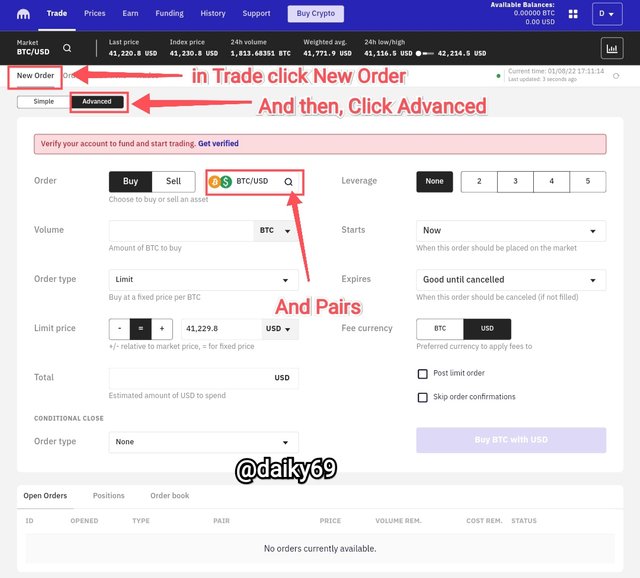

- After that, click on New Trade and select Advanced, after that click on the Pairs to choose the pairs available in the Dark pool.

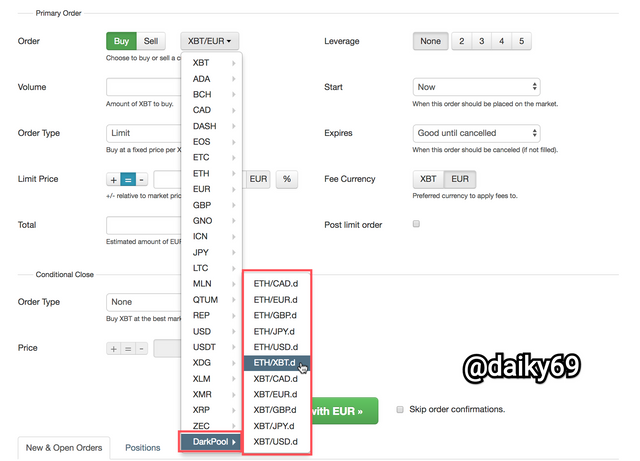

Because the dark pool option is being disabled, so we can't see it this time. If the dark pool option has been reactivated, it will look like in the image below.

After we select the dark pool, a currency trading option will be displayed that we can choose to buy and sell BTC or ETH. Next, we can start trading right away. So that's about a little illustration of how to trade dark pools.

5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

A decentralized dark pool is not much different from a centralized dark pool, only it is more anonymous and is not controlled by any entity, so it is completely safe. In a decentralized dark pool we can directly manage trades without any third party intervention, so it is more anonymous than a centralized dark pool because no one entity knows the trade, only the trader himself knows it.

If a dark pool on a centralized exchange joins a liquidity pool to complete trading orders, this is not the case with a decentralized dark pool. Because, decentralized dark pools rely on Atomic swaps which will involve peer-to-peer transactions or transfers on the blockchain. This is done to protect trading in dark pools from causing price slippage in the market.

In a decentralized dark pool, the buy/sell orders that have been received by the platform will be broken down into smaller parts. Then multiple nodes will compete on a multiparty compute run which is pretty much the same as mining BTC to match orders. If there is a matching order, it will be recorded directly into the system, while orders that do not match and continue to be matched until they really match. Then the node that has successfully matched this order will send a notification to other nodes, and the node that has successfully matched the order will be rewarded with a fee.

In simple terms, Zero knowledge proof is a cryptographic protocol that allows one party (prover) to confirm the truth of a statement to another party (verifier) without revealing any additional information about it.

In Zero knowledge proof there are two parties, the first is the Prover, and the second is the Verifier. The Prover needs to prove to the Verifier the information he has, while the Verifier will verify whether he really has the information or not.

Imagine if you (Prover) were in a room with a person whose eyes were closed. Then there are two black and white balls on the table in the room. You need to prove to a second person (verifier) that the balls are really different colors, without revealing which one.

To do this, you have to ask him to hide both balls under the table. After that, ask to get one ball so you can see it. Then the ball is hidden again and at a later time the Verifier can again show the ball and ask for white or black. However, you will be able to answer him and prove it because you know for sure if he changes it (swaps for another ball) under the table.

However, the examiner will not be completely sure of the truth of these facts, because there could be luck or fraud. This problem is solved by repeating the experiment. With each spin, the odds of being right accidentally are halved, after five repetitions, the odds of cheating are 1 in 32, after 10 spins 1 in 1024, and after 20 spins about 1 in 1,000,000. Repetition can achieve the desired level of evidence reliability, but absolute certainty cannot be achieved.

This is a logical reason why decentralized dark pools use the Zero-Knowledge Proofs protocol. Anonymity is strictly maintained, so users can make transactions without having to tell the contents of the balance they have, nor do they need to tell the volume of transactions they will make.

6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

One of the projects that has introduced a decentralized dark pool on its platform is REN PROTOCOL. LThis platform was founded in 2017 under the name Republik Protocol, then in 2019 they changed it to its current name. And Ren Protocol currently provides a decentralized dark pool feature, for cross-chain trading by utilizing the Zero-Knowledge Proofs protocol.

The Ren Protocol platform can facilitate cross-chain automated transactions between Ethereum and Bitcoin on a hidden order book. Without exposing potential orders, Ren Protocol miners will run settlement nodes to match orders and complete transactions to earn REN token rewards.

This creates a trustless trading system that supports high-volume REC20, ETH and BTC trading pairs without price slippage. Ren Protocol trades bitcoin, ETH and other tokens using atomic swaps on a dark pool concept. Transactions are recorded in an implicit order book and matched via a multi-party computing protocol engine. So that orders or trading history will not be revealed to the public at all.

The Ren Protocol does not require a trusted third party to operate the dark pool, and it builds a healthy and sensible economic ecosystem through the REN token. And the goal is to develop a dark pool protocol with high security, high dispersion, high scalability, and high throughput.

7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

Despite its usefulness, decentralized and centralized dark pools certainly have their own differences and advantages and disadvantages. For that, I will compare the two.

| Decentralized dark pool | Centralized dark pool |

|---|---|

| Privacy or anonymity is comprehensive, meaning no one will know your personal data | Although it is private, this is not entirely because the platform knows your personal data |

| Does not require KYC at all because it is full private | Need to complete KYC to pro level to participate |

| No entity will know and see the order book | The platform can still see the order book that we place |

| Transaction settlement is fully carried out by the system without the intervention of any party | Transaction settlement is still controlled and assisted by the platform |

| Orders will be broken down into smaller ones and matched by nodes for transaction completion | The order is not solved at all and the nodes are not involved in the slightest |

| Can trade multiple coins not only BTC and ETH | Only certain coins can be traded such as BTC and ETH |

| Security is unquestionable | Security is not very good and vulnerable to break-ins |

8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

This time I am interested in analyzing ETH, I witnessed a very sharp decline in the market, even massive sales are taking place on the ETH coin.

In the chart above it can be seen that ETH has experienced a very sharp decline, the ETH market has experienced a decline of 6.04%. This happened of course because there was a huge sales wave from ETH con holders, and it must have been Whale's fault because small users would not be able to influence the market. The price of ETH is currently trading at around $3,033.26 with the highest price in the last 24 hours being $3,240.30, a decline of around $200.

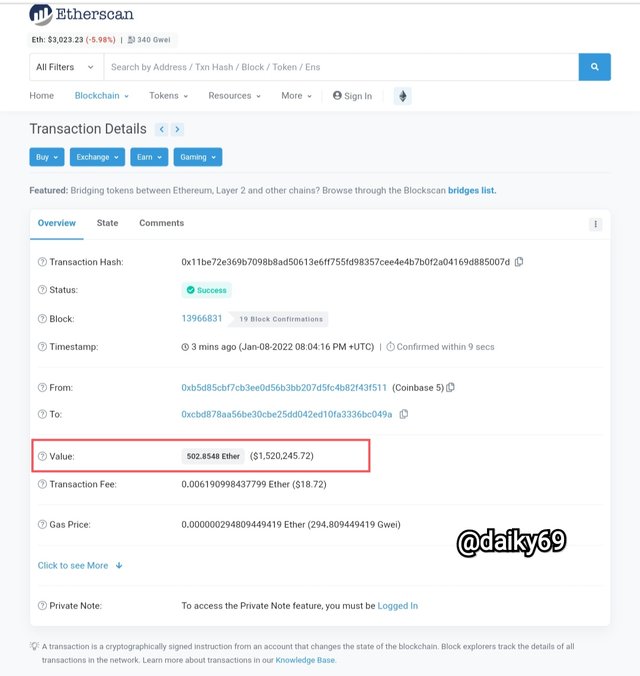

I opened Etherscan to view the history of transactions that occurred on the ETH coin. Sure enough, because there was a whale selling around 502.8548 ETH on 08 January 2022 08:04:16 PM +UTC, that was just a few hours ago. We can see the full details in the screen below.

The whale made a sale on the Coinbase platform, the sale he made in general trading had a worse impact on ETH, because at the same time ETH was indeed in a bearish trend. And as a result of the big sale, the ETH price may be corrected even further.

However, if the whale uses a dark pool to make the sale, perhaps market stability will not be disturbed. And will not cause anxiety for ETH holders, which will have an impact on panic selling.

Since transactions made in the dark pool will not be known by the public, it is still possible to make ETH price stable at the current price before it drops to what it is today. Because only whales are able to control the market and make the price drop by 6.04% it is not an easy matter for ordinary users, but it is very possible for whales to make the market price drop that much.

9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

As is well known, whales are able to control the market by controlling the trading volume. This is also closely related to trading psychology, because in reality small traders will always try to follow the whale's steps. This will cause the market to enter a bearish trend when the whales place a large number of sell orders in the general order book, and will also cause the market to experience a bullish trend when the whales place a large number of buy orders.

But what about the impact if a large number of buy and sell orders are not placed on a public exchange. For example, using dark pools to place very large buy or sell orders, of course, this doesn't really affect the market. While it may still have a small impact on the market, it will not be as severe as selling or buying large amounts on a common exchange.

Because in reality the order is not known by anyone, so it will not cause mass panic. Because retail traders do not know the order and will not follow the whale's steps in selling (if the whale sells) and buys (if the whale buys).

Although it will not have a direct impact on the price of the crypto asset, trading in dark pools will still have little effect on the market. I personally don't know how big the influence is, but it's there and it's not that big.

10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages:

The use of dark pools is not known by the public, so it can reduce market stability caused by market sentiment.

Traders who do not want to be identified for various reasons such as safety, etc., will be greatly helped by the dark pool.

Dark pool users can place orders at the desired price, and can also reduce slippage.

There is no additional fee for market makers or market takers, everything is the same.

The use of dark pools is also very helpful in terms of trading assets with small liquidity, because dark pool trading is carried out directly.

The security and privacy offered by dark pools is second to none.

Disadvantages:

Dark pools can be used by mafias to launder money because there is no transparency.

This is also a disadvantage for small traders because whales can trade at their own set prices without following the market.

Trading in bulk does have a negative impact on the market, but if large amounts are removed from the general market and placed in dark pools, this will reduce market liquidity and thus impact the price of the coin.

Dark pools are only created for whales, and this is an injustice to retail traders.

Conclusion

There is a lot of controversy surrounding the creation of dark pools, both decentralization and centralization each have their own advantages and disadvantages. But overall there are some good effects brought by dark pools, such as not disrupting market stability and many others as well.

However, there are also various drawbacks that accompany the creation of dark pools, such as abuse, one-sided advantage, and much more. This indeed cannot be completely eliminated, because every new innovation is created there will be advantages and disadvantages.